A robust corporate social responsibility (CSR) program impacts corporations, their employees, their customers, and nonprofits. For example, offering opportunities to connect with social good organizations can reduce staff turnover by 50%. Most importantly, CSR initiatives like corporate matching gift programs provide nonprofits with the funding they need to further their missions.

So, how can nonprofits like yours take advantage of these opportunities? In this guide, we’ll explore what you need to know to double donations through corporate matching gifts.

Let’s begin!

What are matching gifts?

Corporate matching gifts are a type of philanthropy in which companies financially match donations that their employees make to nonprofit organizations.

When an employee makes a donation, they’ll request a matching gift from their employer. The employer then makes their own donation to the nonprofit.

Companies usually match donations at a 1:1 ratio, but some will match at a 2:1, 3:1, or even a 4:1 ratio.

Don’t confuse matching gifts with a matching donation challenge—while both require a corporate partner, matching donation challenges (also known as matching grants) are usually time-gated, whereas matching gifts are usually not.

Why are corporate matching gifts valuable?

Corporate matching gifts are one of the most powerful, and yet often underutilized, forms of nonprofit fundraising. At their core, matching gifts represent free money that’s readily available to organizations like yours. When a donor gives and their employer matches that gift, your nonprofit receives twice the impact from a single donation.

Think of it this way: for every dollar donated, there’s potential for another dollar to follow, without asking the donor to reach back into their wallet. That means your fundraising team can double its results with no added expense.

And it’s not just beneficial for nonprofits—supporters love it, too. In fact, research shows that 84% of donors are more likely to give if they know a matching gift is available, and 1 in 3 donors say they’d make a larger gift if their donation is being matched. Offering a match not only encourages initial giving but can also lead to higher average gift sizes and deeper donor engagement.

In short, corporate matching gifts are a win-win-win: for nonprofits, for donors, and for the companies that want to show their commitment to social good. By tapping into this resource, you’re unlocking an easy, scalable way to increase your funding and amplify your mission.

Why do organizations overlook corporate matching gifts?

Because so few donors know about their employer’s corporate matching gift programs to begin with, many nonprofits struggle to raise significant matching gift revenue. Additionally, fundraising teams often lack a comprehensive understanding of matching gifts, and nonprofits don’t always know who each donor’s employer is or what their specific matching gift policy is.

Thus, nonprofit-wide training on the opportunity is a must, and passing insights along to donors can go a long way to boost awareness of these programs.

Case Study: National Multiple Sclerosis Society

The National Multiple Sclerosis Society began using Double the Donation Matching to take advantage of low-hanging fruit, like matching gifts, in order to maximize fundraising revenue. To fund groundbreaking research and treatment options for those suffering from multiple sclerosis, NMSS needed to capture more unclaimed matching gifts.

As a result, NMSS identified over $2.4 million in match-eligible dollars in less than 12 months. Its 370,000 matching gift emails received an impressive 52% open rate, with 56% of donors accessing matching gift forms or guidelines.

Takeaway: Corporate philanthropy programs allow your donors to maximize the impact of their donation without having to reach back into their wallets.

Top Corporate Matching Gift Programs

Most widely used matching gift program

First-ever matching gift program

Most generous matching gift program

| COMPANY | MAXIMUM MATCH AMOUNT | LEARN MORE |

| Microsoft | $15,000 | Microsoft’s matching gift program |

| GE Aerospace (General Electric) | $5,000 | GE Aerospace’s matching gift program |

| Soros Fund Management | $100,000 | Soros’ matching gift program |

| BP | $5,000 | BP’s matching gift program |

| Gap Corporation | $15,000 | Gap’s matching gift program |

| State Street Corporation | $10,000 | State Street Corporation’s matching gift program |

| ExxonMobil | $7,500 | ExxonMobil’s matching gift program |

| CarMax | $5,000 | CarMax’s matching gift program |

| Johnson & Johnson | $20,000 | Johnson & Johnson’s matching gift program |

| The Walt Disney Corporation | $25,000 | Disney’s matching gift program |

Which Types of Nonprofits Are Eligible for Matching Gifts?

Educational Institutions

Including: universities, colleges, seminaries, alumni funds, K-12 schools, or school district foundations

Arts and Cultural Organizations

Including: museums, zoos, aquariums, theaters, orchestras, operas, or public broadcasting stations

Community Organizations

Including: animal shelters, homeless shelters, low-income assistance, child welfare, or public works programs

Environmental Organizations

Including: conservation efforts, wildlife preservation programs, or public state or national parks

Health and Human Services

Including: hospitals, community health centers, substance abuse programs, health services, or other healthcare organizations

Which nonprofits are ineligible for matching gifts?

Restrictions for eligibility ultimately fall to the employer, but the most common restriction is for religious and political organizations.

For example, many employers will not match donations made directly to houses of worship. However, they will often match donations made to institutions affiliated with houses of worship that provide a service to community members regardless of religious beliefs, such as food banks or homeless shelters.

Additionally, some employers may choose not to match contributions to strictly political causes.

Takeaway: Approximately two-thirds of companies match employee donations to nearly any of these kinds of 501(c)(3) organizations or educational institutions. The remaining third typically select organizations and programs more closely related to their mission.

Corporate Matching Gift Program Guidelines

Matching Gift Ratio

Every company has a different idea of what a “match” is for its employees. The majority of companies match at a 1:1 ratio, but others have drastically different standards.

For example, some companies will give $0.50 for every dollar an employee donates, while others will give as much as $4 for every $1 that an employee donates (a 4:1 ratio).

The ratio may also differ based on:

- The type of employee

- The type of organization the employee donates to

Minimum & Maximum Amounts

Wouldn’t it be nice if your major gift donors’ employers could double their gifts? Unfortunately, that’s not feasible in most cases. Companies apply minimums and maximums to their corporate philanthropy programs.

The most common minimum is $25, although it can range from $1 to $100. The maximum can range from $1,000 to $15,000, and sometimes further in either direction.

The minimum and maximum amounts vary by company, employee, and nonprofit type, so every employer will have a different policy.

Submission Deadlines

Different companies have different deadlines. If you and your donors are aware of these dates, you’ll ensure that you don’t miss out on easy money.

Standard match request submission deadlines can include:

- The end of the calendar year.

- A set number of months after the date of the donation, most often 3-12 months.

- End of January, February, or March in the year subsequent to when the donation was made.

Takeaway: Make your follow-up process more efficient and effective by investigating match ratios, maximum and minimum gift amounts, and the submission deadlines of your donors’ employers’ programs.

Types of Matching Gift Submission Process

There are two different ways to submit a request for a matching gift: through traditional, manual submissions and through matching gift auto-submission (recently out of beta).

Here’s how each of these processes works.

Traditional Matching Gift Submission

Here’s the basic process a donor will need to follow in order to submit a corporate matching gift request and have it fulfilled by their employer:

Step 1: Donor submits a donation

The first step in submitting a match request is making the original donation for the company to match.

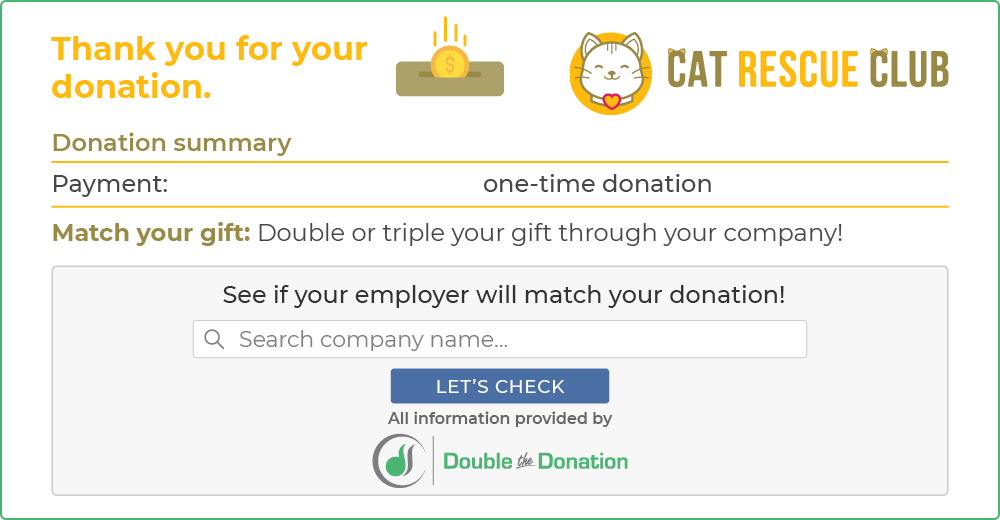

If you’ve followed our top corporate philanthropy marketing strategies, during or immediately after the donation submission process, your donor will encounter corporate philanthropy information on your website.

They might see a plugin on your donation form or on your donation confirmation screen. This plugin is their portal to the matching donation process.

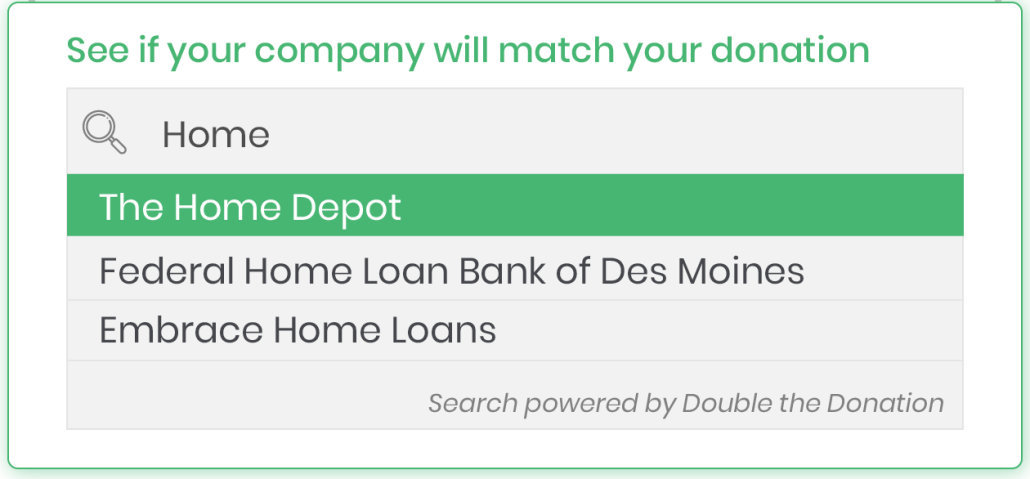

Step 2: Donor determines eligibility

Once your donor decides they want to submit a match request, they need to determine if their donation is eligible to be matched by their employer.

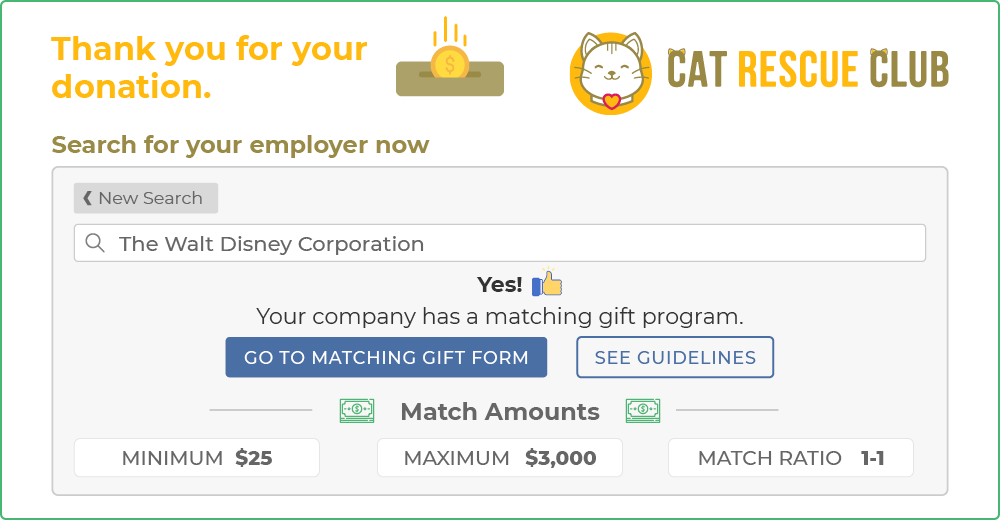

Using a database search tool, your donor types in the name of their employer. If the company offers a corporate philanthropy program, the company’s name will appear in the drop-down menu. All your donor has to do now is click on the name of their company!

Step 3: Donor submits forms

On the resulting company gift information page, donors can check to see if:

- Their employer matches donations by employees like them (e.g., full-time, part-time, or retired).

- The nonprofit they’re donating to is eligible to receive matched donations from their employer.

- Their gift amount qualifies for a corporate donation.

Once donors know that they and the nonprofit they’re donating to are eligible for a matching donation, they click on the link to the necessary online forms provided by the database tool. They fill out those forms and hit submit!

More than 80% of companies require match requests to be submitted online. Directing your donors straight to the online forms makes the process quicker and easier.

Step 4: Company makes donation

Your donor’s employer has to review the forms they submitted and follow up with your nonprofit to confirm that the original donation was made.

If all the forms and information are in order, the company sends your nonprofit a check!

This step in the process is a great opportunity to send an email or letter to your donor. Thank them again for their donation and inform them that the corporate match has arrived.

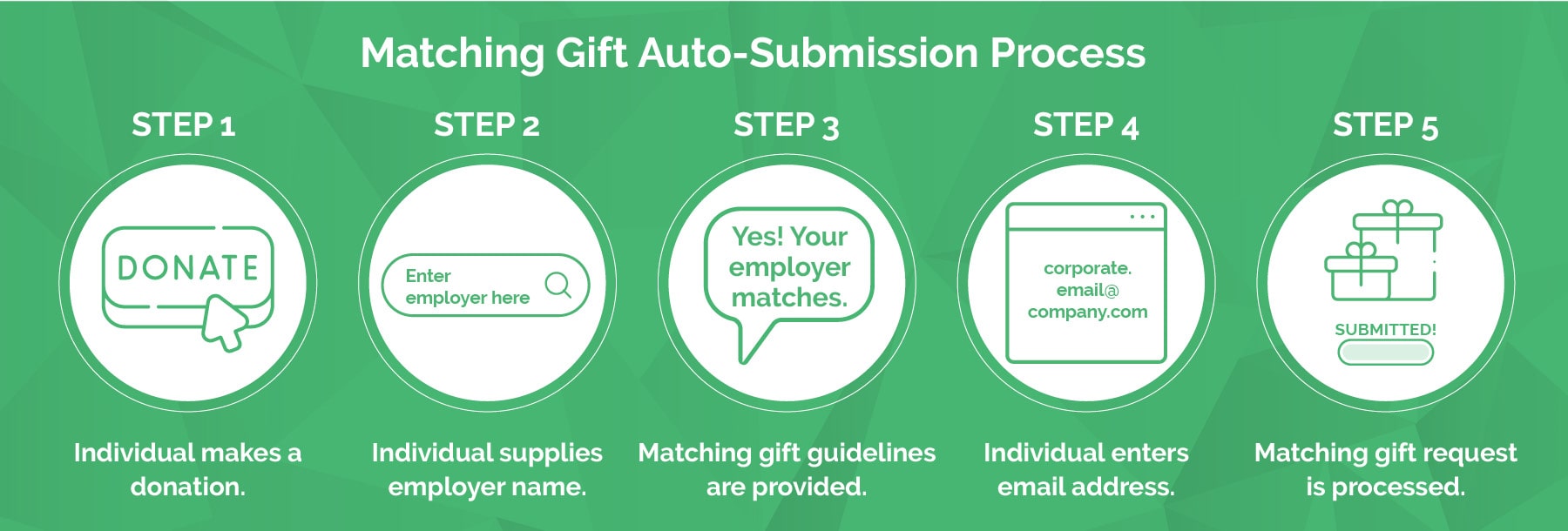

New: Matching Gift Auto-Submission

Matching gift auto-submission simply automates the traditional matching gift request process. This makes requesting a matching gift easier than ever, helping direct more matching gift revenue to nonprofit organizations. Double the Donation offers auto-submission capabilities that complement the power of CSR tools.

Here’s more about auto-submission and how it benefits nonprofits:

Auto-submission requires fewer actions from donors in order to complete the matching gift process. The simple steps they’ll need to take to request a match from their employer include:

- Step 1: Make a donation. This step, a donor making a donation to a charitable organization, is what kicks off any matching gift process.

- Step 2: Supply employer name. Next, the donor enters their employer’s name. This helps your organization determine whether that employer offers a matching gift program and if the particular donor is eligible to participate.

- Step 3: Receive and review matching gift guidelines. After the donor is redirected to the gift confirmation screen, they’ll see their employer’s matching gift program criteria listed. Typically, this includes minimum and maximum gift requirements, the company’s match ratio, submission deadlines, the types of employees who are eligible (e.g., part-time versus full-time), qualifying organization types, and any other relevant details.

- Step 4: Enter email address. If the donor meets all of the criteria for the program, they will be prompted to enter their corporate email address. Then, they’ll be asked to confirm permission for Double the Donation’s matching gift software to make the request on their behalf.

- Step 5: Request is processed. From here, Double the Donation’s matching gift software will take over to process the donor’s request by sending data about the individual and their donation to the corporate giving partner platform.

Finally, the match request will be approved and verified if all requirements are met. The nonprofit will receive match funding from the donors’ employer.

Takeaway:The entire matching donation submission process can be completed by a donor in less than five minutes (or even faster with auto-submission!). The key is to ensure donors know if their company will match their gift, provide them with the forms or links needed to submit their match requests, and leverage Double the Donation’s auto-submission tool.

Raise More Money with Corporate Matching Gift Software

What is a matching gift database?

A matching gift database is a type of corporate giving database that collects information about corporate matching gift programs. For example, Double the Donation’s matching gift database contains specific information about thousands of companies’ matching gift programs that can be accessed all from one place.

Here’s what using this database would look like for your supporters:

STEP 1:

Access the matching gift database.

STEP 2:

Search for your employer.

STEP 3:

View the results and take next steps.

What are the benefits of using a matching gift database?

The benefits are substantial for both donors and companies:

For Donors

Donors can take pride in knowing that their gift will be matched by a corporate matching gift program. Often, this can even make them feel inclined to give more. If they know their donation’s impact can be doubled, this can help them make the decision to donate in the first place.

For Companies

For Companies

Regardless of their size, companies can benefit by building a reputation among their communities and employees as a socially-conscious company that makes an effort to give back.

Takeaway: Using a matching gift database can help you raise more money and give donors and companies a greater sense of pride.

Double the Donation Matching

This comprehensive program is perfect for larger nonprofits who are looking for completely automated matching gifts software.

Double the Donation Matching automatically identifies opportunities to use corporate matching gift programs through verifying email addresses, and it can drive matches to completion through tracking tools and automated messaging options.

You can automate outreach, and analyze and forecast your corporate philanthropy revenue all through one program.

Takeaway: Obtaining matching gifts can be a challenge, but with the right software, you can streamline the process and increase your revenue from corporate matching gift programs.

Generate Revenue by Measuring Matching Gift Analytics

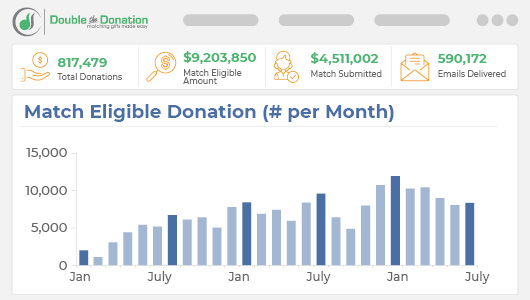

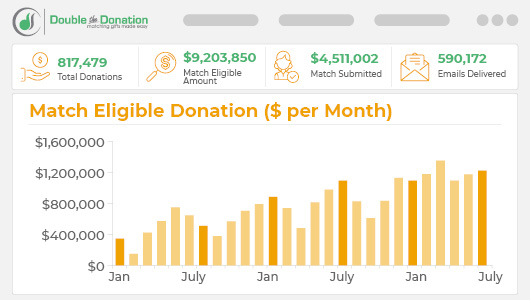

Measuring Matching Gifts

When you understand your matching gift metrics, such as the amount of match-eligible donations you receive and the total revenue raised from matching donations, you can leverage this data to generate even more revenue.

But tracking all of these data points can be difficult, especially when your team is already busy. Double the Donation Matching, the automated matching gifts marketing platform, can help you measure these metrics. And that leaves more time for your team to focus on what matters most: your mission.

Double the Donation’s Data Analysis

Double the Donation’s data tracking capabilities can give you up-to-the-minute updates on information such as:

- The percentage of your donations that are eligible to be matched.

- What stage in the matching gift request process your donors are at.

- Where the largest matching gift revenue opportunities are.

- The match submission rate of donors after you’ve followed up with them.

- How your matching gift marketing emails are performing.

With easy overviews of your data, your nonprofit will quickly be able to see where you’re succeeding and where you have room for improvement.

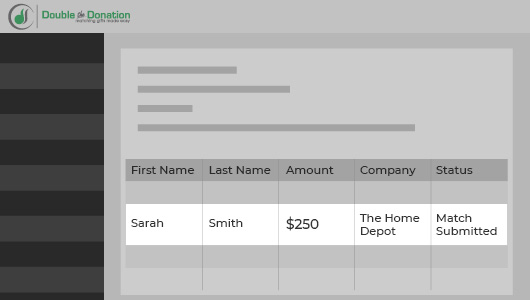

Generating Revenue

In order to start generating more revenue, it’s important to identify the following:

- Top matching gift opportunities. Look for donors who are match eligible who haven’t submitted a match request. This is a key area to identify because doubling these donations means more revenue for your organization!

- Corporate champions. Once you’ve secured matching gift donors, you can now convert them into corporate champions by accessing and engaging with all your donors who work for a specific matching gift company.

When you leverage your donor data in a way that allows you to see matching gift opportunities you haven’t pursued, you’ll identify more chances to engage with your donors and encourage them to take part in their company’s matching gift program.

Takeaway: Tracking data can be hard, but you need to know where you stand in order to track your progress. Use software like Double the Donation to automatically track and report insights for you.

Marketing Matching Gifts to Double More Donations

Provide the Right Information to the Right Donors

Maximize your matching gift potential by making it easy for donors to access the right information at the right time: during the donation process.

Integrating Double the Donation’s matching gift search widget into your donation forms streamlines the experience and increases the likelihood of completed match requests.

Here’s how to use it effectively:

- Customization: Embed the widget so that it automatically recognizes and incorporates donor details, such as their name and donation amount, creating a personalized experience that encourages follow-through.

- Guidelines and Resources: The widget provides instant access to employer-specific matching gift forms, guidelines, and submission instructions—no need for donors to search on their own. This convenience removes a major barrier to match completion.

- Tracking Capabilities: Use built-in tracking features to let donors indicate whether they’ve submitted a match request or encountered an issue. This data helps your team follow up and improve future engagement strategies.

By embedding the widget at the point of donation, you reduce friction, deliver relevant information immediately, and boost your chances of capturing more matching gift revenue.

Automate and Target Your Outreach

It’s important to engage and target each donor who might be eligible for a match. One way you can do this is by automating your outreach to help donors submit their match requests.

In order to do this, consider the following:

- Who is eligible? Identify who is eligible and hasn’t submitted a request yet. Then, engage each of these donors with a set of automated email blasts to follow up and activate matching gift opportunities.

- Who are you missing? Highlight matching gifts immediately after a donation is made by capturing key information at the time of the donation. Add Double the Donation’s matching gift widget to your existing forms, and identify matching gift eligibility based on the email address your donor uses during the donation process.

Helping your donors understand their matching gift eligibility via these methods allows you to more successfully market matching gifts and double your donations.

Advertise Your Matching Gift Page

Your website is already a major part of your marketing strategy. Use it to promote matching gifts, too! Build out a matching gifts page on your site. Then, use paid advertising platforms to promote the page to donors.

The best part? You don’t even have to dip into your marketing budget to do this. Microsoft and Google offer free access to their paid advertising platforms to eligible nonprofits. However, keep in mind that the Microsoft Social Ads for Impact program only offers $3,000 in ad credits each month and is currently not accepting new organizations. The Google Ad Grants program, on the other hand, supplies nonprofits with up to $10,000 monthly.

To promote corporate matching gifts, you’ll need to find the right keywords and create ads that encourage users to click through to your site to learn more. That’s where an advertising agency comes into play! As our recommended partner, Getting Attention will work with you to build winning campaigns that promote your website’s most important content, including your matching gift page.

Takeaway: Marketing matching gifts means understanding the information your donors need and providing it to the right people. This will result in more revenue for your organization.

Additional Corporate Matching Gift Program Resources

Matching Gift Companies

There are lots of companies that will match their employees’ donations.

However, companies like GE, CarMax, and Johnson & Johnson stand out in the crowd. Find out why!

Improve the Donor Journey

It’s important to create a positive experience for matching gift donors. Looking for best practices?

Learn how to optimize the donor experience and understand the matching gift lifecycle here!

Matching Gift Academy

Learn how to market matching gifts to donors, empower submissions, and more.

Plus, find out how to make the most of your matching gift technology with our Matching Gift Academy.

For Companies

For Companies