If your nonprofit is looking for a way to maximize its fundraising efforts, there’s one avenue you might not be paying enough attention to: prospect research.

Regardless of your organization’s size, gathering the right donor data via prospect research can have a huge impact on your nonprofit’s revenue. These funds can help you serve your mission, fund important projects, and work toward your goals.

In this guide, we’ll outline several important pieces of information you’ll need to successfully leverage prospect research, including:

From learning the basics to soliciting your first prospects, a thorough understanding of prospect research can be a game-changer for your organization. Let’s get started!

The Basics of Prospect Research

What Is Prospect Research?

Prospect research is a process performed by a nonprofit’s development team to gather data about donors, volunteers, and other supporters. The process analyzes each individual’s giving capacity, motivations, and affinity for the cause. It helps determine an individual’s ability and desire to support that specific cause, as well as how to appeal to their interests.

Key factors nonprofits look for during prospect research include past giving, wealth markers, business affiliations, and philanthropic tendencies. Nonprofits can also use software or turn to prospect research companies to gather this data.

Wealth Screening vs. Prospect Research

You may have heard the term wealth screening in conjunction with prospect research. While the two terms are often used interchangeably, wealth screening is only one component of prospect research.

Wealth screening analyzes a donor’s financial profile, including real estate and stock holdings, as well as political giving. While it’s an essential part of prospect research, this only indicates an individual’s ability to give.

Prospect research goes a step further and uses both wealth and philanthropic indicators to determine a donor’s willingness and capacity to give. This provides nonprofits with a complete picture of each donor and helps make more informed solicitations. We’ll explore the complete range of data you should collect in the next section.

Who Uses Prospect Research?

A variety of organizations use prospect research to boost revenue and drive more meaningful relationships. These include:

- Educational institutions: Thorough research can pinpoint alumni and parents with a strong financial capacity and a history of philanthropy. Educational institutions can then tailor fundraising appeals to promote scholarships, facilities upgrades, and special programs.

- Healthcare organizations: Prospect research helps identify donors with personal connections to specific medical causes or who have previously donated to health-related initiatives. This allows these organizations to focus on potential donors likely to fund state-of-the-art equipment or patient care facilities.

- Arts and cultural organizations: Arts organizations can identify patrons with a keen interest in the arts and a history of supporting cultural initiatives. This information is crucial for targeting campaigns for exhibitions, performances, and educational workshops.

- Environmental groups: These organizations can identify donors who are passionate about conservation, climate change, or specific regional environmental issues. Effective prospect research can lead to targeted campaigns that resonate deeply with donors’ values, driving funding for crucial projects and advocacy efforts.

- Faith-based organizations: Prospect research helps identify individuals who have shown generosity to religious or spiritual causes, enabling faith-based organizations, such as churches, to personalize solicitations for funding new facilities and mission work.

- Advocacy groups: Prospect research helps uncover supporters who are financially capable and deeply committed to specific causes like civil rights, education reform, or health policy. This insight helps mobilize resources for lobbying and public awareness campaigns.

- Greek organizations: Fraternities and sororities can use prospect research to connect with alumni who have fond memories of their membership and might be interested in funding scholarships and chapter house renovations.

Prospect research can help all of these organizations (plus others!) become more focused in their outreach.

The Value of Thorough Prospect Research

40% of B2B salespeople say prospecting is the most challenging part of the sales process. When it comes to fundraising, nonprofits experience that same exact pain point. Prospect research can be incredibly helpful in sourcing and qualifying leads to avoid wasting time pursuing individuals without the affinity or capacity to give.

Beyond time savings, here are the most important benefits of researching supporters:

- Improved Fundraising Efficiency: Prospect research helps nonprofits identify the most promising donors, focusing efforts on those who are most likely to contribute.

- Tailored Appeals and Marketing: By understanding potential donors’ giving capacity, nonprofits can tailor asks to different supporter segments based on individual wealth indicators and giving history.

- Better Supporter Relationships: Comprehensive prospect research enables nonprofits to understand supporters’ interests and passions, enabling personalized communication that resonates with each individual’s values and helps retain support.

- Strategic Planning: Insights into supporters’ capabilities and preferences help nonprofits plan their projects more effectively.

- Finding Your Next Challenge Match Leader: While many nonprofits view prospect research simply as a way to fill a pipeline with individual donors, the most strategic organizations use it to find partners. The ultimate win is identifying a high-capacity donor who is willing to leverage their gift as a Challenge Match to inspire other donors as well.

- More Reliable Data: Prospect research helps nonprofits gather comprehensive, accurate data on potential donors, including phone numbers, demographics, wealth indicators, and philanthropic interests. Reliable data is crucial for making informed decisions and staying connected with supporters.

Prospect research is essential for nonprofits looking to optimize their fundraising initiatives and build lasting relationships. Make sure you’re working with reliable tools and companies to gather supporter data, and you’ll set your team up for success.

Employment Data: the Most Powerful Piece of Modern Fundraising Intelligence

While real estate and stock holdings have traditionally been the “gold standard” of wealth screening, employment data has emerged as the single most valuable data point in modern fundraising.

Why? Because knowing where a donor works provides a dual layer of financial intelligence that no other data point can offer:

- It Reveals Immediate Capacity: Job titles and employers are direct proxies for income and disposable assets. A Director at a Fortune 500 company or a Partner at a major law firm signals immediate major gift potential without needing to dig through property tax records.

- It Unlocks Corporate Wallets: This is the hidden value. Employment data tells you exactly which donors are eligible for matching gifts, volunteer grants, and even sponsorship programs. When you identify a donor who works for a workplace giving company, you are effectively identifying a donor whose gift can be instantly doubled or tripled, with even greater partnership potential down the road.

In today’s landscape, employment data is the bridge between individual giving and corporate philanthropy. By prioritizing employment information in your prospect research, you aren’t just assessing a donor’s personal checkbook; you are assessing their ability to direct corporate funds to your mission.

Other Data Points To Gather During Prospect Research

Since prospect research involves collecting both wealth and philanthropic indicators, it’s important to understand the common data points under each umbrella.

1) Philanthropic Indicators

Philanthropic indicators represent an individual’s willingness to give to your organization. These include:

Previous Donations to Your Nonprofit

Past giving is the best indicator of future giving because it means the supporter is interested in your cause and has already contributed. Prospect research helps uncover prior donations so your organization can reach out again.

Donations to Other Organizations

If your donors are philanthropically minded, they probably aren’t only giving to your nonprofit. Let prospect research unveil past giving to organizations with causes similar to yours.

Nonprofit Involvement

Giving isn’t the only indicator of an individual’s philanthropic mindset. With prospect research, you can identify other forms of nonprofit involvement, such as advocacy, volunteerism, and board membership.

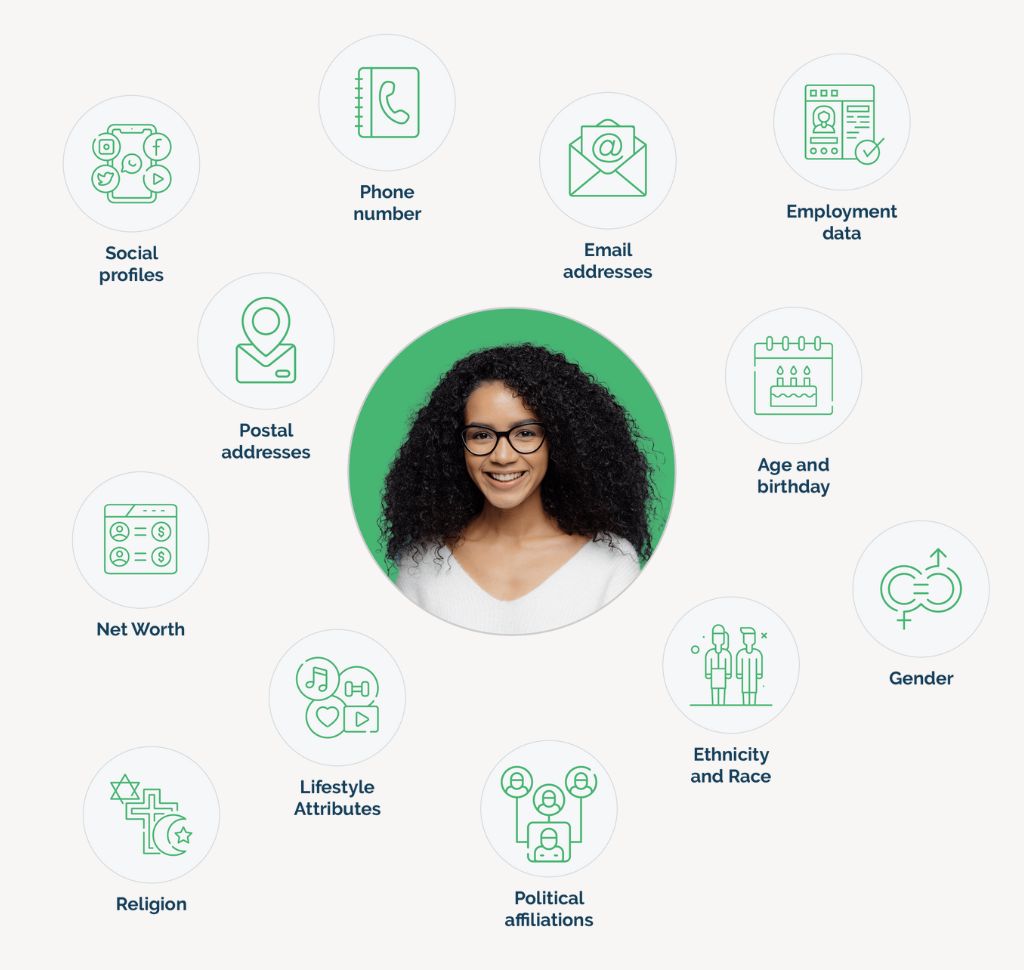

Personal Information

Collecting personal data will give you a more holistic understanding of each donor and how to connect with them on a deeper level. Craft more targeted appeals and deliver those appeals successfully by gathering this donor data:

- Full and preferred name and title

- Gender

- Marital status

- Contact information, like email addresses, phone numbers, and postal addresses

- Hobbies and interests

- Dates of birth

Much of this information can be collected online or through data appending services, helping you identify ideal prospects.

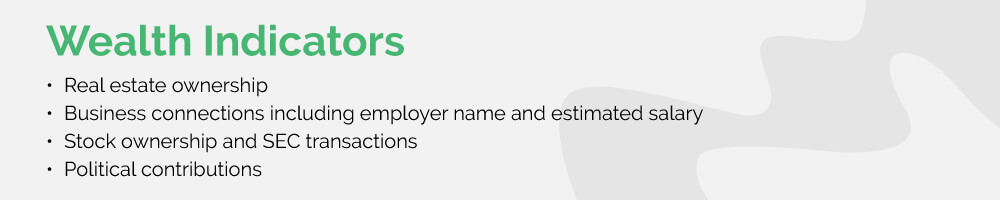

2) Wealth Indicators

Wealth indicators represent an individual’s ability to give to your organization. These include:

Real Estate Ownership

The quality and quantity of real estate someone owns are wealth indicators your fundraising team should pay attention to. Individuals with notable real estate have large giving capacities that you can capitalize on in your nonprofit’s fundraising initiatives.

Business Affiliations

Prospect research can help you detect existing business connections among your donors. This research includes details about a donor’s career, such as salary estimates, which can indicate wealth and ability to give. You may also discover information about a donor’s employer’s corporate giving program, which can provide insights into potential matching gift opportunities.

Stock Ownership/SEC Transactions

Knowing about a contributor’s stock ownership can give you even more insight into their wealth and capacity to donate to your organization.

Political Contributions

Chances are that an individual who has made sizable donations to a political campaign also has the giving capacity to donate major gifts to your nonprofit. By using prospect research to target this group, you can focus on winning over prospects with the potential to make generous contributions.

Primary Uses of Prospect Research

Prospect research can impact several areas of your mission. Let’s explore common ways nonprofits use the data they gather.

Major Giving

Prospect research is the perfect tool for identifying major gift prospects hidden in your existing donor database. It can help you uncover past giving and involvement and track giving patterns that may predict major giving.

For instance, you might have a faithful donor whose contributions have steadily increased over the past five years. With prospect research, you can examine that donor’s history and figure out the best strategy to ask for a major donation.

Capital Campaigns

A capital campaign is a long-term fundraising effort that’s usually tied to a large project, such as the construction of a new building or the development of an endowment.

Capital campaigns typically rely on a set number of major gifts during the “quiet phase” before fundraising is opened to everyone in the “public phase.” Prospect research can help uncover ideal donors for both the quiet and public phases.

Challenge Matches

A challenge match (wherein a major donor pledges a large sum contingent on the nonprofit raising an equal amount from other supporters) creates urgency and excitement. Prospect research can be vital for identifying a lead donor for this strategy by uncovering individuals who not only have high financial capacity but also a leadership profile and deep affinity for the cause.

Identifying these “Challenge Match Leaders” is a powerful way to turn a single major gift into a revenue multiplier for your entire campaign, far exceeding the value of a standard one-time donation.

Annual Giving

Annual giving is what keeps your organization’s wheels turning. Without it, you wouldn’t be able to complete your day-to-day operations.

While your organization likely already asks all supporters to contribute to your annual fund, you can now search for new annual donors via prospect research tools. In addition, you’re more likely to uncover potential supporters by looking into someone’s past giving to organizations that align with your own.

Corporate Giving Opportunities

Prospect research is instrumental in identifying and understanding potential corporate partners whose philanthropic interests align with your nonprofit’s mission. Collecting employer data also helps pinpoint untapped opportunities. Examples include:

- Matching gifts: Many companies match their employees’ donations to eligible nonprofits. Knowing where your supporters work can help you identify match-eligible donors, so you can follow up and double those individuals’ contributions.

- Volunteer grants: Businesses also provide volunteer grants to nonprofits where their employees volunteer regularly. Prospect research can help pinpoint these opportunities.

- Volunteer Time Off: Tons of companies offer their employees bonus PTO to participate in volunteer activities with organizations like ours. Use prospect research to identify volunteers (or prospects) who work for companies with these programs.

- In-Kind Donations: Companies can provide non-monetary support in the form of goods or services. Prospect research helps identify potential donors who can offer in-kind contributions relevant to your nonprofit’s needs, such as technology, office supplies, or professional services.

Once you identify these opportunities, your nonprofit can reach out to supporters who are eligible to participate in their companies’ corporate giving programs.

Planned Giving

Identify donors who are in a position to make significant long-term commitments, such as bequests, trusts, or annuities.

Researching a donor’s financial background and giving history enables your nonprofit to tailor conversations about legacy opportunities that resonate on a personal level, helping you secure future funding and ensure the donor’s lifelong engagement with your mission.

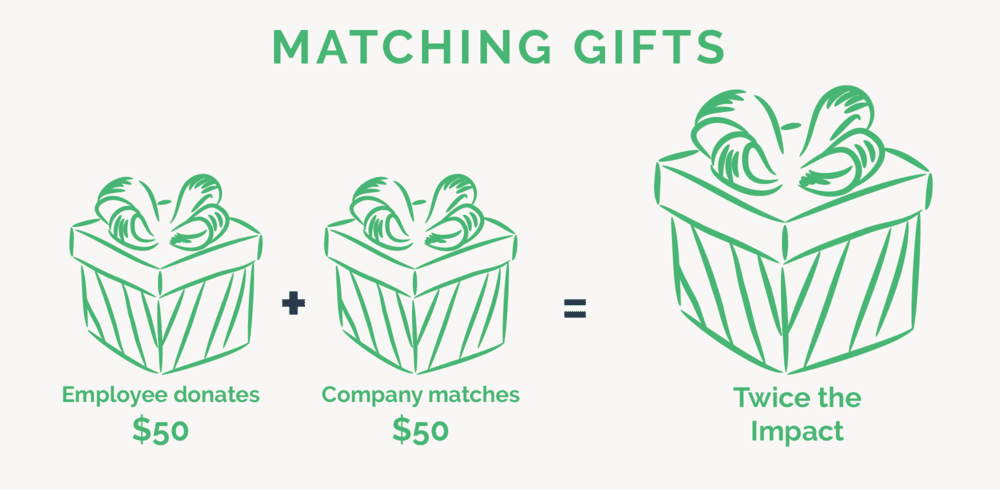

How Matching Gifts and Prospect Research Work Together

Matching gifts and prospect research are both powerful strategies that, when combined, can significantly enhance your fundraising efforts.

As mentioned, prospect research helps identify donors who are affiliated with companies that offer matching gift programs, potentially doubling their donations without requiring extra effort from the donors themselves. This synergy not only boosts your fundraising capacity but also deepens donor engagement, as donors feel their contributions have a greater impact.

Here are some key ways that matching gifts and prospect research can work together to dramatically increase your fundraising success:

- A matching gift search tool can help you identify corporate and individual prospects from a list of people who have already made matching gifts to your nonprofit.

- Matching gifts can encourage prospects to give more to your organization by inspiring them to double their impact. In fact, one in three donors is more likely to donate if a match is offered.

- Prospect research and matching gifts can grow your corporate engagement efforts by pinpointing companies with generous programs.

- Focusing on individuals with matching gift potential doubles the value of that donor’s potential support.

To manage this strategy effectively, consider using specialized tools like Double the Donation Matching. This software simplifies tracking and verifying matching gift eligibility and submissions, ensuring you make the most of every donation opportunity.

How to Research Donors and Other Constituents

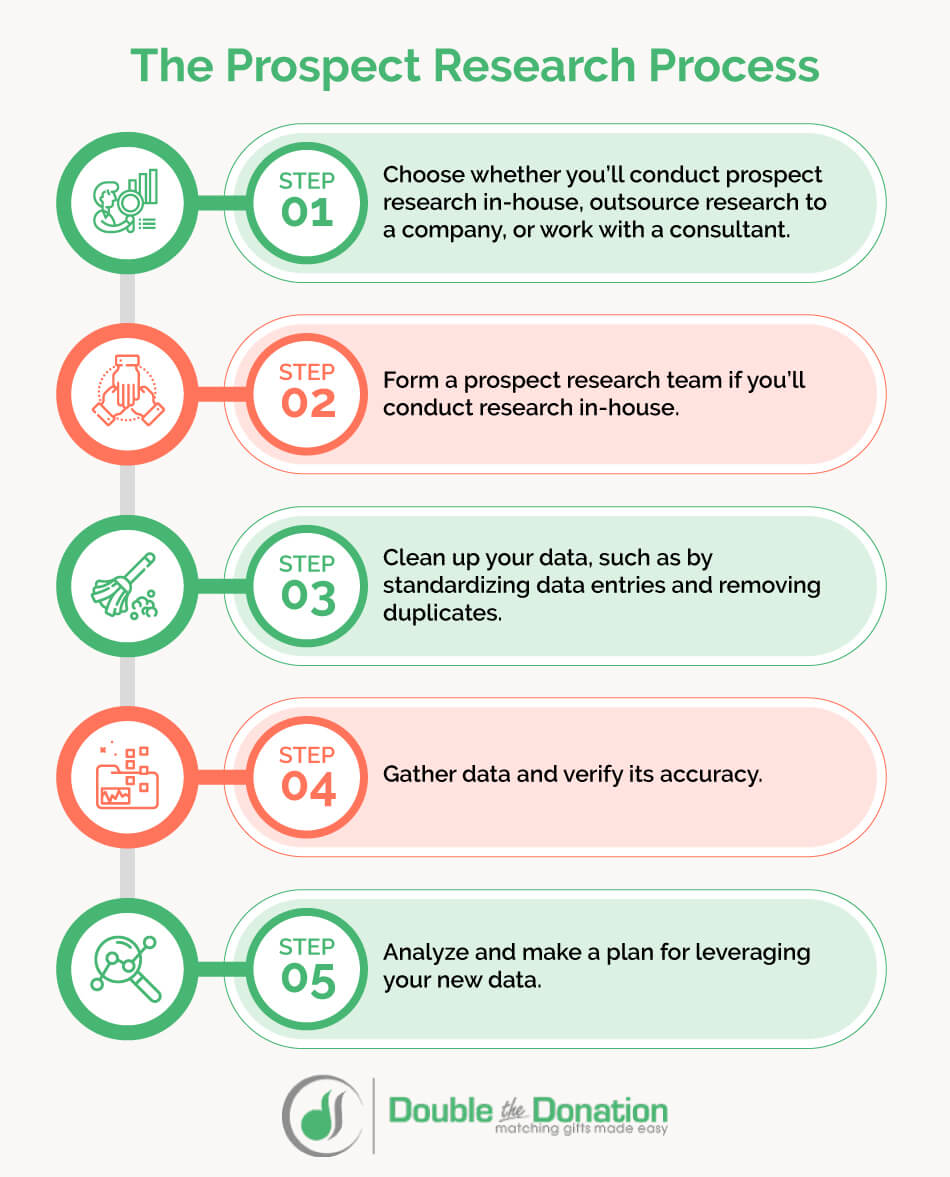

Once you’ve decided to perform prospect research, you might be wondering where you should start. Here are the general steps you can take to gather supporter data.

1) Choose your prospect research method.

Your first step is to plan how you’ll approach your research process by asking yourself about your fundraising goals, current strategies, and timeline. Once you understand what you need out of your research, choose one of these methods:

- Do It Yourself: For smaller or newer nonprofits with tighter budgets, a do-it-yourself prospect screening approach is a good option. Use free or low-cost prospect research tools to examine donors’ giving and philanthropic histories.

- Prospect Research Consultants: Prospect research consulting firms are extremely valuable resources for nonprofits. They offer advice and comprehensive screenings for nonprofits of all shapes and sizes.

- Prospect Screening Companies: Every prospect screening company is different, but most compare your donors against a variety of databases to create a comprehensive profile for each supporter. This will help your organization track, sort, and evaluate all of your supporters.

Make sure you know exactly which data you need to collect and how quickly you need to collect it, so you can pick the right method.

2) Form a prospect research team.

If you’ll conduct prospect research in-house, you’ll need to build an effective prospect research team of individuals with complementary skills. The following roles are critical to your team’s success:

- Director: This individual leads the team, sets strategic goals, and ensures alignment with your nonprofit’s broader objectives. They oversee the entire research process and ensure the team has the necessary tools to conduct research.

- Prospect Researcher: This team member is responsible for gathering data about potential and current supporters. They’re tasked with creating detailed profiles by digging into donor data using various sources, such as databases, public records, and social media.

- Data Analyst: A data analyst focuses on interpreting data and trends from donor databases and external sources. They help the team understand giving patterns and identify potential high-value donors.

- Development Officer: This individual uses insights from prospect research to cultivate and maintain donor relationships. They are typically involved in direct fundraising efforts and use data-driven strategies to approach potential donors, secure donations, and nurture ongoing donor relationships.

- Legal/Compliance Officer: Given the sensitive nature of handling personal data, having someone knowledgeable about legal and ethical standards is crucial. This team member ensures that all prospect research activities comply with privacy laws and ethical fundraising practices.

Each role focuses on a specific aspect of the prospect research process, contributing to a comprehensive approach. While the structure of your team may vary, this suggested structure supports targeted fundraising efforts and helps build a robust foundation for long-term supporter engagement.

3) Clean up your data.

Before conducting prospect research, clean up your data to ensure the process runs smoothly and yields more accurate results. A few ways to maintain proper data hygiene include:

- Identifying and removing duplicate records within your database

- Standardizing data entries to maintain consistency across your database, such as by using uniform formats for dates, addresses, phone numbers, and names

- Identifying and removing outdated or irrelevant information that no longer serves your fundraising strategies

- Removing lapsed donors from your records

- Scanning your database for typos

Your data doesn’t need to be perfect, but cleaning it up as much as possible will optimize your system for prospect research.

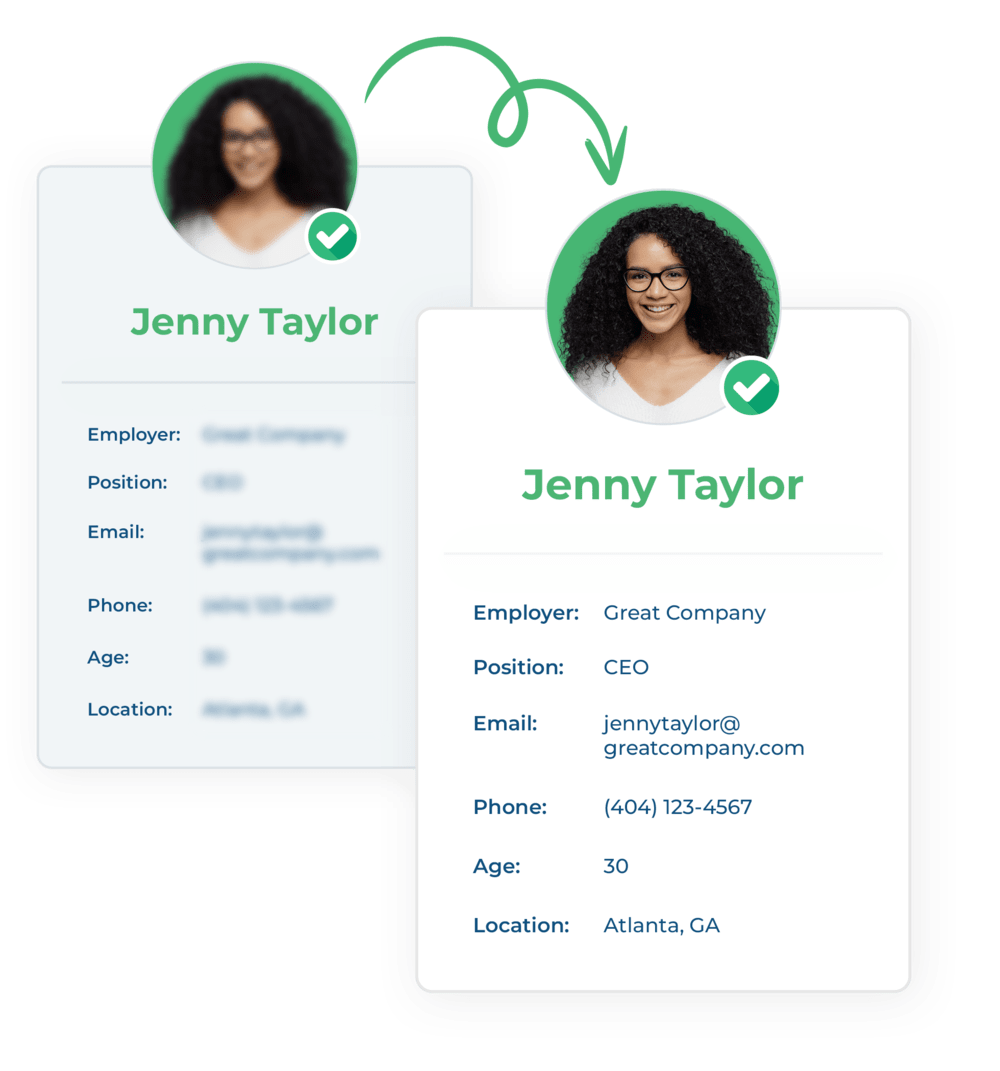

4) Check for accuracy.

Once you’ve actually conducted prospect research, verify the accuracy of the data gathered. This step involves cross-referencing information from multiple sources to confirm details such as contact information, philanthropic history, and financial capacity. Some prospect research companies will have an accuracy-check process, such as manually verifying appended emails and phone numbers.

Ensuring data accuracy helps prevent miscommunication and fosters trust by demonstrating diligence and respect for each prospect’s information. It also optimizes the efficiency of subsequent outreach efforts by reducing the time spent on addressing inaccurate or outdated information.

5) Analyze and make a plan for leveraging your new data.

After integrating the new data into your CRM, be sure to sift through the results to identify the most promising prospects by analyzing factors such as giving capacity, alignment with your nonprofit’s mission, and likelihood of giving. Based on this analysis, create a detailed plan for how to best use this data for outreach.

This plan should outline who to approach, the best ways to reach out to them, and the right time to do so. It involves deciding whether to meet someone in person, invite them to a special event, send them a personalized letter, or connect through online platforms based on their preferences and past donations.

During this stage, you’ll want to segment your supporters based on shared characteristics.

These may include:

- Donation Level: Group donors based on the amount they contribute, such as major, mid-level, and low-level donors. This allows for tailored communication strategies that recognize the level of support.

- Workplace Giving Eligibility: Targeting donors who qualify for matching gifts, volunteer programs, or payroll giving is a great way to make the most of your supporters’ uncovered connections. Be sure to use the information you’ve gathered (such as employer name and program guidelines) to further personalize your outreach.

- Donation Frequency: Identify who gives regularly versus those who donate sporadically. Regular givers can be approached for recurring giving programs, while sporadic givers can be encouraged to give more consistently.

- Geographic Location: Segmenting donors by location can help organize local events, understand regional interests, and tailor communications that resonate with local community values or needs.

- Interests: By understanding what specific projects or aspects of the organization’s work a donor supports, nonprofits can tailor outreach to reflect donors’ interests.

- Type of Support: Differentiate between types of supporters such as volunteers, advocates, corporate sponsors, and individual donors.

- Demographics: Segmenting based on demographics helps choose messages and outreach strategies that are more likely to resonate with different groups.

- Communication Preferences: Some supporters may prefer digital communication, while others might value traditional mail or personal calls. Segmenting by communication preference ensures supporters receive information in the way that is most accessible and engaging to them.

An effective plan ensures your team knows exactly what steps to take to engage each prospect, turning potential interest into actual support. From here, put your plan into action and start reaching out!

Types of Prospect Research Tools and Software

While the prospect research process may sound daunting, there are several prospect screening companies and platforms that nonprofits and educational institutions can use. Let’s explore a few recommended services and tools.

Data Enhancement

Also called data appending companies, data enhancement services improve the quality and depth of existing donor databases by pulling additional information, such as:

- Contact information like email addresses, postal addresses, and phone numbers

- Demographics like ages, birthdates, and geographic location

- Employer data like company names and role titles

These services leverage external data sources to fill in gaps and update outdated information within your database. This ensures your nonprofit has accurate, comprehensive profiles for each prospect.

Prospect Research Database

Prospect research databases are specialized tools that provide access to a wealth of information on potential donors, including personal backgrounds, giving histories, wealth assessments, and affiliations.

These databases compile data from multiple public and proprietary sources, allowing fundraisers to quickly gather detailed insights about prospective donors’ capacity and propensity to give. Using this type of prospect research tool helps nonprofits identify and prioritize high-potential prospects.

Corporate Giving and Prospecting Software

Corporate giving software is designed to help nonprofits identify potential corporate donors. This type of software typically includes features for researching matching gift programs and volunteer grant information. Here are two types of tools that are most helpful:

- Matching gift databases contain information on companies that offer matching gift programs. They store requirements for employee eligibility, nonprofit eligibility, and donation amounts. Plus, they provide relevant submission information such as available forms and deadlines.

- Volunteer grant databases provide details on companies that offer grants to nonprofits where their employees volunteer. This prospect research tool stores records of individual companies’ programs, including volunteer hours, employee and nonprofit requirements, and instructions, along with links to application forms and deadlines.

Additionally, corporate prospecting software like Double the Donation leverages existing donor data to uncover hidden corporate potential. By uploading your current donor list for a quick employer append screening, the platform instantly identifies which of your supporters are eligible for workplace giving opportunities that can significantly grow your organization’s revenue. This transforms your standard donor list into a high-value prospect list, allowing your team to prioritize outreach to donors whose contributions can be immediately doubled, maximizing both individual donor value and overall fundraising efficiency before a major gift ask is even made.

These prospect research tools can help your nonprofit identify donors and volunteers eligible for their companies’ philanthropic programs. Plus, they can help you identify companies that offer generous corporate giving initiatives, which can open the door to strategic partnerships.

Donor News Alert Services

Donor news alert services are platforms that monitor and report news about prospective donors. Your nonprofit can use a platform like this to stay informed about donor activities that signal a willingness or ability to give. Even more importantly, these insights help nonprofits build deep, meaningful relationships with their donors, which may yield significant gifts in the future.

For example, these platforms monitor obituary data, meaning they can notify your nonprofit when a prospect or donor’s loved one passes away. Your fundraising team can then reach out with heartfelt condolences on behalf of your organization. Prospects will likely appreciate this personal outreach and attention to detail, and may be more willing to support your organization in the future.

Insightful Philanthropy is our recommended donor news alert service for its extensive information sourcing and timely notifications. This platform relies on 14,000 news and information sources from more than 200+ countries, and even taps into historical donor data from up to 40 years ago to give nonprofits a complete picture of their prospects.

Your Nonprofit’s CRM

Your nonprofit’s CRM is a fundamental tool for managing donor interactions and tracking engagement history. It stores critical data such as donation records, event attendance, volunteer activity, and communication preferences, which can be leveraged to build stronger relationships with supporters.

Effective use of a CRM helps personalize donor interactions and streamline fundraising activities, making it easier to cultivate and steward donor relationships.

SEC Investment Records

SEC investment records provide information about the investment activities of individuals and institutions, which can be particularly valuable in assessing the financial capacity of potential major donors.

By examining public filings such as insider trading reports and stock holdings, nonprofits can gauge prospects’ wealth level and philanthropic capacity. This is especially useful for identifying high-net-worth individuals and understanding their investment behaviors.

Predictive Modeling Solutions

Predictive modeling solutions use statistical techniques and algorithms to analyze historical data and predict future donor behaviors. These tools help nonprofits anticipate which prospects are most likely to donate, their expected donation amounts, and optimal times for solicitation.

Wealth Screening Tools

These tools help nonprofits assess potential donors’ financial capacity by analyzing data points such as real estate ownership, stock holdings, past charitable contributions, and other publicly available financial information. That way, you can focus on prospects with the means and propensity to give significantly.

As a top recommended prospect research service, DonorSearch blends philanthropic and wealth metrics so your organization can make informed decisions about prospects and plan effective outreach. Plus, the company offers a few choices of tools when it comes to conducting prospect research:

- Charitable giving database. DonorSearch’s charitable giving database is comprehensive and constantly growing, housing tons of useful philanthropic data.

- DSGiving search tool. DSGiving is a free prospect research tool that offers access to a smaller-scale version of DonorSearch’s philanthropic and political contributions data. Simply type in an individual’s name, state of residence, and gift type, and the tool will pull useful data.

DonorSearch helps your nonprofit learn more about your donors and create comprehensive donor profiles. Because the tools analyze philanthropic and wealth indicators, they yield more qualified leads for nonprofits to pursue.

Fueling Your Prospect Research With Double the Donation

Double the Donation is a leading fundraising tool for nonprofits, providing a range of matching gift solutions. Our complete automation platform can give your nonprofit the ability to maximize donations with matching gifts, volunteer grants, payroll giving, and more without lifting a finger.

Here’s an overview of our solution:

- Double the Donation Matching: Using Double the Donation’s matching gift fundraising software, organizations can uncover valuable matching gift prospects by collecting employer information within the donation process. From there, the solution screens for matching gift eligibility and populates the appropriate forms and guidelines for submitting a match. Plus, Double the Donation Matching offers a real-time employer appends add-on that instantly scans donor records and automatically supplies company information if available. Check out this video for a closer look:

- Double the Donation’s Workplace Giving Insights: This powerful new module takes your donor list and provides in-depth prospect research data focused solely on corporate giving potential. It screens donors’ employer affiliations to reveal which companies offer matching gifts, volunteer grants, and other workplace giving programs, transforming a scattering of individual donors into a prioritized list of corporate revenue opportunities.

Want to learn more about how our cutting-edge technology can support your prospect research and drive greater fundraising results? Reach out to our team for a free demo to see the complete platform in action!

Wrapping Up

Prospect research is an invaluable strategy that equips nonprofits with the insights needed to target donors effectively. By harnessing the power of detailed data analysis and strategic donor segmentation, your organization can unlock new opportunities and maximize the impact of its fundraising efforts.

If you’re looking for more information about prospect research, check out the additional resources below:

Capital Campaigns: A Groundbreaking Guide to Success

/in Fundraising Strategy, Learning Center, Fundraising Ideas /by Adam WeingerEvery nonprofit organization reaches a point where its vision outgrows its current capacity. Perhaps you need a new state-of-the-art facility, a substantial permanent endowment, or the resources to launch a massive program expansion that will transform your community. This moment, the leap from your current reality to your boldest future, is powered by a Capital Campaign.

A capital campaign is not just another annual appeal; it is the most ambitious and strategic fundraising effort a nonprofit can undertake. Successfully executed, it can permanently reshape your organization’s financial stability and physical infrastructure.

But where do you start? How do you ensure your multi-million dollar vision doesn’t turn into a multi-year headache?

In this comprehensive guide, we will walk you through every critical phase of the capital campaign process. From assessing readiness and securing your first major gifts in the quiet phase, to selecting the right consulting support and executing a flawless public launch, we’ll provide the roadmap you need to turn your organization’s biggest dreams into reality. This includes:

Let’s begin by answering a few frequently asked questions by nonprofits such as yours.

Capital Campaign FAQs

What Is a Capital Campaign?

At its core, a capital campaign is an extensive, drawn-out fundraiser.

But at a more complex level, a capital campaign is a concerted effort to raise substantial funds for a specific project or undertaking. According to Capital Campaign Pro, these campaigns typically take 2-3 years from start to finish, and most organizations conduct them every 10-15 years.

Because these are the most significant fundraising campaigns your nonprofit will ever take on, capital campaigns require coordination and cooperation from your entire organization and community. Without the support of board members, staff, and individuals who are dedicated to your cause, a capital campaign has little to no chance of succeeding.

Why Do Nonprofits Use Capital Campaigns?

As stated before, nonprofits generally use capital campaigns for large projects that require substantial financial backing. More often than not, capital campaigns are used to raise money for a new building or renovations to an existing building. But they can also be for:

Purchasing Lands or Buildings

The main reason many organizations wish to acquire land is the possibility of future expansion. Capital campaigns are thus used to help organizations raise enough funds to finance land purchases. Organizations may also campaign to buy a building they’ve rented for a long time when the space goes up for sale, to secure a safe future without rent increases.

Expanding an Existing Building

Large organizations such as hospitals and schools often need to regularly expand their facilities to accommodate a growing patient or student population. Such projects are massive undertakings that require substantial financial resources, which is why they are mostly funded through capital campaigns.

Funding New Programs or Increasing Staffing

Sometimes, in order to get a new program or initiative off the ground, your nonprofit needs an influx of funds to secure the necessary resources. You may even need funding to grow your team, ensuring your organization has the capacity to do more for its beneficiaries.

Building an Endowment

An endowment helps secure a bright future for your nonprofit, but it can be difficult to encourage giving to a capital campaign focused solely on an endowment, since the impact of that giving may not be immediate. This is why many organizations choose to include endowment funding as one element of a multifaceted capital campaign.

Purchasing Equipment or Supplies

Nonprofits sometimes need large-scale purchases to further their missions. A hospital, for example, may need to upgrade existing radiology equipment, or a university may require a high-powered telescope for the astronomy department. Capital campaigns can help fund these major purchases.

What Types of Organizations Run Capital Campaigns?

Any type of organization can run a capital campaign! Let’s highlight a few examples:

Hospitals

Many hospitals and healthcare nonprofits launch capital campaigns to raise funds for new wings or buildings, purchase new equipment, replace or repair outdated machines, or fund groundbreaking medical research.

Schools and Universities

Schools, colleges, and universities are another type of organization that frequently uses capital campaigns as a fundraising method. Education-related organizations use capital campaigns to raise funds for new buildings, scholarship programs, or equipment.

Community Organizations

These organizations often launch campaigns to build or expand physical centers that serve local residents, such as new food banks, youth centers, or recreational facilities. Their campaigns focus on scaling essential programs and infrastructure that directly improve the quality of life within a specific geographic area.

Civic Organizations

Civic groups often run capital campaigns to renovate or restore historical landmarks, establish memorials, or fund large-scale public works projects like parks and libraries. Their goals are usually tied to enhancing the public good and preserving shared community assets.

Environmental Nonprofits

Environmental organizations rely on capital campaigns to secure large tracts of land for conservation, establish permanent endowments for long-term stewardship, or build interpretive and educational facilities. These campaigns aim to protect natural resources and fund significant, enduring ecological projects.

Animal-Related Organizations

These nonprofits frequently seek capital funding to construct new shelters with modern veterinary facilities, establish sanctuaries for rescued animals, or expand kennel capacity. Their campaigns are often driven by the urgent need to upgrade facilities that provide direct animal care and housing.

Arts and Culture Nonprofits

Museums, theaters, symphonies, and galleries run capital campaigns to fund the construction of new performance halls, the acquisition or preservation of significant collections, or the renovation of historical venues. These efforts are crucial for expanding programming space and ensuring the long-term viability of cultural institutions.

Churches and Religious Organizations

Religious organizations commonly use capital campaigns to raise funds for major building projects, such as renovating or constructing new places of worship, expanding classrooms for faith-based education, or creating community outreach centers. These campaigns often tie the fundraising goal directly to the organization’s spiritual and community mission.

Who Can Help You Conduct a Capital Campaign?

Capital campaigns are significant undertakings, so nonprofits usually turn to professional fundraising consultants to help plan and execute them. A consultant or advisor can help with campaign planning, feasibility studies, prospect research, fundraising and solicitation, event planning, and more.

Our recommendation:

We suggest taking a hands-on approach to your capital campaign with our preferred expert: Capital Campaign Pro.

This innovative campaign support system gives you everything you need to plan and run your capital campaign: resources, expert guidance, templates, hands-on experience, and access to a community of other nonprofits also conducting campaigns.

The traditional consulting approach, while often effective, can be quite expensive and opaque, meaning your team won’t have access to all of the campaign tools or learn how all the pieces of the campaign fit together. Capital Campaign Pro offers an alternative approach that can yield immense benefits for your team, even long after your capital campaign comes to a successful end.

How Can You Market Your Capital Campaign?

A well-marketed capital campaign can launch big projects for your mission. Before entering the public phase of your campaign, make sure you have a well-thought-out marketing plan. Here are some core considerations as you brainstorm marketing strategies with your team.

Your Website

Your nonprofit’s website should serve as the single most critical communications hub for your entire capital campaign. For this reason, we suggest dedicating a prominent section or a separate landing page to the campaign, ensuring it clearly features the Case for Support, the running campaign total, a direct donation form, and compelling visuals of the project’s future impact.

Furthermore, for your top-tier major donors, it should be easy to launch challenge matches in support of your capital campaign straight from your website. Making this high-level participation seamless signals that you are prepared for transformational gifts and empowers leadership donors to instantly amplify the campaign’s public momentum.

Google Ads

Once your capital campaign information is live on your website, paid advertising is a wonderful way to get that content in front of potential prospects. Using the Google Grants program, you can receive up to $10,000 to spend on Google Ads for free each month. With careful keyword research, you can amplify your campaign’s landing page on Google Search and drive more traffic to it.

For the best results, we recommend working with a Google Grants consultant to create inspiring ads that target the right users on Google.

Brochures

A brochure gives you plenty of space to cover the key details of your capital campaign.

The most compelling brochures feature what your project will accomplish and who it’ll benefit, whether that’s building a shelter for the homeless, an animal sanctuary for endangered species, or something else. Paint a picture with words and images about how your work will create a difference. Then provide details on how to get involved, such as visiting your campaign page’s URL.

Email

Email has the highest ROI of any marketing channel, so include it in your outreach!

When you move into the public phase of your campaign, send regular emails to announce it. Then, provide updates along the way. You have seconds to get your point across, so keep your emails short and include a clear call to action in each one, giving the reader their exact next step. Then, top it all off with a subject line that encourages recipients to open the email.

What Does The Research Say About Capital Campaigns?

Especially if you’re preparing for your organization’s first capital campaign, you may be wondering, “What evidence is there that we can succeed?”

Capital Campaign Pro recently conducted a benchmark study, surveying nearly 300 U.S. and Canadian nonprofits with varying experiences with capital campaigns. Here are some of the insights from the study:

Download your free copy of the benchmark study to learn more.

The Capital Campaign Process

Planning a Capital Campaign

Your nonprofit needs to carefully plan its capital campaign before it begins fundraising to ensure the implementation process goes as smoothly as possible. Without a thorough plan in place, your team may not successfully anticipate issues before they arise and may realize too late that your fundraising strategy needs revision. Some tasks that should be completed in the planning phase include:

Determining objectives & working financial goal

The objectives of your campaign are the reasons you’re conducting your campaign. For instance, you may want to purchase new supplies and equipment or renovate your facility. Your financial goal will depend on the scope and size of the project your organization is undertaking. You should arrive at this number after careful calculation and accounting for hidden costs.

Conducting a feasibility study or report

We’ll go over the details of a feasibility report in a later section, but it’s vital to the success of your capital campaign. A feasibility report is essentially “product-testing” your campaign. You want to ensure the community will support your project, and a feasibility report helps you do just that.

Creating a gift range chart

Once you’ve tested the feasibility of your campaign and have a more solid financial goal, create a gift range chart. This visualization shows how many gifts your nonprofit needs to secure at different levels. You can take this a step further by developing a depth chart, which attaches specific prospect and donor names to each gift.

Establishing your communications strategy

Determine how you’ll get the word out about your campaign during both the quiet and the public phases. Review the strategies listed above, like using Google Ad Grants or creating a brochure, while also considering what you know about your community and the communications they’ve responded to in the past.

Developing your budget

Capital campaigns are used to raise money for large projects, but they also cost money to prepare and launch. You’ll need to account for marketing materials, event costs, and other fundraising expenses that may arise.

Setting a deadline

Your deadline will largely depend on your financial target and the pool of donors you expect to donate. You don’t want to make your deadline too soon and risk not reaching your goal. On the other hand, you don’t want to set a deadline that’s five years from now when it would only take two years to raise the money.

Implementing a Capital Campaign

After all of the hard work in the planning phase, it’s time to implement your capital campaign! There are two main segments within the implementation process:

The Quiet Phase

The quiet phase is not open to the public; instead, it relies on contributions from your major donors. During this stage, your committee members will reach out to your major donors and local businesses to solicit large donations. Usually, capital campaigns raise 50-70% of their total during the quiet phase, and it’s a great opportunity to kick off the prospect research and appending processes to learn more about your target donors.

The Public Phase

The public phase begins with a kickoff event, sometimes at the building site (when applicable). Once the public phase begins, donors can give as much as they want. Your committee can still solicit major gifts, but the focus should be on broad marketing to as many donors as possible.

Once you reach your goal in the public phase, it’s time to celebrate! However, don’t neglect important donor stewardship tasks, such as thanking your donors and continuing to communicate with them. Capitalize on the relationships you strengthened during your campaign in order to secure future engagement and support.

Essentials for a Successful Capital Campaign

A Feasibility Study

Feasibility studies are crucial to the success of any capital campaign. They essentially determine whether or not your donors and the community will be willing to support your organization’s project.

Think of your feasibility study as a critical must-have instead of an optional step. It will help you get a leg up on your campaign from the get-go. In fact, Capital Campaign Pro found that organizations that conducted a feasibility study raised, on average, 115% of their original campaign goal, compared with 101% for those that did not.

During a feasibility study, your organization’s leaders or an outside consultant will sit down and interview 30 to 40 individuals from the community. The experts at Capital Campaign Pro recommend taking a hands-on, guided approach in which your nonprofit’s leaders conduct the interviews personally with the support of a campaign advisor. You’ll then work together to distill insights and recommendations.

We recommend interviewing a combination of:

Questions to ask your interviewees during a feasibility study will range from personal (“What is your connection to the organization?”) to more broad (“Do you think this organization can raise the money for this project?”).

Here are a few questions to consider:

By the end of the feasibility study, your organization should be able to determine whether or not you have the support needed to raise money for your capital campaign.

Powering your feasibility study with employment data

Modern fundraising best practices recognize that wealth indicators and philanthropic connections go hand in hand with professional background. Powering your feasibility study and quiet-phase outreach with up-to-date donor employment data is key to identifying top prospects and accurately assessing their capacity. Traditional wealth screening may only capture real estate or stock holdings, but sophisticated data tools, often powered by workplace giving providers, can pinpoint a prospect’s current employer, workplace giving potential, and more. This information is invaluable because it not only confirms their financial capacity but also reveals their eligibility for matching gifts and volunteer grants.

By combining internal giving history with comprehensive employment data, your team can prioritize outreach to individuals with the greatest capacity to make a transformational gift and simultaneously unlock matching funds from their employers.

A Capital Campaign Committee

Before you begin planning your capital campaign, you’ll first want to gather a committee of dedicated individuals around you to help with its planning and execution. People you should consider for your capital campaign committee include:

Don’t feel obligated to create a massive capital campaign committee that includes every board member, staff member, and major donor in your organization’s history. The committee should be big enough to handle the particulars of the capital campaign but small enough to give everyone an opportunity to voice their opinion.

Prospect Research

As a valuable tool you can leverage to better understand your donor base, prospect research can help you learn more about your donors. This includes their:

Having this information will help guide you toward your major donors. Because major gifts are going to drive the first half to two-thirds of your capital campaign, you’ll need to be well prepared to make those donation appeals.

With prospect research on your side, you’ll be more than ready to solicit those major donations from your supporters.

A Case for Support

A case for support is a document that outlines your nonprofit’s justification for hosting a capital campaign. It is useful for both your feasibility study and the quiet and public phases of the campaign.

For that reason, your case for support must be airtight and convincing! Convey a sense of urgency as concisely and clearly as possible. After all, donors want to know why they should support you and how they can help. Your case for support should include:

A great case for support will be branded to your organization. Just take a look at this example from St. Ursula’s Academy.

As this example from Aly Sterling’s Capital Campaign guide demonstrates, nonprofits can creatively showcase their financial goals while capturing the spirit of their cause! Specifically, the branded colors, the heartfelt text, and the easy-to-understand fundraising goals make this case for support tangible.

The Right Tools + Technology

The complexity and scale of a modern capital campaign require specialized technology to manage donor data, automate outreach, and capture every available dollar. While human relationship building is always paramount, smart technology ensures that no opportunity is left on the table, especially when dealing with thousands of donors and a high financial goal. The good news? The right tools help you move faster and raise more by streamlining complex tasks.

One of the most critical and often overlooked components of a capital campaign is the potential revenue stream from corporate matching gifts, which can easily amount to a multi-million-dollar mistake if ignored. This is where a tool like Double the Donation becomes a non-negotiable part of your campaign technology stack. Not to mention, the platform serves a dual strategic purpose. First, it automatically identifies matching gift eligibility on your donation forms and thank you pages, ensuring donors can easily double their contributions toward your capital goal.

Second, Double the Donation’s data-appending capabilities can power your major gift prospect research by identifying an individual’s employer and associated corporate giving potential. This workplace data is key to calculating capacity, finding corporate grant connections, and confirming eligibility for those high-value matching gifts, giving your team the essential intelligence they need for successful solicitations.

How to Use Challenge Grants as a Capital Campaign Multiplier

Challenge grants offer a core strategy for maximizing campaign success and urgency in a way that just about no other fundraising vehicle can match. A challenge grant is a type of funding awarded by a grant-making entity, often a foundation or wealthy individual, typically after a nonprofit completes a specific fiscal challenge. This challenge typically involves raising a specific amount of money from other sources within a defined period.

Here’s how it works:

Creating Capital Campaign Urgency and Momentum

The primary advantage of a challenge grant is the instant urgency it creates for a capital campaign. The concept is simple yet profoundly effective: the challenge only exists for a limited time, and the matching funds are often framed in a “use it or lose it” way. This structure transforms a general plea for support into a time-sensitive opportunity for donors to double the impact of their gift.

For the public phase of a campaign, announcing a $1 million challenge grant, for instance, provides a massive, irresistible hook for all communications, galvanizing lower- and mid-level donors to participate right away.

Framing the Ask: Leveraging Major Gifts for Broader Participation

Challenge grants do not just pull in general donors; they also leverage the major gifts already secured during the quiet phase. As discussed previously, asking a lead donor to be the source of the challenge match is a powerful framing tool. The initial major gift is then publicly announced as the Challenge Match, inspiring others to follow suit. This strategy ensures that the quiet-phase gifts do double duty: they serve as the foundational funding and the motivational fuel for the rest of the campaign.

A challenge grant will sometimes match the challenge amount at a ratio of 0.5:1 to 2:1, meaning your nonprofit could stand to more than double the funds that you raise during your campaign simply by strategically applying this leverage. Do some research to find out whether there are any challenge grants available in your local area, or whether you have major donors with challenge match potential, to help your campaign reach its goal!

Here’s an example:

What to Know About Capital Campaign Consultants

How to Hire a Capital Campaign Consultant

Capital campaign consultants bring valuable expertise and a refreshing outside perspective to help you plan and execute your capital campaign. However, hiring a consultant can be rather involved. After all, you’re building a partnership and a long-lasting relationship with someone who can understand your mission, meet your needs, and get along well with your existing staff.

Here are some tips for making sure you get the right fit:

1. Determine your nonprofit’s needs.

Do you need a consultant to conduct a feasibility study, or to support your efforts throughout the campaign?

2. Do your research.

Look online for consultants who offer the specialty services that you need. Consider their location, cost, and core values. Ask other nonprofits in your network for recommendations.

3. Start a conversation with your top choices.

Speak with your top consultants on the phone or in person. Get a feel for their personalities and how they’d mesh with your nonprofit.

4. Request a proposal.

Request a proposal from your top choices. Look for a consultant who understands your nonprofit’s unique needs and brings new ideas to the table.

5. Check your consultant’s references.

Ask for former clients that you can speak with to better understand how each consultant can serve your nonprofit.

6. Finalize the details.

Once you’ve selected a consultant, you can discuss changes to their proposal and the engagement. Then, sign a contract that you’re both happy with and get to work!

Top Capital Campaign Consultants

The good news is that there are a ton of capital campaign consultants available to assist your organization with its upcoming campaign. Here are a few of our recommended firms and resources:

Averill Fundraising Solutions

For organizations seeking comprehensive, on-the-ground support, Averill Fundraising Solutions provides a highly experienced consulting model. Averill focuses on maximizing campaign potential through proven strategies and professional execution, offering a partnership that guides your team from the early feasibility study through final gift closing.

Averill’s approach emphasizes rigorous planning, tailored case development, and personalized coaching for your leadership and staff. Their consultants integrate directly with your internal teams, lending expertise in major donor identification, volunteer training, and meticulous campaign timeline management.

Aly Sterling Philanthropy

Organizations that require strategic guidance across various stages of growth often turn to Aly Sterling Philanthropy. While offering comprehensive capital campaign consulting, their focus is on building long-term organizational health that supports fundraising success. They work with nonprofits to ensure the capital campaign is not just a temporary project, but a launchpad for sustained major giving.

Aly Sterling Philanthropy’s campaign services begin with a deep dive into organizational readiness, ensuring your board, staff, and major gift pipeline are robust enough to support a large-scale campaign. Their consultants provide tailored advice on board engagement, case-for-support development, and integrating campaign goals with the nonprofit’s long-term strategic plan.

Capital Campaign Pro

For nonprofit leaders interested in taking a more hands-on approach to planning and running their campaigns, other capital campaign support options are available. For example, Capital Campaign Pro combines online campaign resources with expert advising for budget-friendly support that gives you the best of both worlds. By playing an active, direct role in your capital campaign, your team will learn invaluable skills related to campaign planning, donor stewardship, major gift solicitation, and more.

With Capital Campaign Pro, nonprofits are guided through an organized capital campaign plan. The step-by-step plan, resources and templates, and coaching calls all guide you to campaign success. Further, you’re able to have one-on-one advising with one of their expert capital campaign advisors for additional support.

Unique Capital Campaign Ideas

Capital Campaigns and Fundraising Events

Fundraising events can be a great opportunity for your nonprofit to directly interact with donors and build deeper connections. Because capital campaigns often run for months and even years, there is plenty of time for your nonprofit to host fun events that bring in more donations.

Obviously, the one event you’ll need to plan is the kickoff between the Quiet Phase and the Public Phase. But you can host all sorts of fundraisers to bring your community together and raise money for your campaign.

Check out some of our favorite fundraiser ideas here!

Capital Campaigns and Challenge Grants

A capital campaign committee may elect to apply for a challenge grant to take its fundraising efforts to the next level. Challenge grants are funds released by a grant-making entity after a nonprofit completes a challenge, typically a fiscal one, making them perfect additions to capital campaigns.

A challenge grant will sometimes match the challenge amount at a ratio of 0.5:1 to 2:1. This means that your nonprofit could stand to triple the funds that you raise during your capital campaign with the help of a challenge grant.

Do some research to find out whether there are any challenge grants available in your local area, or whether you have major donors with challenge match potential, to help your capital campaign reach its goal!

Explore our complete guide to challenge match fundraisers here.

Capital Campaigns and Employee Matching Gifts

Matching gifts can speed up your capital campaign by twofold. These corporate giving programs reward employee donations to nonprofits by doubling or, in some cases, tripling employees’ donations to eligible organizations.

Not every donor will work for a company that matches donations, and even if they do, every company has different guidelines and restrictions that must be followed before the matching funds are released. But your organization should still promote matching gifts to all of your capital campaign donors!

Why? Well, since 50-70% of your capital campaign funds will come from major gifts, those donations mean even more when they are doubled. It can’t hurt to remind your donors of matching gift programs.

Download our ultimate guide to matching gifts to learn more!

Capital Campaigns and Other Corporate Donations

Companies, big and small, are often willing to support nonprofit projects, such as capital campaigns. Not only does it allow them to be more philanthropic, but it also provides tax benefits and enables them to form meaningful partnerships with organizations.

Therefore, it’s a smart move for some members of your capital campaign committee to ask businesses for cash and in-kind donations for your capital campaign. Some companies will respond favorably and donate generously, while others will have guidelines on the types of nonprofits and projects they support. The best route to take is to research which companies offer grant programs and regularly donate to nonprofit organizations.

Check out the top companies that donate to nonprofits here!

Wrapping Up & Additional Resources

The journey through a capital campaign is perhaps the most ambitious, rewarding, and transformative endeavor a nonprofit can undertake. It requires meticulous planning, unwavering board commitment, and a willingness to embrace the strategic process.

The ultimate takeaway? Don’t go it alone. Use this guide as your roadmap, commit to thorough preparation, and step confidently into the process. The vision you hold for your organization’s future, that new facility, expanded endowment, or vital program expansion, is within reach.

Now, take this knowledge, choose your path forward, and prepare to make your organization’s boldest dreams a reality.

Interested in learning more with additional fundraising resources and guides? Here’s our recommended further reading:

Prospect Research: A Nonprofit’s Key to Better Fundraising

/in Learning Center, Fundraising Strategy /by Adam WeingerIf your nonprofit is looking for a way to maximize its fundraising efforts, there’s one avenue you might not be paying enough attention to: prospect research.

Regardless of your organization’s size, gathering the right donor data via prospect research can have a huge impact on your nonprofit’s revenue. These funds can help you serve your mission, fund important projects, and work toward your goals.

In this guide, we’ll outline several important pieces of information you’ll need to successfully leverage prospect research, including:

From learning the basics to soliciting your first prospects, a thorough understanding of prospect research can be a game-changer for your organization. Let’s get started!

The Basics of Prospect Research

What Is Prospect Research?

Prospect research is a process performed by a nonprofit’s development team to gather data about donors, volunteers, and other supporters. The process analyzes each individual’s giving capacity, motivations, and affinity for the cause. It helps determine an individual’s ability and desire to support that specific cause, as well as how to appeal to their interests.

Key factors nonprofits look for during prospect research include past giving, wealth markers, business affiliations, and philanthropic tendencies. Nonprofits can also use software or turn to prospect research companies to gather this data.

Wealth Screening vs. Prospect Research

You may have heard the term wealth screening in conjunction with prospect research. While the two terms are often used interchangeably, wealth screening is only one component of prospect research.

Wealth screening analyzes a donor’s financial profile, including real estate and stock holdings, as well as political giving. While it’s an essential part of prospect research, this only indicates an individual’s ability to give.

Prospect research goes a step further and uses both wealth and philanthropic indicators to determine a donor’s willingness and capacity to give. This provides nonprofits with a complete picture of each donor and helps make more informed solicitations. We’ll explore the complete range of data you should collect in the next section.

Who Uses Prospect Research?

A variety of organizations use prospect research to boost revenue and drive more meaningful relationships. These include:

Prospect research can help all of these organizations (plus others!) become more focused in their outreach.

The Value of Thorough Prospect Research

40% of B2B salespeople say prospecting is the most challenging part of the sales process. When it comes to fundraising, nonprofits experience that same exact pain point. Prospect research can be incredibly helpful in sourcing and qualifying leads to avoid wasting time pursuing individuals without the affinity or capacity to give.

Beyond time savings, here are the most important benefits of researching supporters:

Prospect research is essential for nonprofits looking to optimize their fundraising initiatives and build lasting relationships. Make sure you’re working with reliable tools and companies to gather supporter data, and you’ll set your team up for success.

Employment Data: the Most Powerful Piece of Modern Fundraising Intelligence

While real estate and stock holdings have traditionally been the “gold standard” of wealth screening, employment data has emerged as the single most valuable data point in modern fundraising.

Why? Because knowing where a donor works provides a dual layer of financial intelligence that no other data point can offer:

In today’s landscape, employment data is the bridge between individual giving and corporate philanthropy. By prioritizing employment information in your prospect research, you aren’t just assessing a donor’s personal checkbook; you are assessing their ability to direct corporate funds to your mission.

Other Data Points To Gather During Prospect Research

Since prospect research involves collecting both wealth and philanthropic indicators, it’s important to understand the common data points under each umbrella.

1) Philanthropic Indicators

Philanthropic indicators represent an individual’s willingness to give to your organization. These include:

Previous Donations to Your Nonprofit

Past giving is the best indicator of future giving because it means the supporter is interested in your cause and has already contributed. Prospect research helps uncover prior donations so your organization can reach out again.

Donations to Other Organizations

If your donors are philanthropically minded, they probably aren’t only giving to your nonprofit. Let prospect research unveil past giving to organizations with causes similar to yours.

Nonprofit Involvement

Giving isn’t the only indicator of an individual’s philanthropic mindset. With prospect research, you can identify other forms of nonprofit involvement, such as advocacy, volunteerism, and board membership.

Personal Information

Collecting personal data will give you a more holistic understanding of each donor and how to connect with them on a deeper level. Craft more targeted appeals and deliver those appeals successfully by gathering this donor data:

Much of this information can be collected online or through data appending services, helping you identify ideal prospects.

2) Wealth Indicators

Wealth indicators represent an individual’s ability to give to your organization. These include:

Real Estate Ownership

The quality and quantity of real estate someone owns are wealth indicators your fundraising team should pay attention to. Individuals with notable real estate have large giving capacities that you can capitalize on in your nonprofit’s fundraising initiatives.

Business Affiliations

Prospect research can help you detect existing business connections among your donors. This research includes details about a donor’s career, such as salary estimates, which can indicate wealth and ability to give. You may also discover information about a donor’s employer’s corporate giving program, which can provide insights into potential matching gift opportunities.

Stock Ownership/SEC Transactions

Knowing about a contributor’s stock ownership can give you even more insight into their wealth and capacity to donate to your organization.

Political Contributions

Chances are that an individual who has made sizable donations to a political campaign also has the giving capacity to donate major gifts to your nonprofit. By using prospect research to target this group, you can focus on winning over prospects with the potential to make generous contributions.

Primary Uses of Prospect Research

Prospect research can impact several areas of your mission. Let’s explore common ways nonprofits use the data they gather.

Major Giving

Prospect research is the perfect tool for identifying major gift prospects hidden in your existing donor database. It can help you uncover past giving and involvement and track giving patterns that may predict major giving.

For instance, you might have a faithful donor whose contributions have steadily increased over the past five years. With prospect research, you can examine that donor’s history and figure out the best strategy to ask for a major donation.

Capital Campaigns

A capital campaign is a long-term fundraising effort that’s usually tied to a large project, such as the construction of a new building or the development of an endowment.

Capital campaigns typically rely on a set number of major gifts during the “quiet phase” before fundraising is opened to everyone in the “public phase.” Prospect research can help uncover ideal donors for both the quiet and public phases.

Challenge Matches

A challenge match (wherein a major donor pledges a large sum contingent on the nonprofit raising an equal amount from other supporters) creates urgency and excitement. Prospect research can be vital for identifying a lead donor for this strategy by uncovering individuals who not only have high financial capacity but also a leadership profile and deep affinity for the cause.

Identifying these “Challenge Match Leaders” is a powerful way to turn a single major gift into a revenue multiplier for your entire campaign, far exceeding the value of a standard one-time donation.

Annual Giving

Annual giving is what keeps your organization’s wheels turning. Without it, you wouldn’t be able to complete your day-to-day operations.

While your organization likely already asks all supporters to contribute to your annual fund, you can now search for new annual donors via prospect research tools. In addition, you’re more likely to uncover potential supporters by looking into someone’s past giving to organizations that align with your own.

Corporate Giving Opportunities

Prospect research is instrumental in identifying and understanding potential corporate partners whose philanthropic interests align with your nonprofit’s mission. Collecting employer data also helps pinpoint untapped opportunities. Examples include:

Once you identify these opportunities, your nonprofit can reach out to supporters who are eligible to participate in their companies’ corporate giving programs.

Planned Giving

Identify donors who are in a position to make significant long-term commitments, such as bequests, trusts, or annuities.

Researching a donor’s financial background and giving history enables your nonprofit to tailor conversations about legacy opportunities that resonate on a personal level, helping you secure future funding and ensure the donor’s lifelong engagement with your mission.

How Matching Gifts and Prospect Research Work Together

Matching gifts and prospect research are both powerful strategies that, when combined, can significantly enhance your fundraising efforts.

As mentioned, prospect research helps identify donors who are affiliated with companies that offer matching gift programs, potentially doubling their donations without requiring extra effort from the donors themselves. This synergy not only boosts your fundraising capacity but also deepens donor engagement, as donors feel their contributions have a greater impact.

Here are some key ways that matching gifts and prospect research can work together to dramatically increase your fundraising success:

To manage this strategy effectively, consider using specialized tools like Double the Donation Matching. This software simplifies tracking and verifying matching gift eligibility and submissions, ensuring you make the most of every donation opportunity.

How to Research Donors and Other Constituents

Once you’ve decided to perform prospect research, you might be wondering where you should start. Here are the general steps you can take to gather supporter data.

1) Choose your prospect research method.

Your first step is to plan how you’ll approach your research process by asking yourself about your fundraising goals, current strategies, and timeline. Once you understand what you need out of your research, choose one of these methods:

Make sure you know exactly which data you need to collect and how quickly you need to collect it, so you can pick the right method.

2) Form a prospect research team.

If you’ll conduct prospect research in-house, you’ll need to build an effective prospect research team of individuals with complementary skills. The following roles are critical to your team’s success:

Each role focuses on a specific aspect of the prospect research process, contributing to a comprehensive approach. While the structure of your team may vary, this suggested structure supports targeted fundraising efforts and helps build a robust foundation for long-term supporter engagement.

3) Clean up your data.

Before conducting prospect research, clean up your data to ensure the process runs smoothly and yields more accurate results. A few ways to maintain proper data hygiene include:

Your data doesn’t need to be perfect, but cleaning it up as much as possible will optimize your system for prospect research.

4) Check for accuracy.

Once you’ve actually conducted prospect research, verify the accuracy of the data gathered. This step involves cross-referencing information from multiple sources to confirm details such as contact information, philanthropic history, and financial capacity. Some prospect research companies will have an accuracy-check process, such as manually verifying appended emails and phone numbers.

Ensuring data accuracy helps prevent miscommunication and fosters trust by demonstrating diligence and respect for each prospect’s information. It also optimizes the efficiency of subsequent outreach efforts by reducing the time spent on addressing inaccurate or outdated information.

5) Analyze and make a plan for leveraging your new data.

After integrating the new data into your CRM, be sure to sift through the results to identify the most promising prospects by analyzing factors such as giving capacity, alignment with your nonprofit’s mission, and likelihood of giving. Based on this analysis, create a detailed plan for how to best use this data for outreach.

This plan should outline who to approach, the best ways to reach out to them, and the right time to do so. It involves deciding whether to meet someone in person, invite them to a special event, send them a personalized letter, or connect through online platforms based on their preferences and past donations.

During this stage, you’ll want to segment your supporters based on shared characteristics.

These may include:

An effective plan ensures your team knows exactly what steps to take to engage each prospect, turning potential interest into actual support. From here, put your plan into action and start reaching out!

Types of Prospect Research Tools and Software