Volunteer Grants for Faith-Based Groups: A Crash Course

In the landscape of corporate philanthropy, volunteer grants represent a powerful avenue for nonprofits and other mission-focused organizations to increase their fundraising potential. However, when it comes to volunteer grants for faith-based groups (much like that of matching gifts), there can be some nuance regarding eligibility.

While some may assume religious groups to be ineligible for the programs, the truth is that many still qualify for corporate grants. And in this guide, we’ll tell you everything you need to know to make the most of this opportunity for your mission cause. This includes:

- Volunteer Grant Basics: What to Know

- Common Volunteer Grant Restrictions

- Volunteer Grant Eligibility for Faith Organizations

- Sample Wording From Volunteer Grant Companies

- How Our Tools Drive Volunteer Grants for Faith-Based Groups

For churches, synagogues, mosques, and other faith-based institutions, understanding and tapping into volunteer grant programs can offer a meaningful boost to their efforts, enabling them to further their missions and better serve their communities. Let’s find out how you can do so, too.

Volunteer Grant Basics: What to Know

Volunteer grants, also known as “dollars for doers” programs, are corporate giving initiatives where companies provide monetary donations to nonprofits in recognition of their employees’ volunteerism.

Here’s how the programs generally work:

- An individual volunteers with a nonprofit organization.

- After completing their volunteer hours, the individual is prompted to look into their eligibility for a volunteer grant.

- If eligible, the individual completes a brief request form for their employer, verifying their volunteer hours and offering information about their time spent.

- The individual’s employer reviews the volunteer grant request and ensures the effort adheres to the company’s program guidelines.

- A volunteer grant is paid out by the employing company to the nonprofit organization according to the number of hours the individual volunteered.

These grants are popular in corporate philanthropy because they encourage employees to give back while also offering financial support to causes their teams care about. This win-win model provides much-needed funds to charitable organizations while promoting a culture of giving within companies.

Common Volunteer Grant Restrictions

Volunteer grant programs are an excellent way for nonprofits to receive additional funding, but they often come with certain restrictions. After all, companies want to ensure grants paid out align with their corporate policies, values, and other requirements.

As a result, routine restrictions may include:

- Eligible nonprofits: Many companies will permit volunteer grants to any 501(c)(3) nonprofits in the U.S. (or international equivalent). However, some employers may reserve grants for causes that align with their focus areas (education, environmental protection, etc.), while others exclude certain mission categories altogether.

- Eligible employees: Some companies offer volunteer grants only for full-time employees, while others extend the programs to part-time and retired staff—or even employees’ spouses! Meanwhile, select employers require a minimum tenure before team members are eligible to request a grant.

- Verification of time: Some companies require nonprofits to verify volunteers’ hours to ensure accurate reporting has occurred. For this reason, effective time-tracking for corporate volunteers is a must.

- Minimum and maximum volunteer hours: Many programs require employees to volunteer a number of hours before a grant is triggered, typically in increments like 10, 25, or 50. On the other hand, there are often caps on the total grant amount an individual can request in a year.

- Submission deadlines: Many companies establish deadlines for employees to submit volunteer grant requests in order for their time to remain eligible. For example, deadlines are often set within 90 days of a volunteer service or by the end of the calendar year in which an activity was completed.

For nonprofits, understanding these restrictions allows your teams to provide clearer guidance to volunteers while maximizing available funding opportunities. Educating volunteers on their company’s policies, deadlines, and requirements can help ensure their efforts translate to financial support for the organization.

Volunteer Grant Eligibility for Faith Organizations

Volunteer grant eligibility can vary for faith-based organizations—and, unfortunately, there’s no one-size-fits-all answer. Many companies place restrictions on religious activities to maintain inclusivity and adhere to corporate giving guidelines.

However, many religious organizations can still qualify for volunteer grants if they meet specific criteria.

Here’s a closer look at how faith organizations can qualify for volunteer grants and what challenges they might encounter:

- Secular Programs: Many companies provide grants to faith-based organizations if the volunteer work directly supports a secular program that serves the broader community. For instance, a church operating a community food pantry or shelter that is open to all—regardless of religious affinity—may qualify.

- Religious Worship: On the other hand, any activities directly related to religious worship or instruction (e.g., leading Bible studies, performing in church services, or teaching religious classes) are often excluded from volunteer grant eligibility.

That said, there is a wide range of faith-based institutions that do qualify for volunteer grants. These can include:

- Independent Charitable Arms: Organizations affiliated with a faith community but operating independently, such as Catholic Charities or Lutheran Social Services, typically qualify because they serve secular needs and operate as independent 501(c)(3) nonprofits.

- Schools and Educational Programs: Religious schools and educational programs may qualify for volunteer grants if they provide nonreligious instruction or have a broader community service mission.

- Community-Focused Missions: Faith-based organizations involved in community outreach that do not require participation in religious activities (like soup kitchens, after-school tutoring, or disaster relief) are often eligible.

In other words, faith-based organizations often qualify for volunteer grants if their activities meet community needs in a secular or nonreligious context. Understanding each company’s policies on religious involvement can help faith organizations tap into these corporate giving opportunities with greater success than ever before.

Sample Wording From Volunteer Grant Companies

Don’t just take our word for it! Hear directly from several top companies’ program policies regarding volunteer grants for faith-based groups below:

“We do not provide general funding to any organization whose purpose is to promote or discourage the observance or proselytization of religious beliefs. However, we will support such organization’s funding of homeless shelters, soup kitchens or other social service needs. The organization may be asked to provide proof of the community project receiving funding.”

— Bank of America

“Eligible Nonprofits

- United States-based nonprofit public charities that maintain a current tax-exempt status under section 501(c)(3) of the Internal Revenue Code and are registered and active in the Benevity Causes portal.

Ineligible Nonprofits

- Organizations that engage in political activities.

- Organizations that discriminate based on race, ethnicity, gender, gender identity, religion, sexual orientation, disability, age, or or any other legally protected characteristic or class.

- Organizations that do not follow Kohl’s Business Partner Code of Conduct or do not align with Kohl’s overarching mission of giving back to our communities, as determined by Kohl’s.

- Organizations for which its tax-exempt status has been revoked by the Internal Revenue Service.

- Organizations that intend to use Kohl’s donation for a purpose other than its charitable cause.”

— Kohl’s

“Eligible Charities” means organizations that (1) meet Verizon’s eligibility rules at https://www.verizon.com/about/responsibility/grant-requirements and (2) are listed as eligible to receive tax-deductible charitable contributions by the U.S. Internal Revenue Service at the time (a) the hours are volunteered, (b) the grant request is submitted and (c) the Verizon Foundation proposes to pay the grant. Note that not all 501(c)(3) organizations are Eligible Charities.

To be considered for an invitation, an organization must be: Classified by the Internal Revenue Service as a tax-exempt charity under section 501(c)(3) of the Internal Revenue Code and further classified as a public charity under section 509(a)(1)-509(a)(3) of the Internal Revenue Code, as follows:

Organizations described in section 170(b)(1)(A) clauses (i) – (vi):

170(b)(1)(A)(i) – Church, provided that the grant will benefit a large portion of a community without regard to religious affiliation and does not duplicate the work of other agencies in the community.”— Verizon

“What types of organizations are ineligible to receive a Volunteer Challenge Grant?

- Organizations other than those that are 501c3 public charities (such as 509a3 supporting organizations) are not eligible to receive a grant from the CVS Health Foundation.

- Organizations that discriminate against a person or group on the basis of age, race, ethnicity, sexual orientation, political affiliation, or religious beliefs.

- International organizations.

- Churches that DO NOT have a 501c3 public charity status from the IRS.”

— CVS Health

“The company will not support religious organizations for denominational or religious purposes. If a religious organization has a community outreach program with a tax ID number, EIN number or registered charity number, these programs could be reviewed for approval into My Community. You can search for the organization’s tax ID or EIN number on Guidestar. Please see the examples below.

- Ineligible – A Church runs a weekly soup kitchen, but the soup kitchen is not recognized with its own tax ID number, EIN number, or registered charity number – they are simply a program run by the Church and funded directly by the Church.

- Eligible – The Church soup kitchen is registered independently with its own tax ID number, EIN number, or registered charity number and is registered independently. In this case, the soup kitchen would be eligible.”

— Thomson Reuters

“Organizations applying must meet one of following criteria:

- An organization holding a current tax-exempt status as a public charity under Section 501(c)(3) of the Internal Revenue Code, listed on the IRS Master File and conducting activities within the United States, classified as a public charity under Section 509(a)(1), (2) or (3) (Types I or II); and Deed verified.

- A recognized government entity: state, county or city agency, including law enforcement or fire departments, that are requesting funds exclusively for public purposes and Deed verified.

- A K-12 public or nonprofit private school, charter school, community/junior college, state/private college or university; or a church or other faith-based organization with a proposed project that benefits the community at large, such as food pantries, soup kitchens, and clothing closets and Deed verified.”

— Walmart

“The Alliant Energy Foundation will not give volunteer grants to religious institutions such as churches, synagogues, temples, or other houses of worship or to any organization whose main purpose is to promote a specific faith, creed, or religion and/or direct resources to advocate for a specific ideology. However, the hours that an eligible participant volunteers for those types of organizations can be counted toward your total hours for the year.”

— Alliant Energy

“By exception, religious organizations may be eligible if funds are designated for certain secular activities provided they are:

i. Are open to all individuals in the community regardless of religious belief;

ii. Serve a secular purpose, such as a food pantry or a homeless shelter; and

iii. Do not require participants to join in religious worship as a condition of receiving the services that the nonprofit offers.”— Marathon Petroleum Company

How Our Tools Drive Volunteer Grants for Faith-Based Groups

The biggest challenge facing volunteer grant success for any organization—but especially faith-based groups—is a general lack of awareness of the programs. Not to mention identifying those who work for companies with inclusive volunteer grant initiatives in the first place.

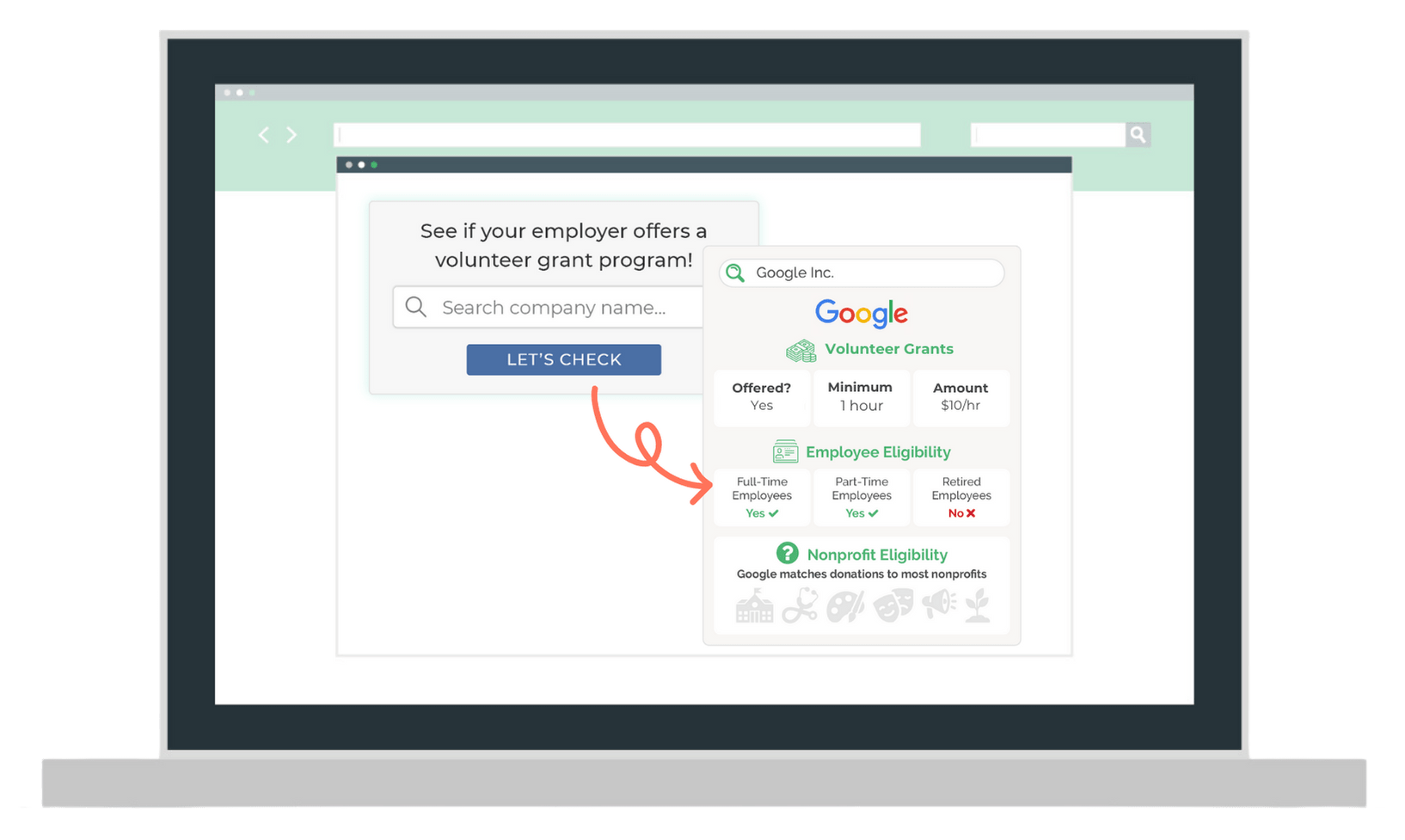

Luckily, the easiest way to discover the information is with a volunteer grant database tool like Double the Donation Volunteering. This is a powerful solution for faith-based and other groups looking to boost their volunteer grant revenue by simplifying the process of uncovering and targeting eligible volunteer grants. With this tool, you can embed a searchable company database directly into your volunteer info page—or even your event registration forms!

From there, all an individual has to do is begin typing their company name and select the appropriate employer from the dropdown list. Then, they’ll be met with company-specific program guidelines and request forms in real-time, making it easier than ever for them to get involved.

Wrapping Up & Additional Resources

For faith-based groups looking to expand their impact, volunteer grants are an underutilized but powerful resource. By tapping into these programs, your organization can cultivate stronger relationships with corporate partners, mobilize your volunteer base, and generate essential funding.

Remember, the key to success with volunteer grants lies in building awareness among your supporters. With a strategic approach, your organization can leverage volunteer grants to not only support day-to-day operations but also fuel programs that drive long-term change.

Interested in learning more about volunteer grants for faith-based groups like yours? Check out these recommended resources:

- Top Volunteer Grant Companies Offering Dollars for Doers. Discover which companies offer the most generous volunteer grants and other standout programs. Then, see which of your supporters work for these employers.

- Top Volunteer Grant Databases to Grow Your Tech Stack. The easiest way to uncover volunteer grant opportunities is with a searchable database tool. Read up on our top suggestion for organizations like yours.

- Standout Strategies for Leveraging Corporate Volunteer Incentives. Dive deeper into corporate volunteer incentives like volunteer grants and paid time off. Our free downloadable resource covers it all!