From recurring donors to annual fundraisers to merchandise sales, the more income streams your nonprofit has, the more financially secure your organization will be. The key source of revenue that can bring in reliable funding year after year is grants.

Grant funding amounts and requirements vary wildly as every grantmaking organization has their own unique application process. While there are skills and knowledge, like grant writing, that carry over from application to application, your nonprofit will need to learn the specific requirements of each organization you apply to.

This is where grant research tools come in. Along with helping you find grants, these tools provide insight into the application process, potential funding amounts, and contact information for the grantmaker.

To help your nonprofit build relationships with funders and earn your next grant, we’ll explore our top recommended grant research tools.

Grant Research Tools FAQ

What are grant research tools?

For the most part, grant research tools are searchable databases of available grants. Given that most grant databases have several thousand grants listed at a minimum, these databases have an extensive array of filters for users to narrow their search to grants applicable to their purposes.

Different grant databases often overlap in content. After all, if one grant database provider is aware of a foundation’s new grant opportunities, chances are many other providers are as well. However, one way to sort grant databases by content is to split them into three categories:

- Government grant databases. Many grant databases include both government and foundation grants. However, databases run by government entities usually only have information on government-offered grants.

- Foundation grant databases. Most third-party grant databases focus on grants provided by foundations. Many foundations lack an online presence or may rely entirely on trusted grant databases to promote their grant opportunities. Since these types of foundation grants are much more difficult to find and apply for than government grants, most independent grant databases focus on promoting opportunities from foundations.

- Research grant databases. Academics use specialized grant databases that focus on research grants and fellowships. These databases usually require a fee to access or can be accessed through a university. For the most part, these databases are irrelevant to nonprofits.

Note that specialty grants may not be listed in these databases. For example, the Google Ad Grant is a unique type of grant that rewards recipients with ad credits rather than dollars. For the Google Ad Grant and other highly specialized types of grants, it’s best to explore their websites directly rather than using a database for information.

Why do grant research tools matter?

Nonprofits can search for individual foundations and open grants they are aware of without needing any specific tool. However, grant research databases compile all the information your nonprofit needs to apply for grants in one place, allowing you to:

- Discover grants. Approximately 90% of grantmaking foundations do not have websites, meaning nonprofits need third-party tools to learn they exist in the first place. Grant research tools can help you refine your search and uncover foundations you may not have known about but are a good fit for your nonprofit.

- Evaluate your nonprofit’s fit. There are thousands of foundations across the United States alone, and deciding which grants to apply for is essential for maximizing your potential funding. Use grant research tools to identify which foundations are the most likely to approve your grant application so you can focus your time and resources.

- Get grantmakers’ contact information. Cultivating relationships with grantmakers is a major part of securing grant revenue long-term. Many foundations prefer nonprofits, especially if they do not have a previous relationship with their organization, reach out to introduce themselves before submitting a grant application. Grant research tools can provide you with the email address or phone number of grantmaking organizations’ point of contact so you can connect and formally introduce your nonprofit.

Some grant research tools have even more features that help streamline the grant application process. For instance, some tools are just databases for finding grant information, while others provide grant management tools that allow you to track specific grant deadlines, organize applications, and manage your awards.

What should my nonprofit look for in a grant research tool?

Grant research tools vary in the features they provide, the depth of information for grants in their database, and the costs of accessing their services. Before conducting grant research, consider what types of grants you intend to apply for and what tools you’ll need to complete your applications.

For instance, if you intend to apply for many grants, it may be worthwhile to invest in a paid but comprehensive grant management tool. In contrast, if you just need basic information about a few grants and would like to avoid extra fees, there are free resources your nonprofit can rely on.

With that, let’s explore our top grant research tools and what types of nonprofits can benefit from each option.

What about matching gift grants?

Corporate giving programs like matching gift grants and volunteer grants are additional funding that your nonprofit can earn from corporate sponsors. While these types of contributions could be considered grants, nonprofits don’t use traditional grant research tools to find them. Instead, you need a matching gift database.

Matching gift databases contain information about a wide range of companies’ matching gift grant programs. Your nonprofit can use this tool to look up specific businesses that employ many of your supporters. You can also provide supporters with access to the database via a matching gift search tool you embed in your website. This way, supporters can look up their own eligibility and apply for a matching grant themselves.

1. Candid

Overview

Formerly known as GuideStar, Candid’s Foundation Directory is one of the most comprehensive grant databases available. Candid’s team uses over 35 distinct information sources, including IRS returns, grantmaker websites, annual reports, philanthropic news, and connections with individual grantmakers, to keep their directory up-to-date on the latest grants.

Candid’s Foundation Directory is primarily meant for registered 501(c)(3) organizations and unregistered nonprofits with fiscal sponsors. These groups can use the directory to search for grants based on:

- Subject

- Location

- Grantmaker type

- Type of support

- Trustee names

The Foundation Directory is ultimately a search tool for nonprofits interested in finding grants relevant to their cause. Candid’s data visualization tools also allow nonprofits to view giving trends and assess whether a specific grantmaker is likely to fund their organization.

Costs

Candid has Enterprise, Professional, and Essential plans available. Foundations, academic institutions, and large organizations are encouraged to explore custom-priced Enterprise plans, but other nonprofits can jump right into Candid via the Professional plan ($133.25 per month) or the Essential plan ($37.42 per month).

2. Grants.gov

Overview

Grants.gov is the United States government’s main resource for organizations seeking federal grant funding. Grants.gov is specifically for United States-based organizations, including nonprofits, educational institutions, Native American organizations, city governments, and small businesses. There are even a few grants individuals can apply to.

The main draw to Grants.gov, of course, is the ability to discover government-backed grants. Organizations looking to apply for a government grant should use this database like they would other grant research tools and narrow their search to the most relevant opportunities. Once you discover a grant that fits your organization, you can hit the red “Apply” button in the top right corner of each grant’s information page to begin your application.

Along with the searchable database, Grants.gov also has a wealth of information on grants in general, including basics on grant terminology, eligibility requirements, fraud, and even career development in the grant space.

Costs

Organizations can sign up with Grants.gov for free. However, there are multiple steps to take before completing their registration. Specifically, nonprofits must register their organization at SAM.gov, the United States registry for organizations that do business with the federal government. Registering for SAM.gov is also free.

Signing up with SAM.gov takes an average of 7-10 business days, after which you will receive a Unique Entity Identifier (UEI) that you can use to sign up for Grants.gov. Nonprofits will need to renew their registration with SAM.gov annually.

3. GrantStation

Overview

GrantStation is a grant database that contains grants from the following types of organizations:

- Independent, family, community, and corporate foundations

- Corporations

- Faith-based grantmakers

Additionally, GrantStation includes grants from U.S. federal and state governments as well as Canadian government grants and some international grants. GrantStation encourages users to select their specific country and state and then enter several terms related to their cause to narrow their search results.

GrantStation also offers several resources related to grant writing, such as examples of past winning proposals, a grants calendar, and grant-related webinars. Some of these resources are available for free while others require a membership.

Costs

Organizations signing up for access to GrantStation’s database can choose between a one-year $179 membership or a two-year $249 membership. GrantStation also offers a newsletter with grant resources that nonprofits can subscribe to for free.

4. Instrumentl

Overview

Instrumentl is a grant management and research tool for nonprofit organizations and grant writing consultants. Nonprofits can use Instrumentl to find, track, and apply for grants, while grant writers can use it as a tool for managing the various grants they are writing for clients.

For each grant opportunity listed in Instrumentl, users can click in and see an overview of the specific grant and a detailed breakdown of the grantmaker’s 990 report. While nonprofits can find 990s themselves with enough research, Instrumentl displays the information in a user-friendly format, allowing users to easily discover grantmakers’ total assets, total giving, giving per year, contact information, and which organizations have received previous grants.

Instrumentl also aims to help nonprofits navigate one of the most common hurdles in finding grant opportunities: discovering and making contact with invite-only grantmakers. These grantmakers only allow select organizations to apply for their grants and often lack a web presence, making introducing your nonprofit and building a relationship a challenge.

Instrumentl provides invite-only grant organizations’ contact information, as well as their history of past grant recipients. This allows nonprofits to better assess their networks to determine if they have an in with these exclusive grantmakers and begin building a relationship.

Costs

Instrumentl offers access to its grant management tools and full grant database at three price points depending on your organization’s size and level of need. Nonprofits can also sign up for a 14-day free trial to see if Instrumentl is right for them before subscribing.

5. GrantScape

Overview

Finding and applying for grants are only the first steps to an effective grant management strategy. To avoid penalties and receive future funding, nonprofits also need to maintain grant compliance. For nonprofits looking for assistance managing their grants, GrantScape is a grant database powered by the grant compliance experts at Thompson Grants.

GrantScape provides subscribers with access to its comprehensive database of more than 11,000 grant opportunities from foundations and government agencies. Additionally, subscribers can access GrantScape’s “knowledge center,” which provides online modules dedicated to various aspects of the grant process. With backing from Thompson Grants, these modules discuss complex legal parts of grant management, such as how to handle grant expenditures, monitor federal subawards, and understand audit law and policy.

Plus, to make sure you know how to use the grant database to its maximum potential, GrantScape provides new users with a 30-minute consultation to answer questions and provide tips for effective grant research strategies.

Costs

Users have the option to subscribe just to GrantScape or get a package deal that includes GrantScape database access by signing up with Thompson Grants. Nonprofits interested solely in the GrantScape database can purchase access at a monthly or annual rate. In contrast, those interested in training rather than a database alone can subscribe to Thompson Grants’ webinar training pass to attend grant-related webinars and subscriber events.

6. GrantForward

Overview

Universities and colleges need specialized grant databases focused on academic funding and research opportunities. Higher education institutions can find what they’re looking for with GrantForward.

GrantForward has a database of over 63,000 grants for researchers. To avoid getting overwhelmed, researchers at your institution can also create individual profiles on GrantForward that state their field of study and research interests. Then, GrantForward will recommend funding opportunities that fit their profiles.

To help train everyone at your higher education institution to use the database, GrantForward provides instructional tools that universities can share with researchers as well as resources for how to roll out GrantForward’s grant research tools to your team.

Costs

The price to access GrantForward is determined by institution size. Contact their team to receive a detailed pricing plan.

7. National Endowment for the Humanities

Overview

Government grants can be divided based on the agency or department funding them. One notable organization to discuss is the National Endowment for the Humanities (NEH). NEH is an independent federal government agency and one of the largest funders of humanities programs in the United States.

NEH grants typically are awarded to:

- Museums

- Archives and libraries

- Higher education institutions

- Public television

- Radio stations

- Individual scholars

The available grants also range widely in specificity from a fellowship for social science research in Japan to a grant meant for strengthening universities’ humanities programs. Each grant has a unique application process that can be explored through Grants.gov.

Costs

NEH is essentially an offshoot of Grants.gov and has the same sign-up requirements and no extra costs.

8. Catholic Funding Guide

Overview

Religious-based nonprofits sometimes struggle to find grants they are eligible for. Fortunately, Catholic organizations and grantmakers alike have the Catholic Funding Guide to connect with one another.

Using highly specialized grant databases like the Catholic Funding Guide can help your nonprofit instantly find more grants that are relevant to your cause. Organizations using the Catholic Funding Guide already start off knowing funders are interested in their organization type and can then further refine their search based on interest area, geographic location, funding amount, and more.

Along with helping grantees find funding, the Catholic Funding Guide helps grantmakers find potential grantees. With the Amplify feature, grantees can create posts about their projects. Then, grantmakers can review proposals and reach out to nonprofits about projects they want to fund.

Costs

Interested Catholic organizations can sign up for either the Standard $229 annual or the Professional $299 annual plans.

9. Local Government Resources

Overview

Sometimes one of the best places to look for grant resources is your own backyard. Check your town, city, or county’s website for grant information. The number of resources and available grants will depend on the size and population makeup of your city.

For example, Atlanta, Georgia is such a strong supporter of the arts that art-related grants have an entire website dedicated to them.

On the other hand, Portland, Oregon has a dedicated grant specifically for small organizations, allowing nonprofits of all types that support the community in some way to receive funding. Additionally, Pittsburgh, Pennsylvania has a special grant for emergency funding that only opens up when disasters hit the city.

Research your local government’s grant resources to see if there are opportunities that fit your nonprofit. If your organization is new to applying for grants, these smaller-scale grants are valuable opportunities in and of themselves and also useful stepping stones for earning larger grants. After all, federal grant applications are often long and detailed, so get practice in applying for a local grant to ensure you’re ready when the time comes to level up your grant strategy.

Costs

Just like with Grants.gov, your local government resources are most likely to be free. You may need to create an account or provide proof of your organization’s nonprofit status, but it’s unlikely there will be any fees.

10. Grantmakers.io

Overview

Not every grant database is a business designed for enterprise-size nonprofits. For instance, Grantmakers.io is a free grant database run by a one-man team. The site scans and formats foundations’ publicly available Form 990s. As a result, nonprofits can conveniently search through basic profiles for over 100,000 foundations.

At a glance, each foundation has essential information displayed, including:

- Number of grants offered

- Average grant amount

- Whether the foundation has recently offered grants

- Whether the foundation has paid staff or is operated by volunteers

- The foundation’s website

- Whether the foundation potentially accepts unsolicited grant applications

- Total assets

In addition to foundations, users can also explore grant recipients. Seeing what organizations foundations are giving to and in what quantities can help set your nonprofit’s expectations when seeking grant funding. After all, if a foundation gives to many nonprofits similar to yours, then your grant proposal is more likely to align with their mission.

Costs

Grantmakers.io promises to be, in the website’s creator’s own words, “Free as in freedom and free as in food.” If you would like to, you can even donate to Grantmakers.io to help keep the content free and support the site.

More Grant Research Tools

Grant research tools are essential for helping your nonprofit find the funding opportunities you need to power your mission. Use grant databases that fit your budget and contain information on the types of grant funding relevant to your nonprofit.

However, keep in mind that there’s more to grants than just receiving funding through foundations and government programs. To discover other types of grants your nonprofit can tap into now, explore these resources:

The Comprehensive Guide to Nonprofit Board Self-Assessments

/in About Double the Donation /by Adam WeingerBoard members play an important role in nonprofits. They have many responsibilities, ranging from governing their organizations to establishing new revenue streams to engaging the community.

Like any other governing body, it’s important for your board to occasionally take the time to reflect on its actions, assessing where individual board members and the board as a whole can improve. That’s where self-assessment comes in.

This guide will go over everything you need to know about nonprofit board self-assessment, covering the following topics:

Even the best nonprofits need check-ups to ensure that they can continue to thrive. Nonprofit board self-assessment allows you to implement practices and strategies for a healthy and engaged board, creating a more efficient and effective team dedicated to your organization’s success. So let’s jump in with the first topic: What is a nonprofit board self-assessment?

What is a nonprofit board self-assessment?

Nonprofit board self-assessments are fairly self-explanatory: You ask each board member to reflect on their tenure as a board member. During the assessment, they may consider if they’re following your nonprofit’s bylaws, meeting expectations as an individual and as a group, and making progress toward goals. Plus, they’ll have the opportunity to give feedback on the board’s health and practices.

Formal nonprofit board self-assessments usually take place annually or every few years. However, you can conduct self-assessments more frequently and informally to ease the pressure on board members. For example, you might ask your board to give quick feedback on what’s working and what could be improved in their processes at the end of each board meeting.

Why perform a nonprofit board self-assessment?

With 56% of nonprofits struggling with board governance, you must implement systems to check in on your board’s health. Self-assessments are a great way to do so—ultimately, they allow board members to improve as individuals and as a team.

By conducting a nonprofit board self-assessment, you can:

The self-assessment isn’t only about how the board members are serving your nonprofit. It’s also about how enjoyable their experience is. Through your assessment, verify that board members feel included, valued, and engaged with their work. Board members who are happy with their experience and responsibilities will be more likely to work harder to support your nonprofit through fundraising, advocacy, or other activities.

How to Conduct a Successful Nonprofit Board Self-Assessment

Now that you know what a nonprofit board self-assessment is and why you should conduct one, let’s go over the steps to a successful self-assessment.

1. Decide who will conduct the self-assessment.

Although board members will complete the assessments, you’ll need to designate an individual to proctor or facilitate the assessments. This individual could be your nonprofit’s:

This individual will organize the assessment. After it is complete, they’ll moderate a board meeting where board members will discuss the results of the assessment. The proctor may not have access to the responses, but they’ll encourage board members to speak their minds and facilitate their growth during the conversation.

2. Prepare self-assessment questions.

No one knows the work of your board members better than themselves, so have them come up with their self-assessment questions. They’ll need to determine what topics they need to assess, including their current work and the potential challenges in the coming years.

A good place to start is the general areas of board operations. These include:

Additionally, include questions about the experience of serving on the board. You may have questions about how their experience has been so far, what they would change, and if there are any responsibilities or tasks they’d like to take on.

If you need more guidance on where to start, there are plenty of board self-assessment questionnaire templates that you can find. For example, BoardSource offers a free example of a self-assessment that you can reference.

3. Decide on self-assessment tools to use.

Having board members fill out and complete self-assessments with pen and paper is a great starting point, especially if your board meets in person. However, if your board meets virtually or if you’re looking for a more elegant solution that makes evaluating the assessments easier, you might look into self-assessment tools.

Common tools you might consider include:

Don’t rush into purchasing technology. First, ensure the tool addresses an obstacle or a need for your nonprofit’s self-assessments. Then, carefully research the available tools and determine which one best fits your needs before making your decision.

4. Schedule the self-assessments.

After you’ve done all the preparation to ensure a smooth process, it’s time to schedule and complete the board self-assessments. Ideally, you’ll set time aside during your next meeting to avoid requiring more time from your busy board members. Depending on the length and depth of your assessment questionnaire, board members may need the entire meeting duration to complete their assessments.

If you’re not able to dedicate board meeting time to your self-assessment, then you’ll need to ask members to complete it on their own time. If this is the route you take, be sure to give board members ample time and set a reasonable deadline. For example, if you want the assessment to be done by the end of March, send out all the relevant materials and information by the end of February.

5. Review the assessments and share the results.

After the self-assessments are complete, it’s time to review the assessments and share the results. Here are a few ways you can conduct this process:

Keep in mind that since these are nonprofit board self-assessments, there’s some expectation of confidentiality. Regardless of which option you choose, uphold that principle. For example, if the facilitator of the assessment reviews each response, they should not mention what a specific board member wrote down. Instead, when discussing an insight with the board, they should simply say that one or more board members provided the response.

Best Practices for Nonprofit Board Evaluations

Now that you know how to conduct your board’s self-assessment, let’s go over the best practices to ensure that your nonprofit board remains engaged and dedicated to your organization’s success.

Conduct assessments regularly.

Regular nonprofit board self-assessments allow you to stay updated on the state of your board, including their engagement levels and satisfaction with their roles. Depending on your board terms, you can conduct assessments:

With regular check-ins, you’ll stay abreast of any important improvements to make, whether they’re for your nonprofit’s general governance or the satisfaction of an individual member. For example, if your board treasurer has been struggling to balance their nonprofit duties with their other responsibilities, you’ll be able to identify that early and help them either move into a less involved role or brainstorm another solution.

Assess individuals and the board as a whole.

Since self-assessments are individual by nature, it’s easy for facilitators and nonprofit boards to get bogged down about individual responses and overlook examining the board as a whole. However, you must not miss the forest for the trees. It’s as important to evaluate your nonprofit board’s general competency as well as the competency of individual board members.

For example, let’s say that after examining the results of your last nonprofit board self-assessment, the assessment facilitator determines that a few board members have a poor understanding of their responsibilities. This may indicate that these board members got confused along the way and may simply need a refresher on what board governance entails.

However, the facilitator may ask, “Why have none of these board members sought help from other members? Why have none of the other members addressed these misunderstandings?” Depending on the answer to these questions, perhaps you only need to realign the initial group of board members with your nonprofit’s expectations. Or perhaps you need to put in place better strategies for creating a more welcoming, inclusive, and helpful board to encourage greater collaboration between members.

Discuss the past and the future.

Maya Angelou once said, “I have great respect for the past. If you don’t know where you’ve come from, you don’t know where you’re going.” The same principle applies to your nonprofit—without reflecting on the past, you won’t know how to improve and grow in the future.

Your self-assessment should contain questions about your nonprofit’s past and future. You might include the following:

With questions such as these, you directly encourage board members to reflect on the past and apply those principles to your nonprofit’s future. This allows you to improve your nonprofit’s operations for the future, ensuring that you create the positive impact on your beneficiaries that you desire.

Improving Board Member Engagement with Corporate Philanthropy

A common struggle for nonprofit board members is being involved in fundraising—beyond making donations themselves, board members may lack initiative when it comes to helping increase funding for their nonprofit.

That’s where corporate philanthropy comes in, specifically matching gifts. If you’re unable to engage board members with fundraising, you can at least maximize the donations they make to your organization.

This is how matching gifts with board members works:

As companies usually match donations at a 1:1 ratio, this allows you to essentially double the donation you receive from your board member. And some organizations are particularly generous to nonprofit board members.

Plus, once you educate board members about this unique corporate giving initiative, they may be happy to spread the word about it on your behalf. With over $4 billion in matching gifts going unclaimed every year, the extra awareness could be invaluable for increasing revenue for your organization.

Additional Resources

All governing bodies, regardless of whether they belong to for-profit or nonprofit organizations, require strategies for accountability, improvement, and growth. Nonprofit board self-assessments are one such strategy. With thorough research and preparation, you’ll be able to facilitate assessments and discussions afterward that move your board and nonprofit as a whole forward.

If you’re looking for more information about nonprofit boards and fundraising, check out these resources:

Double the Donation Updates Salesforce Integration to Continue Serving Nonprofits

/in About Double the Donation /by Adam WeingerDouble the Donation remains committed to helping nonprofits reach their matching gift and fundraising goals. For years, our Salesforce integration has made it simple for fundraisers to identify and pursue matching gift opportunities. In an effort to provide the best client experience possible, we have updated our integration to make it even easier for organizations to set-up the integration alongside Salesforce’s new Nonprofit Cloud and its fundraising data model.

With this update, the field mapping and set-up process is simple and straightforward for nonprofits using that next generation Nonprofit Cloud. This update improves the ease with which nonprofits can use the combined power of these solutions to grow their fundraising through matching gifts.

360MatchPro continues to be compatible and easily accessible for organizations using the Salesforce Nonprofit Success Pack or their own custom data schema. That means that no matter how an organization’s data is modeled within the Salesforce platform, 360MatchPro can be quickly integrated with that instance. Designed with fundraisers in mind, this integration helps organizations better leverage matching gifts as a funding tool.

Activate in Seconds and Start Raising More from Matching Gifts!

For organizations using Salesforce’s Nonprofit Cloud fundraising data model, integrating with 360MatchPro is easy. Once you have connected your Salesforce platform and 360MatchPro instance following our integration guide, navigate to the section where you can apply default configurations. Select the box that says “Salesforce Nonprofit Cloud.”

Your integration is complete! Now, 360MatchPro can pull in donation data from your Salesforce platform, enabling you to identify match-eligible donors and automate engaging matching gift outreach.

Since the integration is also entirely customizable, all organizations can connect their accounts so that donation records flow from Salesforce to 360MatchPro. 360MatchPro is fully compatible with the Nonprofit Cloud fundraising data model, the Nonprofit Success Pack household data model, and other custom data schemas that organizations may have in place. Customize the integration to work for your organization and your unique data needs.

Pursuing Accountability: CSR Reporting Strategies & Examples

/in About Double the Donation /by Adam WeingerCSR reporting is an increasingly popular way for businesses to display their sustainability performance and build credibility. A compelling CSR report can strengthen corporate relationships between employees, stakeholders, and consumers. In this guide, we’ll explore the ins and outs of CSR reporting by covering the following topics:

Keep in mind there is no “perfect” CSR report to rely on. Instead, your CSR report should encapsulate your company’s values and show tangible evidence of its commitment to responsibly steward its resources and influence.

What is Corporate Social Responsibility (CSR)?

Corporate social responsibility also known as CSR or corporate citizenship describes a company’s efforts to improve society in some way.

These efforts fall into several categories such as volunteering, donating cash or in-kind goods or services, or changing operational systems to benefit environmental or social justice-related causes. Although it is not a mandated practice in the U.S., CSR positively impacts companies, employees, and society as a whole and can function as a meaningful differentiator for companies that participate.

What is CSR Reporting?

A CSR report, also known as an extra-financial report or an ESG (environmental social governance) report, is a document published by a company (usually annually) to provide evidence of its CSR efforts and results.

Although there is not a common set of reporting standards in the U.S., typically a CSR report captures at least one of the four categories: environmental, ethical, philanthropic, or economic impact.

Is CSR Reporting Mandatory?

Sustainability reporting falls under ESG reporting which stands for environmental, social, and governance reporting which acts as a quantifiable measurement of a company’s social impact outcome.

Currently, U.S.-based companies are not legally required to provide an ESG report. However, all companies are encouraged to produce ESG reports to provide company insights that pave the way for a more sustainable future.

The United States Security and Exchange Commission (SEC) only requires companies to report on information that may be material to investors, including ESG-related risks. This policy could change soon as the SEC proposed in May 2022 certain “amendments to rules and reporting forms to promote consistent, comparable, and reliable information for investors concerning funds’ and advisers’ incorporation of environmental, social, and governance (ESG) factors.”

That said, delivering a CSR report should be about more than just maintaining potential legal compliance. Instead, it’s about demonstrating your commitment to making the world a better place through responsible stewardship of resources.

Why is CSR Reporting Important?

Aside from the positive societal and environmental impact it accounts for, CSR reporting is important because it communicates and provides evidence for your company’s values. To break it down further, comprehensive CSR reporting accomplishes the following objectives:

For all these reasons, CSR reporting should be a staple at every socially responsible organization as doing so will ensure a company’s internal aims align with its actions. And, if the United States decides to follow the European Union’s lead and enforce distinct reporting standards, companies well-versed in CSR reporting will already have a leg up.

Who Reads CSR Reports?

When writing any report, knowing your audience and why they’d be interested in reading it is helpful. In the case of a CSR report, the document will target both internal and external parties. Let’s take a look at each below.

Investors

Investors are interested in CSR reports because they want to assess your company’s long-term sustainability and ethical practices. Specifically, they evaluate ESG risks and the strategies your company has in place to mitigate them.

Investors are also concerned with your company’s financial performance, so a data-backed CSR report that details associated cost savings and market share increase can be a valuable asset for attracting this group.

Customers

Customers read CSR reports to make informed purchasing decisions that align with their values. For example, 50% of survey respondents even reported conducting online research to see how a business reacts to social issues before making a buying decision.

Remember a customer’s perspective when finalizing your report. For example, a local company may opt to highlight its local community involvement through programs or partnerships. This also translates to choosing engaging imagery and using customer-friendly language.

Current and potential employees

Employees read CSR reports to better understand their employer’s values, ethics, and contributions to society to see if their values align. More recently, employees have noted that CSR is a paramount decision-making factor for new employees as 93% believe companies must lead with purpose.

Therefore, your CSR report can also act as a retention and recruitment tool by plan by highlighting your company’s sustainability and social good plans and accomplishments

What Should a CSR Report Include?

Because CSR reports can vary in length, subject matter, and style, it can be difficult to know where to start. To help you out, we’ve provided CSR reporting do’s and don’ts for you to compare below:

CSR Reporting Do’s

CSR Reporting Don’ts

Strategies to Strengthen Your CSR Reporting

Now that you know the basics of CSR reporting, you might be wondering, How can I take my report to the next level? To start, you’ll want to review your current CSR programs and data collection methods. Other strategies that can take your CSR strategy above and beyond are listed below:

Invest in CSR software

Comprehensive CSR reporting requires that your company keep track of several programs at once spanning from environmental causes to social and economic initiatives. With a CSR platform, your team can manage these historic and incoming data points with ease.

These software solutions make it simple to ingrain your social, environmental, and philanthropic values into your day-to-day operations. This way, you can prioritize your societal impact without sacrificing focus on your company’s growth and long-term success. Aside from streamlining your workflow, CSR platforms can help you reap several benefits, including:

When shopping for the right CSR software, look for a platform that compliments your existing technology. For example, CSR software with an auto-submission integration can skyrocket your employee matching gift participation by making it easier than ever to submit a matching gift request.

This way, when an employee donates to a nonprofit, they only need to submit their corporate email address, and the software automates the rest of the request submission process.

Check out this brief video to understand how the auto-submission feature fits into your CSR strategy:

As seen in the video, CSR software integration can significantly help boost employee participation and elevate your matching gift programs.

Contextualize your data

Your data and performance indicators must be contextualized to be useful for the reader. This means you’ll need to explain the importance of each of your initiatives and provide an honest picture of your progress. Here are a few strategies you can use to offer a complete summary:

By adding these strategies to your CSR report, you’ll provide additional clarity to your readers and effectively communicate your sustainability journey. This way, you’ll foster trust and confidence by exploring the full picture of your company’s challenges and successes.

CSR Report Examples to Emulate

Sometimes it’s helpful to have a few examples to refer to when drafting your CSR report. To help guide your research I’ve handpicked three companies with stellar CSR reports and listed what makes each report worth emulating below:

Meta 2023: Forward-Thinking Strategy

The Social Metaverse Company, or Meta, “builds technologies that help people connect, find communities, and grow businesses.” They specialize in creating immersive technologies that facilitate new social experiences.

Meta’s 2023 CSR report’s forward-thinking strategy makes it worth considering. The company’s concrete and transparent approach to net zero emissions gives the reader a better understanding of its strategy. Take a look at its carbon emissions breakdown below:

This graph shows Meta’s 2022 carbon footprint and the description of how it has achieved net zero emissions in its global operations.

Additionally, the report goes on to say that reaching net zero emissions is not enough and lays out a plan to decarbonize it’s footprint beyond its offices and data centers. Specifically, to align with the Paris Agreement, Meta has set a goal to reach net zero emissions across its value chain in 2030.

This forward-thinking approach uses historical data to set both achievable and measurable goals as Meta sets out to design with less, incorporate sustainable supply chain principles, and embrace low-carbon technology.

Campbell Soup: Consistent Branding

The Campell Soup company is committed to “bringing people together through food they love.” The company’s soups, simple meals, snacks, and beverages are in alignment with its health and well-being goals.

Campell Soup’s homestyle messaging rings through in its 2022 CSR report. The report’s clear branding and engaging visuals remind readers of the company’s purpose. Additionally, the programs Campell Soup supports such as its school nutrition partnerships align with its values:

By providing nutrition education in a variety of school settings to support awareness of and pique interest in nutritious food choices, Campbell Soup affirms its dedication to improving food access and education.

This is just one example of a CSR program that is aligned with Campbell’s Soups values. For more details, check out the full report below.

Intel: Effective Collaboration

Intel specializes in providing technology that seeks to improve the life of every person. The company has driven business and society forward with innovation, expertise, and forward-thinking products.

A main thread of the company’s beliefs is interconnectivity which is alive and well within Intel’s CSR report. Multiple letters from company leadership including the CEO and CPO clearly outline the report’s goals.

Additionally, Intel’s emphasis on employee engagement and stakeholder transparency sets it apart. According to the Executive Vice President “Maintaining a strong culture and positive employee relations is paramount as we grow and transform Intel”.

And, Intel’s integrated investor outreach program speaks to its commitment to corporate accountability. By getting the perspective of multiple stakeholders, Intel’s CSR report is an example of effective collaboration. View the report below for more details.

CSR Reporting: Conclusion + Additional Resources

CSR reports are necessary tools to communicate your company’s sustainability and environmental goals. When drafting your report be sure to include accurate and complete data that builds credibility. Consider researching the reports of companies within your sector to get a better understanding of how to structure your report.

We hope you enjoyed this guide to CSR reporting. Check out these resources to continue learning:

Companies in Richmond, Virginia with Matching Gift Programs

/in Learning Center, Lists and Rankings /by Adam WeingerWe at Double the Donation partner with nonprofits to increase the matching gifts they receive from donors.

An integral step in increasing matching gifts is awareness of local companies that offer these programs. We’ve compiled a short list of companies in Richmond, Virginia, to help nonprofits in the area.

Richmond Matching Gift Corporations

The capital of Virginia has been named the 3rd best city for business in the US. The city is home to six Fortune 500 companies, which means there is plenty of matching gift money for local nonprofits.

Here’s a list of companies in Richmond, VA that currently offer employee matching gift programs. Some also offer employee volunteer grants. Use this list to inform your donors on how they can double their donations to your organization and turn their volunteering hours into a corporate grant.

Altria

The company primarily focuses its charitable giving in five key areas:

Altria has a matching gift program in place where the company matches employee donations made between $25 and $30,000 to most nonprofit organizations. It also offers a volunteer grant program, providing a $500 grant to any organization with which an employee volunteers a minimum of 25 hours.

Read more about the Altria matching gift program.

CarMax

CarMax is also a local company. Full-time, part-time, and retired employees are all eligible to take part in the matching gift program. CarMax will double donations between $25 and $10,000.

Read more about the CarMax matching gift program.

Genworth

Genworth Financial will match up to $10,000 per employee each year. The company also has a volunteer grants program.

Read more about Genworth’s matching gifts.

Double Donations With Canadian Companies That Match Gifts

/in Company Spotlights, About Double the Donation, Matching Gift Companies, Learning Center, Volunteer Grant Companies, Lists and Rankings /by Adam WeingerMatching gifts play a large role in many nonprofits’ fundraising strategies. These opportunities aren’t just limited to the United States, either. Organizations in Canada—and worldwide—can benefit from corporate philanthropy, too. Specifically, Canadian companies that match gifts supply a powerful opportunity for Canadian charities to maximize funds and engagement alike.

In this guide, we’ve selected a few standout programs that your team should be aware of. Plus, we’ll share expert-proven tips and tricks for making the most of the initiatives. This includes:

To learn more about Canadian companies that match gifts and matching gift databases that cover the Canadian matching gift market, read on!

But before we jump in, let’s cover the basics of matching gifts.

The Basics of Matching Gifts Across Any Market

What are matching gifts?

Matching gifts are a unique and widespread form of corporate philanthropy in which companies match donations their employees make to eligible nonprofits. Matching donations are typically made at a 1:1 ratio, but some companies match at a higher rate, such as 2:1, 3:1, or even 4:1.

This type of giving is particularly valuable because it essentially supplies free money for your nonprofit. However, they’re often overlooked by donors due to a lack of program awareness and by nonprofits lacking the necessary staff, resources, or time to pursue the opportunity.

Who qualifies for matching gifts?

Companies that match gifts typically implement a program policy with specific eligibility guidelines. In order for a donor to qualify, their donation and the organization to which they gave must adhere to the pre-determined criteria.

While the criteria will vary from one company to the next, one overarching stipulation is that receiving organizations are generally required to be registered charities in the region in which they operate. In Canada, that means a nonprofit registered under the nation’s Income Tax Act by the Charities Directorate of the Canada Revenue Agency.

Meanwhile, American nonprofits should be registered with the Internal Revenue Service and have received 501(c)(3) status.

Top Canadian Matching Gift Companies

With the 9th largest economy in the world, Canada headquarters many well-known companies with generous employee giving benefits. In fact, Canadian corporations have a long history of philanthropy—which is great news for the nonprofits that call Canada home.

Take a look at the following Canadian companies that match gifts, and find out if your donors work for the generous employers below:

1. BCE Inc.

BCE Inc., formerly known as Bell Canada Enterprises, offers a focused matching gift program benefitting a few specific organizations as well as colleges and universities within the country. The company also offers individual and team volunteer grants, where employees or retirees donate their time throughout the year to earn substantial grants for their favorite nonprofits.

Specifically, employees who volunteer at least 50 hours in a year can acquire a grant amount of $500. Meanwhile, teams are required to volunteer a combined 500 hours within a year-long period to qualify for a $2,500 grant!

Learn more about this Canadian company’s matching gift program here.

2. Gildan Activewear

Headquartered in Montreal, Gildan Activewear matches nonprofit donations from both full- and part-time employees. The matching gift program is open to organizations in Canada, the United States, and Honduras.

In addition to matching donations, the Canada-based company also supplies volunteer grants and multiplies select fundraising collections by employees, too!

Learn more about this Canadian company’s matching gift program here.

3. Green Shield Canada

Green Shield Canada matches gifts of up to $1,000 per full-time employee on an annual basis. The company’s matching gift program is inclusive of most schools and nonprofit organizations, including a variety of institutions ranging from K-12 schools to arts and cultural organizations.

Learn more about this Canadian company’s matching gift program here.

4. Royal Bank of Canada

The Royal Bank of Canada, also known as RBC, matches employee donations to nonprofit causes, and is inclusive of gifts made between $100 and $5,000 per year. A key perk of RBC’s matching gift program is that part-time employees and retirees alike are encouraged to participate with the standard 1:1 ratio.

Like many of these other organizations, RBC also offers dollars for doers grants for active volunteers! After volunteering for a minimum of 40 volunteer hours, the company will provide up to a $500 grant.

Learn more about this Canadian company’s matching gift program here.

5. TC Energy

TC Energy offers two main types of employee giving programs. The first is its standard matching gift program, where the company will match up to $1,000 annually to most nonprofits. The program is open to all employees and retirees.

The second program is TC Energy’s Dollars for Doers program. Through this initiative, the company matches its employees’ volunteer hours with monetary grants. It’s easy for employees to get involved in the program, too, as there is only a one-hour minimum for volunteer hours in a calendar year!

Learn more about this Canadian company’s matching gift program here.

6. AstraZeneca Canada

AstraZeneca is an international Anglo-Swedish pharmaceutical company with a large corporate presence in Canada. The company, which participates generously in corporate philanthropy, also offers different employee giving programs across various markets.

In Canada, active AstraZeneca employees are encouraged to donate between $50 and $500 to the CRA-registered charity of their choice. After doing so, the company matches the gift to stretch its impact even further for the nonprofit cause!

AstraZeneca Canada offers multiple volunteer grant programs, too. Canadian employees or retirees who volunteer 40 hours with an organization can request a corresponding grant of $500. At the same time, the company provides $250 grants to organizations where employees serve as board members or coaches.

Learn more about this Canadian company’s matching gift program here.

7. Enbridge Inc.

Enbridge Inc., a Canadian multinational pipeline and energy company, is renowned for its robust and multi-faceted CSR initiatives. This includes a generous matching gift program and a volunteer grant program designed to empower its employees to make a difference in the communities they serve.

These programs and more not only foster a culture of philanthropy within the company but also strengthen Enbridge’s commitment to social impact across Canada and beyond.

Learn more about this Canadian company’s matching gift program here.

8. Suncor Energy Inc.

Suncor Energy is dedicated to making meaningful contributions to society through its corporate philanthropy efforts. Through a targeted and impactful matching gift program, the company encourages its employees to give generously by matching their donations to eligible charitable causes and higher education institutions.

Learn more about this Canadian company’s matching gift program here.

9. Sun Life Financial Inc.

Sun Life Financial is committed to giving back through a generous matching gift initiative, in which it empowers its employees to demonstrate their own philanthropy as well. When eligible full-time employees support nonprofit organizations of their choice, the company doubles their giving to produce an even greater impact.

One of the best things about this specific program? With no minimum donation amount required, employees can get involved with matching gifts to their favorite organizations with ease.

Learn more about this Canadian company’s matching gift program here.

10. Canadian Pacific Railway

Canadian Pacific Railway (or CP) is deeply committed to corporate citizenship and community engagement, as evidenced by its matching gift program. Through the program, the company encourages its employees to support charitable organizations by matching their donations at a rate of 50 cents to every dollar.

By fostering a culture of philanthropy and supporting causes that matter to its employees, the Canadian Pacific Railway demonstrates its ongoing commitment to social responsibility.

Learn more about this Canadian company’s matching gift program here.

11. Cenovus Energy

Cenovus Energy, a Calgary, Alberta-based oil and natural gas company, aims to enact positive change in the communities in which it operates through its generous corporate philanthropy initiatives. Currently, these include a comprehensive matching gift program that empowers individual employees to request up to $25,000 per year for their favorite causes.

Learn more about this Canadian company’s matching gift program here.

12. Scotia Bank Canada

Scotiabank Canada offers a robust matching gift program, through which the company empowers its employees to support charitable organizations by matching their donations. With no minimum donation amount required and a lofty maximum threshold, individual team members have the chance to make an even greater difference for the nonprofit missions they care about.

Learn more about this Canadian company’s matching gift program here.

13. Magna International

Magna International offers a unique matching gift program through which groups of employees are encouraged to support nonprofit organizations in their communities. Specifically, teams of 10 or more employees should contribute a collective minimum donation of $500. Then, the company contributes its match up to $2,500!

By encouraging team-focused employee engagement in philanthropy and supporting causes aligned with its values, Magna builds its workplace culture and gives back at the same time.

Learn more about this Canadian company’s matching gift program here.

14. Brookfield Properties

Brookfield Properties is a multinational corporation with a substantial Canadian employee base. Through its generous matching gift program, Brookfield Properties encourages its employees to donate time and funds to eligible nonprofit causes by supplying matching funds to the organizations they support.

Currently, full-time Canadian and U.S.-based employees (excluding the Chicago office) with a one-year minimum service are invited to take part in the program.

Learn more about this Canadian company’s matching gift program here.

15. Nutrien

Canadian fertilizer company Nutrien is dedicated to making a positive impact in communities through its comprehensive matching gift program and more. Through the match program, Nutrien empowers its employees to support charitable organizations with matching gifts worth up to $1.50 for every $1 initially donated.

Learn more about this Canadian company’s matching gift program here.

Identifying Other Canadian Companies That Match Gifts

We covered fifteen standout Canadian matching gift companies above. But there are a ton of additional programs available from companies everywhere. In fact, there are so many companies that match gifts—based in Canada and otherwise—that it’s nearly impossible to keep track of each program’s guidelines on your own.

And that’s where a database solution comes in handy! With a matching gift database like Double the Donation, donors are automatically supplied with direct links to their companies’ match request portals along with program guidelines (minimums and maximums, eligible nonprofits and employees, match ratios, submission deadlines, etc.).

Alternatively, if a donor works for an unknown company (or your organization lacks a database tool), your team can encourage the individual to reach out to their HR department to learn more about any available giving programs.

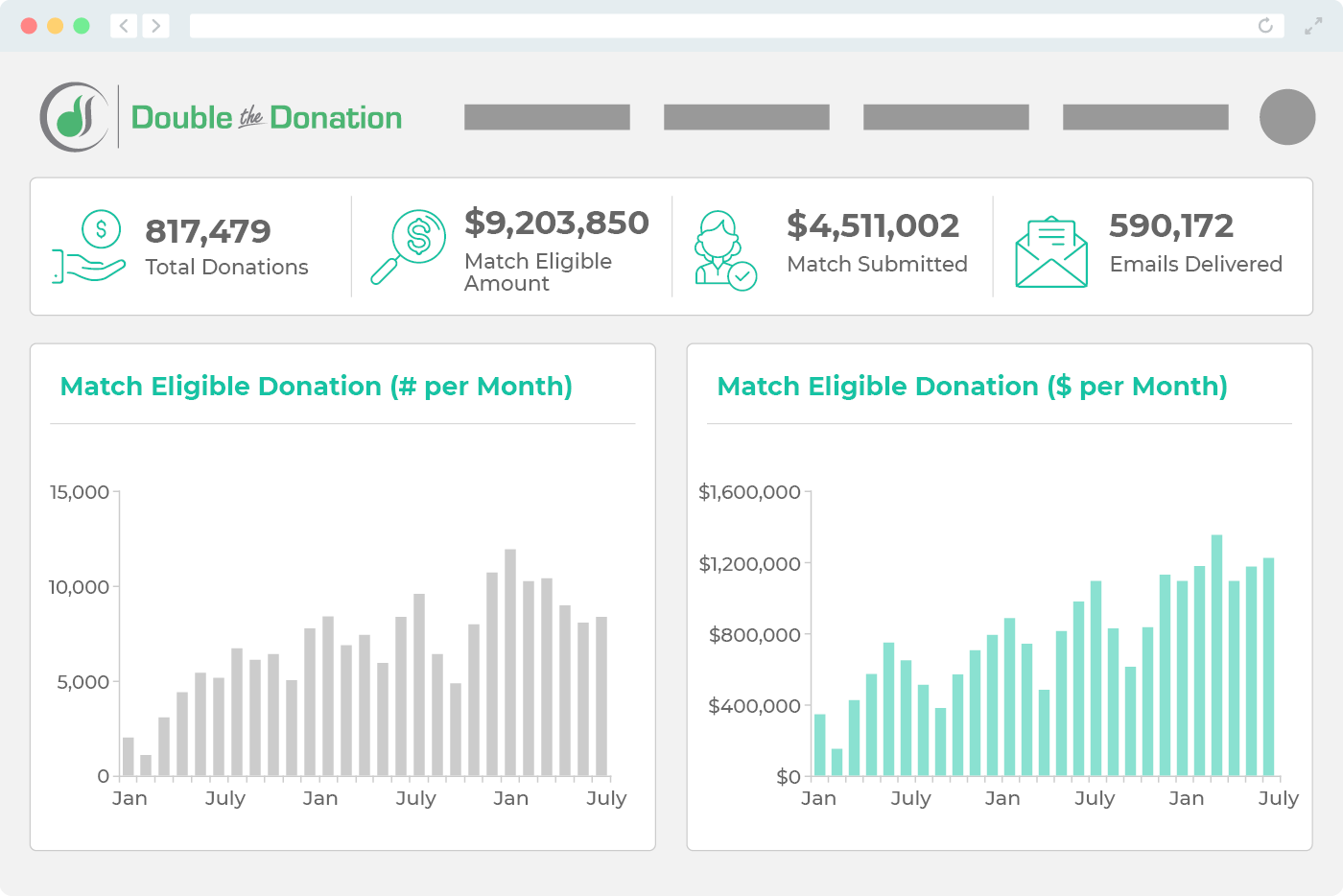

How Double the Donation Can Help

Double the Donation is a complete automation system that screens match-eligible donors and triggers tailored outreach accordingly. As a result, your staff saves time and maximizes its revenue.

With over 24,000 company listings, Double the Donation represents 26+ million match-eligible individuals worldwide. When it comes to Canadian companies that match gifts, recent analyses indicate that the tool remains the country’s most accurate and up-to-date source of matching gift information.

Check out these findings:

All in all, Double the Donation’s database offers substantial coverage of the market, making it a great fit for Canadian-based organizations and their donors.

Meanwhile, additional benefits of Double the Donation include:

Double the Donation essentially serves as your own matching gift team. Where you don’t have the staff, time, or resources necessary to perform matching gift outreach, the platform can step in and handle the rest!

Integrations & Customizations

If you’re thinking about investing in a matching gift database to supercharge your organization’s fundraising efforts, there are a few things to consider in your selection. As a Canadian-based organization, you’ll want to look for a solution that adequately covers the Canadian market and integrates with your existing tech stack for easy implementation and data management.

Fortunately, Double the Donation does just that! Offering 100+ integrations with the leading Canadian and global fundraising tools, the software provides users with direct access to the industry’s most comprehensive database. These ready-built and simple-to-use integrations include:

To get started, all you typically need to do is subscribe to Double the Donation’s tools. Then, activate Double the Donation by entering your API keys into your fundraising platform.

Additionally, Double the Donation is designed to accommodate nonprofits operating in one or more geographic markets. For Canadian-based organizations, this means you can customize the database search results by adjusting the geographic regions that apply to your nonprofit.

Double the Donation will then tailor the matching gift search results and information your donors receive based on your selections.

Top tip: If your nonprofit’s tax status is based in Canada and you primarily have Canadian donors, it’s recommended that you only select Canada. However, if you’re registered as a nonprofit in multiple markets, such as the U.S. and Canada, or have a large number of donors in those markets, it’s recommended that you select both the U.S. and Canada.

Wrapping Up

Choosing the right matching gift database is essential. Make sure to look for a solution that’s designed to enhance your organization’s fundraising. That means seeking tools that specifically cater to Canadian organizations—and Canadian matching gift companies.

While we’ve listed some of the largest Canada-based employers and overviewed their matching gift opportunities, they aren’t the only businesses that offer such initiatives. Be sure to constantly research your donors’ employers and stay up-to-date on companies in your area. And remember: the right matching gift database can help!

[/av_textblock]

Keep learning! Check out these additional resources to continue exploring matching gifts for your organization:

Matching Gift Marketing Guide

After identifying match-eligible contributions, you’ll need to promote the matching gift opportunities to your donors.

Check out our free downloadable resource to get best practices and expert marketing strategies.

Top Matching Gift Companies

Once you’ve uncovered top matching gift companies based in Canada, consider expanding your focus globally!

Explore these top employers that match employee gifts, and see if your donors work for these businesses!

One-Off Matching Gift Programs

One-off matching gift programs are defined by agreements between a single nonprofit and a single corporate donor.

Browse the guide to see how your team can begin making the most of these exclusive opportunities.

A Guide to Navigating University Fundraising with Confidence

/in Fundraising Ideas, Learning Center /by Adam WeingerFundraising is the backbone upon which universities are built, helping to expand educational offerings, enhance campus infrastructure, and prepare the next generation of changemakers.

University fundraising, however, is not merely about securing financial contributions; it is a delicate and multifaceted dance of identifying your need for support, articulating the profound impact of your institution, and cultivating long-term relationships with donors.

With philanthropic giving to higher education increasing by 12.5% in 2022, donors are becoming increasingly more inclined to contribute to colleges and universities. Equipped with the most up-to-date information about university fundraising, you’ll be set to engage donors and garner their support.

In this guide, we’ll cover everything you need to know about university fundraising, including:

Whether you’re a seasoned professional looking to refine your approach or a newcomer seeking a strong foundation of knowledge, these insights will help you build a sustainable fundraising program that stands the test of time.

Emerging University Fundraising Trends

Higher ed fundraisers have to stay up-to-date with evolving donor expectations, technology advancements, and shifting societal priorities to remain competitive and relevant in a dynamic philanthropic landscape.

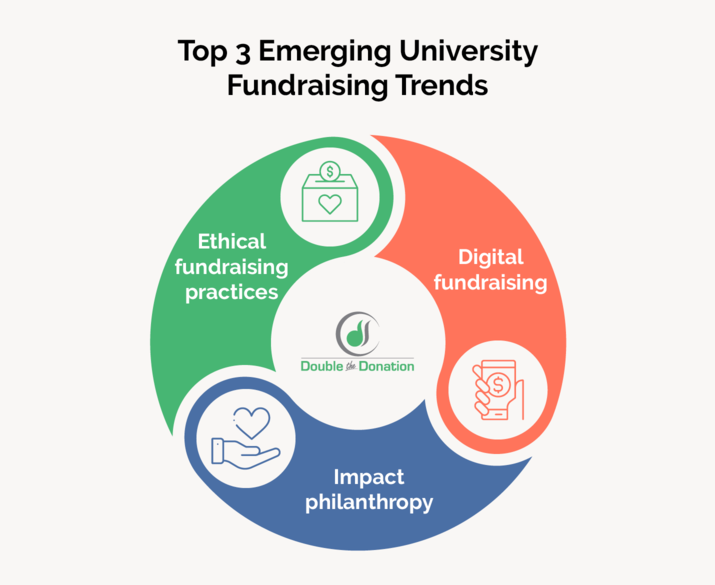

Here are three university fundraising trends to be aware of:

Universities that adapt to these trends can position themselves for success in engaging donors and securing the resources needed to advance their missions.

The Most Popular University Fundraising Ideas

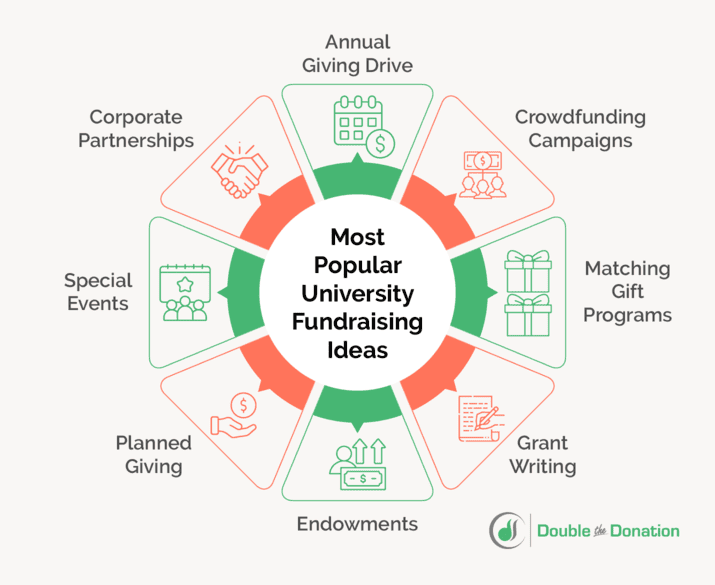

As you review the following fundraising ideas, consider how you can adapt them to align with your specific needs and alumni base.

Annual Giving Drive

The primary goal of an annual giving drive is to generate unrestricted funds that can be used to support the institution’s immediate and ongoing operational needs, such as scholarships, faculty support, program development, and infrastructure maintenance.

Some institutions may choose to run their annual giving drives on a fiscal year schedule rather than a calendar year schedule. Regardless, structure your campaign around this timeline:

It’s important to note that you may need to adjust the specific timeline for your annual giving drive based on your institution’s unique circumstances and objectives.

Matching Gift Programs

Matching gifts are a philanthropic practice in which employers, often corporations, financially match their employees’ charitable contributions to nonprofits and universities. When a university fundraiser secures a donation from a donor whose employer offers a matching gift program, the impact on university fundraising can be substantial. It essentially doubles the donor’s initial contribution, significantly increasing the total funds raised for the institution.

This matching process not only boosts the university’s financial resources but also encourages donors to give more generously, as they recognize the added impact of their contributions.

To encourage donors to leverage matching gifts, take these steps:

Watch the video below to learn how the University of Lynchburg leveraged Double the Donation to streamline its matching gift process and generate increased revenue:

As you’ll see, Double the Donation makes it easy to double the impact of your university fundraising efforts. To get started, request a demo!

Crowdfunding Campaigns

For university fundraisers, crowdfunding can be a lucrative venture because it harnesses the power of the collective, tapping into a broad network of donors who are passionate about the university’s mission and projects, potentially resulting in substantial financial support from a diverse group of contributors. Even students can get involved, with nearly 8% of current students contributing to crowdfunding initiatives.

When you launch a crowdfunding campaign, be sure to:

Use the momentum generated by the crowdfunding campaign to build on the success and cultivate ongoing relationships with donors for future fundraising initiatives.

Grant Writing

Pursue grants from government bodies, private foundations, and corporations to fund research projects, academic programs, and infrastructure development. Leverage these grant-writing tactics to increase your win rate:

Grantmakers often want to see that their funding will have a lasting impact. Therefore, you should also outline a clear plan for the sustainability of your project or program beyond the grant period.

Corporate Partnerships

Corporate sponsors provide universities with a stable source of financial support that can enhance academic programs, scholarships, and research initiatives. Plus, the partnership can strengthen the university’s reputation and attract philanthropic contributions from other sources.

Take these steps to establish strong partnerships with businesses:

Once you’ve secured a corporate sponsor, maintain a strong and transparent line of communication. Regularly update them on the progress of their sponsorship, including the impact of their support and any milestones achieved. Sharing success stories, data, and reports demonstrating the tangible results of their partnership reinforces their commitment and fosters a sense of ownership and pride in the collaboration.

Endowments

Endowments encompass invested donations that grow over time to provide increased value. Educational institutions can use this university fundraising tactic to fund:

Creating endowments for your university is beneficial because it provides your institution with a stable source of income. This type of fundraising also attracts major donors, allowing you to build relationships with supporters who have the highest giving capacities.

Planned Giving

Encouraging donors to include your university in their estate planning can lead to long-term, reliable financial support. Identify donors who are nearing retirement or already retired, have a history of significant contributions, and are actively involved—these are prime candidates for planned giving.

Then, appeal to these prospective donors, keeping in mind that:

Because planned giving often involves complex financial arrangements, you should consult with legal experts throughout this process to ensure compliance with relevant laws and regulations.

Special Events

Fundraising events can attract significant donations and enhance your networking opportunities. For the best results, host events that are creative and will inspire a large turnout like:

Throughout the event planning process, consider how you can engage potential donors who may not be able to attend the event in person. For instance, when hosting a scavenger hunt, you might add an exclusive map to your website or mobile app that allows attendees to participate virtually.

3 Tips for Hosting a University Fundraising Campaign

As you prepare to launch your next university fundraising campaign, keep the following tips in mind to ensure it’s a success.

1. Develop a clear fundraising strategy.

Define your university’s fundraising goals and priorities. Establish a comprehensive plan that outlines the specific projects, initiatives, or areas that require funding.

Be sure to identify your target donors, whether they are alumni, corporations, foundations, or individual philanthropists, and tailor your strategy to appeal to their interests and values.

2. Diversify outreach.

Donors have varying communication preferences and motivations for giving. Using a mix of channels, including social media, email, direct mail, phone calls, and in-person events, caters to these preferences and increases the likelihood of engagement.

In addition to more traditional methods, you may incorporate more unique outreach opportunities like eCards. When you thank your donors or invite them to an event with an eCard, you grab their attention and communicate with them in a more interactive, exciting way.

You may also reach potential supporters through Google Ads. With the Google Ad Grant program, philanthropic arms of higher educational institutions can unlock $10,000 in Google Ad credits for free. This way, your organization can show up at the top of the search results for relevant searches and secure more support.

For the best results, segment your donor list based on factors like giving history, affinity to specific university programs, and communication preferences, and personalize your outreach accordingly.

3. Cultivate strong alumni relationships.

Alumni who feel connected to their alma mater are more likely to contribute. That’s why it’s important to engage with your alumni community on a regular basis, not just when you need their financial support.

Stay in touch through regular newsletters, social media updates, and invitations to alumni events. In addition, recognize their accomplishments and contributions to the university, seek their input on important initiatives, and provide opportunities for alumni to mentor or support current students.

A Final Note About University Fundraising

Remember that the fundraising landscape is not a fixed path but a vast terrain of opportunities waiting to be explored. With each step, you can gain experience, build lasting relationships, and contribute to the enduring legacy of higher education.

For more information on university fundraising, review these additional resources:

GivenGain and Double the Donation Build New Double the Donation Integration for Matching Gifts Automation

/in Learning Center /by Adam WeingerDouble the Donation and GivenGain are excited to announce a new partnership in the form of integration between GivenGain forms and Double the Donation, the leading matching gift automation software from Double the Donation.

The integration educates donors about their match eligibility as they give, guiding them to their next steps and closing the gap of $4-7 billion in funds left on the table each year.

“We’re excited to team up with GivenGain to boost campaigns with advanced matching gifts automation,” said Adam Weinger, President at Double the Donation. “Now, nonprofits have the power to get more value from every donor interaction.”

The GivenGain and Double the Donation integration is now available to users with GivenGain and Double the Donation accounts. Follow our integration guide and get connected in minutes.

Are you a GivenGain user ready to start your matching gifts automation journey? Request a demo of Double the Donation and let us know you use GivenGain for event fundraising!

Want additional resources to help you take your matching gifts strategy to the next level? Enroll today in our Matching Gift Academy for in-depth content about growing your matching gift revenue.

About GivenGain: GivenGain was founded in 2001 on one simple belief, and one global mission: that humans are amazing, and to put the fundraising in the hands of the supporters. Since then, we’ve been the online home of global generosity and we’re just getting started. GivenGain is unlike any other fundraising platform, we’re different. As a nonprofit ourselves, we’re driven by purpose, not profit, and have been shaping the world of giving for over two decades.

About Double the Donation: Automate your matching gift fundraising with the industry-leading solution from Double the Donation. The Double the Donation platform provides nonprofits and educational institutions with tools to identify match-eligible donors, drive matches to completion, and gain actionable insights. Double the Donation integrates directly into donation forms, CRMs, social fundraising software, and other nonprofit technology solutions, and even partners with select CSR platforms to further streamline matching gifts for donors. Through Double the Donation by Double the Donation, the matching gift process has never been simpler.

Get on the Path to Earning Grants: 10 Grant Research Tools

/in Fundraising Ideas, Lists and Rankings /by Adam WeingerFrom recurring donors to annual fundraisers to merchandise sales, the more income streams your nonprofit has, the more financially secure your organization will be. The key source of revenue that can bring in reliable funding year after year is grants.

Grant funding amounts and requirements vary wildly as every grantmaking organization has their own unique application process. While there are skills and knowledge, like grant writing, that carry over from application to application, your nonprofit will need to learn the specific requirements of each organization you apply to.

This is where grant research tools come in. Along with helping you find grants, these tools provide insight into the application process, potential funding amounts, and contact information for the grantmaker.

To help your nonprofit build relationships with funders and earn your next grant, we’ll explore our top recommended grant research tools.

Grant Research Tools FAQ

What are grant research tools?

For the most part, grant research tools are searchable databases of available grants. Given that most grant databases have several thousand grants listed at a minimum, these databases have an extensive array of filters for users to narrow their search to grants applicable to their purposes.

Different grant databases often overlap in content. After all, if one grant database provider is aware of a foundation’s new grant opportunities, chances are many other providers are as well. However, one way to sort grant databases by content is to split them into three categories:

Note that specialty grants may not be listed in these databases. For example, the Google Ad Grant is a unique type of grant that rewards recipients with ad credits rather than dollars. For the Google Ad Grant and other highly specialized types of grants, it’s best to explore their websites directly rather than using a database for information.

Why do grant research tools matter?

Nonprofits can search for individual foundations and open grants they are aware of without needing any specific tool. However, grant research databases compile all the information your nonprofit needs to apply for grants in one place, allowing you to:

Some grant research tools have even more features that help streamline the grant application process. For instance, some tools are just databases for finding grant information, while others provide grant management tools that allow you to track specific grant deadlines, organize applications, and manage your awards.

What should my nonprofit look for in a grant research tool?

Grant research tools vary in the features they provide, the depth of information for grants in their database, and the costs of accessing their services. Before conducting grant research, consider what types of grants you intend to apply for and what tools you’ll need to complete your applications.

For instance, if you intend to apply for many grants, it may be worthwhile to invest in a paid but comprehensive grant management tool. In contrast, if you just need basic information about a few grants and would like to avoid extra fees, there are free resources your nonprofit can rely on.

With that, let’s explore our top grant research tools and what types of nonprofits can benefit from each option.

What about matching gift grants?