Boost Corporate Giving Revenue with Our New Volunteering Features!

The Double the Donation team is excited to announce two major…

How to Market Volunteer Grants at Your Cultural Heritage Org

Volunteer grants offer a remarkable opportunity for cultural…

5 Reasons to Attend the Workplace Fundraising + Volunteering Summit

With the recent Giving USA report indicating corporate giving…

https://doublethedonation.com/wp-content/uploads/2025/07/Blog-Feature_-Now-in-Beta_-Payroll-Giving-Module.png

1256

2400

Erin Lavender

https://doublethedonation.com/wp-content/uploads/2025/11/DTD-horizontal-logo-300x63.png

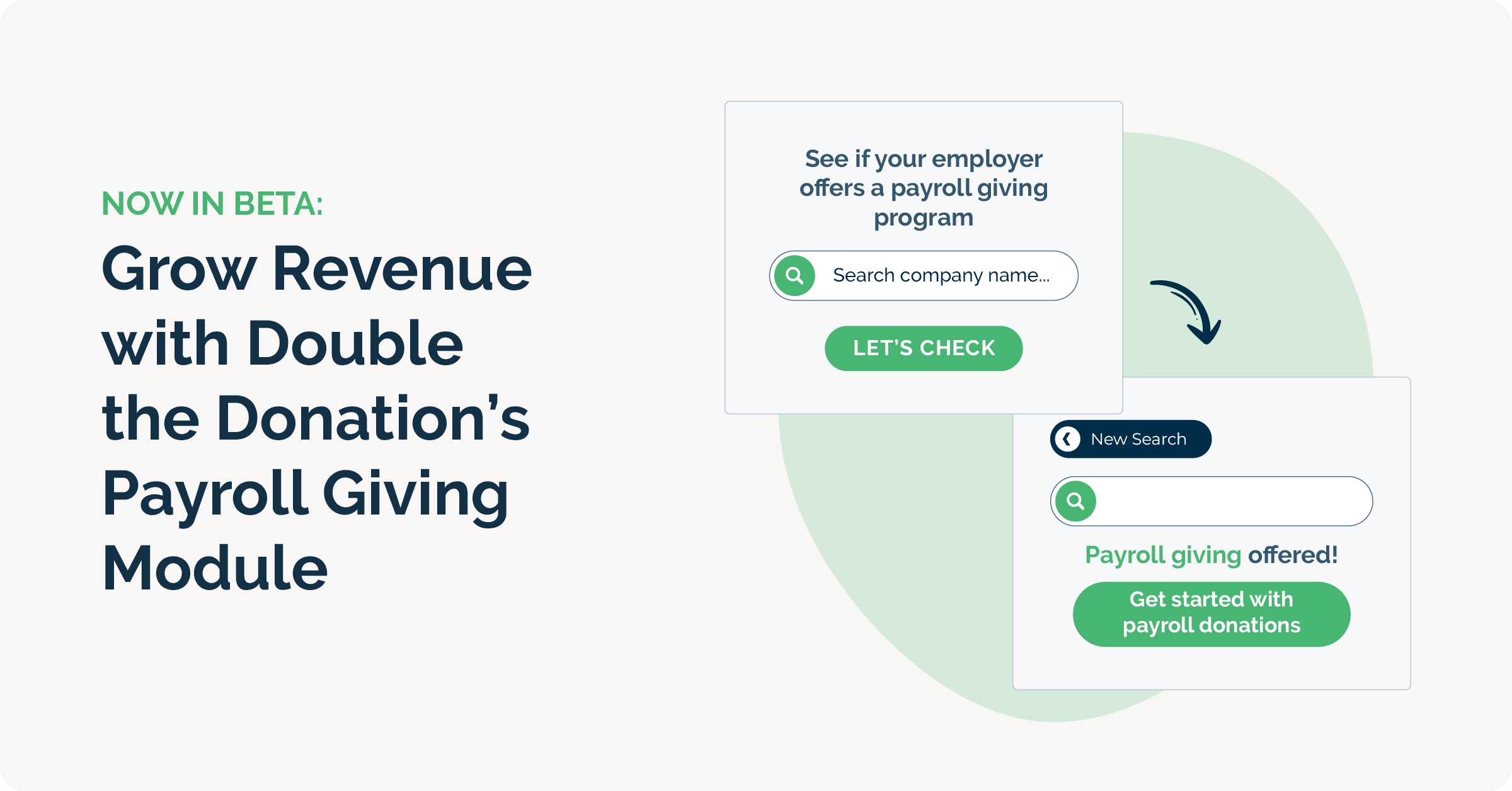

Erin Lavender2025-07-28 12:34:352026-01-07 19:08:01Now in Beta: Grow Revenue with Double the Donation’s Payroll Giving Module

https://doublethedonation.com/wp-content/uploads/2025/07/Blog-Feature_-Now-in-Beta_-Payroll-Giving-Module.png

1256

2400

Erin Lavender

https://doublethedonation.com/wp-content/uploads/2025/11/DTD-horizontal-logo-300x63.png

Erin Lavender2025-07-28 12:34:352026-01-07 19:08:01Now in Beta: Grow Revenue with Double the Donation’s Payroll Giving Module

How Environmental Conservation Groups Can Secure In-Kind Donations

Environmental conservation organizations play a vital role in…

How Animal Shelters Can Secure In-Kind Donations

Animal shelters play a vital role in caring for homeless, abandoned,…

https://doublethedonation.com/wp-content/uploads/2025/07/DTD_Asking-for-Employer-Info-vs.-Using-Appends-What-to-Know_Feature.png

600

1600

Adam Weinger

https://doublethedonation.com/wp-content/uploads/2025/11/DTD-horizontal-logo-300x63.png

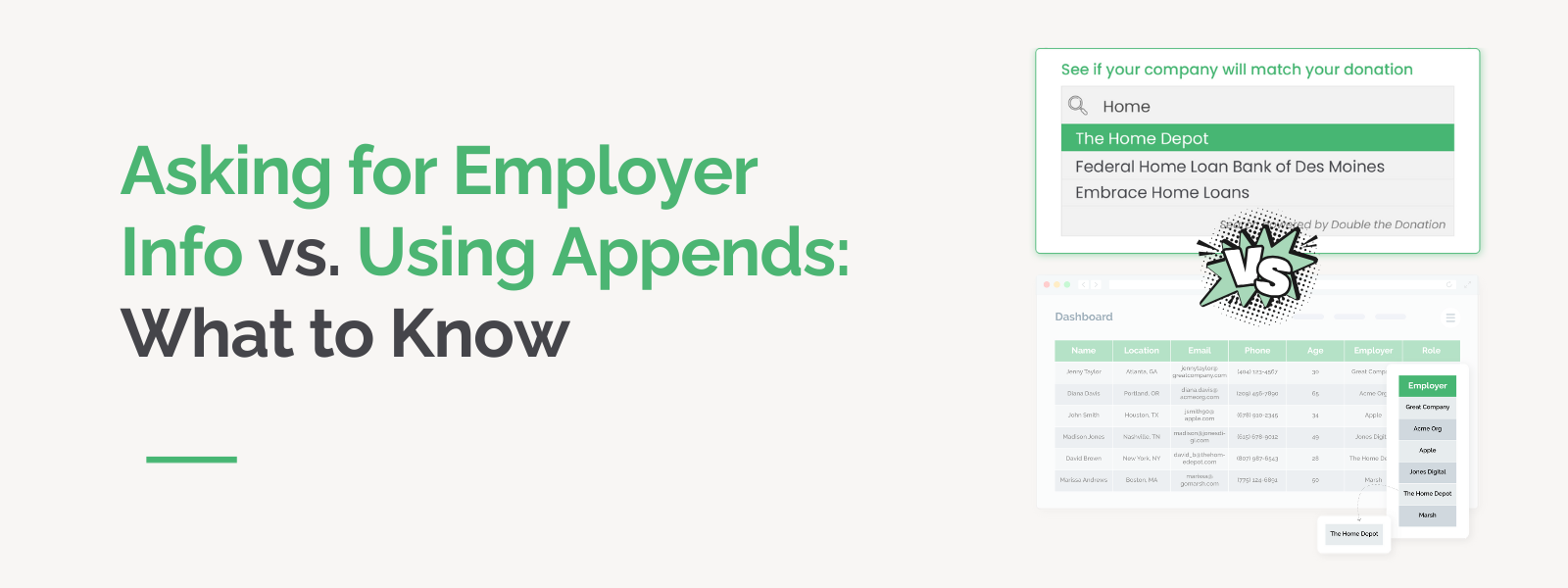

Adam Weinger2025-07-16 19:02:492025-11-21 04:29:31Asking for Employer Info vs. Using Appends: What to Know

https://doublethedonation.com/wp-content/uploads/2025/07/DTD_Asking-for-Employer-Info-vs.-Using-Appends-What-to-Know_Feature.png

600

1600

Adam Weinger

https://doublethedonation.com/wp-content/uploads/2025/11/DTD-horizontal-logo-300x63.png

Adam Weinger2025-07-16 19:02:492025-11-21 04:29:31Asking for Employer Info vs. Using Appends: What to Know

What Your Employer Appends Might Be Missing—and Why it Matters

When it comes to nonprofit fundraising, data is power—especially…

https://doublethedonation.com/wp-content/uploads/2025/06/DTD_Payroll-Giving-Programs-Now-Available_Feature.png

600

1600

Adam Weinger

https://doublethedonation.com/wp-content/uploads/2025/11/DTD-horizontal-logo-300x63.png

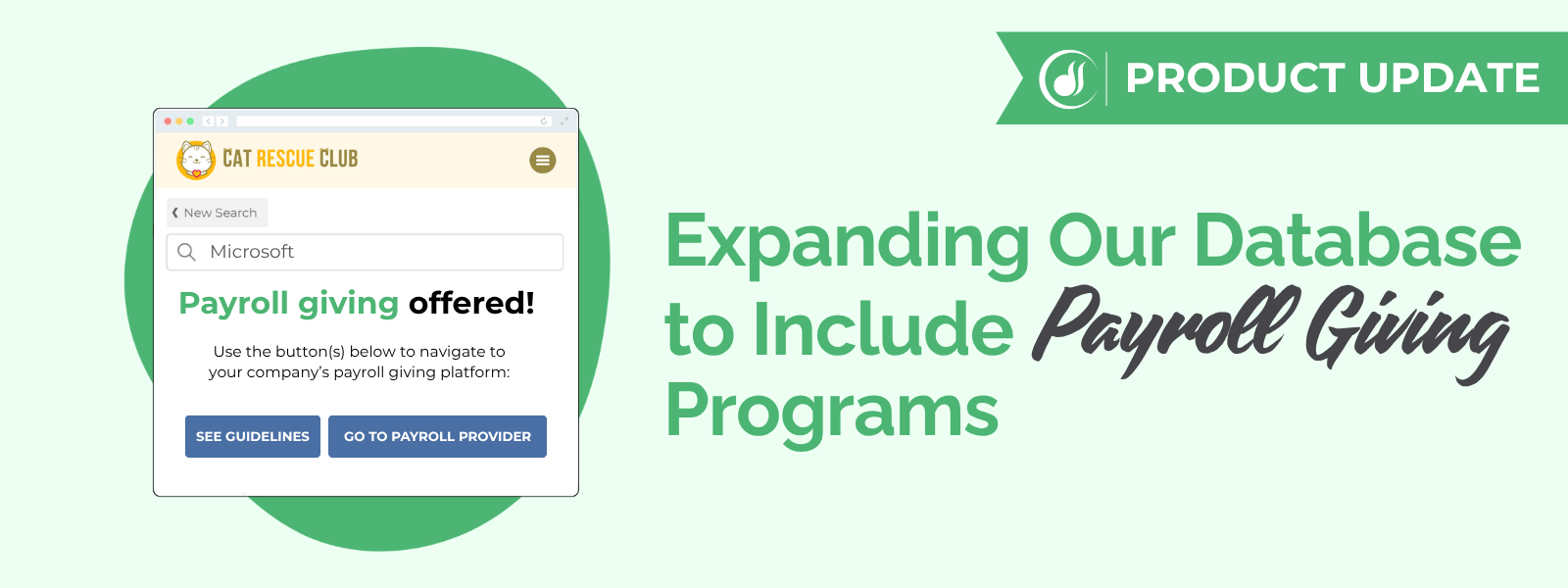

Adam Weinger2025-06-27 14:23:062025-11-21 04:50:46Expanding Our Database to Include Payroll Giving Programs

https://doublethedonation.com/wp-content/uploads/2025/06/DTD_Payroll-Giving-Programs-Now-Available_Feature.png

600

1600

Adam Weinger

https://doublethedonation.com/wp-content/uploads/2025/11/DTD-horizontal-logo-300x63.png

Adam Weinger2025-06-27 14:23:062025-11-21 04:50:46Expanding Our Database to Include Payroll Giving Programs

Avoid These 5 Employer Appending Mistakes Nonprofits Make

When it comes to maximizing donor intelligence, employer appending…