Payroll Giving Statistics | 13 Fun Facts for Fundraisers

Payroll giving is one of the most powerful yet underutilized tools in the fundraising arsenal. With billions of dollars raised annually through workplace giving programs each year, the potential for nonprofits to tap into this steady stream of revenue is immense. Yet, many fundraising professionals may not fully grasp the impact payroll giving can have on their organizations.

In this post, we dive into 13 eye-opening payroll giving statistics that every fundraiser should know. These facts not only highlight the potential of payroll giving but also provide actionable insights to help you maximize participation and boost your fundraising efforts.

- Donor & Employee Behavior

- Financial Impact & Giving Volume

- Corporate Adoption & Program Promotion

- Untapped Potential: Nonprofit Challenges in Corporate Giving

Let’s get started!

Donor & Employee Behavior

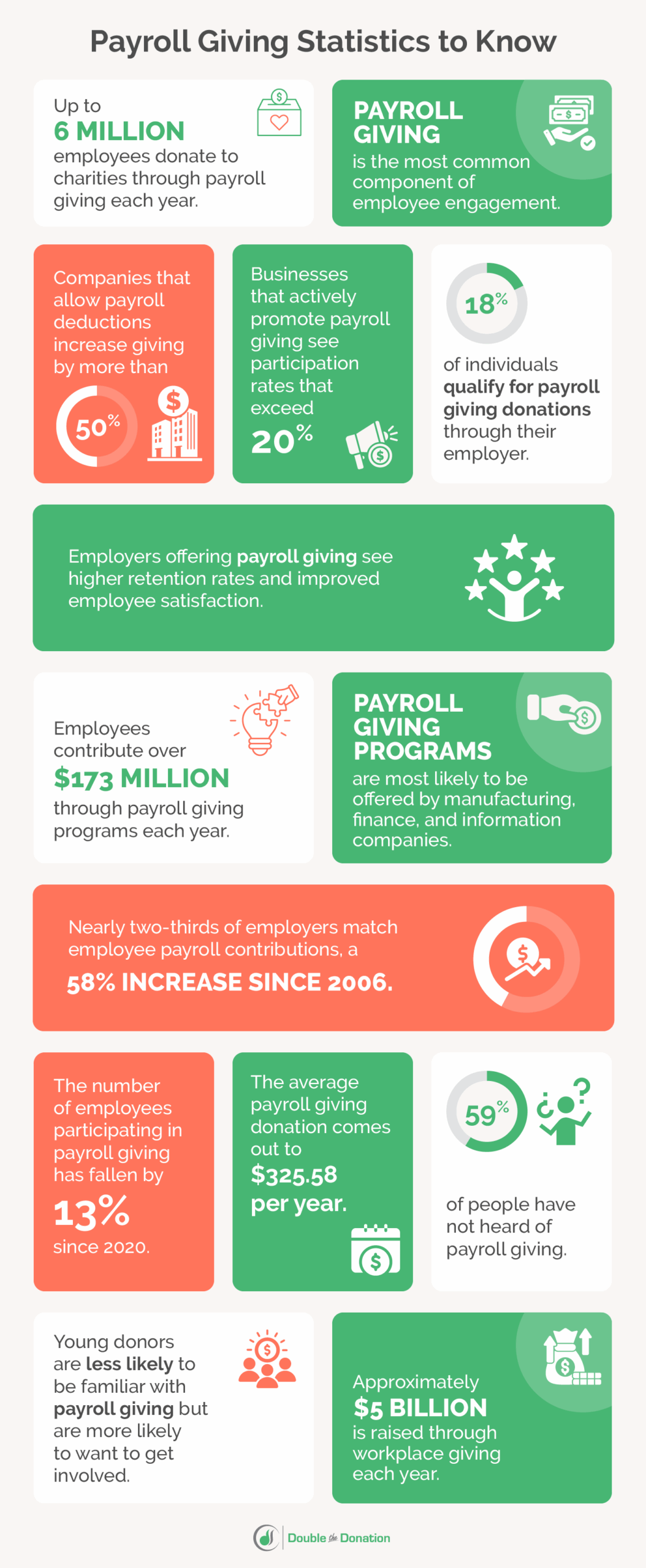

Up to 6 million U.S. employees donate to charities through payroll giving each year.

Payroll giving is a popular option for millions of employees across the U.S., providing a steady stream of donations to nonprofits and other fundraising organizations.

These contributions, though often modest per paycheck, add up significantly over time, highlighting the potential for fundraisers to tap into the consistent revenue source.

Payroll giving is the most common component of employee engagement.

Payroll giving is not just a method for employees to contribute financially. Instead, it’s a key aspect of broader employee engagement strategies.

For nonprofits, this means that partnering with companies to promote payroll giving can align with greater corporate efforts to boost CSR, employee morale, and overall philanthropy.

One study reported that 18% of individuals qualify for payroll giving donations through their employer.

Nearly one in five employees are eligible for payroll giving, but many remain unaware of the programs at all.

For nonprofits and other fundraisers, it’s important to focus on educating supporters about the availability of these initiatives. Encourage them to check with their employers to see if they qualify!

Employers offering payroll giving see higher retention rates and improved employee satisfaction.

Payroll giving programs contribute to higher employee satisfaction and retention, making them an attractive option for companies looking to increase productivity and reduce turnover.

Nonprofits can leverage this opportunity by promoting the dual benefits of payroll giving: supporting charitable causes while also enhancing workplace satisfaction.

59% of people have not heard of payroll giving.

The lack of awareness around payroll giving presents a significant challenge—and opportunity—for nonprofits. When supporters are unaware of payroll giving programs, they’re not going to sign up to give. However, by educating their audience about payroll giving, nonprofits can tap into a largely underutilized source of donations.

Young donors are less likely to be familiar with payroll giving but are more likely to want to get involved.

While younger generations may not be as aware of payroll giving, they tend to be increasingly enthusiastic about supporting causes, particularly through their employers.

As a result, nonprofits should focus on educating younger employees about payroll giving to identify eligible supporters and encourage participation among them.

Financial Impact & Giving Volume

Employees contribute over $173 million annually through payroll giving programs.

Payroll giving is also a significant source of funds across the globe, with substantial contributions coming from over a million charitable-minded employees. This demonstrates the worldwide potential of payroll giving programs as a reliable revenue stream for nonprofits like yours!

Companies that allow employees to donate to charity through payroll deductions increase giving by more than 50%.

The convenience, impact, and flexibility of payroll deductions significantly boost charitable giving among employees, allowing companies to give more and further improve their CSR (or corporate social responsibility).

Nonprofits should actively seek partnerships with companies offering payroll giving, as this can result in a substantial increase in donations and visibility for their causes.

The average payroll giving donation comes out to $325.58 per year.

That’s around $28 a month!

While individual payroll donations may seem small, they typically total over $300 annually per employee. In other words, these gifts add up to make a significant impact on your cause. Nonprofits can emphasize this cumulative impact when encouraging payroll giving among their supporters.

Approximately $5 billion is raised through workplace giving each year.

Workplace giving, including payroll giving programs, generates billions of dollars for nonprofits on an annual basis. This substantial amount highlights the importance for nonprofits to actively engage in workplace giving programs to secure their share of this revenue.

Corporate Adoption & Program Promotion

Nearly two-thirds of employers surveyed indicated they match employee payroll contributions, a 58% increase since 2006.

The rise in matching payroll contributions highlights the growing recognition of corporate philanthropy’s importance. Tons of companies offer matching gift programs, and the vast majority are inclusive of any payroll giving opportunities they supply.

Nonprofits and other fundraising groups should actively seek out these matching initiatives to maximize the impact of donations made through payroll giving.

Businesses that actively promote payroll giving see participation rates that often exceed 20% of their workforce.

Effective promotion of payroll giving within a company can lead to high employee participation rates, which is beneficial for companies, nonprofits, and employees alike.

For nonprofits, this idea underscores the importance of working with employers to actively communicate payroll giving options to their employees.

Payroll giving programs are most likely to be offered by manufacturing, finance, and information companies.

Certain industries are more likely to offer payroll giving programs, giving nonprofits an opportunity to target companies within these sectors for partnerships and campaigns focused on payroll giving. However, they’re expected to continue growing across just about every other business sector, too!

If you’re looking for donors who may qualify for payroll giving programs, take a look at those working in the manufacturing, finance and insurance, or information technology fields.

Untapped Potential: Nonprofit Challenges in Corporate Giving

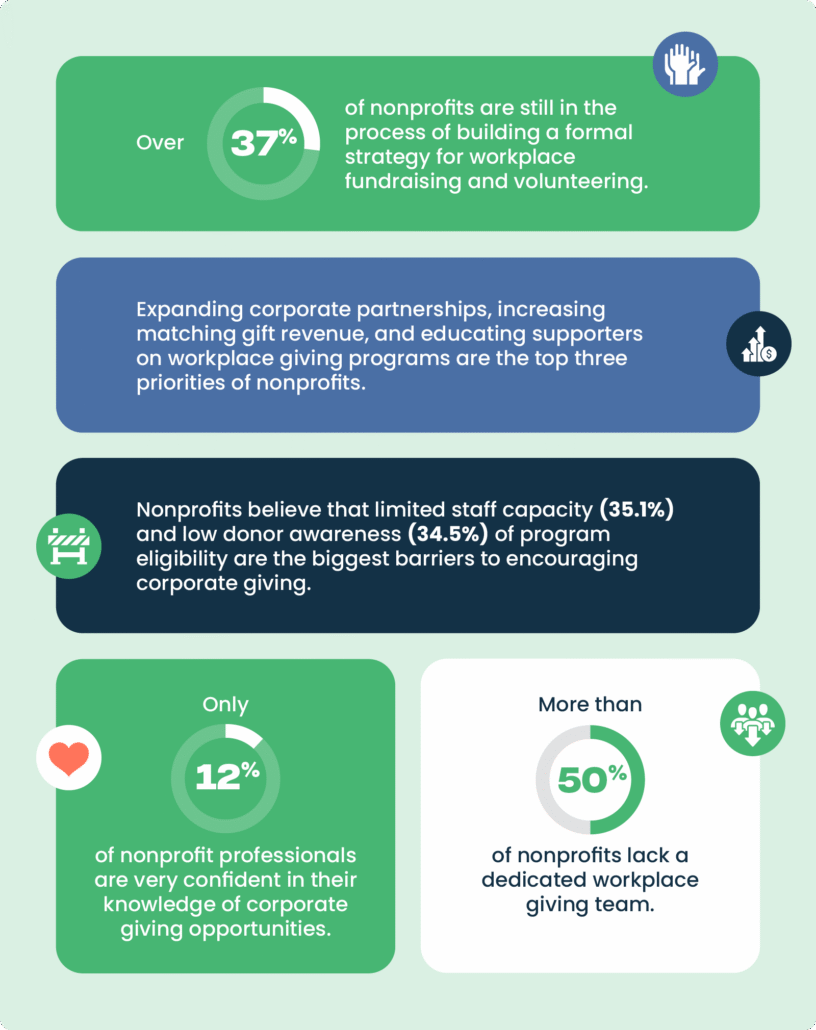

Over 37% of nonprofits are still in the process of building a formal strategy for workplace fundraising and volunteering.

This indicates that many organizations recognize the value of corporate engagement but have yet to fully integrate it into their development framework. Without a structured approach, nonprofits may miss opportunities to align with corporate partners’ giving priorities or effectively mobilize employee participation.

Expanding corporate partnerships, increasing matching gift revenue, and educating supporters on workplace giving programs are the top three priorities of nonprofits.

This reflects a growing recognition that sustained growth depends on deepening engagement with both donors and their employers. By strengthening corporate relationships, nonprofits can unlock new funding streams and create mutually beneficial opportunities for employee participation.

Nonprofits believe that limited staff capacity (35.1%) and low donor awareness (34.5%) of program eligibility are the biggest barriers to encouraging corporate giving.

With often lean teams, many nonprofits struggle to dedicate the time and resources needed to effectively communicate workplace giving opportunities and eligibility back to their supporters. That means revenue-driving opportunities like matching gifts, volunteer grants, and payroll giving often slip through the cracks.

Only 12% of nonprofit professionals are very confident in their knowledge of corporate giving opportunities.

This signals a broader gap in internal education and access to resources that can limit fundraising potential. Without a clear understanding of available corporate giving programs, such as matching gifts, volunteer grants, and payroll giving, staff may struggle to identify or act on partnership opportunities.

More than 50% of nonprofits lack a dedicated workplace giving team.

This often means that responsibilities related to corporate partnerships and matching gifts are spread across multiple roles, adding pressure to teams that are already stretched thin. As a result, follow-up may be inconsistent, causing important opportunities to slip through the cracks.

Final Thoughts & Additional Resources

Payroll giving is a game-changer for nonprofits, offering a reliable and often overlooked source of funding. By understanding the statistics behind these programs, fundraising professionals can better target their efforts and unlock new opportunities for their organizations.

Whether you’re looking to increase participation, educate donors, or partner with employers, these fun facts about payroll giving provide a solid foundation to help you take your fundraising to the next level. Now is the time to embrace payroll giving and ensure your organization reaps the benefits of this powerful fundraising tool. Good luck!

Types of Corporate Philanthropy

There are many types of corporate philanthropy, and understanding the opportunities available to you can go a long way.

Uncover more about innovative corporate giving programs here.

Corporate Matching Gifts Guide

Matching gifts and payroll giving often go hand in hand.

Explore corporate donation-matching and see how your team can make the most of the opportunities with our complete downloadable guide.

Guide to Corporate Sponsorships

Did you know you can use Double the Donation’s intuitive matching gift and volunteer software to uncover broader corporate partnerships?

Find out how your team can do so in this resource.