Nonprofits thrive on the support of major donors. The most major of the major gifts a nonprofit might receive are called principal gifts.

Principal gifts bring transformational benefits and drive incredible impact, growing organizations’ capacities to run programs, serve constituents, and make a difference. They’re elusive but achievable when you have an intentional strategy to identify and secure them.

Note: Principal gifts are the highest tier of major gift fundraising, representing the top 0.1% of your donor pyramid. For a broader look at securing gifts at the major level, see our Ultimate Guide to Major Gifts.

What’s a Principal Gift?

Simply put, a principal gift is a large donation made to a nonprofit by a major donor.

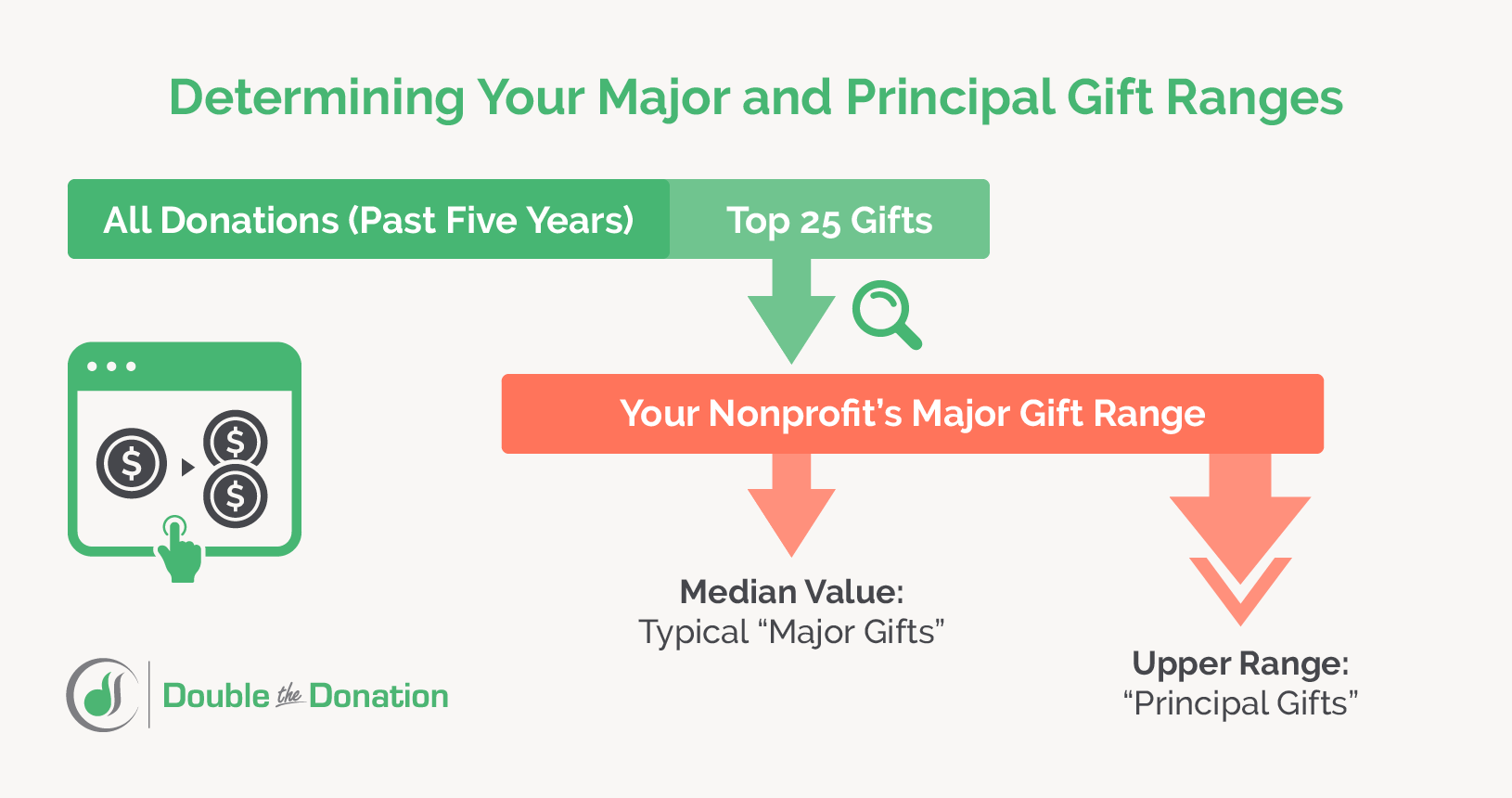

Nonprofits commonly consider principal gifts to be worth $1 million or more, but it’s important to remember that their exact value is relative to the size of an organization’s average gifts. You can define a rough range for major giving for your organization by identifying your top 25 or so gifts received within the past five years and determining the median of this range. This number can serve as a minimum for defining major gifts. Principal gifts would fall at the very top of (or far above) this range.

So how do you snag a principal gift? What background knowledge and strategies do you need to succeed and start transforming your organization?

In this crash course, we’ll take a closer look at principal gifts, how to pursue them, and other ways to maximize the value of your development efforts through tactics like corporate philanthropy.

Understanding Principal Gift Fundraising

Before you can begin laying out a principal gift fundraising strategy, you’ll need to understand some important context.

Principal gifts vs. major gifts: What’s the difference?

When it comes to principal gifts and major gifts, there are a few key things you’ll want to know. While a principal gift is a major gift, a major gift is not necessarily a principal gift. (Think: all squares are rectangles, but not all rectangles are squares.)

As explained above, your organization’s definition of a major gift is highly relative to your donor base and average fundraising data. A principal gift is simply a large gift at the top of or above that range of major giving.

Nonprofits pursue major and principal gifts using similar tactics but note that principal gifts have an especially long lifecycle. The larger the gift, the more discussions, care, and due diligence that go into the process. This is also true because principal gifts can generate significant publicity when given by high-profile philanthropists. Options should be weighed carefully before nonprofits and principal donors make public “investments” in one another and link their images.

You may also encounter the term lead gift. These are also large major gifts, but they’re received specifically in the context of major fundraising campaigns. A capital campaign’s fundraising goal, for example, is traditionally topped by a large lead gift, followed by a couple of smaller (but still major) gifts, and then more and smaller gifts down the line in a pyramid structure. This approach is highly efficient, allowing nonprofits to focus first on the handful of highest-impact gifts that will push the campaign the furthest forward.

Who gives principal gifts?

Major donors give principal gifts to nonprofits.

Sometimes, but not always, these donors are high-profile, high-wealth philanthropists—think Mackenzie Scott making waves in the nonprofit world with a new mega-gift. This situation is often what nonprofits imagine when they hear the term “principal gift.”

But again, it’s important to remember that the value of major gifts is relative and that no two donors are alike. What they do have in common is the capacity and inclination to give major gifts, whatever that might mean for your organization.

If you’ve taken concrete steps to invest in prospect research and major gift fundraising, there’s a good chance you’re already in touch with (or in the orbit of) a potential principal gift donor for your organization’s major giving range.

How are principal gifts usually given?

Principal gifts are not usually given out of cash but rather from saved assets (or a mix of cash and assets).

These non-cash assets often include:

- Real estate

- Stocks and other tradable securities

- In-kind gifts of valuables like jewelry or art

- Grants from donor-advised funds (DAFs)

- Planned gifts like trusts and annuities

- Cryptocurrency

When you pursue large donations, it’s important to be flexible in the types of gifts you can accept. Wealthy donors often prefer to give from saved assets rather than from liquid cash, not only because this won’t affect their day-to-day finances but also for the unique tax benefits that different non-cash gifts can bring. We’ll explore this best practice in greater detail below.

How do nonprofits pursue these gifts?

Nonprofits pursue principal gifts as part of their development programs, typically overseen by a dedicated staff member.

Nonprofit development provides the core structure and processes for principal gift fundraising. Having a development approach in place is generally a prerequisite for success. (Keep in mind, though, that even small shops succeed with development with the right tools and prioritization tactics!)

The fundraising strategies used for principal gifts are similar to those for other major gifts but heightened in intensity. One-on-one engagement is even more important for principal gift fundraising, for example. Other best practices take increased emphasis, as well, like the importance of networking in the prospect identification process.

How can you frame a principal gift as a high-impact challenge match?

When soliciting a gift of this magnitude (such as $1M or more), you aren’t just asking for a donation. Instead, you are inviting the donor to become a strategic partner. One of the most effective ways to do this is by positioning the principal gift as the funding source for a multi-year challenge match campaign.

Instead of the money simply going into a building fund or endowment, it serves as “leverage” to inspire hundreds or even thousands of other donors. For example: “Your $1 million gift will be used to match every dollar raised from the community for the next three years, effectively turning your $1 million investment into $2 million of impact.”

This approach appeals to the entrepreneurial mindset of many principal donors. It offers them:

- Amplified Impact: They see their gift doing “double duty.”

- Legacy: They are credited not just with their own generosity, but with catalyzing a movement.

- Partnership: They are not just writing a check; they are co-anchoring a powerful, ongoing campaign with you.

By presenting the gift in this light, you shift the conversation from simple philanthropy to strategic investment. This collaborative approach validates their financial acumen and often provides the final push a donor needs to commit to a transformational gift.

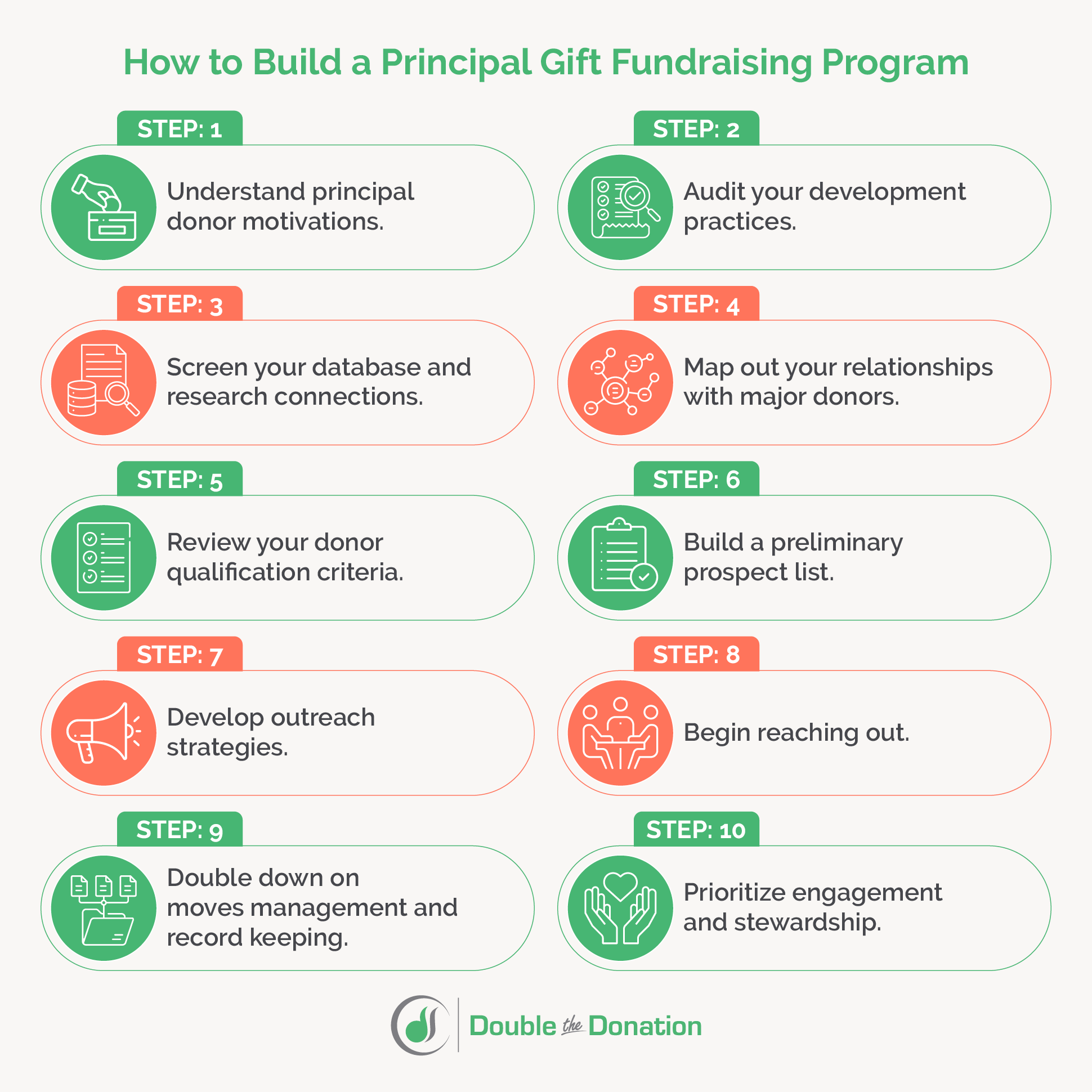

How to Build a Principal Gift Fundraising Program: 10 Key Steps

So you’re ready to get serious about pursuing and securing principal gifts for your nonprofit. How do you build a program to support that goal? We break it down into the following key steps:

1. Understand principal donor motivations.

First, take the time to understand why principal donors give such large gifts. As with other major donations, these gifts are motivated by a range of different personal reasons. These might include:

- The simple desire to give back

- Giving back to a personally meaningful cause or institution

- Tapping into significant tax benefits

- Simplifying estate and financial plans with bequests and in-kind donations of property

- Public recognition for personal brand-building

Always keep in mind that philanthropists give strategically—of course, they choose to give to the specific causes and organizations that matter to them, but additional motivations usually come into play. Understand these, and you can better align your own goals with those of your prospects.

2. Audit your existing development practices.

Principal gift fundraising occurs as part of your other development practices. Review your current processes for major gift fundraising, planned giving, and other high-impact or nontraditional forms of one-on-one fundraising. Consider the entire major donor lifecycle and the steps, tools, and best practices you use at each stage. These include:

- Prospect research and wealth screening

- Prospect qualification

- Gift cultivation and your messaging during this process

- Your solicitation strategies

- Your stewardship strategies and cadences

- Your nonprofit’s gift acceptance policy (create one if needed!)

Pay extra attention to the logistical processes that drive this lifecycle, especially moves management and your CRM practices. You’ll rely on these for principal gift fundraising just as you do for other giving programs.

Ideally, you’ll have data to refer to. Check out your historical performance with major gifts. Is your prospect pipeline consistently full or running low? Are there stages in the lifecycle where many prospects seem to drop off? Are your qualification criteria appropriate and up-to-date?

Identify potential improvements and make them (and/or consider how you’ll adjust them for principal gifts).

3. Screen your database and research connections.

Next, you’ll begin identifying your first principal gift prospects.

Look to your existing base of support. A pre-existing relationship with your nonprofit is one of the most reliable indicators of giving likelihood. Run a wealth screening to find those donors and contacts with the means to give a gift in the upper half or so of your nonprofit’s defined range for major gifts.

It’s normal in major and principal gift fundraising to branch outside of your direct contacts to find prospects, as well. However, this doesn’t mean cold-calling individuals in your community who you know to be wealthy. Existing, organic connections will yield the best results. Look to your current major donors and consider what you know or could find out about:

- Their families, friends, and community ties

- Their careers, colleagues, and employers

- Past nonprofits they’ve given to or volunteered for

Local histories, publications, social media (especially LinkedIn), the annual reports of other nonprofits, and more are all viable research routes. And remember, if you have strong working relationships with any major donors, don’t be afraid to just ask. Set up a call or lunch to let them know your organization is seeking more high-impact support. Do they have any friends, family, or colleagues who’d also be interested in your mission?

Top Tip: Using Advanced Employment Data for Verification

When vetting prospects for principal gifts, standard wealth screening often isn’t enough. Instead, you need to verify liquid capacity and career trajectory. This is where donor employment data becomes a critical, advanced tool.

After all, identifying a prospect’s specific industry, job title, and employer (e.g., “Senior Vice President at [Publicly Traded Company] in the tech industry”) allows you to look deeper than just real estate holdings. It unlocks insights into:

- Executive Compensation: Base salary plus bonuses.

- Stock Options: Access to liquid assets that can be gifted tax-free.

- Matching Eligibility: While rare for principal gifts, some corporations will match executive gifts at higher ratios or caps.

By confirming employment details, you move a prospect from “suspected wealth” to “verified capacity,” ensuring you don’t waste time soliciting a principal gift from someone who is merely house poor.

4. Map out your relationships with major donors.

Review everything you’ve learned from researching top prospects and their connections. Then, map it out.

This might mean using a notebook or simple design tool to literally draw connections between your contacts and individuals you’d like to meet—whatever works! You’ll likely be surprised to find that many high-impact donors move in similar social circles, especially in smaller communities.

Visually look for connections and correlate them to your research insights. This process can yield some valuable results. For example, you might find several connections from existing donors pointing to one individual in the community. This person might be a prime candidate for outreach because of the organic personal or professional connections that you already have with them.

5. Review your donor qualification criteria.

Before finalizing a list of prospects, you need to qualify and prioritize them. Principal gift fundraising is highly time-intensive and requires one-on-one communication over extended periods. You’ll need to have a plan to spend your time wisely, that is, by focusing first on those most likely to give.

Qualification is the process of defining the characteristics of a strong giving prospect and using them to update your prospect lists for more efficient and targeted outreach. Qualification criteria can include:

- Certain giving capacities (shaped by your organization’s definition of major gifts)

- Stock ownership

- Property ownership

- Active engagement with your nonprofit

- Active engagement with other nonprofits

- Demonstrated interest in or personal connection to your cause

- Direct, second-degree, third-degree, etc., connection to your nonprofit

- Personal vs. professional indirect connections

Note that some criteria can (and often should) be weighted more heavily than others. Existing direct connections with your nonprofit should be prioritized over indirect connections, or you may learn over time that personal indirect connections are better indicators than professional ones.

Not every prospect will check every box, but this approach does allow you to tackle the prioritization process in a standardized, easily repeatable way. Many fundraising experts recommend making qualification a recurring activity for your development team to ensure continued effectiveness—Graham-Pelton’s donor qualification guide lays out why and how to do this.

You should also keep your qualification criteria up-to-date over time, and create different variations of them for different giving programs. For example, while principal gift donors, major donors, and planned gift donors might share some common characteristics, these are not perfectly overlapping groups. Qualification makes it easy to build in a more targeted approach from the very start.

6. Build a preliminary list of principal giving prospects.

Next, use your qualification criteria to screen the list of donors and prospects you identified in Steps 3 and 4.

Rank them according to your criteria, and you’ll have a handy, easy-to-use shortlist of your very top principal gift prospects.

7. Develop outreach strategies.

Now you can begin thinking about how you’ll get in touch with your prospects. Consider these tips:

- Review known communication preferences of existing contacts.

- Look back at previous conversations with existing contacts to refresh yourself on their personal life developments, career changes, etc., and use these to begin new conversations.

- Ask your existing contacts for introductions to new prospects based on the mapping exercise in Step 4.

- Create or update your nonprofit’s general case for support.

- Create more context-specific cases for support if needed. For example, if you’re seeking a lead or principal gift as part of a major fundraising campaign, you’ll need talking points tailored to the campaign’s objectives.

- Prepare some preliminary shareable resources like your annual report, one-pagers, and brochures about your nonprofit and its impact. You likely won’t need these until you’re closer to actually soliciting a gift, but it doesn’t hurt to be prepared.

With these tips in mind, take a closer look at everything you’ve learned about each prospect and conduct more research if needed. Use this information to lay out personalized outreach strategies for each individual.

8. Start reaching out to build relationships.

Begin reaching out! Work your way down your shortlist of prospects, starting conversations, having calls and meetings, and introducing them to your organization, its work, and its needs.

During this stage, take your time and follow standard gift cultivation best practices that you follow for other major gifts.

Take an interest in your prospects’ personal and professional lives, and work to show them how a partnership would drive impact in the community. Remember that gifts of any size can be restricted or unrestricted—if a prospect shows interest in one particular program or service that your nonprofit runs, lean into it.

You should also seek to learn more about your prospects’ giving motivations so that you can best tailor your eventual solicitations. For example, a wealthy middle-aged prospect might be nearing retirement age and interested in financial planning. You could explain to him or her that various types of planned gifts can actually provide donors with regular income payments while reducing their tax bills, making these arrangements ideal vehicles for principal donations.

9. Double down on moves management and record-keeping.

Throughout the cultivation and solicitation processes, keep close track of your touchpoints with prospects. Organized moves management is essential.

Use your CRM to record each touchpoint, add notes, and tag it with the appropriate prospect. This will take all the guesswork out of preparing for your next conversation and determining the right time to make the ask.

Check out our introduction to moves management for a quick overview of this process.

And aside from tracking your interactions with prospects, be prepared to handle other logistics once you make a successful solicitation. Finalizing a principal gift will involve working closely with the donor and perhaps their (and your) lawyer to hash out the details, especially for non-cash gifts that require legal transfers of ownership or other arrangements. Keeping tidy records of your organization’s finances is always important, and you’ll need to have crystal-clear records of your principal gifts.

10. Prioritize engagement and stewardship.

As you build relationships with principal gift prospects, introduce your giving programs, and lay out compelling cases for support, you’ll hopefully soon successfully solicit your biggest donation yet. Thank your donor, work out the fine print, thank them again, and begin facilitating the donation.

What next?

Ongoing engagement and stewardship are already important for your major donors—doubly so for principal gift donors. They are extremely valuable partners for your mission. You should have a plan to:

- Stay in touch and aware of developments in their lives

- Keep them up-to-date on the progress of your work and any specific campaigns or programs they funded

- Offer ongoing opportunities to get involved with event invites, personal meetings, tours, and more

- Offer new giving options over time that you think they may be interested in

By maintaining and growing your relationships with key supporters over time, you’ll retain their support, secure additional gifts in the future, and build a stellar reputation for your nonprofit. Who wouldn’t want to be known as an organization that inspires transformational gifts and fosters a thriving community?

How to Make the Most of Your Development Strategies

You’ve built effective development strategies and are well on your way to securing a principal gift that will take your work to the next level. Your prospect pipeline is humming along, and everyone’s excited to drive your nonprofit’s goals forward. What next?

Stay on the lookout for ways to maximize the impact of your development work. There are all kinds of ways you can generate more value through your giving programs. For example:

1. Promote matching gifts, volunteer grants, and payroll giving. These employer-offered CSR perks are effortless ways to boost the value of your donations. Ask your donors (at all giving levels) to check their eligibility or have you research it for them. Nonprofits’ board members are also often significant donors—don’t forget that their board service might qualify for volunteer grants through their employers, as well!

Luckily, Double the Donation streamlines the entire process for you and creates easy value-adds up and down your donor pyramid. Learn more or request a demo to see our platform in action. For more information on how the platform works, check out this video:

2. Provide flexible giving options. As mentioned above, major and principal donors often like to give from assets rather than cash for numerous reasons. Be prepared to offer and discuss these giving options. Making it easy to give in a preferred way almost guarantees that you’ll raise more in the long run. Look for tools that simplify the process of accepting stock donations, gifts crypto, donor-advised fund grants, and more as needed.

3. Monitor federal and state tax changes. Tax incentives are powerful motivators for donors when large gifts are involved. Stay aware of developments at the federal and state levels so that you can have productive conversations with prospects. Help them understand the potential benefits of donating (but don’t give explicit financial advice—leave that to the financial and legal professionals).

4. Suggest gift-matching challenges to your top donors. Planning a new major fundraising campaign or giving day? Try asking a longtime major donor to offer a unique gift-matching challenge! This involves your major donor matching all gifts made to your organization within a specific timeframe, and it can be an easy way to supercharge your fundraising results in a short time. Plus, it’s an easy way to engage your major donor with a serious opportunity to drive impact.

5. Research further funding connections and opportunities. Keep researching your donors’ and prospects’ connections over time. Major supporters who are philanthropically active might have connections with foundations that you can tap into to get your foot in the door for new grant funding. Wealthy individuals might even eventually form their own private or family foundations—make sure your nonprofit is a preferred partner right from the start.

Additional Considerations of Principal Gift Fundraising

Principal gift fundraising can completely transform your nonprofit’s ability to pursue its mission. But it also comes with unique challenges and considerations to keep in mind:

- By forging such a big partnership with an individual, you link your organization’s image with theirs. Consider their reputation, the publicity that an announced gift will generate, and whether you can (or want to) honor any restrictions that a donor places on their gift. You can turn down a gift in the best long-term interest of your mission. Think carefully about these factors long before soliciting a gift. Reference your gift acceptance policies, and create them now if you haven’t yet.

- Prepare for the logistics of accepting non-cash gifts. You may need to liquidate stock, work with attorneys and accountants to make arrangements for complex planned gifts, or even handle accepting gifts of real estate. Consider these processes in advance and be prepared to invest in new tools, hire external professionals, and expand your bookkeeping practices as needed.

It’s also recommended to look for ways over time to build more business connections as your organization grows. By integrating corporate philanthropy into your development strategies, you can build extremely fruitful and resilient revenue sources for your nonprofit. Ask your major and principal donors about their careers. Learn more about their employers. Use your existing relationships to springboard new corporate partnerships or sponsorships—the sky’s the limit!

New to corporate philanthropy? Here’s the complete playbook.

Wrapping Up & Next Steps

Despite its nuances and unique considerations, principal gift fundraising is easily the highest-impact form of fundraising that a nonprofit can conduct. These particularly generous gifts are often the foundation of a successful capital campaign, providing the early momentum needed to go public. For a complete guide on how these gifts fit into that broader structure, see our Ultimate Guide to Capital Campaigns.

From there, understanding principal gift fundraising, its distinctions, and why major donors choose to give can go a long way. Build and improve upon your existing development strategies, and focus heavily on research and preparation. With the right plan in place and plenty of time to build relationships, you’ll be on your way to securing a transformational gift.

Want to learn more? Take a deeper dive with these related resources:

A Smart Nonprofit’s Guide to the Volunteer Grant Process

/in Volunteer Grant Basics, Learning Center /by Erin LavenderThe lifeblood of any nonprofit organization is the dedication of its volunteers. From preparing food boxes to mentoring youth, the hours given freely by passionate supporters are invaluable. But what if those hours could be converted into hard cash, providing a secondary revenue stream with no extra time commitment from your supporters? This is the power of the volunteer grant process, a key component of corporate philanthropy that most nonprofits overlook. It’s a goldmine of unclaimed funding, often sitting right under your nose, waiting for a simple, proactive nudge.

For nonprofits operating with lean teams and tight budgets, securing every possible dollar matters. Volunteer grant programs, sometimes called “Dollars for Doers,” offer a remarkable opportunity to increase the financial return on volunteer time, essentially giving your organization “free money”. However, tapping into this potential requires a clear understanding of the process and a proactive strategy to guide your supporters through it. With thousands of companies offering these programs, learning how to leverage the Volunteer Grant Process can dramatically boost your volunteer program’s return on investment (ROI).

In this guide, we’ll cover:

The misconception that corporate giving is reserved only for major organizations or requires too much administrative work often prevents mid-sized and smaller nonprofits from exploring the lucrative avenue of volunteer grants. Yet, technology solutions now exist to streamline the identification, outreach, and submission steps, removing the heavy manual lifting for your development team. By integrating simple, automated tools into your existing volunteer and fundraising processes, your nonprofit can systematically convert volunteer hours into much-needed revenue, fueling your mission on a whole new level.

Why the Volunteer Grant Process Matters for Your Nonprofit

Volunteer grants represent a crucial but often unrealized funding source in the philanthropic landscape. These programs are designed by companies to provide monetary donations to organizations where their employees dedicate their time. This means that the valuable time your volunteers invest is multiplied by a financial contribution from their employer, substantially increasing the overall impact of their service.

For every hour an employee volunteers, their company may offer a grant, with many programs ranging from $8 to $15 per hour of service. This “free money” drastically increases the ROI of your entire volunteer program, making this an essential piece of corporate giving strategy. Despite this immense potential, a significant portion of volunteer grant funding goes unclaimed because both nonprofits and volunteers often lack awareness about the programs or the detailed steps required to secure the funds. Implementing a clear strategy focused on the Volunteer Grant Process is the key to unlocking this overlooked revenue.

Step 1: The Volunteer Shift and Employer Data Collection

The Volunteer Grant Process officially begins the moment a supporter decides to dedicate their time to your cause. At this initial stage, the two most critical actions for your nonprofit are ensuring the volunteer completes their shift and, more importantly, capturing their employment information.

Completing the Volunteer Shift

For any volunteer grant to be approved, the volunteer must complete a qualifying period of service. This time commitment varies widely from company to company; while some require as little as 10 hours, others may require 20 or more. As a nonprofit, your job is to provide meaningful volunteer opportunities and a reliable system for logging the time contributed.

Collecting Employer Data

The most common reason for unclaimed volunteer grant funding is the lack of information on where your volunteers work. If you don’t know the employer, you can’t tell the volunteer they’re eligible. To solve this, you must proactively integrate an employer search tool directly into your volunteer registration form. This straightforward step allows the volunteer to instantly check if their company offers a volunteer incentive program right as they sign up.

Essential Data Collection Points:

By collecting this data upfront, your organization creates a foundation for an automated, proactive outreach strategy that eliminates manual guesswork. This automated tool turns employment data into actionable insights for next steps.

Step 2: Determining Volunteer Grant Eligibility

Once a volunteer has logged their hours and provided their employer’s name, the next phase of the Volunteer Grant Process involves quickly determining their eligibility. This step is critical for sending personalized, targeted follow-up communication.

Utilizing a Volunteer Grant Database

Manually researching the thousands of companies that offer volunteer grant programs is time-prohibitive for any nonprofit team. This is where a dedicated, centralized volunteer grant database becomes indispensable. By cross-referencing the collected employer data against the database, your team can instantaneously pull up company-specific program parameters, including:

Segmenting Your Volunteer Base

With eligibility criteria determined, you can segment your volunteers into targeted groups for outreach:

This streamlined segmentation, often automated by dedicated software, ensures that every follow-up email is highly relevant and actionable, directly addressing the next step the volunteer needs to take.

Step 3: The Volunteer Grant Request and Submission

This is the make-or-break point in the Volunteer Grant Process. The responsibility for completing the official grant request lies entirely with the volunteer. Your role as a nonprofit is to eliminate all barriers by providing clear, direct access to the required submission forms and guidelines.

Delivering Company-Specific Next Steps

The most effective way to drive submissions is through automated, personalized outreach immediately following the donation or volunteer shift. This typically involves:

This immediacy capitalizes on the volunteer’s high engagement level immediately after interacting with your organization, maximizing the chances of follow-through.

The Volunteer’s Task

The volunteer typically needs to:

Your targeted outreach must clearly communicate these steps, alleviating any confusion and reducing the perceived administrative burden on the volunteer.

Step 4: Securing the Corporate Grant Funding

After the volunteer submits the request, the process shifts to the corporate side for review and disbursement.

Corporate Review and Approval

The employer’s corporate social responsibility (CSR) or human resources department will review the submission. This review confirms the employee’s status, verifies the volunteer hours logged with your organization, and checks that your nonprofit meets all eligibility criteria. If all conditions are met, the request is approved.

Grant Disbursement and Tracking

Once approved, the company issues the grant funding to your nonprofit. This payment, whether electronic or by check, completes the Volunteer Grant Process and is categorized as corporate revenue.

Marketing Strategies to Promote the Volunteer Grant Process

Maximizing revenue from volunteer grants depends heavily on successfully marketing the opportunity to your entire supporter base. A multi-channel strategy ensures you reach every eligible person.

Promote on Your Website

Your website is the single most important tool for promoting the Volunteer Grant Process. It should include:

Utilize Email and Social Media

Email and social media are perfect for personalized and broad outreach. Here’s what you should know:

Engage Local Business Partners

Don’t just wait for national companies. Target local businesses and professional service firms (e.g., law, accounting) in your area. Research their VTO policies and pitch group volunteer events, which are often covered by their employee incentive programs.

Measuring Success and Optimizing Your Volunteer Grant Strategy

To ensure your investment in promoting the Volunteer Grant Process is worthwhile, rigorous tracking and analysis are necessary.

Key Performance Indicators (KPIs)

Focus on these key metrics to gauge performance:

Continuous Optimization

Use your data to continually refine your strategy. If the “Grant Submission Rate” is low, focus on improving the clarity and timing of your follow-up emails. If “Volunteer Hours Logged” is low, promote more flexible or team-based volunteer opportunities that align with corporate VTO programs. Investing in dedicated software is the most efficient way to track these KPIs, automate outreach, and continually increase revenue without overtaxing your team.

Wrapping Up & Next Steps

The Volunteer Grant Process is a powerful mechanism for nonprofits to double the value of their volunteers’ time, converting dedication into a reliable revenue stream. While the process hinges on the volunteer submitting the final form to their employer, the nonprofit’s role in proactive promotion and streamlined execution is essential. By seamlessly integrating employer data collection into the volunteer sign-up flow, leveraging automated tools to check eligibility and deliver customized instructions, and actively marketing the opportunity across all channels, your nonprofit can unlock hundreds, and potentially thousands, of dollars in annual funding.

If your nonprofit is ready to stop leaving money on the table and fully monetize your volunteers’ generosity, explore technology solutions that automate the entire Volunteer Grant Process. Get started with Double the Donation Volunteering!

Volunteer Grant Requests: The Ultimate Nonprofit Guide

/in Volunteer Grant Basics, Learning Center /by Erin LavenderVolunteers are the heartbeat of the nonprofit sector. From stuffing envelopes to mentoring youth and cleaning up local parks, these dedicated individuals provide the essential labor that powers your mission. But did you know that their contribution can go even further? There is a hidden revenue stream attached to those volunteer hours that often goes completely untapped: corporate volunteer grants. By mastering the art of Volunteer Grant Requests, your organization can turn the gift of time into essential unrestricted funding.

For many nonprofits, the focus remains heavily on individual cash donations or major gifts. However, overlooking the corporate philanthropy sector—specifically volunteer grants—means leaving significant money on the table. These programs, often called “Dollars for Doers,” allow companies to provide monetary donations to eligible nonprofits based on the number of hours their employees volunteer. It essentially converts volunteer zeal into financial support, increasing the ROI of your volunteer program without demanding more time from your supporters.

Despite the clear benefits, many organizations struggle to secure these funds. The barrier isn’t usually corporate unwillingness; it is a lack of awareness and process. Volunteers often don’t realize they are eligible, and nonprofits often lack the mechanisms to remind them to submit a request.

In this guide, we’ll cover:

If you are ready to monetize your volunteer hours and build stronger relationships with corporate partners, this guide will serve as your roadmap to mastering the Volunteer Grant Requests workflow.

What is a Volunteer Grant Request?

A volunteer grant request is the formal mechanism through which an eligible employee asks their company to make a charitable contribution to a nonprofit where they have volunteered. It is the bridge between the physical act of volunteering and the financial payout from the corporation.

These grants are a specific type of corporate giving program designed to encourage employee engagement in the community. When an employee logs a certain number of hours (note: thresholds vary by company), they become eligible to submit a request. Once approved, the company cuts a check to the nonprofit.

Why is this important? Because it represents “free money” for your organization. Unlike competitive grant applications that require hours of writing and reporting, volunteer grants are earned through work you are already doing: engaging volunteers. However, these funds do not appear automatically. They require the volunteer to initiate a Volunteer Grant Request, and that requires your guidance and encouragement.

Did You Know? The average employee participation level for volunteer grants sits at just 3%. This low number isn’t due to a lack of volunteering; it is due to a lack of awareness that the Volunteer Grant Requests process exists. Bridging this gap is your biggest opportunity for revenue growth.

The Anatomy of a Volunteer Grant Request

To help your supporters navigate the process, you must understand what they will be asked to provide. While every company uses a slightly different portal or form (such as Benevity, CyberGrants, or YourCause), the core data requirements remain consistent. A standard request typically requires information from three distinct categories:

1. Employee Information

The company needs to verify the identity of the requester to ensure they are a current, eligible employee.

2. Nonprofit Information

The company must verify that your organization is a valid 501(c)(3) or equivalent charitable entity eligible to receive funds.

3. Volunteer Activity Information

This section proves that the service occurred and met the program’s criteria.

Quick Tip: Make this easy for your volunteers! Create a “Volunteer Grant One-Pager” that lists your nonprofit’s EIN, correct mailing address, and a contact email for verification. Hand this out at every volunteer orientation or include it in your post-event thank-you emails.

The Volunteer Grant Request Process: Step-by-Step

Understanding the lifecycle of a request allows you to intervene at the right moments to ensure completion. The process typically follows five distinct stages .

Step 1: The Volunteer Act

The process begins with the individual volunteering with your nonprofit or school. Whether they are painting a classroom, walking dogs, or providing pro-bono legal advice, the clock starts ticking on their eligibility. It is vital that you have a system in place to log these hours accurately, as the volunteer will need this data later.

Step 2: Determining Eligibility

After volunteering, the individual must determine if their employer offers a grant program. Currently, 40% of Fortune 500 companies offer volunteer grant programs. However, the specific criteria vary.

If the volunteer doesn’t know the answers, they likely won’t proceed. This is where providing a search tool on your website becomes invaluable.

Step 3: Submitting the Request

Once eligibility is confirmed, the volunteer accesses their company’s CSR portal to submit the Volunteer Grant Request. They will input the data regarding their service hours and your organization’s details. This step must often be completed by a specific deadline, such as the end of the calendar year or a set number of months after the service date.

Step 4: Verification

After the employee hits “submit,” the request enters the verification phase . The company or its third-party administrator will reach out to your organization to confirm that the volunteer actually performed the hours claimed. Responsiveness is key here; if your team ignores the verification email, the grant may be denied.

Step 5: Fulfillment and Payout

Once verified, the company approves the request and disburses the funds. These payments are often bundled and sent on a quarterly or monthly basis.

Top Companies with Standout Volunteer Grant Programs

Knowing which companies offer these programs helps you target your outreach. If you see groups of volunteers from these corporations, you should immediately be thinking about Volunteer Grant Requests.

Microsoft

Microsoft has one of the most generous programs in the corporate world. They offer a grant of $25 for every hour an employee volunteers, with no minimum threshold. This means even a single hour of service can generate revenue for your cause.

ExxonMobil

ExxonMobil encourages sustained service. They provide a $500 grant for every 20 hours an employee volunteers. This structure incentivizes repeat volunteering, which is excellent for retention.

Verizon

Verizon offers a competitive program where employees can earn $750 for 50 hours of volunteer work. They focus heavily on rewarding employees who make a significant time commitment to a specific charity.

Allstate

Allstate provides grants generally ranging from $500 to $1,000, depending on the role and time commitment of the volunteer. They are a strong partner for community-based organizations.

Disney

Disney’s “Disney VoluntEARS” program allows employees to turn their hours into charitable contributions, offering grants of up to $2,000 per year for eligible nonprofits.

Did You Know? 80% of companies with volunteer grant programs provide between $8 and $15 per hour volunteered. While this might seem small per person, when applied to a group of 20 volunteers working a 4-hour shift, the revenue adds up instantly.

Marketing Strategies to Drive More Requests

The primary reason volunteers don’t submit requests is simply that they don’t know they can. A robust marketing strategy creates multiple touchpoints to educate your supporters about the Volunteer Grant Requests process.

Leverage Your Website

Your website is your digital headquarters. You should have a dedicated “Ways to Give” or “Volunteer” page that explicitly mentions volunteer grants.

Optimize Your Email Communication

Email has the highest ROI of any marketing channel. Use it to remind volunteers of the value of their time.

Social Media Awareness

Social media is perfect for quick, educational bursts. Share graphics that explain the concept of “Dollars for Doers.”

Catch Them During Registration

The best time to get data is when the volunteer is signing up. Add an optional field to your volunteer registration forms asking for their employer. If they indicate they work for a grant-eligible company, you can trigger an automated email with submission instructions the moment they complete their shift.

Leveraging Technology to Automate Requests

Manual tracking of volunteer employment data can be overwhelming. Fortunately, technology can automate the identification and reminder process, ensuring no Volunteer Grant Requests fall through the cracks.

The Power of a Corporate Giving Database

Tools like Double the Donation’s database provide comprehensive information on thousands of companies. When a volunteer enters their employer’s name into the search tool, they are instantly presented with:

Seamless Integration

By integrating these tools into your volunteer management system or website, you create a frictionless experience. The volunteer doesn’t have to hunt for forms or ask HR; the information is served to them on a silver platter. This convenience significantly boosts the submission rate.

Furthermore, automated email streams can be set up to “nudge” volunteers who have reached a certain hour threshold. For example, if a volunteer hits 20 hours and you know they work for ExxonMobil, the system can automatically send an email congratulating them and providing the link to claim their $500 grant.

Wrapping Up & Next Steps

Volunteer Grant Requests offer a unique opportunity to double the impact of your supporters. They transform the time and energy already invested in your organization into unrestricted revenue to fund operations, programs, and growth. While the process relies on the volunteer to take the final step, the responsibility for education and encouragement lies with the nonprofit.

By understanding the anatomy of a request, identifying eligible donors through improved data collection, and leveraging automation to guide them through the submission process, you can unlock a sustainable revenue stream that grows alongside your volunteer base.

Ready to maximize your volunteer revenue?

Don’t let your volunteers’ hard work go unmonetized. Start driving more Volunteer Grant Requests today and give your mission the funding it deserves. Plus, find out how Double the Donation Volunteering can help!

Navigating the Volunteer Time Off Process for Nonprofits

/in Volunteer Time Off, Learning Center /by Erin LavenderVolunteers are the engines that keep nonprofits running, fueling everything from event logistics to daily operations. But for many supporters, the biggest barrier to getting involved isn’t a lack of passion—it’s a lack of time. Between 9-to-5 jobs and personal responsibilities, finding hours to dedicate to your mission can be a challenge. This is where Volunteer Time Off (VTO) changes the game. By compensating employees for the time they spend volunteering, companies are removing the logistical hurdles that prevent supporters from showing up.

For nonprofits, understanding the Volunteer Time Off process is not just about logistics; it is about unlocking a massive, untapped reservoir of supporter bandwidth. When a company pays its employees to volunteer, your organization gains access to motivated, reliable, and often highly skilled help without the risk of donor burnout. However, simply hoping volunteers know about these benefits isn’t enough. You need a strategy to guide them through the administrative steps, ensuring they can utilize their benefits to support your cause.

In this guide, we’ll cover:

With 66% of employers now providing some form of paid time off program for volunteering, the opportunity is vast. Yet, without a clear roadmap, these hours often go unused. By mastering the nuances of the process—from registration to verification—your nonprofit can turn corporate policy into tangible impact.

What is Volunteer Time Off?

Volunteer Time Off, often abbreviated as VTO, is a type of employee benefit where team members receive a designated number of hours to volunteer with nonprofit organizations above and beyond their existing paid time off (PTO). Essentially, it is a mechanism through which employees partake in volunteer activities during work hours while still receiving their regular pay.

While corporate philanthropy often focuses on cash donations or matching gifts, VTO focuses on human capital. It removes financial and logistical barriers for volunteers, producing a larger pool of supporters for your organization to engage with. When supporters are compensated by their employers for their time, they are more likely to get involved initially and continue their support over the long term.

Did You Know? The number of companies offering VTO programs has increased by 2 in 3 over the last decade. Furthermore, 49% of individuals state that work commitments are their biggest obstacle to volunteering. Promoting the Volunteer Time Off process directly addresses this pain point!

Why the VTO Process Matters for Your Nonprofit

Understanding the mechanics of VTO is crucial because the burden of proof often falls on the volunteer. Unlike a direct corporate grant that might be handled between a CSR officer and your development director, VTO is an employee-driven benefit. If your volunteers don’t know the process, they likely won’t use the benefit.

By familiarizing your team with how these requests are made, approved, and verified, you can become an active partner in the process. You can provide the necessary documentation, offer shifts that align with corporate requirements, and remind volunteers to utilize their hours before they expire. This proactive approach transforms your organization from a passive recipient of help into a strategic partner for corporate employees.

Step 1: Registration and Employer Identification

The Volunteer Time Off process begins long before the volunteer arrives at your facility. It starts the moment a supporter expresses interest in an event or opportunity.

The Volunteer’s Role: The individual visits your website or volunteer portal to sign up for a specific shift. At this stage, they are looking for dates and times that fit their schedule.

The Nonprofit’s Role: Your primary goal here is data collection. You cannot assist a volunteer with their VTO request if you do not know where they work. During the registration process, integrate a field for employment information. This allows you to identify VTO opportunities immediately using employer data.

If you utilize volunteer management software or a corporate giving database, you can prompt volunteers to search for their employer while signing up for a shift. This is the most critical step in the funnel; catching the volunteer at the point of registration ensures that VTO is top-of-mind before they even check their calendar.

Step 2: Determining Eligibility for VTO

Once the volunteer has registered and provided their employer’s name, the next step in the Volunteer Time Off process is verifying that their specific company offers a VTO benefit and that your nonprofit is eligible to receive it.

Corporate Criteria: Every company has different guidelines. Some offer VTO only to full-time employees, while others extend it to part-time staff. Additionally, companies offer an average of 20 hours of paid volunteer time per year (equaling about 2.5 days), but this varies wildly.

Organization Eligibility: Companies may also have restrictions on the types of activities they support. While most 501(c)(3) organizations are eligible, some corporations may restrict VTO for political or religious activities.

How to Streamline This: Instead of asking volunteers to dig through their employee handbooks, you can use a corporate giving database to connect eligible supporters to volunteer time off opportunities instantly. These tools can populate eligibility requirements, minimum hours, and links to the company’s internal portal, effectively doing the research for the volunteer.

Step 3: Submitting the VTO Request and Pre-Approval

This is the step where many potential volunteers drop off if they are not properly supported. Before the volunteer shift occurs, the employee typically must submit a formal request to their employer.

The Request Workflow: In most corporate portals (such as Benevity, CyberGrants, or YourCause), the employee must log in and submit a request for “Volunteer Time Off.” They will need to provide:

Getting Pre-Approval: Most companies require this request to be approved by the employee’s direct manager or the HR department before the volunteering takes place. This ensures the employee’s absence won’t disrupt business operations.

Quick Tip: Create a “VTO Cheat Sheet” for your major corporate partners. If you know you have many volunteers from a specific local company (e.g., Home Depot or Target), draft a template email or PDF that gives them the exact description of duties and tax ID number they need to fill out their internal request forms.

Step 4: Completing the Volunteer Shift

With approval in hand, the volunteer arrives to complete their service. While this seems straightforward, it is a vital part of the Volunteer Time Off process because it is where the “transaction” of time occurs.

On-Site Experience: Ensure the volunteer has a positive experience! Remember, 62% of individuals report that the ability to volunteer during business hours is a top factor for a positive experience. If they are using VTO, they are effectively “on the clock” for their employer while serving your mission. Treat their time with the same respect you would a major donor’s money.

Tracking Hours: Accurate timekeeping is essential. Whether you use a digital check-in system or a paper sign-in sheet, you must have a verifiable record of exactly when the volunteer started and stopped their shift. This data will be required for the final step of the process.

Step 5: Verification and Proof of Volunteerism

The final step in the Volunteer Time Off process occurs after the shift ends. To ensure the employee is paid for their time (and not docked a vacation day), they usually need to provide proof of volunteerism to their employer.

Methods of Verification:

The “Double Dip” Opportunity: This verification stage is the perfect moment to ask about other corporate giving programs. If a company offers VTO, there is a high likelihood that they also offer Volunteer Grants (monetary donations based on hours served) or Matching Gifts. When verifying hours, ask the volunteer: “Does your company also donate money for the hours you just served?”

Top Companies with Standout VTO Programs

Familiarizing yourself with major employers that offer VTO can help you target your outreach. If you see volunteers registering with email addresses from these domains, you know they likely have access to a VTO benefit.

1. Patagonia

Patagonia is a leader in corporate activism. Their program offers up to 18 paid volunteer hours per year. Furthermore, they offer an environmental internship program where employees can take up to two months of paid time away from work to volunteer with an environmental group.

2. Thomson Reuters

This major information conglomerate offers two paid days (16 hours) of volunteer time each year. Their program is inclusive of company-sponsored volunteer activities and focuses on local community investment .

3. Microsoft

A giant in corporate philanthropy, Microsoft is known for its high matching gift limits, but they also support volunteerism vigorously. They focus on accessible legal knowledge and services and hack-for-good tech innovation events .

4. Deloitte

Professional services firms are among the most likely to offer paid VTO. Deloitte offers generous VTO, encouraging their highly skilled workforce to engage in skills-based volunteering .

5. GM Financial

GM Financial structures their VTO to encourage regular engagement, offering 8 hours per quarter for full-time staff and 4 hours per quarter for part-time staff . This quarterly structure is perfect for recurring volunteer roles.

Marketing the VTO Opportunity to Your Supporters

Even the most generous VTO program is useless if the employee doesn’t use it. Nonprofits play a vital role in marketing these benefits. Here are several strategies to promote the Volunteer Time Off process to your audience.

1. Create a Dedicated “Volunteers” Page

Your website should have a centralized hub for volunteer resources. If you already have a volunteer page, incorporate specific information about paid volunteer time off programs. Explain that volunteering during the workday is a valid and encouraged way to support the organization.

2. Leverage Social Media

Social media is an excellent tool for inspiring action. Share information about VTO programs on your channels. Use engaging visuals and testimonials from volunteers who have successfully used their VTO days.

Example Post: “Did you know you could get paid to hang out with us? Many companies like [Company A] and [Company B] offer Volunteer Time Off. Check your benefits and spend a day giving back!”

3. Implement Personalized Outreach

If you have captured employer data during registration, use it! Implement personalized outreach that speaks directly to the donor’s employment status.

Strategy: Send an automated email to all volunteers who work at GM Financial, reminding them that their 8 hours of VTO resets every quarter.

4. Encourage Group Events

VTO is often used for team-building. Encourage your existing volunteers to organize group events. Sometimes, encouraging a single volunteer to rally their colleagues is all it takes to expand your reach significantly . Pitch a “Department Day of Service” where a whole team uses their VTO together.

Tools to Streamline the VTO Process

Managing the Volunteer Time Off process manually can be time-consuming, especially when dealing with multiple companies and verification methods. Investing in dedicated software can automate these steps and increase your revenue.

Double the Donation’s Solutions Tools like Double the Donation and its complete automation platform are not just for matching gifts. They maintain a massive database of over 24,000 company records that includes data on VTO and volunteer grants, too.

How Automation Helps:

By automating the identification and follow-up steps, you ensure that every eligible volunteer is aware of their benefit and knows exactly how to use it, without adding administrative burden to your volunteer coordinator.

Measuring Success and Optimizing Your Efforts

To ensure your focus on the Volunteer Time Off process is yielding results, you need to track the right metrics. Establish a baseline and monitor key performance indicators (KPIs) to refine your strategy.

Key Metrics to Track:

Continuous Improvement: Use the data you collect to solicit feedback from volunteers. Are they finding the internal approval process difficult? Are your volunteer shifts too short or too long for a standard VTO day? Use surveys to understand barriers and refine your donor journey.

Wrapping Up & Next Steps

Mastering the Volunteer Time Off process is a powerful way to diversify your support streams. It transforms the volunteer experience from a personal sacrifice of time into a professional benefit, allowing you to engage a workforce that is eager to give back but constrained by the 9-to-5 grind.

By understanding the steps—registration, eligibility, request, service, and verification—and actively marketing these opportunities, your nonprofit can build stronger relationships with corporate partners and secure the operational support you need to thrive.

Ready to start capitalizing on corporate volunteerism?

Don’t let these valuable hours go to waste. Start guiding your supporters through the VTO process today and watch your volunteer program grow. Plus, find out how Double the Donation Volunteering can help!

Maximizing Volunteer Time Off Requests for Nonprofits

/in Volunteer Time Off, Learning Center /by Erin LavenderThe most valuable resource a nonprofit has is its people. Volunteers power events, drive programs, and provide the essential manpower needed to fulfill your mission. Yet, for many dedicated supporters, the desire to help is often hampered by the constraints of a traditional work schedule. This is where corporate philanthropy steps in to bridge the gap. Through Volunteer Time Off (VTO) programs, companies pay their employees to step away from their desks and into their communities. However, accessing this benefit requires navigating a specific administrative hurdle: Volunteer Time Off Requests.

For nonprofits, understanding how these requests work is not just administrative trivia; it is a strategic necessity. When you demystify the request process for your supporters, you remove the barriers standing between your organization and hundreds of hours of skilled, reliable, and “free” labor. Furthermore, because VTO programs are often tied to volunteer grants (in which companies donate money for hours served), facilitating these requests can directly increase revenue.

In this guide, we’ll cover:

By mastering the mechanics of Volunteer Time Off Requests, your nonprofit can transform corporate policies into tangible impact, ensuring that your volunteers can afford to give you the time you so desperately need.

The Strategic Value of Volunteer Time Off

Volunteer Time Off (VTO) is a type of employee benefit where team members receive a designated number of hours to volunteer with nonprofit organizations above and beyond their existing paid time off. Essentially, it is a mechanism through which employees partake in volunteer activities during work hours for regular pay.

For nonprofits, the rise of VTO is a game-changer. It provides operational support without added costs and produces a larger pool of supporters to engage with by removing financial and logistical barriers. When supporters are compensated by their employers for the time they spend with you, they are more likely to get involved and continue their support over time.

Moreover, the prevalence of these programs is skyrocketing. The number of companies offering VTO has increased by two in three over the last decade. With 66% of employers providing some sort of paid time off program for volunteering, the potential for your nonprofit to tap into this resource is massive.

Did You Know? Lack of time is the primary barrier to volunteerism. 49% of individuals state that work commitments are their biggest obstacle to volunteering. However, 62% of individuals report that the ability to volunteer during business hours would be the top factor for a positive experience. Promoting Volunteer Time Off Requests directly solves this problem.

The Anatomy of a Volunteer Time Off Request

To help your volunteers utilize their benefits, you must understand what they are required to submit to their employers. While every company has a slightly different portal or policy, a standard Volunteer Time Off Request generally requires specific data points to ensure the time is being used for legitimate charitable purposes.

This request is the formal internal process an employee must complete to get paid for their time away. It typically includes three main categories of information:

1. Employee and Policy Information

The company needs to verify that the requester is eligible for the benefit.

Employee Eligibility: Not all staff members may qualify. The request often cross-references the employee’s status (full-time vs. part-time) against the company’s guidelines.

Accrued Hours: The form will check the VTO hours the employee has accrued or is allotted for the year. For example, companies with paid VTO programs offer an average of 20 hours per year.

2. Nonprofit Information

The employer must verify that your organization is a valid charity.

Eligible Organizations: The request will ask for your nonprofit’s name and likely your tax ID or 501(c)(3) status to ensure you meet the company’s philanthropic criteria.

Contact Details: You may need to provide a contact name or email at your organization who can verify the volunteer’s attendance.

3. Volunteer Activity Information

This section details what the employee will actually be doing.

Qualifying Activities: The employee must describe the activity to ensure it aligns with the company’s values and VTO policy.

Date and Duration: The specific date of the shift and the number of hours requested are crucial for payroll giving purposes.

Quick Tip: Create a “VTO Cheat Sheet” for your volunteers. This simple PDF or webpage should list your organization’s legal name, Tax ID/EIN, a brief description of volunteer duties, and the contact info for your volunteer coordinator. When a volunteer opens their corporate portal to submit a Volunteer Time Off Request, having this info ready makes the process frictionless.

The Lifecycle of a VTO Request

Navigating the corporate bureaucracy can be intimidating for volunteers. By understanding the lifecycle of a request, your nonprofit can guide supporters through each stage, ensuring they don’t drop out of the process due to confusion.

Step 1: Identification and Registration

The process begins when a supporter registers for an event or shift with your nonprofit. At this stage, it is critical to identify where they work. If you know their employer, you can inform them of their VTO eligibility immediately.

Step 2: Submission of the Request

Before the volunteer shift occurs, the employee must log into their company’s HR or CSR portal to submit the formal request. They will input the dates, times, and your organization’s details. This acts as a request for time off, similar to asking for a vacation day, but coded specifically as volunteer service.

Step 3: The Approval Process

Once submitted, the request enters an internal approval process. This usually involves the employee’s direct manager approving the time away from work to ensure it doesn’t interfere with business operations. It may also involve the CSR department verifying that your nonprofit is an eligible 501(c)(3).

Step 4: Completing the Service

The volunteer completes their shift with your organization. This is the most important part! Ensure they sign in and out so you have an accurate record of their hours.

Step 5: Verification and Follow-Up

After the event, the employee may need to provide proof of service to their employer to finalize the VTO claim. Furthermore, this is the perfect moment to encourage the volunteer to check if their company also offers a volunteer grant (a monetary donation for hours served). 40% of Fortune 500 companies offer volunteer grant programs, so a VTO request often opens the door to further funding.

Top Companies with Standout VTO Programs

Familiarizing yourself with companies that offer generous VTO policies helps you target your outreach. If you see volunteers registering with email addresses from these domains, you should immediately encourage them to submit a Volunteer Time Off Request.

Patagonia

Patagonia is a leader in corporate activism. Their program offers up to 18 paid volunteer hours per year. Furthermore, they offer an environmental internship program where employees can take up to two months of paid time away from work to volunteer with an environmental group.

Thomson Reuters

This major information conglomerate offers two paid days (16 hours) of volunteer time each year. Their program is inclusive of company-sponsored volunteer activities and focuses on local community investment.

GM Financial

GM Financial structures their VTO to encourage regular engagement. They offer 8 hours of VTO per quarter for full-time staff and 4 hours per quarter for part-time staff, focusing on strengthening communities.

Microsoft

A giant in corporate philanthropy, Microsoft is known for its high matching gift limits, but they also support volunteerism vigorously. While they focus heavily on pro bono services, they are a prime example of a company that integrates volunteering into its culture.

Sentinel Group

Sentinel Group offers two paid days of service (16 hours) each year, focusing on education, communities, and health and wellness.

Marketing Strategies to Drive Requests

Your volunteers likely don’t know they have VTO available, or they don’t know how to use it. It is up to your nonprofit to market the opportunity. Here are several strategies to promote Volunteer Time Off Requests to your supporter base.

1. Dedicate a Page on Your Website

Create a centralized “Volunteers” page on your website. If you already have one, update it to include specific information about paid volunteer time off programs. Explain that volunteering during the workday is a valid and encouraged way to support the organization and link to resources that explain the request process.

2. Leverage Social Media

Social media is an excellent tool for inspiring action. Share information about VTO programs on your channels. Use engaging visuals and testimonials from volunteers who have successfully used their VTO days to “take a day off to do good”. This social proof can be the nudge other supporters need to submit their own requests.

3. Identify Opportunities with Employer Data

Your supporters’ employment data contains a wealth of information about available engagement opportunities. If you already know where a volunteer works, look into the company’s volunteer incentive programs. If you don’t have this data, consider using a corporate giving database tool or an employer append service to fill in the gaps.

4. Implement Personalized Outreach

Once you identify supporters who work for companies with VTO programs, initiate tailored communications. Don’t just reach out to current volunteers; engage donors who work for VTO companies as well. Focus your outreach on the benefits of paid volunteerism—a meaningful experience and a fun day out of the office.

5. Encourage Group Events

If you have existing supporters who work for companies with paid VTO policies, see if they would be willing to rally their colleagues. Encouraging a single volunteer to organize a group activity can expand your reach significantly. Corporate teams often look for VTO opportunities that accommodate groups, so positioning your nonprofit as “VTO-friendly” for groups is a smart strategy.

Leveraging Technology to Automate Requests

Managing the nuances of different corporate policies can be time-consuming. Fortunately, technology can streamline the Volunteer Time Off Request process, ensuring you capture every available hour without overburdening your staff.

Seamless Integration

Tools like Double the Donation integrate directly with your volunteer management software. When a volunteer registers for a shift, the system can prompt them to search for their employer. This captures employment data at the moment of highest intent.

Actionable Insights

Once the employer is identified, the database connects eligible supporters to volunteer grant and VTO opportunities. The system can provide the volunteer with their specific company’s guidelines, forms, and instructions, effectively automating the “how-to” portion of the request.

Automated Follow-Up

You can set up automated email streams to drive supporters to claim volunteer grants and VTO. For example, if a volunteer from Thomson Reuters signs up for a shift, the system can automatically send them an email reminding them that they have 16 hours of paid volunteer time available and linking them to the portal where they can submit their request.

Wrapping Up & Next Steps

Volunteer Time Off Requests represent a massive, underutilized opportunity for nonprofits to increase their capacity and deepen relationships with corporate partners. By shifting the perspective of volunteerism from a “nights and weekends” activity to a part of the professional work week, you open the door to a new demographic of skilled, energetic supporters.

The key to success lies in education and facilitation. Your volunteers want to help, but they need you to show them how to navigate the corporate process. By providing the right information, marketing the opportunity effectively, and leveraging technology to automate the nudges, you can turn corporate VTO policies into real-world impact for your mission.

Ready to start maximizing your corporate volunteer support?

Don’t let these valuable hours go to waste. Start guiding your supporters through the VTO process today. Plus, find out how Double the Donation Volunteering can help!

Principal Gift Fundraising: Securing Transformational Gifts

/in Learning Center, Nonprofit Basics /by Adam WeingerNonprofits thrive on the support of major donors. The most major of the major gifts a nonprofit might receive are called principal gifts.

Principal gifts bring transformational benefits and drive incredible impact, growing organizations’ capacities to run programs, serve constituents, and make a difference. They’re elusive but achievable when you have an intentional strategy to identify and secure them.

What’s a Principal Gift?

Simply put, a principal gift is a large donation made to a nonprofit by a major donor.

Nonprofits commonly consider principal gifts to be worth $1 million or more, but it’s important to remember that their exact value is relative to the size of an organization’s average gifts. You can define a rough range for major giving for your organization by identifying your top 25 or so gifts received within the past five years and determining the median of this range. This number can serve as a minimum for defining major gifts. Principal gifts would fall at the very top of (or far above) this range.

So how do you snag a principal gift? What background knowledge and strategies do you need to succeed and start transforming your organization?

In this crash course, we’ll take a closer look at principal gifts, how to pursue them, and other ways to maximize the value of your development efforts through tactics like corporate philanthropy.

Understanding Principal Gift Fundraising

Before you can begin laying out a principal gift fundraising strategy, you’ll need to understand some important context.

Principal gifts vs. major gifts: What’s the difference?

When it comes to principal gifts and major gifts, there are a few key things you’ll want to know. While a principal gift is a major gift, a major gift is not necessarily a principal gift. (Think: all squares are rectangles, but not all rectangles are squares.)

As explained above, your organization’s definition of a major gift is highly relative to your donor base and average fundraising data. A principal gift is simply a large gift at the top of or above that range of major giving.

Nonprofits pursue major and principal gifts using similar tactics but note that principal gifts have an especially long lifecycle. The larger the gift, the more discussions, care, and due diligence that go into the process. This is also true because principal gifts can generate significant publicity when given by high-profile philanthropists. Options should be weighed carefully before nonprofits and principal donors make public “investments” in one another and link their images.

You may also encounter the term lead gift. These are also large major gifts, but they’re received specifically in the context of major fundraising campaigns. A capital campaign’s fundraising goal, for example, is traditionally topped by a large lead gift, followed by a couple of smaller (but still major) gifts, and then more and smaller gifts down the line in a pyramid structure. This approach is highly efficient, allowing nonprofits to focus first on the handful of highest-impact gifts that will push the campaign the furthest forward.

Who gives principal gifts?

Major donors give principal gifts to nonprofits.

Sometimes, but not always, these donors are high-profile, high-wealth philanthropists—think Mackenzie Scott making waves in the nonprofit world with a new mega-gift. This situation is often what nonprofits imagine when they hear the term “principal gift.”

But again, it’s important to remember that the value of major gifts is relative and that no two donors are alike. What they do have in common is the capacity and inclination to give major gifts, whatever that might mean for your organization.

If you’ve taken concrete steps to invest in prospect research and major gift fundraising, there’s a good chance you’re already in touch with (or in the orbit of) a potential principal gift donor for your organization’s major giving range.

How are principal gifts usually given?

Principal gifts are not usually given out of cash but rather from saved assets (or a mix of cash and assets).

These non-cash assets often include:

When you pursue large donations, it’s important to be flexible in the types of gifts you can accept. Wealthy donors often prefer to give from saved assets rather than from liquid cash, not only because this won’t affect their day-to-day finances but also for the unique tax benefits that different non-cash gifts can bring. We’ll explore this best practice in greater detail below.

How do nonprofits pursue these gifts?

Nonprofits pursue principal gifts as part of their development programs, typically overseen by a dedicated staff member.

Nonprofit development provides the core structure and processes for principal gift fundraising. Having a development approach in place is generally a prerequisite for success. (Keep in mind, though, that even small shops succeed with development with the right tools and prioritization tactics!)

The fundraising strategies used for principal gifts are similar to those for other major gifts but heightened in intensity. One-on-one engagement is even more important for principal gift fundraising, for example. Other best practices take increased emphasis, as well, like the importance of networking in the prospect identification process.

How can you frame a principal gift as a high-impact challenge match?

When soliciting a gift of this magnitude (such as $1M or more), you aren’t just asking for a donation. Instead, you are inviting the donor to become a strategic partner. One of the most effective ways to do this is by positioning the principal gift as the funding source for a multi-year challenge match campaign.