4 Payroll Giving Web Pages to Inspire Your Own Nonprofit’s

In the nonprofit sector, the "sustainers" program, or monthly…

Top Columbus Companies that Offer Employee Payroll Giving

Columbus, Ohio, stands out as a vibrant city with a dynamic business…

Top Denver Companies that Offer Employee Payroll Giving

Denver, Colorado, is not only known for its stunning mountain…

Top Indianapolis Companies that Offer Employee Payroll Giving

Indianapolis stands out as a vibrant center for business and…

Top Jacksonville Companies that Offer Employee Payroll Giving

Jacksonville, Florida, stands as a vibrant economic and cultural…

Top San Jose Companies that Offer Employee Payroll Giving

San Jose, located in the heart of Silicon Valley, is not only…

Top San Diego Companies that Offer Employee Payroll Giving

San Diego stands out as a vibrant city with a thriving economy…

Top Dallas Companies that Offer Employee Payroll Giving

Dallas stands as a vibrant and dynamic city, renowned not only…

Top Austin Companies that Offer Employee Payroll Giving

Austin, Texas, is not only known for its vibrant music scene…

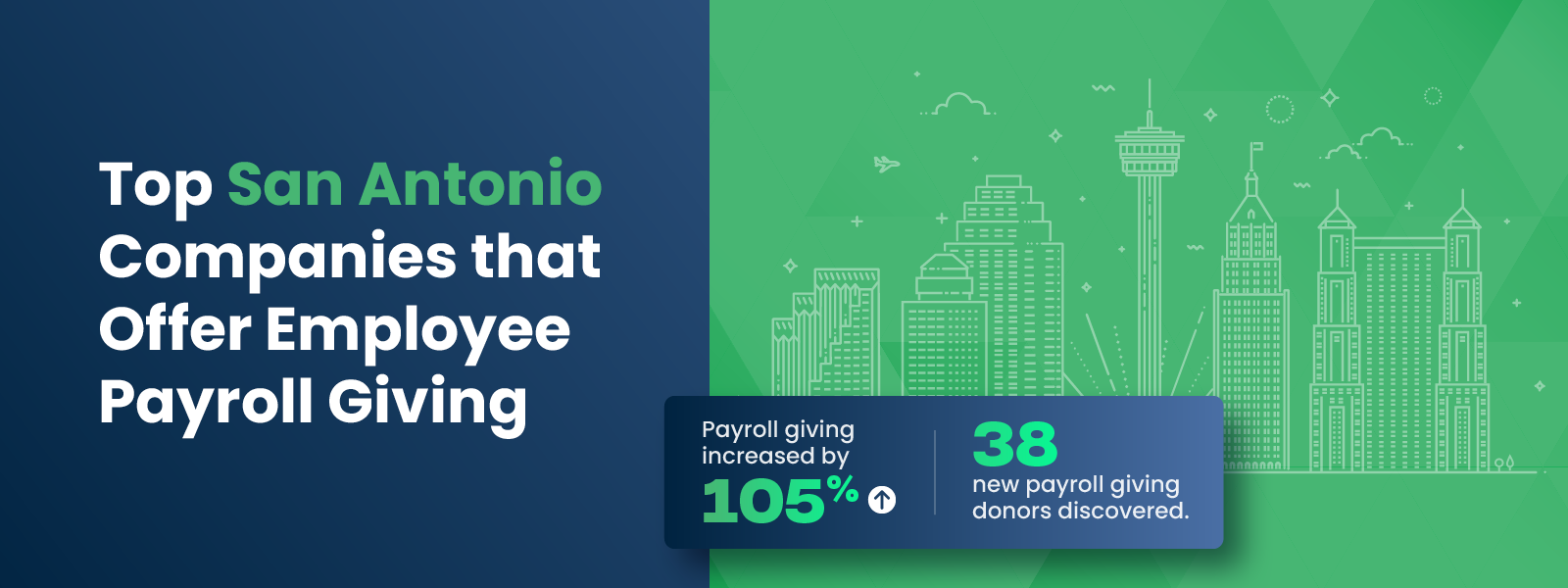

Top San Antonio Companies that Offer Employee Payroll Giving

San Antonio is a vibrant city known for its rich history, cultural…