How Animal Shelters Can Secure In-Kind Donations

Animal shelters play a vital role in caring for homeless, abandoned, and abused animals, providing them with shelter, medical care, and a chance for adoption. To sustain these essential services, shelters often rely on a mix of funding sources, including cash donations and in-kind contributions. In-kind donations, which consist of goods and services rather than money, can be a game-changer for animal shelters by directly supplying the resources needed to care for animals and maintain operations.

Securing in-kind donations requires a strategic approach tailored to the unique needs of animal shelters. Unlike cash gifts, in-kind donations can include pet food, veterinary supplies, cleaning products, and even professional services that reduce operational costs and improve program delivery. Understanding how to identify, request, and manage these donations effectively can significantly enhance a shelter’s capacity to serve its community.

In this article, we will explore what in-kind donations are, why they matter specifically for animal shelters, the types of donations that are most valuable, where to find potential donors, and how to make compelling donation requests. We will also introduce tools and resources designed to help animal shelters maximize their in-kind fundraising efforts.

Table of Contents

- What Are In-Kind Donations for Animal Shelters?

- Types of In-Kind Donations for Animal Shelters

- Where Animal Shelters Should Look for In-Kind Support

- How Animal Shelters Should Make the In-Kind Donation Ask

- Tools and Resources to Help Animal Shelters Get Started

What Are In-Kind Donations for Animal Shelters?

In-kind donations refer to non-cash gifts that a nonprofit organization receives to support its mission. These can include physical goods, professional services, or volunteer time that directly benefit the organization’s programs or operations. Unlike traditional cash donations, which provide flexible funding, in-kind donations supply specific resources that can reduce expenses or enhance service delivery.

Across all nonprofit sectors, in-kind donations are valued for their ability to meet tangible needs without requiring immediate financial outlay. For example, a nonprofit might receive donated office furniture, printing services, or event catering. These contributions help stretch limited budgets and allow organizations to allocate cash donations toward other priorities.

For animal shelters, in-kind donations are especially impactful because they often address critical, ongoing needs. By securing in-kind donations, animal shelters can reduce operational costs, allowing more funds to be directed toward medical care, adoption programs, and community outreach. These donations also foster partnerships with businesses that share a commitment to animal welfare, creating opportunities for long-term collaboration and community engagement.

Understanding the Difference Between Cash and In-Kind Donations

While cash donations offer flexibility, in-kind gifts provide specific resources that might otherwise be costly or difficult to procure. For animal shelters, this means receiving exactly what is needed to care for animals and maintain facilities without diverting funds from other critical areas. Both types of donations are complementary and essential for a balanced fundraising strategy.

The Unique Value of In-Kind Donations to Animal Shelters

Animal shelters operate with a constant demand for supplies that directly impact animal health and well-being. In-kind donations help meet these demands efficiently. For example, receiving donated veterinary supplies can enable shelters to provide vaccinations and treatments without incurring high costs. Similarly, pet food donations ensure animals receive proper nutrition daily, which is fundamental to their recovery and adoption readiness.

Maximizing Impact Through Smarter Fundraising Strategies

In-kind donations are a strategic asset for animal shelters looking to maximize their impact. By identifying and cultivating relationships with companies that can provide relevant goods and services, shelters can build a sustainable support network. This approach aligns with best practices in nonprofit fundraising, emphasizing mission-focused partnerships and resource optimization.

Types of In-Kind Donations for Animal Shelters

Animal shelters benefit from a wide range of in-kind donations that support both animal care and organizational operations. Below are some of the most valuable types of in-kind gifts, along with explanations of their importance:

Pet Food & Treats

Donations of pet food and treats are among the most critical in-kind gifts for animal shelters. High-quality food ensures animals receive proper nutrition, which is essential for their health, recovery, and adoption readiness. Treats can also be used for training and enrichment, helping animals adjust to shelter life and improve their behavior for potential adopters.

Pet Supplies

Items such as bedding, collars, leashes, crates, toys, and grooming tools greatly enhance the daily care and comfort of shelter animals. These supplies contribute to animal welfare by providing safe, comfortable living conditions and opportunities for mental stimulation, which are crucial for reducing stress and promoting well-being.

Cleaning & Sanitation Products

Maintaining a clean and sanitary environment is crucial to preventing the spread of disease and ensuring the health of animals and staff. Donations of cleaning agents, disinfectants, gloves, and other sanitation supplies help shelters uphold high standards of hygiene without straining their budgets.

Veterinary Supplies

Medical supplies such as vaccines, medications, bandages, syringes, and diagnostic tools enable shelters to provide essential veterinary care on-site. These donations reduce the cost of medical treatments and support timely interventions that improve animal outcomes.

Office Supplies

Operational efficiency is supported by donations of office supplies like paper, printers, computers, and software. These resources help shelter staff manage records, coordinate adoptions, and communicate with donors and volunteers effectively.

Professional Services

Beyond physical goods, shelters can benefit from donated services such as legal advice, marketing support, transportation, and skilled volunteer work. For example, legal assistance can help with compliance and contract management, while marketing services can enhance adoption campaigns and strengthen fundraising efforts.

Event Support and Venue Sponsorship

Donations of event space, catering, or auction items from local businesses can enhance fundraising events, increasing revenue and community engagement. These contributions reduce event costs and add value for attendees.

Where Animal Shelters Should Look for In-Kind Support

Identifying the right sources for in-kind donations is a strategic process that involves researching companies whose corporate social responsibility (CSR) initiatives align with animal welfare. Animal shelters should focus on businesses that have a history of supporting nonprofits or whose products and services naturally complement shelter needs.

Local businesses engaged in community impact efforts are often eager to support shelters, especially when they see a direct connection to their brand or customer base. Industry-relevant retailers, manufacturers, and service providers are prime candidates for partnerships because their offerings match shelter requirements.

Below are some companies known for providing in-kind donations that align well with animal shelters’ missions:

Purina

Purina frequently donates pet food, litter, and nutritional products to animal shelters. Their support helps ensure animals receive balanced diets, which is fundamental to health and adoption success. Purina’s commitment to animal welfare makes them a natural partner for shelters seeking food donations.

Petco

Petco offers a variety of in-kind donations, including pet supplies, grooming products, vaccines, and sometimes event sponsorships. Their retail presence and focus on pet care align closely with shelter needs, making them a valuable source of support.

Chewy

Chewy is known for donating pet food, treats, toys, and supplies. Their extensive product range and focus on pet care make them a strong partner for shelters looking to stock up on essential items.

Kong

Kong donates durable pet toys that provide enrichment and mental stimulation for shelter animals. These toys help reduce stress and improve animal behavior, aiding in successful adoptions.

Blue Buffalo

Blue Buffalo offers premium pet food and treat donations that support animal nutrition and health. Their commitment to quality aligns with shelters’ goals of providing the best care possible.

Ecolab

Ecolab specializes in sanitation and hygiene products and services. Their donations help shelters uphold rigorous cleaning standards, protecting both animals and staff from infections.

How Animal Shelters Should Make the In-Kind Donation Ask

Making a successful in-kind donation request requires a thoughtful, strategic approach. Building long-term relationships with corporate donors is essential, as is aligning the shelter’s needs with the company’s mission and CSR goals. A well-crafted ask increases the likelihood of a positive response and fosters ongoing support.

Personalize Your Outreach

Address the company by name and reference specific programs or initiatives they have supported. Show that you understand their values and explain how your shelter’s mission aligns with their goals.

Be Clear and Specific About Needs

Detail the exact items or services you are requesting and how they will be used. For example, specify the quantity and type of pet food or the kind of veterinary supplies needed.

Highlight Mutual Benefits

Describe how the company’s support will be recognized, such as through social media shoutouts, logo placement at events, or employee volunteer opportunities. Emphasize the positive impact on the community and the company’s brand.

Offer Flexible Giving Options

Allow donors to choose how they want to contribute, whether through product donations, services, or sponsorships. This flexibility can increase participation.

Make It Easy to Give

Provide clear instructions for donation delivery or service scheduling. Include contact information for follow-up questions and express gratitude in advance.

Tools and Resources to Help Animal Shelters Get Started

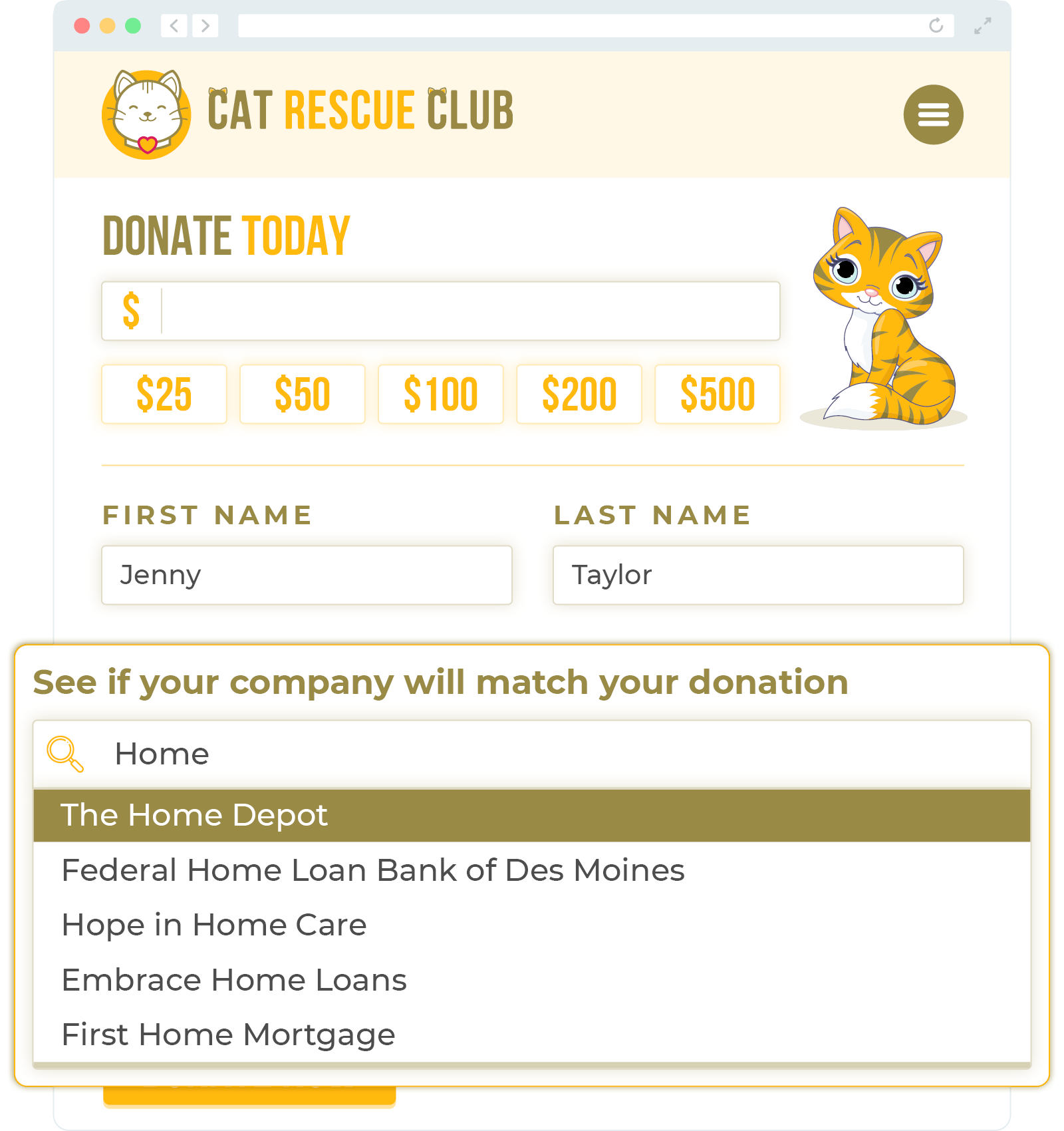

Using dedicated tools can greatly streamline the process of identifying and securing in-kind donations. Many companies have formal donation programs, but these opportunities are often scattered across websites and difficult to track manually. Leveraging technology helps animal shelters save time and expand their network of potential donors.

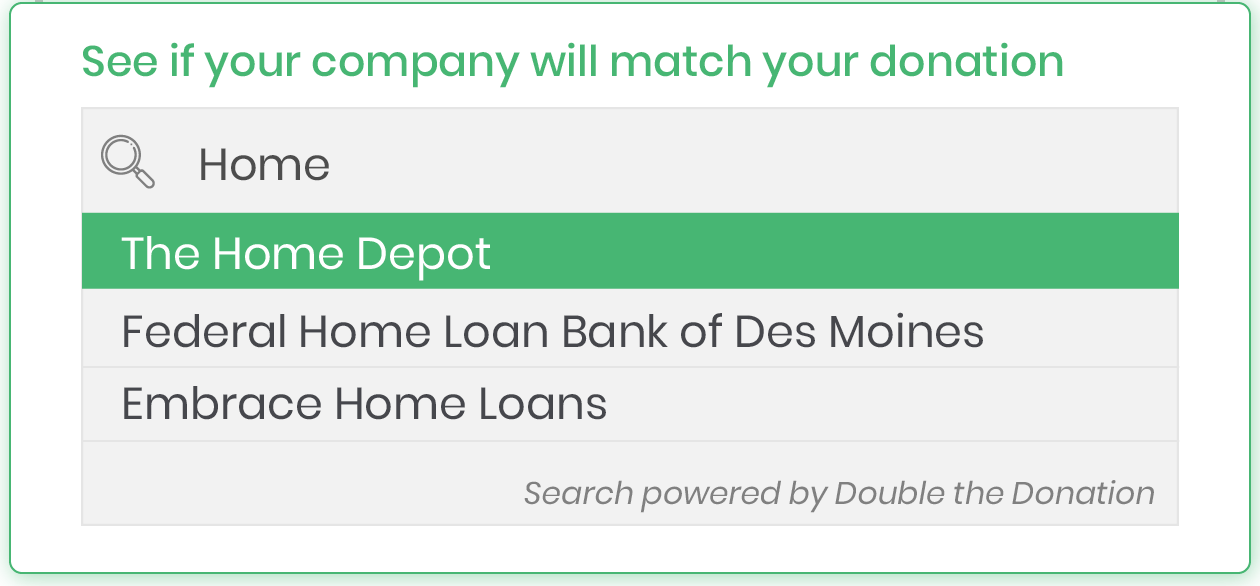

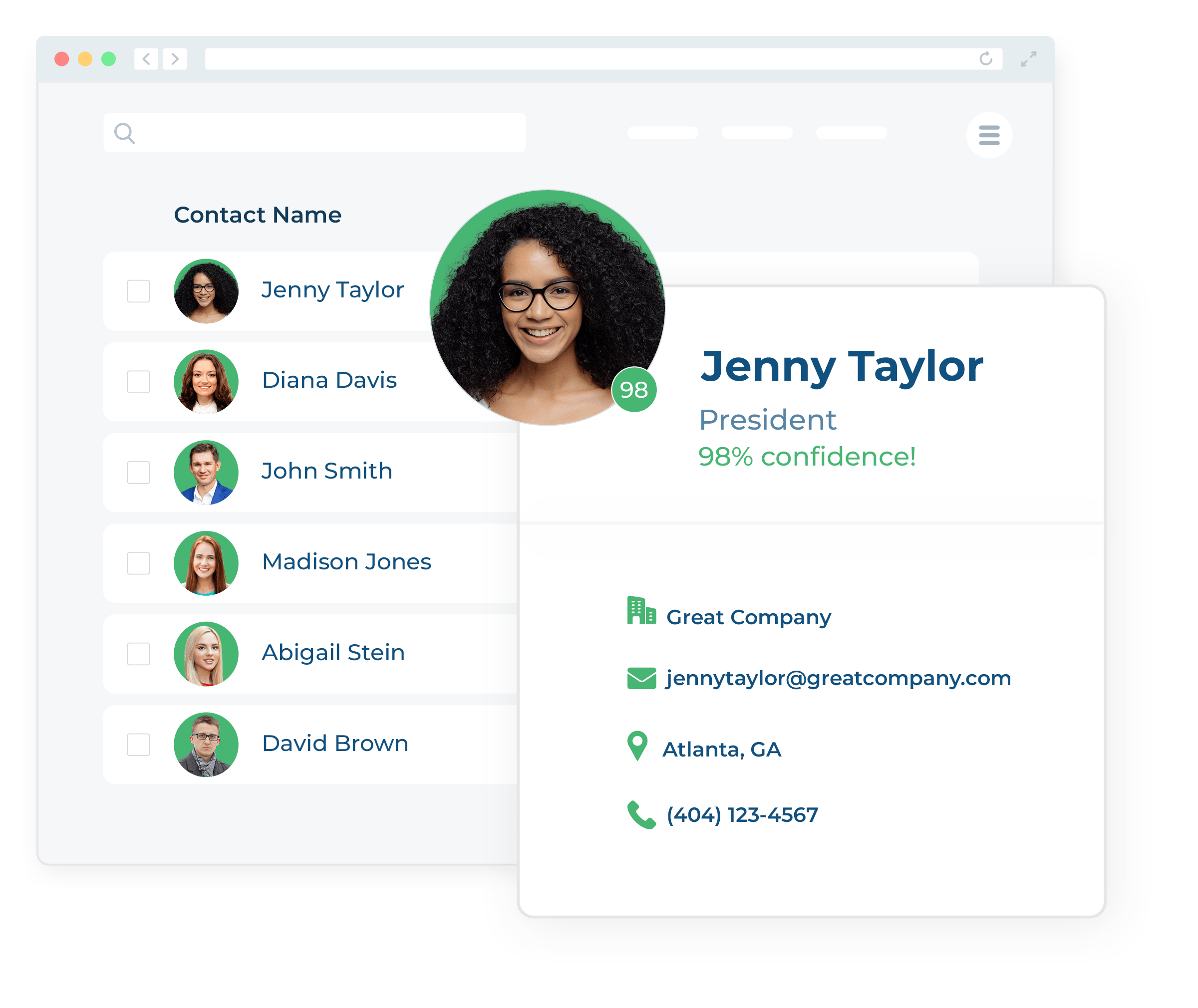

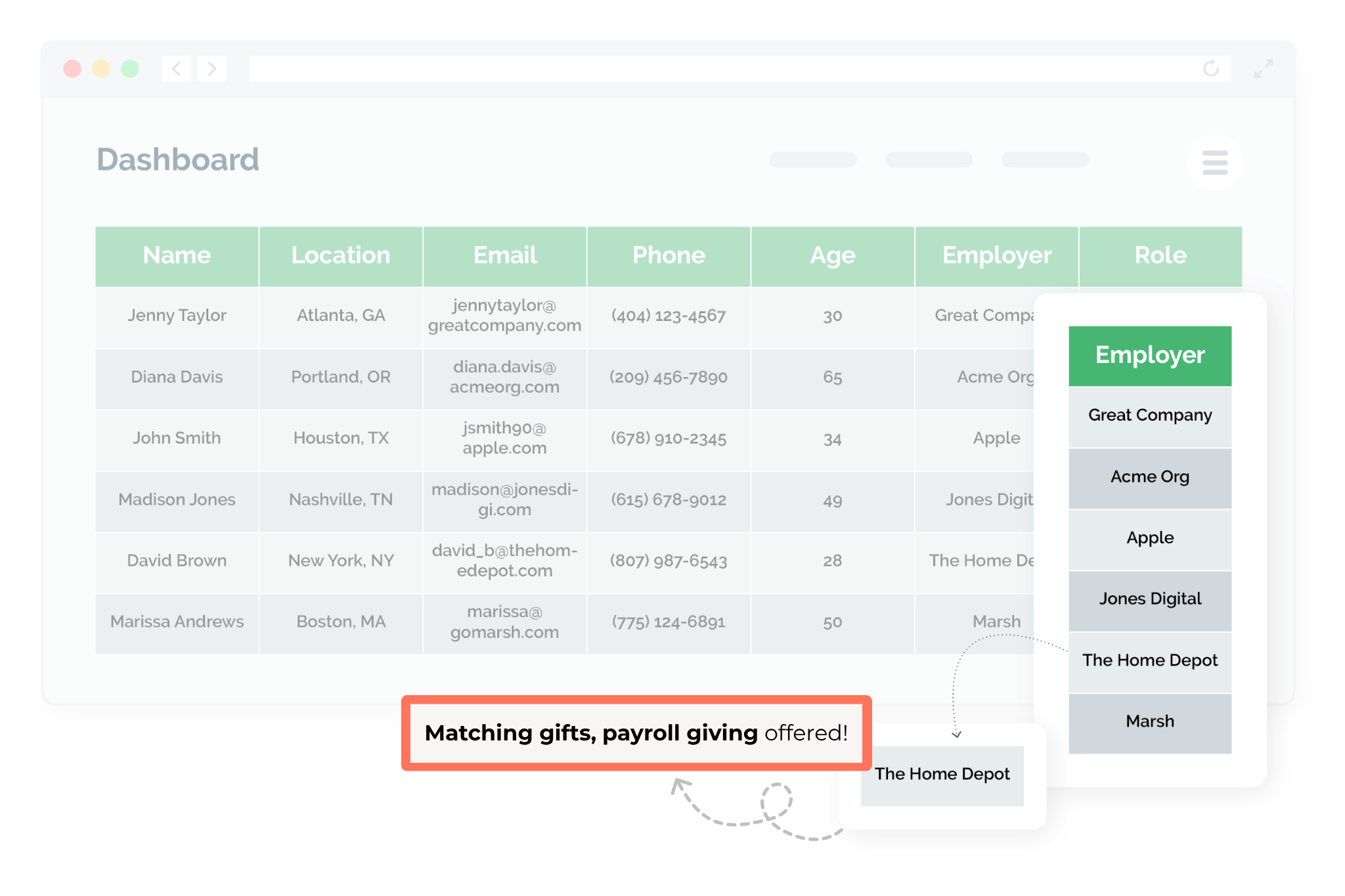

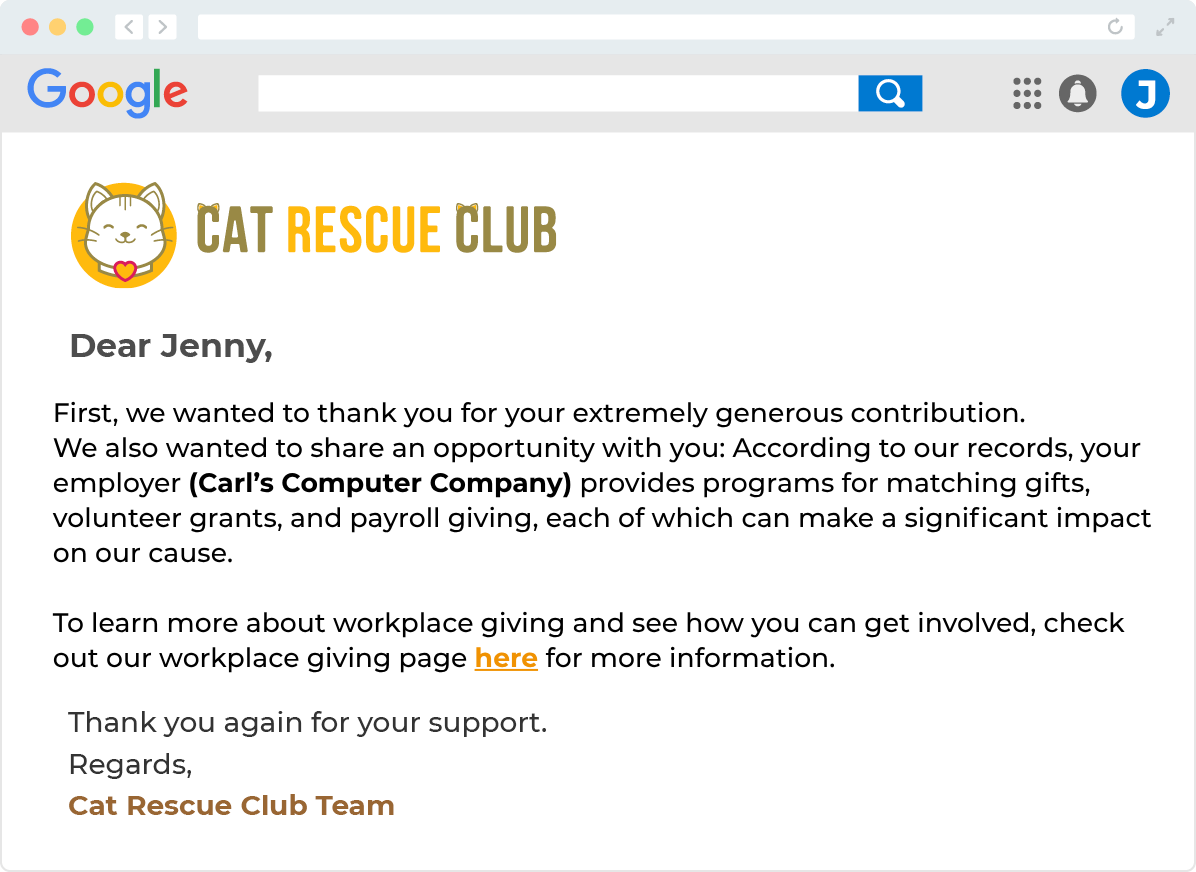

Tools designed for nonprofit fundraising can help shelters uncover company donation programs that align with their mission, provide direct application links, and clarify eligibility criteria. For example, one of the top solutions in this space is Double the Donation’s corporate giving program database. This comprehensive resource includes thousands of verified corporate giving programs, covering in-kind donations, grants, and workplace giving opportunities. By using this platform, animal shelters can quickly identify companies that offer relevant support and access detailed information to guide their outreach.

Wrapping Up & Additional Resources

Securing in-kind donations is a powerful way for animal shelters to enhance their capacity to care for animals and operate efficiently. By understanding the types of donations that are most valuable, identifying the right corporate partners, and making thoughtful, personalized asks, shelters can build sustainable support networks that amplify their mission.

Using tools like Double the Donation’s corporate giving database can simplify the research and outreach process, helping shelters connect with companies ready to provide meaningful in-kind support. Taking these first steps (assessing your needs, researching donors, and leveraging technology) can transform an animal shelter’s fundraising strategy and ultimately improve outcomes for the animals they serve.

Unlock More Support with Double the Donation

Corporate sponsorships and in-kind donations are critical to the success of nonprofit events and programs, but sourcing the right partners can be time-consuming and overwhelming. Luckily, Double the Donation streamlines the entire process, helping your team find, secure, and manage corporate support with ease.

With our industry-leading corporate giving database, you can quickly identify companies that offer financial sponsorships, in-kind donations, and corporate grants, giving you a data-driven edge in building meaningful partnerships. Whether you’re planning a gala, community fundraiser, or shelter initiative, Double the Donation makes it simple to source high-value in-kind donations so you can focus on what matters most: delivering impact.

Raise more with corporate grants and in-kind gifts; get a demo today!