Is an Employer Append Right for Your Nonprofit? How to Know

If your donor database is missing key employment information, you might be wondering: Is an employer append right for your nonprofit?

Employer appends, or the process of enhancing donor records by filling in employment data, can unlock new opportunities for improved workplace giving efforts, deepened corporate partnerships, and better segmentation. But like any data investment, it’s important to weigh the benefits against your organization’s readiness and goals.

In this post, we’ll walk through the pros, cons, and key inquiries that can help you decide whether this strategy is a smart next step for your fundraising efforts.

Specifically, we invite you to ask yourself (or your team) the following questions:

- Do you receive a high volume of individual gifts?

- Are you missing employment information in your database?

- Does your organization have many volunteers?

- Is your team ready to prioritize workplace giving?

- Do you have the right tools in place to support your efforts?

If you answered “yes” to most (or all) of the above, an employer append might be a strategic next step. Now, let’s take a deeper dive into each key question.

Do you receive a high volume of individual gifts?

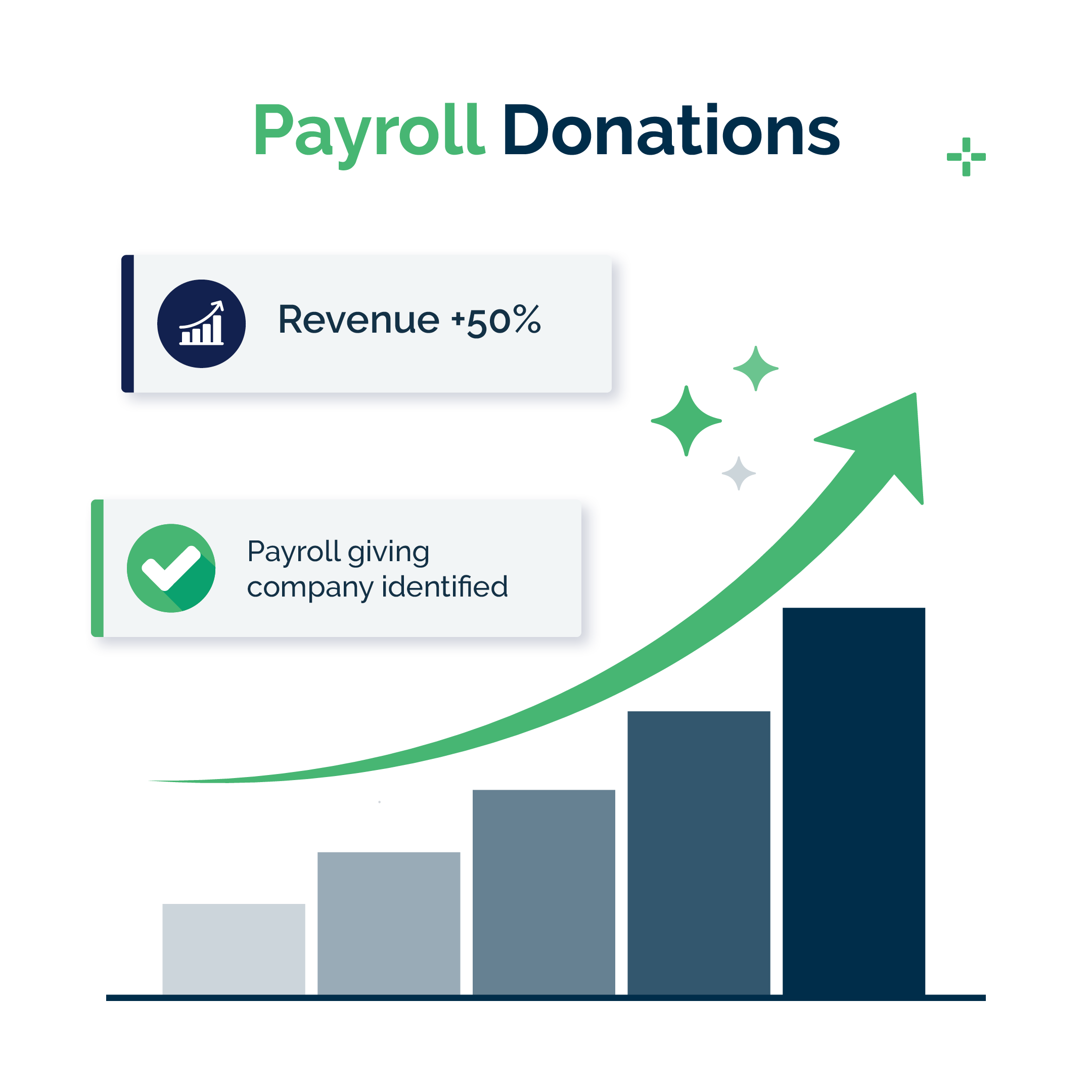

YES: One of the clearest indicators that an employer append might be a wise investment is the volume of individual donations your organization receives. If a significant portion of your fundraising comes from individual donors—especially in the form of small to mid-sized gifts—you likely have untapped potential for employer matching and corporate engagement.

Why does volume matter? Because even if just 20–30% of your individual donors are eligible for matching gifts through their employers, that could represent thousands of dollars in additional revenue you’re currently missing.

NO: By contrast, if your funding is primarily made up of grants, major gifts, or government contracts, an employer append may not deliver the same return. In those cases, employment data may be less relevant to your core fundraising strategy.

So, if you’re regularly processing hundreds or thousands of individual gifts each year, it might be worth it to consider an append. In other words, the higher your individual donor volume, the stronger the case for appending employer data.

Are you missing employment information in your database?

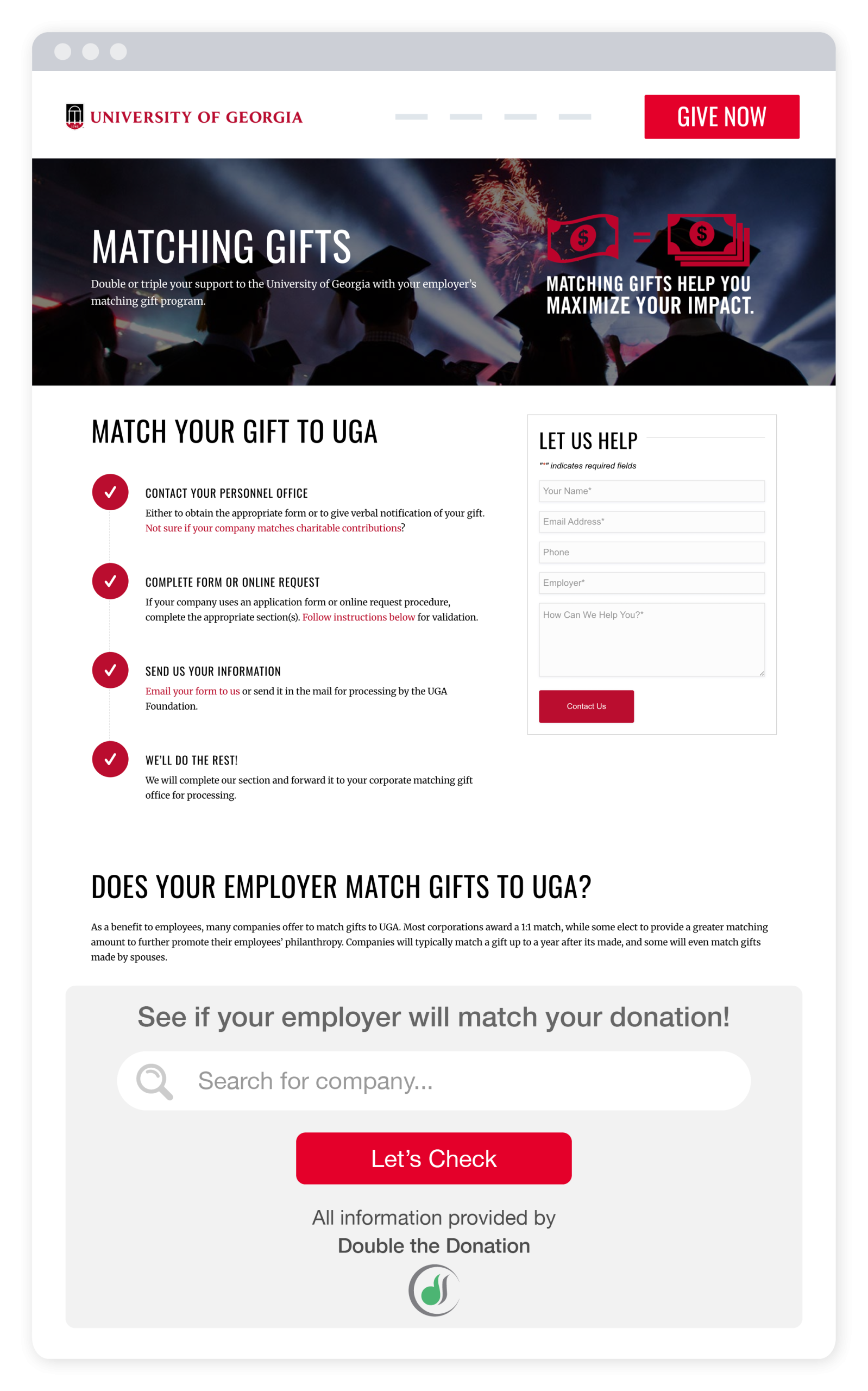

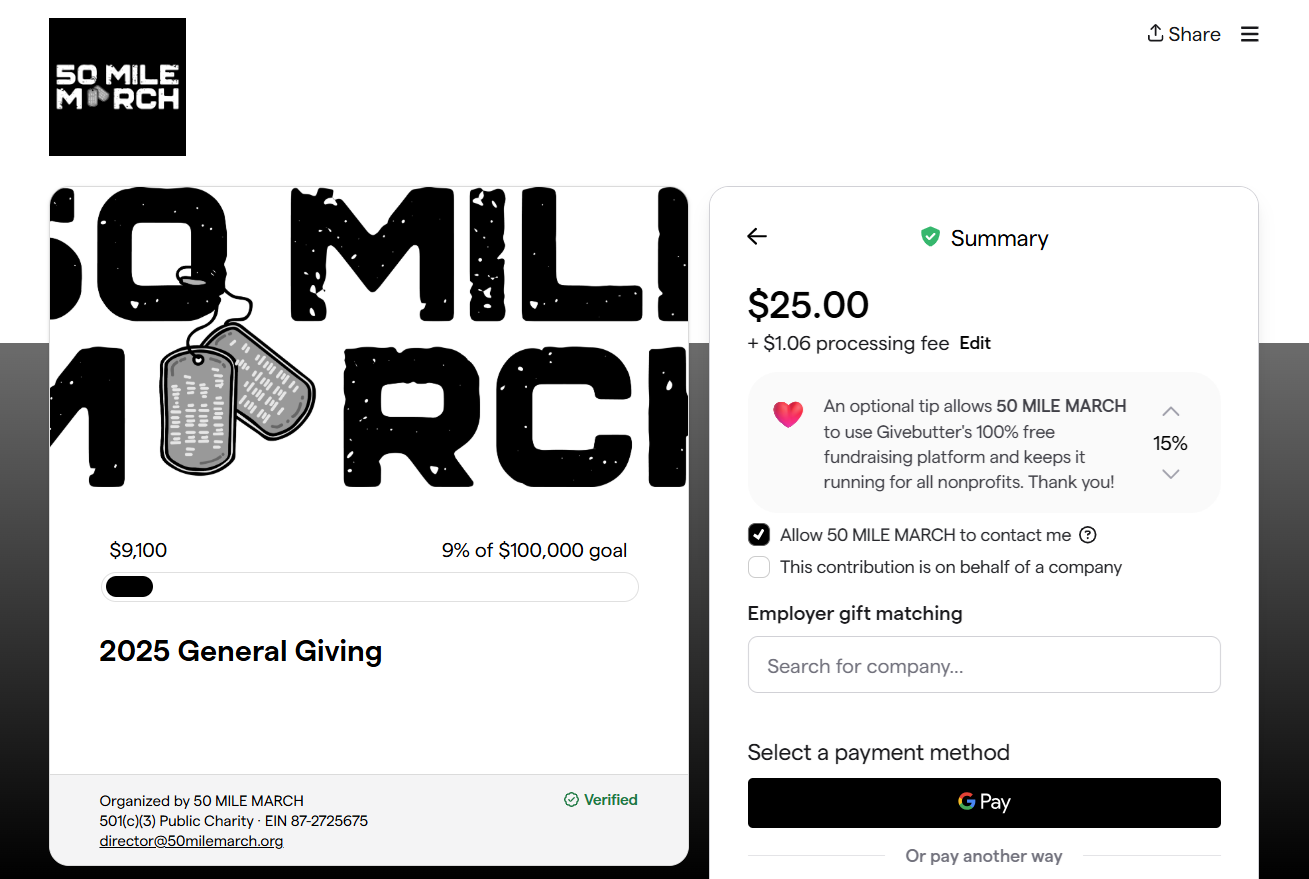

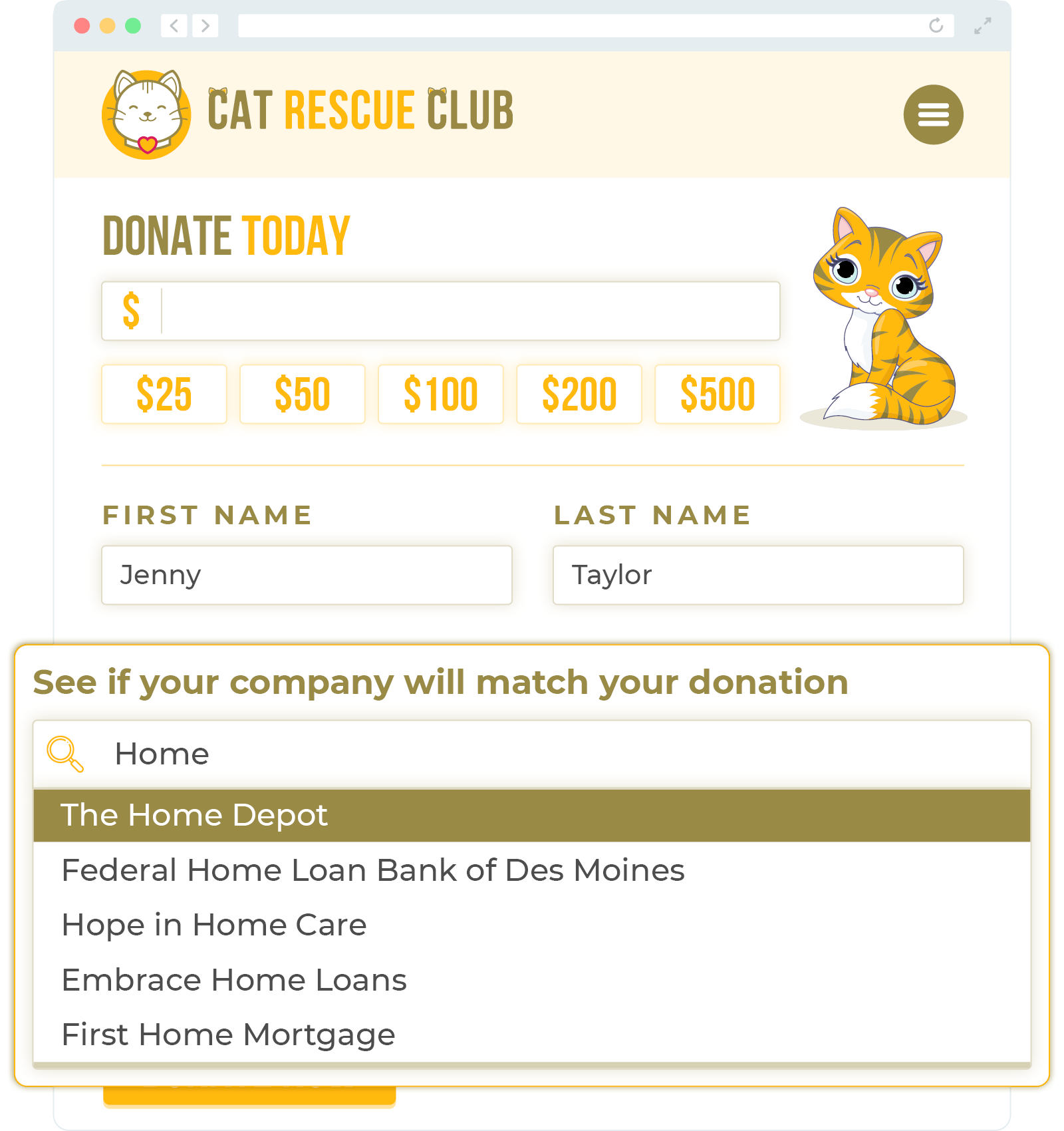

YES: Before you can take advantage of matching gifts or other workplace giving campaigns, you need one essential piece of data: where your donors work. If your CRM is filled with blank employer fields, that’s a clear sign that an employer append could be beneficial.

Appending employer data helps fill these gaps efficiently, especially for organizations with a large donor base and limited staff capacity. Even if only a portion of your records can be matched, it’s often enough to uncover significant corporate giving potential and segment communications more effectively.

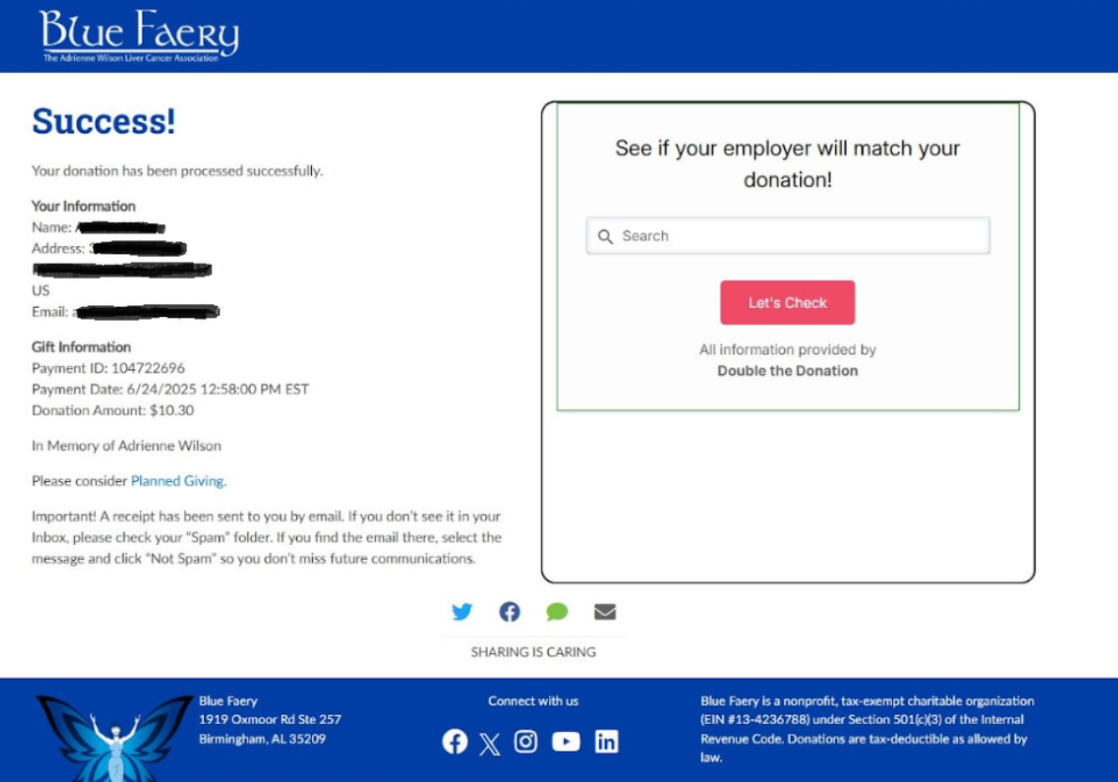

NO: On the other hand, perhaps you collect employer information consistently, whether through your donation forms, volunteer registrations, follow-up emails, or other supporter onboarding efforts. In that case, you may already have a strong foundation in place.

In other words, if the employer field in your database is mostly complete and kept up to date, an employer append may not deliver as much added value. If so, your resources might be better spent on activating the employer data you already have through targeted matching gift outreach or broader workplace giving campaigns.

Does your organization have many volunteers?

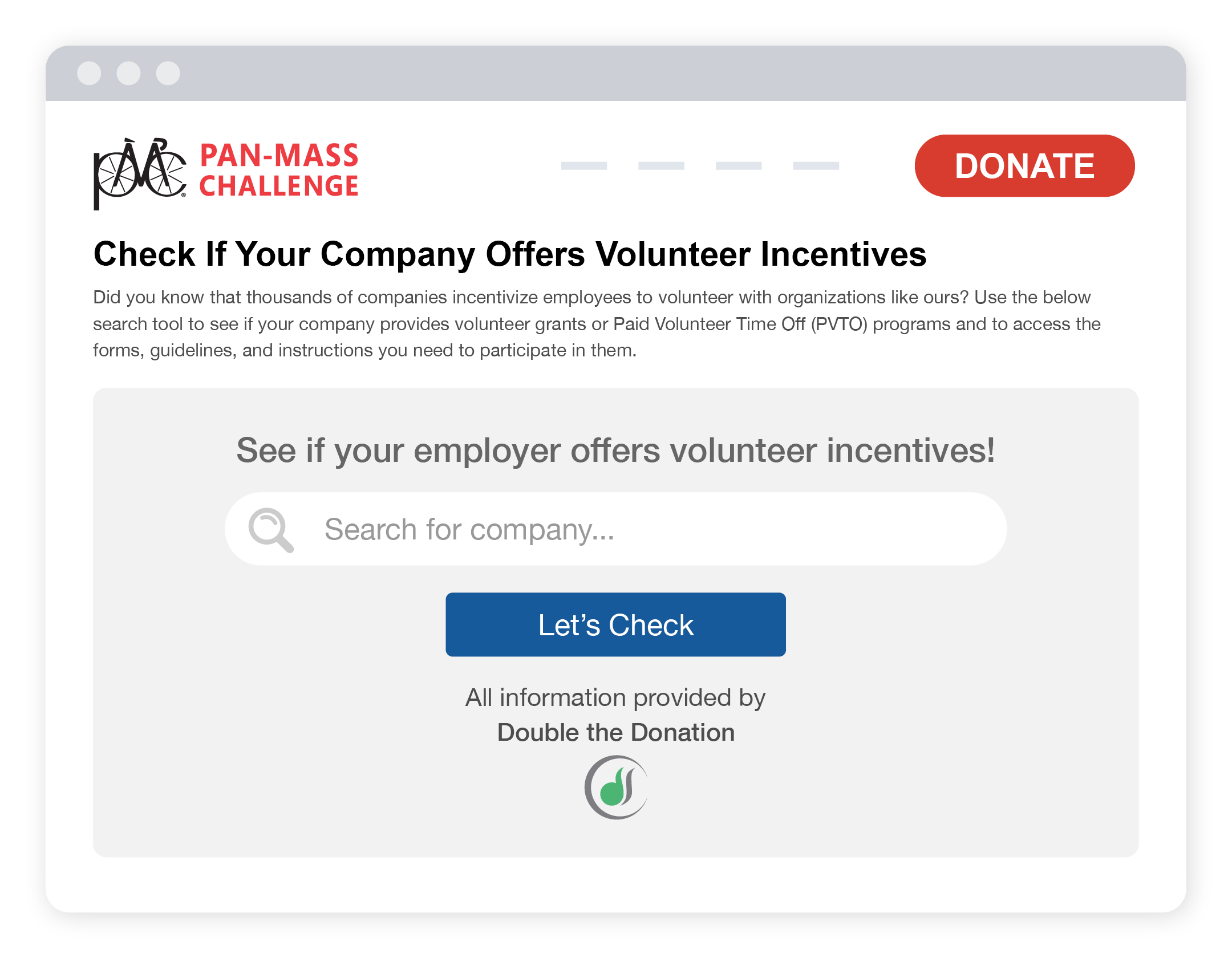

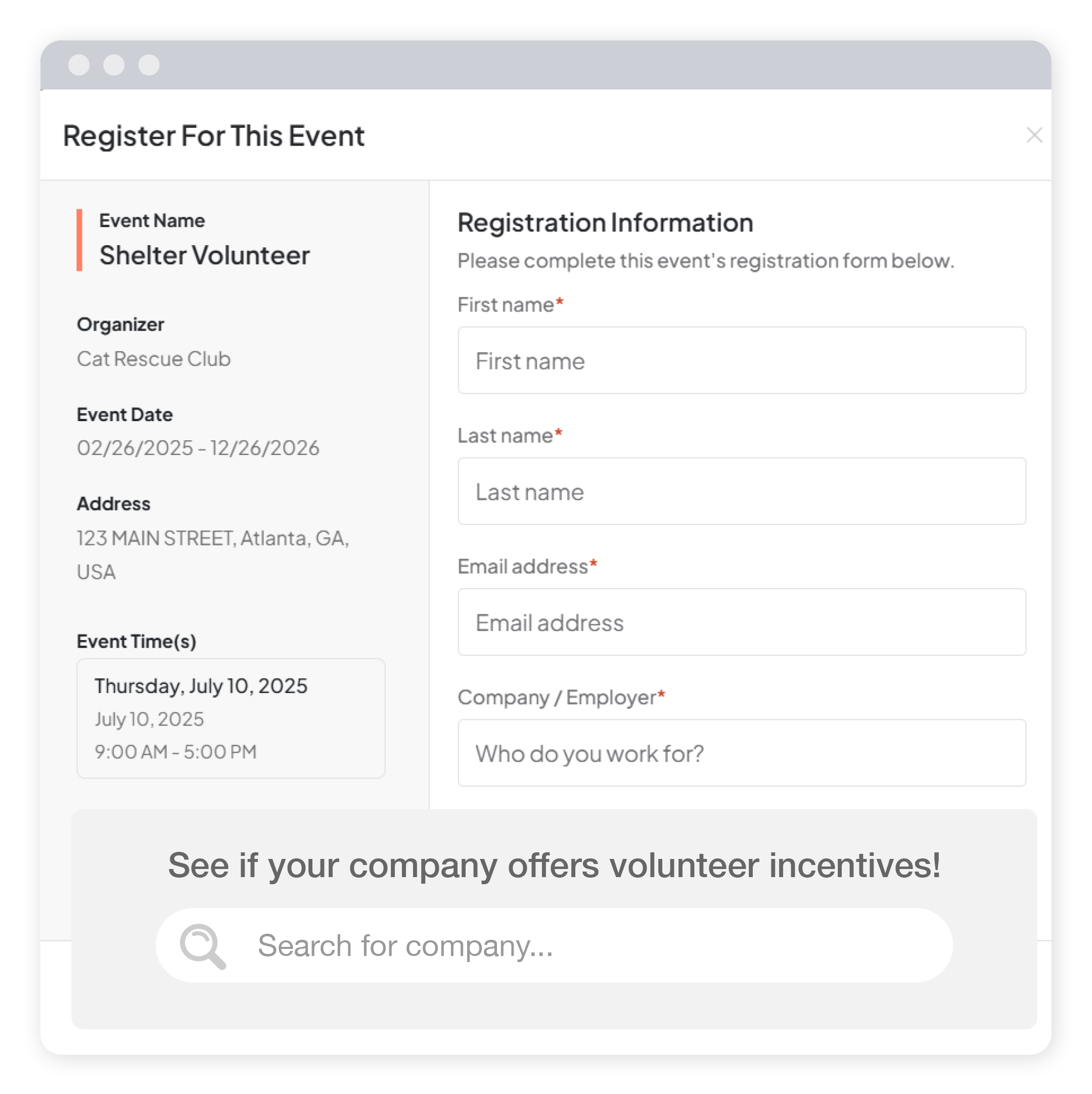

YES: Volunteers often give more than just their time—they can also open the door to valuable funding opportunities, especially if you know where they work. If your organization relies heavily on volunteer support but lacks employment information for those individuals, you could be missing out on corporate volunteer grants and Volunteer Time Off (VTO) programs.

After all, many companies offer financial donations in recognition of their employees’ volunteer hours. Others provide paid VTO, encouraging employees to give back during work hours at approved nonprofit partners. But you can’t take advantage of these programs if you don’t know where your volunteers are employed.

An employer append can help fill in those missing details. Plus, it allows you to follow up with volunteers about corporate giving opportunities tied to their time. Even if only a portion of volunteers qualify, the combined value of grants and engagement can make a meaningful impact. If volunteers are a core part of your community, enhancing your data with employer information is a strategic next step.

NO: If your organization doesn’t rely heavily on volunteers—or volunteer engagement makes up a very small portion of your operations—then an employer append for volunteer records may not deliver significant value. In this case, your time and resources might be better spent optimizing donor data or focusing on other segments of your supporter base, such as recurring givers or event participants.

However, if volunteer involvement grows, revisiting this opportunity could unlock new sources of funding and corporate engagement in the future.

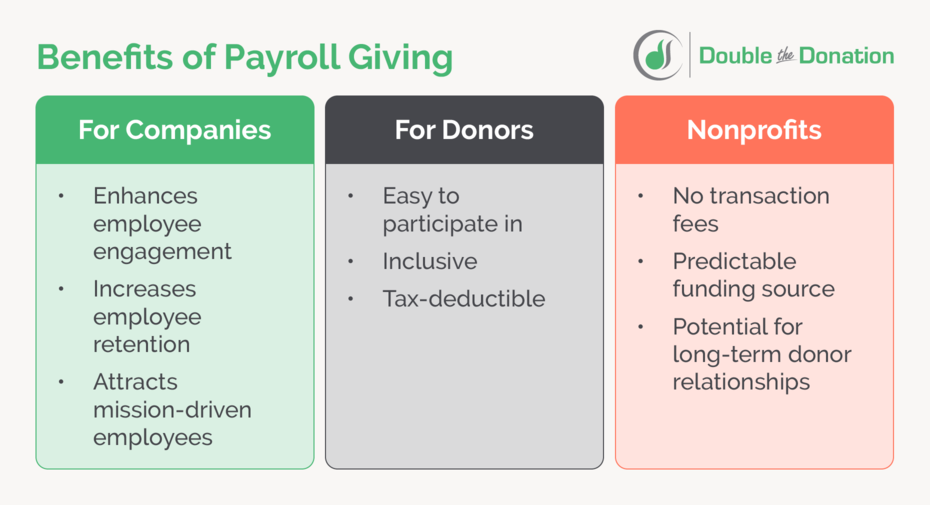

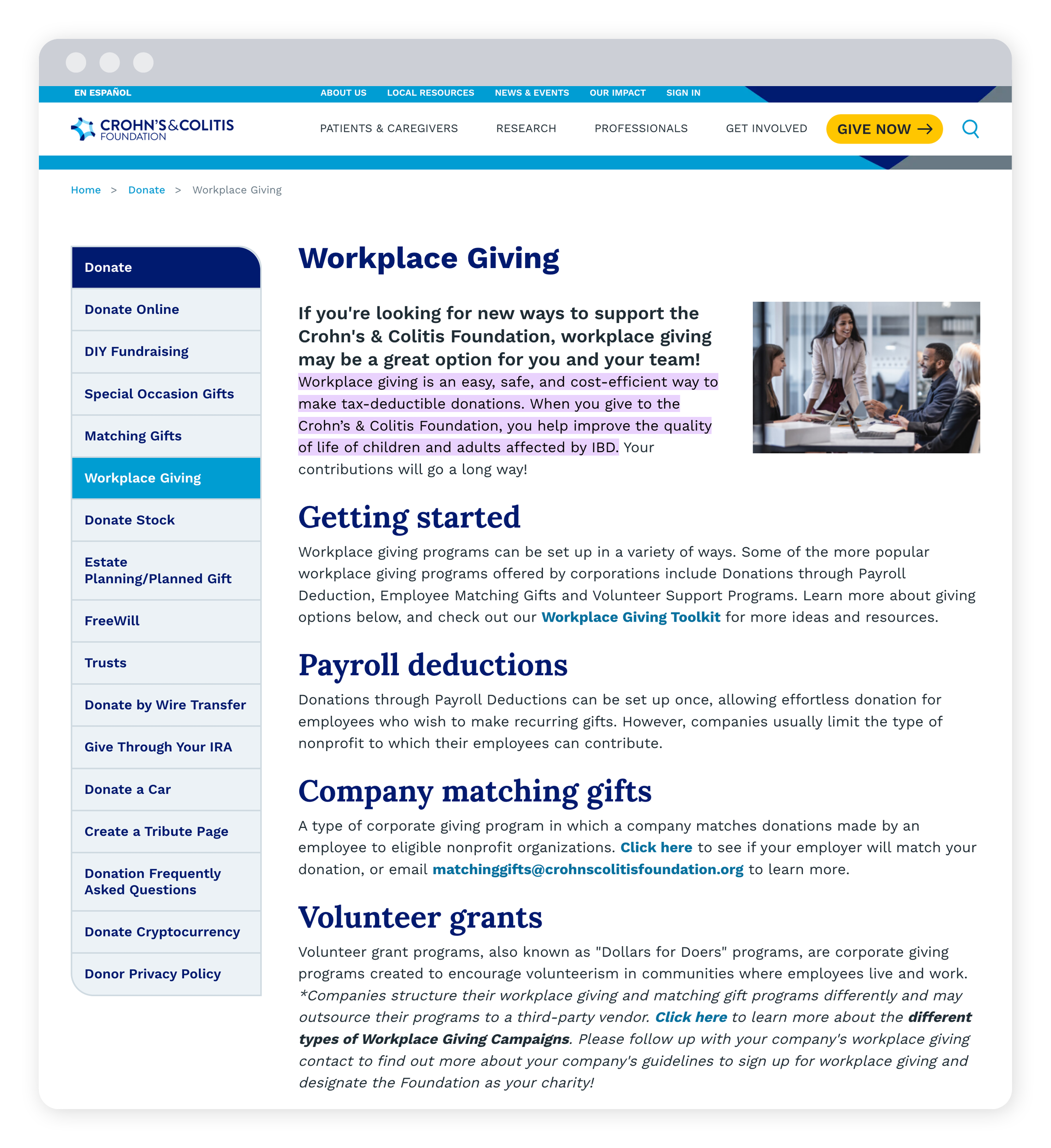

Is your team ready to prioritize workplace giving?

YES: If your team already sees workplace giving as a strategic priority, an employer append can significantly enhance your efforts. However, adding employment data to your records is only valuable if your team has the resources to act on it. That means following up on workplace giving opportunities, running targeted campaigns, and having someone focused on corporate outreach or stewardship.

When workplace giving is embraced organization-wide, you unlock greater ROI and longer-lasting corporate partnerships. If your team is aligned, resourced, and ready to collaborate around workplace giving, an employer append can serve as the catalyst for smarter outreach and greater impact.

NO: If workplace giving hasn’t yet become a focus—or your team lacks the time, tech, or clarity to act on employer data—it may be worth holding off on an employer append until you’re better prepared. Without a clear plan to integrate employment data into your campaigns, stewardship efforts, or corporate outreach, the data may go unused and offer limited returns on your investment.

Instead, consider starting small. Develop a workplace giving strategy, assign ownership of workplace giving-related tasks, and ensure your team is equipped with program knowledge. Once you’re aligned on prioritizing workplace giving, you’ll be in a stronger position to turn employer data into meaningful results. At that point, an employer append can be a high-impact next step.

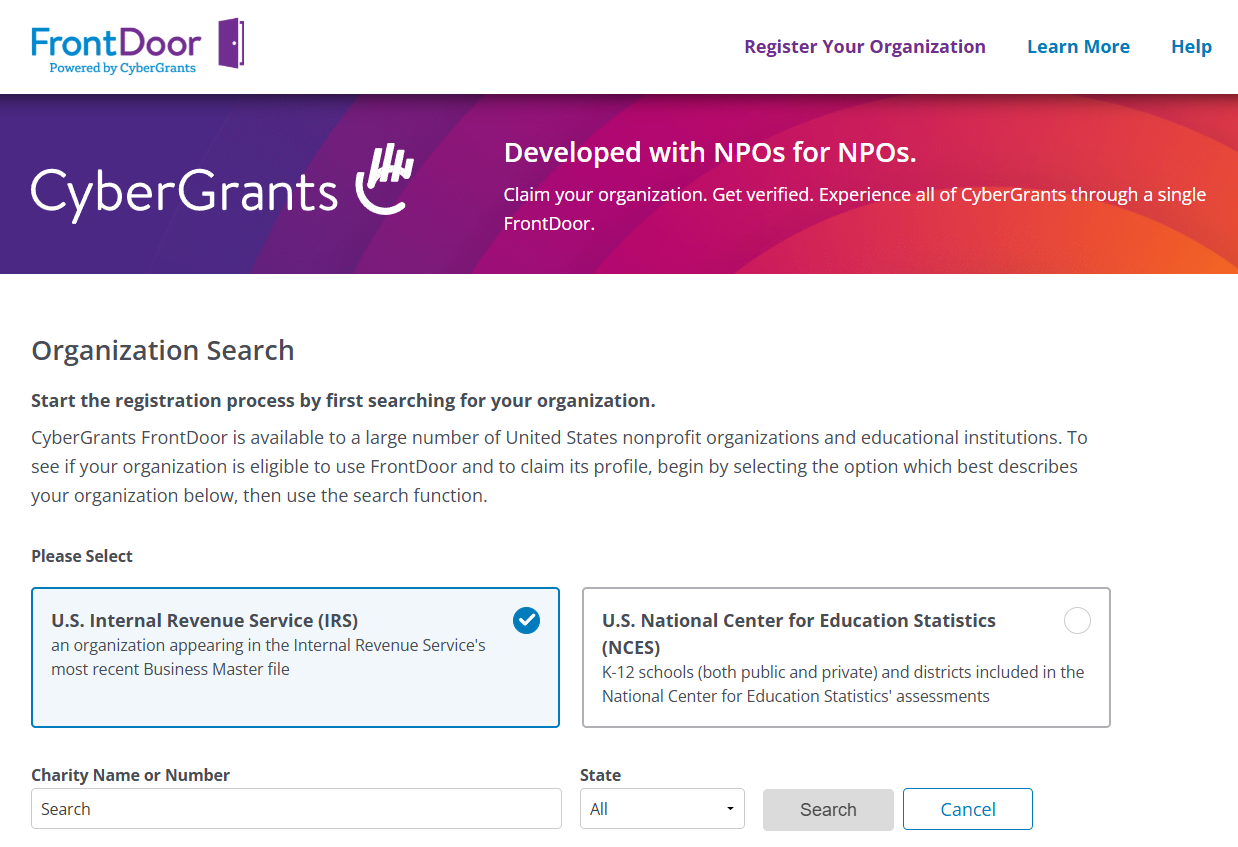

Do you have the right tools in place to support your efforts?

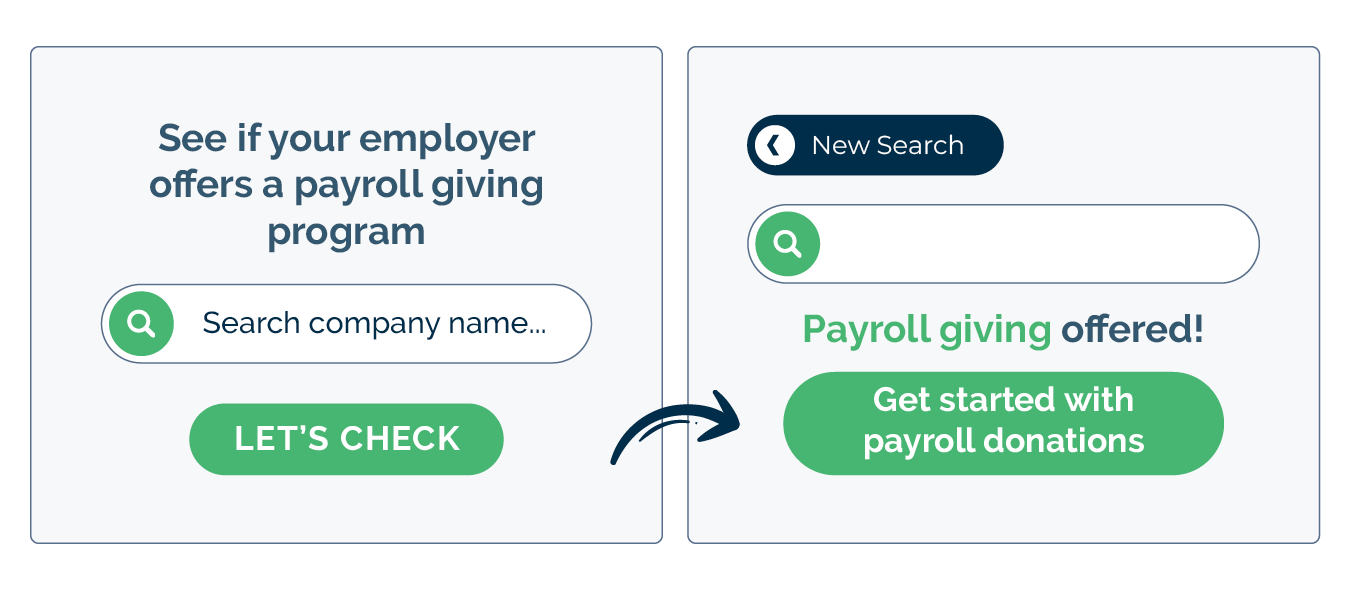

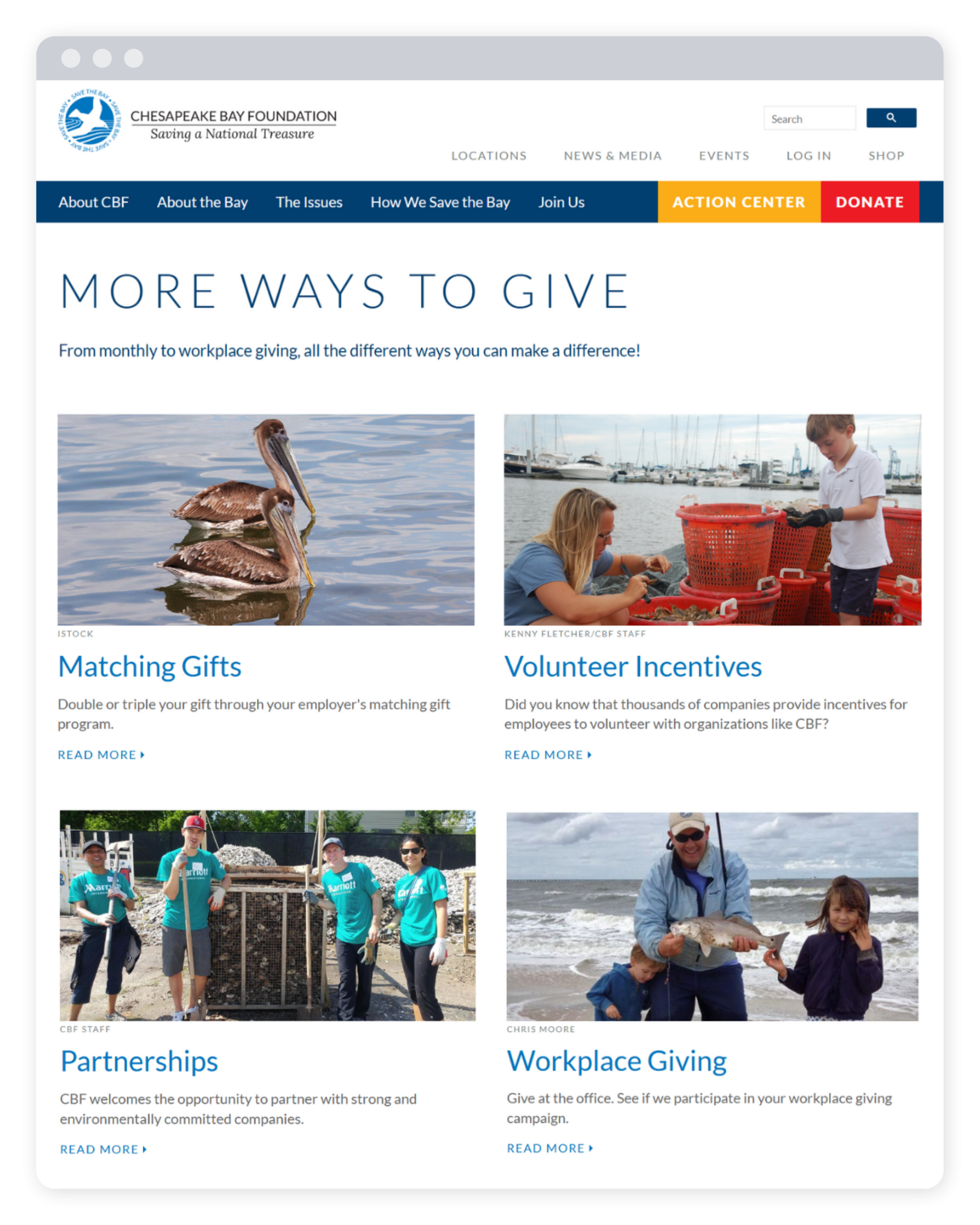

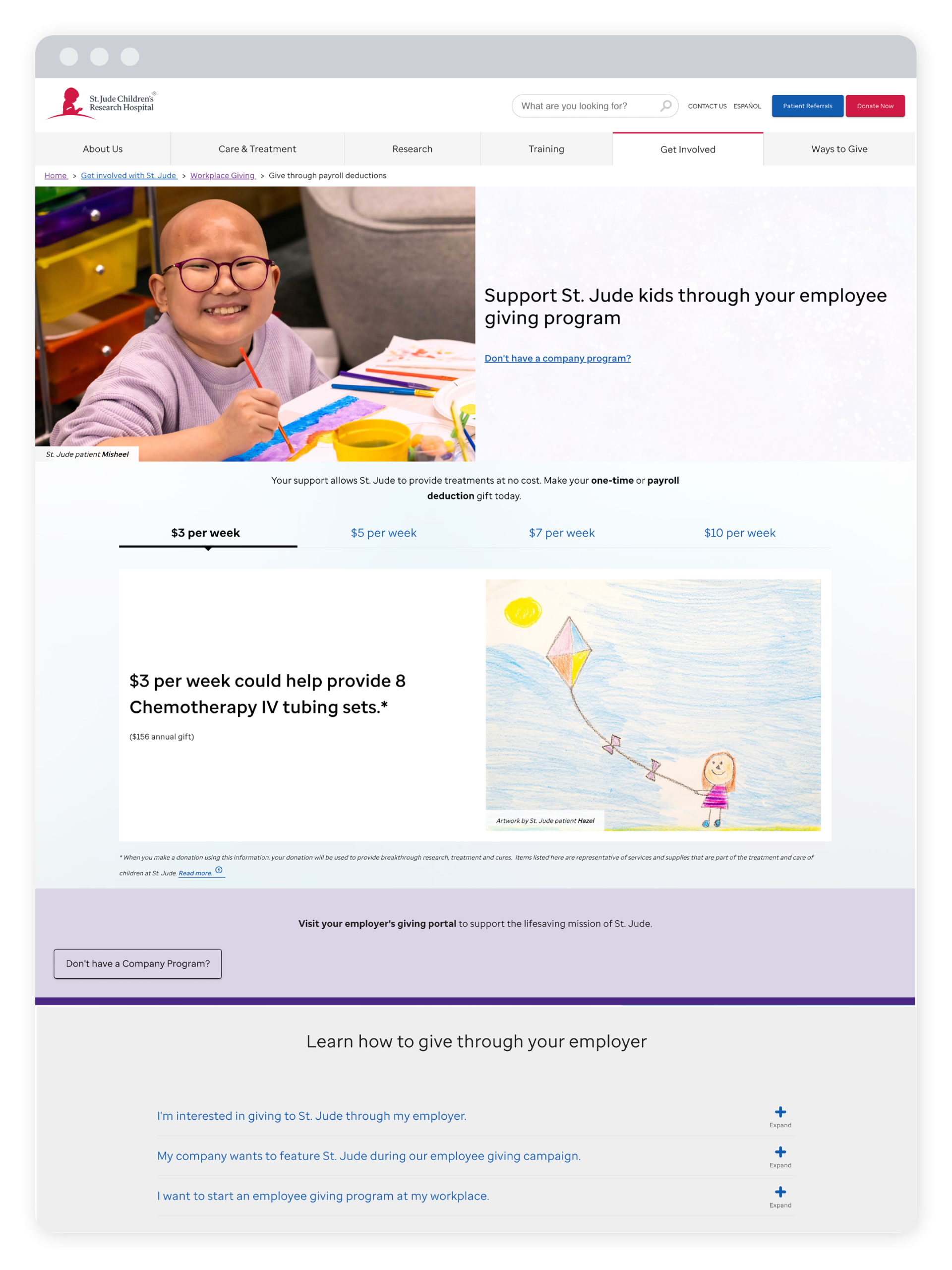

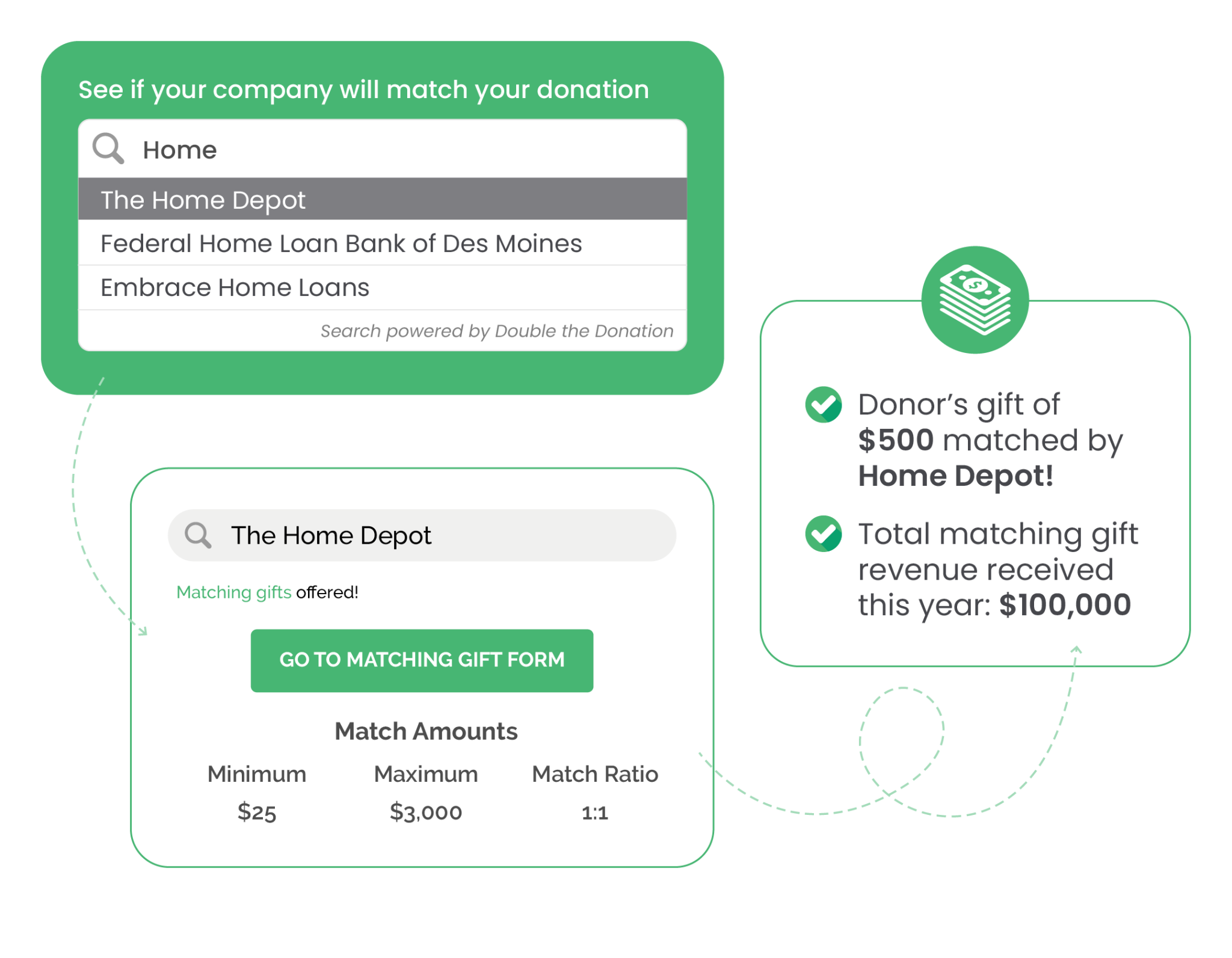

YES: If your organization already has strong tech infrastructure, like a modern CRM, mobile-friendly donation forms, and a workplace giving automation platform, you’re in a great position to act on the insights gained from an employer append. These tools allow you to leverage employer data, uncover employee giving eligibility, and send targeted follow-ups based on employment data.

Beyond basic functionality, think about how your tools help connect supporters to their next steps. Can donors see if their company will match a gift as soon as they donate? (I.e., is your matching gift tool connected to your giving forms?) Do volunteers have a clear path to request a volunteer grant or engage their employer? (Is your corporate volunteering solution integrated with your VMS?)

If your systems support those experiences, you’re well-positioned to maximize the value of appended data and drive meaningful action.

NO: If your organization is still working with outdated systems, manual spreadsheets, or donation forms that don’t support employer-related functionality, an employer append might not yield strong results—at least not yet.

Without the right tools to store, track, and act on employment data, much of that insight may go unused. In this case, focus first on upgrading your tech stack. Prioritize a donor management system that allows for custom fields and segmentation. Plus, explore integrations that support matching gifts and workplace giving platforms.

When your tools are ready to handle and act on employer data, you’ll be able to extract real value from an append, boosting engagement, unlocking corporate funding, and streamlining supporter journeys.

Wrapping up & additional employer append resources

Employer appends are a powerful tool for nonprofits looking to deepen donor insights and tap into underutilized corporate giving opportunities. But they aren’t a one-size-fits-all solution. Evaluate your data quality, fundraising strategy, and capacity to act on new information and make a clear, informed decision about whether it’s the right fit.

If you’ve answered “yes” to many of the readiness questions shared above, your organization may be well-positioned to benefit from this next-level data enhancement.

Interested in learning more about employer appends and how your organization can benefit from them? Check out the additional recommended resources below:

- The Ultimate Guide to Employer Appends for Fundraisers. Everything you need to know about employer appends. This guide covers how they work and how they boost matching gifts, corporate outreach, and donor segmentation.

- Avoid These 5 Employer Appending Mistakes Nonprofits Make. Learn the most common pitfalls nonprofits face when appending employer data. Plus, see how to avoid costly missteps that could hurt your results.

- Best Employer Append Providers for Growing Workplace Giving. Explore top-rated employer append services to find the right partner for your needs. Access insights on pricing, features, and integration options.

![Why and How to Reach Out to Payroll Giving Donors [A Guide]](https://doublethedonation.com/wp-content/uploads/2025/06/DTD_Why-and-How-to-Reach-Out-to-Payroll-Giving-Donors-A-Guide_Feature-1536x576.png)