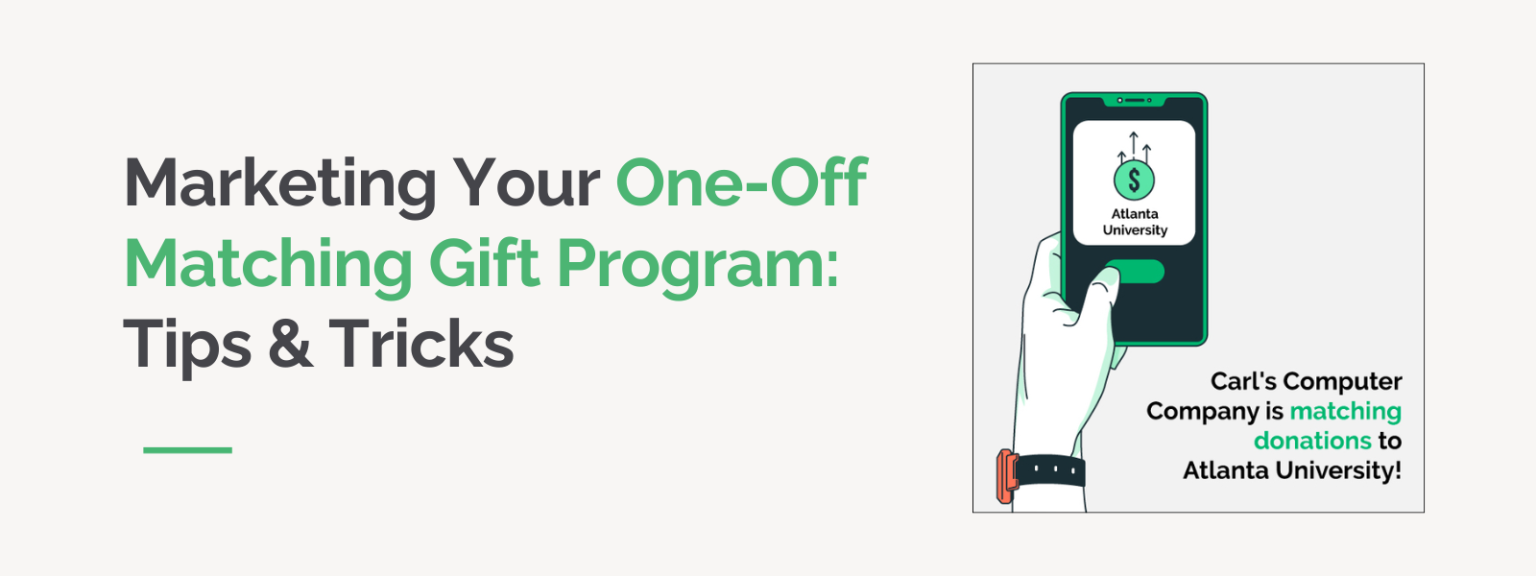

Marketing Your One-Off Matching Gift Program: Tips & Tricks

Custom or exclusive matching gift partnerships are powerful fundraising opportunities—but only if your target audience knows about them. The solution? Marketing your organization’s one-off matching gift program well.

To make the most of the campaign, you’ll need a thoughtful strategy that reaches the right people at the right time with the right message.

In this post, we’ll break down tips and tricks to help your nonprofit successfully market your one-off matching gift program, boost donor participation, and build long-term value from short-term opportunities.

Let’s get started!

The Basics: What is a one-off matching gift program?

A one-off matching gift program is a customized partnership between a company and a specific nonprofit. Unlike ongoing corporate matching gift programs that apply broadly to employee donations made to any eligible nonprofit, one-off matches are tailored to support a single organization, typically for a limited time or tied to a specific campaign or event.

In this type of program, the company agrees to match employee donations exclusively to the selected nonprofit, often at a 1:1 ratio or higher. The timeframe can vary—it might be a single giving day, a multi-week campaign, or a long-term engagement.

These programs can be incredibly effective because they create a sense of urgency and focused support, while also generating excitement and engagement among employees. For nonprofits, they offer a unique opportunity to deepen a relationship with a corporate partner, raise more funds quickly, and increase visibility among the company’s workforce.

Why does marketing your one-off matching gift program matter?

Marketing your one-off matching gift program is essential because even the most generous offer won’t make an impact if no one knows it exists. These programs are often time-bound and specific, which means you have a narrow window to engage donors and maximize participation. Without strategic promotion, you risk leaving matching dollars on the table.

When you market a one-off matching gift effectively, however, you can:

Drive Immediate Action

One-off matches create shared purpose. A well-communicated match can motivate donors to give now rather than later, knowing their contribution will go twice as far.

Increase Total Revenue

Studies consistently show that donors are more likely to give—and to give more—when they know their gift will be matched. Marketing your program broadly helps you boost donation volume and average gift size during the campaign period.

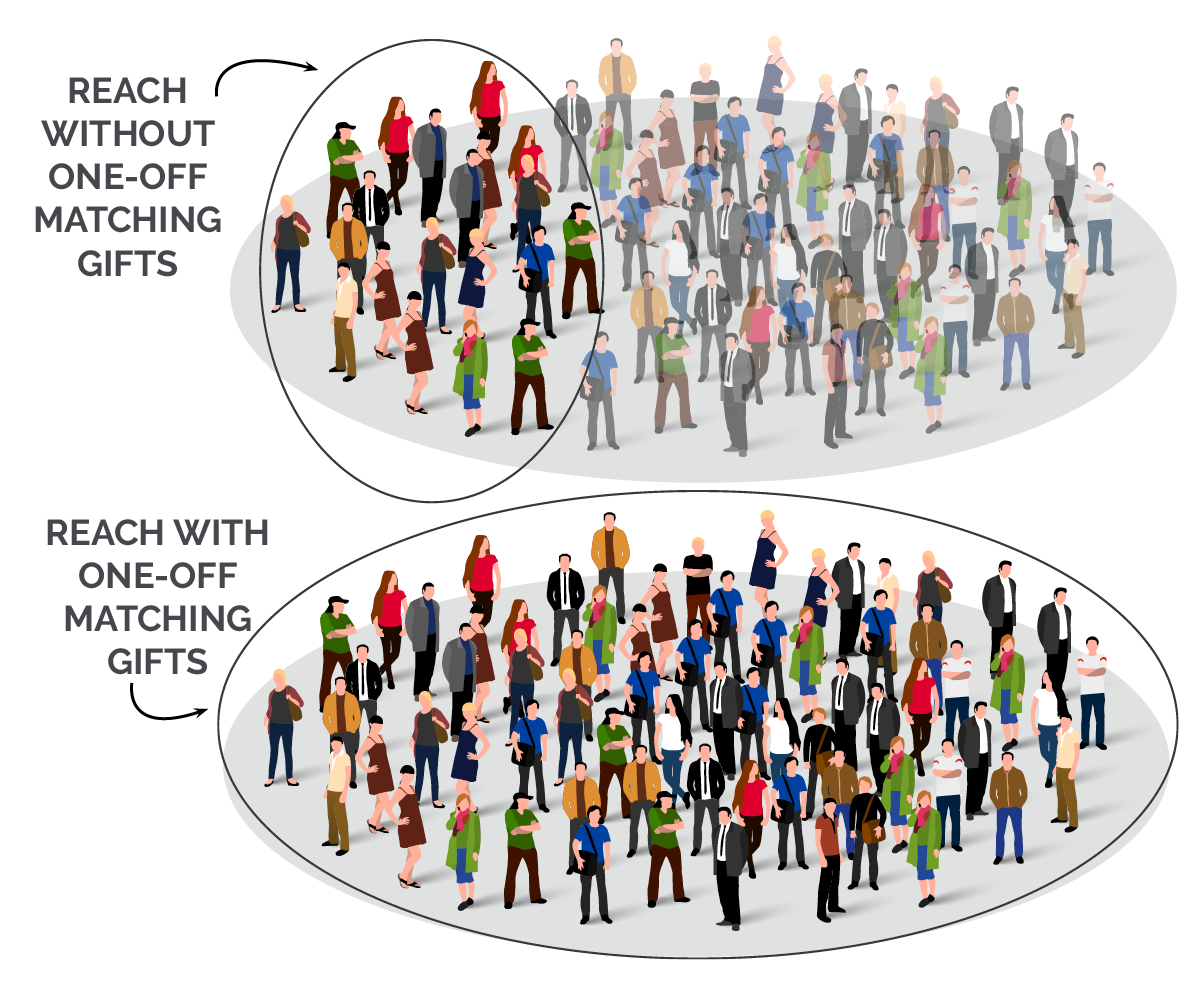

Expand Visibility and Awareness

By thoroughly promoting the match, you not only increase donations but also raise awareness of your nonprofit’s partnership within the company. This strengthens your brand, highlights corporate support, and may even attract future opportunities. Plus, it gives you a chance to form relationships with individuals that can last beyond the dedicated partnership, too.

Deepen Donor Engagement

A one-off match can be a great moment to reconnect with lapsed donors or encourage new supporters to give for the first time. Promoting the opportunity gives you a compelling reason to reach out and spark engagement with clear, impact-driven messaging.

Ultimately, a strong marketing push ensures your one-off matching gift program lives up to its full potential, benefiting your organization, your supporters, and your corporate partner.

Marketing Tip #1: Create a dedicated landing page on your website.

One of the most effective ways to market your one-off matching gift program is to build a dedicated landing page on your nonprofit’s website. This page will serve as a central hub for all information related to the matching gift opportunity, making it easy for donors to understand the program and take action.

Here’s why it works:

Clear, Focused Messaging

A standalone page allows you to focus entirely on the details of the one-off match—who is matching, how long the program runs, which gifts are eligible, and how donors can participate. This keeps your messaging consistent and avoids confusion.

Increased Visibility in Campaigns

Be sure to link to the landing page in all related marketing materials, including emails, social posts, and blog content. This helps drive traffic to a single, reliable source of truth, and it gives your campaign a professional, cohesive feel.

Highlight Your Corporate Partner

Use the page to highlight your business partner, emphasizing their dedication to philanthropy and community engagement. Include their logo, a quote from a company representative, or a thank-you message to show appreciation.

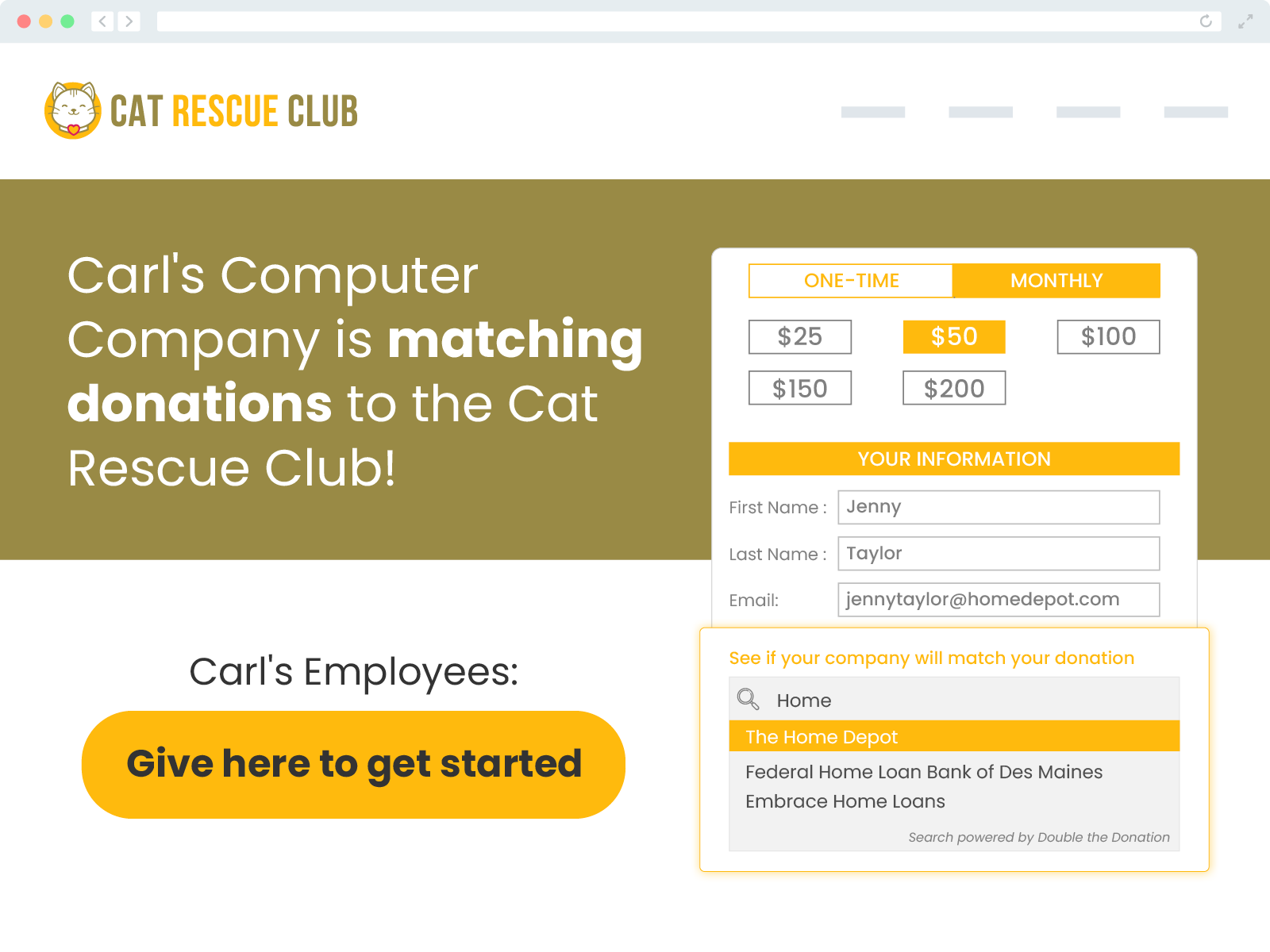

Capture More Matches

You can also include helpful tools, such as donation forms, FAQs, and direct links to corporate giving portals, if applicable. If your organization uses Double the Donation’s tools, this is a great place to embed your matching gift search widget to help donors check their eligibility—by adding the program to your database specifically.

By dedicating a space on your website to promote your one-off match, you boost engagement, streamline the donor experience, and demonstrate the value of your partnership.

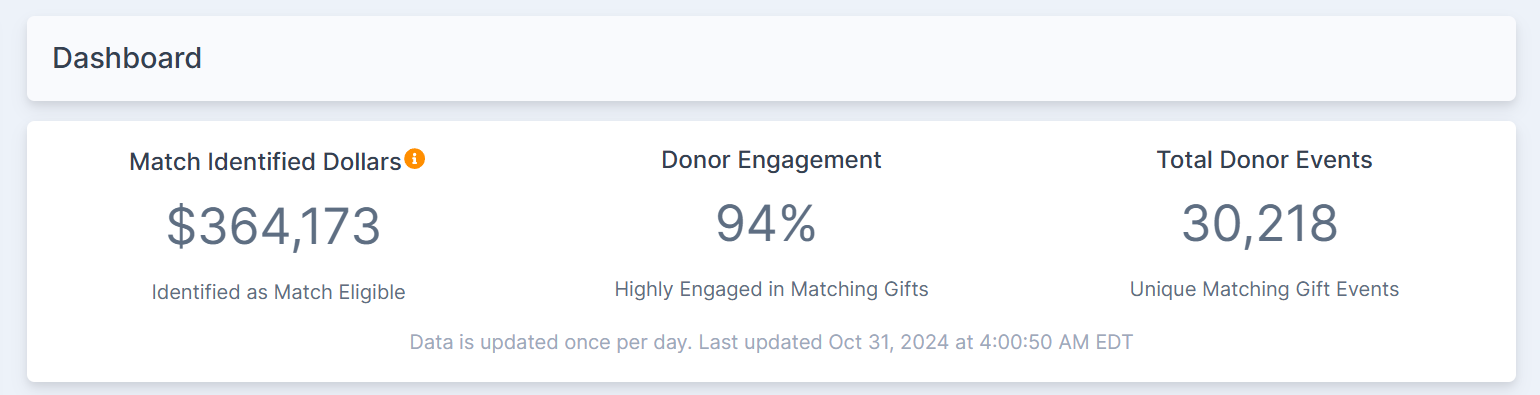

Marketing Tip #2: Add the matching gift program to your Double the Donation database.

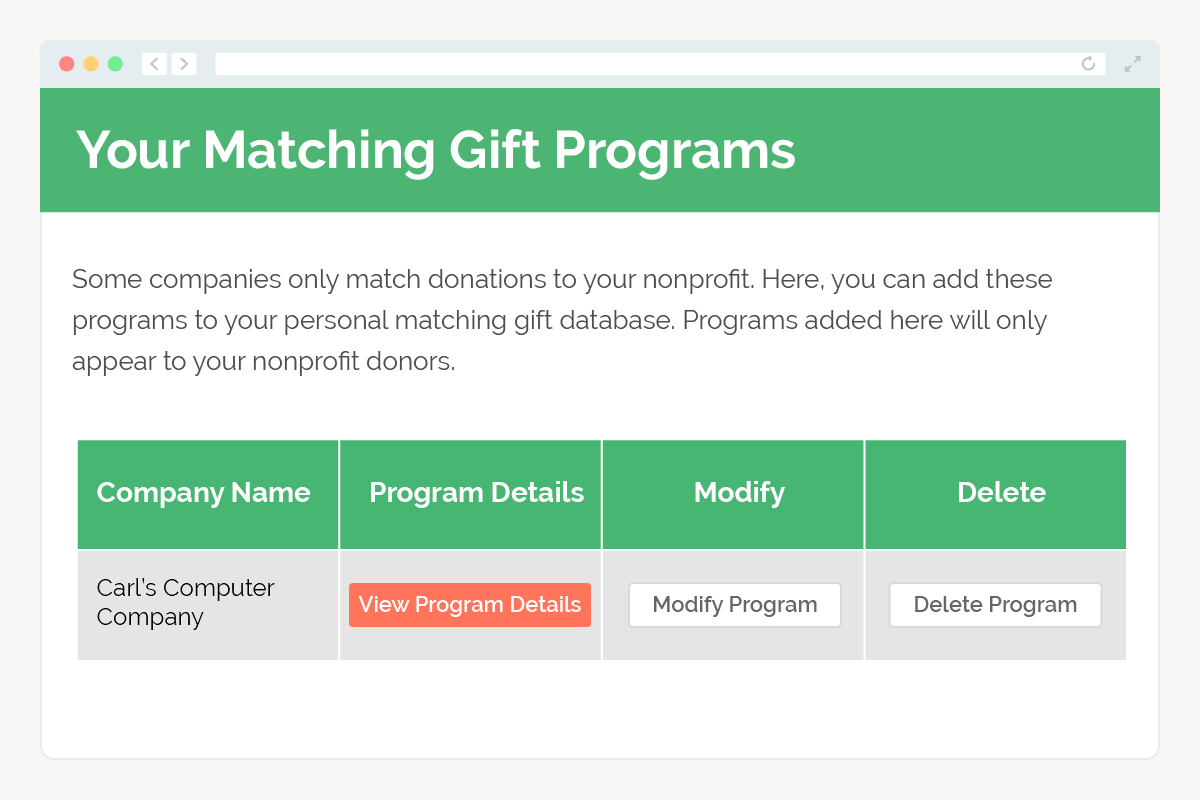

If your organization is partnering with a company on a one-off matching gift program, one of the most strategic moves you can make is to add the program to your Double the Donation search tool.

Here’s why this step is so valuable:

Surface the Match at the Right Moment

Double the Donation’s tools are integrated directly into many nonprofits’ donation forms and confirmation pages. When a donor identifies their employer, the system will instantly show whether a matching gift is available—including, with its dedicated custom match functionality, one-off programs. That means donors working for your partner company will see the promotion when they’re most likely to act: right after making a gift.

Streamline Donor Access to Key Details

Your listing can include all the relevant information about the one-off program: including match ratio, deadline, eligibility guidelines, and submission instructions. This saves your donors from having to dig for details and reduces friction in the matching process.

Enable Matching Gift Auto-Submission

Speaking of the matching process, Double the Donation’s exclusive matching gift functionality includes the ability to enable auto-submission for one-off matches. This means that qualifying donors won’t have to complete a separate matching gift request form, but instead can trigger a match straight from your gift confirmation page with a few clicks.

By adding your one-off matching gift opportunity to the Double the Donation platform, you enhance your campaign’s reach and efficiency—ensuring more donors are informed, eligible matches are claimed, and your organization receives the full benefit of the partnership.

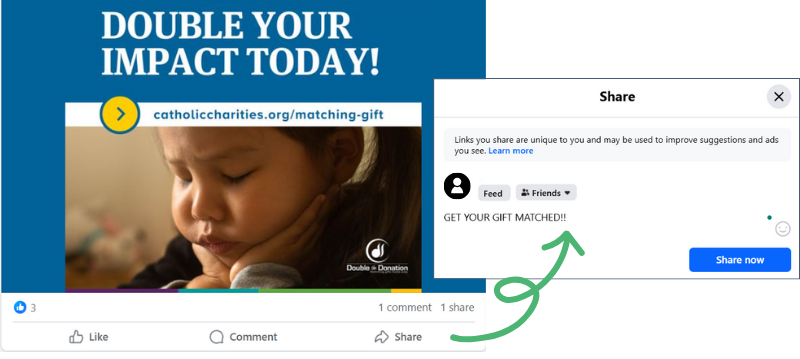

Marketing Tip #3: Post about your one-off matching gift program on social media.

Social media is one of the most effective and accessible tools for spreading the word about your one-off matching gift program. It allows you to reach a wide audience quickly, generate excitement, and encourage action from your followers—especially those employed by your corporate partner.

Here’s how to use social media strategically to promote your limited-time match:

Target the Right Audience

Focus your messaging on engaging both current supporters and employees of the partnering company. Be clear about who qualifies for the match and how long it’s available. Tag the sponsoring business (with their permission), use relevant hashtags, and consider boosting posts to reach your partner’s network more effectively.

Post Regularly With Timely Updates

A single post won’t be enough—create a content schedule that builds momentum over the course of the match. Start with an announcement, then share reminders, encouragements, and a final push before the deadline. Visuals like countdown graphics and short videos can help drive engagement, too.

Make It Easy to Share

Encourage your followers, staff, and corporate partner to reshare your posts. Provide suggested captions or graphics that make it simple for them to spread the word. When employees promote the program in their own circles, you’ll reach more colleagues who are eligible to give and get their donations matched.

Marketing Tip #4: Send a tailored fundraising appeal to the company’s employees.

One of the most effective ways to maximize participation in a one-off matching gift program is to connect directly with the employees of your corporate partner. A targeted, thoughtful fundraising appeal can drive awareness, boost engagement, and inspire action—all while making the most of the limited-time match opportunity.

Employees are more likely to give when they know their company is actively supporting the cause—and even more so when their donation will be doubled. A tailored appeal reinforces the partnership, communicates the impact of their gift, and makes the process of giving (and matching) as easy as possible.

When writing your appeal, be sure to:

- Personalize the message. Address employees directly and reference the partnership with their company by name.

- Clearly explain the match—how long it lasts, what types of donations qualify, and how to make their gift count.

- Share a story or example of the real impact their gift can have. Use emotion and specificity to bring your mission to life.

- Include easy next steps with a direct link to your donation form, instructions for requesting a match, and any relevant deadlines.

All in all, a targeted appeal shows employees that their support matters—and that now is the perfect time to make a difference. When done well, this outreach can significantly increase donations and ensure your one-off matching gift campaign reaches its full potential.

Marketing Tip #5: Provide resources for your corporate partner to distribute.

One of the simplest ways to amplify your one-off matching gift campaign is by equipping your corporate partner with ready-to-use marketing materials they can easily share with their employees. By making it easy for the company to promote the initiative internally, you significantly increase your reach and participation rates.

Corporate partners are often enthusiastic about supporting their nonprofit partners, but they may not have the time or capacity to create their own promotional content. Supplying polished, branded materials ensures the message is communicated clearly and consistently—while saving your partner time and effort. It also helps you stay in control of the messaging, emphasizing the key details and urgency of the match.

Your promotional toolkit might include:

- Email templates announcing the match and encouraging employees to donate

- Social media graphics and suggested captions for internal company platforms or LinkedIn

- Flyers or posters that can be displayed in physical office spaces

- A one-pager overview of your organization’s mission, the impact of the partnership, and matching gift instructions

- Talking points for HR leaders or team managers to use when discussing the match with employees

Be sure to brand all materials with your nonprofit’s logo and your partner’s logo, and clearly state the timeframe and match opportunity.

When you hand off these resources, you can even offer to meet briefly with your contact at the company to walk through how best to use them. Ask if there are other communication channels you can support—such as company town halls, onboarding materials, lunch and learns, or employee giving portals.

By arming your corporate partner with the right tools, you empower them to become active champions of your mission and help drive more traffic—and donations—to your campaign.

Marketing Tip #6: Share impact stats or donor testimonials.

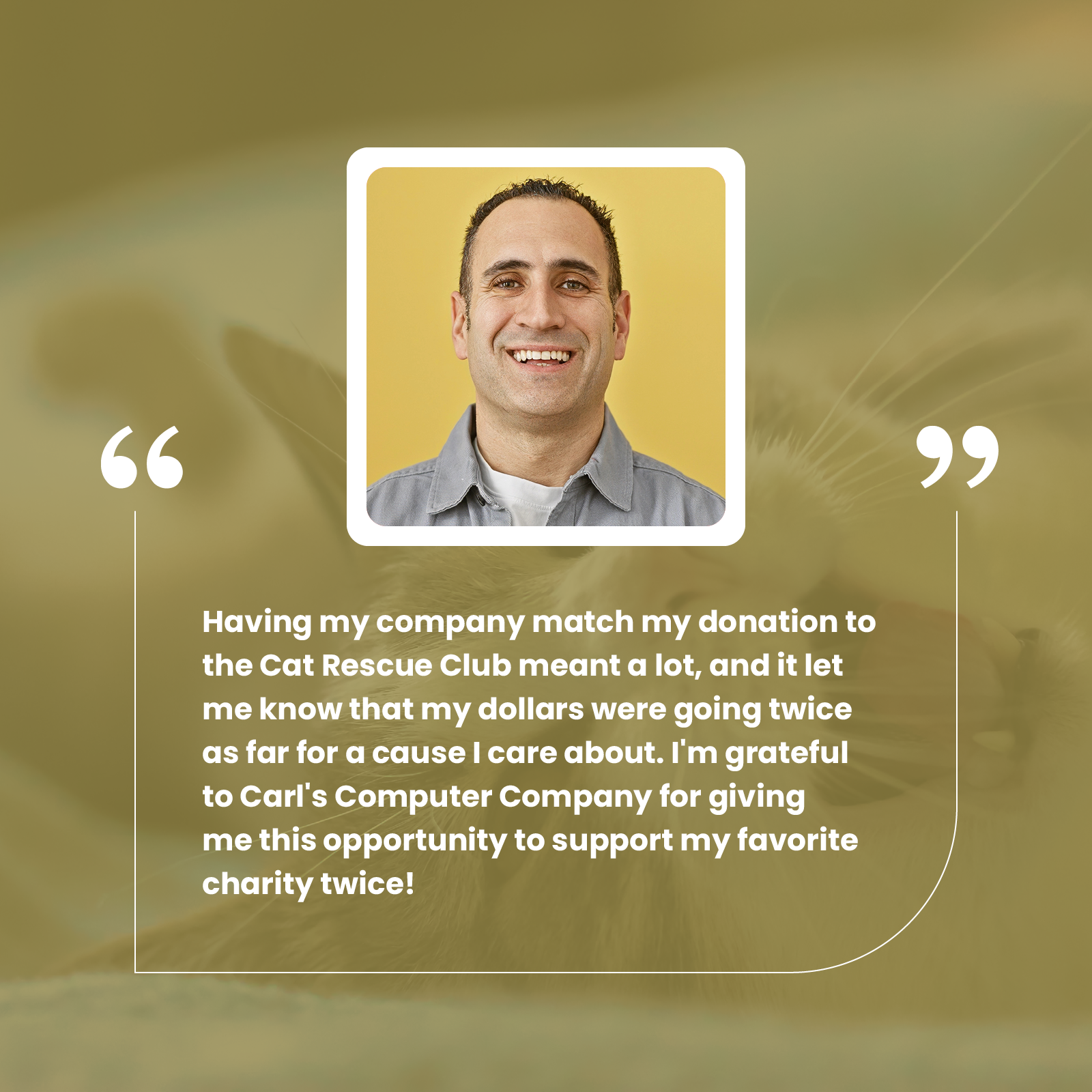

When promoting your one-off matching gift program, real numbers and stories speak volumes. Donors want to know that their gifts make a difference—and nothing reinforces that message better than real-world impact and personal testimonials.

Why? Sharing compelling statistics or heartfelt testimonials builds trust, inspires generosity, and motivates action. When supporters see the tangible outcomes of giving—or hear from others who’ve donated—they’re more likely to feel confident that their own contribution will matter. It also reinforces the value of the matching gift partnership and showcases the company’s positive role in driving that impact.

Depending on the stage of your campaign, you might highlight:

- The number of gifts matched so far or total dollars raised

- Specific programs or communities impacted by the campaign’s success

- Quotes from donors about why they gave and how the match inspired them

- Statements from beneficiaries about how donations have changed lives

- Comments from employees of the corporate partner about how proud they are to support the cause

Don’t be afraid to use graphics, short video clips, or personal stories (with permission!) to add a human element to your stats.

By spotlighting real results and authentic voices, you create a more emotional, meaningful connection that drives engagement and fuels ongoing support.

Marketing Tip #7: If applicable, establish urgency with upcoming deadlines.

One of the most powerful motivators in fundraising is a sense of urgency—and one-off matching gift programs are a natural fit for this tactic. These (often) limited-time opportunities are typically available for a defined period or tied to a particular campaign, event, or initiative. That means your supporters should act fast if they want their donation to go twice as far.

When donors know there’s a deadline, they’re more likely to act now rather than put off giving. Creating a clear sense of urgency drives immediate action and helps your nonprofit make the most of the matching gift window. It also keeps your campaign top of mind during a critical period of opportunity.

Here are a few ideas for integrating urgency into your marketing strategy:

- Highlight any deadlines in bold, clear language: “All gifts matched through June 30!” or “Only 3 days left to double your impact!”

- Use countdowns in emails or on your campaign landing page to show exactly how much time is left.

- Send last-chance reminders: A final push as the deadline approaches can significantly boost participation.

While the final days of a campaign often see the biggest surge in giving, your messaging should mention the time limit early and often. Repetition reinforces urgency and ensures that no donor misses the opportunity due to lack of awareness.

By emphasizing urgency, you help donors understand the limited nature of your one-off matching gift opportunity—and inspire them to take action while they still can.

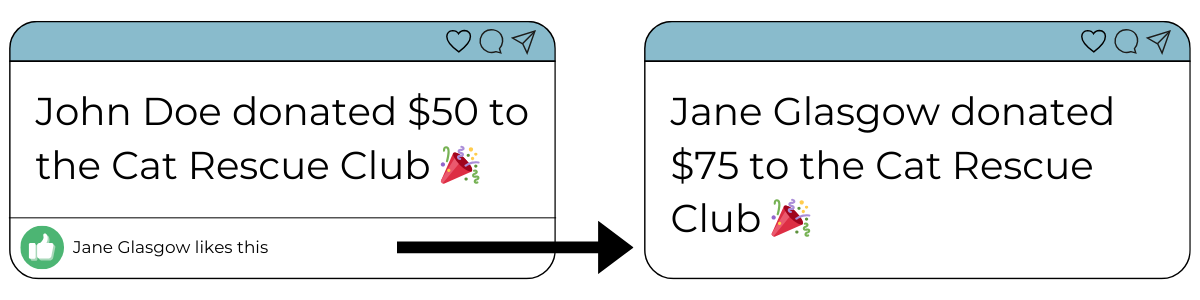

Marketing Tip #8: Celebrate milestones and successes publicly.

Sharing progress is more than just a nice gesture—it’s a strategic marketing move that can build momentum, deepen engagement, and drive additional donations. As your one-off matching gift campaign unfolds, make it a point to celebrate key milestones and successes in public, visible ways.

After all, recognizing campaign progress and achievements signals to supporters that their gifts are making a real difference. It fosters a sense of community and shared purpose, encourages continued involvement, and inspires new donors to get involved. Public celebration also gives your corporate partner positive visibility, which helps reinforce the value of the partnership for both sides.

Here are a few ways to celebrate and promote your success:

- Share milestone updates across email and social media: “We’ve raised $10,000—halfway to our goal! Let’s keep going!”

- Feature donor spotlights or shout-outs to recognize individuals or employee groups who participated.

- Post real-time updates during events or campaign pushes, especially if you’re running a day-of-giving or time-bound challenge.

- Create thank-you graphics or short videos highlighting the impact of the donations received and the matched total.

- Tag your corporate partner in public acknowledgments to strengthen your relationship and encourage them to share the content as well.

When you celebrate milestones publicly, you not only honor the generosity of your donors. You also reinforce the value of the one-off match, elevate your nonprofit’s credibility, and create more opportunities for future engagement.

Wrapping Up & Additional Matching Gift Resources

One-off matching gift programs provide nonprofits with a unique opportunity to amplify the impact of their donors and strengthen relationships with corporate partners. But without a clear, strategic marketing plan, it’s easy to leave dollars on the table.

By aligning with your partner, using a multi-channel approach, creating urgency, and sharing real-time results, you can turn a time-limited match into long-lasting value for your mission. With proper preparation and promotion, your next one-off campaign can be a win for your organization, your supporters, and your corporate sponsor alike.

Ready to elevate your approach? Use these marketing tips to make every dollar—and each match—count.

Check out the following recommended resources to continue growing your knowledge of all things matching gifts:

- One-Off Matching Gift Programs | What to Know for Your Org. Explore the fundamentals of one-off matching gift programs. This includes how they work, when and how to pursue them, and what makes them a unique opportunity for nonprofits.

- How to Identify Corporate Partnerships [With Double the Donation]. A successful one-off match program involves partnering with the right company. See how you can leverage Double the Donation’s tools and insights to find the right partners here.

- Free Download: The Ultimate Guide to Marketing Matching Gifts. Looking for a strategy to promote your matching gift programs? This downloadable guide covers everything from messaging and design tips to timing and automation, helping you drive more participation.

![How to Find Grants for Nonprofits [Quickly & Easily!]](https://doublethedonation.com/wp-content/uploads/2025/01/DTD_How-to-Find-Grants-for-Nonprofits-Quickly-Easily_Feature-1536x576.png)