Matching Gifts and Environmental Nonprofits | What to Know

In today's world, where environmental challenges are at the forefront…

Make the Most of Matching Gifts for Arts & Culture Groups

Matching gifts are a powerful yet continuously underutilized…

Matching Gifts for K-12 Schools | A Crash Course

Educational institutions, public and private alike, rely on strategic…

Driving Matching Gifts for Health & Medical Services

In the world of healthcare fundraising, effective revenue generation…

Matching Gifts for Food Security + Anti-Hunger Organizations

Food security and anti-hunger organizations play a critical role…

Matching Gifts and Animal Rescues | How to Double Impact

When it comes to running an animal rescue, there are a few things…

What’s the Impact of CSR? FAQ & Key Benefits for Businesses

Corporate social responsibility (often referred to as CSR) is…

https://doublethedonation.com/wp-content/uploads/2013/02/DTD_Why-Companies-Have-Matching-Gift-Programs-A-Complete-Guide_Feature.png

600

1600

Adam Weinger

https://doublethedonation.com/wp-content/uploads/2025/11/DTD-horizontal-logo-300x63.png

Adam Weinger2023-01-03 02:20:332025-10-06 06:14:44Why Companies Have Matching Gift Programs: A Complete Guide

https://doublethedonation.com/wp-content/uploads/2013/02/DTD_Why-Companies-Have-Matching-Gift-Programs-A-Complete-Guide_Feature.png

600

1600

Adam Weinger

https://doublethedonation.com/wp-content/uploads/2025/11/DTD-horizontal-logo-300x63.png

Adam Weinger2023-01-03 02:20:332025-10-06 06:14:44Why Companies Have Matching Gift Programs: A Complete Guide![How to start a matching gift program [for companies]](https://doublethedonation.com/wp-content/uploads/2022/08/DTD_How-to-Start-a-Matching-Gift-Program-For-Companies_Feature.jpg)

How to Start a Matching Gift Program [For Companies]

Thousands of companies host matching gift programs that encourage…

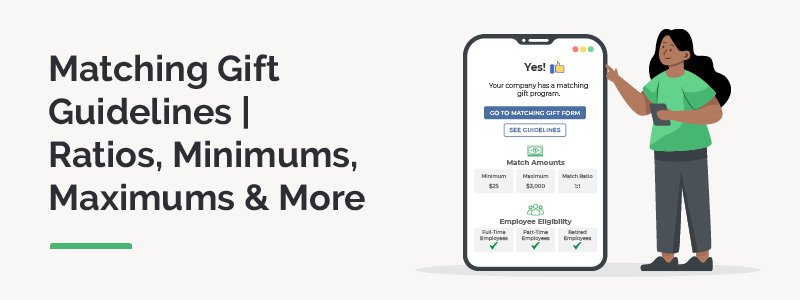

Matching Gift Guidelines | Ratios, Minimums, Maximums & More

Thousands of companies match donations made by employees to a…