Do Companies Match Payroll Gifts? How It Works + Who Does

Tons of generous employees give to causes they care about through their employers’ workplace giving campaigns, but a common question still arises: Do companies match payroll gifts? The short answer is that yes, many do.

Payroll gift matching is an easy way for employees to increase the impact of their donations, often doubling or even tripling the funds received by nonprofits. But in order to reap the combined benefits of these workplace giving programs, it’s important to start with a solid foundation of knowledge.

That’s why, in this post, we’ll explain the following:

- Do companies match payroll gifts?

- How matching gifts work with payroll donations

- 12 Leading companies that match payroll gifts

By the end, you should have a clear understanding of how payroll gift matching works, which companies offer it, and how to take full advantage—whether you’re an employee looking to amplify your giving or a nonprofit aiming to tap into this powerful source of support.

Let’s dive in and explore how matching payroll gifts can make a bigger impact for causes like yours.

Do companies match payroll gifts?

Many companies do indeed match payroll gifts as part of their broader workplace giving and corporate social responsibility (CSR) programs. Payroll gift matching enables employees to donate a portion of their paycheck directly to a nonprofit, with the employer matching that contribution, often on a dollar-for-dollar basis. This approach makes it easy for employees to give consistently while also significantly increasing the total donation reaching the nonprofit.

While not every company offers payroll matching, it’s increasingly common among businesses that prioritize employee engagement and community impact. These programs may come with specific guidelines—such as donation minimums or eligible nonprofit categories—but they share a common goal: to support causes employees care about and encourage year-round giving.

How matching gifts work with payroll donations

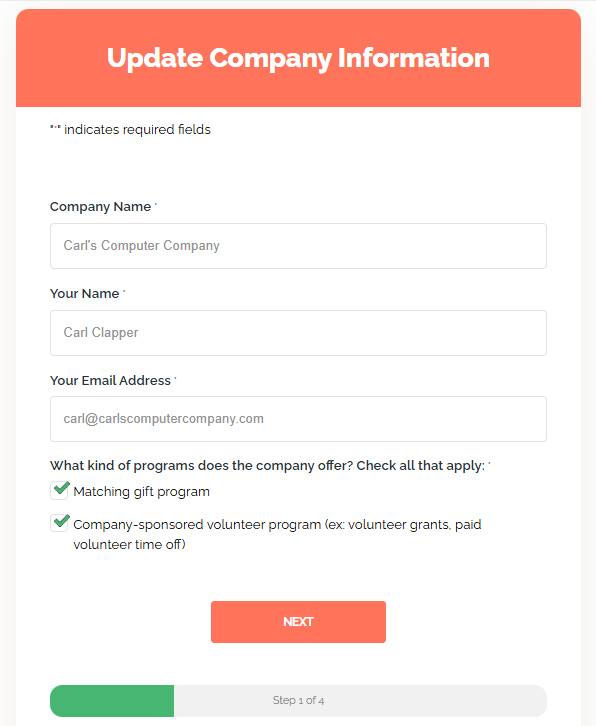

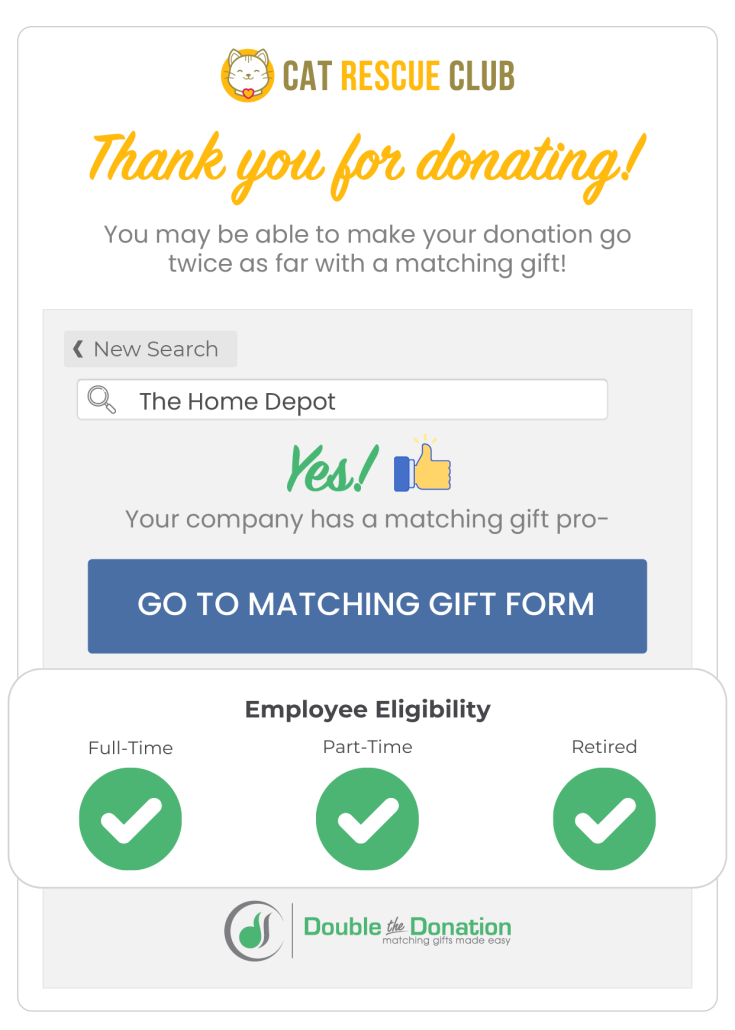

Matching gifts and payroll donations often go hand in hand, creating a seamless and impactful way for employees to give more to the causes they care about. Here’s how the process typically works, step by step:

- Employee Enrolls in Payroll Giving. The process begins when an employee signs up for their employer’s workplace giving program, often through an internal HR portal or a third-party giving platform. They choose a nonprofit and specify a donation amount to be deducted directly from their paycheck, either as a one-time gift or a recurring contribution.

- Donation Is Automatically Deducted. Once enrolled, the donation is automatically deducted from the employee’s paycheck, typically on a pre-tax basis. This makes giving simple, predictable, and budget-friendly, encouraging consistent support for nonprofits throughout the year.

- Employer Matches the Donation. If the company offers a payroll gift matching program, they’ll contribute an additional amount, typically matching the employee’s donation dollar for dollar—though some companies may offer a higher or lower match ratio. The match may be made on a monthly, quarterly, or annual basis, depending on the company’s policies.

- Funds Are Distributed to the Nonprofit. Both the employee’s payroll deduction and the employer’s matching contribution are sent to the designated nonprofit. This may be done directly or via a third-party administrator that processes and distributes the funds.

- Donor and Nonprofit Receive Confirmation. Employees usually receive confirmation of their donations and matched gifts for their records. Nonprofits may also receive donor details (if shared) along with the matched funds, allowing them to acknowledge the support and build stronger relationships.

Here are a few additional considerations to note:

- Eligibility matters. Not all nonprofits qualify under every company’s matching policy. Most employers will match gifts to 501(c)(3) organizations, but some exclude religious or political causes or narrow their program criteria to include only a particular type of cause.

- There are usually caps. Companies often set annual limits on how much they’ll match per employee, with maximums landing anywhere from $500 to $10,000 or more. Once that maximum amount is reached, the employee can keep making payroll donations, but they may not be matched again until the following year.

- Employees may need to opt in. Some programs require employees to request a match or verify their donation, even if it was made via payroll. Don’t skip this step, or else incoming matchable gifts are likely to slip through the cracks!

When your supporters enroll in payroll donation programs and get their gifts matched, you’ll find that you can efficiently boost funding for your cause. Combining the two programs streamlines giving for employees while delivering steady, reliable funding for nonprofits—all with minimal administrative burden.

12 Leading companies that match payroll gifts

Now that you understand how payroll gift matching works, you might be wondering which companies actually offer these programs. While not every employer participates, many well-known organizations are leading the way by making it easy for employees to give back—and amplifying those efforts through generous match policies.

Below, we’ve highlighted 12 standout companies that match payroll donations, along with key details about how their programs work.

1. Microsoft

As a global leader in the technology sector, Microsoft employs approximately 220,000 people worldwide and is headquartered in Redmond, Washington. The company is renowned for its robust philanthropic culture centered around its Employee Giving Program.

Through this program, Microsoft encourages employees to make recurring donations to eligible nonprofits directly from their paychecks. Then, to double the impact, the company matches these contributions dollar for dollar, up to $15,000 per employee annually. This seamless integration of payroll giving and matching gifts empowers employees to support their communities efficiently and meaningfully.

Learn more about Microsoft’s corporate giving programs here.

2. Pfizer

Pfizer, a pharmaceutical giant based in New York City, employs around 83,000 people worldwide. The company’s philanthropic programs reflect its healthcare mission, with a strong emphasis on making charitable giving accessible and impactful.

Through Pfizer’s Giving Station, employees can donate via payroll deductions and have their gifts matched up to $5,000 annually. The combination of automatic payroll giving and matching contributions makes it easy for employees to give consistently while significantly increasing the nonprofit’s impact.

Learn more about Pfizer’s corporate giving programs here.

3. Apple

With headquarters in Cupertino, California, Apple is a technology powerhouse employing over 160,000 people. Apple’s Giving program includes both payroll giving and matching gifts, where employee donations are matched dollar for dollar up to $10,000 annually.

The company has made it easy for employees to regularly support causes of their choice, and Apple’s match applies whether the donation is made through payroll or another method, making it a truly inclusive program that maximizes employee impact.

Learn more about Apple’s corporate giving programs here.

4. Google

Google, under its parent company Alphabet Inc., is a dominant name in the internet and software industry. Headquartered in Mountain View, California, Google employs about 180,000 people globally.

The company encourages giving through its Google Giving program, offering employees the option to make recurring donations via payroll deductions, which are matched dollar for dollar up to $10,000 annually. This unified structure allows Googlers to support global and local nonprofits with sustained, matched contributions throughout the year.

Learn more about Google’s corporate giving programs here.

5. Intel

Intel, a leading semiconductor and technology company based in Santa Clara, California, employs approximately 120,000 people. The company’s philanthropic infrastructure includes an integrated payroll giving option and a 1:1 matching gift program with a cap of $10,000 per employee each year.

Intel also promotes volunteering, offering match dollars for hours served. By making payroll giving and matching both accessible and generous, Intel encourages employees to be actively involved in community support.

Learn more about Intel’s corporate giving programs here.

6. AbbVie

AbbVie, headquartered in North Chicago, Illinois, was founded in 2013 as a spin-off from Abbott Laboratories and employs approximately 50,000 people worldwide.

The company supports charitable engagement through a matching gift program that matches employee donations to eligible nonprofit organizations at a 1:1 ratio, up to $5,000 annually. AbbVie’s program encourages giving across various causes, including education, health, and human services. Employees also have the option to contribute through payroll deductions, allowing them to support charitable organizations on an ongoing basis directly from their paychecks.

Learn more about AbbVie’s corporate giving programs here.

7. Hewlett Packard Enterprise

Hewlett Packard Enterprise (HPE), based in Houston, Texas, was formed in 2015 following the split of Hewlett-Packard into two separate entities. HPE currently employs around 60,000 people globally and actively fosters a culture of corporate citizenship.

Through its matching gift program, HPE matches employee donations to eligible nonprofits, often on a dollar-for-dollar basis. The company also promotes payroll giving by enabling employees to contribute directly from their paychecks to qualified organizations, making it convenient to support causes they care about year-round.

Learn more about HPE’s corporate giving programs here.

8. Nike

Founded in 1964 as Blue Ribbon Sports and headquartered in Beaverton, Oregon, Nike, Inc. is a global leader in athletic apparel and footwear, employing over 83,000 people worldwide. Nike demonstrates a strong commitment to social responsibility through its employee giving programs.</p>

Specifically, the company offers a matching gift program that typically matches donations to eligible nonprofits at a 1:1 ratio. Nike also supports payroll giving, allowing employees to make regular, automated contributions to charitable organizations, further amplifying their philanthropic impact.

Learn more about Nike’s corporate giving programs here.

9. Adobe

Adobe, founded in 1982 and headquartered in San Jose, California, is a leading software company with more than 30,000 employees globally.

Adobe’s social impact initiatives include a robust matching gift program, in which the company matches donations made by employees to qualifying nonprofits, up to $10,000 each year. The company also facilitates payroll giving, making it easy for employees to support causes they’re passionate about through automatic paycheck deductions.

Learn more about Adobe’s corporate giving programs here.

10. Visa Inc.

Visa Inc., a global leader in digital payments, was founded in 1958 and is headquartered in Foster City, California. The company employs over 26,000 people worldwide and places a strong emphasis on giving back.

As such, Visa’s matching gift program allows employees to double their charitable contributions by matching donations to eligible nonprofits. Additionally, Visa supports payroll giving by offering employees the opportunity to donate a portion of their paychecks to vetted charitable organizations—and then matching them—thus reinforcing its commitment to social impact and community involvement.

Learn more about Visa’s corporate giving programs here.

11. Macy’s

Macy’s, one of the most iconic department store chains in the United States, was founded in 1858 and is headquartered in New York City. The company employs over 80,000 people across its stores, corporate offices, and distribution centers.

Macy’s supports employee philanthropy through a matching gift program that matches contributions to a wide range of nonprofit organizations. The company also promotes payroll giving, enabling employees to make regular charitable donations directly from their paychecks.

Learn more about Macy’s corporate giving programs here.

12. T-Mobile

T-Mobile, headquartered in Bellevue, Washington, is a major U.S. wireless network operator with more than 70,000 employees. Founded in its current form in 2001, T-Mobile places a high value on social responsibility and employee engagement.

The company offers a matching gift program that amplifies employee contributions to eligible nonprofits. T-Mobile also facilitates payroll giving, allowing employees to donate easily and consistently through automated payroll deductions.

Learn more about T-Mobile’s corporate giving programs here.

Wrapping up & additional payroll giving resources

Matching payroll gifts is a powerful yet often underutilized way to amplify charitable giving. However, the full potential of these programs are hardly realized, largely due to a lack of awareness surrounding the opportunities.

When combined, matching gifts and payroll giving can go together well, offering a significant impact for organizations like yours. Don’t let these contributions fall by the wayside!

Looking to learn more about payroll giving for nonprofits like yours? Check out these additional recommended resources:

- Explore 15 Leading Companies with Payroll Giving Programs. Discover top organizations making an impact through payroll giving. This post highlights how major companies support charitable donations through their workplace, offering inspiration and partnership ideas for your nonprofit.

- 5 Proven Ways to Increase Payroll Donations at Your Nonprofit. Learn effective, actionable strategies to grow your payroll giving program. From employee engagement to corporate partnerships, this guide helps you boost recurring donations and long-term impact.

- 4 Email Templates to Boost Payroll Giving Participation. Save time and drive results with these ready-to-use email templates. Whether you’re launching a new campaign or reminding donors to enroll, these messages are crafted to increase participation and engagement.

Dell

Dell Oracle

Oracle

AMD

AMD Vrbo

Vrbo