In the world of nonprofit fundraising, few strategies have stood the test of time as effectively as the phonathon. While technology has transformed the fundraising landscape, the power of a well-placed phone call can still work wonders.

Phonathons may seem like a relic of the past, but they remain a tried-and-true resource for all sorts of nonprofits and higher education institutions to engage donors and raise money. While the benefits of a phonathon campaign are straightforward, running a successful campaign isn’t easy. A lot of hard work goes into powering these campaigns, but they can generate incredible results for your cause — especially when you know how to identify donors eligible for matching gifts from their employers.

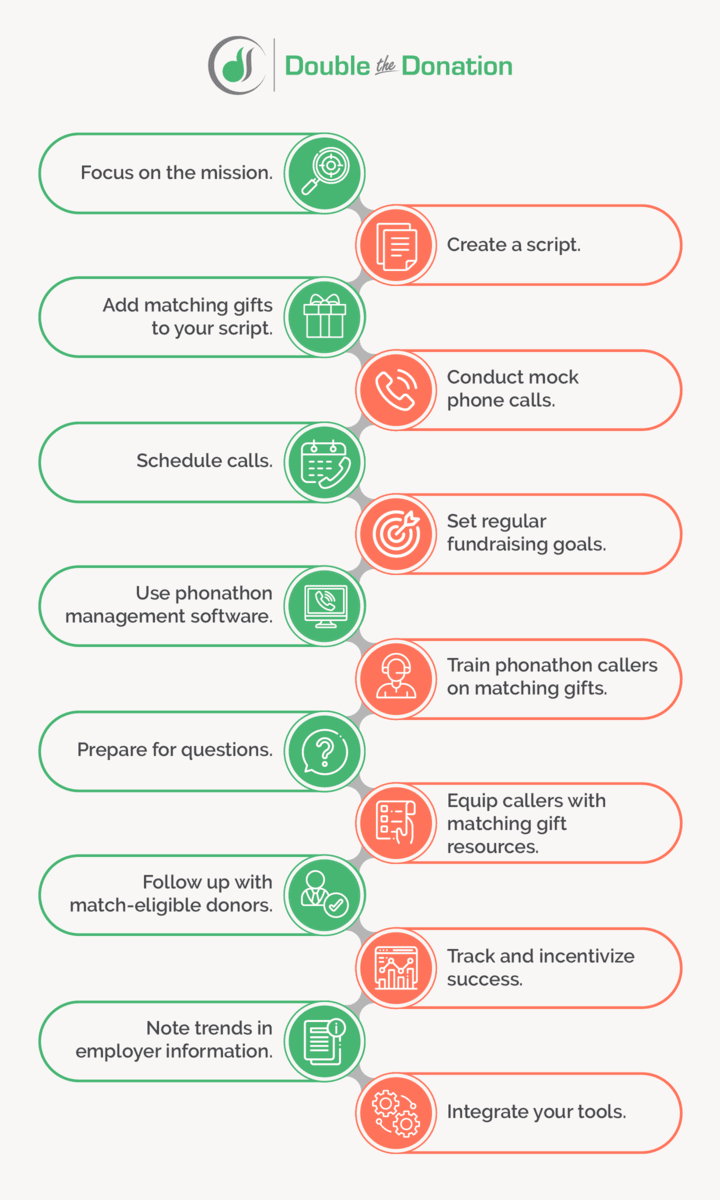

So, how do you optimize your phonathons and drive even greater results with matching gifts? We’ve compiled a number of tips and tricks to effectively communicate with your donors about matching gifts and raise more in phonathon revenue overall. By the end of this guide, you’ll be a phonathon pro and ready to start dialing!

Want to find out how to optimize your organization’s upcoming phonathon to raise more? Let’s cover the basics before diving into tips that will transform your next campaign.

The Fundamentals of Phonathons

Making the most of any type of campaign requires you to understand the basics of how they work. Let’s make sure you have the background knowledge you need before crafting your phonathon plans.

What is a phonathon?

A phonathon is a fundraising campaign in which organizations call supporters to solicit donations and engage with them. During a phonathon, trained staff or volunteers make outbound calls to donors to encourage contributions, share mission updates, and strengthen relationships via personalized conversations.

Often hosted by nonprofits and educational institutions, phonathons are a valuable tool for connecting with supporters, increasing donor retention, and boosting fundraising revenue. Successful phonathons require effective training, well-prepared scripts, and donor management systems to track and manage interactions.

What role do matching gifts play in phonathons?

Corporate matching gifts have the power to double (or sometimes even triple) the contributions your donors make. Through these CSR programs, companies offer to match their employees’ donations to charitable organizations. However, they often implement eligibility criteria alongside minimum and maximum donation amounts they’re willing to match.

By adding matching gifts to your phonathon strategy, your campaign will see even greater success. If you can capitalize on that potential during your phonathon, you’ll see a massive increase in raised funds. In fact, our matching gift research found that 84% of donors are more likely to donate if a match is offered. Meanwhile, 1 in 3 donors actually indicate they’d give a larger gift if matching is applied to their donation.

If you play your cards right, you can raise a lot more during your phonathon with corporate giving. You’ll just need to let donors know how to check their eligibility and submit a match request to their employers. After all, who wouldn’t want to double their contributions without reaching back into their own wallet?

1. Focus on the larger mission.

The most successful fundraising campaigns are focused on more than raising a certain dollar amount. If you can help donors understand why your cause is a worthy one, then you are far more likely to succeed. By highlighting the larger purpose of the campaign, you can motivate both donors and callers to feel good about what they’re doing!

To illustrate our point, take a look at two possible phonathon script introductions:

- Phonathon Script Introduction #1: “I’m calling on behalf of University X to raise money for our annual phonathon campaign. Would you consider making a donation of $100 to the university’s endowment fund?”

- Phonathon Script Introduction #2: “I’m calling on behalf of University X to raise money for our annual phonathon campaign. Would you consider making a donation of $100 to the university’s endowment fund? Every dollar you donate will go to scholarships for students in financial need!”

See the difference? In both cases, the caller is asking for the same dollar amount. But in our second example, the donor understands how their donation will be helping someone in need.

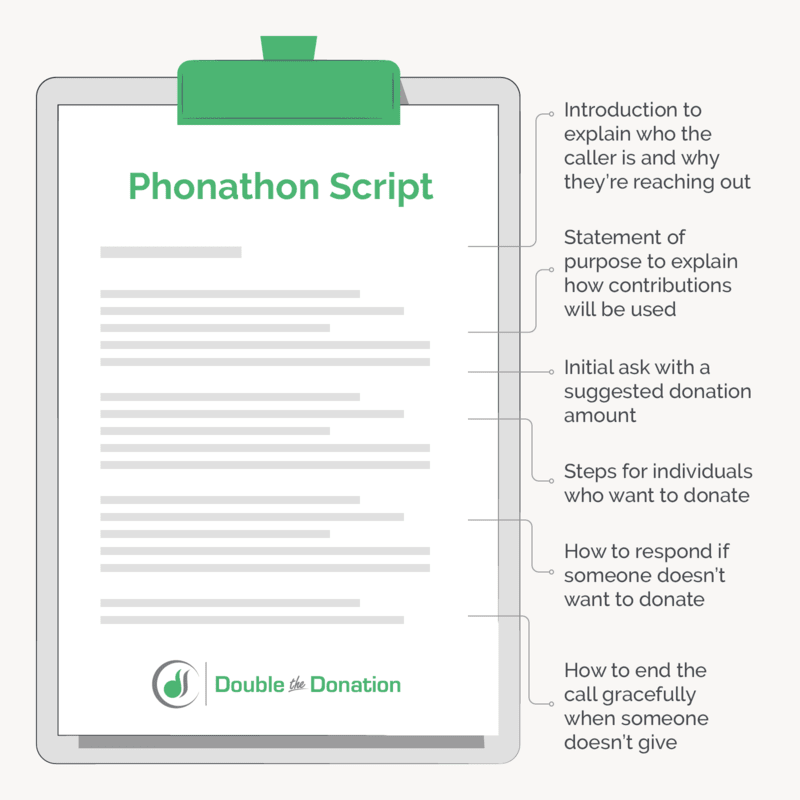

2. Create a standardized script for your phonathon.

For many of your callers, this will be their first phonathon campaign. The idea of getting on the phone with prospective donors or school alumni to ask for donations can be extremely intimidating.

Creating a detailed and interactive script can help ease the nerves of new callers when requesting contributions and standardize the giving experience. Here are the key components to any phonathon script:

- Introduction: Answer the most basic questions: Who are you? What is your relationship to the organization running the campaign? Why are you calling?

- Statement of purpose: Why is your organization asking for donations? What will the contributions be used for?

- First ask: Make the initial request for a donation. What is the suggested donation amount? If the donor has made a donation previously, how much should the caller suggest they donate this year?

- Gift confirmation: Success! How do we close the deal? How do we accommodate different payment methods?

- Answers to common objections: Not everyone wants to donate. How do we respond to common objectives such as a lack of interest, recent issues with the organization, or other giving priorities?

- Non-pledge close: For those calls that don’t end in success, it’s important to help close the conversation gracefully to maintain the relationship with the donor.

A great script is arguably the most important component of a successful phonathon, as it’s a resource that every caller will use. Spend significant time working with your organization’s communication director to put this resource together.

3. Include matching gifts in your phonathon’s scripts.

With over 26 million individuals working for companies with matching gift programs, many of your phonathon donors are bound to be eligible for a corporate match. Your callers should always ask donors if their employer offers a matching gift program.

Here’s how (it’s as easy as A-B-C!):

- A: Ask every time. Few donors are thinking about (or are even aware of) matching gifts. In fact, 78% of those 26 million match-eligible individuals don’t know whether their companies offer these programs. Introduce the concept to see if they have any information about their employers’ corporate giving opportunities off-hand.

- B: Be persistent. Donors sometimes default to, “I don’t think so,” when asked if their company will match their donation. Have callers ask for their employer’s name and then quickly research that specific company using our database.

- C: Come prepared. If a donor has submitted a matching gift in the past, come to the call prepared with the company’s matching gift information. Make the process simple and easy for your donors.

Being well-versed in matching gifts and anticipating donors’ questions can go a long way in driving more matches to completion! You’ll be impressed by how much you raise in matching gifts during your phonathon.

An Example of This Strategy in Action

Let’s walk through an example of how to properly incorporate matching gifts into your script. A normal phonathon call will consist of the following steps:

- The caller introduces themself and the organization that’s fundraising.

- The caller asks the potential donor if they are willing to donate.

- The potential donor says yes/no.

- If the answer is no, the caller politely thanks the prospect for their time and ends the call.

- If the answer is yes, the caller begins the donation process with the new donor and helps guide them through the experience.

Once the donation is secured, have your caller make the matching gift ask. Use a template similar to this:

Many companies actually match donations made by their employees to schools and other nonprofits. Do you know if you or your spouse works for a company that offers a matching gift program? I’m happy to do a quick check to see if your company will double or possibly triple your donation.

Scripts take the guesswork and pressure out of calls. Plus, if you standardize your request process, you’re in a better position to evaluate and adjust it according to the results.

4. Practice for your phonathon with mock calls.

Having a team of well-trained callers is the secret to any successful phonathon campaign.

Prepare callers by organizing mock calls. During this time, they’ll read through the provided script and respond to a variety of different “donor personas.” See how they respond when a donor has questions about the campaign, voices objections, or wants to complete their transaction. Include some matching gift-related questions to ensure volunteers are prepared, too.

Proper preparation will help callers feel more at ease when it comes time to dial a real donor’s phone number. Plus, it can help get some of the roadblocks and uncertainties out of the way early!

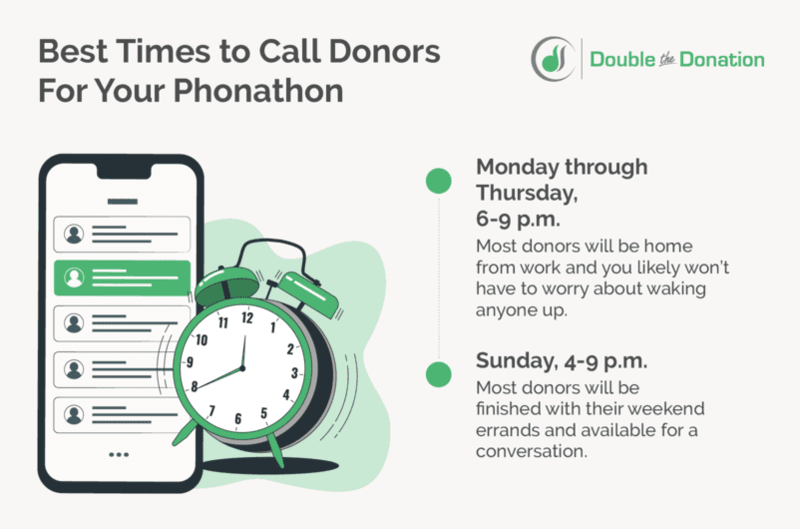

5. Schedule calls when donors are home.

One of the most common challenges for phonathon callers is simply reaching donors in the first place.

To improve the chances that your donors pick up the phone, consider calling during the hours when they are most likely to be home and available. These are some of our recommended times to do so:

- Monday – Thursday, 6-9 p.m. If you call within this time window, most donors will be home from work. Yet, it’s early enough that you reduce the risk of waking anyone up. After all, cranky donors rarely give donations.

- Sunday, 4-9 p.m. At this time on a Sunday, most donors will be finished with their weekend errands and are likely available for a conversation.

Make sure that you’re planning to reach donors when they’re ready and able to chat for the greatest fundraising success.

6. Set nightly/weekly fundraising goals for your phonathon.

Setting goals greatly increases your chances of fundraising success. Encourage your callers to set nightly or weekly donation goals to instill a sense of accomplishment when they reach and exceed their objectives.

Then, there are plenty of opportunities to use these metrics to improve your fundraising results. We suggest that you:

- Identify any knowledge gaps and situations where additional training is needed.

- Assign your most effective callers to your highest-value prospective donors.

- Communicate the concrete donation impact of your callers’ fundraising goals.

Setting detailed objectives helps your organization keep track of how many donations you bring in within a certain timeframe. You can even leverage some friendly competition among callers this way!

7. Use phonathon management software.

Consider purchasing phonathon software from a well-established vendor, such as industry leader Wilson-Bennett Technology’s DonorConnect. This type of tool can save you time, money, and many of the technical headaches that would ordinarily get in the way of a successful campaign.

Common tasks that phonathon software handles include:

- Managing and updating your donor database.

- Automating pledge verification via email.

- Tracking call results.

- Issuing reports on campaign progress.

By automating these time-consuming tactical steps, you can spend your time managing callers, increasing donations, and engaging in deeper relationships with supporters.

8. Train phonathon callers on matching gifts.

Using matching gifts to boost phonathon funds starts and ends with your callers. These individuals are the voice of your campaign, working hard to help you fulfill your mission. They need to be prepared to explain matching gifts and answer any questions a prospect may have.

While you may understand the value of capturing employer data and pursuing a matching gift from your donors, your caller and digital engagement teams may not. Make sure the people who will engage in those real-time conversations understand the what, why, and how of matching gifts.

Invest in a matching gift database to make researching donors’ eligibility a breeze. Then, consider these four components of effective matching gift phonathon training:

- Materials: Document how callers should ask about matching gifts and the process by which they should share company rules, guidelines, and instructions.

- Speakers: Who at your organization is responsible for matching gifts? Invite this team member to speak with your callers.

- Practice: Have your callers pair up and do trial runs on a few matching gift companies. Provide feedback as needed.

- Coaching: Like with anything, there’s always room for improvement. Listen for matching gift asks during calls and provide guidance to improve techniques.

Ensuring your team is on the same page about matching gift goals will make the ask that much easier when the opportunity arises. Check out this video for ideas to integrate matching gifts into your phonathons and everyday fundraising efforts:

You’ll need to teach them about the latest technology,

such as matching gift auto-submission, too. This feature cuts out a few steps in the request process when donors fill out your online donation form. They’ll click a checkbox to opt into auto-submission. If their employer uses CSR software that integrates with our tools, our software will automatically fill out their match request to their employer.

Overall, being a caller for a phonathon is no easy task. But with proper training, you’ll situate your callers in the best possible position to make matching gift asks.

9. Implement screening and segmentation.

Make the most of your callers’ (and your donors!) time by pre-screening and segmenting your calling list beforehand in terms of matching gift prospects.

Think of it this way: would you rather call 10 people and have one person respond positively, or call five and have three people respond positively? By segmenting your contacts prior to reaching out, you ensure that each call is a valuable use of your team’s time and resources.

For matching-gift-related segmentation, you’ll enact a three-point process:

- Pre-screen your file for matching gift eligibility. It is likely that a sizable percentage of your existing prospects are matching gift-eligible. Know who they are in advance by researching local matching gift businesses and determining donors’ eligibility.

- Append relevant information to your file. Append employer data and phone numbers to either your entire file or best prospects.

- Segment your calling list accordingly. Assign your best callers to high-value match-eligible prospects. Not only are those candidates’ donations likely to get matched, but they are likely to have higher average donation amounts. If they don’t respond the first time, this group might even be worth a second call!

Increasing matching gift eligibility awareness is only going to help your campaign. Give your callers the information they need to have the biggest impact.

Of course, call volume is always going to be crucial for successful phonathons. But if your organization can be even 10% more deliberate about who you’re calling, you can significantly increase your call conversion rate.

10. Prepare for donor questions.

Some donors will be hesitant to give, especially if they’ve never contributed to your organization before. If they have questions about your mission, your particular fundraising need, or anything else that might be holding them back, you’ll want to have the answers prepped and ready.

Additionally, your donors might have questions about matching gift opportunities. Be sure your callers are able to provide basic information on company gift-matching by answering questions such as these:

- What is a matching gift?

- How do I figure out if my company will match my gift?

- What’s the submission process, and how does auto-submission work?

Making sure that everyone is on the same page with regard to these questions ensures that your callers give supporters the most thorough, accurate information and drive as many donations as possible.

11. Equip callers with matching gift resources.

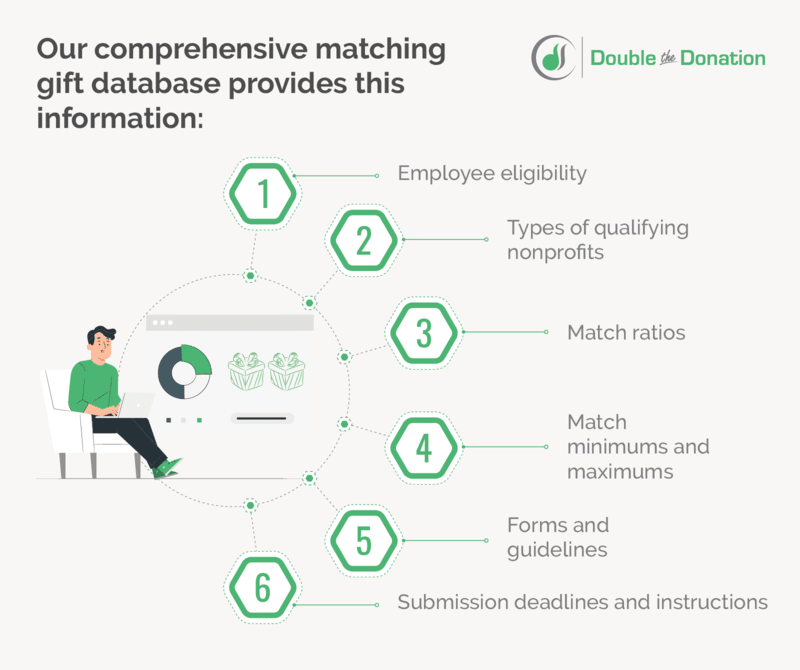

Do your callers have the information they need to help donors? You can’t expect them to memorize the program guidelines for all the thousands of companies that offer matching gifts—so where can they find that information to pass along?

That’s where your matching gift company database comes in! This type of tool allows users to conduct a quick search of an employer’s name and receive detailed guideline information in seconds. Equip callers with access to this comprehensive database to uncover the following:

- Employee eligibility

- Types of qualifying nonprofits

- Match ratios

- Match minimums and maximums

- Forms and guidelines

- Submission deadlines and instructions

Providing callers with ample information will help them quickly and easily answer common questions from donors. Once a donor has expressed interest in requesting a matching gift, you want your caller to be able to help in any way they can. Don’t miss out on a matching gift due to a technical or otherwise avoidable issue!

12. Follow up with match-eligible donors.

If a donor has expressed interest in matching gifts on the phone, your organization should follow up afterward to increase the likelihood of turning that interest into action.

Immediately after the conversation, send an email with matching gift request instructions for the individual’s employer. You’ll also want to include matching gift reminders across various donor communications, including:

- Pledge acknowledgments: When confirming a donor completed their pledge, encourage them to check their eligibility, or if you know they’re eligible, direct them to their employer’s form.

- Thank yous: When showing appreciation for your donors, include matching gift reminders, encouraging them to take their impact even further.

- End-of-year reminders: Many companies set deadlines for match requests at the end of the calendar year. Remind donors to submit their requests before time runs out!

Telling donors their gift is eligible for a match is only one component of boosting matching gifts. It’s far more valuable if you pair that information with actionable next steps.

We also recommend embedding matching gift information into your website. Give your alumni and supporters a trusted place to find their matching gift information and next steps on an easy-to-find webpage, so they can take action after speaking with your ambassadors. This helps interested supporters discover gift matching and double their own donations!

13. Track and incentivize successful conversations.

Are your callers held accountable and rewarded for their overall fundraising and matching gift performance? One of the best ways to ensure that callers know how important matching gifts are to your phonathon is by implementing incentives.

Giving your callers something to work towards will only help your fundraising efforts. Then, once they reach and surpass their goal, provide them with a small token of appreciation, such as a t-shirt, hat, mug, or even public recognition!

Tracking and incentivizing fundraising results also gives you a positive metric for tracking caller proficiency and efficiency. This enables you to define where your phonathon is doing well and where it has room for improvement. Once you’ve isolated those areas, you’ll be in a great position to adjust your efforts as needed.

14. Keep an eye on trends in employer information.

As you start to collect employer information from your alumni and supporters, you may notice trends in company data. Be sure to ask questions like these:

- Do a lot of your donors work for the same companies?

- In similar industries?

- In specific locations?

- Do those common companies your donors work for have strong matching gift programs?

- Is there a concentrated area of match-eligible donors you could target for your next campaign?

These are all characteristics you can determine with greater accuracy the more donors you collect employer data from. While these are nice-to-know facts for general fundraising initiatives, they can also have a more significant impact on your greater matching gifts strategy.

Therefore, make sure you’re considering matching gifts when analyzing those trends for future initiatives. You never know when that information could come in handy for future events, digital outreach, or even a future phonathon!

15. Integrate your fundraising and matching gift tools.

Phonathons and other digital engagement events can be huge operations, and a lot can get lost in the shuffle if you don’t have the right tools. Luckily, providing a scalable system for your fundraising ambassadors and callers is an easy and effective way to organize your donor data. With matching gifts added to the mix, you’ll want an automated system to take care of all the nitty-gritty details for you.

Phonathon Software Integration

We recommend using a phonathon system to manage all your digital engagement needs—particularly one that integrates with powerful gift-matching tools! Donor Connect by Wilson-Bennett Technology and Double the Donation offer an integrated solution that allows callers to retrieve and communicate valuable matching gift information when speaking to donors in real time.

It takes virtually no effort from your team to set up the integration, and you’ll be able to start using it right away in your next digital engagement event. Automate the best practices listed above by incorporating the autocomplete search tool within Donor Connect scripts, automated email outreach, and regularly updated donor data.

Matching Gift Auto-Submission Integrations

A big part of driving greater matching gift revenue is simplifying the process for donors and their employers. That’s where matching gift auto-submission comes in handy.

Many companies leverage CSR software to manage employee giving programs. When these companies use platforms that integrate with our tools, this is how streamlined the match request process is:

- A donor gives using your organization’s online donation page.

- They enter their corporate email address and click a checkbox to opt into auto-submission.

- If eligible, our tools will automatically complete their match request.

It’s that simple! Otherwise, they’d need to fill out the form themselves. Leading CSR software like Givinga, Millie, POINT, and Selflessly enable auto-submission, so be aware of donors who work for companies that use these platforms. From here, make sure your phonathon volunteers know the basics of how this software works, too!

Bonus! Fundraising advice from phonathon experts

Hear from the phonathon fundraising experts at Wilson-Bennett Technology: a phonathon management services and software company serving nonprofits since 1998.

Todd Smith

Founder and CEO – Wilson-Bennett

Ensure training is ongoing throughout the campaign and each caller receives assistance, along with reminders, before calling begins each session.

We always encourage callers to excel while teaching methods to overcome negative comments.

During training, be sure to explain campaign policies and procedures, ensuring callers make the highest quality call on behalf of your institution.

Rob Schlitts

Former President – Wilson-Bennett

“Play chess with your phonathon.”

Matching the right prospects up with the right caller makes for a great connection, conversation, and ultimately a gift. Your alumni and student callers will both enjoy the ability to connect with prospects who share similar traits and experiences.

A well-trained student caller will always be the engine of a successful phonathon.

Wrapping Up

In an age of social media, texting, and online transactions, the human element of fundraising can get lost in the shuffle. Thankfully, phonathons offer a unique opportunity to bridge the gap between technology and personal connection.

Many organizations recognize that traditional phonathons remain a smart fundraising strategy. However, most don’t think about the potential of incorporating matching gift promotions into those invaluable donor conversations.

By following these tried-and-true phonathon fundraising tips, you can set up your team—and your mission—for long-term success. Looks like it’s time to get calling!

For more information, be sure to check out our other educational fundraising resources below:

The Ultimate Phonathon Playbook for Nonprofits: 16 Pro Tips

/in Marketing Strategies, Fundraising Ideas, Learning Center /by Adam WeingerIn the world of nonprofit fundraising, few strategies have stood the test of time as effectively as the phonathon. While technology has transformed the fundraising landscape, the power of a well-placed phone call can still work wonders.

Phonathons may seem like a relic of the past, but they remain a tried-and-true resource for all sorts of nonprofits and higher education institutions to engage donors and raise money. While the benefits of a phonathon campaign are straightforward, running a successful campaign isn’t easy. A lot of hard work goes into powering these campaigns, but they can generate incredible results for your cause — especially when you know how to identify donors eligible for matching gifts from their employers.

So, how do you optimize your phonathons and drive even greater results with matching gifts? We’ve compiled a number of tips and tricks to effectively communicate with your donors about matching gifts and raise more in phonathon revenue overall. By the end of this guide, you’ll be a phonathon pro and ready to start dialing!

Want to find out how to optimize your organization’s upcoming phonathon to raise more? Let’s cover the basics before diving into tips that will transform your next campaign.

The Fundamentals of Phonathons

Making the most of any type of campaign requires you to understand the basics of how they work. Let’s make sure you have the background knowledge you need before crafting your phonathon plans.

What is a phonathon?

A phonathon is a fundraising campaign in which organizations call supporters to solicit donations and engage with them. During a phonathon, trained staff or volunteers make outbound calls to donors to encourage contributions, share mission updates, and strengthen relationships via personalized conversations.

Often hosted by nonprofits and educational institutions, phonathons are a valuable tool for connecting with supporters, increasing donor retention, and boosting fundraising revenue. Successful phonathons require effective training, well-prepared scripts, and donor management systems to track and manage interactions.

What role do matching gifts play in phonathons?

Corporate matching gifts have the power to double (or sometimes even triple) the contributions your donors make. Through these CSR programs, companies offer to match their employees’ donations to charitable organizations. However, they often implement eligibility criteria alongside minimum and maximum donation amounts they’re willing to match.

By adding matching gifts to your phonathon strategy, your campaign will see even greater success. If you can capitalize on that potential during your phonathon, you’ll see a massive increase in raised funds. In fact, our matching gift research found that 84% of donors are more likely to donate if a match is offered. Meanwhile, 1 in 3 donors actually indicate they’d give a larger gift if matching is applied to their donation.

If you play your cards right, you can raise a lot more during your phonathon with corporate giving. You’ll just need to let donors know how to check their eligibility and submit a match request to their employers. After all, who wouldn’t want to double their contributions without reaching back into their own wallet?

1. Focus on the larger mission.

The most successful fundraising campaigns are focused on more than raising a certain dollar amount. If you can help donors understand why your cause is a worthy one, then you are far more likely to succeed. By highlighting the larger purpose of the campaign, you can motivate both donors and callers to feel good about what they’re doing!

To illustrate our point, take a look at two possible phonathon script introductions:

See the difference? In both cases, the caller is asking for the same dollar amount. But in our second example, the donor understands how their donation will be helping someone in need.

2. Create a standardized script for your phonathon.

For many of your callers, this will be their first phonathon campaign. The idea of getting on the phone with prospective donors or school alumni to ask for donations can be extremely intimidating.

Creating a detailed and interactive script can help ease the nerves of new callers when requesting contributions and standardize the giving experience. Here are the key components to any phonathon script:

A great script is arguably the most important component of a successful phonathon, as it’s a resource that every caller will use. Spend significant time working with your organization’s communication director to put this resource together.

3. Include matching gifts in your phonathon’s scripts.

With over 26 million individuals working for companies with matching gift programs, many of your phonathon donors are bound to be eligible for a corporate match. Your callers should always ask donors if their employer offers a matching gift program.

Here’s how (it’s as easy as A-B-C!):

Being well-versed in matching gifts and anticipating donors’ questions can go a long way in driving more matches to completion! You’ll be impressed by how much you raise in matching gifts during your phonathon.

An Example of This Strategy in Action

Let’s walk through an example of how to properly incorporate matching gifts into your script. A normal phonathon call will consist of the following steps:

Once the donation is secured, have your caller make the matching gift ask. Use a template similar to this:

Many companies actually match donations made by their employees to schools and other nonprofits. Do you know if you or your spouse works for a company that offers a matching gift program? I’m happy to do a quick check to see if your company will double or possibly triple your donation.

Scripts take the guesswork and pressure out of calls. Plus, if you standardize your request process, you’re in a better position to evaluate and adjust it according to the results.

4. Practice for your phonathon with mock calls.

Having a team of well-trained callers is the secret to any successful phonathon campaign.

Prepare callers by organizing mock calls. During this time, they’ll read through the provided script and respond to a variety of different “donor personas.” See how they respond when a donor has questions about the campaign, voices objections, or wants to complete their transaction. Include some matching gift-related questions to ensure volunteers are prepared, too.

Proper preparation will help callers feel more at ease when it comes time to dial a real donor’s phone number. Plus, it can help get some of the roadblocks and uncertainties out of the way early!

5. Schedule calls when donors are home.

One of the most common challenges for phonathon callers is simply reaching donors in the first place.

To improve the chances that your donors pick up the phone, consider calling during the hours when they are most likely to be home and available. These are some of our recommended times to do so:

Make sure that you’re planning to reach donors when they’re ready and able to chat for the greatest fundraising success.

6. Set nightly/weekly fundraising goals for your phonathon.

Setting goals greatly increases your chances of fundraising success. Encourage your callers to set nightly or weekly donation goals to instill a sense of accomplishment when they reach and exceed their objectives.

Then, there are plenty of opportunities to use these metrics to improve your fundraising results. We suggest that you:

Setting detailed objectives helps your organization keep track of how many donations you bring in within a certain timeframe. You can even leverage some friendly competition among callers this way!

7. Use phonathon management software.

Consider purchasing phonathon software from a well-established vendor, such as industry leader Wilson-Bennett Technology’s DonorConnect. This type of tool can save you time, money, and many of the technical headaches that would ordinarily get in the way of a successful campaign.

Common tasks that phonathon software handles include:

By automating these time-consuming tactical steps, you can spend your time managing callers, increasing donations, and engaging in deeper relationships with supporters.

8. Train phonathon callers on matching gifts.

Using matching gifts to boost phonathon funds starts and ends with your callers. These individuals are the voice of your campaign, working hard to help you fulfill your mission. They need to be prepared to explain matching gifts and answer any questions a prospect may have.

While you may understand the value of capturing employer data and pursuing a matching gift from your donors, your caller and digital engagement teams may not. Make sure the people who will engage in those real-time conversations understand the what, why, and how of matching gifts.

Invest in a matching gift database to make researching donors’ eligibility a breeze. Then, consider these four components of effective matching gift phonathon training:

Ensuring your team is on the same page about matching gift goals will make the ask that much easier when the opportunity arises. Check out this video for ideas to integrate matching gifts into your phonathons and everyday fundraising efforts:

You’ll need to teach them about the latest technology, such as matching gift auto-submission, too. This feature cuts out a few steps in the request process when donors fill out your online donation form. They’ll click a checkbox to opt into auto-submission. If their employer uses CSR software that integrates with our tools, our software will automatically fill out their match request to their employer.

Overall, being a caller for a phonathon is no easy task. But with proper training, you’ll situate your callers in the best possible position to make matching gift asks.

9. Implement screening and segmentation.

Make the most of your callers’ (and your donors!) time by pre-screening and segmenting your calling list beforehand in terms of matching gift prospects.

Think of it this way: would you rather call 10 people and have one person respond positively, or call five and have three people respond positively? By segmenting your contacts prior to reaching out, you ensure that each call is a valuable use of your team’s time and resources.

For matching-gift-related segmentation, you’ll enact a three-point process:

Increasing matching gift eligibility awareness is only going to help your campaign. Give your callers the information they need to have the biggest impact.

Of course, call volume is always going to be crucial for successful phonathons. But if your organization can be even 10% more deliberate about who you’re calling, you can significantly increase your call conversion rate.

10. Prepare for donor questions.

Some donors will be hesitant to give, especially if they’ve never contributed to your organization before. If they have questions about your mission, your particular fundraising need, or anything else that might be holding them back, you’ll want to have the answers prepped and ready.

Additionally, your donors might have questions about matching gift opportunities. Be sure your callers are able to provide basic information on company gift-matching by answering questions such as these:

Making sure that everyone is on the same page with regard to these questions ensures that your callers give supporters the most thorough, accurate information and drive as many donations as possible.

11. Equip callers with matching gift resources.

Do your callers have the information they need to help donors? You can’t expect them to memorize the program guidelines for all the thousands of companies that offer matching gifts—so where can they find that information to pass along?

That’s where your matching gift company database comes in! This type of tool allows users to conduct a quick search of an employer’s name and receive detailed guideline information in seconds. Equip callers with access to this comprehensive database to uncover the following:

Providing callers with ample information will help them quickly and easily answer common questions from donors. Once a donor has expressed interest in requesting a matching gift, you want your caller to be able to help in any way they can. Don’t miss out on a matching gift due to a technical or otherwise avoidable issue!

12. Follow up with match-eligible donors.

If a donor has expressed interest in matching gifts on the phone, your organization should follow up afterward to increase the likelihood of turning that interest into action.

Immediately after the conversation, send an email with matching gift request instructions for the individual’s employer. You’ll also want to include matching gift reminders across various donor communications, including:

Telling donors their gift is eligible for a match is only one component of boosting matching gifts. It’s far more valuable if you pair that information with actionable next steps.

We also recommend embedding matching gift information into your website. Give your alumni and supporters a trusted place to find their matching gift information and next steps on an easy-to-find webpage, so they can take action after speaking with your ambassadors. This helps interested supporters discover gift matching and double their own donations!

13. Track and incentivize successful conversations.

Are your callers held accountable and rewarded for their overall fundraising and matching gift performance? One of the best ways to ensure that callers know how important matching gifts are to your phonathon is by implementing incentives.

Giving your callers something to work towards will only help your fundraising efforts. Then, once they reach and surpass their goal, provide them with a small token of appreciation, such as a t-shirt, hat, mug, or even public recognition!

Tracking and incentivizing fundraising results also gives you a positive metric for tracking caller proficiency and efficiency. This enables you to define where your phonathon is doing well and where it has room for improvement. Once you’ve isolated those areas, you’ll be in a great position to adjust your efforts as needed.

14. Keep an eye on trends in employer information.

As you start to collect employer information from your alumni and supporters, you may notice trends in company data. Be sure to ask questions like these:

These are all characteristics you can determine with greater accuracy the more donors you collect employer data from. While these are nice-to-know facts for general fundraising initiatives, they can also have a more significant impact on your greater matching gifts strategy.

Therefore, make sure you’re considering matching gifts when analyzing those trends for future initiatives. You never know when that information could come in handy for future events, digital outreach, or even a future phonathon!

15. Integrate your fundraising and matching gift tools.

Phonathons and other digital engagement events can be huge operations, and a lot can get lost in the shuffle if you don’t have the right tools. Luckily, providing a scalable system for your fundraising ambassadors and callers is an easy and effective way to organize your donor data. With matching gifts added to the mix, you’ll want an automated system to take care of all the nitty-gritty details for you.

Phonathon Software Integration

We recommend using a phonathon system to manage all your digital engagement needs—particularly one that integrates with powerful gift-matching tools! Donor Connect by Wilson-Bennett Technology and Double the Donation offer an integrated solution that allows callers to retrieve and communicate valuable matching gift information when speaking to donors in real time.

It takes virtually no effort from your team to set up the integration, and you’ll be able to start using it right away in your next digital engagement event. Automate the best practices listed above by incorporating the autocomplete search tool within Donor Connect scripts, automated email outreach, and regularly updated donor data.

Matching Gift Auto-Submission Integrations

A big part of driving greater matching gift revenue is simplifying the process for donors and their employers. That’s where matching gift auto-submission comes in handy.

Many companies leverage CSR software to manage employee giving programs. When these companies use platforms that integrate with our tools, this is how streamlined the match request process is:

It’s that simple! Otherwise, they’d need to fill out the form themselves. Leading CSR software like Givinga, Millie, POINT, and Selflessly enable auto-submission, so be aware of donors who work for companies that use these platforms. From here, make sure your phonathon volunteers know the basics of how this software works, too!

Bonus! Fundraising advice from phonathon experts

Hear from the phonathon fundraising experts at Wilson-Bennett Technology: a phonathon management services and software company serving nonprofits since 1998.

Todd Smith

Founder and CEO – Wilson-Bennett

Ensure training is ongoing throughout the campaign and each caller receives assistance, along with reminders, before calling begins each session.

We always encourage callers to excel while teaching methods to overcome negative comments.

During training, be sure to explain campaign policies and procedures, ensuring callers make the highest quality call on behalf of your institution.

Rob Schlitts

Former President – Wilson-Bennett

“Play chess with your phonathon.”

Matching the right prospects up with the right caller makes for a great connection, conversation, and ultimately a gift. Your alumni and student callers will both enjoy the ability to connect with prospects who share similar traits and experiences.

A well-trained student caller will always be the engine of a successful phonathon.

Wrapping Up

In an age of social media, texting, and online transactions, the human element of fundraising can get lost in the shuffle. Thankfully, phonathons offer a unique opportunity to bridge the gap between technology and personal connection.

Many organizations recognize that traditional phonathons remain a smart fundraising strategy. However, most don’t think about the potential of incorporating matching gift promotions into those invaluable donor conversations.

By following these tried-and-true phonathon fundraising tips, you can set up your team—and your mission—for long-term success. Looks like it’s time to get calling!

For more information, be sure to check out our other educational fundraising resources below:

How to Offer the Ultimate Employee Giving Experience

/in Corporate Consulting, Learning Center /by Adam WeingerPicture this: you’re the owner of a mid-size technology company that employs around 100 staff members. You’ve been brainstorming ways to boost employee morale and show your target customers that you run a value-driven business making its mark on the world.

You stumble across the idea of corporate philanthropy and, more specifically, employee giving. Quickly, you realize that this one concept can help you meet your previously stated goals—and the tax break would be an added bonus!

You decide to take the plunge and invest in developing a workplace giving initiative that will simultaneously benefit your company, your employees, and a wide range of charitable organizations.

But how can you ensure your staff will actually want to participate? By offering them an employee giving experience that prioritizes their wants and needs and is as simple a process as possible!

Here’s how you can do that:

In this guide, we’ll dive into these valuable tips for employers like yourself looking to make the most of their workplace giving programs.

Ready to get started with our first step? Let’s begin!

1. Inform employees of available workplace giving opportunities.

Before you can expect employees to participate in your workplace giving initiatives, you’ll need to ensure your staff is made aware of these programs in the first place. Prior to that, you’ll need to determine which types of giving programs you’ll be offering:

Here are a few of the most common examples:

Regardless of the combination of giving programs you choose, informing your staff about the new offerings and how to get involved is of utmost importance.

According to matching gift research, 78% of individuals eligible for corporate giving programs are completely unaware. As a result, they’re not able to make the most of these philanthropic initiatives.

We recommend providing informational materials that outline your corporate giving programs to all existing staff to get started. For example, you might hold a meeting, send a company-wide email, share a pamphlet, and add an explainer to your employee handbook. Then, be sure your staff knows where to go to seek additional details on the program!

Going forward, you’ll want to educate all new team members about workplace giving opportunities as well.

2. Provide employees with ample ways to give.

There are tons of ways that individual donors can support nonprofit causes. So when you create your workplace giving program, your offerings must be inclusive of all types of employee giving.

Top donation channels might include (but are not limited to):

The opportunities are endless—and each staff member at your business might have a different favorite way to give.

According to the same matching gift studies above, “96% of employees at companies with matching gift programs have a strong or very strong preference for their company to match donations made directly to a nonprofit (such as through the nonprofit’s website, peer-to-peer fundraising platform, or mail) rather than only matching donations through a workplace giving software platforms. The more options an employee has to give and to get their gift matched, the more likely they are to utilize available company matching opportunities.”

3. Make it simple for employees to determine eligibility guidelines.

As you work to ensure your company is well-informed about the existence of your employee giving programs, it’s equally critical that your programs’ eligibility guidelines are readily apparent as well. But what are these so-called guidelines?

Let’s take matching gifts (i.e., one of the most-used forms of workplace giving) as an example. In order for employees to participate in your company gift-matching initiative, you’ll need to provide your staff with the following information:

Because these criteria are necessary for employees to determine their eligibility for a company match, it’s important that you communicate this information effectively. Ensure your guidelines are provided in any previously mentioned explainer materials and even on your business’ website. Even interested employees won’t likely be willing to search high and low for this information. If it is hard to find, you’re likely creating an unnecessary obstacle to program success.

Here’s an example of what these criteria can look like:

Plus, as a general rule, keeping your guidelines as open as possible will provide an optimal employee giving experience for your staff. For example, when you set low minimums, high maximums, and generous deadlines, more individuals’ gifts will qualify for your programming. The more employees who qualify, the more will participate. And you know that higher your levels of participation, the more advantages brought to your company.

4. Ensure your company is listed in corporate giving databases.

One of the easiest ways employees can uncover your aforementioned program guidelines is by accessing a corporate giving database. This is essentially a compilation of information on thousands of businesses and their available corporate giving programs.

For example, Double the Donation offers the industry-leading database for matching gifts and volunteer grants. Thousands of nonprofits utilize this comprehensive tool—likely many of the same ones your employees will support.

For organizations that leverage Double the Donation’s embeddable search widget, donors are typically prompted within the donation experience to enter their employer information in search of matching gift eligibility.

If your employees follow this process, you don’t want them to search your company name, only to be met with “no results found.” This can cause discouragement in the process, even if they know how to locate your program guidelines elsewhere. Plus, many well-intentioned donors simply forget to follow up after losing their initial giving inertia.

So what can you do to avoid this scenario? Make sure your business is listed in corporate giving databases, complete with your programs’ eligibility criteria and links to submission forms.

Luckily, Double the Donation accepts submissions for new companies to add to their most comprehensive database, making it as easy as possible for your business to increase its program reach. As a result, you provide the simplest, most optimal employee giving experience while actively supporting their favorite charities.

And if you go the custom program route with a nonprofit partner that uses Double the Donation’s matching gift database, the organization can ensure the program is added correctly using the platform’s one-off match program management feature!

*While Double the Donation offers custom matching gift program management functionality, this feature is designed specifically for fundraisers looking to manage custom matching gift initiatives—Double the Donation does not work directly with corporations. If you’re a company interested in creating a matching gift program, contact us, and we’ll share information about our corporate vendor partners.

That way, your nonprofit-specific program will populate in that organization’s company search tool but won’t appear as an option for other nonprofit causes in order to avoid confusion.

5. Incentivize participation in employee giving programs.

By now, your employees should be aware of your employee giving initiatives in place and understand how they can participate. But what if your staff requires a little extra push to get involved with your philanthropic efforts?

That’s where strategic incentivization comes in!

If you want to encourage individuals to partake in new employee giving experiences, consider motivating the team with giving goals—either in terms of percentage of overall participation or in total fundraising goals.

Once your team reaches the predetermined objectives, you might treat the company to rewards like these:

Be sure to remind your employees that the ultimate benefit of a well-run workplace giving program revolves around providing mission-based organizations the funds they need to change the world. But some extra motivation never hurts, either!

6. Simplify requests with auto-submission functionality.

Want to increase employee participation in (and satisfaction with) your workplace giving programs? Make it as easy as possible to get involved. And it’s never been easier than with auto-submission!

Here’s what you need to know:

The Historic Submission Process

Once an employee determines that they qualify for a workplace giving program—such as matching gifts—they’ve traditionally been required to complete a request process put in place by the company they work for. Typically, the individual will be asked to provide basic information about their donation (e.g., amount, method of giving, date the gift was made, etc.) and the organization to which they contributed (such as its mission, mailing address, tax ID number, and more).

New Auto-Submission Functionality

Matching gift auto-submission functionality recently came out of beta. Now some programs can offer the new functionality, which substantially streamlines the process for donors and increases the likelihood that matches will be submitted. Instead of asking for all of the above-listed information, companies taking part in auto-submission simply request the individual’s corporate email address. The software ecosystem will take it from there to process, approve, and disburse funding for the match.

Leveraging Auto-Submission Providers

If you’re interested in getting started with auto-submission capabilities, the easiest way is to partner with a CSR management platform that already offers the functionality through a seamless integration with Double the Donation’s innovative technology. These currently include the following providers:

If you already work with a CSR platform that doesn’t yet offer this functionality, consider reaching out to your provider to advocate for the technology. After all, auto-submission is available with no added cost—it’s free for both the matching gift company and the software vendor they use—so you can offer the ultimate employee giving experience to your team.

Keep in mind—the more employees who take part in your company’s matching program, the better the results you can expect to see in terms of team member engagement, brand reputation, and more. And auto-submission abilities set your team up for continued success on all accounts!

There’s little to no purpose in investing in an employee giving program if nobody at your workplace will participate. To drive participation, you need to look at your employee giving experience from a staff member’s perspective and determine whether it’s a positive one.

So provide ample opportunities and avenues for giving, make available programs known, simplify the processes involved, and incentivize participation. This can make a world of difference—to your workforce, your community, and even your company’s bottom line.

Interested in learning more about employee giving? Check out our other educational resources:

Top 8 Employee Engagement Companies Leading By Example

/in Corporate Consulting, Learning Center /by Adam WeingerEmployee engagement has become an increasingly important part of organizational success. After all, businesses with engaged employees are 23% more profitable than companies whose employees are not engaged.

However, if you’re just starting to prioritize employee engagement, it can be difficult to determine where to begin. It can be helpful to take a look at what other companies are doing to engage their employees to gain actionable insights into how your organization can handle your new priority.

To show you how you can center employee engagement in your organization, we’ll cover the following topics in this guide:

Before we dive into the companies leading by example with their employee engagement programs, you need to understand what exactly employee engagement is and why it’s important. Let’s get started!

What is employee engagement?

Simply put, employee engagement refers to the level of emotional and mental connection an employee has to their team, general workplace, and employer. This translates to the employee’s commitment to the organization and dedication to achieving its goals. There are four different levels of employee engagement:

As you begin evaluating the general engagement levels at your organization, keep in mind that engagement does not equal enthusiasm. It’s easy to look at a happy employee and assume that they’re engaged with their work. However, employee engagement is tied to your organization. Ask yourself: Is this employee connected to their work alongside being a happy person?

What are the benefits of employee engagement?

We’ve lightly touched on a few benefits of employee engagement. The main one is profitability—employees who are determined to help your organization meet its goals are more likely to do their best to increase your cash flow.

Aside from profitability, here are a few other benefits for companies with engaged employees:

Employee engagement is important for all organizations, even those that work in the nonprofit sphere. Plus, it’s especially important for companies that have remote or hybrid employees, as those individuals are more likely to feel emotionally disconnected from their employer due to physical distance.

By prioritizing employee engagement, you’ll be able to leverage these benefits to your organization’s advantage. It’s a win-win—your company will see greater success and your employees will be happier to contribute to that.

The Top 8 Employee Engagement Companies

Now that you know more about what employee engagement is and how it’s helpful for your organization, let’s take a look at the top employee engagement companies that are leading by example.

1. Checkr

By implementing a generous matching gift initiative, Checkr amplifies the impact of its employees’ donations, doubling their contributions to eligible nonprofits. This not only supports the causes employees care about but also enhances their engagement and satisfaction within the company.

Plus, Checkr is recognized as a Certified Leader in Matching Automation (CLMA), which represents its dedication to philanthropy with a streamlined engagement process and more. This makes it easier than ever for its staff to get involved!

2. Adobe

If you’ve worked with or created visual media before, you’re undoubtedly familiar with Adobe. This company offers a product suite for photographers, videographers, graphic designers, and more. Founded on the idea of creating innovative products that change the world, Adobe also prioritizes employee engagement alongside offering technology that empowers people to create.

Here are a few ways the company handles employee engagement:

Additionally, Adobe has a special focus on helping employees from underrepresented groups gain visibility and grow in their careers. To that end, it provides programs that help employees build leadership skills and connect with other employees across the company.

3. Cisco

Cisco provides innovative cloud-based networking and security solutions to businesses. Its mission is to power an inclusive future for all with technology that connects the world.

Additionally, Cisco believes in creating a workplace where employees can find more than just a job. Ranked by Fortune as one of the best companies to work for, Cisco uses the following strategies to center employee engagement:

Cisco recognizes that it’s important for workforce leaders to understand employee needs and provide an ideal work experience without sacrificing performance. And its efforts are working, as they are one of PEOPLE magazine’s top companies that care.

4. ExxonMobil

This oil and gas company pioneers new research and technologies dedicated to reducing emissions while creating more efficient fuels. It’s also committed to engaging its employees in meaningful ways—and it’s paying off. In a survey conducted by resume.io, ExxonMobil ranked 15th in employee retention in the United States with a median employee tenure of seven years.

A few of the ways this company focuses on employee engagement include:

This company’s employee engagement strategies have resulted in visible benefits. For example, it was awarded the top most attractive U.S. energy company for engineering students for 10 consecutive years and the second most attractive company globally. It also has strong global acceptance rates from potential employees, about 10-15% higher than other large companies.

Plus, ExxonMobil boasts corporate giving initiatives that keep its employees engaged with philanthropy. If you’d like to learn more about their programs, click on the button below!

5. Kaiser Permanente

Kaiser Permanente is a healthcare organization that operates hospitals and medical offices and provides health insurance. Aside from caring for the well-being of employees at other organizations, it also focuses on engaging its own employees.

Here are three reasons why Kaiser Permanente is an example of a great employee engagement company:

As a health-related company, Kaiser Permanente leadership understands the importance of creating a positive and healthy workplace environment to engage its employees.

6. Microsoft

This technology corporation doesn’t measure employee engagement—it measures employee thriving. It defines thriving as “to be energized and empowered to do meaningful work.” As one of its core aspirations, employee thriving is meant to help employees find their sense of purpose within the company.

A few ways Microsoft focuses on employee engagement and thriving include:

From Microsoft’s perspective, thriving is different from work-life balance—the former is about being motivated to do meaningful work, and the latter involves an employee’s personal life, too. While it’s possible for an individual to thrive but lack work-life balance or vice versa, Microsoft is dedicated to creating a positive experience in both aspects for its employees.

7. NVIDIA

Multinational tech company NVIDIA designs top-of-the-line graphics processing units, cutting-edge computer chips, and effective employee engagement programs. This organization is dedicated to creating an empowering environment where employees have the support and inspiration to take on the world’s greatest challenges together.

Here are a few elements of their employee engagement strategy:

Although NVIDIA lives in the technology industry, it understands that its employees are not robots or data points and deserve compassion and empathy. It’s committed to supporting its team members holistically, not just as employees, but as humans.

8. Spotify

Spotify is one of the world’s largest music streaming service providers, with over 550 million active users. It offers over 100 million songs and five million podcasts to listeners. Aside from that, it’s also one of the leading employee engagement companies.

A few ways that Spotify keeps its employees motivated and engaged in their work are:

When it comes to its employees, Spotify’s approach is that they are all a band—dependent on each other to create the best audio experience. This employee engagement company focuses on creating an environment where employees are energized and excited to inspire those around them and drive innovation.

Additional Resources

Business magnate Richard Branson once said that businesses should “train people well enough so they can leave [and] treat them well enough so they don’t want to.” And these companies do—in some shape or form, they’ve mastered the art of employee engagement to create a great environment where employees are happy and even proud to work. As you begin forming or improving your organization’s employee engagement initiatives, consider taking a leaf out of their book to create a great experience for your team members.

If you’d like to learn more about employee engagement, consider the following resources:

The Impact of Matching Gift Programs on Employee Engagement

/in Matching Gift Companies, Learning Center /by Adam WeingerWith a whopping 85% of employees actively disengaged at the workplace, implementing intentional engagement programs is crucial for ensuring your company’s success. By implementing corporate social responsibility (CSR) programs into your company culture you can access benefits on multiple sides—workforce productivity, community impact, and customer satisfaction.

One of the top workplace giving program ideas is matching gifts. Starting a matching gift program boosts engagement by allowing you to invest in your employees’ passions. However, if you’re new to CSR or don’t know where to start with matching gifts, it can be difficult to know where to start. Don’t worry—this guide will provide you with everything you need to cultivate a more engaged and effective workforce by covering these topics:

Without further ado, let’s explore the valuable relationship between matching gift programs and employee engagement.

Matching Gift FAQs

Whether you’re a newcomer or a seasoned pro, you likely have some questions about the vast world of matching gifts. Let’s get you the answers you need before we move into our engagement strategies.

What are the key terms to know regarding matching gifts?

If you’re new to matching gifts, there are a lot of important terms that you might not be aware of. Here are some definitions to keep in mind:

All of these terms (and a few more) will eventually be fully fleshed out in your corporate giving policy. If you’d like to more clarity on how other organizations define them, research companies that donate to nonprofits to get a more informed perspective on how you can tailor these ideas to your employee engagement goals.

What are the primary benefits of matching gift programs?

Matching gift programs offer a plethora of advantages for both companies and nonprofits alike. Besides feeling fulfilled after committing a good deed, companies who embrace matching gifts can boost:

That said, you can’t harness these benefits without putting a sincere effort towards making philanthropy a core value of your company. That means actively promoting your program to employees and iterating on it.

What can affect employee engagement with matching gift programs?

Numerous factors can impact a company’s employee matching gift engagement, such as:

To gauge what influences your own company’s matching gift participation rate, survey your employees and ask what aspects are beneficial and where improvements can be made. These answers usually directly correlate with your program’s effectiveness and appeal to your employee community.

Tips for Maximizing Employee Engagement through Matching Gift Programs

Now that your initial questions are answered, you might be wondering how to launch your own matching gift program. Before we go over the details, let’s review the big-picture ways that you can increase engagement.

Your company needs to do more than simply start a matching gift program to get employees excited about getting involved. Implementing these large-scale atmospheric and program shifts will make it easier for your matching gift program to make a lasting impact.

How to Start an Employee Matching Gift Program

These simple steps can help you start your matching gift program on the right foot:

Develop a corporate giving policy

Before you lay out your specific matching gift policies, you should create a framework for your overall approach to corporate social responsibility and giving. Ensure you cover the following aspects in your policy:

Record all of these stipulations in a visible location, such as the employee handbook or in your employee-facing CSR platform, so your staff has the most essential information at their fingertips. If you make changes to your policy, communicate them to your entire team to keep your program running smoothly.

Pick a CSR platform

If you haven’t already settled on a CSR platform that supports matching gifts, now is the time to research your options and pick the best fit. Keep these important considerations in mind while you choose your platform:

Once you’ve narrowed down your prospective providers based on these criteria, schedule demos, consultations, and any other meetings to help you make your decision. Also, remember to include all relevant parties in your research and trial processes, such as your software experts, company leadership, and CSR program chairs, so you get a diverse array of perspectives on the available options.

Communicate the program’s impact to employees

As previously mentioned, one of the biggest barriers to employee participation in matching gift programs is a lack of awareness. To achieve maximum visibility, you should:

Similar to your external marketing efforts, your program will only be as popular as your communications are effective. Use marketing tools such as powerful calls to action and branded images to make your communications stand out.

Celebrate successes and recognize employee participation

Once the matching gift requests start rolling in, you should take the time to thank those who made the program successful—your employees. Showing your heartfelt gratitude can help employees feel more engaged and inspired to renew their involvement going forward. Share your thanks by:

A little recognition can go a long way in securing long-term support for your matching gift program. As long as your sincerity comes through, your employees will feel the love and keep giving!

Wrapping Up + Additional Resources

Now that you know how and why matching gift programs can influence your employee engagement, it’s time to launch your own efforts! By keeping your employees at the center of your strategy and leveraging the right technology, you can achieve remarkable results for your company, both internally and externally.

2023 at a Glance | Double the Donation’s Year in Review

/in Press Releases, Company Updates, About Double the Donation /by Kyra EngleAs we near the end of another extraordinary year, the Double the Donation team is thrilled to reflect on the incredible journey we’ve taken in our 2023 Year in Review. Throughout these last twelve months, we’ve seen remarkable growth, exciting developments, and forward-thinking strategies emerge.

And we’re thrilled to review some of our most compelling milestones and updates here! These include:

Now, let’s rewind and see what’s happened in the past year.

Exciting product updates & enhancements

Over the last twelve months, Double the Donation has continued to enhance our flagship product, 360MatchPro. Marked by an exciting array of more than 35 product updates and enhancements in the past year, the consistent developments are designed to bolster our matching gift automation platform and its overall effectiveness for users.

Let’s take a look at some of our standout new features and enhancements here:

Matching gift auto-submission released to improve and simplify the matching experience

As one of our most cutting-edge developments, matching gift auto-submission came out of beta this year! By significantly streamlining the match request process and strengthening relationships between companies and nonprofits, auto-submission functionality remains projected to yield matching gift revenue growth of 200% or more.

Custom matching gift program management to empower deeper corporate partnerships

Custom (or “one-off”) matching gift programs can provide organizations with an additional source of matching gift funding. Initially offered exclusively to 360MatchPro Enterprise clients but now available for all standard users as well, our new custom matching gift program functionality makes managing these opportunities simple and impactful for nonprofits.

*As a note: this feature is designed specifically for fundraisers to manage their end of the matching gift process. If you’re a corporation interested in matching gifts, let us know, and we’ll refer you to a corporate vendor partner that can help.

Improved tracking and reporting functionality to demonstrate the impact of matching gift automation

We want to make match tracking and reporting as easy (and insightful) as possible for our users. In order to do so, recent product updates include a new “Simple Statistics” module, a donor event tracking log, an updated reporting tab that provides quick, pre-built action items and data-informed recommendations, and more.

Renewed VPAT for Revised 508 Standards to verify and increase software accessibility for all users

An accessibility audit and updated Voluntary Product Accessibility Template ensure our platform stays up to date with and adheres to the most current accessibility guidelines. After all, our goal is always to offer a fully inclusive tool for fundraisers and donors alike.

These product updates and more have paved the way for our most powerful solution yet. As a result, our team is better equipped to serve nonprofit fundraisers and aid as they maximize their matching gift potential. And we’ve built a strong foundation for future advancements in 2024 and beyond.

Continually expanding client base

At Double the Donation, we take great pride in our ability to forge meaningful relationships with an ever-growing number of nonprofit and school fundraisers. Over the past year, we’ve been delighted to welcome more than 1,800 new organizations into our ever-growing client family.

Here’s what a few of our newly onboarded clients have had to say:

By collaborating with causes like these across widespread verticals and mission types, our team is honored to support the work our clients are doing to make a positive impact on the world around them.

As we head into 2024, we’re excited to see the upcoming successes that occur as new organizations dive deeper into strategic matching gift fundraising with our tools.

Numerous new & enhanced partnerships

At Double the Donation, successful partnerships are at the core of what we do. We understand that the more extensive our integration offerings, the more effortlessly organizations can incorporate matching gifts into their existing donation processes. This facilitates a streamlined and positive experience for donors, ultimately increasing the impact of their support.

That’s why we continually prioritize partnership network growth by establishing integrations with new donation tools, peer-to-peer fundraising software, CRMs, corporate giving platforms, and more. At the same time, we’re improving and enhancing existing integrations to provide the most seamless, impactful solutions for our clients.

In 2023, we’re happy to report that our team has celebrated more than fourteen new integrations and eighteen partnership enhancements. And that’s in addition to our existing technology network!

Remarkable levels of overall matching gift success

A key recurring highlight of our annual Year in Review report involves examining our clients’ monumental matching gift fundraising outcomes. And this year was no exception!

So far in 2023, Double the Donation software users have boasted impressive metrics like these:

Not only do matching gift strategies identify new opportunities for additional funds, but they also produce greater levels of donor engagement with impactful communications and outreach. And this year, we are glad to say that our clients have reaped the benefits outlined above and more!

Significant matching gift database growth

At Double the Donation, our extensive matching gift and volunteer grant database is one of our most powerful assets. And organizations use this tool every day to power their own corporate giving strategies.

That’s why it’s so crucial that we provide the best, most comprehensive compilation of program information. And why we continue to expand its coverage and scope.

At the time of our 2023 Year in Review, our database consists of more than…

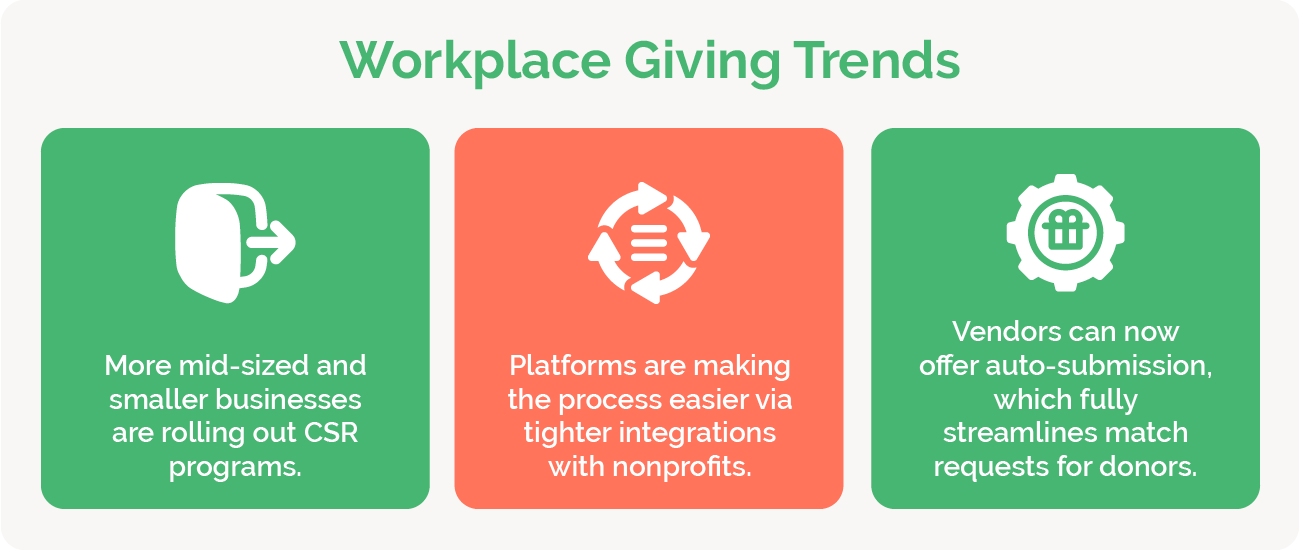

And these figures will only continue to grow—especially as corporate giving trends show more and more companies matching gifts.

Invaluable matching gift resources

A lot of what we do at Double the Donation involves equipping nonprofits with the resources to maximize matching gifts. In addition to our complete automation platform, 360MatchPro, another type of tool we provide is educational content on corporate giving.

This year, the Double the Donation team has significantly grown our resource library. We’re proud to introduce a wealth of readily available materials, such as…

Plus, we can’t forget about our most standout resource this year: the Matching Gift Academy! This online learning system, which is available free of charge to Double the Donation users (a $199 value/year), consists of all new materials with 11 modules, 45 lessons, and 7 hours of video content. It provides a comprehensive, self-paced, and immersive learning experience for nonprofit professionals looking for a complete overview of the matching gift opportunity.

Check out this quick overview of our webinar offerings to learn more:

By equipping fundraisers with a robust array of resources, we empower organizations to make the most of matching gifts to the best of their ability. After all, knowledge is power!

Wrapping Up

As we eagerly step into the new year, we’re filled with excitement and enthusiasm for what’s to come. To our inspiring clients, partners, team members, and more: we greatly appreciate the support you’ve given us this year. We truly couldn’t do it without you!

We look forward to another year of innovation, growth, and development as we continue to seek new ways to empower fundraisers to maximize their matching gift potential.

From all of us at Double the Donation, here’s to a joyful holiday season and a prosperous, promising year ahead. Thank you for being part of our journey, and we can’t wait to see what 2024 has in store!

Corporate Volunteering Platforms: Boost Employee Engagement