What to Do When Donors Don’t Qualify for an Employer Match

Donors who don’t qualify for an employer match might initially seem like a setback for nonprofits, but this doesn’t always have to be the case. While employer matching gifts programs are an incredible way to amplify donations, there are numerous strategies that can help nonprofits ensure that donations still get doubled. Therefore, it’s important for nonprofits to understand the alternatives available for maximizing donor impact, even when an individual doesn’t qualify for matching gifts through their employer.

In the following post, we’ll explore four effective strategies for nonprofits looking to make the most of their fundraising efforts. These include the following employer match alternatives:

- Alternative #1: Host a challenge match campaign.

- Alternative #2: Look into a spouse or family member match.

- Alternative #3: Advocate for a new employer match program.

- Alternative #4: Encourage recurring gifts (including payroll giving!).

While it’s true that many donors rely on corporate matching gifts to amplify their contributions, there are a variety of ways nonprofits can still maximize their donations, even if a donor isn’t eligible for employee matching gifts. By leveraging creative strategies, nonprofits can turn these situations into opportunities for growth and engagement, helping nonprofits maintain momentum and improve their fundraising outcomes.

Let’s begin with our first recommendation.

Alternative #1: Host a challenge match.

When donors don’t qualify for an employer match, empowering them to turn their initial donation into a challenge match campaign can be an incredibly effective way to encourage giving and motivate other donors. A challenge match works by offering to match donations if certain fundraising goals are met within a specified timeframe.

For example, a major donor might agree to match donations up to $10,000 for a set period, such as a week. This gives supporters an exciting reason to contribute, even if they don’t qualify for a traditional employer match.

Challenge matches are highly effective because they play on the psychology of “matching” to motivate donors to act quickly and contribute more. They introduce a sense of urgency and competition, which can lead to an increase in donations overall.

How to Set Up a Challenge Match

The first step in hosting a challenge match is to find a matching donor. This could be an individual, corporation, or group that wants to incentivize others to give. In this case, it can be the key donor who recently found out they don’t qualify for an employer matching gift program!

Why? A challenge match gives donors the opportunity to double their impact through the nonprofit itself, bypassing the need for an employer’s involvement.

Once you have a matching donor in hand, it’s important to clearly define the terms of the match being offered. Here are some things to consider:

- Matching Amount: Determine how much the matching donor is willing to match, and set a cap if needed.

- Time Frame: Establish a clear timeframe for the match. Will it run for one day, one week, or one month? What happens if your match runs out early? Is there an opportunity to upsell the matching gift donor to increase their match pledge mid-campaign?

- Matching Criteria: Clarify whether the match applies only to new donors or to existing donors as well. Will there be any restrictions on what types of contributions are eligible for the match (e.g., online gifts, event donations)? Additionally, does your organization need to reach the full match goal in order to unlock the funding, or is match funding released as donations are made?

From there, you’ll need a robust marketing strategy to promote your challenge match campaign. We recommend establishing a sense of urgency, making it visual with a fundraising thermometer or progress bar, and sharing the story behind the match. Not to mention, challenge matches often work best when paired with email campaigns, social media promotion, special incentives, and more.

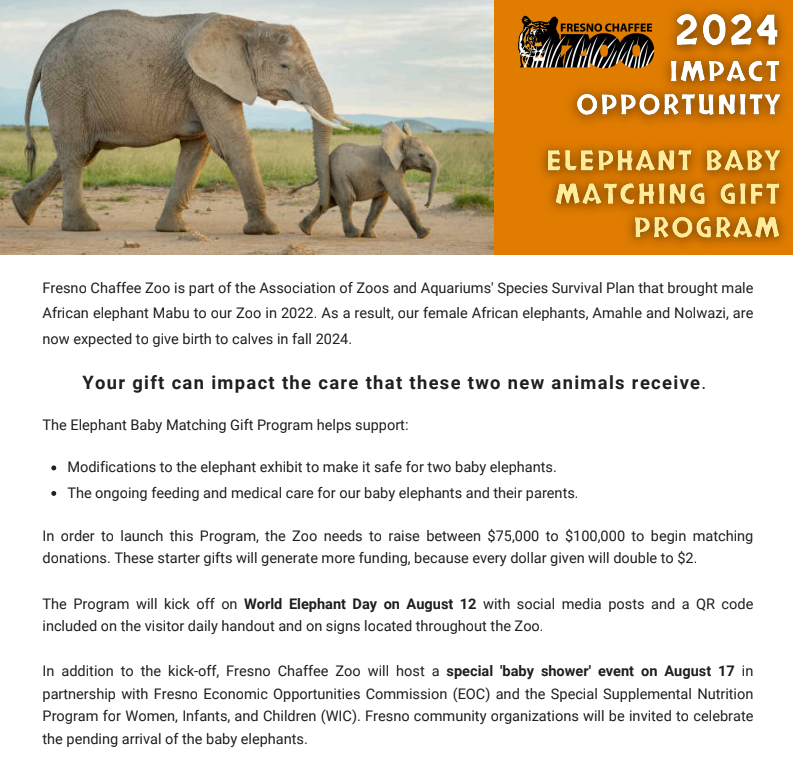

Here’s how one organization promoted its challenge match fundraiser to increase awareness and participation:

Alternative #2: Look into a spouse or family member match.

When a donor doesn’t qualify for an employer match on their own (whether because they are not employed, don’t work at a company with a matching gift program, or don’t meet the specific qualifications), it might feel like a matching gift is completely out of reach. However, before giving up on the idea of additional matching funding, nonprofits should encourage donors to consider the possibility of family member matching gifts. After all, many companies offer matching gift programs that extend beyond the employee themselves, including spouses, dependents, and other family members.

By exploring these available options, nonprofits can uncover additional opportunities to double or even triple a donor’s impact.

For instance, let’s say that a donor named John works for a company that doesn’t offer a matching gift program, but his wife, Jane, works for a company that does. If John makes a donation to your nonprofit, Jane could submit a matching gift request to her employer, thus ensuring that John’s donation is ultimately matched. This provides a unique way to maximize the impact of donations, even when one spouse isn’t directly eligible for a match.

How to Check for Spouse Matching Opportunities

It’s essential for nonprofits to remind donors to check if their spouse’s employer offers matching gifts. As part of your donor communications, consider including a prompt or reminder about spouse matching opportunities. For example, on donation forms or in confirmation emails, you might add a message like:

“Did you know that many companies will match gifts made by you or your spouse? If your employer doesn’t match your donation, check with your spouse’s company to see if they offer matching gifts.”

This simple call-out can help donors think about this additional avenue and could significantly increase the amount of match funding your nonprofit receives. Encourage donors to contact their HR department or benefits coordinator to confirm if their spouse’s company has a matching gift program. Providing a list of well-known companies with matching gift programs in your donor communications (or linking to a matching gift search tool) can help jump-start the conversation and make it easier for donors to inquire about these opportunities.

Many major companies offer matching gifts to both spouses and other family members, though it’s important to remember that each program has different rules, eligibility criteria, and limits. Some notable employers that have been known to offer spouse and dependent matching include CarMax Foundation, Coca-Cola Company, Intel Corporation, and more.

While spouse and dependent matching programs are often overlooked, they can significantly increase the total funding your nonprofit receives if the original donor doesn’t qualify for a match. By encouraging donors to tap into their family members’ eligibility, you’re opening new funding streams that wouldn’t otherwise be available.

Alternative #3: Advocate for a new employer match program.

If a donor works for a company that doesn’t currently offer a matching gift program, that doesn’t mean it never will. In fact, the employer might just need a little nudge to do so, which may make it worth advocating for the introduction of a matching gift program at their business.

Unfortunately, the process of advocating for a new employer match program can seem daunting for individual employees. Still, with the right approach, it can be a highly effective strategy for nonprofits and their donors looking to expand their fundraising opportunities. In other words, an advocate, a donor, or a nonprofit can help bridge this gap by presenting the compelling case for why their employer should establish such a program. By working with the donor to navigate the advocacy process, your organization can open the door to a consistent stream of matching gift opportunities that will continue to generate significant support in the future.

How to Advocate for a New Matching Gift Program

Advocating for a new corporate matching gift program generally involves an existing employee presenting the case clearly, organized, and compellingly. Here are the key steps that nonprofits can guide their donors through when advocating for a matching gift program:

-

Cover the Basics of Matching Gifts: The first step is to help the donor understand how matching gift programs work. This will ensure they can clearly explain the concept to their employer and make an informed case. Knowing how these programs operate helps build the foundation for a successful advocacy effort.

-

Explain the Benefits to the Employer: Advocating for a matching gift program benefits the nonprofit and the donor and provides several advantages to the company. Donors should emphasize these benefits when communicating with their employers. The added employee engagement and retention, as well as the positive impact on brand image and overall sales, are key selling points that can help convince decision-makers to establish a program.

-

Provide Examples of Companies with Matching Gift Programs: To further bolster their case, donors can highlight examples of well-known companies that already have matching gift programs in place. Showing that competitors or similar businesses within the industry are already offering matching gifts can serve as social proof and motivate employers to keep up with the trend.

-

Share Resources to Streamline Program Development: Many employers may hesitate to start a matching gift program because they worry about the time and effort required to manage it. To address this concern, nonprofits can share resources that streamline the process. For instance, Double the Donation offers a step-by-step guide to establishing a matching gift program, including setting up submission processes, determining eligibility criteria, and tracking donations. Sharing such resources (including recommended CSR management platforms) makes it easier for companies to implement the program and ensures it runs smoothly.

-

Use a Template to Communicate the Request: To make the process easier, donors can use a template letter (such as the one in this guide) to request that their company launch a matching gift program. A well-crafted template will ensure that the message is clear, professional, and persuasive, increasing the chances that the request will be taken seriously.

All in all, advocating for a new matching gift program at an employer can be a game-changer for nonprofits, unlocking a new stream of funding and expanding the reach of their fundraising efforts. This not only benefits the individual donor but also strengthens the long-term partnership between the nonprofit and the company, helping both sides maximize their impact on the causes they care about.

Alternative #4: Encourage recurring gifts (including payroll giving!).

When a donor doesn’t qualify for a workplace matching gift program, it might seem like all options for amplifying their donation are exhausted. However, just because they can’t participate in one type of workplace giving program doesn’t mean they can’t participate in another. One valuable alternative is encouraging donors to set up recurring gifts, including payroll giving, which can significantly benefit both the donor and the nonprofit.

Recurring gifts are donations that are automatically charged to a donor’s credit card or deducted from their paycheck on a regular basis, such as monthly, quarterly, or annually. Even if a donor doesn’t qualify for a matching gift through their employer, they can still give in a consistent, impactful way that extends their contribution over time.

In fact, encouraging recurring donations, including payroll giving, is an excellent strategy for nonprofits, as it provides sustainable, predictable revenue streams. When donors commit to giving regularly, they ensure their support for your cause extends far beyond a single contribution. This provides nonprofits with a steady flow of funds to support ongoing programs, plan for future initiatives, and maintain organizational operations without the constant need to raise new funds.

How to Encourage Recurring and Payroll Gifts

To effectively encourage recurring and payroll giving, nonprofits should clearly communicate the benefits of these giving methods to their donors. This could include:

-

Highlighting the ease of payroll giving: Emphasize how simple it is to set up payroll deductions and how it allows donors to give automatically without having to remember to make regular payments. Providing clear instructions on how to set up payroll giving through an employer is key.

-

Promoting the long-term impact of recurring gifts: Donors may be more inclined to commit to recurring gifts if they understand the significant impact of their contributions. For example, a donor who gives $10 per month is contributing $120 annually, which can make a substantial difference when aggregated with contributions from other recurring donors.

-

Offering donor recognition for recurring and payroll gifts: Donors who commit to recurring donations should be recognized for their continued support. This not only acknowledges their contribution but also strengthens their sense of belonging and engagement with the organization.

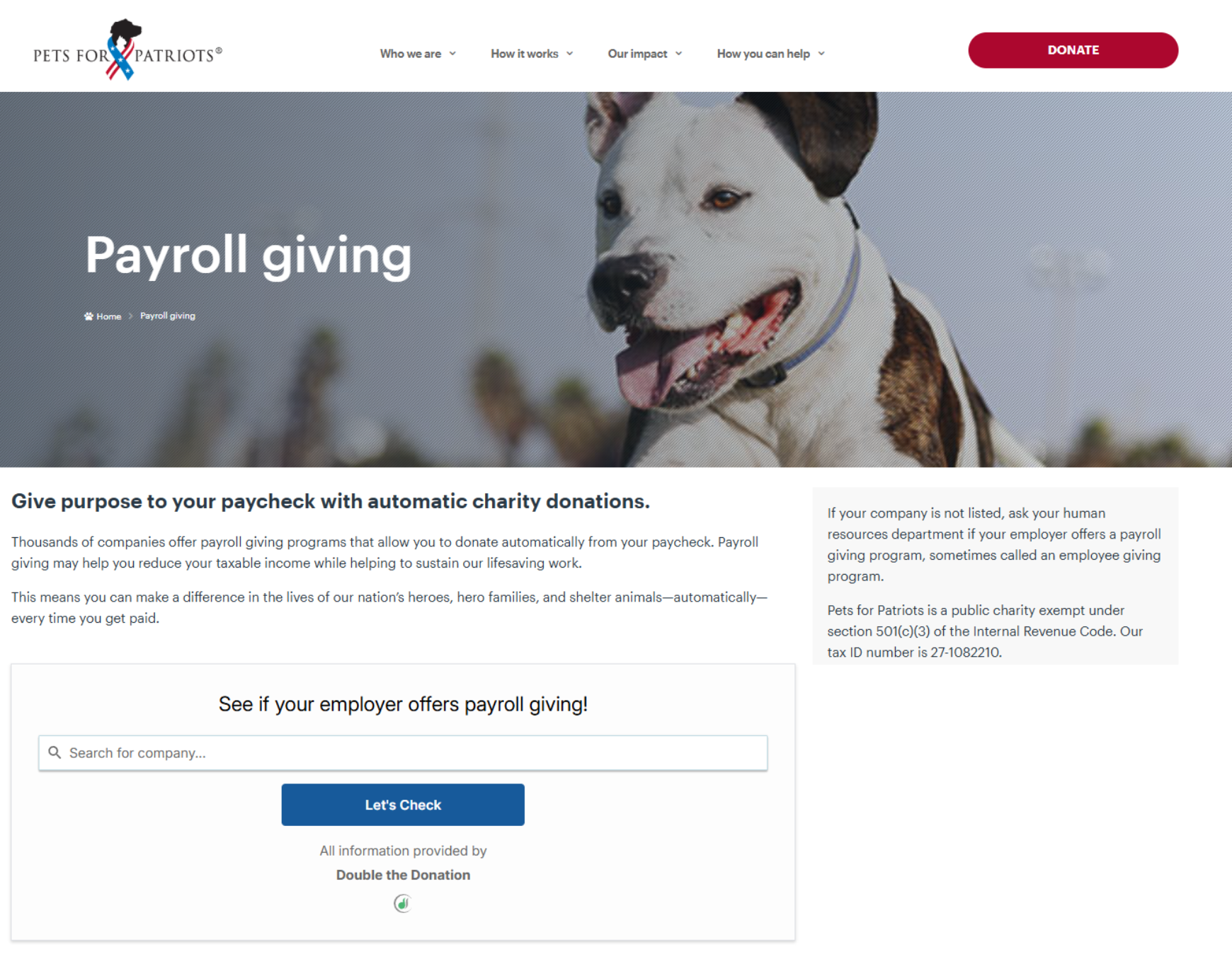

Take a look at how Pets for Patriots promotes the payroll giving opportunity on their website:

Encouraging recurring gifts, including payroll giving, is a highly effective way to maximize donations when donors don’t qualify for workplace matching programs. These giving options provide nonprofits with a reliable and predictable revenue stream, enabling better financial planning and long-term sustainability. They also deepen the relationship between donors and organizations, ensuring that contributions continue to have a lasting impact.

Wrapping Up & Next Steps

When donors don’t qualify for an employer match, it’s essential to understand that there are still numerous ways for them to maximize their contributions. By implementing strategies such as challenge matches, leveraging family member matching opportunities, or even advocating for new employer programs, nonprofits can sustain their fundraising momentum in the long run.

These alternatives not only help maximize the individual’s impact but also create long-term engagement and loyalty.

Interested in learning more about how you can maximize your fundraising? Check out these recommended resources:

- Types of Fundraising Matches Your Org Should Think About. Donor not eligible for corporate matching gifts? See how these other fundraising match types can help unlock additional support for your organization.

- How to Advocate for a Matching Gift Program to Your Employer. Just because a company doesn’t currently match donations doesn’t mean it never will. Sometimes they just need a push, and advocating for a program can be the right way to do it!

- Winning Workplace Giving Strategies & How to Leverage Them. There’s more to workplace giving than just matching gifts! Learn how ineligible donors can expand their impact through payroll giving, volunteer grants, and more.