Tracking Payroll Giving: A Nonprofit’s Step-by-Step Guide

Payroll giving is a powerful tool for fundraising organizations, providing a steady and reliable stream of income through regular donations directly from supporters’ paychecks. As more companies implement payroll giving programs to support charitable causes, nonprofits like yours must understand how effectively managing and tracking payroll giving can make an impact.

Why? Properly monitoring payroll donations ensures accurate financial reporting, strengthens donor relationships, and maximizes the overall impact of this funding source.

In this blog post, we’ll walk you through a step-by-step guide on how to track payroll giving for your cause. This includes:

- Registering for companies’ payroll giving platforms.

- Determining specific payroll giving metrics and objectives.

- Establishing a system for recording payroll donations

- .Monitoring regular contributions.

- Reconciling payroll donations with financial records.

- Reporting on KPIs and other giving patterns.

From setting up the necessary infrastructure to reconciling your financial records and beyond, we’ll cover everything you need to know to stay on top of your payroll giving program and enhance its long-term success. Let’s dive in!

1. Register for companies’ payroll giving platforms.

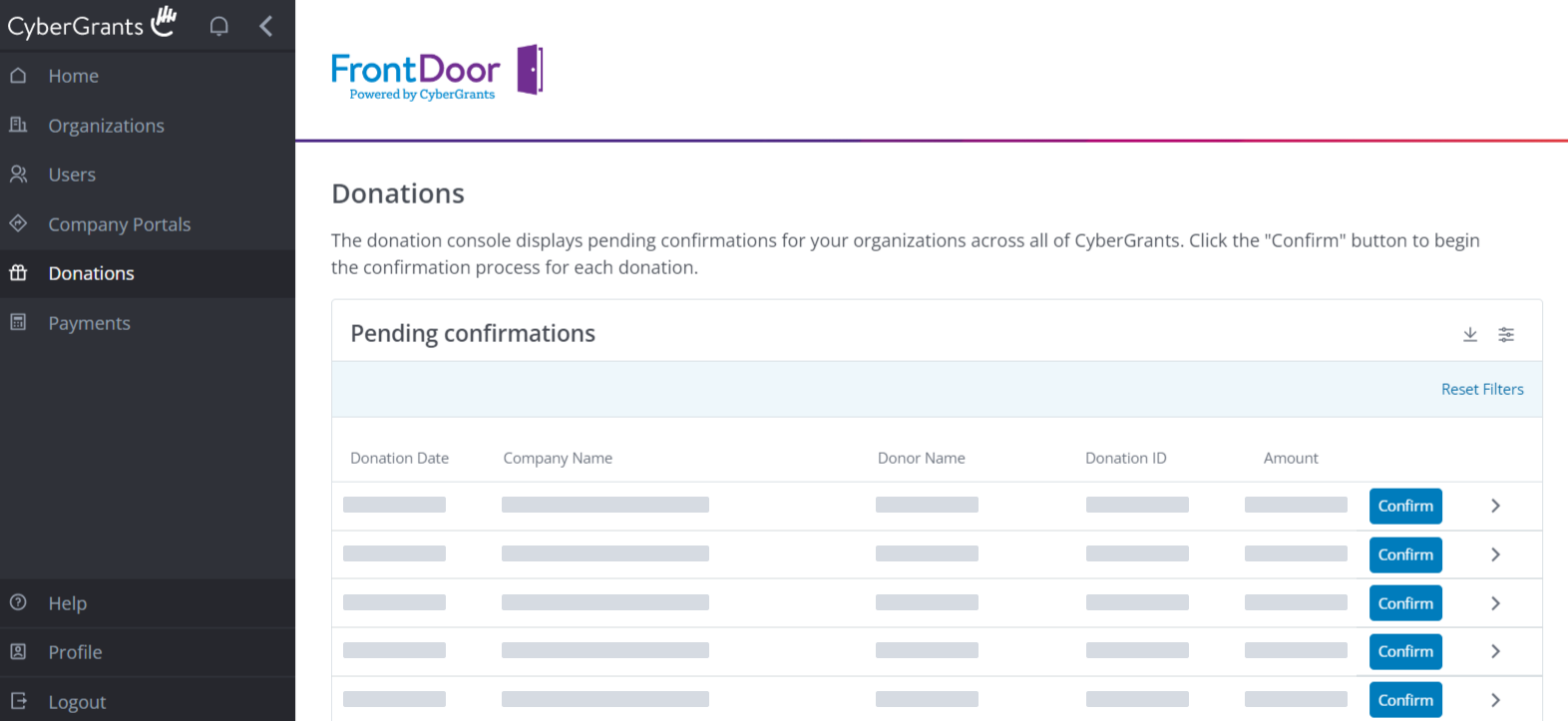

The first step in effectively tracking payroll giving is for your nonprofit to register with the companies or platforms that offer payroll giving programs. Many corporations partner with specific third-party platforms, such as CSR software, to manage their payroll giving initiatives. By registering on these platforms, your organization becomes eligible to receive donations directly from employees’ paychecks, making it easier to capture funds and track giving trends.

The registration process itself typically involves providing key organizational information, including your nonprofit’s EIN (Employer Identification Number), mission statement, and financial documentation. You may also be asked to complete a verification process to confirm your nonprofit’s status as a registered 501(c)(3) organization.

Then, once approved, your organization can be listed on the company’s payroll giving platform, enabling employees to select your nonprofit as a beneficiary of their payroll contributions. Just keep in mind that the better you maintain your profile, the more accessible your organization will be to potential donors within participating companies.

Top tip: While there’s a ton of CSR software out there, we recommend prioritizing CLMA-designated solutions first. These platforms demonstrate an ongoing commitment to streamlining the employee giving process, and even offer a seamless matching gift experience for donors who qualify for donation-matching!

2. Determine specific payroll giving metrics and objectives.

Before tracking payroll giving, your nonprofit must first establish clear metrics and objectives that you wish to capture. By determining what success looks like, you can collect and analyze the right data to optimize your approach. These metrics will help guide your analysis, identify trends, and allow you to make necessary improvements to maximize your payroll giving revenue.

To start, we recommend identifying key performance indicators (KPIs) that align with your organization’s goals. Some important payroll giving metrics you might consider include:

- Number of payroll donors: How many employees are participating in payroll giving?

- Average donation size: How much are donors contributing through payroll deductions?

- Total amount raised: What is the overall financial impact of your payroll giving program?

- Donor retention rates: How many payroll donors continue their contributions over time?

- Donor growth rate: Are you attracting new donors through payroll giving programs?

- Employer match rates: How often are donations being matched by the participating companies?

In addition to financial metrics, consider tracking engagement and awareness-building efforts. For instance, you may want to monitor how many companies your organization has registered with, how frequently your nonprofit is being promoted on payroll platforms, and the extent to which employees are aware of your participation.

Defining these objectives will not only help you track progress but also assist in creating a strategy to optimize payroll giving. Clear metrics allow you to compare your results over time, analyze what’s working, and adjust your approach accordingly. Ultimately, having well-established goals will help your nonprofit make data-driven decisions and achieve sustained growth in your payroll giving efforts.

3. Establish a system for recording payroll donations.

Once your organization is listed on payroll giving platforms and you’ve determined the KPIs you wish to track, the next step is to establish a reliable system for recording payroll donations. Remember: effective tracking requires organized and accurate documentation of each gift, making it crucial to develop a robust method for capturing payroll donation data.

Start by integrating your nonprofit’s CRM (or Constituent Relationship Management) system with payroll platforms or donation management tools. Many CRM systems even offer specialized features for recording recurring donations like payroll contributions. Ensure that your CRM is set up to automatically track the donation details, including the donor’s name, donation amount, frequency, and employer.

Additionally, your system should be capable of categorizing payroll donations separately from other types of contributions, such as individual one-time gifts or grants. This allows your team to monitor and report on payroll giving specifically, ensuring better accuracy in your overall financial reporting.

Create standardized procedures for entering payroll donation data, especially if the process requires manual entry. This should include guidelines for inputting donor information, donation amounts, and transaction dates, as well as how to handle any errors or discrepancies in reporting.

Maintaining organized and updated records will help you avoid common pitfalls like double-counting donations, losing track of donors, or failing to reconcile your financial reports properly. A well-structured system ensures that your organization can track, analyze, and optimize payroll giving effectively, resulting in better decision-making and streamlined reporting.

4. Monitor regular contributions.

Once you have an efficient system in place to record payroll donations, the next step is to monitor these contributions regularly. Since payroll donations are often recurring, tracking and reviewing them on an ongoing basis is essential for managing your nonprofit’s cash flow and donation trends.

It’s important to set a schedule for checking donation activity, whether that’s weekly, biweekly, or monthly. Regular monitoring allows your nonprofit to quickly identify fluctuations in giving patterns, such as increases during key fundraising periods or decreases during off-seasons. It also helps ensure that donations are consistently received from payroll platforms and that there are no delays in disbursement.

During these reviews, verify that the correct donation amounts are being recorded and ensure that no payments have been missed. Monitoring should also include keeping an eye on matching gift contributions if companies offer them alongside payroll giving. These matching donations can significantly boost the overall funds received, making it crucial to track and follow up on any outstanding matches.

In addition, consider setting up automated alerts or reports to notify your team of key changes in payroll donations, such as when a new donor begins contributing or an existing donor alters their contribution amount. Having this information readily available will allow you to respond proactively, whether by thanking new donors, reaching out to those who adjusted their contributions, or following up on any discrepancies in donation amounts.

5. Reconcile payroll donations with financial records.

To maintain transparency and accuracy in your nonprofit’s finances, it’s crucial to regularly reconcile payroll donations with your broader financial records. Reconciliation involves comparing your internal records of payroll donations with the financial data provided by payroll platforms or corporate partners to ensure everything matches and there are no discrepancies to consider.

This process typically starts by reviewing your financial reports, which should list all donations received during a specific period. From there, compare these records with the reports generated by payroll giving platforms or the companies facilitating the donations. Look for any discrepancies between the two sets of data, such as missed donations, incorrect amounts, or unmatched transactions.

Be sure to track donation timing as well. Payroll donations are often disbursed on a different schedule from one-time gifts, meaning you may need to account for delays in receiving funds or differences between when donations are pledged and when they appear in your account.

Once you’ve identified any inconsistencies, work with your finance team and the payroll platform to address and correct any issues. This might involve contacting the donor’s employer or the payroll platform to verify missing contributions or to reconcile donation amounts.

All in all, accurate reconciliation is key to ensuring that your nonprofit’s financial health remains intact. Not to mention, donors can trust that their contributions are being properly recorded and used as intended.

6. Report on KPIs and other giving patterns.

The final step in tracking payroll giving is to report on the key performance indicators (KPIs) and analyze the giving patterns. Once you’ve gathered sufficient data, use it to create reports that offer insights into how well your payroll giving program is performing. This not only helps your internal team assess progress but also demonstrates accountability to your board, stakeholders, and donors.

When preparing your reports, consider including metrics such as:

- Total payroll donations received over a specific period

- Number of active payroll donors

- Average contribution size

- Growth in payroll giving participation

- Comparison of payroll donations versus other giving channels

- Employer match contributions and their impact

These reports can highlight trends in donor behavior and reveal patterns in employee giving, such as increased donations during specific months or after targeted marketing campaigns. Additionally, breaking down contributions by employer can help identify which companies are driving the most payroll giving and where more efforts might be needed to engage new partners.

Beyond financial reports, it’s valuable to analyze donor retention and engagement rates. Are employees continuing their payroll contributions year over year, or do they tend to drop off after a few months? Understanding this will help you tailor your outreach and stewardship efforts.

Regular reporting allows your nonprofit to fine-tune its approach to payroll giving, identify opportunities for growth, and ensure your program’s long-term success.

Final thoughts & additional resources

Tracking payroll giving donations is essential for ensuring your nonprofit fully benefits from this invaluable funding source. Follow the steps outlined in this guide to equip your team to manage payroll donations efficiently, maintain accurate records, and nurture strong relationships with your supporters.

As payroll giving continues to grow in popularity, nonprofits that implement effective tracking strategies better position themselves to capitalize on this consistent source of revenue and ultimately drive greater impact for their missions. Good luck!

For more information on payroll and other workplace giving strategies, check out the following recommended resources:

- Payroll Giving: Drive Employee Donations For Your Cause. Get the complete guide to payroll giving! Find out how your team can make the most of these programs with our comprehensive overview.

- Top 20+ Matching Gift (+ Payroll Giving) Companies. Matching gifts and payroll giving go hand in hand. Take a look at the top companies offering matching gifts and payroll deduction opportunities here.

- Payroll Giving Statistics | 14 Fun Facts for Fundraisers. Expand your knowledge of all things payroll giving with these inspiring statistics. Then, use these insights to guide your organization’s own strategy!