The Ultimate Guide to Employer Appends for Fundraisers

You likely gather many details about your donors—those who support your cause with their funds, time, or resources. Perhaps you collect names, contact information, engagement history, interests, and hobbies. The more comprehensive an understanding you have of each supporter, the better you can tailor your fundraising strategy to effectively reach your target audience.

However, one critical piece of the puzzle that’s often overlooked is employment data. Knowing where your donors work can play a significant role in how you relate to them in terms of fundraising, corporate giving opportunities, and more. And if you don’t already have this data point on file? That’s where employer appends come in.

In this guide, we’ll provide a walkthrough of all things employer appends—including:

- The Basics of Data Appends

- What Are Employer Appends?

- How Employer Appends Work for Fundraisers

- Benefits of Employer Appends for Nonprofits and Universities

- Employer Appends Services | What to Look For

Understanding your donors’ employment status can elevate your fundraising efforts in huge ways. You won’t want to discard the wealth of information gathered through employer appends, nor the amplified impact it brings.

Let’s get started!

The Basics of Data Appends

Data appends are a particular type of data enhancement strategy that allows nonprofits and other fundraising groups to learn more about the individuals in their networks. These efforts aim to provide organizations with more comprehensive and up-to-date information, often concerning their donors and other supporters. This empowers fundraisers to adjust their messaging and overall engagement strategies by better discerning who a donor is and what makes them tick.

Organizations typically provide the information they do have to a company dedicated to data enhancement services. The company then compares donor information against a mega-database of individual data, filling in the details the organization lacks as they go.

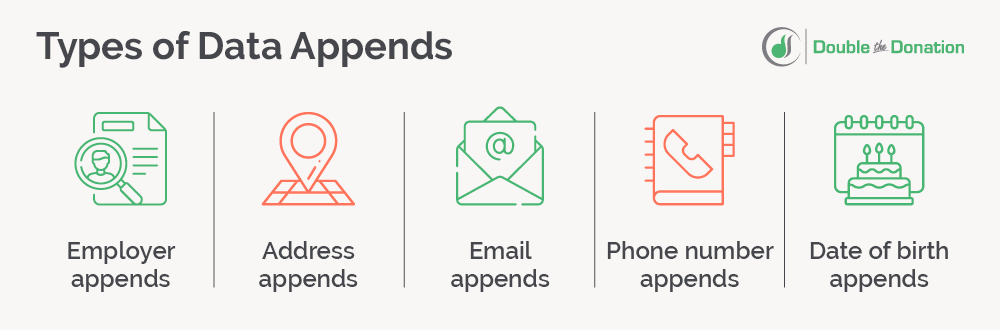

Employer appends, in particular, empower organizations to collect new and optimized data regarding the companies their supporters work for. Beyond employer information, other common types of data appends include mailing addresses, email addresses, birth dates, and phone numbers.

As you’ll notice, these types of appends primarily fill in missing or outdated contact information. That makes connecting with supporters easy for email outreach, phonathon fundraisers, direct mail solicitations, and other campaigns.

What Are Employer Appends?

Employer appends are one of the most common types of data appends for nonprofits, schools, and other fundraising organizations. In this case, the unknown information an organization seeks is that of a donor’s employer.

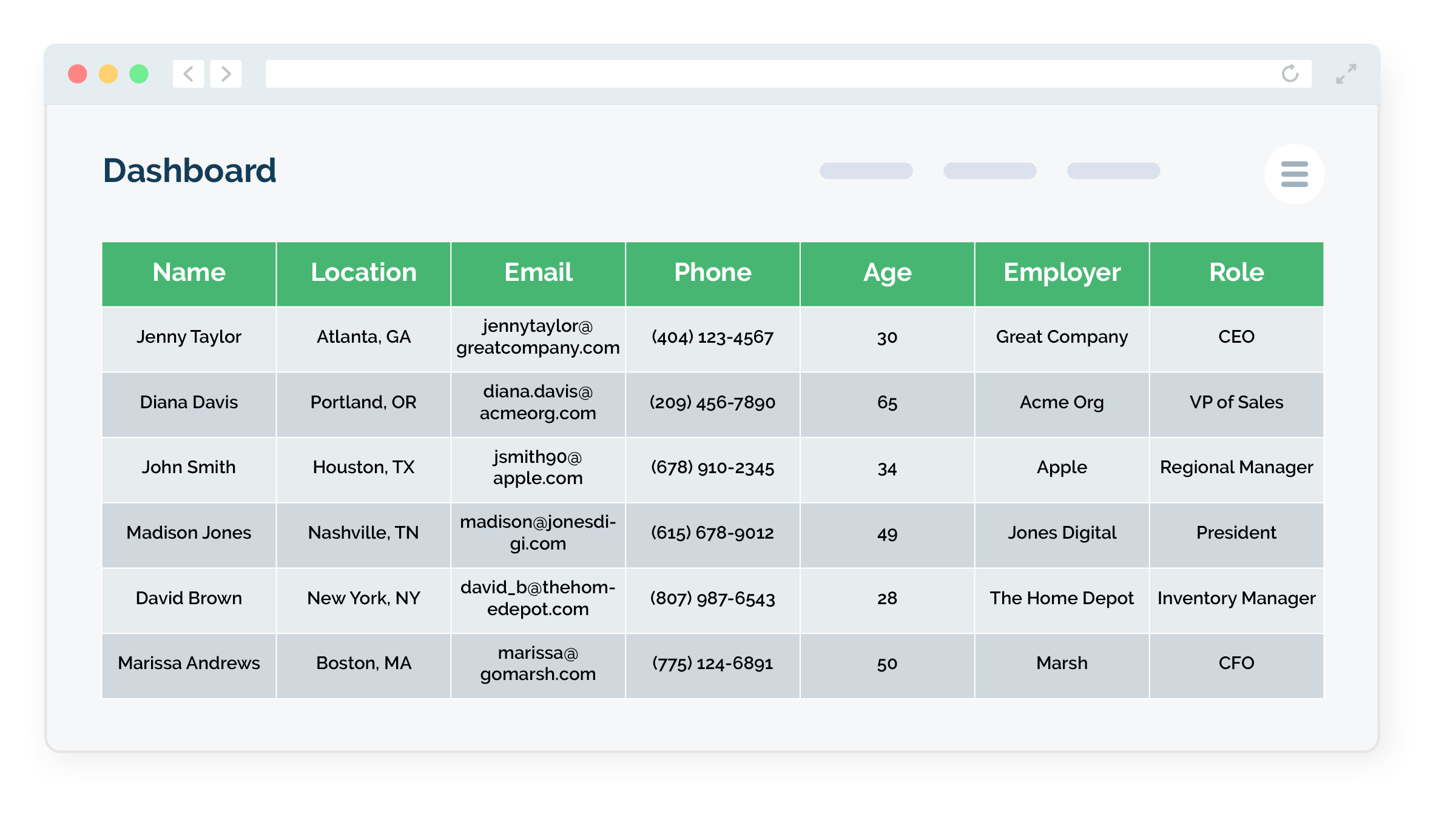

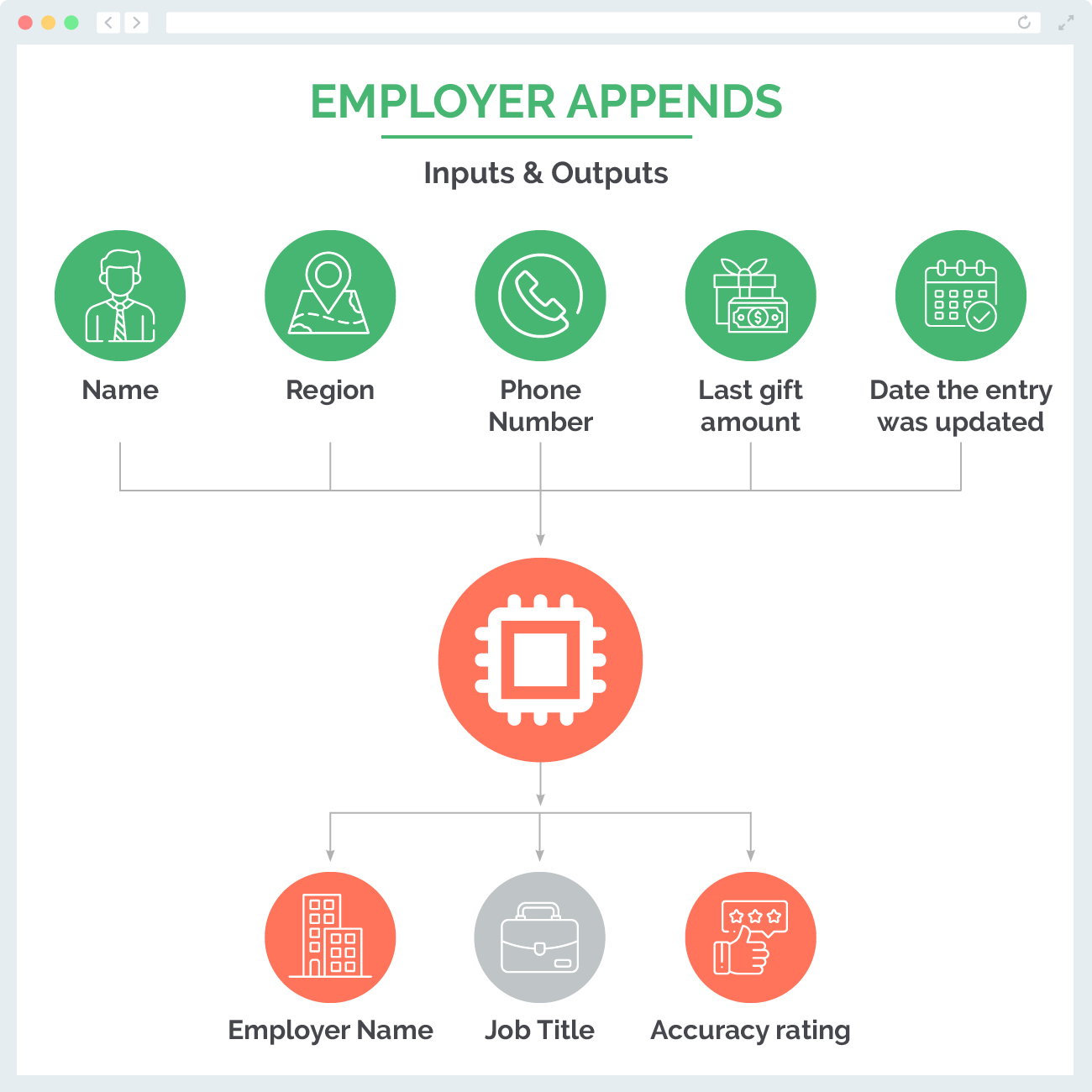

By providing other data points—such as the person’s name, location, phone number, education experience, etc.—the intended result is to locate the company that the individual works for (and sometimes even their job title!). In the end, the organization receives invaluable insights that can help uncover matching gift and other workplace giving opportunities, estimate wealth data, and more.

How Employer Appends Work for Fundraisers

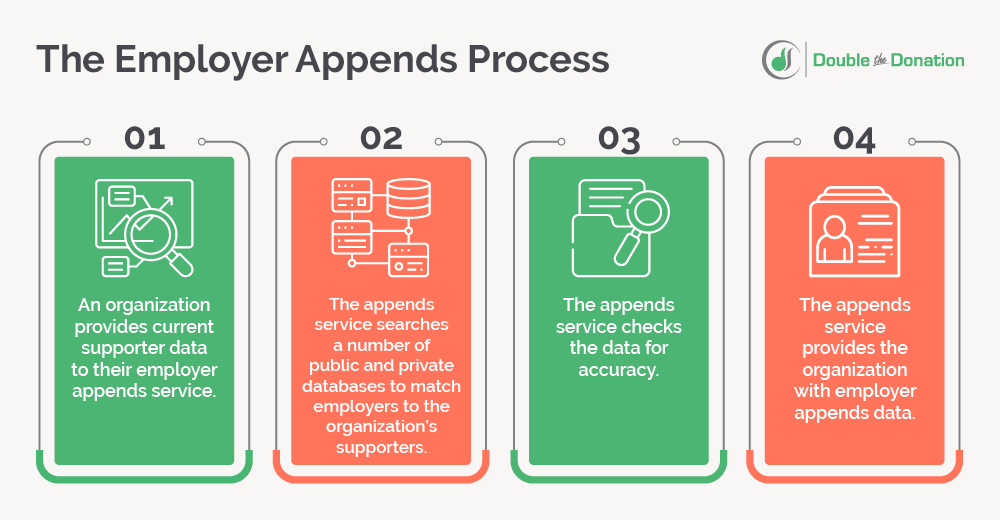

The employer appends process is simple. After locating a data appending service (we’ll cover what to look for below), you’ll want to collect as much data about your donors as possible. This should include:

- Name

- Unique ID number

- Mailing address (home, business, or both)

- Region (state, city, and country)

- Email address(es)

- Phone number(s)

- College or university (along with class year and major/degree, if available)

- Last gift amount

- Date of last donation

- Date the entry was last updated

You will likely not have every data point available for each donor. And that’s okay! However, starting with as much information as possible increases the likelihood that the appending service provider can locate and match supporter records to the right employer information.

From there, the appending service will conduct its own research, typically scanning a number of public and privately held databases, which may include government records, SEC filings, social media profiles, business registrations, and more.

When the service provider is able to match a donor record with an employing company, they make a note of the identified information, check the newly collected data for accuracy, and share their findings with the organization. Ultimately, the organization is able to utilize the information to its best advantage in terms of optimal fundraising and donor relations.

Benefits of Employer Appends for Nonprofits and Universities

Employer appends can bring big results to nonprofit fundraising. Knowing where your donors and other key supporters work plays a significant role in overall engagement strategies, not to mention enabling targeted efforts regarding available workplace giving opportunities.

Specifically, employer appending can help your team:

Determine matching gift eligibility —

Thousands of companies offer matching gift programs where they agree to match employee donations to charitable organizations.

However, you likely won’t know which donors are eligible for (and, as a result, which to follow up with about) matching opportunities if you don’t know where they work. In fact, this knowledge gap even results in over $4 to $7 billion in matching gift funding going unclaimed each year!

Once you have the information you need, however, you’ll be able to prompt qualifying donors to complete the match process and secure additional funding on your organization’s behalf. This is true not only in the form of corporate match revenue but in elevated individual giving (and donor engagement), as well.

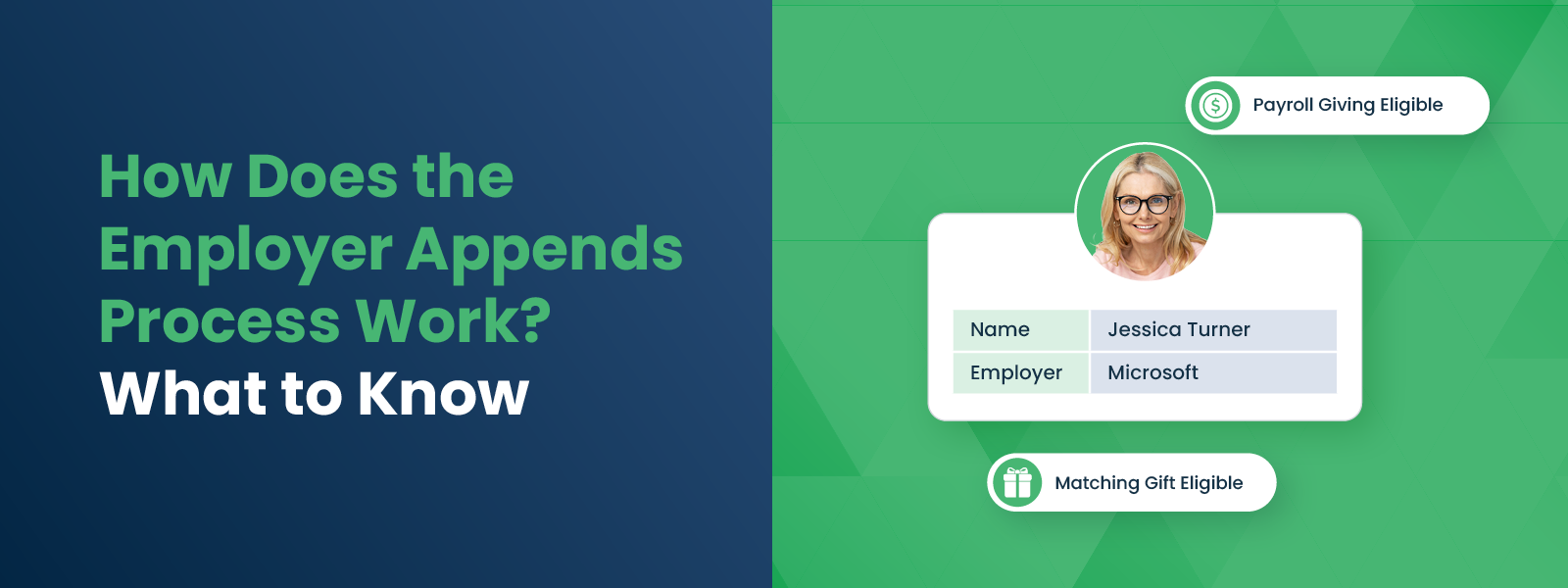

Keep in mind that matching gift services—like Double the Donation—can help nonprofits target and follow up with matching gift opportunities as well. However, employer appends are often able to provide additional data points with which to guide an organization’s strategy, allowing fundraisers to capture supporter information even if the individual is not currently in the donation pipeline.

Here’s an example: “Jody, did you know that your employer, the Home Depot, matches full- and part-time employee donations up to $3,000 per person each year? Click here to request your matching gift!”

Uncover volunteer grant opportunities —

Similarly, if your organization has a supporter base of dedicated volunteers, corporate volunteer grants can help stretch their donated time even further. These are additional giving programs offered by philanthropic-minded businesses, the difference being that employers contribute monetary funds to the organizations with which their employees volunteer their time. Volunteer grants, which are also referred to as “dollars for doers,” can be an excellent way to multiply the impact of volunteer time for your organization, and supporters love being able to get involved in that way as well.

But again, you’ll need to know which companies your volunteers work for, which is where your employer appends come in. That way, you can be sure to inform them about the opportunities, encourage participation, and direct them to their employers’ request processes to get involved.

Here’s an example: “Thanks for all of your help at the shelter this weekend and over the past several months, Sam! As a Verizon employee, your volunteer hours likely qualify you to request a corporate volunteer grant on our behalf. Click here to learn more about how to request your grant!”

Identify potential corporate sponsorships —

Corporate sponsors can bring your nonprofit’s next fundraising event to the next level, and knowing which companies your supporters work for can aid in determining top prospective sponsors and help get your foot in the door! Once you know where your donors work, leverage the information as an in with a potential sponsor or encourage donors to advocate for a partnership on your behalf.

Here’s an example: “Ashley, it’s great to connect with the Microsoft team. More than 100 of our nonprofit’s donors work for Microsoft, and we’ve received thousands of dollars in matching gifts from your company in the past. As it’s clear that we already have a lot in common, would you be interested in sponsoring our upcoming event?”

Estimate wealth data —

Your donors’ wealth levels can play a significant role in their ability to give charitably, and understanding their limits can help organizations determine ideal fundraising asks. Knowing which companies your donors work for, their roles in the businesses, and more can help shed light on their estimated incomes and, by extension, giving abilities.

Here’s an example: “Sarah, we thank you for your continued support of our nonprofit cause. Will you consider making a $10,000 donation to help us reach our year-end giving goal?”

Tailor donor communications —

You want your donor outreach to be as personal and targeted as possible. Including direct references to donor-specific information helps develop relationships and shows that you’re not sending the same copied-and-pasted message to each person in your contacts. And, as you likely know, targeted messaging can be one of the best ways to develop strengthened, beyond-surface-level donor relationships, build connections with the cause, and ultimately drive more nonprofit involvement among supporters.

Highlighting an individual’s employing company can be a great way to do so, especially regarding getting involved with workplace giving programs. And if you don’t already have your donors’ employment information, that’s where employer appends can help.

Here’s an example: “Jeffrey, the Walt Disney Corporation offers a range of corporate giving opportunities that can benefit our organization in big ways. As a member of the Disney team, you have the chance to participate in matching gifts, volunteer grants, and more.”

Learn more about your supporters —

The more you know about your supporters—donors, volunteers, and prospects alike—the better you can connect with the individuals who make your mission possible. Since most people’s careers are a key component of their lives and what makes them who they are, understanding where they work and what they do can be a key piece of the “getting to know your donors” puzzle. Plus, it can even help shine a light on their own interests and hobbies.

Here’s an example: “As a Petco employee, you likely care about the wellbeing of the little, furry friends in our community. That’s exactly what our organization, the Atlanta Animal Shelter, is dedicated to, as well. Learn more about how you can get involved with the cause here!”

Overall, employer records are an extremely beneficial tool for designing targeted and effective outreach. However, you likely don’t have that information on file for all of your supporters. By leveraging employer appends, you can collect the information you need to guide your organization’s engagement efforts toward success.

Employer Appends Services | What to Look For

It’s possible to conduct donor research on your own; however, your organization is significantly more likely to uncover accurate and up-to-date information about more donors more quickly when you outsource the efforts to a third-party provider. And employer appends services are dedicated to doing just that in the most effective and efficient ways possible.

So how can you select the right employer (or other donor data) appends provider for your needs? Be sure to do your research beforehand.

For example, here’s how it works with Double the Donation:

- Organizations typically see successful appends rates between 20% and 50% of the records they provide to the appending service (which is significantly higher than the industry average).

- Employer appends are typically completed and provided within a few days of the organization submitting their inputs.

- Appends records are assigned an accuracy rating. This takes into account the uniqueness of a donor’s name and the level of detailed inputs initially provided, as well as the comprehensiveness and recency of the data source used.

- As an added bonus, previously unknown corporate executives are often identified and flagged as potential major donors.

- Multiple appending options are available, including real-time employer appends for Double the Donation users, as well as one-time bulk appends services for any organization.

- Employer appends can be uploaded into Double the Donation to trigger matching gift emails and other automated donor outreach.

Other Frequently Asked Questions

Where does Double the Donation get its employer data?

Our propriety screening method combines data from both publicly and privately available sources. These sources include public government records, SEC filings, social media profiles, business registrations, and a variety of other sources.

What hit rate should our organization expect?

We typically see append rates which range from 20%-50%. This is based on a variety of factors such as:

- Donor demographics (higher append rates among organizations which have a greater percentage of donors still in the workforce)

- Average donation amount (higher append rates for wealthier donors)

- Type of nonprofit (higher append rates for higher education)

How does Double the Donation determine its “accuracy score” for each record?

Our accuracy score is based on a number of factors including:

Uniqueness of donor names:

With only a name it can be tough to determine whether we’ve identified the correct individual. The number of individuals with the same name plays a role in our accuracy score. A search for a common name such as “Steve Smith” will have a much lower accuracy score than a more unique / one of a kind name.

Level of detail provided on a record:

The more information that you provide on each record, the greater the accuracy score. Even though there may be 1,000 individuals named “Steve Smith” if we’re able to match additional fields such as a phone number or mailing address it increases the accuracy score for that record.

Our data source / date the data source was updated:

We recognize that not all of our data sources are created equal. The data source, as well as the update frequency, plays a role in each individual record’s accuracy score.

Which types of nonprofits see the highest append rates and the most accurate results?

Our ability to append employer data is dependent upon the input file an organization provides to us. Organizations which keep their databases up-to-date see the best results.

For instance:

- Do you have an up-to-date email address?

- Do you have an up-to-date mailing address?

- For higher education institutions, can you provide us with the years your donor / alumni graduated?

How complete are the input files that nonprofits normally send to Double the Donation?

It depends. Very rarely does an organization have comprehensive data on all of its donors, especially when you consider an organization which raises funds from multiple channels (mail, online, phone, in-person, etc.)

We do request that you provide us with as much data as you can as it helps us locate and match your records to the appropriate individual.

Are subsidiaries and alternate spelling variations listed separately or all in a single subsidiary field?

Our matching gift database is comprised of the following two tables:

- A table mapping subsidiaries to parent companies

- A table mapping all company details to a single parent company

These tables are then joined using a unique ID that ties all the data together.

Can I use employer append files I already have with Double the Donation?

Yes — though this feature is currently exclusive to Double the Donation Enterprise.

Here’s how it works:

- An organization navigates to the “import wizard” to upload its employer appends CSV file.

- The organization previews record uploads to ensure the data has been mapped properly.

- The organization leverages employer append workflows to match Unknown Eligibility donors with the correct employers.

You can learn more about leveraging bulk employer appends files alongside Double the Donation with our Knowledge Base article on the topic here.

Concluding Thoughts

The more you know about your donors, the more effectively you can target and attract them to your cause. Not to mention, having employment data on file empowers organizations to seek workplace giving opportunities as well.

You may have a solid base of information pertaining to donors’ employing companies already. However, employer appends can go a long way toward filling in the blanks and connecting the dots. This is especially true in terms of matching gift programs, volunteer grants, and more.

Interested in further developing your organization’s donor data strategy? Dive into these other forms of data appends services—and how they can benefit your team—below:

- What Is an Email Append? All Your Questions Answered. Learn more to better reach your nonprofit’s audience with accurate and up-to-date email addresses. And comprehensive email appends can help!

- What Is Phone Number Appending? How the Process Works. Planning a phonathon fundraiser or looking for new ways to get in touch with key donors? Consider phone number appending.

- What Is an Address Append? Ultimate Guide for Nonprofits. Knowing where your donors live can have a big impact on geographic-based engagement and direct mail strategies. Find out more with this guide.

- What Is a Date of Birth Append? A Comprehensive Guide. Uncover more about your organization’s supporters with date of birth appending. Find out donors’ ages for strategic segmentation, send birthday outreach, and more.