Matching Wednesday: Drive Matching Gifts Post #GivingTuesday

After the whirlwind of #GivingTuesday, many nonprofits find themselves…

Volunteer Grants for Faith-Based Groups: A Crash Course

In the landscape of corporate philanthropy, volunteer…

Using Matching Gifts to Strengthen Corporate Relationships

A common inquiry we receive at Double the Donation centers on…

How to Increase Matching Gift Revenue in 30 Minutes or Less

According to our recent Nonprofit Corporate Engagement report,…

Corporate Philanthropy Infographics: 8 Designs to Inspire

In today’s competitive business landscape, corporate philanthropy…

15 Employee Engagement Strategies to Get Your Team Motivated

What causes your employees to clock into work every day? The…

Matching Gift Companies which Call Denver, Colorado Home

Employee matching gifts in Denver represent a massive, untapped…

How ACS Doubled More Donations with Matching Gifts

The American Cancer Society (also known as ACS) is renowned for…

A Look at Save the Children’s Winning Matching Gift Strategy

Corporate matching gifts are an invaluable revenue opportunity…

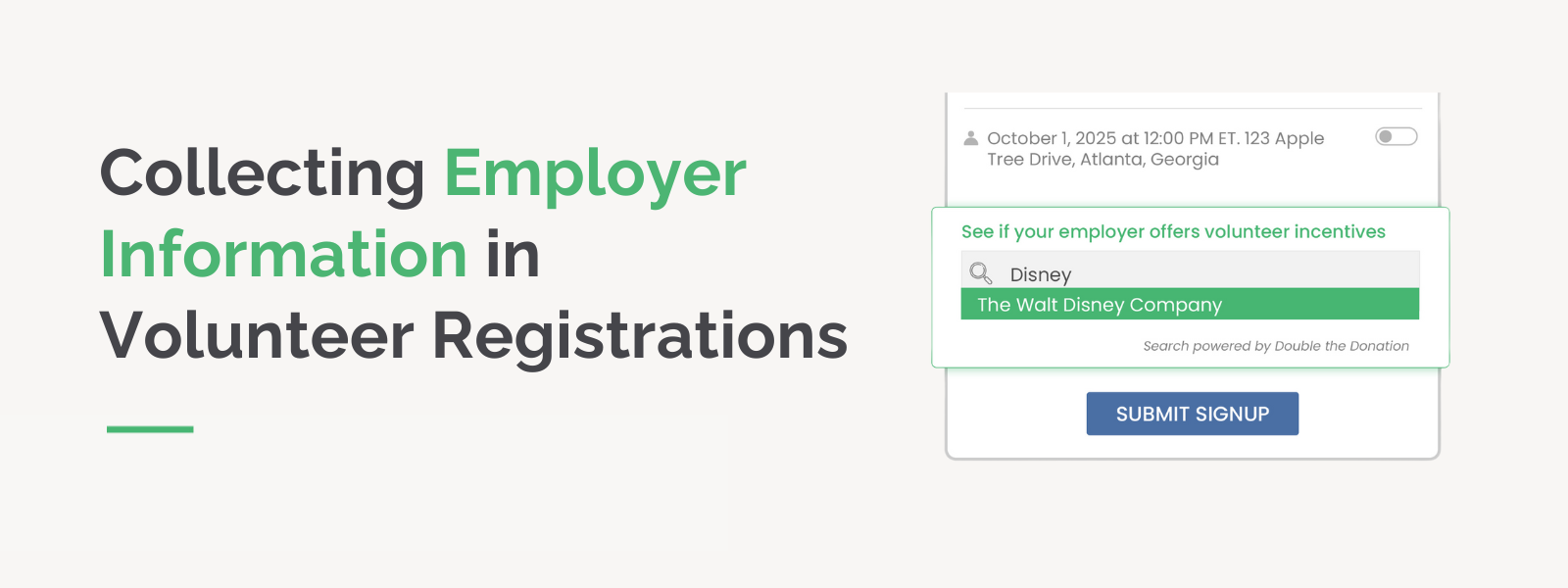

Collecting Employer Information in Volunteer Registrations

Collecting employer information in volunteer registrations is…