The Strategy Behind BCU’s $3.4M in Corporate Matching Revenue

Introduction: The Challenge of Scale in Legacy Nonprofits

Founded in 1949, Blood Cancer United (formerly known as LLS) is a titan in the nonprofit sector. With a mission to cure leukemia, lymphoma, Hodgkin’s disease, and myeloma, and to improve the quality of life of patients and their families, the organization has grown into a fundraising powerhouse. Today, BCU generates approximately $285 million in annual contributions, funding lifesaving research and patient support services across the globe.

Operating at this level of magnitude is fundamentally different from running a small community charity. When an organization processes hundreds of millions of dollars in donations, “inefficiency” isn’t just a minor annoyance; it is a multi-million dollar leak.

BCU is particularly unique because of its reliance on peer-to-peer (P2P) fundraising. The organization hosts two of the top 15 peer-to-peer fundraising events in the nation, each bringing in over $50 million. In a P2P model, the volume of transactions is incredibly high. Instead of a few large checks from major donors, these events rely on hundreds of thousands of small donations from friends, family, and colleagues of participants.

This volume created a specific operational crisis regarding corporate matching gifts. BCU knew that a significant percentage of these thousands of donors worked for matching-eligible companies. However, the sheer number of transactions made manual verification impossible. As a result, millions of dollars in potential corporate matching revenue were being left on the table simply because the organization could not scale its outreach to match its donation volume.

By turning to Double the Donation’s automated platform, BCU solved this crisis of scale. The results were historic: a $3.4 million increase in matching gift revenue, secured not by working harder, but by working smarter.

The Challenge: The “Full-Time Job” Multiplied by Thousands

The core challenge for Blood Cancer United was the mathematical impossibility of manual labor in a high-volume environment. The case study notes that “tracking match eligibility and status manually was a full-time job.”

The Peer-to-Peer Complexity

Peer-to-peer fundraising adds a layer of complexity to matching gifts that standard donations do not.

- The Disconnect: In P2P, the donor is often giving to support a friend (the participant), not necessarily because they have a deep, long-standing relationship with the organization (BCU). This means the donor may not know about BCU’s specific matching gift policies or tax ID status.

- The Volume: A $50 million event comprised of $50 donations implies one million distinct transactions. Even if only 10% of those donors are match-eligible, that is 100,000 prospects to research, contact, and verify.

- The Participant Factor: In P2P, the fundraiser (the participant) is often the one asking for the match. If the organization can’t arm the participant with the right tools, the opportunity is lost.

BCU realized that their manual processes were drowning in this volume. They needed a system that could handle the throughput of a top-tier national event without crashing and without requiring a legion of data entry staff. They needed “to identify and pursue all opportunities automatically.”

The Solution: 360-Degree Automation

To capture this lost revenue, Blood Cancer United implemented a comprehensive automation strategy powered by Double the Donation. The solution was designed to cover the entire lifecycle of a donation, from the moment the credit card was charged to the moment the matching check arrived.

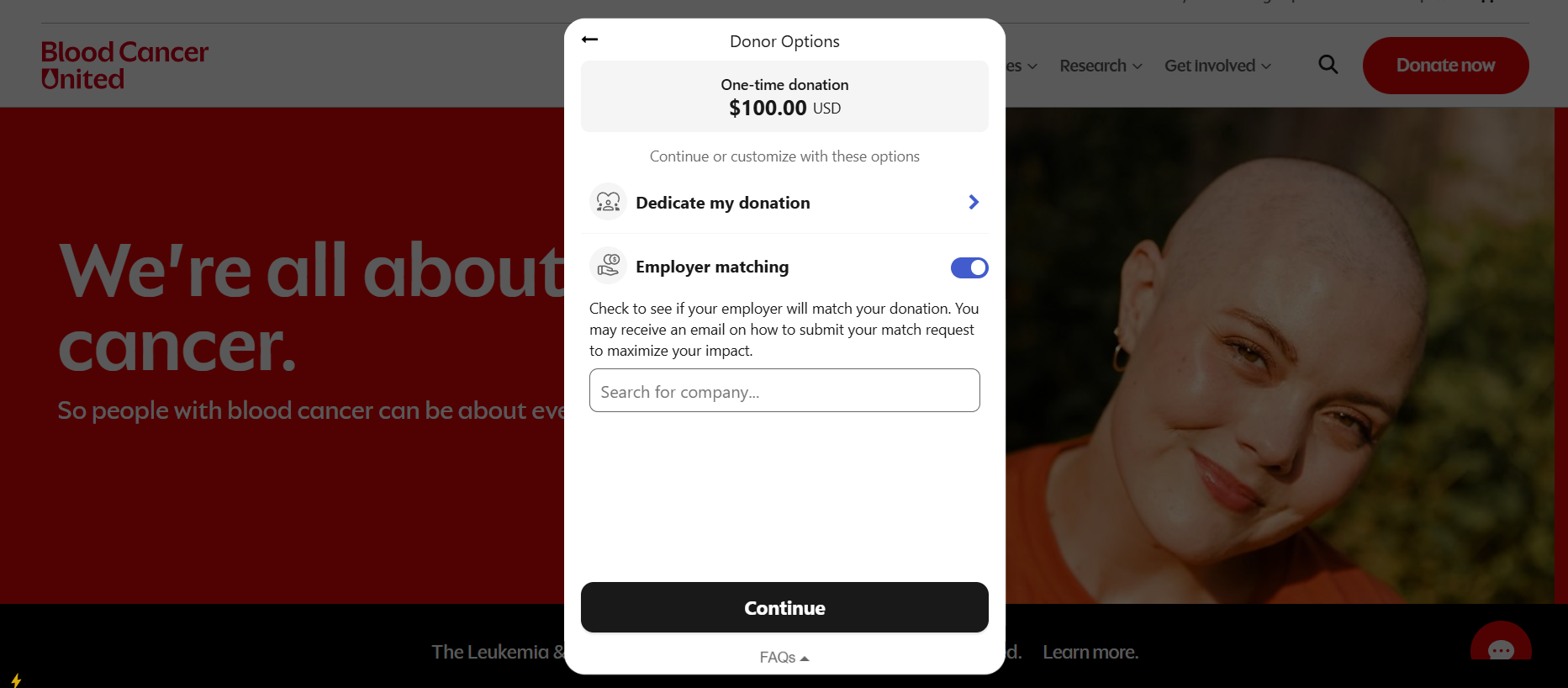

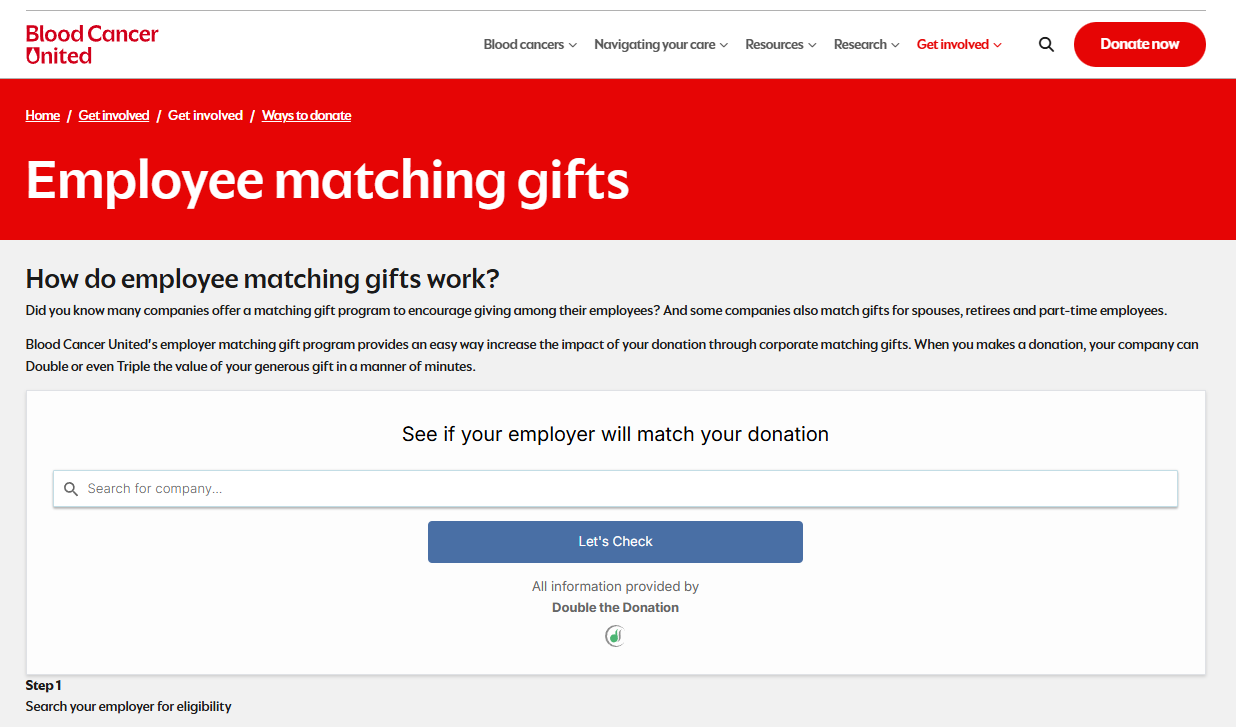

1. Integration at the Point of Capture

BCU integrated the matching gift search tools directly into their fundraising platforms. This is critical for P2P events. When a donor visits a participant’s fundraising page to give $25, they are presented with the option to search for their employer immediately.

- Strategic Value: This captures the data at the source. It prevents the need for retroactive data scraping. The donor self-identifies, providing BCU with clean, actionable employment data instantly.

2. The “One Hour” Rule

A specific, highly effective tactic employed by BCU was the timing of its automated outreach. The case study specifies that “automation tools drive matching gifts to completion with emails sent approximately 1 hour after donation.”

This timing is strategic genius.

- The “Cool Down” Period: If an email is sent immediately (0 minutes), it might get lost in the flurry of transaction receipts and thank-you notes.

- The Sweet Spot: By waiting one hour, BCU ensures the donor has stepped away from the transaction but is still in the “afterglow” of their good deed. They are likely back at their desk or checking their phone. The email arrives as a separate, distinct notification: “Make your gift go twice as far.”

- Re-Engagement: This timing re-engages the donor just as their attention might be drifting, pulling them back into the BCU ecosystem to complete one final, high-value task.

3. Pursuit of All Opportunities

The automation wasn’t just for the “easy” matches. The system allowed BCU to “identify and pursue all opportunities automatically.” This suggests a comprehensive approach where even smaller gifts or gifts from obscure companies were chased down by the software. In a manual system, a development officer might ignore a $25 match to focus on a $1,000 match. In an automated system, the $25 match costs $0 to pursue, so every single dollar is chased.

The Results: $3.4 Million in Growth

The financial impact of this automation was transformative, reshaping the revenue composition of the organization.

The Headline: $3.4 Million Growth

Blood Cancer United reported that “matching gift revenue grow[n] by over $3.4 million.” To put this in perspective, $3.4 million is not just a line item; it is an entire program budget. It is enough to fund a major multi-year research study or provide support services to thousands of families. This revenue was generated without a corresponding increase in fundraising expense; it was purely the result of better data capture and automation.

Year-Over-Year Acceleration

The growth wasn’t slow. BCU saw a “48% year-over-year matching gift revenue increase.” For a mature organization founded in 1949, seeing nearly 50% growth in any revenue stream is rare. Mature organizations typically fight for 3-5% incremental growth. A 48% jump indicates a structural break from the past; a clear “before and after” moment triggered by the adoption of this technology.

Engagement at Scale: 61% Open Rate

Despite sending emails to the massive volume of donors associated with $285M in contributions, BCU maintained high engagement. The automated emails achieved a 61% open rate.

- Analysis: Maintaining a >60% open rate at high volume is difficult. It suggests that the “One Hour” rule is highly effective and that the messaging (focused on the donor’s power to help patients) was compelling.

Strategic Deep Dive: The Peer-to-Peer Multiplier Effect

The most interesting strategic lesson from the BCU case study is how matching gifts interact with Peer-to-Peer (P2P) fundraising.

In P2P, the fundraisers (participants) are motivated by goals. They want to hit their $1,000 or $5,000 fundraising minimums to earn rewards (jerseys, bibs, recognition). Here’s how it works with matching gifts:

- The Incentive: Matching gifts are a “cheat code” for participants. If a donor gives $50 and matches it with another $50, the participant gets $100 closer to their goal.

- The Loop: By automating the matching gift process, BCU helped its participants succeed. When participants see that BCU makes it easy to get matches, they are more likely to encourage their donors to use the tool.

- Retention: Successful participants come back. By using corporate matching to help participants hit their goals faster, BCU likely improved its participant retention rates for future events.

The Human Element: Saving Time for Mission

While the dollar figures are the headline, the operational impact on the staff was equally profound. The Director of Direct to Constituent Initiatives noted: “Double the Donation Matching has been well received by both our staff and our donors. It’s saved us time and helped grow our matching gift revenue by over $3.4 million.”

“Saved Us Time”

In an organization as large as BCU, “saving time” translates to saving payroll and reducing burnout. The “full-time job” of manual tracking was eliminated.

- Staff Reallocation: The staff who used to spend hours verifying employment data could now be reallocated to donor stewardship. They could spend their time calling major donors, supporting P2P participants, or planning the next big event.

- Donor Satisfaction: The quote mentions the tool was “well received by… our donors.” Donors want to help, but they hate bureaucracy. By automating the process, BCU respected its donors’ time, making it easy for them to maximize their impact without jumping through hoops.

Conclusion: The Future of High-Volume Fundraising

Blood Cancer United’s success is a signal to the rest of the major nonprofit sector. It proves that size is no excuse for lack of agility. In fact, large organizations have the most to gain from automation because they have the highest volume of low-hanging fruit.

By implementing a strategy that combined point-of-sale identification, timed automated outreach, and comprehensive pursuit, this organization turned the challenge of scale into a massive opportunity. And the results are undeniable:

- $3.4 Million in new revenue.

- 48% annual growth.

- 61% donor engagement.

For BCU, this isn’t just about efficiency; it’s about accelerating the cure. Every dollar matched is another dollar for research, bringing the world closer to a future without blood cancers.

Download the full case study compilation here to uncover even more successful strategies.