One of the largest global giving initiatives in the world, Giving Tuesday, will be here before we know it this year. Now is the time to prepare for a successful Giving Tuesday matching gifts campaign.

Falling each year on the first Tuesday immediately after Thanksgiving, this worldwide day of generosity can have a tremendous impact on nonprofit fundraisers. Last year boasted a record-breaking giving day, with 37 million participating adults contributing over $3.1 billion in the U.S. alone. And corporate matching gifts empower nonprofits to double their fundraising success.

However, many organizations did not realize their fullest potential when it came to matching gifts. After all, more than $4 to $7 billion in available match funds go unclaimed on an annual basis. This is primarily due to a lack of awareness among eligible donors, who do not ultimately request the associated match funding from their employers. Taking steps to secure this revenue for your organization as you head into the end-of-year giving season can go a long way.

In this guide, we will walk you through the unmatched value of corporate gift-matching and expert practices your team can implement to make each donation count more. Specifically, we’ll cover:

Let’s begin!

Understanding Your Giving Tuesday Matching Gift Potential

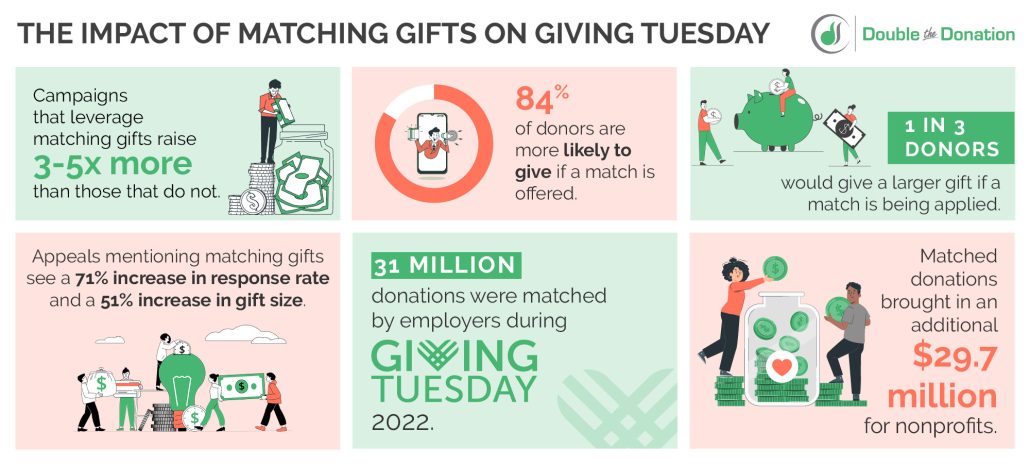

Matching gifts can dramatically improve fundraising outcomes. On Giving Tuesday, organizations anticipate increased donor engagement, surges in incoming donations, and more. And, Giving Tuesday campaigns leveraging donation matching typically raise 3 to 5 times more than those that do not.

But why is this, and how does it impact your fundraising group?

Matching gifts are one of the most widely utilized types of corporate philanthropy by companies of all shapes, sizes, and sectors. When donors give to their favorite nonprofits, their employers pledge to match those gifts with their own funds. It’s essentially the “Buy One, Get One Free” sale of fundraising.

Not only do matching gifts provide an accessible form of corporate giving revenue, but they also tend to drive individual involvement in fundraising. In fact, our research indicates that 84% of surveyed donors are more likely to contribute to a fundraising campaign if a match is available. At the same time, 1 in 3 supporters stated that they’d increase the size of their donation if they knew it would be matched.

This results in fundraising appeals that incorporate matching gifts, producing a 71% increase in response rate and a 51% increase in average donation amount.

Each year, Giving Tuesday sees millions of donor gifts matched by employers, generating significant additional revenue for nonprofits and schools to support their missions. This year, we’re aiming to surpass those numbers, and the Double the Donation team is here to help you achieve that goal.

Check out our other leading workplace giving strategies for end-of-year fundraising! Access the free, downloadable guide: What to Know About Workplace Giving & the Year-End Fundraising Season.

14 Tips to Incorporate Matching Gifts in Your Giving Tuesday Plan

When it comes to Giving Tuesday, one thing you DON’T want to overlook is matching gifts. At Double the Donation, we have extensive experience working with fundraising organizations to optimize their matching gift strategies. Thus, we know the most effective methods for driving matching gift success this Giving Tuesday and beyond.

Consider these proven strategies as your team develops its giving day fundraising plan. Then, determine how you can implement these tips in your own strategy.

1. Introduce matching gifts in internal Giving Tuesday preparations.

More likely than not, your organization plans to host a dedicated Giving Tuesday training session in the lead-up to the big day. This may involve establishing a fundraising timeline, crafting donor-facing messaging, and setting specific goals to ensure your whole team is on the same page.

One of the first steps you can take to set your nonprofit up for success on Giving Tuesday is to incorporate matching gifts into your preparations.

Getting your fundraising staff on board with the opportunity allows you to empower them as some of your greatest matching gift advocates.

And how can you do so? It all starts with marketing matching gifts to your internal team.

Specifically, you’ll want to cover:

- The basics of corporate matching gift programs (i.e., what they are, standard stipulations, etc.)

- The impact that corporate gift-matching can have on your fundraising efforts (donation response rates and gift sizes, corporate partnerships, and supporter engagement)

- An overview of the matching gift cycle (from identification to submission and funding disbursement) and how to assist donors through the process

- How team members can make the most of any matching gift technology in your fundraising software toolkit

- How to learn more about the opportunity (attend a webinar, enroll in Double the Donation’s Matching Gift Academy)

Consider utilizing a number of communication channels to engage your internal audience (such as fundraising staff, marketers, board members, key volunteers, and more). This may include in-person or virtual presentations, emails, and other resources to spread awareness.

Ultimately, it’s crucial that you get your team excited to maximize matching gifts on Giving Tuesday and beyond.

2. Establish a matching gift fundraising goal beforehand.

Just like you probably have (or will have) a goal that represents your supporters’ total giving on Giving Tuesday, it’s a good idea to establish a separate goal exclusive to matching gifts for the campaign. Regardless of whether you opt to measure total revenue through corporate gifts or the number of donations successfully matched, tracking goals is the key to determining success and inspiring engagement.

To set a lofty yet realistic matching gift fundraising goal this Giving Tuesday, you’ll first want to analyze your past fundraising and matching gift performance. For example, let’s say your team collected $1,000 worth of matching gifts associated with Giving Tuesday donations last year, with little to no promotional activity around corporate matching. This year, you can expect to see a significant increase by taking a proactive approach to informing donors, encouraging participation, and even automating the matching gift experience.

From there, be sure to communicate this goal (and your progress toward it) throughout your Giving Tuesday campaign, leading up to, during, and after the event. Aiming for a specific target will allow you to establish a sense of urgency and motivate eligible supporters to take their next steps. Consider using a fundraising thermometer on your campaign page, social media, or donor messaging to visually illustrate your progress toward the matching gift goal.

Note: As you set your goal, however, keep in mind that the disbursement of matching gift funds is often delayed. That said, tracking your matching gift participation by the total number or value of matches identified, or the number of matching gifts requested, can be an excellent substitute. This is especially beneficial for a time-bound campaign during the giving season!

3. Consider engaging taglines, graphics, and blurbs.

Many nonprofits devote significant time, energy, and creativity to planning and executing their Giving Tuesday fundraising efforts. And often, the campaigns with the most unique and engaging elements are the ones that stand out and see the greatest level of success.

The Giving Tuesday organizers even encourage nonprofits to customize the official campaign logo to best connect with their own audiences for this reason.

So, what does that mean for your matching gift efforts on this day?

We, like the Giving Tuesday team, encourage you to get creative with your promotions. That might mean coming up with inventive taglines, crafting novel hashtags, designing eye-catching graphics, or writing witty blurbs. While the goal is to drive participation in your matching gift campaign, the path to achieving it involves creating unique content and delivering actionable messaging.

Here are a few examples to consider. Feel free to adjust these ideas to reflect your organization’s mission, voice, and style!

Double the #GivingTuesday Love

Promote corporate matching gifts as a way to amplify the impact of donations on Giving Tuesday. This type of effort pairs well with match-related imagery to symbolize the doubling of donations. For instance, pairs of animals, twins posing in identical outfits, matching (or mismatched) socks, and more. If it’s something relevant to your mission, that’s even better.

By emphasizing that donors’ contributions may be matched, you can reiterate how each gift can multiply in value for your cause.

This Giving Tuesday, Match Away!

Encourage donors to “Match Away” this Giving Tuesday and watch their generosity grow. This catchy tagline is perfect for promoting corporate matching gifts, making it clear that donors have the chance to amplify their impact with every contribution. By emphasizing how donations can be matched, you’ll motivate supporters to give, knowing that their gift can stretch even further, helping you raise more for your cause on this global day of giving.

We’re Seeing Double on Giving Tuesday

“We’re Seeing Double” highlights the power of matching gifts, where every donation can be matched and go twice as far. Play off the theme with visuals of doubled items to reinforce the message. By focusing on how donors’ generosity can be amplified, you’ll inspire them to give, knowing that their support will have an even greater impact on your cause.

From Giving Tuesday to Giving MORE Tuesday

This tagline highlights how matching gifts can transform a single donation into significantly more. It’s not just about giving on Giving Tuesday; it’s about giving more, thanks to the power of matches. Pair it with visuals of growth, such as expanding trees or multiplying gifts, to illustrate how each donation can blossom into something larger.

Having a hard time coming up with a catchy tagline for your campaign? Try plugging some ideas into ChatGPT and seeing what it can produce for you!

4. Get inspired by other nonprofits’ matching gift efforts.

Sometimes the best way to inspire your own organization’s fundraising initiatives is to take a look at other nonprofits that have seen great success in their efforts. When it comes to matching gifts on Giving Tuesday, exploring organizations that have been effective in matching gifts in previous years can help inform your team’s strategy.

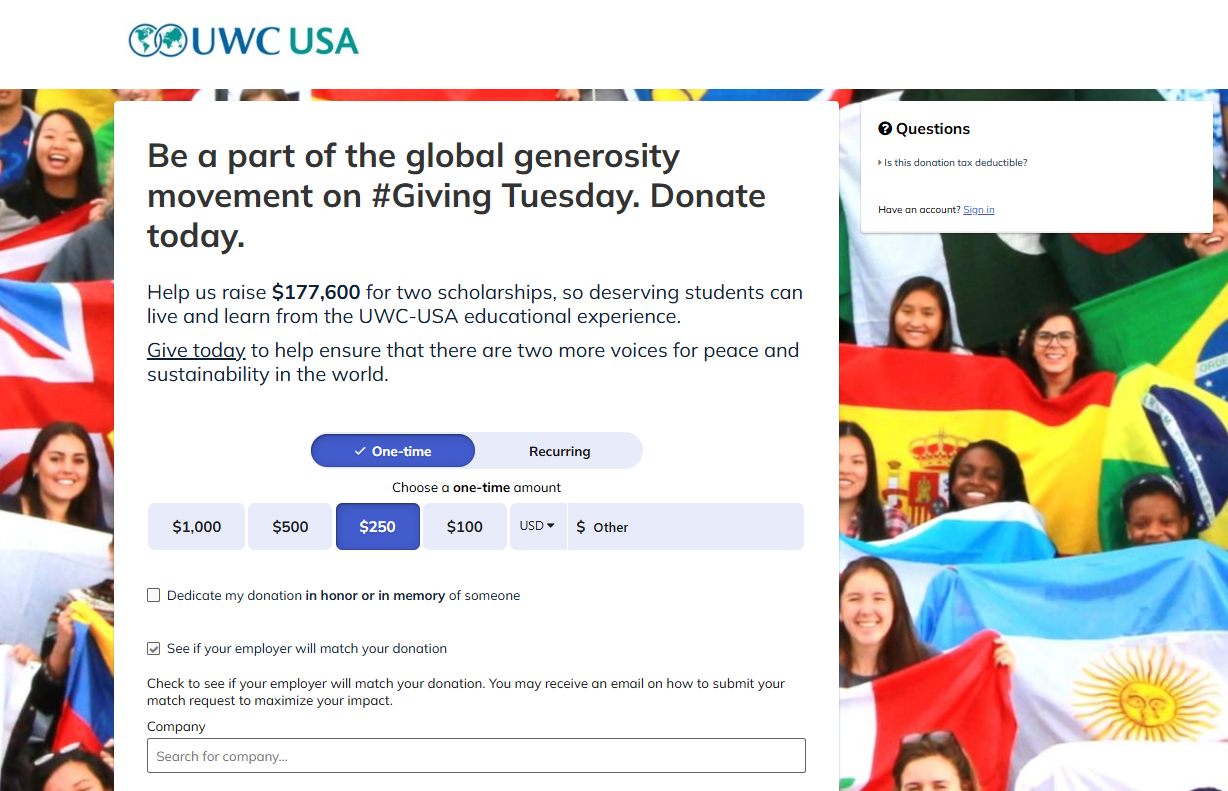

We’ve located a few standout examples of Giving Tuesday matching gifts campaigns that engaged their audiences, informed supporters of matching gift opportunities, and ultimately drove more matches to completion.

First, these matching gift banners were incorporated into one of the largest healthcare and research organizations’ Giving Tuesday pages:

This organization repeatedly highlights the matching gift opportunity throughout its campaign landing page. It also utilizes a customized Giving Tuesday logo to capture the audience’s attention and employs donor-centric language to prompt the supporter to take immediate action.

Not to mention, this nonprofit also equips its supporters with a matching gift automation platform. This makes it quicker and easier than ever before for donors to double their impact with a match from their employer!

Here’s another example from an animal welfare and service dog training organization promoting matching gifts in its Giving Tuesday campaign:

This visually focused campaign leverages the “cuteness factor” to capture supporters’ attention and evoke an emotional response to the fundraising appeal. With matching dog photos to represent the matching donation opportunity, the organization aims to drive donations and matches with a mission-relevant custom graphic.

And again, this organization utilizes matching gift software to streamline the employee matching gift process for its donors. The simpler it is for supporters to complete the match request process, the more revenue a team can expect from the funding source.

Next, a Utah-based food bank incorporates a matching gift appeal on its Giving Tuesday page, as seen below:

This effort places a strong emphasis on the organization’s impact. Not only does the campaign graphic quite literally put a face to the fundraising need, but it also shares a relevant statistic that emphasizes the importance of donor giving for the nonprofit’s audience. And it allows the supporter to see how their potential gift can make twice the difference!

Plus, with a matching gift software in this food bank’s Giving Tuesday tech stack, supporters can receive information about and participate in their employers’ matching gift programs with just a few easy (and guided) steps.

Finally, check out this example from an environmental nonprofit based in Los Angeles, California:

This Giving Tuesday matching gifts promotion incorporates a dedicated blog post on the organization’s website. The content shares several easy ways that supporters can enhance their donations when participating in the giving day campaign and is designed to help fundraisers maximize individual support.

The highlighted ways include making a recurring donation, contributing gifts of stock, amplifying the organization’s efforts through word-of-mouth marketing, and, of course, participating in employee matching gifts.

5. Read up on companies with Giving Tuesday matching programs.

More than 24,000 companies have known matching gift programs worldwide. Some of the most notable examples include General Electric, Microsoft, Google, Walt Disney Company, Coca-Cola, and Home Depot. As these initiatives are generally organized as year-long efforts, employees working for these companies will likely qualify to have their Giving Tuesday donations matched.

However, it’s also worth noting that some businesses opt to go above and beyond with their matching gift programs, specifically for Giving Tuesday! Familiarizing your staff with top matching gift programs beforehand will enable you to prepare effectively to share the information with donors who work for these companies. Not to mention, promoting Giving Tuesday-specific matches is a great way to incentivize giving and matching by eligible employees.

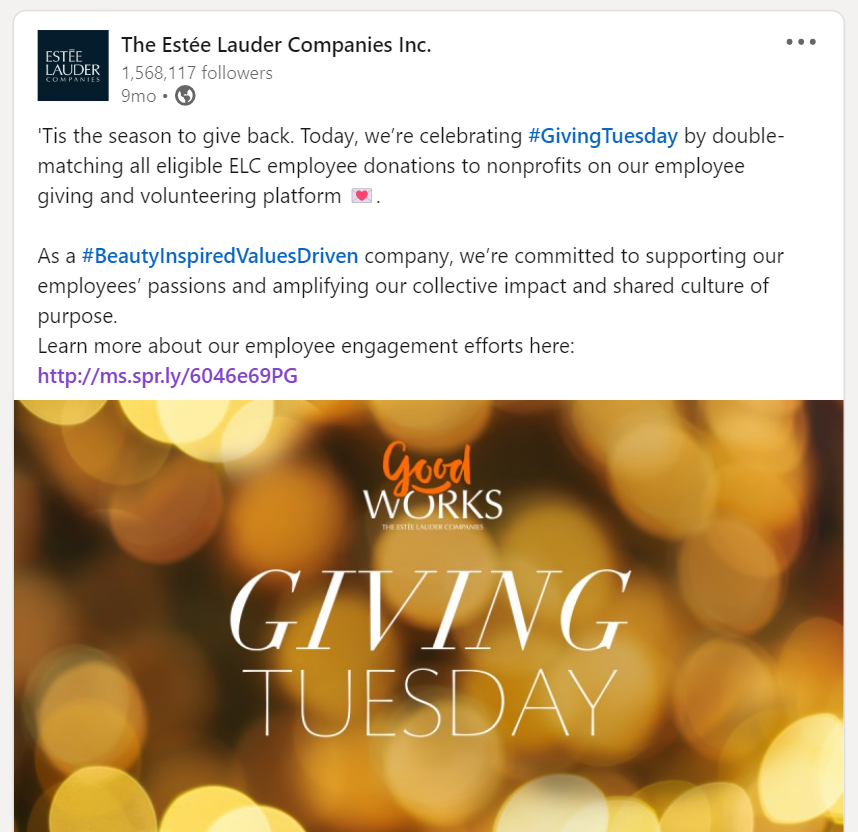

For instance, the companies below have increased their matching gift ratios to multiply employee gifts made on Giving Tuesday at a greater rate.

Typically matching donations at a 1:1 rate (i.e., a $50 gift produces a $50 match), Estée Lauder offers its employees a “double-matching gifts” program on Giving Tuesday. When a qualifying staff member makes a donation on Giving Tuesday, the company ultimately triples the gift for the organization.

Fiserv generally matches employee gifts at a standard 1:1 match rate. However, gifts made on Giving Tuesday were multiplied at a higher level, offering a limited-time 2:1 matching gift ratio.

Caterpillar Inc. matches gifts through the Caterpillar Foundation, incentivizing employee participation in Giving Tuesday with a 2:1 match. This limited-time motivator is typically hosted for the two weeks leading up to Giving Tuesday while the company establishes an annual match limit of $1.5 million.

BlackRock encourages employee giving on Giving Tuesday by offering a 2:1 match ratio for gifts made during the designated period. For most other donations throughout the year, however, the company matches at a standard 1:1 rate.

Though this company typically matches gifts at a dollar-for-dollar rate, team member gifts contributed on Giving Tuesday were matched at a 3:1 ratio. That means if an employee gives $100, Elevance Health matches with $300, essentially quadrupling the value of the initial gift.

6. Propose Giving Tuesday custom match programs with corporate partners.

Unfortunately, some companies still don’t have widely accessible matching gift programs. But that doesn’t mean you should give up on match opportunities for those donors. It just means you need to adjust your strategy! One tactic that we recommend pairs particularly well with Giving Days, end-of-year fundraising, and other time-based initiatives is custom (or one-off) matching gift programs.

Here’s how it works: As you prepare for Giving Tuesday, locate a company that employs a decent segment of your donor base but doesn’t currently match team members’ donations. Reach out to that company’s leadership (or encourage your donors to reach out themselves to forge a connection) and propose a dedicated matching gift partnership for Giving Tuesday.

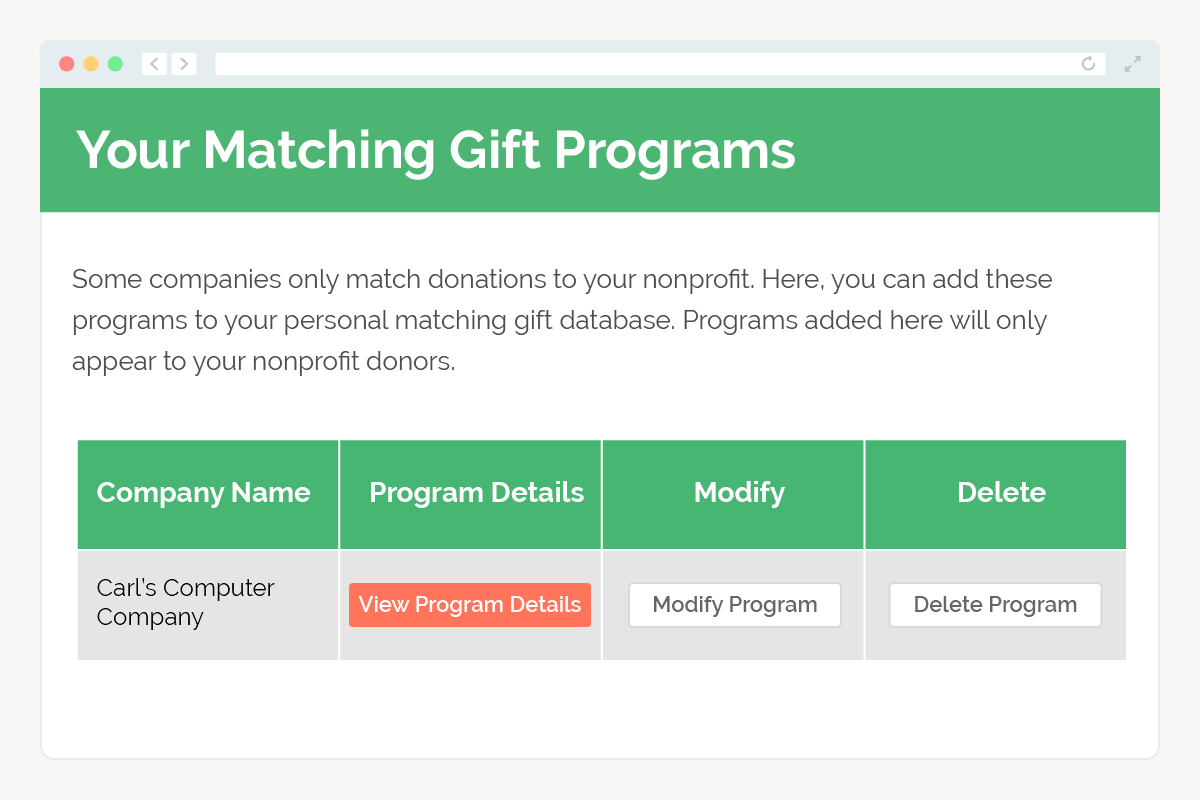

Once agreed upon, your team will add the custom program to your matching gift search tool. (Hint: Nonprofits using Double the Donation’s platform can add one-off initiatives to their database using the unique program management feature.) This way, it will populate in the qualifying donors’ employer queries when the campaign is live.

In this type of program, the company would commit only to matching gifts to your organization, likely within a set campaign window on or around this year’s annual Giving Day. And it’s a great way for unfamiliar employers to become familiar with employee donation matching, too!

*As a note, this feature is designed specifically for fundraisers looking to manage custom matching gift initiatives. Double the Donation does not work directly with corporations. If you’re a company interested in creating a matching gift program, contact us, and we’ll share information about our corporate vendor partners.

7. Share about Giving Tuesday and matching gifts on social media.

Your organization’s social media profiles are likely some of your greatest marketing and communications assets, especially regarding your fundraising efforts. As Giving Tuesday is a largely digital campaign, leveraging your online presence is a must. And promoting matching gift opportunities through these channels can be particularly impactful.

Prior to the big day, teaser posts can create anticipation by highlighting not only the upcoming Giving Tuesday campaign but also the opportunity to amplify donation impact with employee matching gifts.

Check out the sample post below, and be sure to link to your matching gifts page in the caption to provide additional information.

At the start of Giving Tuesday, consider posting something like this (hint: it can also be added to your giving day campaign page!). Again, ensure it directs viewers to your match page or donation form, enabling supporters to learn more and get involved.

Then, throughout the day, real-time updates (such as progress toward your general fundraising and matching gift goals) can showcase engagement and inspire giving through social proof.

Soon after Giving Tuesday concludes, share something like this to acknowledge and appreciate donor giving and encourage them to take the next steps:

Remember: consistent messaging across these phases enhances engagement, prompts urgency, and extends the influence of your campaign. Not to mention, you also provide digital content that is easily shareable, allowing donors to increase their impact even further by spreading the word about the opportunity to their own networks.

8. Highlight matching gifts on your campaign landing page and giving form.

You likely expect a significant amount of web traffic to head to your Giving Tuesday campaign landing page. Don’t let this resource go to waste! Instead, incorporate information about corporate matching gift programs to ensure each visitor is exposed to the opportunity.

Not only will this increase the likelihood that qualifying donors ultimately complete their matches, but it can also inspire more supporters to give in the first place.

From there, donors will click to access your donation form and provide the information required to process the gift. In addition to the basics (such as their name, intended donation amount, and payment details), we also recommend collecting employment information.

When supporters provide the name of the company they work for, it will be easier to uncover eligible gifts and follow up with targeted instructions for completing the match.

Hint: If your team has purchased a matching gift database software, it’s a good idea to embed your search tool on both the Giving Tuesday landing page and your online giving form. This widget can collect company data during the donation process and provide program guidelines and links to submission forms from your confirmation page, making it as easy as possible for your donors to participate.

9. Craft an inspiring matching gift ask.

Your matching gift appeal is one of the most essential components of your Giving Tuesday matching gifts plan. Crafting an ask that incites your intended action (donors completing corporate matching gifts on your behalf) requires a strategic blend of urgency, emotion, and information. As you begin workshopping your match appeal, consider borrowing tips and tricks from your broader donation requests.

For example, the official Giving Tuesday toolkit provides a framework for establishing impactful fundraising asks. This includes a…

- Belief statement — a declaration of the organization’s core values and convictions (ex, “We believe that no student should have to choose between food and learning.”)

- “You” statement — an explanation of the donor’s role in the campaign and how their support can help (ex, “You can help us stock the pantry so that no student goes hungry.”)

- Opportunity statement — a call to action inspiring donors to get involved (ex, “Are you with us?”)

Working off these three elements, here’s a sample matching gift appeal the same institution might use to promote corporate-matching opportunities on Giving Tuesday:

- Belief statement — “Matching gifts have the potential to multiply our school’s fundraising impact, ultimately providing much-needed support for students in our community.”

- “You” statement — “By completing a brief online submission form for your employer, you can double the value of your initial donation to our food pantry fundraiser, allowing more students to benefit from essential food and resources.”

- Opportunity statement — “Will you click here to complete your matching gift request?”

As always, just remember to adjust this sample messaging to reflect your organization’s own mission, vision, and fundraising needs.

10. Build out your fundraising and matching gift tech stack.

Powering your Giving Tuesday campaign with the right software is essential for optimal fundraising results.

The Giving Tuesday team recommends testing your technology by walking through the entire giving process from the donor’s perspective. This allows you to gauge the user experience, identify any roadblocks, and ensure a seamless giving experience on Giving Tuesday. We suggest going a step further and also testing out your matching gift experience!

As you make your test donation, ask yourself the following questions:

- Does the giving page request my employment information?

- Does the confirmation page encourage me to pursue a corporate matching gift, if applicable?

- If I provide my employment information, does the confirmation page populate with company-specific program details?

- If I provide my employment information, will I be given a link to my company’s online match request form?

- Do I receive a follow-up email that contains detailed information on the matching gift process and urges me to complete my match?

If you notice areas with room for improvement in your strategy (or identify significant gaps in your tech stack), begin tackling any issues that arise immediately. You want to ensure that you provide your supporters with the best experience possible, and an integrated fundraising platform and matching gift tool can make a significant difference.

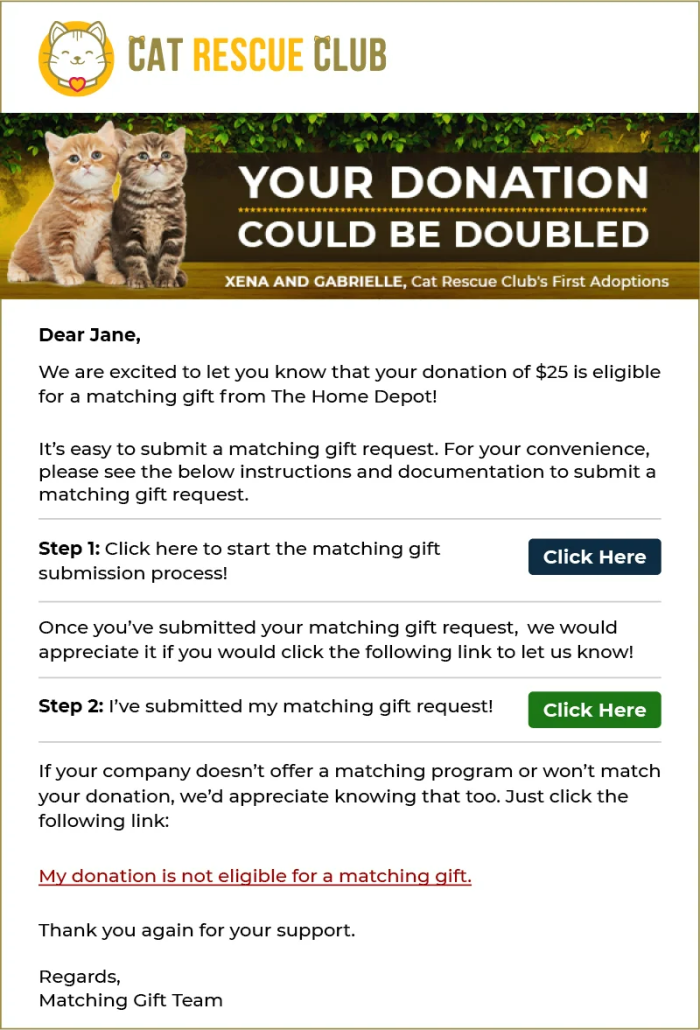

11. Send post-transaction matching gift outreach.

After donors contribute to your Giving Tuesday campaign, be sure they’re informed (or reminded) about matching gift opportunities to keep them engaged. Sending post-transaction match-related outreach is a great way to utilize your already high levels of donor engagement.

It’s important to provide clear instructions on how supporters can initiate the matching process with their employers. For the best results, timing is crucial. Double the Donation studies indicate that matching gift emails sent within 24 hours of a donation being made see a 53% open rate. That’s 2-3x the average nonprofit email open rate.

Plus, with a matching gift software, you can automate tailored messaging so that your fundraising team doesn’t have to lift a finger.

Free resource: Check out our sample matching gift letters to get a head start on your organization’s matching gift communications. Customize our free templates to best engage your audience!

12. Enlist supporters to advocate for matching gifts on your behalf.

Another key component of Giving Tuesday participation is advocacy. Thus, using this chance to empower your nonprofit supporters to advocate for matching gifts on behalf of your organization and its mission should be a no-brainer.

For example, not all of your donors will work for employers that have existing matching gift programs. But if an employee were to ask the company to reconsider its workplace giving offerings by matching gifts, it could make a big difference. Thus, enlisting supporters as advocates for matching gifts on (or leading up to) Giving Tuesday can help your team amplify its long-term impact and engagement, even if it doesn’t result in an immediate match.

Consider sharing a customizable email template, like this one, with your supporters:

Subject line: Request for a corporate matching gift program at [company name]

Hi [company leader],

I am writing to request the addition of a corporate matching gift program at [company name].

Thousands of companies offer employee matching gift programs as a way to support their staff and give back to their communities.

These programs also tend to benefit companies in terms of employee engagement and retention, opportunities to attract competitive candidates, improved brand image, increased sales, and more.

Thank you for your consideration,

[Your name]

[Job position]

Not to mention, donors can also advocate for matching gifts to their friends, families, colleagues, and more. We previously mentioned that numerous match-eligible individuals remain unaware of the opportunity, and your supporters can help bridge the knowledge gap by spreading the word.

13. Don’t forget about volunteer grants.

Giving Tuesday isn’t just about giving financially; it’s also about giving time and effort. Many nonprofit supporters worldwide choose to engage with this global day of giving by donating their time and skills. Thus, ensure your team isn’t overlooking another type of workplace giving program: volunteer grants.

Unfortunately, like traditional matching gifts, many eligible employees remain completely unaware of the opportunity available to them. By informing the volunteers who support your nonprofit’s efforts about the chance to amplify their impact with volunteer grants, your team can further enhance engagement on and long after Giving Tuesday.

Encourage existing volunteers to research their employers’ giving programs to determine eligibility. (Hint: If you have access to a matching gift database, see if it contains volunteer grant information, too. Double the Donation does!) Then, ask that your volunteers apply for these grants to support your organization.

14. Thank donors for all their involvement in your Giving Tuesday efforts.

At the conclusion of Giving Tuesday, it’s time to shift your efforts from an ongoing campaign to post-fundraising stewardship and retention. For matching gift donors, doing so is more important than ever.

Thanking supporters for their involvement in your campaign is vital for building and strengthening lasting relationships. In the days following Giving Tuesday, automate personalized thank-you emails, make phone calls, or send handwritten letters that express gratitude for donors’ support.

Then, as matching gifts are completed, don’t forget to send match-related acknowledgments, as well! We recommend thanking donors at two key points: once they confirm that they’ve submitted their match request and after your organization receives their employer’s match.

Additionally, if you have supporters get involved through volunteerism, advocacy, or other employee giving programs, be sure to thank them for their engagement as well.

Post-Giving Tuesday Practices to Extend Momentum for Your Fundraising

Giving Tuesday is a major milestone in your nonprofit’s fundraising calendar, but the work doesn’t stop once the day is over. In fact, much of the real magic happens after the event, when you have the opportunity to build on the momentum generated and sustain engagement throughout the rest of the year.

Here are some effective strategies to extend the impact of your Giving Tuesday campaign beyond the big day itself:

Update Donors on the Campaign’s Success

Once Giving Tuesday is over, share how much was raised, how it compares to your original goal, and what this success will mean for your organization’s mission. Utilize various channels, including social media, email newsletters, and your website, to keep supporters informed about the impact of their contributions.

This not only reinforces the value of their gift but also shows accountability and transparency, which can increase donor trust and retention.

Celebrate #MatchingWednesday

Another idea for extending campaign momentum involves engaging your donors in matching gifts the day after Giving Tuesday. By introducing a #MatchingWednesday follow-up campaign, you can retain your organization at the forefront of supporters’ minds for longer. Additionally, doing so allows them to stretch their gifts without having to reopen their wallets.

Not to mention, much of the Giving Tuesday buzz will have settled down by then. This means you’ll have less competition for your audience’s attention and likely a more prominent spot in their inboxes the following day. However, it still allows you to capitalize on the engagement of Giving Tuesday to drive continued giving and make a lasting impact.

Nurture New Donor Relationships

Many nonprofits see a spike in new donors on Giving Tuesday. It’s essential to keep this momentum by nurturing these new relationships. Follow up with new donors with a personal message or update, offering them a special thank-you gift, or inviting them to an exclusive event or webinar. Show them how they can stay involved beyond Giving Tuesday, whether through monthly giving, volunteer opportunities, or other campaigns you have planned.

Create Opportunities for Recurring Donations

One of the best ways to sustain the energy from Giving Tuesday is to offer recurring giving options to your new and returning supporters. Donors who made a one-time contribution on Giving Tuesday may be more likely to sign up for regular monthly or quarterly donations, especially when they feel connected to your cause.

Make the sign-up process simple and convenient, highlight opportunities for donors to do so through payroll giving, and offer incentives such as special updates or recognition for recurring donors.

Promote Future Fundraising Campaigns

Use the momentum from Giving Tuesday as a springboard for future fundraising efforts. Let your donors know about upcoming campaigns, events, or initiatives, and give them the chance to sign up or get involved early. This keeps your supporters engaged in the long run and creates a sense of anticipation for what’s to come in your future.

Analyze and Reflect

After the excitement of Giving Tuesday dies down, take the time to analyze the performance of your campaign. What worked well? Where did you see the most engagement? Which strategies led to the highest number of donations? Then, use this data to refine your approach for future campaigns. Understanding the metrics behind your Giving Tuesday success will help you improve your strategy for upcoming events and even year-round fundraising.

Next Steps

With Giving Tuesday quickly approaching, there’s no better time to revamp your organization’s matching gift efforts. You certainly don’t want to overlook this key source of revenue or the individual and corporate engagement opportunities it brings. To optimize your strategy, it’s important to take a proactive approach to matching gifts.

However, remember that equipping your fundraising team with the right tools is essential. Automation allows you to make the most of matching gifts without investing much of your (perhaps already stretched-thin) time and resources.

And it’s not just helpful on the big day, either. A matching gift platform can enhance matching gifts throughout the rest of your giving season, into the new year, and beyond.

Start prepping for Giving Tuesday! Get your matching gifts strategy ready by exploring these additional guides:

7 Strategies for Marketing Payroll Giving to Your Supporters

/in Payroll Giving, Donor communications, Fundraising Ideas, Marketing Strategies, Learning Center /by Gabe DinardiAccording to recent payroll giving statistics, 59% of survey respondents have no familiarity with payroll giving initiatives. Fortunately, however, marketing payroll giving opportunities to your nonprofit supporters can significantly boost participation in the programs—and enhance your overall fundraising efforts.

After all, payroll giving programs allow donors to contribute a portion of their salary to your organization automatically, providing a steady stream of income with minimal effort. However, many potential donors remain unaware of this giving method or how easy it is to participate.

In this post, we’ll explore seven practical strategies to help you market payroll giving and make it a core component of your fundraising plan.

By implementing the right marketing strategies, you can educate your supporters, promote the convenience of payroll giving, and inspire long-term donor engagement. Not to mention, increase revenue through the programs.

Let’s begin!

1. Create a Payroll Giving page on your nonprofit website.

Starting off, you’re going to want to market payroll giving programs prominently throughout your nonprofit or school’s website. A dedicated payroll giving page on your nonprofit’s website is a powerful tool for educating potential donors about this giving option, serving as a centralized hub where supporters can easily learn about the benefits, process, and impact of payroll giving.

Start by explaining what payroll giving is, highlighting how it allows employees to contribute to your cause directly from their paycheck on a recurring basis. Ensure the page features clear instructions on how to enroll in payroll giving, too, such as through their employer’s CSR platform or by contacting their HR department.

You’ll also want to emphasize the convenience of payroll giving. Once donors sign up, they don’t have to worry about making regular donations manually. It’s a simple, consistent, and tax-efficient way to support the cause they care about.

2. Incorporate payroll giving in your email marketing.

Email marketing is one of the most effective ways to reach your nonprofit’s supporters, and incorporating payroll giving into your email campaigns can significantly boost participation.

Start by crafting a compelling email that educates your audience on the advantages of payroll giving, emphasizing its ease, convenience, and long-term impact. Highlight the benefit of steady, recurring donations for your organization, personalizing the message to show supporters how their payroll donations can drive meaningful change in the community or cause they care about.

Include clear calls-to-action in the email, encouraging recipients to enroll in payroll giving through their employer. You can link directly to your nonprofit’s payroll giving webpage or provide detailed steps for contacting their HR department to inquire about the program. It’s also helpful to include examples of companies that offer payroll giving or suggestions for how donors can advocate for the program if their employer doesn’t currently provide it.

For the best results, we recommend regularly mentioning payroll giving in different types of email communications—such as newsletters, thank-you emails, or special campaign updates. This keeps the option top of mind for donors while reinforcing the importance of their continued support.

3. Promote payroll giving initiatives on social media.

Social media is a powerful channel for engaging with your nonprofit’s audience, and it can be a highly effective tool for promoting payroll giving programs, too.

Use platforms like Facebook, Twitter, LinkedIn, and Instagram to share posts that explain what payroll giving is and how supporters can participate. Share success stories, testimonials, or case studies from current payroll donors to demonstrate the program’s real-world impact. Not to mention, visual content like infographics or short videos can be particularly effective in grabbing attention and communicating key messages.

Regularly include payroll giving in your content rotation, using relevant hashtags to increase visibility when appropriate. Remember: the goal is to ensure supporters are consistently reminded about this giving option and can easily find the information they need to get started.

4. Collect and leverage employment information in your outreach.

The more you know about your donors, the better you can engage them in workplace giving programs like payroll deductions and more. Specifically, having access to accurate and up-to-date employment data can go a long way.

But how can you collect this information? Start by incorporating questions about employment during the registration or donation process. Ask supporters to share the name of their employer, as well as whether they are aware of any workplace giving programs like payroll giving, matching gifts, or volunteer grants.

Once you’ve collected employment data, segment your donor list by company and customize your communications based on the giving opportunities available at those businesses. For example, if you know that a particular company offers payroll giving, you can send targeted emails to employees at that company, providing detailed instructions on how they can enroll in the program. If their company doesn’t currently offer payroll giving, encourage those donors to advocate for it within their workplace.

Top tip: If you lack quality employment information about your donors, consider utilizing a data enhancement service. This will allow you to fill in some gaps and provide the information you need to identify the best workplace giving programs in your network!

5. Consider donors already eligible for other workplace giving programs.

When it comes to workplace giving, most participating companies offer more than one way for employees to get involved. For example, statistics indicate that nearly two-thirds of companies report matching employee payroll contributions, and many of the top matching gift companies offer volunteer grants, too.

But what does that mean for your team?

Supporters who already participate in other workplace giving programs, such as matching gifts or volunteer grants, may be ideal candidates for payroll giving initiatives. To target this segment, begin by identifying donors who have previously submitted matching gift requests or applied for volunteer grants. These individuals already have a relationship with their company’s corporate social responsibility initiatives, which makes them a strong target audience for payroll giving.

In your outreach, emphasize the complementary nature of payroll giving to other workplace programs. You’ll want to acknowledge their previous participation in workplace giving programs and thank them for their ongoing support. Then, introduce payroll giving as a way to streamline their contributions and make an even greater difference. You can even highlight how their regular contributions through payroll giving can be further amplified through matching gift programs, doubling, or even tripling their impact.

6. Collaborate with corporate partners to highlight the opportunity.

Nowadays, more and more organizations are beginning to take an increasingly proactive approach to marketing payroll giving programs to their supporters. Still, many companies choose to promote the opportunity to their employees, too. And for that reason, collaborating with the businesses offering the programs can go a long way in heightening visibility and participation.

Start by reaching out to companies that already support your nonprofit through donations, sponsorships, or volunteer programs. Ask if they have a payroll giving program in place and discuss ways to promote the initiative to their employees. This could even involve co-branded marketing materials, such as email templates, flyers, or social media posts that both the company and your nonprofit can share with their audiences.

7. Offer exclusive incentives for payroll giving donors.

To encourage supporters to participate in payroll giving, consider offering exclusive incentives that reward their commitment to ongoing contributions. This can make the process more appealing and demonstrate your nonprofit’s appreciation for their support.

While it will likely vary based on the wants and needs of your particular audience, potential incentives may include…

Consider tying incentives to donation milestones, such as offering a special gift to donors who have contributed for a certain number of months or reached a specific donation amount. This not only encourages initial sign-ups but also helps retain donors over the long term.

Wrapping Up & Additional Resources

Effectively marketing payroll giving can transform the opportunity into a powerful, recurring revenue stream for your organization. By leveraging digital and other marketing tactics to educate supporters and partner with companies in your network, you can unlock the full potential of workplace giving and build stronger, more consistent donor relationships.

As you implement the seven strategies above, you’ll not only raise awareness of payroll giving but also encourage long-term contributions that help sustain your nonprofit’s mission. Don’t let the opportunity go to waste!

For more information about effectively marketing payroll and other employee giving opportunities, check out the following resources:

Major Atlanta Companies with Matching Gift Programs

/in Lists and Rankings, Matching Gift Companies /by Adam WeingerWhile Double the Donation works with nonprofits across the country, the fact that we’re headquartered in Atlanta means we have a special place in our hearts for Atlanta nonprofits.

Through corporate giving programs, nonprofit supporters can double (maybe even triple!) their contributions to eligible organizations, allowing their employers to showcase their social responsibility. These programs boost nonprofits toward their goals by contributing much-deserved revenue. Your organization does not want to overlook these opportunities.

If your nonprofit is based in Atlanta, brush up on these important areas of corporate giving:

Ready to boost your nonprofit’s revenue by learning about corporate giving opportunities in your area? Let’s get started!

Statistics on Atlanta Matching Gift Companies

From a nonprofit’s standpoint, being located in a major city like Atlanta is ideal for raising money with corporate giving programs. The city is home to many of the largest employers in the world, some of which offer extensive employee matching gift and volunteer grant programs. Here are a few statistics on Atlanta-based companies and their employee giving programs which may interest you:

Curious about employee matching gift programs and volunteer grant programs? Click here to explore more corporate philanthropy statistics.

Otherwise, let’s dive into some major companies that offer matching gifts in the Atlanta area!

Companies in Atlanta, GA with Matching Gift Programs

With over 75% of Fortune 1000 companies having a presence in Atlanta, there are definitely opportunities for your nonprofit to increase fundraising from employee giving programs. A great place to start is by looking at the largest companies based in Atlanta.

Let’s take a look at a few of the employee giving programs at some of Atlanta’s leading employers.

Coca-Cola

Coca-Cola offers a very generous employee giving program. The company offers a 2:1 match, which means eligible employee donations are tripled! They’ll match donations anywhere from $25 to $20,000, as long as they’re made to eligible nonprofits.

Coke is willing to match donations to nearly all nonprofits but does have a few restrictions on their matching gift program. For instance, part-time employees are ineligible to participate.

Another aspect of Coca-Cola’s program worth mentioning is that the company does a great job promoting the programs to Coke employees! Read more about this in our previous article that covers employee matching gift participation rates at various companies across the nation.

Click here for additional info on Coke’s matching gift program.

Home Depot

As one of the major companies based in Atlanta, Home Depot is also a generous supporter of nonprofits in the city. They match donations anywhere from $25 to $3,000 at a 1:1 ratio.

Similar to Coca-Cola, the company has few restrictions in place. For instance, both full-time and part-time employees are eligible, but unlike some other major companies, retired employees are ineligible.

The company has an easy-to-use electronic matching gift submission process, which means your donors can submit matching gift requests in a matter of minutes.

If you’re interested in learning more about the typical process a donor goes through to submit a matching gift request electronically, learn more about Home Depot’s electronic submission process.

Click here for additional info on Home Depot’s matching gift program.

IBM

IBM matches donations made by both current employees and retirees.

The matching gift ratio varies depending upon whether it’s an employee or retiree making the donation. For instance, IBM will match eligible contributions of up to $5,000 per institution per current employee at a 1:1 ratio. For retired employees, they’ll match at a .5:1 ratio.

Plus, they provide volunteer grants for employees and retirees who prefer to donate their time rather than money. They offer both individual and team volunteer grants. Depending on the amount of volunteered hours, employees can request from $500 to $5,000, starting at 40 hours.

Charitable employees who volunteer for eligible organizations can request either a monetary grant or an equipment grant. Specifically, team volunteer grant requests for eligible schools and nonprofits can be up to $7,500 in equipment. For individuals volunteer grant requests, IBM employees and retirees can request up to $3,500 in technology grants or $1,000 in cash awards each year.

Click here for additional info on IBM’s matching gift program.

Delta Air Lines

Delta matches up to $5,000 annually per eligible individual at a dollar-for-dollar rate. This is up from a 50% match on up to $2,000 annually just a few years ago.

The program is offered to full-time employees, part-time employees, and retirees.

Click here for additional info on Delta Air Lines’ matching gift program.

AT&T

While AT&T doesn’t offer a matching gift program, the company supports organizations that full-time employees are passionate about through its Cause Cards program.

Cause Cards are grants from AT&T given to eligible charities recommended by employees. All employees that participate in the annual Employee Giving Campaign are eligible to receive a Cause Card.

The grant amount depends on each individual employee’s total giving amount. These Cause Cards are expected to range from $25 to $250, and once they’re approved, employees are notified of the amount offered by AT&T and the deadline to select an eligible charity.

Click here for additional info on AT&T’s matching gift program.

United Parcel Service (UPS)

UPS does not offer an employee matching gift program. Upon hearing this news, our team reached out to the UPS Foundation for confirmation and received the following response:

While they don’t match employee donations, they are avid supporters of their local communities. For instance, in recent years, they’ve invested over 1.8 million volunteer hours and over $100 million to charitable organizations.

Equifax

Both full-time and part-time employees are eligible to participate in the program. Donations of $50 to $5,000 may be matched at a 1:1 ratio. In other words, donations to eligible nonprofits can potentially be doubled!

As with many corporate giving programs, Equifax aims to enable employees to use a part of the company’s budget to support their own philanthropic interests.

Click here for additional info on Equifax’s matching gift program.

Additional Atlanta Matching Gift Companies

Hundreds of other major employers in the Atlanta area also match employee donations. Check out some other Fortune 1,000 companies in Atlanta that offer matching gift programs:

By familiarizing yourself with employers who offer corporate giving programs, you set yourself up for a successful fundraising strategy. Otherwise, you may miss out on important revenue opportunities.

Exploring Opportunities with a Matching Gift Database

By adding a matching gift database (like Double the Donation) to your nonprofit’s tech toolbox, you’ll substantially increase your revenue potential.

Double the Donation’s database has data on more than 24,000 companies that represent 26+ million match-eligible individuals, making it the world’s leading matching gift database. Here’s how it works:

Plus, there’s more to Double the Donation. The system recognizes match-eligible donors through email domain screening and enables email automation to drive matches to completion.

Want to find out how these tools can help your Atlanta nonprofit increase its fundraising potential?

Atlanta is home to many of the nation’s leading companies that match employee donations. Make sure everyone in your organization is familiar with major employers that offer giving programs in your area.

You should also consider taking it a step further by providing donors and volunteers with detailed information on their company / their spouse’s employer. By raising awareness and simplifying the match process for supporters, you should increase your fundraising revenue.

Take a tour of Double the Donation’s matching gift service to see if we can help your organization raise more money from these programs.

Ecopixel Integrates with Double the Donation to Provide Advanced Matching Gift Solution for Nonprofits

/in Press Releases, Company Updates /by Adam WeingerDouble the Donation and Ecopixel are proud to announce a new partnership that makes requesting corporate matching gifts more intuitive to the donor experience. With the new integration between Double the Donation by Double the Donation and Ecopixel’s giving forms, guiding eligible donors to completing their match is easier than ever.

The new integration makes it easy for donors to discover their match eligibility and go straight to their matching gift request form with the click of a button while they’re still in the giving process.

“This integration allows us to offer nonprofits and donors alike the most accurate, comprehensive, and up-to-date information about corporate matching gift programs from our database of over 24,000 companies,” said Adam Weinger, President at Double the Donation. “That way, organizations can spend their time working on the causes that matter most to them instead of worrying about chasing every eligible donation individually.”

Once set up, organizations can start identifying more match-eligible donors immediately through Ecopixel’s built-in donation forms.

The Ecopixel team will activate your integration for you – from there, all you’ll have to do is place the Double the Donation tools on your desired forms. You’ll be up and running in no time!

Donors have it easy too with the autocomplete search tool and confirmation page widget now at their disposal. When they begin searching for their company name, the search tool will autocomplete their entry by suggesting companies from Double the Donation’s database. After completing their donation, donors are directly led to their company-specific matching gift request form based on their search tool input.

Even if donors don’t have the time to fill out their matching gift request directly after they give, they’ll be reminded via Double the Donation’s automated email streams. This is true for both match-eligible donors and donors who did not fill out their company name. Eligible donors will receive follow-up communication reminding them to complete their request. Donors with an unknown employer will receive a nudge to check their eligibility. This way, all match-eligible donors are given multiple touchpoints to get their gift matched!Looking to learn more? Check out our in-depth integration guide to get started!

About Ecopixel: Ecopixel creates and sustains effective and compelling websites for nonprofits. With flexible content editing and robust integrations, Ecopixel delivers an accessible, mobile-friendly, and multilingual front for fundraising, outreach, and events. For more information, visit the Ecopixel website.

About Double the Donation: Automate your matching gift fundraising with the industry-leading solution from Double the Donation. The Double the Donation platform provides nonprofits and educational institutions with tools to identify match-eligible donors, drive matches to completion, and gain actionable insights. Double the Donation integrates directly into donation forms, CRMs, social fundraising software, and other nonprofit technology solutions, and even partners with select CSR platforms to further streamline matching gifts for donors. Through Double the Donation, the matching gift process has never been simpler.

Companies with Matching Gift Programs in Tampa, Florida

/in Matching Gift Companies, Learning Center /by Adam WeingerMatching gifts are becoming a favorite way of giving among America’s top companies. Matching gifts are an easy way to double your current donations. Familiarize your organization’s staff with this list of companies.

Unfortunately, many donors are unaware that their companies have these programs. Often, the responsibility falls on nonprofits to inform their donors.

Tampa has a dynamic economy that relies on industry, national defense, tourism, and shipping. The city is home to several multinational corporations and Fortune 1000 companies, many of which operate employee giving programs.

Learn about the top companies in Tampa, FL, with matching gift programs. Use this list to help your organization optimize its fundraising efforts.

Humana

Humana will match up to $1,000 for each of its employees who donate to eligible causes. The company also offers an interesting incentive for volunteers.

Read more about Humana’s employee giving programs.

Publix

Publix will match donations made between $25 and $5,000 per employee. Part-time workers and retirees are eligible.

Read more about the Publix matching gift program.

USAA

USAA will match gifts made between $25 and $500. They match on a 1:1 ratio. See if your organization is eligible.

Read more about the USAA matching gift program.

Interested in learning how Double the Donation increases nonprofit fundraising with employee matching gifts?

Tracking Payroll Giving: A Nonprofit’s Step-by-Step Guide

/in Payroll Giving, Learning Center /by Adam WeingerPayroll giving is a powerful tool for fundraising organizations, providing a steady and reliable stream of income through regular donations directly from supporters’ paychecks. As more companies implement payroll giving programs to support charitable causes, nonprofits like yours must understand how effectively managing and tracking payroll giving can make an impact.

Why? Properly monitoring payroll donations ensures accurate financial reporting, strengthens donor relationships, and maximizes the overall impact of this funding source.

In this blog post, we’ll walk you through a step-by-step guide on how to track payroll giving for your cause. This includes:

From setting up the necessary infrastructure to reconciling your financial records and beyond, we’ll cover everything you need to know to stay on top of your payroll giving program and enhance its long-term success. Let’s dive in!

1. Register for companies’ payroll giving platforms.

The first step in effectively tracking payroll giving is for your nonprofit to register with the companies or platforms that offer payroll giving programs. Many corporations partner with specific third-party platforms, such as CSR software, to manage their payroll giving initiatives. By registering on these platforms, your organization becomes eligible to receive donations directly from employees’ paychecks, making it easier to capture funds and track giving trends.

The registration process itself typically involves providing key organizational information, including your nonprofit’s EIN (Employer Identification Number), mission statement, and financial documentation. You may also be asked to complete a verification process to confirm your nonprofit’s status as a registered 501(c)(3) organization.

Then, once approved, your organization can be listed on the company’s payroll giving platform, enabling employees to select your nonprofit as a beneficiary of their payroll contributions. Just keep in mind that the better you maintain your profile, the more accessible your organization will be to potential donors within participating companies.

Top tip: While there’s a ton of CSR software out there, we recommend prioritizing CLMA-designated solutions first. These platforms demonstrate an ongoing commitment to streamlining the employee giving process, and even offer a seamless matching gift experience for donors who qualify for donation-matching!

2. Determine specific payroll giving metrics and objectives.

Before tracking payroll giving, your nonprofit must first establish clear metrics and objectives that you wish to capture. By determining what success looks like, you can collect and analyze the right data to optimize your approach. These metrics will help guide your analysis, identify trends, and allow you to make necessary improvements to maximize your payroll giving revenue.

To start, we recommend identifying key performance indicators (KPIs) that align with your organization’s goals. Some important payroll giving metrics you might consider include:

In addition to financial metrics, consider tracking engagement and awareness-building efforts. For instance, you may want to monitor how many companies your organization has registered with, how frequently your nonprofit is being promoted on payroll platforms, and the extent to which employees are aware of your participation.

Defining these objectives will not only help you track progress but also assist in creating a strategy to optimize payroll giving. Clear metrics allow you to compare your results over time, analyze what’s working, and adjust your approach accordingly. Ultimately, having well-established goals will help your nonprofit make data-driven decisions and achieve sustained growth in your payroll giving efforts.

3. Establish a system for recording payroll donations.

Once your organization is listed on payroll giving platforms and you’ve determined the KPIs you wish to track, the next step is to establish a reliable system for recording payroll donations. Remember: effective tracking requires organized and accurate documentation of each gift, making it crucial to develop a robust method for capturing payroll donation data.

Start by integrating your nonprofit’s CRM (or Constituent Relationship Management) system with payroll platforms or donation management tools. Many CRM systems even offer specialized features for recording recurring donations like payroll contributions. Ensure that your CRM is set up to automatically track the donation details, including the donor’s name, donation amount, frequency, and employer.

Additionally, your system should be capable of categorizing payroll donations separately from other types of contributions, such as individual one-time gifts or grants. This allows your team to monitor and report on payroll giving specifically, ensuring better accuracy in your overall financial reporting.

Create standardized procedures for entering payroll donation data, especially if the process requires manual entry. This should include guidelines for inputting donor information, donation amounts, and transaction dates, as well as how to handle any errors or discrepancies in reporting.

Maintaining organized and updated records will help you avoid common pitfalls like double-counting donations, losing track of donors, or failing to reconcile your financial reports properly. A well-structured system ensures that your organization can track, analyze, and optimize payroll giving effectively, resulting in better decision-making and streamlined reporting.

4. Monitor regular contributions.

Once you have an efficient system in place to record payroll donations, the next step is to monitor these contributions regularly. Since payroll donations are often recurring, tracking and reviewing them on an ongoing basis is essential for managing your nonprofit’s cash flow and donation trends.

It’s important to set a schedule for checking donation activity, whether that’s weekly, biweekly, or monthly. Regular monitoring allows your nonprofit to quickly identify fluctuations in giving patterns, such as increases during key fundraising periods or decreases during off-seasons. It also helps ensure that donations are consistently received from payroll platforms and that there are no delays in disbursement.

During these reviews, verify that the correct donation amounts are being recorded and ensure that no payments have been missed. Monitoring should also include keeping an eye on matching gift contributions if companies offer them alongside payroll giving. These matching donations can significantly boost the overall funds received, making it crucial to track and follow up on any outstanding matches.

In addition, consider setting up automated alerts or reports to notify your team of key changes in payroll donations, such as when a new donor begins contributing or an existing donor alters their contribution amount. Having this information readily available will allow you to respond proactively, whether by thanking new donors, reaching out to those who adjusted their contributions, or following up on any discrepancies in donation amounts.

5. Reconcile payroll donations with financial records.

To maintain transparency and accuracy in your nonprofit’s finances, it’s crucial to regularly reconcile payroll donations with your broader financial records. Reconciliation involves comparing your internal records of payroll donations with the financial data provided by payroll platforms or corporate partners to ensure everything matches and there are no discrepancies to consider.

This process typically starts by reviewing your financial reports, which should list all donations received during a specific period. From there, compare these records with the reports generated by payroll giving platforms or the companies facilitating the donations. Look for any discrepancies between the two sets of data, such as missed donations, incorrect amounts, or unmatched transactions.

Be sure to track donation timing as well. Payroll donations are often disbursed on a different schedule from one-time gifts, meaning you may need to account for delays in receiving funds or differences between when donations are pledged and when they appear in your account.

Once you’ve identified any inconsistencies, work with your finance team and the payroll platform to address and correct any issues. This might involve contacting the donor’s employer or the payroll platform to verify missing contributions or to reconcile donation amounts.

All in all, accurate reconciliation is key to ensuring that your nonprofit’s financial health remains intact. Not to mention, donors can trust that their contributions are being properly recorded and used as intended.

6. Report on KPIs and other giving patterns.

The final step in tracking payroll giving is to report on the key performance indicators (KPIs) and analyze the giving patterns. Once you’ve gathered sufficient data, use it to create reports that offer insights into how well your payroll giving program is performing. This not only helps your internal team assess progress but also demonstrates accountability to your board, stakeholders, and donors.

When preparing your reports, consider including metrics such as:

These reports can highlight trends in donor behavior and reveal patterns in employee giving, such as increased donations during specific months or after targeted marketing campaigns. Additionally, breaking down contributions by employer can help identify which companies are driving the most payroll giving and where more efforts might be needed to engage new partners.

Beyond financial reports, it’s valuable to analyze donor retention and engagement rates. Are employees continuing their payroll contributions year over year, or do they tend to drop off after a few months? Understanding this will help you tailor your outreach and stewardship efforts.

Regular reporting allows your nonprofit to fine-tune its approach to payroll giving, identify opportunities for growth, and ensure your program’s long-term success.

Final thoughts & additional resources

Tracking payroll giving donations is essential for ensuring your nonprofit fully benefits from this invaluable funding source. Follow the steps outlined in this guide to equip your team to manage payroll donations efficiently, maintain accurate records, and nurture strong relationships with your supporters.

As payroll giving continues to grow in popularity, nonprofits that implement effective tracking strategies better position themselves to capitalize on this consistent source of revenue and ultimately drive greater impact for their missions. Good luck!

For more information on payroll and other workplace giving strategies, check out the following recommended resources:

Payroll Giving Statistics | 13 Fun Facts for Fundraisers

/in Fundraising Ideas, Corporate Consulting, About Double the Donation, Learning Center /by Adam WeingerHow to Hire A Google Grants Agency + 8 Best Firms for 2024

/in Marketing Strategies, Learning Center, Lists and Rankings /by Adam WeingerThe Google Ad Grants program empowers nonprofits to connect with prospects searching for causes like theirs around the globe. However, maximize the program’s potential requires a strategic approach.

Google Grants agencies specialize in helping nonprofits fully leverage the program. They handle everything from applying for the program to picking the best keywords, removing the learning curve so you can focus on your mission and engage new constituents.

Whether you’re new to Google Ad Grants or looking to refresh your account management strategies, a Google Ad Grants manager can elevate your ad campaigns and keep your account compliant with Google’s rules. In this guide, we’ll cover the program basics and recommend top Google Grants agencies to help you make the most of your $10,000 monthly grant. Here’s what we’ll cover:

At Double the Donation, we’ve witnessed organizations achieve remarkable results with corporate giving programs like Google’s. While we focus on employee giving programs like matching gifts, we believe Google Ad Grants can also significantly enhance your organization’s impact. Let’s explore how specialized agencies can streamline this process.

An Overview of Google Ad Grants Management

Before researching specific Google Grants agencies, make sure you know what Google is offering eligible nonprofits through the program. This will help you understand whether outsourcing the work to a professional is the right move. If you’re already well-versed in Google Ad Grants, feel free to jump ahead to learn how an agency fits into your strategies.

What is the Google Ad Grant?

The Google Ad Grants program is a corporate giving initiative that gives 501(c)(3) organizations $10,000 every month to spend on amplifying their pages in Google search results. That adds up to $120,000 every year that qualifying nonprofits can invest into marketing their missions.

Nonprofits pick the landing pages they’d like to promote, then build ad campaigns that target different keywords related to their mission. The goal of the program is to help nonprofits scale their impact by getting in touch with more donors, volunteers, and advocates online.

So long as your nonprofit complies with the program’s guidelines, the grant will automatically renew each month. The program has pretty strict guidelines for eligibility and ongoing compliance. That’s why organizations typically outsource account management to Google Ad Grant marketing agencies who will oversee their campaigns and keep their accounts compliant.

Are Google Ad Grants worth it?

Since 2001, Google has awarded over $10 billion in free advertising to 115,000+ nonprofits in 51 countries, according to recent nonprofit marketing statistics. Your nonprofit can easily become part of this amazing program!

While it can be challenging to create winning ad campaigns, any organization can (and should) apply for the program. It’s $10,000 of free funding every month that can amplify your cause if you allocate it strategically. With proper Google Ad Grants management, the program empowers your nonprofit to:

To make the most of the program, have someone at your organization spend a few hours each week learning about Google Ad Grants management. If you face limited staff bandwidth and can’t invest enough time into your campaigns, outsource the work to a dedicated Google Ad Grants manager.

Either way, $10,000 a month is a good chunk of change that will pale in comparison to the amount of staff time you spend or the money you pay an expert to manage your campaigns.

Why should I invest in Google Ad Grants management?

This Google Ad Grants impact report shows that nonprofits can see incredible returns with proper Google Ad Grants management. In fact, search ads offer the highest ROI among paid advertising platforms for nonprofits.

Google processes 3.5 billion search queries daily and accounts for over 90% of the search engine market, making it the world’s most popular search engine. Advertising your cause on Google connects you with a vast audience, and effective grant management ensures you deliver the right content to the right individuals.

However, getting started comes with a steep learning curve, from conducting keyword research to maintaining compliance with Google’s standards. With your team’s busy schedule, dedicating enough time to manage your Google Ad Grant may be challenging.

Investing in professional Google Ad Grants management offers several benefits:

Especially when working with a Google-certified agency, you’ll gain access to the best advice and a direct line to Google for any account issues.

How A Google Grants Agency Can Help Your Nonprofit

From determining your eligibility to finding the right keywords, a lot goes into effective Google Ad Grants management. That’s where a dedicated Google Grants agency comes into play.

Agencies will take the guesswork out of account management and develop winning campaigns that supercharge your marketing efforts. They spend their time understanding the program’s requirements and learning how to leverage relevant tools that will maximize their clients’ results. Specifically, they help nonprofits with the following:

A Google Grants agency knows what it takes to create winning campaigns that inspire users to click through to your website. And like we mentioned, the money you spend on hiring a professional will be well worth it compared to the $10,000 in marketing money you’ll receive every month.

If you’re curious about any of these services, Getting Attention’s Google Grant agency guide explores how agencies help nonprofits in-depth. That way, you can understand if investing in an agency is the right move.

What Is A Google Partner?

Any marketing agency can offer Google Grants management services. While some promising startup agencies can provide sufficient services, nonprofits can ensure they’re hiring a reliable agency by choosing a certified Google Partner.

A Google Partner is an organization that has earned a certification from Google for demonstrating expertise in managing Google Ads accounts. To become a Google Partner, a company must meet specific requirements set by Google, including:

Being a Google Partner provides a company with access to special benefits, including training and support from Google, early access to new features, and the ability to display the Google Partner badge on their website and marketing materials.

This designation is a mark of trust and expertise, indicating that the company is recognized by Google as capable of effectively managing Google Ads campaigns and maximizing the return on investment for their clients.

How To Choose A Google Ad Grants Manager

At this point, you’re almost ready to explore different agencies. As you explore your options, you should take certain steps to make sure you find a Google Grants agency that you can fully depend on to make the most of this CSR opportunity.

For instance, you’ll want to:

By walking through these steps, you’ll narrow down your options in no time. Remember, the right Google Ad Grant marketing agency will act as an extension of your team and do everything it can to champion your cause. We recommend choosing a Google Partner since these agencies demonstrate a clear understanding of the program.

Whoever you choose, spending time finding a good fit will pay off in the long run as you’ll be able to fully rely on them to make the most of your grant money.

8 Recommended Google Grants Agencies

To simplify the extensive vetting process, we’ve compiled a list of recommendations, so you can find ones that might be a good fit for your team. Each of these partners works with nonprofits to enhance their Google Ad Grants management and displays knowledge of the program’s requirements and opportunities. Use this list to narrow down your options and request their support when you’re ready.

Getting Attention | Best All-Around Agency

Getting Attention specializes solely in Google Ad Grants management. They’re committed to maximizing your grant money, keeping your account compliant, and connecting you with lifelong prospects through powerful marketing campaigns. Backed by a team of seasoned professionals, they’ll act as an extension of your team and work with you to drive results. By managing every aspect of your Google Ad campaigns, they’ll help get your cause in front of qualified prospects who want to make an impact on your cause.

This agency is also a certified Google Partner, meaning the Google Ads team has personally reviewed their team’s abilities to manage Google Ad accounts properly. Their core services include:

Getting Started With This Google Grants Agency

Getting Attention strives to be fully transparent with its clients, which is why they don’t charge any upfront fees and instead only charge a monthly fee of $600. Compared to the $10,000 in grant money they’ll secure for you, that’s a small price to pay for expert Google Ad Grants management, especially from a certified Google Partner!

If you require additional services beyond what’s included in their pricing package, they’re open to discussing their experience with you to find a plan that will work. Reach out to discuss your needs with their team today.

Nonprofits Source | Best Agency for Educational Resources

If you’re new to the Google Ad Grant program, the most vital thing you need in this stage is information, and that’s where Nonprofits Source steps in. This digital marketing agency empowers nonprofits to grow their digital footprints, and where it really stands out is its expansive educational library.

Know that they only offer general digital marketing services to nonprofits, though. These services include search engine optimization and web design, which are both essential for improving your Google Search presence. While they don’t manage Ad Grant accounts, they offer plenty of free resources about the program, such as:

Exploring This Agency’s Resources

Check out Nonprofits Source’s blog for the latest tips in the nonprofit digital marketing world. In no time, you’ll be an expert! You can also partner with them for your SEO and website design needs.

DNL OmniMedia | Best Consultant for Nonprofit Technology

DNL OmniMedia is a nonprofit technology consultant. Their mission is to help your nonprofit leverage technology in ways that amplify your cause and focus on goals rather than getting bogged down with code and data. While they don’t specialize solely in Google Grants, they do offer services that will help enhance your Google Ad Grants management.

Their pay-per-click (PPC) marketing services include:

Getting Started With This Google Grants Agency