Building a Reciprocal Corporate Partnership Strategy 2026

The days of purely transactional corporate giving are fading.…

Fundraising Intelligence: Capture + Leverage the Right Data

In the modern nonprofit landscape, data is more than just numbers…

Using Wealth Screening to Identify Challenge Match Donors

Challenge matches rely on securing a significant financial pledge…

A Nonprofit Guide to Employer Appends Educational Resources

Data is the currency of the modern nonprofit sector, yet so many…

Employer Appends Best Practices for Nonprofits to Know

Data is the lifeblood of modern fundraising. It informs who you…

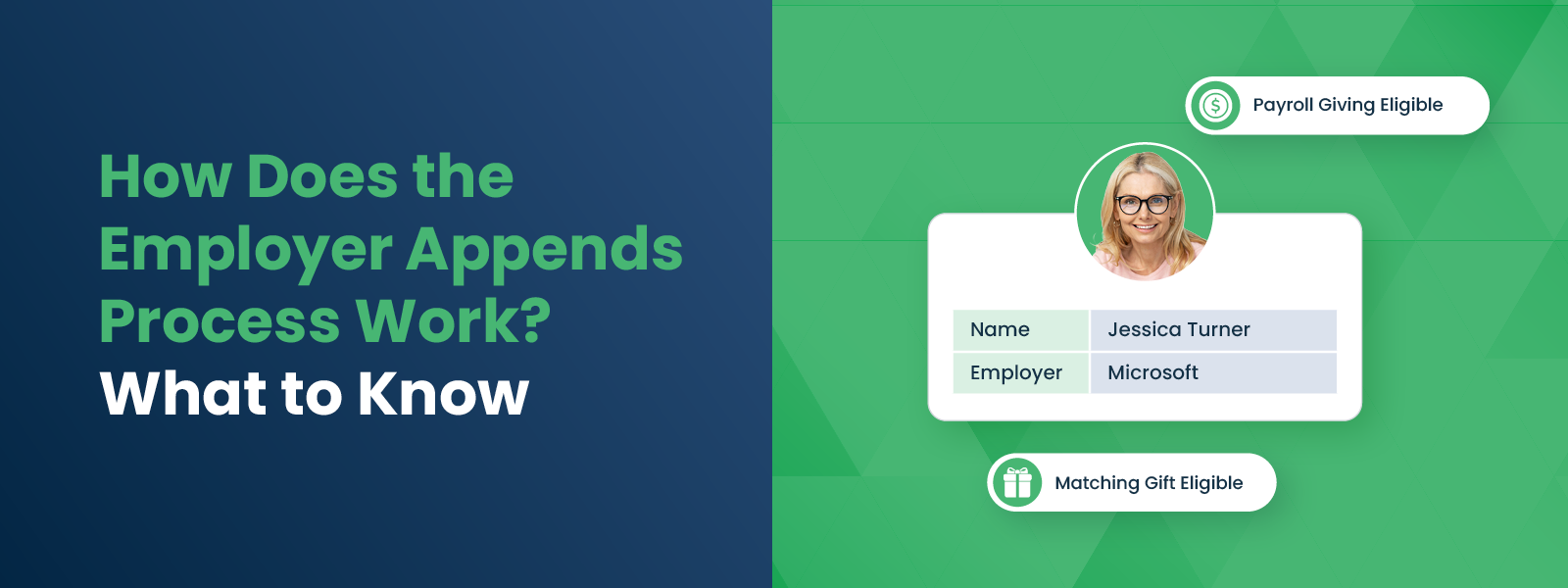

How Does the Employer Appends Process Work? What to Know

Data is the currency of modern fundraising, but for many nonprofits,…

Unlocking Corporate Grants Using Supporter Employment Data

Securing corporate grants can often feel like a daunting task,…

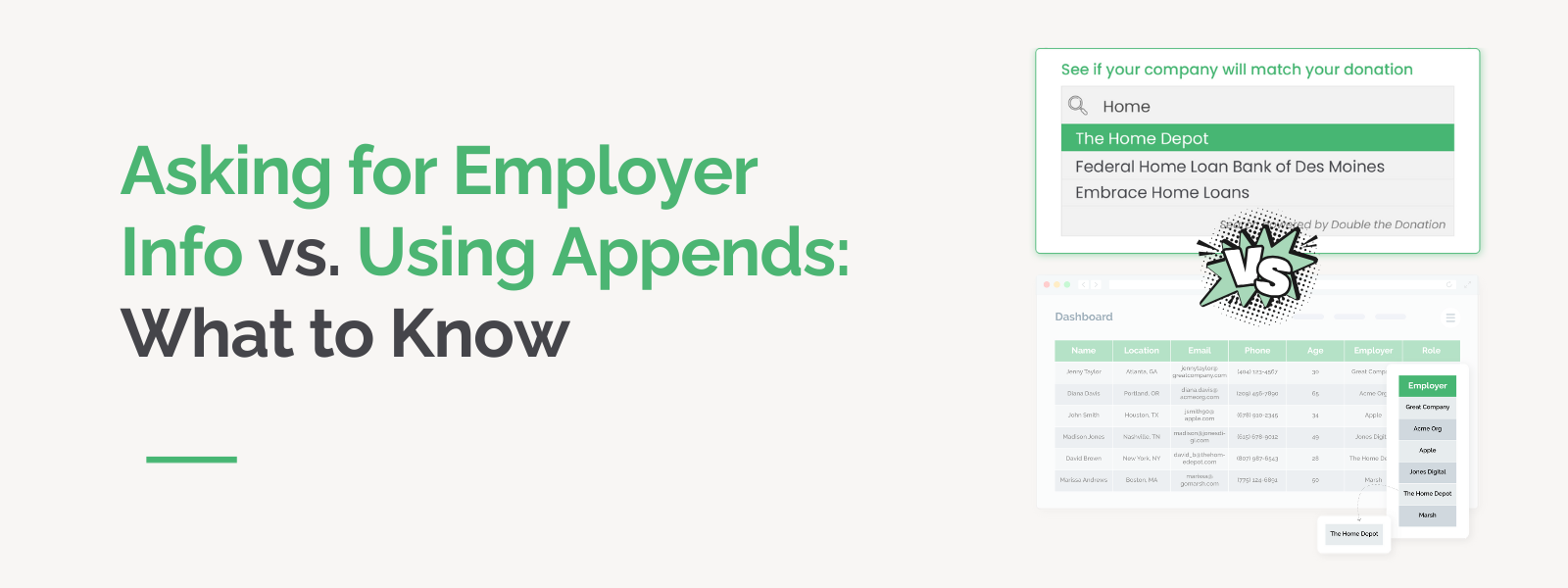

https://doublethedonation.com/wp-content/uploads/2025/07/DTD_Asking-for-Employer-Info-vs.-Using-Appends-What-to-Know_Feature.png

600

1600

Adam Weinger

https://doublethedonation.com/wp-content/uploads/2025/11/DTD-horizontal-logo-300x63.png

Adam Weinger2025-07-16 19:02:492025-11-21 04:29:31Asking for Employer Info vs. Using Appends: What to Know

https://doublethedonation.com/wp-content/uploads/2025/07/DTD_Asking-for-Employer-Info-vs.-Using-Appends-What-to-Know_Feature.png

600

1600

Adam Weinger

https://doublethedonation.com/wp-content/uploads/2025/11/DTD-horizontal-logo-300x63.png

Adam Weinger2025-07-16 19:02:492025-11-21 04:29:31Asking for Employer Info vs. Using Appends: What to Know

Is an Employer Append Right for Your Nonprofit? How to Know

If your donor database is missing key employment information,…

How Employer Appending Completes Your Workplace Giving Donor Profiles

When it comes to equipping your team with enhanced workplace…