Matching Gift Upsells | A Guide for Boosting Donations

If you’re looking to drive additional fundraising revenue through corporate gift-matching programs, making the most of matching gift upsells is the way to go.

Picture the following scenario:

A donor is in the process of making a gift to your organization. As they fill out your online donation form, they select the second suggested gift size at $20. Upon submitting their donation, however, they realize that the gift would have been eligible for a corporate match from their employer should it have been just $5 more.

Since the company they work for has a $25 minimum donation for matching gifts, the donor’s initial $20 gift doesn’t quite make the cut. Suppose they had known that before completing their donation, they would have sacrificed an additional latte that week to boost the contribution into the eligible gift-matching threshold. As a result, your nonprofit would have received not only the extra $5 from the donor but a $25 match as well—bringing the total donation value to more than $50.

The above scenario perfectly illustrates the importance of matching gift upsells and the impact they can have on nonprofit fundraising strategies.

In this guide, we’ll walk through the following topics to provide more information about matching gifts and how you can drive corporate support with donation upsells effectively. Specifically, we’ll cover:

- What Are Matching Gifts?

- What Are Matching Gift Upsells?

- The Value of Matching Gift Upsells

- Best Practices for Leveraging Matching Gift Upsells

Ready to learn more about matching gift upsells and the opportunities they can present fundraising organizations like yours? Let’s get started with the basics.

What Are Matching Gifts?

Before diving into the value of matching gift upsells and how you can use this strategy to increase your fundraising revenue, you’ll first need to understand a few key concepts surrounding matching gifts. We’ll answer those questions here!

Essentially, matching gifts are donations made through a particular type of corporate giving program in which companies match charitable donations made by their employees to eligible nonprofit causes.

The process typically looks like this:

- A donor makes a donation to your nonprofit organization.

- The donor determines that their employer offers corporate gift matching and that their gift is eligible for a match.

- The donor submits a form to their employer with details about their donation and the nonprofit they gave to.

- The employer reviews the request and confirms the initial donation with your organization.

- The employer makes their own matching donation to your cause.

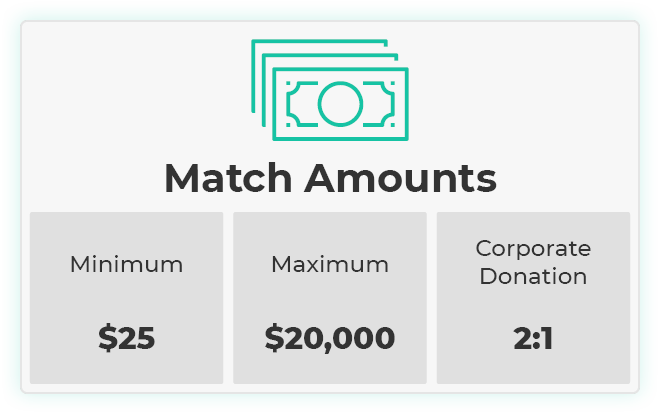

The exact parameters surrounding an employer’s matching gift program varies by company, though the vast majority of participating businesses match eligible donations at a dollar-for-dollar rate. Others, however, choose to match at a lower (e.g., 50 cents per initial donor dollar) or higher rate (e.g., $2 or even $3 per donor dollar).

What Are Matching Gift Upsells?

Driving matching gift revenue effectively is all about using the right verbiage in your fundraising asks. One thing that nonprofits are beginning to see more of is called matching gift upsells.

Every company puts different eligibility criteria and guidelines in place for their matching gift program. One of these criteria is minimum and maximum donation amounts that the business is willing to match. A matching gift upsell occurs when organizations encourage donors to make larger gifts in order for their contributions to be eligible for a corporate match.

In other words, when a donor is about to make a donation that falls below their employer’s donation threshold, a matching gift upsell convinces them to increase their gift size to fall between the minimum and maximum match amounts.

The Value of Matching Gift Upsells

Matching gift upsells offer significant value to nonprofits looking to improve their corporate fundraising strategies while raising more for their causes and building strengthened relationships with supporters. As you lean into this powerful tactic, here are three key benefits to consider:

- Increased initial donations: According to Double the Donation research, 1 in 3 donors reported that they’d likely make a more significant gift to a nonprofit if they knew it was being matched by their employer. By increasing the initial donation size to fall into their employer’s match eligibility criteria, donors put more dollars towards your organization.

- More corporate matches: When donors bump up their gifts to become match-eligible, it allows you to collect additional corporate matches for your cause. That means more donations for your organization, along with better corporate relationships.

- Improved donor engagement: Matching gifts offer an invaluable engagement opportunity for donors who are looking to provide additional support to a mission they care about. When you make it easier for donors to become eligible for these programs, more individuals get the privilege of knowing their gifts are going further and making a more significant difference.

Just as matching gifts offer value to each party involved, matching gift upsells do as well. Without specific strategies in place to leverage this impactful concept, you’re likely to miss out on a ton of potential fundraising revenue.

Best Practices for Leveraging Matching Gift Upsells

Now that you understand the importance of matching gift upsells, how can you adjust your efforts to emphasize this type of fundraising strategy? Let’s discuss three of our favorite tried-and-true ideas for maximizing your matching gift upsell.

1. Collect employment data from donors as they give.

One of the most effective—yet often overlooked—strategies for increasing matching gift revenue is simply asking donors where they work at the time of donation. By collecting employment data during the giving process, nonprofits can unlock a powerful stream of potential funding while setting the stage for matching gift upsell opportunities.

Here’s what we recommend:

- Add a simple employment data field to your donation form. Make it optional but highly visible.

- Use an autocomplete tool or dropdown list of known employers to reduce friction and improve data accuracy.

- Incorporate match-related messaging like: “Many employers match donations—tell us where you work to see if your gift can go twice as far.”

- Integrate with a matching gift database so that employment info instantly triggers a check for eligibility.

Collecting employment data at the point of donation isn’t just a smart tactic—it’s a strategic move that sets the stage for unlocking free money. It allows you to identify the right donors at the right moment, enabling your team to raise more while deepening engagement with supporters.

2. Provide access to matching gift program data.

One of the best ways to encourage matching gift upsells is by sharing company-specific matching gift details with donors. You can’t expect donors to increase their donations to meet match-eligibility requirements if they’re unsure of their employer’s program guidelines!

Luckily, the right software can be a huge help here, as both a time-saver and a donation booster. For example, consider embedding a matching gift database tool in your online donation page. This way, donors completing an online gift can simply do a quick and easy search of their employer name to determine both if their company offers matching gifts and if the gift they’re about to make would be eligible.

If they see that their gift falls below their employer’s minimum, they can choose to adjust their donation size accordingly.

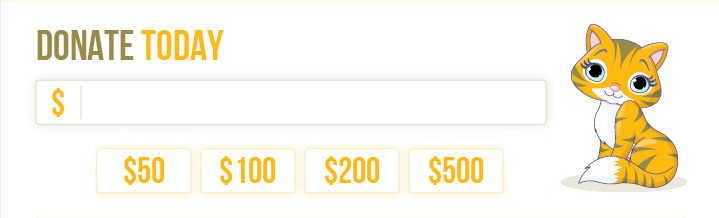

3. Incorporate suggested donation sizes.

Many organizations utilize suggested donation sizes to coax donors into giving larger amounts than they initially may have. When you choose your suggestions carefully, you can encourage more donors to make match-eligible donations and ultimately secure corporate gifts for your cause.

How? Matching gift statistics report that 93% of participating companies have a minimum donation threshold of less than or equal to $50. Further, the average minimum amount falls at only $34. As you determine which donation sizes to set for your online giving form, keep these figures in mind.

For example, consider setting your lowest donation tiers at $35 to $50, with more significant gift options increasing from there. Just remember, it’s crucial to retain a “choose-your-own-donation” field that allows supporters to go lower, higher, or in between levels if they so choose.

4. Look for software that automates the upsell process.

Having the right software in place is a critical prerequisite for optimizing your matching gift efforts. When it comes to leveraging matching gift upsells, we suggest exploring donation tools that offer that specific feature.

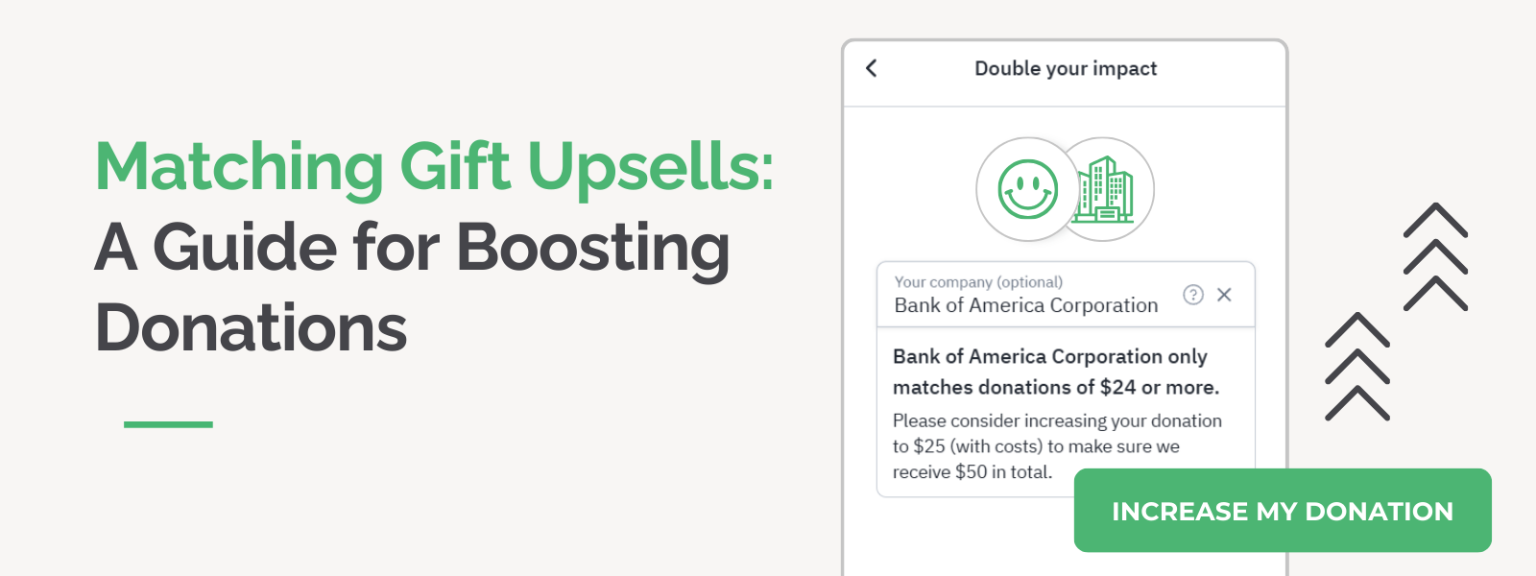

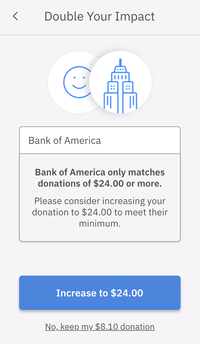

For example, Double the Donation offers a native integration with Fundraise Up, a popular online donation platform that incorporates matching gift upsell functionality directly into the giving process.

If a user is about to make a gift that falls below the minimum threshold for their employer, they’re automatically notified of the donation size gap and asked if they’d like to up their contribution to meet program requirements.

This collaborative tool allows donors to adjust their giving before clicking submit, often leading to increases both in donation sizes and matching gift eligibility. Talk about a win-win!

5. Encourage repeat gifts.

When it comes to maximizing matching gift revenue, encouraging donors to give more than once throughout the year isn’t just good for overall fundraising—it’s also a smart strategy for helping them qualify for their employer’s matching gift program.

Because many companies that offer matching gift programs set a minimum donation threshold before a match is triggered, if a donor gives below that amount, they might fall short of eligibility. But if they make multiple donations over time that cumulatively meet or exceed that threshold, they may still qualify for a match.

Here’s what we recommend:

- Educate donors! In follow-up communications, let donors know that their cumulative giving might meet their employer’s matching threshold. Include messaging like: “Your recent gift brings you closer to qualifying for a matching donation from your employer. Making multiple gifts throughout the year can count toward your eligibility!”

- If using a donor portal or CRM, track cumulative giving and trigger reminders when a donor is approaching the minimum match amount. You can even implement follow-up giving appeals to remind donors of how close they are to reaching their match threshold.

- Combine this strategy with monthly giving programs—after all, automated recurring gifts often meet minimums over time.

Repeat giving doesn’t just boost donor retention—it also increases the chances of unlocking matching funds that might otherwise go untapped. By keeping donors informed and engaged throughout the year, you make it easier for them to qualify, and easier for your organization to benefit.

Wrapping Up & Additional Resources

Matching gift upsells are one of the best ways to bring an already lucrative fundraising strategy to the next level. You’ll receive additional funding for your cause while allowing more donors to make a larger impact on your nonprofit mission—which is a win-win for everyone involved.

To make the most of this strategy, it’s vital that you equip your team and your donors with the matching gift fundraising technology required to make this idea a reality for your organization.

Learn more about matching gifts and other impactful fundraising strategies with these additional resources:

- The Ultimate Guide to Matching Gifts. Matching gifts can make a big difference for nonprofits looking to make the most of every donation. Get the free downloadable resource to learn more about the programs here.

- Corporate Giving Programs: The Ultimate Fundraising Guide. Matching gifts aren’t the only option for corporate giving programs, either. Explore all sorts of corporate fundraising opportunities with our ultimate guide.

- Database of Matching Gift and Volunteer Incentive Companies. Providing donors with information about their employers’ programs is a must. Learn how you can do so with Double the Donation’s database!