Top Austin Companies that Offer Employee Payroll Giving

Austin, Texas, is not only known for its vibrant music scene…

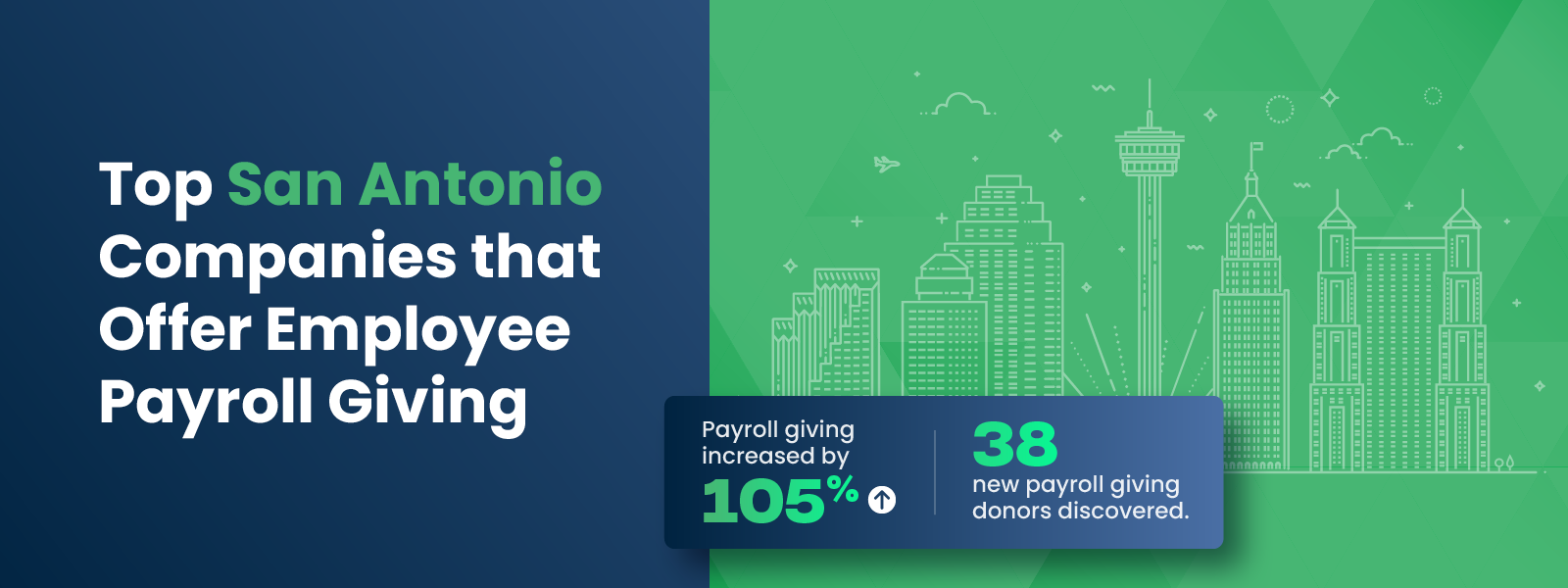

Top San Antonio Companies that Offer Employee Payroll Giving

San Antonio is a vibrant city known for its rich history, cultural…

Top Philadelphia Companies that Offer Employee Payroll Giving

Philadelphia stands as a vibrant city with a rich history and…

Top Phoenix Companies that Offer Employee Payroll Giving

Phoenix, Arizona, stands as a vibrant and growing metropolitan…

Top Houston Companies that Offer Employee Payroll Giving

Houston stands as a vibrant economic powerhouse, home to a diverse…

Top Chicago Companies that Offer Employee Payroll Giving

Chicago stands as a vibrant epicenter of commerce and culture…

Top LA Companies that Offer Employee Payroll Giving

Los Angeles, commonly known as LA, is not only a vibrant cultural…

Top New York Companies that Offer Employee Payroll Giving

New York City stands as a beacon of commerce, culture, and philanthropy,…

Top San Francisco Companies that Offer Employee Payroll Giving

San Francisco stands as a beacon of innovation, culture, and…

Top Charlotte Companies that Offer Employee Payroll Giving

Charlotte, North Carolina, stands as a vibrant and growing metropolitan…