What Are Corporate Grants for Nonprofits? Guide + Examples

Securing funding is a top priority for charitable organizations, and corporate grants for nonprofits can be a game-changer. From powering community programs to supporting innovative solutions for societal challenges, these funds provide critical resources to help nonprofits achieve their missions. But what exactly are corporate grants, and how can nonprofits tap into this valuable funding source?

In this guide, we’ll break down what corporate grants are, how they work, and the different types available. We’ll also share examples of successful corporate grant programs and actionable tips for nonprofits to enhance their grant application strategies.

And we’ll do so by answering the following frequently asked questions:

- What are corporate grants for nonprofits?

- Why do companies provide corporate grants for nonprofits?

- How do nonprofits benefit from corporate grants?

- How can organizations obtain corporate grants?

- What companies offer corporate grants for nonprofits?

Whether you’re new to the grant-seeking process or are simply looking to refine your approach, this resource is designed to help your organization secure impactful partnerships with corporate funders. Let’s begin!

What are corporate grants for nonprofits?

Corporate grants for nonprofits are financial contributions made by companies to support charitable organizations, initiatives, or projects that align with the company’s philanthropic goals or Corporate Social Responsibility (CSR) efforts. These grants can be one-time donations or part of an ongoing partnership and typically aim to address specific social issues or community needs.

While there’s no one-size-fits-all structure, it’s essential to recognize that corporate grants can be provided in various forms. These include:

- Direct Grants: Cash or funding provided to nonprofit organizations to support a particular program or project.

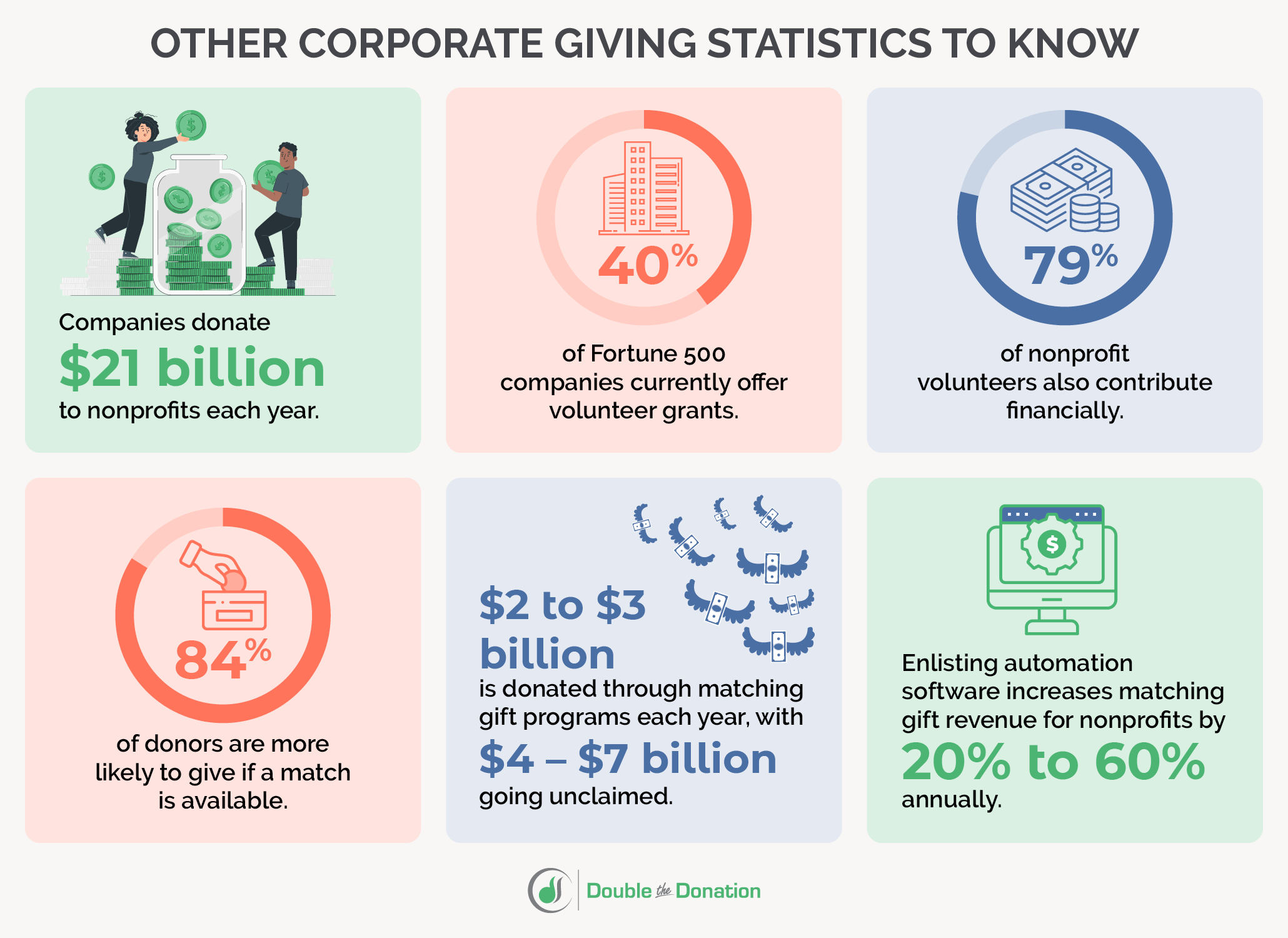

- Matching Grants: Companies match donations made by employees to qualified nonprofits, often on a dollar-for-dollar basis.

- In-kind Grants: Non-cash support, such as product donations, services, or resources, which can assist nonprofits in their operations or programs.

- Challenge Grants: A type of grant where the company pledges to contribute funds only if the nonprofit can raise a certain amount from other sources.

All in all, corporate grants offer nonprofits a significant source of funding and can also strengthen relationships between businesses and the communities they serve.

Why do companies provide corporate grants for nonprofits?

There are a number of reasons why a company might offer a grant to a nonprofit. While altruism may play a role in things, other corporate benefits offered by grant-making include:

Increased Social Responsibility

Many companies provide grants to support social causes and give back to their communities. Through corporate grants, businesses can contribute to addressing societal challenges, such as education, health, environmental sustainability, and poverty alleviation. Doing so helps them align with their CSR strategies and demonstrate their commitment to social good, which is often important to consumers and employees alike.

Enhanced Corporate Image and Reputation

Supporting nonprofits through grants can enhance a company’s public image and reputation. Companies that contribute to community well-being are often viewed more positively by customers, investors, and employees. As a result, philanthropy can build trust, loyalty, and goodwill, ultimately benefiting the company’s brand.

Growth in Employee Engagement and Satisfaction

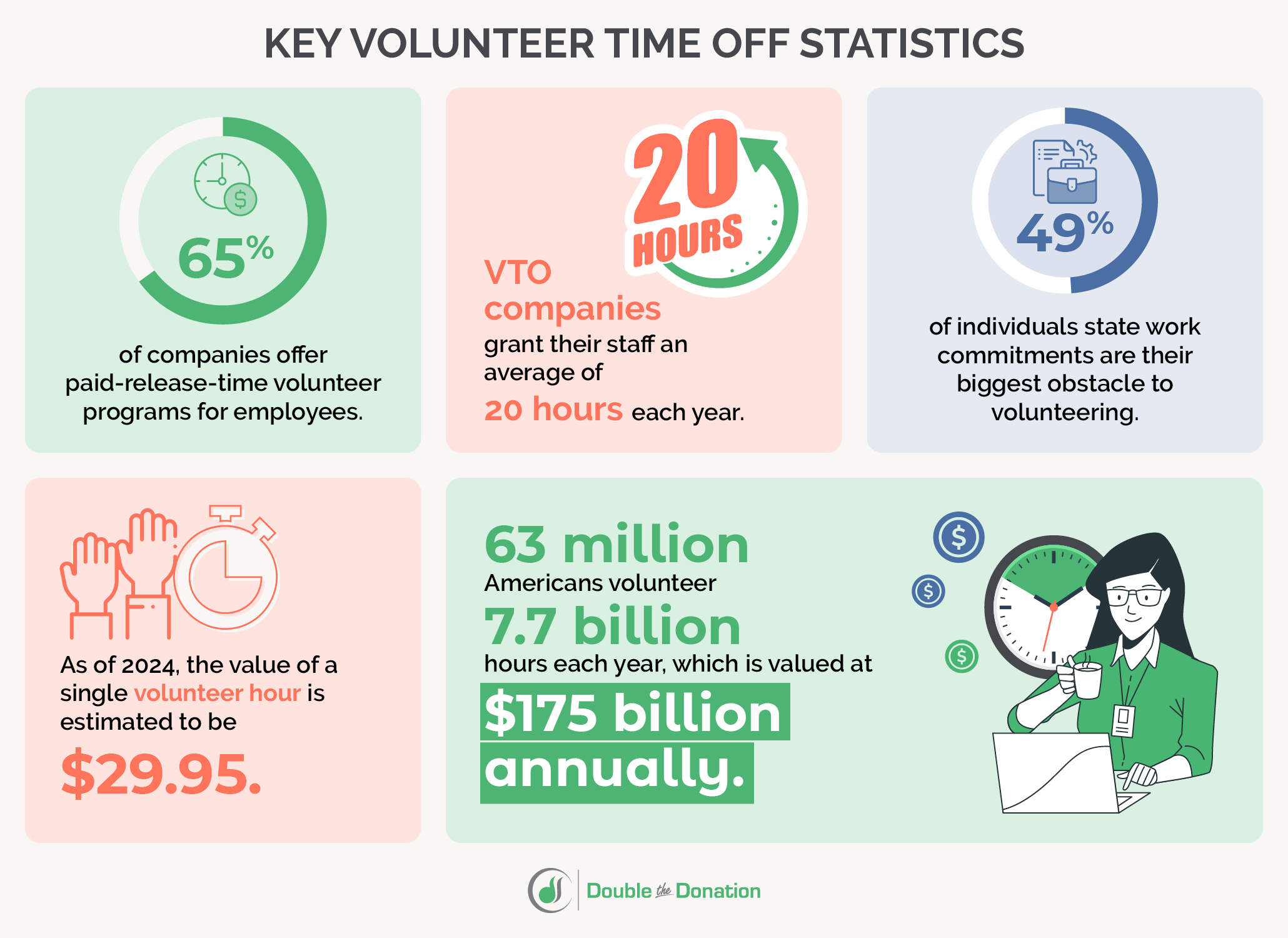

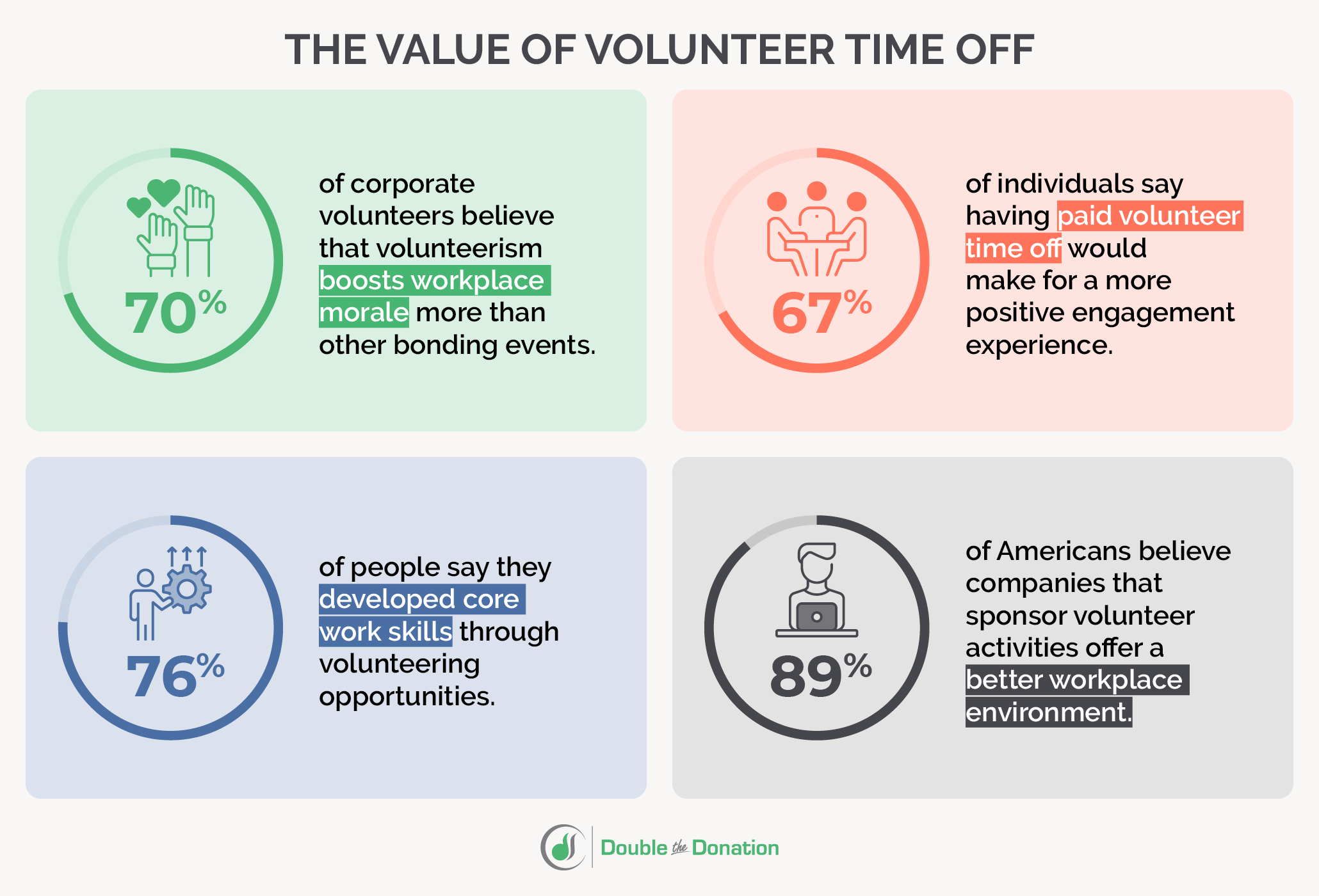

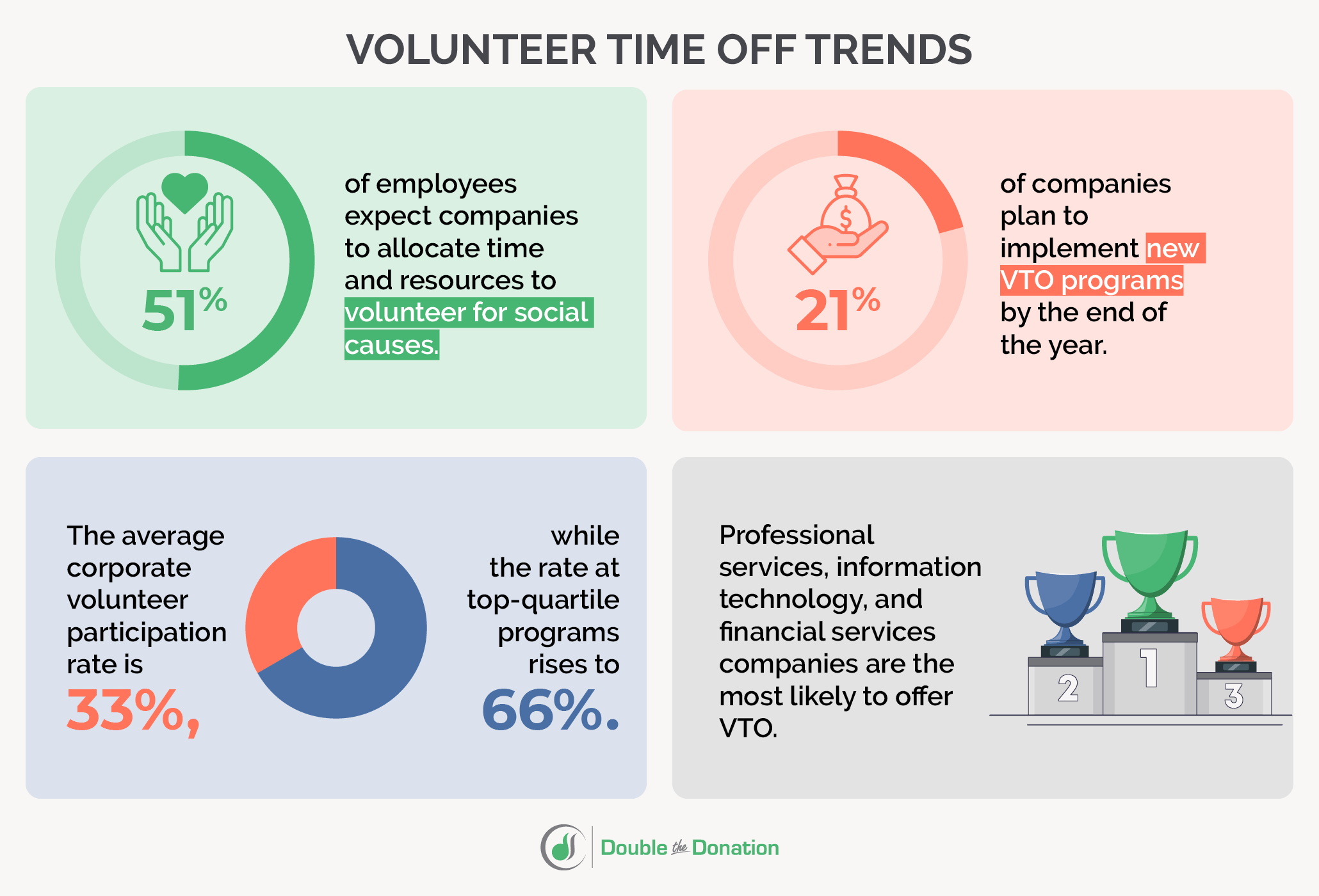

Companies often provide grants as part of broader employee engagement strategies. This funding, especially matching gifts or volunteer grants, can encourage employees to donate to causes they care about, fostering a sense of pride in the company. Offering grants can improve employee morale and loyalty while fostering a culture of giving within the workplace.

Deepened Community Relations

By supporting nonprofits, companies can deepen their ties to the communities in which they operate. Doing so can improve relationships with local stakeholders, including government entities, customers, and community leaders. It can also help companies better understand and respond to community needs.

Annual Tax Benefits

Corporate grants to nonprofits can offer tax advantages for companies. In many regions, businesses can deduct charitable contributions from their taxable income, which reduces their overall tax liability. These benefits can make corporate giving a financially beneficial strategy, in addition to being socially responsible.

Strengthened Partnerships and Collaborations

Through grants, companies can build long-term relationships with nonprofit organizations that align with their business values. These partnerships can lead to co-branded initiatives, marketing opportunities, or collaboration on community-based projects, further benefiting both parties.

Overall, corporate grants serve both as a tool for enhancing a company’s reputation and as a means to create a meaningful, lasting impact within society.

How do nonprofits benefit from corporate grants?

Corporate grants provide fundraising organizations with additional, often much-needed revenue. But the advantages don’t stop there!

Check out the following benefits offered by corporate grants for nonprofits:

Financial Support for Programs and Operations

Corporate grants provide nonprofits with the funding they need to support their programs, operations, or special projects. This financial support allows nonprofits to execute their missions, expand their initiatives, and create a more significant impact in the communities they serve.

Increased Visibility and Credibility

Often, receiving a corporate grant elevates a nonprofit’s visibility and credibility. Being associated with well-known, reputable companies can build trust with donors, volunteers, and the general public. It signals that the nonprofit is trustworthy and capable of managing significant funding.

Access to New Resources

Beyond financial support, corporate grants sometimes include in-kind donations of goods or services. In-kind grants can include technology, office supplies, expertise, or even employee volunteers. These additional resources can help nonprofits reduce costs, improve efficiency, and enhance their capacity to serve their beneficiaries.

Opportunities for Long-Term Partnerships

Corporate grants can lead to long-term relationships and partnerships with businesses. These partnerships may evolve to include joint campaigns, co-branded initiatives, or additional financial support in the long run.

Employee Engagement and Support

Some companies encourage their employees to become more engaged with nonprofits by offering matching gift programs or volunteer incentives. These initiatives can help nonprofits build stronger relationships with individual donors and increase their supporter base, as employees of the company may be more likely to contribute to causes supported by their employers.

Strengthening Community Relationships

Receiving support from a local or national company can help a nonprofit strengthen its ties to the community. Corporate grants help nonprofits expand their reach and impact, fostering deeper community engagement, which can, in turn, lead to more donors, volunteers, and advocates.

Increased Credibility with Other Funders

When a nonprofit receives funding from a reputable company, it may enhance its ability to attract additional funding from other sources, such as foundations or individual donors. Corporations often have rigorous vetting processes, so their endorsement can serve as a seal of approval for other funders.

Opportunities for Marketing and Publicity

Corporate grants can provide nonprofits with opportunities for joint marketing campaigns, events, or publicity efforts that raise awareness of their cause. Companies often help nonprofits with public relations and media outreach, which can help generate visibility for the nonprofit’s work.

In summary, corporate grants provide nonprofits with the financial support and resources necessary to grow their programs, increase their visibility, and build long-term, beneficial relationships with businesses. These grants help strengthen the nonprofit’s overall impact and sustainability.

How can organizations obtain corporate grants?

Now that you better understand the corporate grant opportunity, how can you solicit and secure the best grants for your nonprofit? It doesn’t have to be complicated!

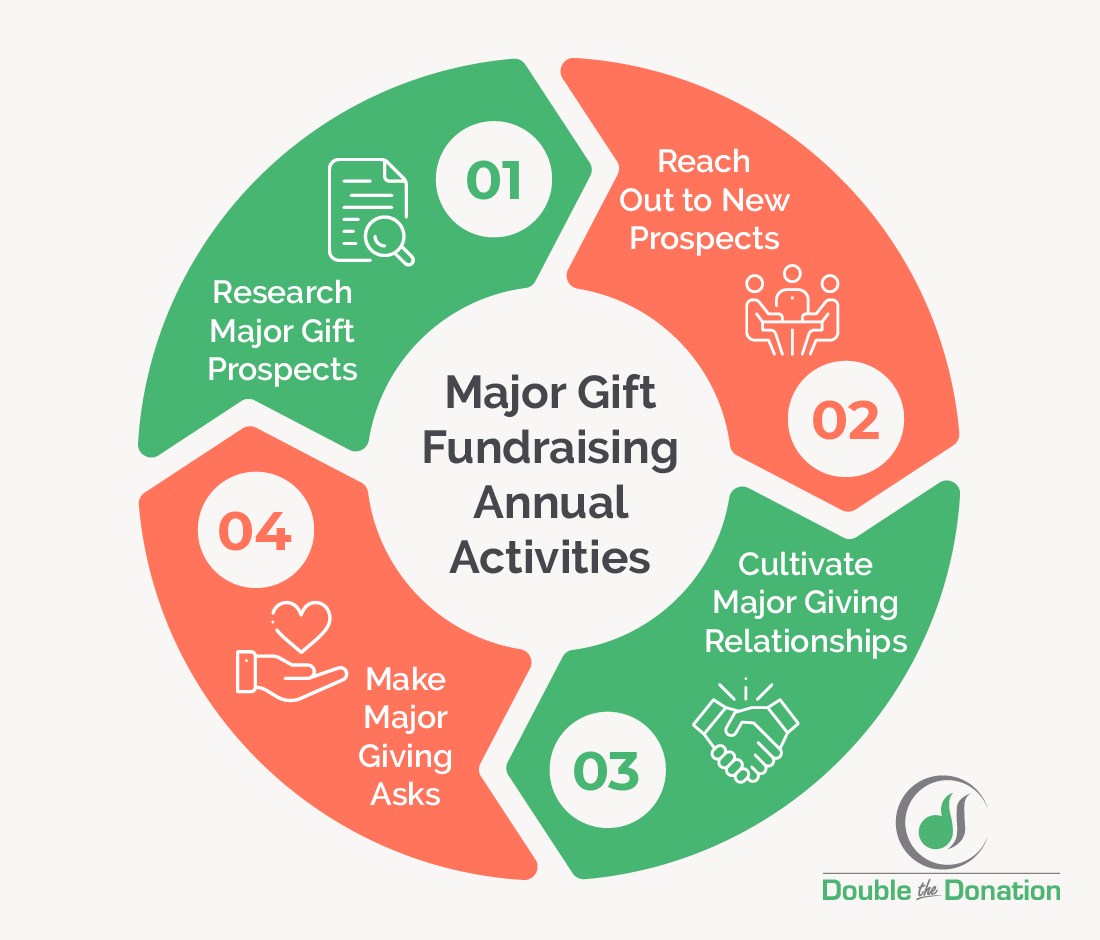

Obtaining corporate grants is a dedicated process that includes the following steps:

1. Identifying Potential Corporate Grant Makers

To begin locating grant opportunities, research companies that offer grants or support the work your organization prioritizes. Doing so can involve:

- Browsing company websites: Many companies have dedicated CSR or philanthropy pages that outline their grant programs, eligibility requirements, and application processes.

- Leveraging grant databases: Platforms like Foundation Center, GrantStation, Guidestar, or Double the Donation provide searchable databases that include corporate giving opportunities.

- Implementing networking and outreach: Attend corporate philanthropy events, industry conferences, or other professional groups to learn about potential corporate grant opportunities.

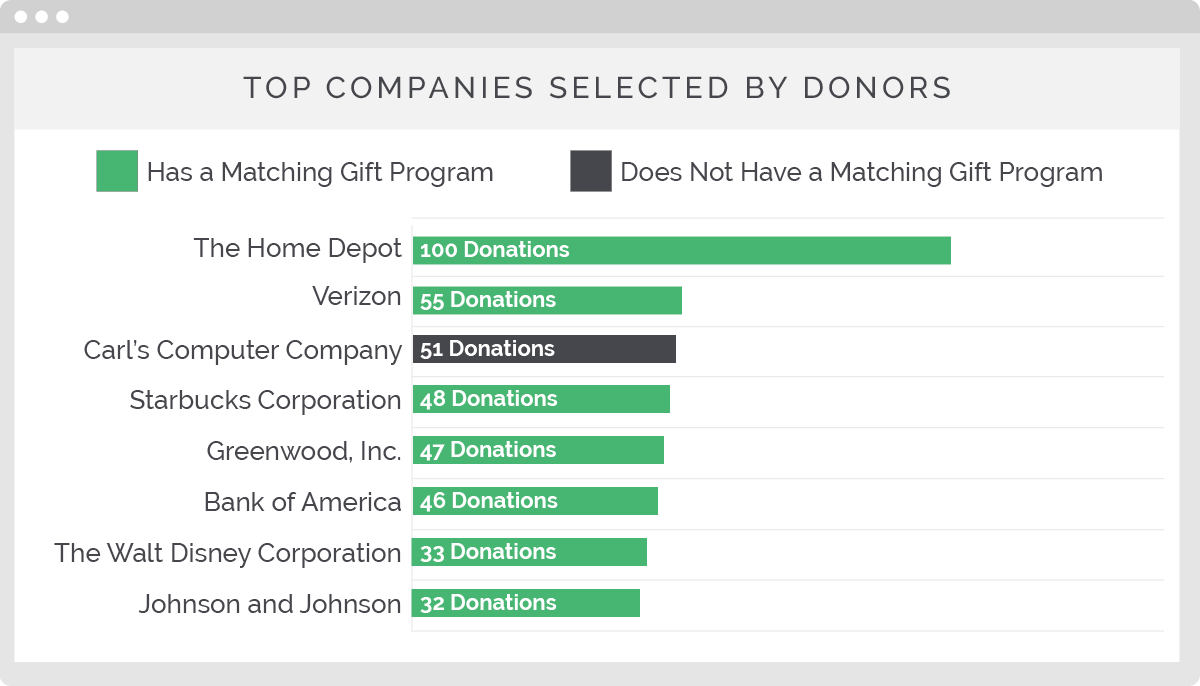

- Utilizing donor employment information: See if your donors’ employing companies offer grants for nonprofits. You already have an opportunity to get your foot in the door—employee interest!

2. Aligning Your Mission with Corporate Priorities

Corporate grants are often aligned with a company’s values, mission, or CSR focus areas. In order to ensure available grants fit well with their own organization’s efforts, nonprofits should start by researching the company’s CSR strategy. Identify if their giving aligns with the nonprofit’s work (e.g., education, healthcare, or environmental sustainability).

You may also want to take a look at corporate giving patterns. For example, some companies prefer supporting local causes, employee-driven initiatives, or specific social issues, while others may have a broader national or international scope.

3. Researching Corporate Grant Criteria

Corporate grants often have specific application processes, guidelines, and deadlines. For the best results, it’s a good idea for your team to:

- Review eligibility criteria: Ensure your nonprofit meets the company’s qualifications (e.g., tax-exempt status, geographic location, type of project).

- Understand the funding process: Companies may request proposals, impact reports, or specific documentation. Be prepared to meet the requirements.

- Track deadlines: Many companies have annual grant cycles, so it’s integral that you stay on top of when applications are due.

4. Building Relationships with Corporate Partners

Establishing connections with companies can increase the likelihood of securing grants. In order to do so effectively, nonprofits should…

- Leverage existing connections: Engage with companies that have employees or leadership who are already involved with or passionate about the nonprofit’s mission.

- Attend networking events and conferences: Companies often attend events to connect with nonprofits, so it’s a good idea to participate and build relationships with corporate representatives.

- Reach out directly: Contact the company’s CSR or community relations department to inquire about available funding opportunities and to introduce the nonprofit’s work.

5. Crafting a Compelling Grant Proposal

A strong, clear, and well-structured grant proposal is essential for securing corporate funding. As you begin crafting your grant proposals, you’ll want to::

- Clearly outline your nonprofit’s mission: Explain the organization’s mission, values, and the work being done in the community or with specific populations.

- Detail the specific project or program: Provide a clear description of the project or program that will benefit from the grant. This section should include goals, target outcomes, and how it aligns with the company’s CSR objectives.

- Show measurable impact: Include metrics that demonstrate how the grant will contribute to tangible results and how success will be measured.

- Provide a budget: Include a detailed budget that explains how the funds will be spent and how they will support the project’s goals.

- Include a sustainability plan: Highlight how the nonprofit plans to sustain the project after the corporate grant has been used.

6. Submitting the Grant Application

It’s vital that you properly submit your grant application in order to ensure it makes its way to corporate leadership for decision-making. After submitting a corporate grant proposal, it’s critical that you:

- Follow the submission guidelines: Pay close attention to the company’s preferred method of submission, such as online portals, email, or mail.

- Submit required documentation: Ensure all requested materials (e.g., tax-exempt status, financial statements, board of directors list) are included with the application.

7. Following Up and Staying Engaged

Don’t forget about a grant once you’ve completed your application! Instead, the art of following up well is essential.

After submitting a corporate grant proposal, it’s important to:

- Send a thank-you note: Acknowledge the company’s consideration of the grant request, expressing appreciation for their time and attention.

- Keep in touch: Even if the nonprofit isn’t selected for a grant, maintaining communication with corporate grantmakers can build a relationship for future funding opportunities.

- Stay engaged with the company’s initiatives: Participate in corporate social responsibility events or initiatives the company hosts, which can further deepen the nonprofit’s relationship with the company.

8. Reporting on Grant Impact

Finally, many corporate grantmakers require progress or impact reports to track how their contributions are being used. In order to maintain compliance with the funder, organizations should:

- Keep detailed records: Track how the grant is spent and document the outcomes.

- Provide regular updates: Share reports, photos, or stories about the progress and impact of the funded project.

- Acknowledge the company: Highlight the company’s support on social media, in newsletters, or during events, recognizing their contribution and further fostering the relationship.

By following these steps, nonprofits can increase their chances of successfully obtaining corporate grants and building long-term partnerships with businesses that align with their mission.

What companies offer corporate grants for nonprofits?

Many companies offer corporate grants for nonprofits, especially those with robust Corporate Social Responsibility (or CSR) programs. Below are some examples we’ve compiled of 25 companies known for providing generous grants.

Note: These companies often have specific criteria and application processes, so nonprofits should research each company’s giving priorities and guidelines to determine if they are eligible for funding. Additionally, many of these companies offer employee giving programs, which can be a valuable way for nonprofits to receive additional funding.

Bank of America

Bank of America offers grants through its Charitable Foundation, primarily focusing on economic mobility, workforce development, education, and health.

In order to support nonprofits in their communities, the company provides cash grants and resources aimed at fostering long-term social and economic progress, with an emphasis on creating equitable opportunities in underrepresented communities.

Other giving programs include: Matching gifts ✔️ Volunteer grants & VTO ✔️

Learn more and apply for the grant here.

Google for Nonprofits is a program that offers grants and in-kind support to eligible nonprofits. The program focuses on empowering organizations through technology, education, and sustainability initiatives, and nonprofits benefit from free access to Google tools, including Google Ads, Google Workspace, and other cloud resources.

Google also offers financial grants to organizations leveraging technology to address social challenges, enabling them to amplify their impact and reach broader audiences.

Other giving programs include: Matching gifts ✔️ Volunteer grants & VTO ✔️

Learn more and apply for the grant here.

Target

The Target Foundation focuses its grants on education, arts and culture, social services, and environmental sustainability. The company’s community giving efforts are dedicated to supporting youth education programs, arts initiatives, and nonprofit organizations that contribute to environmental conservation and social equity.

Target provides grants to nonprofits working to improve communities and create opportunities for underserved populations, with particular emphasis on initiatives that promote educational access and community engagement.

Other giving programs include: Volunteer grants ✔️

Learn more and apply for the grant here.

Microsoft

Microsoft Philanthropies supports nonprofits that focus on education, technology access, and economic development. The company’s grant programs are designed to promote digital literacy, provide educational opportunities, and improve community well-being through technology.

All in all, Microsoft’s philanthropic efforts are aimed at reducing the digital divide by supporting nonprofits that enhance technology access and build skills in underserved populations, ultimately contributing to long-term economic growth.

Other giving programs include: Matching gifts ✔️ Volunteer grants & VTO ✔️

Learn more and apply for the grant here.

Nordstrom

Nordstrom’s corporate giving focuses on community-based programs related to youth, education, and workforce development. The company offers grants to nonprofits that align with its commitment to providing opportunities for young people and helping them gain essential life skills.

Nordstrom also supports organizations that promote career readiness and leadership development, particularly in the areas of fashion, retail, and business.

Other giving programs include: Matching gifts ✔️ Volunteer grants ✔️

Learn more and apply for the grant here.

Clif Bar

The Clif Bar Family Foundation offers grants to nonprofits working in the areas of environmental sustainability, food systems, and outdoor recreation. Clif Bar supports initiatives that align with their values of promoting sustainability, health, and environmental stewardship.

Their grants focus on projects that address issues like climate change, biodiversity, healthy food systems, and the promotion of outdoor activities, aiming to create lasting positive impacts on communities and the environment.

Other giving programs include: Matching gifts ✔️

Learn more and apply for the grant here.

Coca-Cola

The Coca-Cola Foundation provides grants that focus on water access, community development, education, and healthy living. The company supports nonprofits that address critical global issues, particularly in water conservation, sustainability, and improving access to clean water.

Coca-Cola also funds initiatives that promote education, community empowerment, and health, with an emphasis on enhancing the well-being of underserved populations.

Other giving programs include: Matching gifts ✔️

Learn more and apply for the grant here.

Dick’s Sporting Goods

The Dick’s Sporting Goods Foundation offers grants to nonprofits focused on youth sports, education, and community development. Their programs aim to inspire and enable young people to participate in sports and develop leadership skills.

The foundation’s grants are designed to provide funding for organizations that increase access to sports programs, promote physical fitness, and support the development of young athletes in underserved communities.

Learn more and apply for the grant here.

Geico

Geico offers corporate grants through its philanthropic initiatives, with a focus on education, health, and community development. The company supports nonprofit organizations that improve access to education, promote wellness, and strengthen local communities.

Geico’s grants are often directed toward initiatives that address specific community needs, including youth development, disaster relief, and supporting military families.

Other giving programs include: Matching gifts ✔️

Learn more and apply for the grant here.

Kroger

The Kroger Foundation focuses on hunger relief, health, and sustainability. The company’s grants are dedicated to reducing food insecurity, supporting sustainable agriculture, and promoting healthy lifestyles.

Kroger provides funding to nonprofits that work to address the root causes of hunger and nutrition disparities, especially in underserved communities. Their philanthropic efforts also extend to environmental sustainability and education initiatives.

Learn more and apply for the grant here.

State Farm Insurance

State Farm Insurance offers grants through the State Farm Foundation, focusing on community development, education, and safety initiatives. The foundation supports nonprofits that enhance public safety, promote financial literacy, and provide educational opportunities to underserved populations.

State Farm’s grants are aimed at improving community resilience, safety, and accessibility to essential resources for individuals and families in need.

Other giving programs include: Matching gifts ✔️ Volunteer grants & VTO ✔️

Learn more and apply for the grant here.

Walmart

The Walmart Foundation provides grants that support hunger relief, education, workforce development, and sustainability. Walmart’s philanthropic efforts focus on tackling food insecurity, improving educational opportunities, and supporting initiatives that promote economic development in local communities.

The foundation also funds environmental sustainability programs, helping nonprofits that address issues like climate change and resource conservation.

Other giving programs include: Matching gifts ✔️ Volunteer grants ✔️

Learn more and apply for the grant here.

Wells Fargo

Wells Fargo’s philanthropic focus is on community development, education, and environmental sustainability. The Wells Fargo Foundation supports nonprofit organizations that foster financial literacy, improve housing and workforce development, and promote educational access.

The company also funds environmental initiatives that aim to address climate change, resource management, and sustainable practices within communities.

Other giving programs include: Matching gifts ✔️ Volunteer grants & VTO ✔️

Learn more and apply for the grant here.

Costco

Costco’s charitable giving is focused on education, health, and community support. The company provides grants to nonprofits that promote access to education, improve health outcomes, and contribute to community development.

Costco’s support is often directed toward programs that help low-income and underserved populations, with a particular emphasis on youth services and health initiatives.

Other giving programs include: Executive matching gifts ✔️

Learn more and apply for the grant here.

Best Buy

The Best Buy Foundation supports nonprofits that focus on youth, education, and technology access. The company offers grants to organizations that provide tech-related education, mentorship, and skills-building programs for young people, particularly those in underserved communities.

Best Buy’s grants help increase access to technology and digital literacy, empowering the next generation of innovators.

Other giving programs include: Matching gifts ✔️ Volunteer grants ✔️

Learn more and apply for the grant here.

Lowe’s

Lowe’s offers grants through its Lowe’s Foundation, focusing on community improvement, homebuilding, and disaster relief. The foundation supports nonprofits that are improving the quality of life in local communities, particularly those engaged in building and renovating homes for low-income families.

Lowe’s also funds disaster recovery and rebuilding efforts, especially in communities affected by natural disasters.

Other giving programs include: VTO ✔️

Learn more and apply for the grant here.

General Motors

General Motors (also known as GM) offers grants through the GM Foundation, supporting education, community development, and sustainability. GM’s philanthropic initiatives focus on STEM education, workforce development, and environmental sustainability.

The GM Foundation provides funding for programs that enhance educational access, improve career readiness, and support environmental projects that help communities thrive.

Other giving programs include: Matching gifts ✔️ Volunteer grants ✔️

Learn more and apply for the grant here.

Verizon

Verizon offers corporate grants through the Verizon Foundation, with a focus on education, healthcare, and community empowerment. The foundation supports nonprofit organizations that leverage technology to promote digital literacy, improve access to healthcare, and enhance education opportunities.

Verizon’s grants are designed to help organizations address social issues through technology-driven solutions.

Other giving programs include: Matching gifts ✔️ Volunteer grants & VTO ✔️

Learn more and apply for the grant here.

Ford

The Ford Motor Company Fund offers grants to nonprofits focused on community development, education, and environmental sustainability. The fund supports organizations that address critical social issues, such as mobility, workforce development, and reducing carbon footprints.

Ford’s philanthropic efforts aim to improve lives by fostering educational opportunities, enhancing environmental sustainability, and driving innovation.

Other giving programs include: VTO ✔️

Learn more and apply for the grant here.

Citizens Bank

Citizens Bank provides grants through its Citizens Bank Foundation, with an emphasis on financial literacy, education, and community development. The foundation supports nonprofits that promote economic empowerment, improve access to education, and strengthen local communities.

Citizens Bank’s grants focus on providing opportunities for underserved individuals and families, helping them achieve long-term financial stability.

Other giving programs include: Matching gifts ✔️ VTO ✔️

Learn more and apply for the grant here.

Home Depot

The Home Depot Foundation focuses on housing, veterans’ services, and community development. The foundation supports nonprofits that are working to improve access to affordable housing and assist military veterans.

Home Depot’s philanthropic efforts also extend to community rebuilding initiatives and programs that improve the living conditions of vulnerable populations.

Other giving programs include: Matching gifts ✔️

Learn more and apply for the grant here.

American Express

The American Express Foundation provides grants focused on historic preservation, arts, culture, and community development. The foundation supports nonprofits working to preserve cultural heritage, increase access to the arts, and revitalize underserved communities.

American Express also funds projects that improve local economies and encourage inclusive development in both urban and rural areas.

Other giving programs include: Matching gifts ✔️ Volunteer grants ✔️

Learn more and apply for the grant here.

Cigna Group

Cigna Group’s philanthropic initiatives focus on health, well-being, and community resilience. The company’s grants support nonprofits working to improve health outcomes, promote mental well-being, and enhance access to healthcare services.

Cigna is particularly interested in initiatives that address health disparities and work to create healthier communities.

Other giving programs include: Matching gifts ✔️ Volunteer grants & VTO ✔️

Learn more and apply for the grant here.

Patagonia

Patagonia’s corporate giving focuses on environmental conservation, climate change, and social activism. The company’s Patagonia Action Works program provides grants to nonprofits working to protect the environment, promote sustainability, and advocate for climate action.

Patagonia supports grassroots organizations that are leading efforts to protect natural resources and combat environmental challenges.

Other giving programs include: Matching gifts ✔️ VTO ✔️

Learn more and apply for the grant here.

U.S. Bank

U.S. Bank offers grants through the U.S. Bank Foundation, focusing on economic development, financial literacy, and community health. The foundation supports nonprofits that foster financial education, create affordable housing, and strengthen community health initiatives.

U.S. Bank’s philanthropic efforts aim to increase economic opportunity and financial security for underserved populations.

Other giving programs include: Matching gifts ✔️ Volunteer grants & VTO ✔️

Learn more and apply for the grant here.

Wrapping up & additional resources

Corporate grants offer nonprofits a unique opportunity to gain financial support while building meaningful relationships with companies that share their vision. By understanding the types of grants available and crafting strong, strategic proposals, nonprofits can position themselves as valuable partners in corporate philanthropy initiatives.

As you pursue this type of grant, remember that the process is not just about funding—it’s about creating a long-term partnership with a company that believes in your mission. Start exploring corporate grant opportunities today and unlock new possibilities for your organization’s growth and success.

Ready to learn more about corporate giving opportunities for your organization? Check out the following resources to keep reading:

- Corporate Sponsors: 65+ Companies That Donate to Nonprofits. Check out this list of companies known for their generous support of nonprofits like yours. Find some of the best corporate sponsors here!

- How to Identify Corporate Partnerships [With Double the Donation]. Find out how your organization’s existing matching gift software can help your team uncover broader corporate partnerships.

- Free Download: The Ultimate Guide to Matching Gifts. Get caught up on the basics of matching gifts with this complete guide. It has everything you’ll need to know about corporate gift-matching!