Tax Benefits of Corporate Matching Gifts: The Basics

As a result of a growing understanding of the importance of corporate social responsibility, businesses are implementing more and more employee giving programs. These programs give employees a voice in where their company’s philanthropic dollars end up.

For businesses, corporate giving is a great way to promote their company while giving back to the community. For nonprofits, these programs represent a great fundraising opportunity. Finally, for donors, their employers’ programs can double (maybe even triple!) their generous efforts.

However, have you wondered about the tax implications of employee giving programs, specifically matching gifts? To answer this, let’s go through the following main points:

- The Basics of Matching Gifts

- Tax-Deductible Contributions for Companies

- Tax-Deductible Contributions for Nonprofits and Donors

- How a Matching Gift Database Can Help Nonprofits

When it comes to matching gifts, there’s no avoiding the tricky tax component that comes with them. To better understand matching gifts and their tax implications, let’s get started!

1. The Basics of Matching Gifts

Simply put, a matching gift is when a company matches an employee’s monetary donation to a nonprofit organization. Companies design these programs specifically to support the organizations that their employees are passionate about. Plus, companies view it as a great way to give back to their communities, develop their brand, and create a generous work environment.

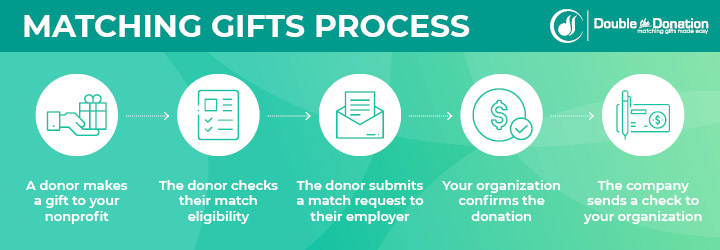

The matching gifts process is simple:

Once a donor makes a donation, all they have to do is fill out a form and submit it to their employer. Then, if the nonprofit is eligible, the company will send a check to the organization.

For instance, Coca-Cola matches retiree and full-time employee donations at a 2:1 ratio. This means if an employee donates $1,000 to an eligible nonprofit, the employer will donate $2,000, totaling $3,000! While most companies match at a generous dollar-for-dollar rate (1:1 ratio), companies like this can potentially triple eligible organizations’ donation revenue.

Corporate Donations

Sometimes, a company’s board of directors or officers will choose specific organizations to receive donations from their giving budget. This is either put in place of a matching gift program or it coexists with the matching gift program.

The organizations that receive these donations are not chosen by individual employees. Rather, these donations represent a mix of broader corporate support, and decisions are typically made based on organizations their customers suggested.

That being said, all corporate giving is generous—no matter how much or how little. Corporate philanthropy is expressed in many ways, including matching gifts, corporate donations, volunteer grants, and so on. Now that you know the basics of corporate philanthropy, let’s dive into the tax component of it.

Takeaway: Corporate philanthropy has a growing presence in both the business and nonprofit worlds. Review the basics before you tackle the tricky tax portion of corporate giving.

2. Tax-Deductible Contributions for Companies

The IRS deems donations to eligible 501(c)3 nonprofit organizations as tax-deductible. This rule pertains to both employees and their employers.

Specifically, corporations can take up to 10 percent of their annual income in tax deductions from charitable giving. However, a major exception to this rule is matching gifts.

Since a matching gift is technically a donation, companies can deduct the matches they make from their reported income. Decreasing reported income means a company will not have to pay taxes on the donated money.

Plus, the 10 percent rule doesn’t apply to these donations. Instead, when matching donations exceed 10 percent of the company’s annual income, companies can deduct the extra donations.

Let’s take a look at the other benefits of matching gifts for companies.

Benefits for Companies

As previously stated, a major benefit of implementing an employee match program is the tax deduction on the company’s earned annual income. Luckily, if a corporation simply donated money to a nonprofit organization, it would still receive the same tax benefits.

While the corporation doesn’t receive a greater tax benefit from choosing one or the other, there is an added benefit of choosing a matching gift program. When a company offers a generous matching gift or volunteer grant program, employees become much more engaged.

They’ll feel like they have a say in where their company’s giving budget goes. They’ll also feel as though their company supports their philanthropic efforts and the causes they care about. Plus, if an employee is unsure about donating, having access to a corporate giving program may be the push they need to contribute.

Takeaway: Companies can take tax deductions for their charitable giving. Plus, corporate giving promotes a philanthropic work environment!

3. Tax-Deductible Contributions for Nonprofits and Donors

Typically, when something has major benefits, it also has a few setbacks. This reigns true with matching gifts and its tax implications. While actually implementing the programs in the first place is the hurdle for companies, donors and nonprofits have a different set of obstacles.

For donors, that’s determining if they can take a tax deduction on a matching gift. For nonprofits, that’s calculating the tax-deductible amount itself. Let’s dive into these key tax issues.

Tax Implications for Nonprofits

It’s up to nonprofits to determine tax-deductibility for their special events, membership programs, and so on. While it can be tricky at first, calculating the tax-deductible amount is a vital step in securing matching gift funds.

The tax-deductible amount, which is a specific dollar amount, is the portion of a donation that is eligible to be matched by employers. It should be communicated with donors in a straightforward way.

For instance, if a nonprofit hosts a gala, there should be a line that discusses the tax-deductible amount on the ticket. This line might be similar to the following: “Did you know that $X of this ticket is tax-deductible? If your employer offers a matching gift program, this amount might be eligible for a match!”

In short, to calculate the tax-deductible amount of an event, you calculate the fair market value (i.e. the amount that someone would pay to receive the benefits if it wasn’t a fundraiser). Subtract the fair market value from the total ticket price. That’s the tax-deductible amount.

Doing this takes a bit of research on the nonprofit end. To learn more about calculating this amount, visit this guide about determining the tax-deductible amount for events and memberships. Otherwise, let’s look at the challenges donors face.

Tax Implications for Donors

Oftentimes, there’s confusion among employees regarding their ability to take a tax deduction on a matching gift. In short, each party (i.e. the employee and the company) can only take deductions on the actual charitable contributions that they made.

In other words, if an employee donates $500 to an organization and it was matched at a 1:1 ratio by the employer, then both the employee and the company can only deduct $500, not the full $1,000 with the matched gift. If there’s still confusion, donors should reach out to both their employer and the nonprofits they support.

However, there’s a different set of rules for tax-deductibility on non-personal donations. In short, avoid non-personal donations.

Non-personal donations are those that are made on behalf of someone. In other words, if a supporter works for a company that doesn’t offer matching gifts, they may give their money to a friend who does work for a matching gift company. However, this causes confusion during tax season.

For instance, who gets to claim the tax deduction on the original donation? Should it be the individual whose money was donated, or should it be the friend who donated the money and submitted the match request? Not only is this confusing (and probably illegal), but it undermines the whole reason for corporate philanthropy.

Companies want to support the causes their employees care about, not the causes their employees’ friends care about. Don’t make the tax side of it even more confusing by doing this. Stick to the spirit of corporate philanthropy!

Takeaway: While matching gifts are fairly straightforward, the tax implications can be confusing for nonprofits and donors. It’s up to nonprofits to determine and communicate the tax-deductibility with their donors.

4. How a Matching Gift Database Can Help Nonprofits

While a matching gift database can’t calculate the tax-deductible amount of a donation, it can pinpoint all the guidelines surrounding companies’ guidelines on tax-deductible donations.

With a matching gift database like Double the Donation, your organization can pinpoint all available corporate giving opportunities. Plus, it makes it easier for donors to recognize their opportunities to increase their contributions, too!

Once you embed the tool across your online fundraising channels, here’s what it does:

- Enables donors to search for 20,000+ companies.

- Gives users all available guidelines and forms for companies’ programs.

- Allows nonprofits to identify more matching gift opportunities.

- Allows nonprofits and donors to do much more with matching gifts!

Plus, Double the Donation offers an automated system for larger nonprofits. 360MatchPro by Double the Donation automatically identifies match-eligible donors with email domain screening, contacts these eligible donors, and even puts an automated matching gift plan in place for you.

Either tool allows nonprofits to pinpoint more matching gift opportunities. Also, these databases can help determine specific companies’ guidelines about matching tax-deductible donations.

Matching gifts are typically straightforward for all parties involved. This includes companies, nonprofits, and donors. However, tax-deductibility adds a layer of complication.

All it takes is a little effort from each party. While companies should write clear matching gift requirements in terms of tax-deductibility, nonprofits should also determine the tax-deductibility for their memberships and event tickets. From here, organizations can advertise these amounts to donors, who can then react accordingly.

When each stakeholder works together, the matching gift process is simplified, and all confusion is clarified. Now that you understand the tax benefits and obstacles of matching gifts, put this information to good use!

Additional Resources

To learn more about corporate philanthropy, visit the following additional resources:

- Matching Gifts: A Q&A Guide for Nonprofits by re:Charity. Go back to the basics of matching gifts to gain a full understanding of corporate giving.

- Corporate Giving Programs: The Ultimate Fundraising Guide. Matching gifts are just one part of corporate giving. Find out what all corporate philanthropy encompasses.

- Corporate Giving and Matching Gift Statistics. Check out these impressive matching gift statistics to see the impact corporate philanthropy can have.