What causes your employees to clock into work every day? The obvious answer is their compensation. But what drives them to strive to do their best work, go the extra mile to complete projects, and expand their skills to create more value at your business? That’s where employee engagement strategies come in.

Today’s savvy business owners are more than aware of the difference strong motivation can have on every aspect of their company, from lowering accidents and mistakes to improving customer relationships.

With the importance of keeping motivation high, you might assume employee engagement is a priority for most businesses. However, approximately 85% of employees report being unengaged or actively disengaged at work. That’s a big problem for businesses that don’t want to see increased absenteeism, higher turnover, and lower-quality work.

Fortunately, there is a solution if your employees are part of that 85%. Several employee engagement strategies are easy to implement and manage in the long term. We’ll explore those tips in this article, but first, let’s define employee engagement.

What is Employee Engagement?

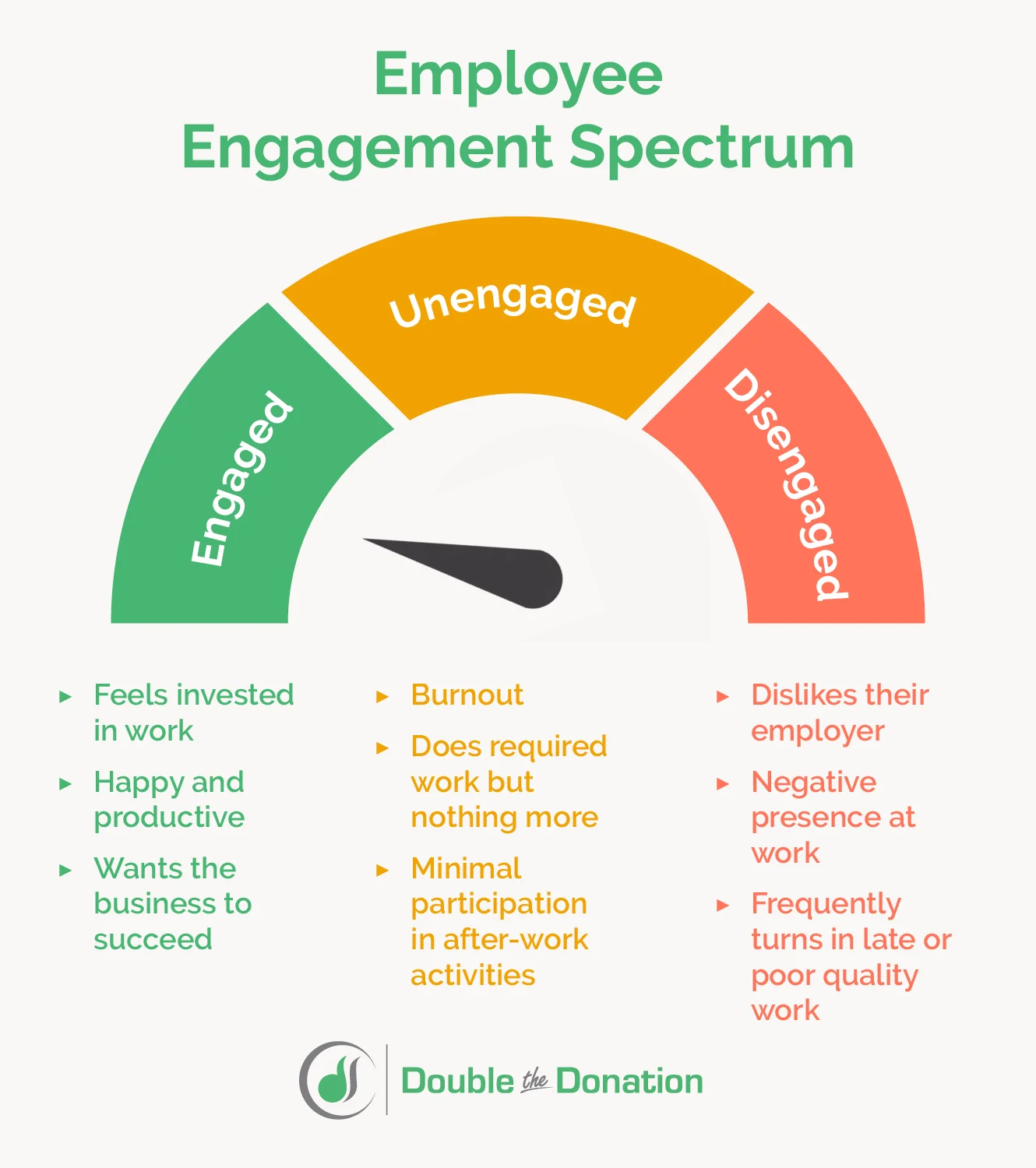

Employee engagement refers to how employees feel about and behave at their work. Ultimately, engagement is a scale that goes from engaged to unengaged to disengaged.

Engaged employees are committed to their work and see it as important. These employees often feel a sense of ownership over their assignments and constantly strive to do better and improve. They feel like they’re an important part of their workplace and want to see the businesses they work for succeed.

Unengaged employees are middle-of-the-road in the scale. They come to work and do their assignments, but ultimately they aren’t that invested in the quality of their work as long as they’re not actively getting in trouble. Before judging unengaged employees too harshly, remember if it’s possible for formerly engaged employees to become unengaged due to a variety of factors, such as burnout, sudden life events, and frustrations at work.

Disengaged employees are an active detriment to their workplaces. These employees feel resentful of their place of work and may try to spread that discontentment. They might create a negative work atmosphere, sabotage projects, or simply not show up for work at all.

It is possible to turn the feelings of unengaged and disengaged employees around, but doing so requires taking a hard look at why employees become disengaged in the first place.

What are the Benefits of Employee Engagement?

Outside of preventing actively disengaged employees, is it worth the time and effort to turn unengaged employees into engaged ones? Research shows that yes, it is, and multiple studies have the numbers to back it up, finding that engaged employees:

To tap into these benefits, businesses need to look at their practices, identify any processes or systems that might be leading to disengagement, and start implementing practices that improve engagement. To inspire you to turn around any poor employee attitudes, here are nine of our favorite strategies:

15 Leading Employee Engagement Strategies

Employee engagement strategy #1: Collect employee feedback.

Before launching a new product or service, your business collects audience data to understand what customers need and the type of solutions they’re looking for. After all, selling a product designed to fit customer needs is much easier than creating a product first and trying to convince customers it’s right for them second.

The same goes for your employee engagement strategies. Your team is much more likely to respond positively to programs they feel were created with their specific needs and feedback in mind.

Prioritize engagement at your company by surveying your employees with questions like:

- Do you feel supported at work? Why or why not?

- Are there any routine processes that are frustrating?

- What types of changes would you like to see implemented?

You can make these surveys anonymous to get more honest feedback or ensure each is linked to the specific employee to address concerns and gather more information as needed.

After your initial survey, regularly reach out to employees for more feedback to make sure you’re on the right track. Additionally, vary which employees you survey to collect a variety of feedback and also prevent over-surveying.

Employee engagement strategy #2: Create an appreciation strategy.

Even if it’s your job to do a particular task, it can be hard to complete quality work and continually strive to do your best if you never hear a thank you in return. Fortunately, implementing an appreciation strategy that takes a deliberate approach to showing employees gratitude is relatively easy.

Here are three recognition methods businesses can get up and running in just a few days:

eCards

eCards are digital greeting cards that can be sent through emails or text messages. While handwritten cards are heartfelt, sending a fast electronic message of thanks is more practical for the workday and allows your employees to receive a meaningful thank-you message as soon as their work is noticed. To implement eCards, you will need to use an eCard platform and go over how to use it with your staff. From there, encourage employees to keep sending eCards whenever they want to congratulate their peers on a job well done.

Employee awards

Some people enjoy a little public recognition, which is why employee of the month awards and their ilk have been a staple of workplace appreciation strategies for decades. Set up informal awards to honor the values you want to see in your employees, such as for best mentor, commitment to inclusivity, and creative problem solver.

Perks

Tangible benefits don’t need to be expensive bonuses to motivate employees and make them feel appreciated. For example, you might give everyone in the office a thermos with the company logo or give special thanks to a few overachievers, such as extra vacation days or a gift card to a nice restaurant.

The best employee appreciation strategy depends on your staff. For instance, if your employees are already social and supportive of one another, employee awards are an opportunity for everyone to celebrate, whereas that might not be the case in environments where employees feel competitive.

Use the surveys you conducted earlier on employee experience to learn how they feel about your current company culture and what changes they want to see when crafting your appreciation strategy.

Employee engagement strategy #3: Provide employee giving opportunities.

Giving back to your community feels good, and employees want to know they’re part of an organization that’s dedicated to making a positive difference in the world. While your business might have various corporate philanthropy initiatives like sponsoring nonprofits, try providing additional employee giving opportunities that allow your team to feel like active participants in giving back.

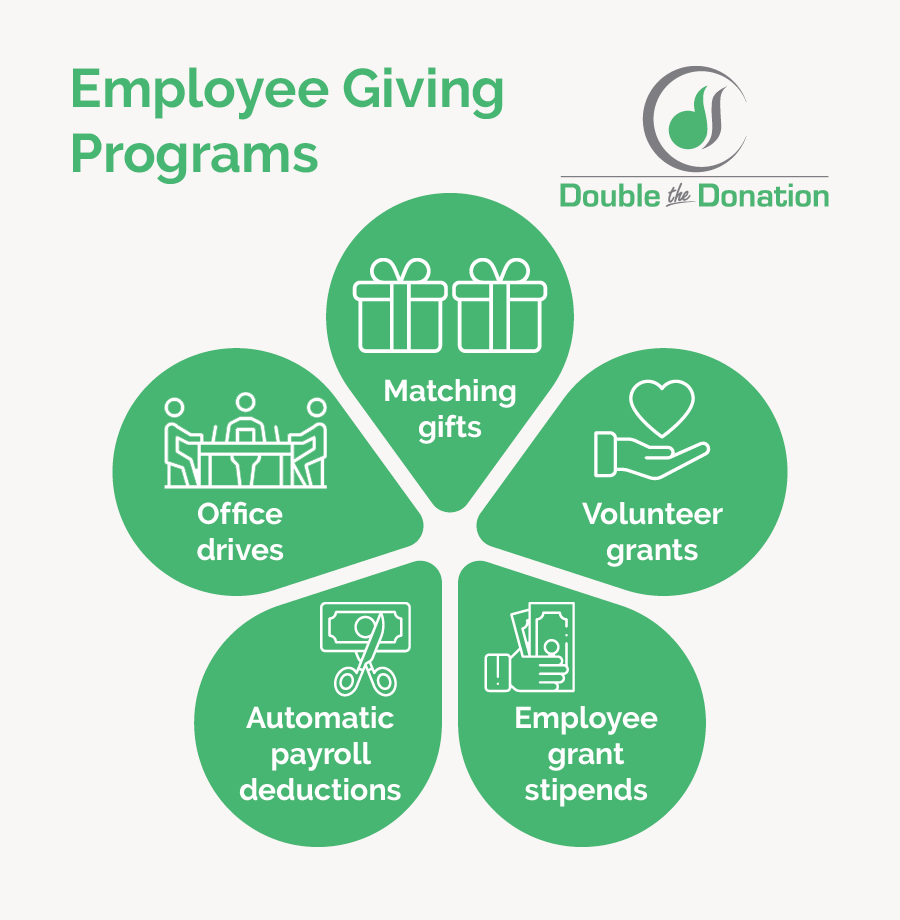

A few programs you might consider include:

Matching gifts

Matching gifts are a staple of employee giving programs that enable employees to give to the causes they want to and feel like their specific charitable interests are supported by their employer. In a matching gift program, you would agree to match donations your employees make to nonprofits. You can set restrictions for what types of causes and organizations you’ll support or provide employees with the freedom to distribute their gifts as they please.

Volunteer grants

Support your employees by offering to donate to the nonprofits where they volunteer. This could be a set amount per hour or a certain amount after they reach a certain number of hours, such as donating $100 after an employee volunteers 5 hours. You can also organize corporate volunteer opportunities that your business oversees and where your entire team is encouraged to participate.

Employee grant stipends

Take the financial burden of giving off employees altogether with grant stipends. Rather than donating their own money, employees can use grant funds provided by your business to give to the nonprofits they care about.

Automatic payroll deductions

Make donating a no-brainer by making it automatic. When first joining your company or at the start of a new fiscal year, allow employees to enroll in automatic payroll deductions. Most payroll deductions go to nonprofits the business picks out, so make sure you choose organizations your employees are invested in and have information readily available about these nonprofits’ missions and programs.

Office drives

Make giving a team activity with office drives. Office drives can be monetary in nature but are often more successful for collecting in-kind donations, like non-perishable food or new and lightly used clothes. Physically seeing items pile up can convince people to join in and create a sense of accomplishment for everyone involved.

Beyond these core opportunities, there are plenty of other workplace giving initiatives you can lead, like skilled volunteering or annual giving campaigns. It all depends on what inspires your employees.

When defining your corporate giving strategy, talk with your employees about the causes they care about and how they want to give back. If it seems like there are multiple winners, remember you don’t need to limit yourself to just one giving program. For example, you might offer both matching gifts and volunteer grants!

Whichever employee engagement programs you decide to launch, remember to choose a software solution with features that allow you to run your engagement activities as smoothly as possible.

Employee engagement strategy #4: Leverage software for support.

Keeping track of your employee engagement initiatives can become challenging as you grow your motivation program. By leveraging employee engagement software solutions, you can streamline your employee stewardship efforts, measure their attitude toward your organization, and adjust your strategy based on employee feedback.

Here are a few types of software that can help your organization better engage and retain employees:

- Corporate social responsibility (CSR) software. CSR software is designed to help manage corporate responsibility initiatives—typically business-led efforts to support employee giving and charitability. This type of software includes matching gift platforms, volunteer grant management, corporate volunteerism software, and platforms for managing employee assistance programs.

- Employee appreciation software. These tools help organizations express gratitude toward their employees for their hard work and dedication. These platforms include leadership-to-employee and peer-to-peer recognition platforms, like eCard software.

- Employee experience software. This software category includes solutions for improving the overall quality of the employee experience. This typically includes any tools used to send surveys to employees to gather their feedback and summarize their input.

When determining the right software solution for your organization, first consider your employee engagement goals. Which aspects of employee engagement are priorities at your business? For example, if you’re looking to strengthen your recognition approach first and foremost, then appreciation software may be the right choice.

Make sure also to consider your budget and schedule demos for any solutions you’re interested in. Then, be sure to communicate clearly with employees about how you’ll be using the new platform and any tips they need to know to get involved in your initiatives.

Employee engagement strategy #5: Host culture events.

With 83% of employees preferring a hybrid work environment, building a cohesive work culture can be a challenge. You shouldn’t necessarily turn away from a hybrid model. In fact, employees have shown to enjoy remote work and the flexibility to determine when they’ll come into the office. Instead, think about how you can engage employees even when they’re remote.

Office culture events are an easy way to mix up the workday, and they’re a highly flexible engagement strategy that can be adapted to all types of workplace models. Here’s how you can host culture events in each of these settings:

- In-person only. In this work model, your goal is to provide a new context that encourages employees to socialize more openly than they would during their normal work routine. This might involve going outside the office to a nearby park or restaurant or hosting creative after-work events like a knitting tutorial or paint-along.

- Hybrid. In a hybrid work model, you can use your culture events as incentives for employees to coordinate their work schedules to choose the same in-office days. For example, if you announce that you’ll order pizza for everyone on a specific day, you’ll likely see more employees show up.

- Remote only. For remote employees, host virtual events that provide plenty of socialization opportunities and the ability to show off their personalities and interests. Trivia contests, virtual escape rooms, and movie-watch parties are all easy remote get-togethers to consider.

Rather than having just leadership organize culture events, this can be an easy responsibility to give to your employees. Provide a budget and other necessary guidelines (such as no alcohol) and let trusted employees plan events. This encourages employees to share their interests and frees up leadership’s time.

Employee engagement strategy #6: Offer opportunities for growth.

Employees who are serious about their work don’t want a job; they want a career. In other words, they want to grow their role, take on new responsibilities, and generally move up the ladder in their industry.

If employees know their hard work will pay off in the form of career advancement, they’re more likely to take their work seriously and be personally invested. You can provide growth opportunities at your business by:

- Offering skill training. Give employees the time and opportunity to improve their skills. This might involve paying for courses they can take in their free time or providing additional training as part of their daily responsibilities.

- Promoting internally. It can be tempting to bring in an outside expert when you have an opening, but research shows that companies with strong internal mobility retain employees nearly twice as long as their counterparts. When a manager, director, or specialized employee leaves your business, look inward first to see if anyone has the skills needed to perform the role or would be willing to step up their training to attain those skills.

- Providing mentoring opportunities. One of the best ways to prepare your employees for moving into a new role is to have them shadow someone already in that position. Consider implementing a mentorship program that allows employees to get hands-on experience with the roles and responsibilities they want, while also having the safety net of a senior employee guiding them during the learning process.

To create a healthy work environment, encourage supervisors to have frank conversations with their directs about the future they want to have at your company. This can help you shape career paths, provide needed training, and spot retention risks.

Employee engagement strategy #7: Promote autonomy.

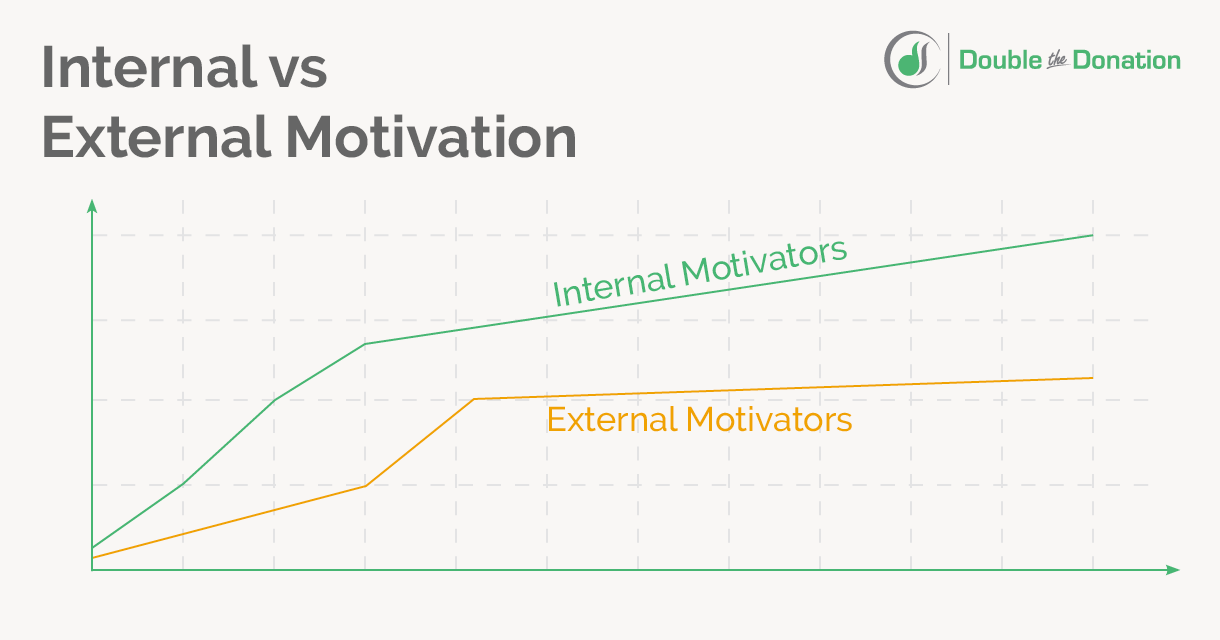

When considering how to motivate your employees, it can pay to look at psychological studies on behavior and motivation. One compelling study is researchers Richard Ryan and Edward Deci’s Self-Determination Theory.

This theory proposes that external motivations, such as compensation, can only impact motivation so much. While proper compensation is important and pay raises are appreciated, is an employee who receives a $25,000 bonus really that much more motivated than one who receives $20,000? Or, conversely, is docking an employee $5,000 from their expected bonus actually going to motivate them? Essentially, the theory reports that external motivators like rewards and punishments eventually hit a wall where their impact becomes negligible.

So if throwing money at the problem of disengaged employees doesn’t work, what does? According to the theory, the level of autonomy employees are granted highly impacts self-determination. In other words, providing employees with greater freedom in how, when, and where they approach their work increases their motivation to complete that work and do a good job.

Why? Essentially, autonomy causes employees to feel a greater sense of ownership over their work, and since they feel their work is a reflection on them, they want to make sure it’s their best work.

Consider how you can promote autonomy in your workplace. This might be encouraging greater employee input in how projects are tackled so they can pursue their own ideas, allowing employees to propose ideas and take leadership roles in new projects, or even letting employees decide which days they want to work in the office in a hybrid model.

Employee engagement strategy #8: Be transparent.

Trust is a key sign of a healthy workplace. Employees who believe in their employers, know what their company is doing, and understand why certain decisions are made are more likely to feel like they are a part of that company. However, many employees feel in the dark about what goes on with senior leadership as 80% of workers want to know more about how decisions are made at their organizations.

So how can you be more transparent, and is there such a thing as being too transparent? It’s definitely possible to overshare, and there certainly are times to keep information under wraps until you’re ready to announce it.

However, when you can provide the rationale for a decision, even if it’s not positive, do so. Be honest about your current priorities and what is considered when approving or shooting down ideas. On occasion, this might involve discussing sensitive subjects, such as finances.

While sometimes it may seem like it’s better to keep things secret and avoid panic, many employees can tell when something is being hidden from them and will make assumptions of their own. Facilitate two-way communication and be as transparent as possible to prevent anyone from jumping to conclusions.

Employee engagement strategy #9: Encourage a healthy work-life balance.

Highly engaged employees can become unengaged, and one common culprit for this is burnout. Burnout is an absolute killer when it comes to productivity, and while many employees appreciate a hybrid or remote work model, working from home does not make your team immune to burnout.

Why? Moving the office to home can blur the lines between the two, leading to an unhealthy work-life balance. While it’s great when employees go above and beyond, working too many hours when employees are supposed to have time off can lead to poorer quality work.

Encourage your employees to reassess their work-life balance and take a healthier approach by…

Creating a no-pressure PTO policy.

This might sound obvious, but as a business, when you implement a PTO policy, be prepared for employees to actually take time off. Additionally, while it seems generous in theory, avoid unlimited PTO plans as multiple companies have found that such programs actually result in employees taking less time off due to social pressures. If employees do feel pressured not to take time off, consider why that is and do the hard work of implementing policies that will undo a workplace culture that leads to burnout.

Being clear about what is and isn’t expected during off hours.

Some companies ask employees to answer phone calls, check their emails, and work on projects during their off hours. Do not be one of these companies unless you want your employees to get burned out and stop performing their best work.

Discussing how to make an in-home office productive.

Provide your employees with tips about creating a work environment in their homes with clear boundaries between work time and off-time. Some people working from home for the first time may assume they’ll be able to juggle other responsibilities like childcare. However, advise against this to prevent workers from getting distracted, resulting in them taking too much time off during the day and having to reallocate work to what should be their off hours.

If you feel your business can’t comfortably operate without asking employees to work additional hours that disrupt their work-life balance, that’s a sign to take a hard look at your business model. Consider hiring new staff, implementing more efficient policies, or limiting the number of projects you take on.

This might seem like a poor business decision on the surface, but peeling back the layers reveals that it’s for the best. After all, if you’re assigning more work than your current employees can successfully complete, your relationships with customers may suffer, too.

Employee engagement strategy #10: Improve communication.

Unclear or lacking communication is one the easiest ways to frustrate employees, leading to disengagement. Plus, poor communication has other downsides, such as mistakes, wasted time, and confusion.

When surveying employees about their satisfaction at work, focus on the effectiveness of your communication by asking questions like:

- How often do you communicate with your manager? Is this enough? Is this too much?

- When you receive instructions, are they clear? How often do you need to ask follow-up questions?

- Is it clear how and when to reach out to your manager with questions?

- Is our communication platform meeting your needs?

Be wary of both under- and overcommunication. While some businesses pride themselves on overcommunication, poorly implemented policies can easily tip into micromanagement, which reduces employee autonomy and, subsequently, engagement.

A strong communication policy is especially important for retaining remote and hybrid employees since they’ll be operating independently a majority of the time.

Employee engagement strategy #11: Uphold company values.

Every company has stated values, such as teamwork, respect, and compassion. However, how often do you see a report in the news of a company with values like these doing the opposite? Due to this frequent phenomenon, many employees are skeptical about whether their employer actually believes in their corporate values.

Prove to your employees that you’re not all talk by upholding company values at every opportunity. A few ways you can accomplish this include:

- Linking accomplishments to values. We’ve already discussed how employee appreciation strategies like eCards can boost engagement. Take those strategies to the next level by linking your appreciation to specific company values. Recognition methods like eCards make this easy since they provide a space to explain the value the employee demonstrated.

- Getting leadership on board. If your leadership embodies your company values, the rest of your team will likely follow suit. Have leadership model the behaviors and values you want to see in the rest of your team, whether that means being transparent about the company’s current status, giving credit to individuals working behind the scenes, or staying late to work alongside your staff.

- Engaging in corporate philanthropy. If your business has a CSR program, ensure it involves giving to charitable organizations that are aligned with your corporate values. For example, if your company values “sustainability,” you might donate to environment-related causes, while a business that promotes its commitment to community might offer a scholarship program.

Ensure your company values are clearly stated in your employee handbook, so your staff can check them any time they need to. However, if you’re properly infusing your values into your workplace, your employees should know them by heart in no time!

Employee engagement strategy #12: Set clear expectations.

If employees aren’t sure what they’re supposed to do or how their contributions are benefiting your company, they’re likely to become confused, frustrated, and disengaged. Prevent this by setting clear expectations from day one and ensuring employees know who to contact if they have questions.

At all-hands meetings, take time to explain how each team’s work fits into your business’s overall goals. This gives meaning to employees’ individual assignments and helps them understand what overall objectives they should be working for.

Additionally, remember that clear directions and employee autonomy can exist hand-in-hand. Provide clarity for what your business needs accomplished but, when appropriate, give employees opportunities to add their own contributions, get creative with how they complete their work, and suggest ways to improve on similar projects in the future.

Employee engagement strategy #13: Host team volunteer days.

Combine the power of volunteer grants and culture events by hosting team volunteer days. These are official events where your employees volunteer together as a team.

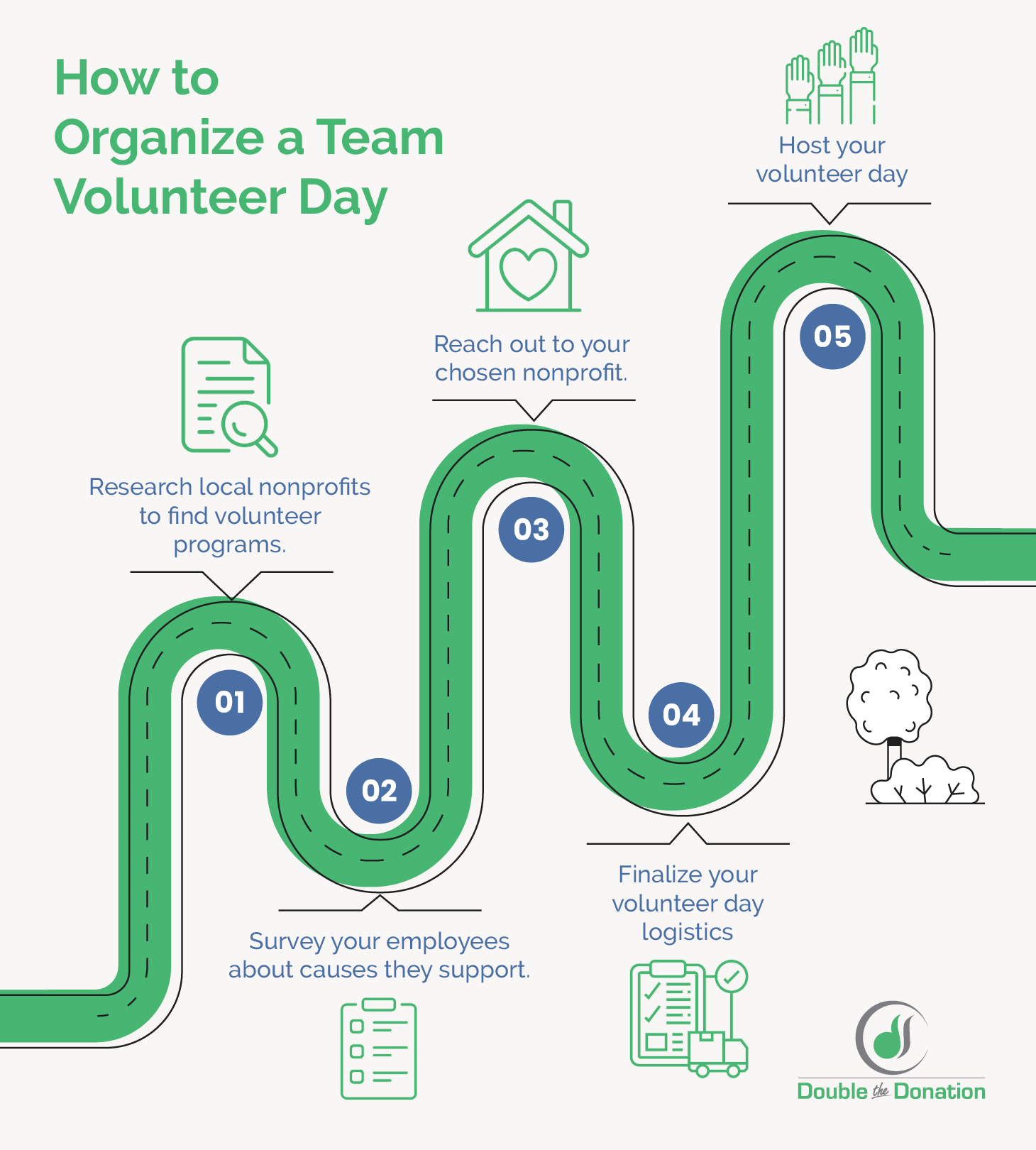

To host a volunteer day, follow these steps:

- Research local nonprofits.Check with local nonprofits about volunteer opportunities that could accommodate your team. When researching nonprofits, look for organizations with missions that match your philanthropic goals and have volunteer roles where your team members could lend their unique skills.

- Survey employees. After identifying a few prospective nonprofits, survey your team about which nonprofits they would like to volunteer at and when. You can also ask for suggestions for other nonprofits to discover organizations you might have missed in your initial research. If there’s interest in your survey, you might also arrange future team volunteer days to support more worthwhile causes.

- Reach out to nonprofits. Do not just show up at a nonprofit with a team of volunteers. Instead, reach out at least a few weeks in advance to explain your team volunteer day, your employees’ skills, and how many people you expect to bring. This allows nonprofits to organize volunteer opportunities that can accommodate your entire team.

- Finalize logistics. Confirm your team volunteer event day, how long you will be volunteering, how many employees are going, and where employees should meet up ahead of the event. Additionally, tell employees if lunch will be provided, communicate expected attire, and share any forms or waivers to complete ahead of time.

- Host your volunteer days. It’s time for your employees to meet up and volunteer! Ask employees to check in at the start of the day so you have a record of who is volunteering. After the volunteer day, check in again to get employee feedback about the event.

Team volunteer days have several benefits. They give employees the opportunity to give back and serve as a team-building activity at the same time. Implementing team volunteer grants can also encourage employees to volunteer together.

Employee engagement strategy #14: Offer competitive benefits.

We’ve already discussed how external benefits can only motivate employees so much, but employees do require that initial motivation before they fully engage with your business. Ensure you provide competitive benefits to attract, retain, and engage employees in your industry.

For example, you might offer:

- Competitive wages. Assess salaries and benefits in your industry when setting your own wages, as even highly motivated employees may become disengaged if they feel they are undervalued. Additionally, clearly communicate any changes to compensation so employees know why their benefits are changing and ask questions through the appropriate channels.

- Time off. Time off recharges employees, meaning that when they’re back in the office, they’re ready to work hard and be fully engaged. In addition to regular paid time off, consider offering volunteer time off (VTO). VTO provides employees with time off specifically to volunteer, giving them the opportunity and motivation to lend a helping hand in their communities.

- Insurance. Show an investment in your employees’ well-being by offering insurance coverage. Ensure this is an opt-in program so employees who want to pursue their own insurance options can do so and don’t feel they are losing benefits when compared to their colleagues who opt in.

The benefits that are adequate for your business depend on your industry, size of your organization, and local area. However, be conscious of employees’ feedback. While all employees would enjoy increased benefits, if employees regularly express the need for expanded benefits or seek other employment opportunities citing better compensation elsewhere, those are clear signs it’s time to reassess your policies.

Employee engagement strategy #15: Refine your onboarding process.

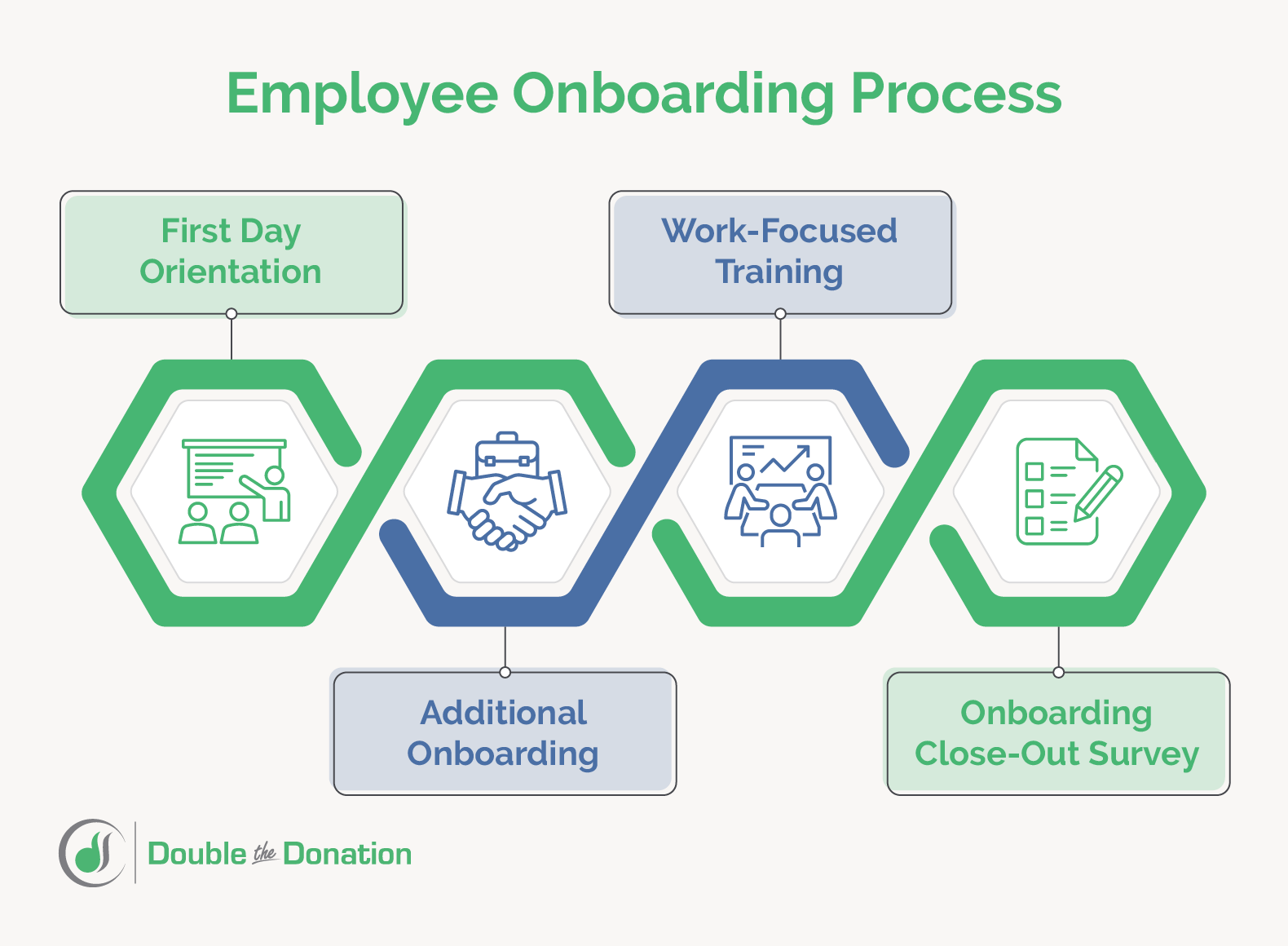

For our last tip, let’s go back to the beginning: your onboarding process. Initial employee training will set the tone of their tenure at your business, so ensure they start off on the right foot with a strong, organized, and focused onboarding process.

You can improve your onboarding process by:

- Staying focused. Even for experienced professionals, there’s a lot to learn when joining a new company. Avoid overwhelming new employees by focusing the onboarding process on immediate necessities. Ensure employees get a handle on how to complete their regular responsibilities first and foremost. In some cases, consider a protracted onboarding process where employees learn the smaller ins and outs of your company—such as how to send an eCard, host a culture event, or participate in your volunteer program—after their initial work-focused onboarding.

- Setting up mentorships. Employees’ managers should guide new employees through onboarding, but it’s also helpful to pair new hires with peers at the same level for additional support and easy question-asking. Ensure new team members have an opportunity to get to know their colleagues and even set up mentorships, where a specific co-worker becomes their go-to person for small questions about daily tasks.

- Having resources ready. If new employees ever need to refresh their knowledge, ensure they can do so by having shareable training resources ready. This might include an employee handbook, software guide printouts, and sales call scripts.

Post-onboarding is an opportune time to survey employees to discover if your training processes are effective. Wait a few weeks after completing onboarding to reach out. This gives employees time to settle into their roles and determine whether their training was useful but not too long that it’s no longer fresh in their minds.

Final Thoughts on Employee Engagement Strategies & More

From talking to customers and creating marketing materials to coding your website and designing your products, employees are what keeps your business running. The better you can engage them, the more motivated they’ll be to help make your business a success.

You can connect with your team in numerous ways, and these employee engagement strategies are just one place to start. To learn more about how you can motivate your team, explore these resources:

Adding Corporate Programs to our Workplace Giving Database

/in Company Updates, About Double the Donation, Matching Gift Companies, Learning Center, Volunteer Grant Companies /by Adam WeingerIn today’s landscape, companies are increasingly focusing on giving back through a variety of corporate social responsibility (or CSR) initiatives. Among these are workplace giving programs, which include matching gifts, volunteer grants, and more, all designed to amplify the impact of employees’ contributions to nonprofits. However, so many companies are giving back that it can be difficult to keep track of which businesses offer these giving initiatives. That’s where a workplace giving database comes in!

Still, keeping your database updated with fresh insights is a must. After all, nonprofits understanding and leveraging these programs can open doors to greater financial support, as well as unlock a broader network of donors and volunteers. And a comprehensive dataset is a great place to start.

That said, this guide will address the basics of workplace giving databases and how organizations like yours can add to and enhance ours. Specifically, we’ll cover:

An accurate and up-to-date database is an invaluable resource for nonprofits seeking to make the most of corporate philanthropy, ensuring that no available support goes untapped. Let’s dive in to see how your team can play a role in this occurrence.

What is a workplace giving database?

A workplace giving database is a comprehensive resource that aggregates information about corporate philanthropy programs offered by companies. These databases typically include details on workplace giving initiatives such as matching gifts, corporate volunteer incentives, and more.

To increase accessibility, a workplace giving database generally comes with a built-in search tool as well, making it quick and easy for donors to uncover the information they need to get involved.

A database tool is typically embeddable, too, offering a simple way for organizations to implement the solution on their websites—including donation pages, volunteer registration forms, confirmation screens, and more.

Benefits of a comprehensive workplace giving database

A comprehensive workplace giving database offers numerous benefits for both nonprofits and donors, empowering them to maximize support through corporate philanthropy programs. Here are some key advantages:

1. Increased Revenue Opportunities

2. Streamlined Supporter Engagement

3. Time Savings and Efficiency

4. Improved Corporate Relationships

5. Proactive Fundraising Strategies

In summary, a comprehensive workplace giving database simplifies the process of connecting with corporate giving opportunities, enabling nonprofits to increase funding, strengthen donor relationships, and build proactive strategies—all while promoting greater corporate involvement in social responsibility.

About Double the Donation’s workplace giving database

Double the Donation’s workplace giving database is the largest and most comprehensive resource available for nonprofits and donors looking to maximize the impact of corporate giving programs. It’s designed to streamline the identification of corporate philanthropy opportunities, providing nonprofits with the tools they need to increase revenue through workplace giving.

This specific database includes information on:

Here’s what makes Double the Donation’s solution stand out:

Extensive Company Coverage: Double the Donation’s database includes detailed information on thousands of companies with matching gift and volunteer programs. This coverage ensures that nonprofits and their supporters can find opportunities related to almost any company, regardless of industry or location.

Real-Time Program Updates: To keep nonprofits informed and reduce outdated information, Double the Donation regularly updates its database, ensuring that users have access to the latest information on corporate giving guidelines, eligibility requirements, submission deadlines, and more.

Easy Integration with Nonprofit Websites: Double the Donation’s database tool seamlessly integrates with a nonprofit’s website and donation forms, making it easy for donors to check if their employers offer workplace giving programs right as they engage with your cause.

Automated Donor Outreach and Matching Gift Reminders: In addition to the database tool, Double the Donation also offers automated email streams to remind donors to get involved. These messages empower nonprofits to follow up with those who may be eligible for matching gifts or volunteer grants, complete with company-specific workplace giving insights from the database, too! This proactive approach increases the likelihood that donors will complete the matching gift process, meaning more revenue for your cause.

How our database gets updated (regularly!)

Double the Donation’s workplace giving database is kept accurate and up-to-date through a systematic process. This ensures nonprofits and donors always have access to the latest information on corporate giving programs.

Here’s how Double the Donation maintains the database’s accuracy and reliability:

Together, these practices ensure that nonprofits and donors can rely on Double the Donation’s database to provide the most accurate information, making it a valuable resource for maximizing corporate giving opportunities.

Adding corporate programs to our database

Double the Donation provides several straightforward options for organizations, companies, or employees to add or update information about corporate giving programs in its database. Thus, individuals or groups can ensure their workplace giving programs are accurately represented by following one of these methods:

Complete the Add a Company Form.

If you want to add a corporate giving program (such as a matching gift, volunteer grant, or VTO program) to Double the Donation’s database for the first time, representatives can fill out the Add a Company Form on Double the Donation’s website. This brief online submission gathers essential information about the company’s programs, including:

Then, once the form is submitted, Double the Donation’s team reviews the information and adds the program to the database. From there, the record will become accessible to nonprofits and donors through the search tool.

Complete the Update Company Information Form.

If a company already listed in the database makes changes to its workplace giving program (for instance, altering match ratios or adjusting eligibility requirements) or otherwise notices inaccurate information, a representative can fill out the Update Company Information Form. This allows users to provide updated details, ensuring that donors see the latest version of the program when they search.

Again, after submission, the information is reviewed by Double the Donation’s data team and promptly updated in the database. This keeps it current for nonprofits and donors who may be impacted by the changes.

Send an Email to data@doublethedonation.com.

For those who prefer a direct approach to adding or refreshing company records, our team also accepts requests via email. All you need to do is send an email to data@doublethedonation.com with the necessary details about the program.

This might include:

From there, the Double the Donation team will verify the information provided in the email. Then, update the database accordingly, ensuring the accuracy of the program details going forward.

[For One-Off Matching Gifts] Manage Programs in Double the Donation Matching.

Note: Sometimes, a company will offer a matching gift program with a single nonprofit rather than a widely available initiative. These are referred to as one-off (or custom, unique) matching gift programs, and there’s an easy way to add the program to your database within the Double the Donation platform itself—that is, if the program is specific only to your organization.

In that case, simply log into your Double the Donation account, navigate to the “Settings” tab, and select “Manage Programs.” From there, you’ll be prompted to add a new one-off matching gift program by filling out the requested information.

Once complete, the program will show up in your organization’s database search tool—but not for other nonprofits’ donors.

Wrapping up & next steps

Empowering organizations and companies to add new corporate programs to our workplace giving database is just one more step in our commitment to helping nonprofits reach their fundraising potential. By keeping this resource up-to-date with the latest information on matching gifts, volunteer grants, and other workplace giving opportunities, we aim to empower nonprofits to connect more deeply with donors and leverage support from their employers.

Take a look at the companies that have contributed matching gifts to your organization in the past. Are they already included in our database? If not, follow the steps to get them added so that your donors can access program guidelines, forms, and more. That means more matches in the future!

Together, we can make giving back a seamless, rewarding experience for companies, employees, and nonprofits alike.

Double the Donation’s Year in Review: 2024 Edition

/in News, About Double the Donation /by Kyra EngleAs we wrap up 2024, it’s the perfect time to look back and acknowledge the milestones, innovations, and impact achieved by our team and its partners in the nonprofit and corporate giving sectors. In Double the Donation’s Year in Review 2024, we’ll share key insights, highlights, and achievements that have propelled us forward and helped nonprofits like yours make an even bigger difference.

All in all, this year has been one of remarkable growth, with exciting developments in matching gift technology, ready-built integrations, and groundbreaking functionality designed to help nonprofits unlock more from their fundraising efforts.

In order to celebrate our successes, this overview will cover:

Join us in reflecting on this year’s wins as we gear up for another impactful fundraising season ahead!

Significant product updates & enhancements

In 2024, Double the Donation rolled out a series of significant product updates and enhancements designed to improve the workplace giving experience for nonprofits and their donors. These updates have been instrumental in helping our clients drive more donations, simplify their workflows, and engage donors and other supporters more effectively.

These product updates reflect our commitment to evolving alongside our clients’ needs, ensuring they have the most powerful tools to elevate their workplace giving efforts. As we look to 2025, we’re excited to continue innovating and delivering new features that make a measurable impact on nonprofit fundraising.

Check out an overview of three of our most impactful updates here:

This year, we expanded the capabilities of our platform by launching our corporate volunteering tools. Double the Donation Volunteering is a built-in solution designed to support organizations in targeting corporate volunteer initiatives in addition to traditional matching gift management. These initiatives, which include volunteer grants and paid volunteer time off, can go a long way in attracting, engaging, and retaining volunteers. And Double the Donation Volunteering makes it easier than ever to benefit from the programs by growing awareness and simplifying the engagement experience.

If you haven’t already, take steps to embed our corporate volunteer database directly into your Volunteers Info page on your website, along with any volunteer registration forms you have.

Learn more about Double the Donation Volunteering here!

Security and data protection are top priorities at Double the Donation, and in 2024, we took our commitment to the next level by achieving SOC 2 Type 2 compliance. This integral milestone demonstrates our adherence to rigorous standards for security, availability, confidentiality, and processing integrity.

Achieving SOC 2 Type 2 assures clients like you—as well as their donors—that their data is handled with the highest standards of security and care. Not to mention, it reinforces our role as a trusted partner for nonprofits that prioritize the protection of donor information.

Learn more about our SOC 2 Type 2 compliance here!

Auto-submission enhancements

Enhancing the auto-submission functionality has been a major focus in 2024, making it even easier for donors to complete matching gift submissions without the added manual effort. Our most recent improvements to the auto-submission process mean that donors are prompted to auto-submit their matches at multiple touch points throughout the donor journey, increasing the likelihood that they ultimately do so. Now, donors are encouraged to partake in auto-submission once again when they indicate they’ve requested a match, but Double the Donation has no record of the submission.

All in all, these auto-submission enhancements streamline the matching process, driving more completed matches and enabling nonprofits to capture more matching gift revenue. And it’s all done with minimal time and effort!

Learn more about matching gift auto-submission here!

Our continuously expanding client base

So far this year, our team has welcomed over 1,055 new clients to the Double the Donation family, expanding our community of nonprofits, educational institutions, and other fundraising organizations dedicated to making a difference through matching gifts and workplace giving.

Each new client represents a unique opportunity to drive more donations, streamline fundraising efforts, and unlock the full potential of corporate philanthropy. And we’re so grateful for the causes that trust Double the Donation to do so. This growth among our expanding client base strengthens our commitment to helping nonprofits of all sizes access critical matching gift revenue, ultimately increasing their ability to create positive change in the communities they serve.

All in all, we’re honored to work with a diverse array of organizations this year and look forward to supporting them as they continue maximizing their fundraising impact through matching gifts and more in the future.

Standout reviews & testimonials

Double the Donation has been thrilled to receive more than 40 new 5-star Google reviews, underscoring the impact of our commitment to customer and user success. Each of these reviews highlights the effectiveness of our sales and onboarding processes, the value of our technology, and the powerful results nonprofits achieve through our matching gift solutions.

Here are a few examples collected in the last year:

In addition to Google reviews, we also received a number of customer testimonials in the past year—including videos detailing the impact of our tools on various organizations’ efforts. Here’s what a few of these nonprofits have had to say (or check out our testimonials page to watch the clips):

Each of these generous reviews motivates us to keep delivering the best possible experience for our customers, and we’re grateful to our clients for sharing their success stories.

Looking ahead, we’re excited to continue empowering nonprofits with the tools they need to raise more and make an even bigger impact. And we hope to hear from even more organizations benefitting from our tools!

Network growth: new partnerships & integrations

2024 has been a year of exciting growth for Double the Donation’s integration network. With the addition of more than 14 new partnerships and 11 integration enhancements, we’ve been able to significantly broaden our reach and capabilities.

New integrations include:

These partnerships are designed to allow nonprofits to seamlessly integrate Double the Donation’s matching gift technology into their existing workflows, offering a more streamlined and efficient experience for both organizations and their donors.

By expanding our network of partners and continuously improving integrations, Double the Donation is making it easier than ever for nonprofits to leverage matching gifts as a key component of their fundraising efforts. We’re excited to see the positive impact these partnerships will continue to have as we move into the next year, helping even more organizations maximize their matching gift revenue.

Overall matching gift fundraising success across clients

This is a powerful testament to the impact of matching gift programs when paired with the right tools and strategies. Through effective communication and proactive engagement, our clients were able to reach more donors, secure more matches, and ultimately drive greater funding to support their missions.

These metrics underscore the power of Double the Donation’s solutions in amplifying donor participation and optimizing matching gift revenue. By driving strong engagement rates and making it easy for donors to complete matches, our clients are leveraging every opportunity to boost their fundraising success.

This year’s results highlight the effectiveness of our tools in helping nonprofits expand their impact through matching gifts, and we’re proud to be a part of their journey toward sustainable growth and more.

Comprehensive workplace giving database development

In the past year, Double the Donation has continued to strengthen its position as the leading resource for matching gift and workplace giving information with ongoing enhancements to our comprehensive database.

Today, our database contains over 24,493 company records, providing an extensive resource for nonprofits to easily identify matching gift and other workplace giving opportunities across a broad spectrum of corporations. This robust database represents more than 26,802,622 employees, significantly expanding the reach of our clients to potential supporters worldwide.

But one of the biggest developments we’ve seen this year is the introduction of VTO (or volunteer time off) programs to the database. We are dedicated to helping nonprofits and schools earn more in workplace giving, and we believe it should be easy for you to leverage corporate volunteerism to power your mission. These programs continue to grow in popularity, and our database makes it easy to uncover and leverage their potential.

Our continued focus on database development reflects our dedication to helping nonprofits unlock the full potential of matching gifts and beyond. By providing comprehensive, accurate, and accessible company data, we’re enabling organizations to connect with more donors, raise more funds, and further their missions with confidence.

Invaluable matching gift resources & materials

So far in 2024, Double the Donation has significantly expanded its library of resources, offering nonprofits even more tools and materials to succeed with matching gift fundraising. After all, our goal is to empower organizations with the knowledge, strategies, and practical assets they need to unlock more matching gift revenue and streamline their outreach efforts.

Among our most popular resources this year are…

79 webinars and counting—including a few of our top sessions here:

129 new blog posts, such as these fan-favorites:

New corporate volunteer-focused downloadable resources:

In addition, we also rolled out a number of customizable marketing materials directly within the Double the Donation platform. These include templates for matching gifts and volunteer incentives that are free for clients to access, personalize, and share, making it easier to promote the programs than ever before.

With the introduction of these new resources, our team aims to equip nonprofits with everything they need to succeed at every stage of the matching gift journey. As always, we’re committed to delivering high-quality materials that make a tangible difference in our audience’s fundraising efforts, and we look forward to adding even more valuable resources in the coming year.

Wrapping up & additional resources

As we close out 2024, we’re grateful for the nonprofits, corporate partners, and donors who made this a remarkable year. Together, we’ve driven substantial change, innovated how matching gifts are identified and managed, and enabled countless nonprofits to expand their impact.

Going forward, Double the Donation remains committed to enhancing the matching gift experience, providing cutting-edge tools, and supporting organizations in achieving their fundraising goals. Here’s to an even more successful year ahead as we continue to work together for a brighter, more generous future.

Thank you for being part of this journey—let’s make 2025 even better!

Interested in reading more about workplace giving and how Double the Donation can supercharge your efforts? Check out the following resources:

Top New York Companies with Matching Gift Programs

/in Lists and Rankings, Matching Gift Companies /by Adam WeingerDouble the Donation’s nonprofits clients come from all across the country—so we wanted to highlight a few select matching gift companies in key markets. Like most major metropolitan areas, New York is home to tons of notable employers, many of whom offer matching gift programs.

Is your New York-based organization tapping into this source of corporate giving?

To help you launch or finetune your strategy, we’re going to look at the following matching gift companies your team should be aware of:

Follow along for a look at New York City’s corporate philanthropy and the tools you can use to discover these opportunities.

Statistics on New York Matching Gift Companies

If you dig into your organization’s database of corporate donors from the past few years, you’ll probably notice you received matching gifts from a variety of companies. Some are probably headquartered in your area, while others may have a much smaller presence.

Here are a few statistics on the New York market that may interest you:

Now, let’s dive in!

Discovering Matching Gift Opportunities in Metropolitan Areas

The fact that New York has major matching gift opportunities means little if nonprofits don’t capitalize on them. If you’re like most organizations, you probably aren’t reaching your full corporate philanthropy potential.

A great place to start is making sure everyone in your organization is familiar with the largest employers in your area. If you want to take it a step further, however, consider providing donors and volunteers with detailed information about their employer or their spouse’s employer.

Double the Donation Matching, a fundraising automation platform suited for nonprofits looking to improve their existing matching gift processes, can help. With this software, your organization can automatically identify and contact eligible donors regarding matching gifts.

With that, continue reading for a look at New York City’s top 5 companies with matching gift programs.

Companies in New York with Matching Gift Programs

It would be difficult to go into detail regarding every company in New York offering matching gift programs, so we’ve highlighted some of the area’s largest employers for this list.

Based on the current Fortune 500 list, JPMorgan Chase and Verizon are the two biggest companies in New York City. Even better? Both offer matching gift programs!

Further, we’ve included IBM, Goldman Sachs Group, and American International Group, each of which is a large employer in the city offering matching gifts.

JPMorgan Chase

JPMorgan Chase offers both a matching gift and volunteer grant program. The company matches up to $1,000 per employee or retiree each year to pretty much any school or nonprofit.

The company also offers a tiered volunteer grant program where grants average $10 per hour volunteered. The grant amount varies based upon the number of hours an employee volunteers.

Learn more about JPMorgan Chase’s employee giving programs.

Verizon

Verizon offers both a matching gift and volunteer grant program for employees. The company matches up to $5,000 to schools and $1,000 to all other nonprofits per employee each year.

Additionally, through the Verizon Volunteer Incentive Program, employees who volunteer for 50 hours in a calendar year can request a $750 grant for an organization.

Learn more about Verizon’s employee giving programs.

IBM

IBM also offers multiple types of employee giving programs. Not only does the company offer matching grants on donations and cash grants for volunteering, but it also allows nonprofits to receive a significantly larger donation if the organization elects to receive IBM technology instead of cash.

For instance, IBM offers a 2:1 technology grant on employee donations. This means that if an IBM employee donates $500 to your organization, you can receive $1,000 in IBM equipment or $500 in cash.

Learn more about IBM’s employee giving programs.

Goldman Sachs

Goldman Sachs, an investment banking company based in New York City, New York, offers a generous matching gift program that current, full-time employees are encouraged to take part in.

In fact, the company agrees to match donations between $50 and $20,000 at a 1:1 ratio to nearly all nonprofit organizations—including educational institutions, health and human services, arts and cultural organizations, civic and community groups, environmental nonprofits, and more.

Learn more about Goldman Sachs’ employee giving programs.

American International Group (AIG)

AIG focuses its philanthropic efforts on three main groups of giving:

AIG has a matching gift program with a minimum match of $25 and a maximum of $10,000 per employee per year.

Learn more about AIG’s employee giving programs.

But that’s not all!

Other NY-based Fortune 500 companies with employee matching gift and volunteer grant programs include:

Bottom line: Many of New York’s leading employers match donations employees make to nonprofits. Make sure everyone in your organization’s membership and development offices is familiar with major employers in your area that match employee donations.

Matching Wednesday: Drive Matching Gifts Post #GivingTuesday

/in Donor communications, News, Fundraising Ideas, About Double the Donation, Learning Center /by Adam WeingerAfter the whirlwind of #GivingTuesday, many nonprofits find themselves wondering how to maintain the momentum of generosity—and make the most of corporate matching gifts in their efforts. While donations tend to surge on Giving Tuesday, organizations can amplify their impact by making the following day just as powerful. And that’s why we’re introducing the idea of Matching Wednesday.

By strategically focusing on matching gifts the day after Giving Tuesday, nonprofits like yours can create an additional wave of support that builds on the previous day’s success.

In this guide, we’ll share everything you need to know to get started with this unique and impactful campaign idea. This includes:

Matching Wednesday can help nonprofits capitalize on donors’ enthusiasm, encourage more employees to seek corporate matches, and double (or even triple) the support for their causes.

Ready to find out how? Let’s get started with the basics.

What is Matching Wednesday?

Matching Wednesday is a strategic fundraising initiative in which nonprofits can participate immediately following #GivingTuesday.

While Giving Tuesday sparks a boost in donations from individuals eager to support their favorite causes, Matching Wednesday aims to keep this momentum going by encouraging donors to double (or even triple) the impact of their contributions through corporate matching gift programs.

Here’s how it works: on Matching Wednesday, nonprofits reach out to donors who gave on Giving Tuesday (or even before) and remind them to submit their gifts for matching through their employers. They can also highlight matching gift opportunities to new donors, underscoring the added impact their support can have.

The idea behind Matching Wednesday is simple yet powerful—leveraging the enthusiasm generated on Giving Tuesday to unlock even more funding for the cause. By making matching gifts easy and front-of-mind, nonprofits can turn a single day of generosity into an extended period of amplified giving, helping them reach their goals and maximize their mission impact.

Following Up With #GivingTuesday Donors

Giving Tuesday sees some of the highest rates of charitable giving each year. In 2023, 34 million adults in the U.S. alone participated in Giving Tuesday festivities, contributing a total of more than $3.1 billion. And while a lot of those gifts were matched by donors’ employers, the truth is that a lot of match-eligible gifts went unclaimed. And that’s where Matching Wednesday steps in!

Following up with Giving Tuesday donors come Matching Wednesday is essential to capture the full potential of corporate matching gifts. Many donors may not realize that their contributions can be matched by their employers, effectively doubling or even tripling their impact on the cause. But when they do know, they’ll be eager to get involved.

Here are a few things your team can do to engage these donors and make the most of Matching Wednesday:

1. Send a Personalized Matching Gift Reminder Follow-Up.

The day after Giving Tuesday, send a follow-up message reminding donors who gave about the chance to make an even bigger difference with a matching gift.

Start with a heartfelt thank-you for their Giving Tuesday support, expressing gratitude for their contribution and sharing the impact it will make. Then, (re)introduce the concept of matching gifts, highlighting that many employers will match their donations at no additional cost to them. This gentle reminder can spark interest and motivate donors to check if their employer participates in a matching gift program.

2. Educate Donors About the Ease and Benefits of Matching Gifts.

Many donors may be unfamiliar with how matching gifts work. Use Matching Wednesday as an opportunity to educate them on the process. Provide clear, easy-to-follow, and company-specific instructions on how they can request a matching gift from their employer, and offer assistance for any questions or concerns donors might have about matching gift submissions.

3. Establish a Sense of Doubled Impact.

Use Matching Wednesday to create a sense of amplified donation impact by highlighting how beneficial matched gifts can be. Let donors know how their contributions, when doubled, can address specific needs, such as providing additional meals, funding critical programs, or expanding highly demanded services. This approach makes the matching gift feel like an extension of their Giving Tuesday contribution, deepening their connection to your cause.

Engaging Supporters Who Gave Earlier in the Year

While the idea is centered around the better-known global giving day, it’s important to note that Matching Wednesday doesn’t have to be exclusive to Giving Tuesday donors, either. In fact, it’s also an ideal time to engage supporters who donated earlier in the year but, as far as you know, haven’t submitted their gifts for matching.

By reaching out with a timely reminder to submit their matches, nonprofits can turn previous contributions into a new wave of support on Matching Wednesday.

Here’s how to maximize engagement with these past donors:

1. Segment and Personalize Your Outreach.

Identify donors who gave earlier in the year but may not have submitted their gifts for matching. Send a personalized email acknowledging their previous support and sharing how impactful it would be if they submitted their gift for a match—and how Matching Wednesday is the perfect time to do it. After all, a tailored message makes supporters feel valued and motivates them to take the extra step, knowing that their contributions are still on the nonprofit’s radar.

2. Create a “Last Call for Matching Gifts” Campaign.

Use Matching Wednesday as a final push for matching gift submissions, presenting it as a time-sensitive opportunity. Explain that this is a last chance to double or triple their support this year, especially for those who might have forgotten or overlooked the option earlier. A sense of urgency can inspire action, as donors may be more likely to submit a match if they know it’s the final opportunity for the year. Many companies establish year-end request deadlines, too, meaning time is of the essence.

3. Provide a Simple, Step-by-Step Guide for Matching Gifts.

Many supporters might hesitate to submit their gifts for matching due to uncertainty around the process. Include a quick guide in your Matching Wednesday email to help simplify it. A “Check Your Eligibility” button leading to a matching gift search tool can be particularly effective, allowing donors to quickly confirm if their company offers matching and access any necessary forms.

Re-engaging past supporters for Matching Wednesday allows nonprofits to revive donations from throughout the year and turn them into even greater impact. This last-call reminder serves as an easy and effective way to connect with donors, ensuring their gifts stretch further and help end the year on a high note for the cause.

Best Practices for Matching Wednesday Success

To maximize the impact of Matching Wednesday, nonprofits can implement several best practices to ensure their outreach is compelling and effective. From targeted follow-ups to clear messaging, here are strategies that can help nonprofits make the most of this post-Giving Tuesday initiative:

Mention matching gifts leading up to and on Giving Tuesday, too.

Matching Wednesday is all about matching gifts. But it shouldn’t be the first time your audience hears about the opportunity. In fact, it’s best to begin highlighting matching gifts alongside Giving Tuesday promotions leading up to and on the big day.

By promoting matching gift opportunities early and often, nonprofits can begin building familiarity with the programs. This can substantially boost the day’s revenue, motivating more donors to give—and encouraging them to make their contributions go further when the time comes.

Not to mention, knowing that their donation could be matched can even inspire donors to contribute in larger amounts. Matching gifts allows donors to double or triple their contributions, which is a compelling reason to increase their initial support. Research shows that fundraising appeals—such as those for Giving Tuesday—see a 71% increase in response rate and a 51% increase in average gift size when matching gifts are mentioned.

Take a multi-channel approach to engaging donors.

When it comes to marketing matching gifts, you want to make sure your message is getting across far and wide. Luckily, a multi-channel approach engages donors on multiple platforms, making it easier for them to take action and get involved.

Not to mention, each donor has preferred ways of receiving information. Some may respond best to email reminders, while others are more likely to engage on social media or through text. By reaching out across multiple channels, you can ensure you’re meeting donors where they already are.

Leveraging a combination of email, social media, SMS, and even phone calls empowers nonprofits to create comprehensive, engaging Matching Wednesday experiences that keep matching gifts at the top of donors’ minds.

Highlight matching gift success stories.

Social proof is a powerful tool. On a big giving day like Giving Tuesday (or the subsequent Matching Wednesday), incorporating success stories regarding corporate matching gifts can go a long way toward inspiring action.

For the best results, we recommend supplying specific examples to illustrate the power of matching gifts. Try sharing stories or metrics that showcase what matching funds have previously achieved for your organization. For instance, you might say, “Last year, matching gifts helped us provide meals for 500 additional families.” Impact-driven messaging like this can inspire donors to act, as they can directly see how their matched gifts contribute to the mission.

Alternatively, consider sharing a brief story or example of a past donor whose gift was matched. You can even source a quote from a previous matching gift donor to act as a testimonial! After all, real-world examples can serve as powerful motivation, helping donors see the tangible outcomes of submitting a matching gift.

Invest in matching gift software before Matching Wednesday.

Leading up to Matching Wednesday (or Giving Tuesday, for that matter), you’ll want to conduct an analysis of your existing tech stack and decide if you have what you need for success. If you’re currently missing a matching gift software, we highly recommend getting up and running with such a solution prior to the start of the giving season.

After all, this kind of tool simplifies the matching process by enabling donors to quickly find their employer’s matching gift policy, forms, and submission instructions. The easier it is for donors to confirm eligibility and access forms, the more likely they’ll be to follow through—so this is not something you want to overlook. Not to mention, an automation platform like Double the Donation’s can streamline the entire process from start to finish, so your team doesn’t have to lift a finger!

Share Matching Wednesday results and outcomes.

After Matching Wednesday concludes, maintain the matching gift momentum by sharing the campaign results with your supporters. For example, highlight the total number of submitted matches and the impact they’ll have on your programs. This kind of transparency fosters trust and shows donors that their efforts to secure a match made a concrete difference, setting the stage for continued engagement.

From there, you’ll want to track key metrics, such as the number of matching gifts secured, total matched revenue, and engagement rates, so you can adjust and improve your efforts for the next year. After all, a successful Matching Wednesday can become an ongoing part of your end-of-year fundraising efforts, extending Giving Tuesday’s impact well beyond a single day in the years to come.

6 Sample #MatchingWednesday Promotions

Ready to get started promoting Matching Wednesday but not sure where to begin? We’ve created a few sample promotions your team can use to engage its donors leading up to and on to the big day.

Matching Wednesday Text Message

Text message copy: Thank you for supporting us on #GivingTuesday! 🎉 Did you know your donation could go twice as far? Today is #MatchingWednesday—click here to see if your employer matches: [Matching Gift Page URL]

Matching Wednesday Email Template

Subject line: Have you given to [nonprofit] this year? Double your impact today—on #MatchingWednesday!

Body:

Dear [donor’s first name],

Thank you for being part of the [nonprofit] family! Your support means the world to us, and today, on #MatchingWednesday, there’s an exciting opportunity to make your impact go even further.

If you’ve donated to [nonprofit] this year, you might be able to double or even triple your gift through your employer’s matching gift program! Many companies offer to match their employees’ charitable donations, but these matches often go unclaimed. Submitting a matching gift request is a simple way to amplify your impact and ensure your generosity reaches even more people in need.

Here’s how you can participate in #MatchingWednesday:

Why submit your gift for a match today? Matching Wednesday is a limited opportunity to help us close out the year strong and make a difference for the communities we serve. Your support matters, and by taking just a few minutes to check your match eligibility, you can double the power of your donation at no extra cost!

Thank you for your continued generosity. Together, we can make an even greater impact.

Warm regards,

[Your Name]

[Nonprofit Name]

[Nonprofit Contact Information]

Matching Wednesday Facebook Post

Caption: Many employers match donations to [nonprofit], doubling (or even tripling!) your impact at no extra cost to you. Take a moment today to check if your gift qualifies for a match by visiting the Matching Gifts page on our website: [Matching Gift Page URL] #DoubleYourImpact #MatchingGifts

Matching Wednesday Instagram Post

Caption: It’s #MatchingWednesday! 🎉 Did you know that thousands of companies match employee donations? That means your gift could go twice as far—just by submitting a matching request!

Don’t miss this chance to maximize your support and make an even bigger impact. Visit our Matching Gifts page to learn more. #GiveMore #AmplifyYourImpact #MatchingGifts

Matching Wednesday LinkedIn Post

Caption: #GivingTuesday was just the beginning! 🌟 Did you know that your donation could go even further? Many companies offer matching gift programs, meaning your contribution can be doubled or even tripled at no extra cost to you.

Now, Matching Wednesday is the perfect time to take advantage of this opportunity! If you gave to [nonprofit] yesterday or at any point this year, check to see if your employer will match your donation. It’s an easy way to maximize your impact and support the causes that matter most to you.

Not sure if your company participates? Don’t worry—just use our matching gift search tool to find out: [Matching Gift Page URL]

This #MatchingWednesday, let’s make every dollar count for even more. Thanks again for helping us create lasting change. #DoubleYourImpact #EmployerMatching #CorporateGiving #SocialGood #GivingTuesday

Matching Wednesday Twitter Post

Caption: #MatchingWednesday is here! 🎉 It’s the perfect chance to make your #GivingTuesday gift go even further. Check to see if your employer will match your donation and double your impact today! [URL]

Next Steps & Additional Giving Season Resources

Establishing a Matching Wednesday campaign following Giving Tuesday is a smart way for nonprofits to extend their outreach—and make every gift count twice. By promoting matching gift opportunities immediately after a major giving day, organizations can reinforce their message, reach new donors, and deepen their impact overall.

This strategic timing leverages the global popularity and extensive goodwill of Giving Tuesday and engages donors further, reminding them that their support can do more. Embracing the idea of Matching Wednesday can ensure the season of giving extends beyond a single day, unlocking new possibilities for funding and growth in the year-end season and beyond. Just don’t forget to equip your team with the right software going into it!

Interested in learning more about matching gifts heading into a period of holiday giving? Check out these additional resources:

Top Matching Gift Companies in Boston, Massachusetts

/in Matching Gift Companies, Lists and Rankings /by Adam WeingerMaximizing employee matching gifts from a nonprofit’s donors is a critical element of fundraising for any organization.

Double the Donation often receives requests from Boston-based nonprofits asking if there are companies in their city offering employee matching gift or volunteer grant programs.

To clear up some of the confusion, we’ve highlighted a few of the top companies in Boston that offer to match donations from their employees. We’re going to examine the following companies:

Follow along for a look at Boston’s corporate philanthropy and the tools that can help you discover these opportunities.

Boston and Corporate Philanthropy

Boston is the largest city in Massachusetts and, in turn, has a diverse local economy consisting of companies in the financial services, publishing, media, and nearly every other industry.

If you’re a nonprofit with a large Boston donor base, you should be asking yourself one question: “Are we taking full advantage of philanthropic giving from corporations in Boston?”

There’s a decent chance you’re not. Boston has the 6th largest economy in the country, with many companies building headquarters in the city. Therefore, there is a major opportunity for matching gift programs in Boston.

If you’re not familiar, matching gift programs occur when companies pledge to make donations matching those their employees made to a nonprofit organization. Nonprofits that prioritize matching gift solicitation effectively receive two donations for the price of one.

The Best Way to Solicit Matching Gifts

When it comes to collecting matching gifts, the biggest obstacle for nonprofits is a lack of education around the subject–many donors are entirely unaware of the potential impact of their donation! This is true in many large cities, including Boston.

The most important thing your organization can do to secure matching gifts is to educate donors whenever possible about these corporate philanthropy programs. As each company with a matching gift program has different parameters, this may seem like a difficult task. However, with a matching gift software solution, educating donors is actually easier than you may think.

For example, Double the Donation allows organizations to automatically discover match-eligible donors and send them information regarding the gift request process. This solution also equips users to embed an industry-leading matching gifts database into their websites and donation forms so donors can search their own eligibility.

List of Boston’s Top Matching Gift Programs

Fidelity

Responsible in part for Boston’s status as a top financial center, Fidelity Investments matches employee donations between $50 and $4,000.

While the program company’s program is generous, only donations made to educational institutions (ex. colleges, universities, and educational organizations) are eligible.

Read more about the Fidelity Investment matching gift program.

Houghton Mifflin Harcourt

Houghton Mifflin Harcourt is a major publishing firm headquartered in Boston. It matches gifts up to $500 to a wide variety of nonprofits including:

Both full and part-time employees are eligible for this program.

Read more about the Houghton Mifflin matching gift program.

Raytheon Corporation

Raytheon will match any gift greater than $25, up to $10,000 made to an educational institution. This includes both public and private higher education institutions, as well as K-12 programs.

In addition to Boston, Raytheon has a large presence in multiple states across the U.S. That means that the company holds a huge opportunity for increasing donations to your nonprofit through matching gift programs.

Read more about the Raytheon Corporation’s matching gift program.

Thomson Reuters