EIN Numbers for Matching Gift Programs: A Basic Guide

As a nonprofit fundraiser, you should hopefully know all about the enormous impact that corporate matching gifts bring to strategic fundraising efforts.

(If you’d like a matching gifts refresher before diving into what you should know about EIN numbers for matching gifts, we recommend checking out our comprehensive guide on matching gift fundamentals.)

Here’s a brief recap: matching gifts enable organizations to double existing donations when qualifying donors request corporate matches from their employers on your behalf. Yet unfortunately, millions of dollars of available matching gift revenue are left on the table each year. Two significant roadblocks to matching gift success are a lack of awareness of these programs and a lack of understanding of how eligible donors request their company matches.

And there’s one little piece of information that plays a huge role in just about any donor’s matching gift employer submission: the nonprofit’s EIN or employer identification number.

In this resource, we’ll dive deep into the world of EINs by covering the following key topics:

- EIN Numbers: The Definition

- Where Should a Nonprofit’s EIN Number Be?

- The Importance of EIN Numbers for Matching Gift Programs

- The Role of EIN Numbers With CSR Platforms

- How to Simplify EIN Numbers for Donors

Ready to learn more about nonprofit EIN numbers—including what they are and their critical role in maximizing matching gifts? Let’s jump in with the basics.

1. EIN Numbers: The Definition

According to the Internal Revenue Service (commonly referred to as the IRS),

“An Employer Identification Number [EIN] is also known as a Federal Tax Identification Number, and is used to identify a business entity.”

But don’t think that’s referring to for-profit businesses only!

In regards to nonprofits, an EIN is critical for identifying the organization as being an officially registered 501(c)(3) cause. By extension, this nine-digit number (formatted as XX-XXXXXXX) verifies an institution as a tax-exempt nonprofit, to which charitable donations are considered tax-deductible by the U.S. government.

You might even think of an organization’s EIN as the nonprofit (or business) version of a social security number.

This is the unique identifier belonging solely to the entity in question. No two groups share the same tax ID number, which allows the figure to pinpoint a particular organization and track all sorts of critical financial data. For nonprofits, this includes donations, tax receipts, and more.

2. Where Should a Nonprofit’s EIN Number Be?

Whether you’re a donor attempting to locate your favorite charity’s EIN number for a matching gift program or a nonprofit aiming to ensure your EIN is easily accessible to your audience, understanding the prime location for this information is essential.

So, where should an organization’s EIN number be found?

On the organization’s website

A nonprofit’s website is one of its most valuable assets for driving fundraising, improving donor engagement, and providing educational resources to viewers. As such, it’s critical that an organization incorporates its EIN number in multiple prominent locations across its site.

That’s why we recommend nonprofits include this information on their:

- About Us page

- Ways to Give page

- Frequently Asked Questions page

- Dedicated matching gift page

Keep in mind that if donors have to search particularly hard or click through a whole trail of breadcrumbs to locate your tax ID, they’re likely to call it quits before reaching the intended destination.

And if they need your EIN to submit their matching gift request, you might just miss out on that possible match. That’s why it’s essential to keep this information as openly accessible as possible.

Within donor communication materials

Beyond your nonprofit website, it’s also a good idea to include your EIN within a number of donor-facing communications. This typically includes:

- Donor acknowledgments

- Tax-exempt donation receipts

- Matching gift follow-up emails

Not only does providing your tax ID number in communication materials ensure donors have access to the information they need for their matching gift requests, but it can also help when it comes time to report their charitable contributions as tax-deductible!

Through third-party resources

There’s also a good chance that an organization’s tax ID number is available online through a third-party resource such as Charity Navigator, GuideStar, or the IRS itself. These sites can be useful for donors and prospects looking to learn more about nonprofit causes they support.

As a nonprofit, however, you should not rely on this being the case—let alone the available resources providing accurate and up-to-date information. Thus, make sure to prioritize getting your organization’s EIN number out via your own website and communication materials.

3. The Importance of EIN Numbers for Matching Gift Programs

Most companies that offer matching gift programs will require the receiving organization’s EIN number to successfully process the matching gift request and ultimately disburse the funding.

The EIN requirement will typically be in addition to other information about their employee’s donation, such as:

- Donation amount

- Date of donation

- Nonprofit name

- Nonprofit address

- Copy of the donation receipt (which should also include the EIN)

Without the organization’s ID number, the donor will likely be unable to submit their online match request—or if they do submit it without an EIN included, the request may be denied.

The purpose of the above information is so that the matching gift company can verify that the initial donation was made, along with it having been contributed to a qualifying nonprofit cause. Not to mention, having access to the organization’s official tax ID number also ensures that the employer is able to give to the same organization its employee did.

4. The Role of EIN Numbers With CSR Platforms

Thousands of companies with workplace giving programs utilize CSR platforms (sometimes referred to as corporate giving platforms, matching gift software vendors, etc.). These solutions were developed to help businesses manage their philanthropic initiatives. For many, that means matching gifts.

If your donors work for those companies (which it’s fairly likely that they do), participating individuals are often required to submit corporate matching gift requests through their employer’s CSR software portal.

And to complete their request, they’ll need the EIN number of the organization to which they gave.

Many companies even choose to automate their matching gift facilitation through the use of corporate giving software. When this occurs, donors simply fill out an online form provided by the CSR platform. The donation information entered (including EIN) is then quickly scanned against the business’s pre-determined matching gift criteria. This typically includes minimum and maximum donation amounts, types of qualifying nonprofits, and more.

The request is then approved or denied, and, if approved, the funding moves toward the distribution process. So as you work to drive as many matching gifts as possible—with as few roadblocks as possible—it’s essential that you provide individuals with the information they require.

5. How to Simplify EIN Numbers for Donors

So you understand why your organization’s EIN is essential to matching gift fundraising. But what can you do to make this information easily accessible and simplify the process of obtaining the figure for donors?

Leveraging matching gift automation software like Double the Donation can help in two keys ways:

- Providing a dedicated matching gift web page with an explanation of matching gifts and an embedded search tool, alongside an organization’s EIN and other contact information

- Offering customizable and automatically triggered post-donation follow-up emails to inform and remind donors about matching gifts

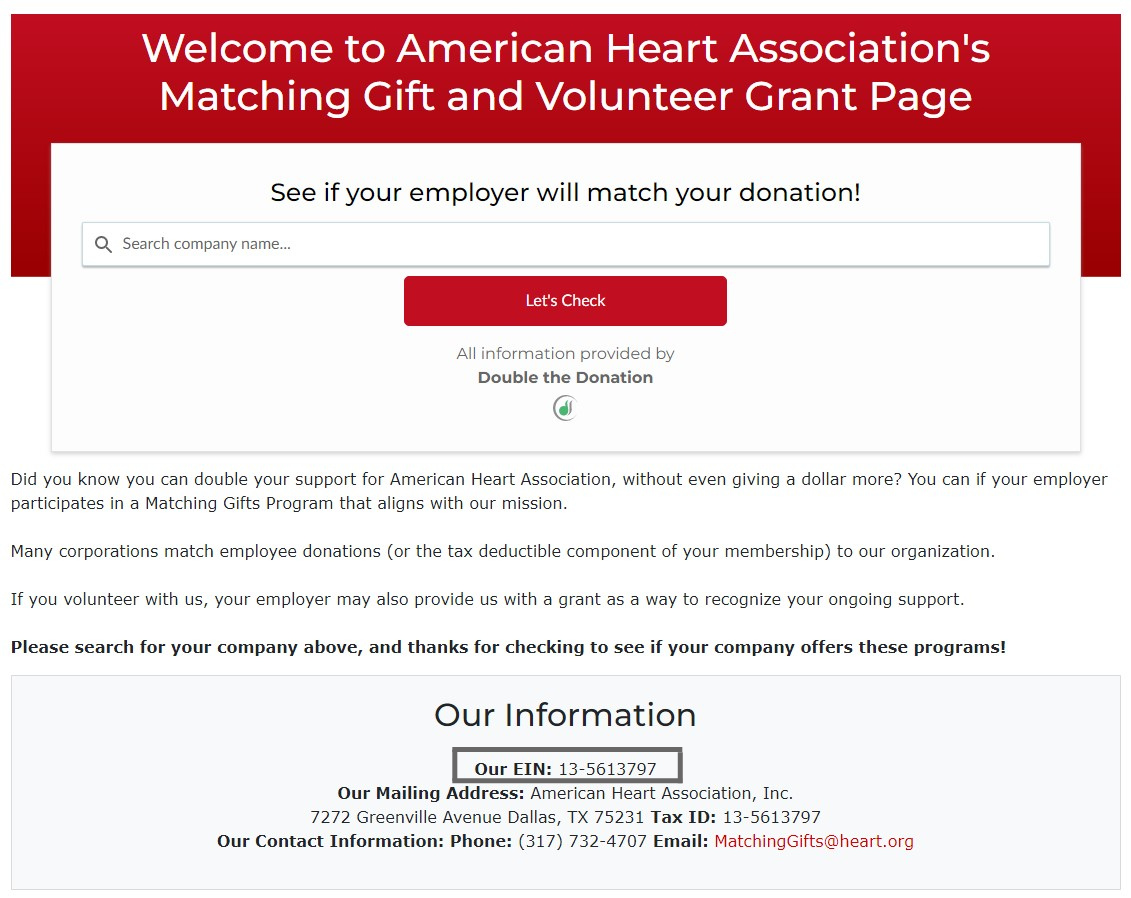

For example, check out how two leading nonprofit organizations display their EINs on their dedicated matching gifts pages for supporters:

American Heart Association

Leukemia & Lymphoma Society

Sometimes the process of identifying the right EIN number can be particularly difficult for nonprofit supporters. For example, some large schools, universities, and multi-chapter organizations may have multiple tax ID numbers—often a different EIN for each component of the overall cause.

In that case, you might want to include brief instructions within your matching gift follow-up emails that direct donors to the correct information. This can be as simple as incorporating a note near your matching gift company instructions. For example: “Kindly visit our dedicated matching gift page and look for the correct EIN for your matching gift request.”

If your organization has a single EIN number, you might still choose to include a reminder that the information is available on your matching gift web page. Alternatively, you could insert the number directly into your matching gift follow-up email for even easier access.

The more your organization simplifies the matching gift process for its donors, the more individuals are likely to participate—namely, following their matching gift request from beginning to end.

By highlighting EIN numbers for matching gift programs, your team can ensure your match-eligible supporters have the information they need to complete their employer’s submission process. You’ll receive additional corporate funding, and your donors are able to make an even more significant impact on a cause they care about. That’s what we like to call a win-win!

Want to learn more? Make the most of matching gifts with our other top fundraising and corporate giving resources here:

- Corporate Matching Gift Programs: The Definitive Guide for Growing Your Revenue. Find out everything you need to know about company gift-matching initiatives and how you can leverage these programs for your cause. Your EIN plays a helpful role, but there are a lot of other pieces to consider as well!

- 3 Reasons to Register Your Nonprofit with CSR Platforms. Are you interested in simplifying the corporate giving process for your organization, its donors, and their employers? Make sure to get your nonprofit registered with the top CSR management platforms and streamline fund disbursements.

- Corporate Giving and Matching Gift Statistics [Updated 2022]. Take a look at these powerful corporate giving-related statistics to better inform your nonprofit team about the importance of corporate philanthropy. You’re sure to be inspired by these hard-to-believe (yet entirely true!) facts and figures.