Payment Processing for Nonprofits: A Guide

Glossary of Payment Processing Terms

Before we launch into an explanation of payment processing, we should define some of the key terms associated with it.

Merchant Account

A merchant account is a bank account that allows a nonprofit to accept online donations via credit or debit cards. This account is set up under a contract between a nonprofit and a merchant-acquiring bank.

Third-Party Processor

A third-party processor helps nonprofits accept online donations without their own merchant account. The processor allows nonprofits to use their merchant account after agreeing to the terms of service.

Payment Gateway

A payment gateway is a fraud prevention method practiced by payment processors. Payment gateways protect donors’ credit or debit card information during and after the donation process.

VPN

VPN (virtual private network) provides a secure internet connection for payment processing. A VPN uses data encryption to stop fraudulent payments and prevent unauthorized users from gaining access.

Aggregator

An aggregator is a large company that processes transactions and donations on behalf of many smaller businesses and nonprofits that are in its portfolio. PayPal and Stripe are examples of aggregators.

ACH

ACH (the Automated Clearing House) provides electronic funds transfers (ETFs) between banks and merchant accounts. ACH operations are done in batches, which can take up to 72 hours to be completed.

Why Do Nonprofits Need a Payment Processor?

To Accept Donations

The most common reason nonprofits seek out a payment processor is to accept donations online. Without a payment processor, collecting online donations is difficult, if not impossible, for most nonprofits.

With a payment processor, nonprofits can accept donations from supporters in the U.S. Most payment processors also allow nonprofits to accept international donations in select currencies.

To Collect Membership Fees

Many supporters of nonprofit causes show their support by joining an organization’s membership program, and most memberships have a monthly or yearly fee associated with them.

With a payment processor, your nonprofit’s most loyal supporters are able to pay their membership dues online without having to send in a check or make a payment over the phone. It’s easy for everyone!

To Sell Online Merchandise

Some nonprofit organizations have an online storefront where they sell branded merchandise like t-shirts, mugs, or keychains.

A payment processor makes it easy for donors to buy this merchandise directly online without having to set foot in the nonprofit’s office.

To Sell Event Tickets

When nonprofits host fundraising events, they need a way to accept ticket payments and other fees from attendees.

With a payment processor feature, nonprofit organizations can quickly and easily accept donations that come in the form of online ticket sales.

What’s the Difference Between a Payment Processor and an Online Donation Tool?

Payment Processors

Think of a payment processor as more of a “behind-the-scenes” tool. They help your nonprofit collect online donations from your donors. Some payment processors even have their own donation forms that you can brand to your organization and use.

However, that is not the primary purpose of the processor, and not all payment processors have online donation forms. The processor is there to help you securely capture your donor’s financial information and translate that into a gift for your nonprofit.

If you’re looking for a solution that offers comprehensive options for donation pages and seamless integrations with your nonprofit’s CRM, you’re probably looking for an online donation tool.

Online Donation Tools

An online donation tool does just as advertised…it helps your organization collect online donations from supporters. While styles may vary (donation forms to merchandise sales to crowdfunding), the core principle remains the same.

With an online donation tool, you can set up a webpage that supporters will visit and use to donate to your organization. Many software providers even offer customization options and integrations with your other technology.

Most online donation tools work with a handful of payment processors to help your organization safely and securely collect the donations from your loyal and dedicated donors. When searching for an online donation tool, make sure it is compatible with your payment processor and vice versa.

Let’s Use Fundly to Explain the Difference

Fundly is a nonprofit software provider and online crowdfunding platform. Using Fundly, individuals and organizations can set up online fundraising pages and collect donations from friends, family, and even strangers.What is Fundly?

Payment processor or online donation tool?

Fundly is an online donation tool. Specifically, Fundly is a crowdfunding platform.

How are payments processed?

As a service, Fundly provides the software its donors use to create and manage their online donation pages. When a supporter makes a donation on the Fundly platform, they use Fundly’s donation form to fill in their info. However, the payment ends up being processed by a third-party credit card processor, either WePay or Stripe.

If you’re looking for a way to collect donations online and you need a solution that goes beyond just payment processing, Fundly is a great option to look into.

Top Rated Payment Processors for Nonprofits

#1) CharityEngine

CharityEngine is an all-in-one nonprofit CRM solution, complete with its own secure payment processing system. Streamline your payment process by keeping all of your data in one place with CharityEngine’s complete software package!

While most payment processors are PCI-compliant, CharityEngine’s payment processing system goes the extra mile and is PCI-certified, offering your nonprofit the highest level of security possible.

#2) iATS Payments

iATS Payments is the perfect payment processing solution for nonprofit organizations looking for quick, reliable, and customizable donation processing. With iATS, your organization can create donation forms that are branded for and integrate with your site, accept multiple types of donations, and transfer data directly to Salesforce. Best of all it removes the hassle of waiting for funds, all donations are available for use within two business days!

iATS Payments only works with nonprofits, and their expertise in the sector is second to none.

#3) BluePay

BluePay offers PCI-compliant payment processing solutions for nonprofit organizations. BluePay also offers a recurring donations option on their donation form, increasing nonprofits’ donor retention rates.

BluePay mostly markets their services to B2B merchants, but they have some nonprofit solutions as well.

#4) Heartland

Heartland Payments offers payment processing services to for-profit entities as well as nonprofit organizations. Additionally, they can assist nonprofits with their online and mobile fundraising and their payroll for staff members.

Heartland Payments’ CEO also helped found a nonprofit, making them knowledgeable in the field.

How Does Payment Processing Work?

1. Donor Makes a Contribution

Payment processing begins when a donor makes an online donation or purchases merchandise, event tickets, or a membership. Supporters can make a contribution to a nonprofit using their computers, tablets, or smartphones. Any donation that is not made with cash or check must go through a payment processing system to be verified before the funds are accessible to the nonprofit. When a donor uses your online donation page, a text-to-give service, or a mobile giving app, they must input their debit or credit card information. This information then triggers a series of backend activities that are performed by the payment processor.

2. Info Goes to the Payment Gateway

Once the donor initiates a transaction, their donation goes through the payment gateway.

A payment gateway is used to ensure that the credit card is not fraudulent and to verify that the person making the donation or purchase is a human, not a robot.

The payment gateway checks the credit card number’s validity and might look at addresses, names, and security codes as well.

If a card is rejected for any reason, the payment gateway communicates the problem to your nonprofit’s website or mobile app so that you can alert the donor.

If all goes well, the payment processing goes on.

3. Donation is Sent to the Merchant Account

After the credit card has been verified, the payment gateway starts the transfer process. The donation goes from the credit card company to a merchant account.

The merchant account only holds credit card donations, and many nonprofits can open one through their regular bank.

However, some payment processors (like PayPal) have their own merchant accounts that nonprofits must use if they use the payment processor in question.

Merchant accounts are just like any bank account, and each one has a different rate. This rate determines the amount your nonprofit will pay per donation or transaction.

4. Donor Info Goes to Database

Whenever a donor makes an online contribution, they are submitting a certain amount of information to your nonprofit. Oftentimes, this information includes (but is not limited to):

- Name

- Address

- Email address

- Phone number

This information should be logged in your donor database. However, you have to have a way to get the data from your payment processor into your database.

If your payment processor integrates with your database, this step should be fairly straightforward. If it doesn’t, you will have to export a file from the payment processor and upload it into your CRM system.

5. Money is Deposited in Nonprofit’s Account

Of course, the end result of this process is that your nonprofit receives the supporter’s contribution! If the merchant account you’re using is in your nonprofit’s name, the funds will automatically be transferred into your organization’s bank account in a few business days. However, if you are using your payment processor’s merchant account, it is up to that company to transfer the donations to your nonprofit’s bank account. These transfer usually take place once or twice a month and can be made via check or wire transfer.

What’s the Difference Between ACH Debit and Credit Card Payments?

ACH Debit Payments

ACH (automated clearing house) debit payments are made directly from a donor’s bank account. ACH payments are essentially electronic checks that individuals use to make purchases and donations.

ACH transactions now account for over half of all non-cash payments, and they can also help nonprofits minimize credit card transaction fees.

Payment processors will often charge one flat fee for ACH debit payments (as opposed to a flat fee and a percentage for credit card payments).

Credit Card Payments

Did you know that recent studies have found that individuals spend up to 20% more when they pay with a credit card over other forms of payment? Donors with credit cards can really impact your nonprofit!

Additionally, credit card holders spend 2.5x more on impulse than donors who use cash, making a payment processor a necessity for your nonprofit.

Most payment processors will accept most major credit cards including Visa, MasterCard, American Express, and Discover.

What is PCI Compliance and Why is it Important?

Definition of PCI Compliance

The Payment Card Industry (PCI) Security Standards Council set up data security standards (DSS) in 2007 to protect both customers and merchants involved in online transactions.

There are a dozen major PCI DSS compliance requirements. Nonprofits who have PCI DSS violations can face penalties and fees. Some organizations can even be suspended and have their card-processing capabilities retracted.

Importance of PCI Compliance

Maintaining PCI compliance is crucial for nonprofits that want to continue to accept online donations. It also helps reassure donors that their credit card and personal info are safe.

It is estimated that nearly half of all donors give up on a donation process because they feel it isn’t secure. If you aren’t using a PCI compliant payment processor, you’re not only putting yourself at risk of a breach, you’re also missing out on donations!

Other Payment Processing Security Features

Tokenization

Tokenization is a security measure that is mandated by the Payment Card Industry’s standards.

In the simplest of terms, tokenization takes sensitive information (such as credit card numbers) and replaces the data with a string of alphanumeric symbols.

Tokenization makes it much more difficult for hackers to access sensitive information related to online giving. It is also a standard security feature that all payment processors must have.

Payment processors issue the tokens themselves and are responsible for keeping the information safe.

Encryption

Encryption takes sensitive data (known as “plaintext”) and converts it into “cyphertext.”

This cyphertext can only be read in its original plaintext form if it is opened with the right “key.” The entire process is set into motion by encryption algorithms.

Encryption keeps donor data private as it passes through the various stages of the payment processing cycle.

Of course, encryption is only an effective security measure if the encryption key is kept a secret. Any attacker who gains access to the key will be able to read the sensitive information. Make sure that any member of your nonprofit who needs access to encrypted information is briefed on the security risk of leaking the encryption key.

Fraud Protection Tools

There are a number of other fraud protection and prevention tools that payment processors offer nonprofits. These include, but are not limited to:

- Address Verification System (AVS): AVS verifies the address of the donor using a credit card. The system checks the billing address that the donor provided with the address the credit card company has on file.

- Bank Identification Number (BIN) Checking: BIN checking lets your nonprofit know that the bank account used in an ACH/Debit donation is legitimate.

- Card Verification Code Requirement Capability (CVV2): CVV2 checks the 3 or 4 digit number on the front or back of a credit card (depending on the card being used).

- IP (Internet Protocol) Blocking: IP blocking prevents connections from a specific IP address that are hostile or unwelcome.

Your payment processor might offer some or all of these security features. When looking for a payment processor provider, ask about the extra fraud protection tools they offer.

What’s the Difference Between PayPal and a Payment Processor?

Many nonprofits think that they can simply use PayPal to accept donations. And while PayPal (and services like it) is a useful tool for small nonprofits who don’t yet have the funds to pay for a whole suite of fundraising and payment processing solutions, it can be frustrating as your nonprofit grows. Why?

First of all, donor conversions are lower when nonprofits use PayPal over a nonprofit-focused payment processing service. This is because donors have to log in to PayPal to make a contribution.

Plus, a PayPal donation page doesn’t have your nonprofit’s branding, logo, or colors, potentially discouraging supporters from completing the donation process.

Finally, PayPal (and companies like it) are known as aggregators, meaning that they handle the payment processing for thousands and often millions of companies and nonprofits. This translates into a less personal customer service and support experience for your organization and your donors.

Because of these reasons, nonprofits often turn to alternative options that integrate with their existing donation processes and provide a more personalized experience.

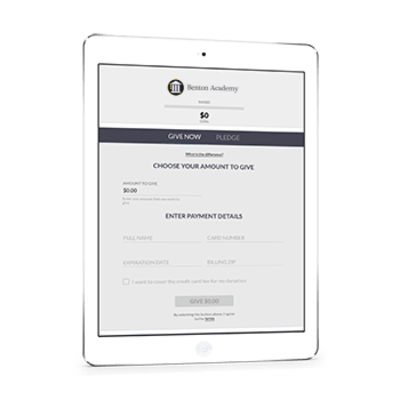

Choose a payment processor that integrates with your web forms, including your branding, like this sample donation form by OneCause.

Benefits of a Great Payment Processing Tool

Safely Process Donations

Obviously, the most significant benefit of having a great payment processor is the ability to securely process donations.

With a payment processor, you can keep your donors’ information safe and minimize your nonprofit’s risk of a security breach.

This allows your donors to continue giving with confidence and protects your nonprofit. Even free security plugins for your site can make a huge difference.

Capture Donor Information

With a great payment processor, your nonprofit has the opportunity to capture more of your donors’ information.

At the very least, you will discover names, addresses, email addresses, and phone numbers. This info can then be migrated to your CRM system.

The more you know about your donors, the more prepared you’ll be when you ask them for donations down the road.

Additional Fundraising Features

Some payment processing companies will offer a suite of other fundraising options for their nonprofit clients.

For example, a payment processor might have different types of donation forms that a nonprofit can easily build on its website.

If your payment processor doesn’t offer these additional fundraising features, it’s probably because they integrate with several fundraising software companies that do! Either way, your nonprofit should look at the different fundraising capabilities that come along with a payment processing provider.

Retain More Donors

When donors see how secure the donation process is with your nonprofit, they are more likely to give again.

This, in the long run, boosts your donor retention rates. The better your payment processor is, the more effective your fundraising efforts will be.

Donor retention is a constant struggle for most nonprofits. In the past few years, donor retention rates have been hovering around 40%, which means that 6 out of 10 donors are giving once and never giving again! With a great payment processing tool, you can start your nonprofit on the path toward better donor retention.

Payment Processing Fees

Flat Fees

Flat fees are standard, set amounts that nonprofits have to pay on a monthly or yearly basis. These fees can include:

- Payment gateway fees

- PCI compliance fees

- Annual/monthly service fees

- Early termination fees

- Statement and reporting fees

Before you choose a payment processing service, it’s important to understand what kinds of flat fees they charge.

Per-Transaction Fees

Per-transaction fees occur each time a donor makes an online contribution.

These fees are also known as interchange reimbursement fees, and they are the largest payment-processing-related expense that nonprofits should have to pay.

Essentially, this type of fee is the cut that the credit card companies take each time a supporter makes an online donation. They are usually a percentage plus a flat fee (i.e., 2.5% + $.10).

Incidental Fees

Incidental fees do not occur on a regular basis; rather, they are charged whenever there is a financial dispute between a nonprofit and a donor.

These types of fees include:

- Retrieval request fees

- Chargeback fees

- Batch fees

- Non-sufficient funds fees

- And more

Payment Processors and Additional Features

Facebook Donations

Payment processors that offer other fundraising features may include Facebook donation pages as part of that package.

A Facebook donation page is a branded form that allows donors to give to your nonprofit without ever leaving Facebook.

A Facebook donation page can accept credit card and ACH debit payments just like a normal donation form.

On-Site Donations

Another common fundraising feature that many payment processors offer is the ability to accept on-site contributions.

This additional option enables nonprofits to easily accept contributions at fundraising events with a terminal or a card reader.

Some of the terminal options also allow nonprofits to accept cards with chips and other payment forms, like Apple Pay.

Choosing a Payment Processor

Cost

We’ve already discussed some of the common fees and costs associated with payment processing, but it’s one of the most important things to consider when selecting a payment processor.

Keep in mind all of the flat fees, incidental costs, and per-transaction fees that come along with payment processing.

Ease-of-Use

This point is for your nonprofit and your donors. If your payment processor is difficult to use, it only makes it harder to accept online donations. Plus, you might frustrate and drive away your donors!

Your payment processing system should be easy to use and understand. Make sure you know what you’re getting!

Capabilities & Extra Features

Some payment processors come with additional fundraising capabilities and features. If this is something your nonprofit needs, make sure you look into the different add-ons that payment processors offer.

For instance, if you also need a donation page and on-site payment options, ask about those features during your exploratory calls and demos with payment processors.

Customer Care & Support

If you’ve read any part of this guide, you know just how complicated payment processing can be! It’s crucial for your payment processor to be available for support, training, and questions when they arise.

Whether it’s an online support portal, a 24/7 help line, or email support, make sure that your payment processor will be there for you when you run into problems or issues.

Understanding of the Industry

Some payment processors work with for-profit merchants and nonprofit organizations. But some deal exclusively with nonprofits.

The latter solution is preferable from the nonprofit’s viewpoint. Why?

The more knowledgeable a payment processor is about the nonprofit industry, the more easily you’ll be able to communicate with them about your concerns, needs, wishes, and problems.

Reliability

You don’t want a payment processor that’s going to break down every time your nonprofit accepts a lot of online or mobile contributions.

The reliability of your payment processor is crucial for your day-to-day operations.

A reliable and trustworthy payment processing system will result in more recurring donations from your donors. If they trust your payment processor, they will be more likely to give in the future.

Additional Payment Processing Resources

Payment Processors

Now that you know about payment processing, it’s time to select a payment processing tool!

Check out our list of the top payment processors for nonprofits to learn more.

More Payment Processing Info

Looking for more information about payment processing. Well, you’re in luck!

This guide will tell you how to accept online payments from donors and supporters.

Online Payment Fraud

Unfortunately, fraud is a reality that nearly every nonprofit organization will have to face.

But this article will teach you how to effectively detect and avoid online fraud!