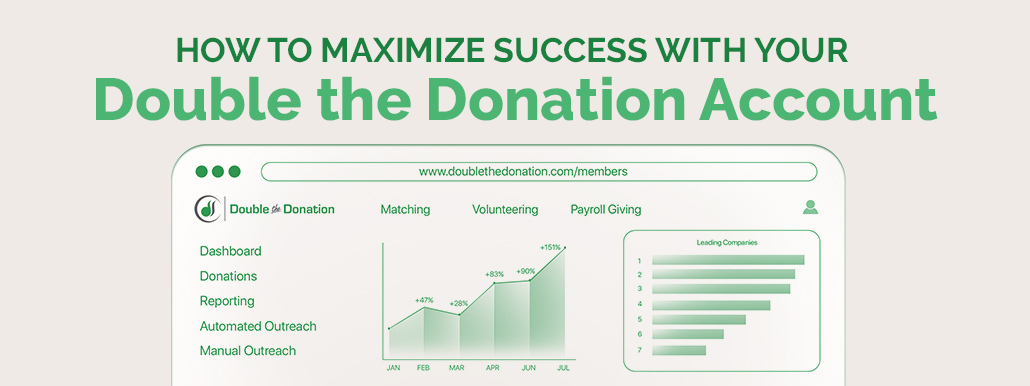

How to Maximize Success With Your Double the Donation Account

To maximize success with your Double the Donation account,…

How Lazarex Increased Matching Gift Conversions by 200%

Quick Brief: The Lazarex Cancer Foundation faced a critical challenge:…

How KQED Leveraged Donor Data to Find $800k in Match Revenue

Quick Brief: KQED, one of the nation's most prominent public…

How Duke School Grew its Matching Gift Revenue by 587%

Quick Brief: Duke School, an independent school committed to…

How Cleveland State Identified $55k in Annual Matching Gifts

Quick Brief: Cleveland State University struggled with a fragmented…

MMRF: Identifying Over $275k via Matching Gift Enhancements

Quick Brief: The Multiple Myeloma Research Foundation (or MMRF)…

Celebrating Pet Partners’ 81% Matching Gift Email Open Rate

Quick Brief: Pet Partners, a national leader in promoting the…

Central Texas Food Bank’s $720k in Matching Gift Potential

Quick Brief: As one of the largest hunger-relief organizations…

The Strategy Behind BCU’s $3.4M in Corporate Matching Revenue

Quick Brief: Blood Cancer United, a massive non-profit raising…

How Boston College Generated $141k in Alumni Matching Gifts

Quick Brief: Boston College sits at the intersection of a highly…