Asking for Employer Info vs. Using Appends: What to Know

Employment information is a valuable asset in nonprofit fundraising. It can help identify matching gift opportunities, uncover potential corporate partners, and personalize donor outreach. But how should your organization go about collecting this data? That’s where the question of asking for employer info vs. using appends comes in.

In other words, should you rely on donors to self-report where they work, or use a data append service to fill in the blanks?

Each method has its benefits and limitations, and understanding these differences is crucial for building a strong, complete, and accurate donor database. In this post, we’ll break down what nonprofits should know about both approaches and how to decide which is right for your organization. Specifically, we’ll cover:

- The value of employer info in nonprofit fundraising

- Method #1: Asking for employer info directly

- Method #2: Utilizing employer appends and employer data enrichment

- Method #3: Taking a combined approach

- Integrating employment data into your fundraising strategy

Whether you’re just starting to collect employment data or are looking to refine your current approach, this guide will help you weigh your options and make informed decisions about how you do so.

By understanding how to gather and use this information effectively, your nonprofit can unlock new opportunities for engagement, funding, and long-term donor relationships. Let’s dive in!

The value of employer info in nonprofit fundraising

Understanding where your donors work is more than a data point; it’s a strategic advantage. Employer information opens the door to a range of fundraising opportunities that can significantly amplify donor impact and deepen engagement.

After all, tons of companies offer employee-led giving programs. When you know where your supporters work, you can easily determine if they qualify for these programs and configure targeted next steps accordingly.

Here are just a few of the opportunities that employment information can help uncover:

- Matching Gifts: Many companies match donations their employees make to nonprofits, often doubling or even tripling the original gift. Knowing a donor’s employer helps identify matching gift eligibility and streamline follow-up accordingly.

- Volunteer Incentives: Some employers offer monetary grants or other incentives in exchange for volunteer hours logged by their employees. Capturing employer info allows you to promote these volunteer programs to the right supporters.

- Payroll Giving: Payroll giving programs enable employees to donate directly from their paychecks. Identifying where a supporter works enables you to guide them toward these convenient giving options.

- In-Kind Support and Sponsorships: Employer data can reveal connections to businesses that may offer non-cash support, such as products, services, or corporate sponsorships.

- Targeted Engagement: With accurate employer information, you can personalize outreach and suggest relevant corporate giving options, maximizing impact for both your organization and your supporters.

In short, employer information helps nonprofits move from one-size-fits-all fundraising to smarter, more strategic engagement. The more you know about where your donors work, the better positioned you are to connect their personal giving to broader opportunities through their employer.

Method #1: Asking for employer info directly

One of the most straightforward and effective ways to gather employment data is to ask donors directly. This method relies on self-reporting, or inviting donors to share their employer information at specific points in their journey with your organization.

What it means:

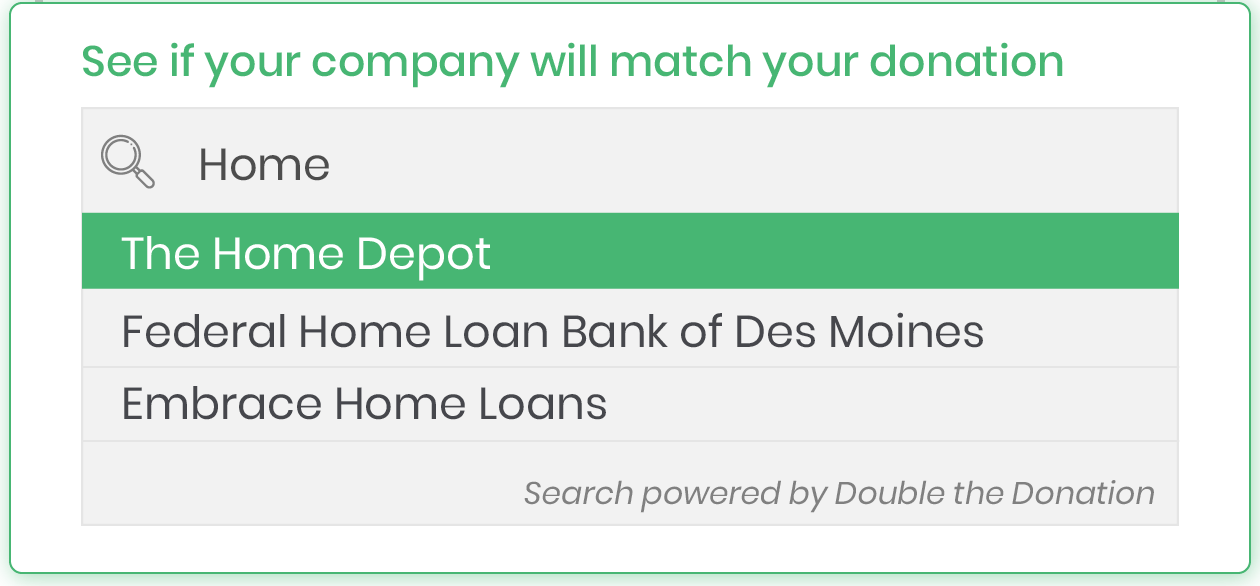

Asking for employer info directly means including a field in your donation form, event registration, volunteer sign-up, or post-gift follow-up where donors can share where they work. This approach is entirely opt-in and allows you to gather current, self-reported data straight from the source.

Pros:

- High Accuracy: Because the data comes directly from the donor, it’s more likely to be correct and up to date. Asking each time an individual engages with your cause reduces the odds of the information going stale, too.

- Opportunities to Connect Supporters to Next Steps: When you ask donors where they work during or immediately after a donation, it’s easier to connect them to the next opportunity, like submitting a matching gift or volunteer grant request.

- Gets Individuals Thinking About Eligibility As They Give: The point of donation is often the height of supporter engagement. Requesting employment info at this time gets donors and other supporters thinking about their eligibility as they give, which can even function as a generosity motivator or giving catalyst.

Cons:

- Gaps in Completion: Donors may skip optional form fields, especially during a streamlined donation or registration process, while others may opt to give offline. This would leave your organization with blank lines in your database, unless you had a backup method in place for collecting this information.

Best practices for success:

- Make It Optional and Simple: Keep the question brief. For example, consider an additional form field asking “Where do you work?”—and don’t require the information to complete a transaction.

- Explain the Why: Let donors know why you’re asking by providing context around the form. A simple note like “Your employer may match your gift and increase your impact” encourages participation.

- Include It Strategically: Add the field to donation forms, confirmation pages, volunteer registrations, and thank-you emails where engagement is already high. It’s easy to do with Double the Donation’s integration options!

- Follow Up: If the employer field is left blank, consider a polite follow-up email asking for the information and explaining the benefits to both the donor and your mission.

- Use the Data Promptly: If you collect employer info, make sure it’s tied to direct action, like checking for match eligibility or tracking corporate volunteer hours.

💡 Key Takeaway: Asking for employer information directly can be a highly effective way to gather accurate data and engage donors more deeply. This is especially true when paired with a clear purpose and thoughtful timing.

Method #2: Utilizing employer appends and employer data enrichment

When donor records lack employment information, a data append can help fill in the blanks at scale. This method uses external databases to match donor records with publicly available or proprietary employment data, giving your organization a broader view of where your supporters work.

What it means:

An employer append essentially involves sending a list of donor names, email addresses, and other identifying details to a trusted data provider. The provider then returns employment information for matched records, typically including company name, industry, and even workplace giving eligibility and next steps. This process can enrich your CRM without requiring any action from the donor.

Pros:

- Efficient and Scalable: Append hundreds or thousands of donor records in a single batch, saving time and manual effort while scaling up the information available to you.

- Fills in Gaps: Even with a robust data-collection strategy, you’re not likely to have employment data for every individual in your supporter base. An employer append is perfect for uncovering employer information in legacy data, unresponsive donors, or those who skip form fields.

- Revenue-Driving Potential: Appending helps connect supporters to their workplace giving programs quickly, leading to more matching gifts, volunteer grant opportunities, and stronger corporate partnership leads.

- No Disruption to the Donor Journey: Because this method functions entirely behind the scenes, there’s no negative impact on the donor experience or giving flow.

Cons:

- Potential for Inaccuracy: Matches are based on probability and third-party sources, which can occasionally return outdated or incorrect data.

- Cost: Most employer append services charge based on volume or subscription, making it a significant investment you’ll need to plan for.

Best practices for success:

- Start with Clean Data: Ensure your existing donor records (i.e., names, emails, addresses) are accurate and up to date before submitting them for an append.

- Use a Trusted Provider: Work with a reputable vendor that specializes in nonprofit employment data and can deliver high-confidence matches.

- Validate Where Possible: If a donor responds or updates their info later, compare it to appended results and adjust the results accordingly.

- Combine with Workplace Giving Tools: Integrate your new employment data with workplace giving software to automatically prompt eligible supporters with next steps following the donation or volunteer registration flow.

- Refresh Regularly: Employment changes over time. Consider appending your file annually or semi-annually to keep your data fresh and relevant.

💡 Key Takeaway: Utilizing employer appends allows nonprofits to dramatically expand their understanding of who their donors are without relying solely on self-reported information. When done strategically, it can accelerate your workplace giving efforts and turn hidden data into new revenue opportunities.

Method #3: Taking a combined approach

The most effective strategy for collecting employment data often isn’t choosing between asking supporters or using appends; it’s combining both. By blending direct collection with employer appends, your nonprofit can build a more complete, accurate, and actionable database while maximizing both reach and reliability.

What it means:

A combined approach involves collecting employer information directly from donors through forms, surveys, and follow-ups, while also running periodic employer appends to fill in the blanks or update existing records. This method leverages the strengths of both strategies and minimizes their individual limitations.

For example, you might collect employer info on your donation forms and then run an append on all records that remain blank, or use appends to verify and enrich self-reported data over time.

Pros:

- Maximum Coverage: You get the best of both worlds: accurate self-reported data and a broader reach through appends. As your database grows, a combined approach ensures new and existing records remain as up-to-date and complete as possible.

- Stronger Personalization and Segmentation: With more complete data, you can confidently tailor outreach, identify corporate giving opportunities, and create targeted campaigns.

- Increased Workplace Giving Revenue: More employment data means more potential matches and grants identified, and more donors ultimately connected to workplace giving programs.

Cons:

- More Complex to Manage: Running both processes requires careful coordination, particular workflows, and detailed attention to data hygiene.

- Costs Still Apply: Append services still require a budget, and collecting directly can demand time and resources for training, communication, and follow-up.

- Duplicate or Conflicting Data: You may encounter discrepancies between self-reported info and appended data, requiring validation and thoughtful resolution.

Best practices for success:

- Create a Data Workflow: Establish clear processes for collecting, appending, validating, and updating employment information across your database.

- Segment Your Data: Keep track of how employer data was collected (self-reported vs. appended) and treat each group accordingly when testing campaigns or messaging.

- Prioritize Data Accuracy: When there’s a conflict, favor donor-reported data unless you have a compelling reason to override it. Always aim to confirm before acting.

- Use Clear Messaging: When asking for employer info, explain how it helps increase impact (e.g., uncovering matching gifts or volunteer grants) to encourage more donors to participate.

- Schedule Regular Updates: Use append services on a regular basis to keep your records current, especially as employment status frequently changes.

💡 Key Takeaway: By combining direct collection and employer appends, your nonprofit can establish a smarter, more reliable approach to employment data. It’s a strategy that balances donor engagement with data scale, giving you the tools to increase revenue, deepen relationships, and tap into the full potential of workplace giving.

Integrating employment data into your fundraising strategy

Collecting employment data is only valuable if you use it. That’s why the most effective nonprofits treat this information as a core part of their fundraising strategy.

When integrated thoughtfully, employer information can inform everything from campaign planning to workplace giving outreach and corporate partnership development.

Here’s how to make employment data work for your fundraising goals:

1. Identify and Promote Workplace Giving Opportunities

Once you know where a supporter works, you can check if their employer offers a matching gift, volunteer grant, or payroll giving program. From there, you can use this information to trigger workplace giving marketing efforts: personalize follow-up emails, include employer-specific instructions, and make it easy for donors to complete the process of getting involved, ultimately increasing the impact of every gift.

2. Strengthen Corporate Relationships

If multiple donors or volunteers work for the same company, that can be a natural lead-in for broader partnership opportunities. Use this data to approach businesses for event sponsorships, in-kind donations, team volunteer days, or dedicated workplace giving campaigns, backed by the fact that their employees already support your mission.

3. Enhance Stewardship and Donor Experiences

When you receive third-party disbursements, like matching gifts or volunteer grants, it’s a valuable opportunity to thank donors and reinforce your appreciation. Having employment data on hand allows you to follow up promptly and personally, recognizing both their direct and facilitated support.

Mentioning a donor’s employer in thank-you messages or impact reports (when appropriate) shows you’re paying attention and actively working to maximize their impact. This thoughtful, personalized stewardship builds trust, deepens loyalty, and improves the donor experience over time.

Integrating employment data into your stewardship strategy isn’t about adding complexity. It’s about working smarter with insights you likely already have (or can easily collect). When used well, employer information becomes more than just a database field; it’s a powerful tool to drive engagement, gratitude, and lasting impact.

Frequently Asked Questions (FAQs)

1. What is the difference between asking supporters for their employer information and using employer appends?

Asking supporters directly captures first-party, self-reported data during interactions such as donations, registrations, or volunteer signups. Employer appends, by contrast, use third-party data sources to infer or verify a supporter’s workplace when information is missing or outdated. Both methods work together to build a complete and reliable employment dataset.

2. What are the pros and cons of asking supporters for employment information?

Direct collection provides highly accurate data and enables clear donor consent, but completion rates can vary depending on form placement and user experience. Nonprofits must balance data requests with a friction-free process, making optional fields, auto-complete tools, and strategic placement critical to strong response rates.

3. How do employer appends help nonprofits fill gaps in their donor data?

Employer appends leverage multiple data points, such as name, address, phone number, and education history, to identify a supporter’s likely employer. This method scales quickly, enriches large datasets, and uncovers match-eligible supporters and corporate prospects that would otherwise remain hidden.

4. Why should nonprofits collect employment information from auction or event attendees?

Employment data helps nonprofits identify attendees whose companies offer matching gifts, volunteer grants, or other corporate-giving programs. When captured at registration or ticket purchase, this information allows nonprofits to activate employer-related revenue immediately after the event.

5. How can nonprofits use employment information gathered from event attendees to increase post-event revenue?

By connecting attendee gifts with employer programs, nonprofits can pursue matching gifts, volunteer grants, and corporate sponsorship opportunities tied to attendee workplaces. This improves donor follow-up segmentation, strengthens corporate outreach, and increases revenue generated from a single event.

Wrapping up & additional resources

When it comes to collecting employment data, both methods have value, and often, the best strategy combines them. Here’s what it comes down to: asking for employer info vs. using appends isn’t necessarily an either/or decision. Instead, it’s about understanding how each approach fits into your broader data and fundraising goals.

Directly asking donors provides accurate, relationship-building insights, while employer appends can efficiently fill in gaps and scale your outreach. By leveraging both, your nonprofit can build a more complete picture of your donor base and turn workplace connections into meaningful opportunities for engagement, giving, and growth.

Interested in learning more about how supporter employer information can benefit your organization? Check out these additional resources:

- The Value of Donor Employer Information in Workplace Giving. Learn how employer data can unlock workplace giving opportunities and enhance your organization’s broader fundraising efforts.

- Enhancing a Donor Profile With Employment Data [A Guide]. Enrich your donor profiles with employment details. Then, use the insights to personalize outreach, identify workplace giving potential, and strengthen relationships.

- Is an Employer Append Right for Your Nonprofit? How to Know. Considering a data append? This post outlines what an employer append involves, the benefits and limitations, and how to determine if it’s the right move for you.