On Catholic Education Arizona’s $135k via Matching Gift Tool

Introduction: Faith, Education, and Financial Stewardship

For over two decades, Catholic Education Arizona (CEA) has served as a vital bridge between generous taxpayers and underserved students. As the largest School Tuition Organization (STO) in the Diocese of Phoenix, CEA has a clear and powerful mission: to change lives one scholarship at a time. Since its inception in 1998, the organization has raised hundreds of millions of dollars to award over 161,000 scholarships, ensuring that families from all economic backgrounds can access the quality, faith-based education provided by Catholic schools.

The stakes for CEA are high. The scholarships they provide often determine whether a child can attend a school that aligns with their family’s values and educational needs. The statistics speak to the success of this investment: CEA-supported schools boast a 99.8% graduation rate, with 96% of graduates matriculating to higher education or military service.

However, the funding model for STOs in Arizona is unique. While individual tax credits form the backbone of their revenue, there is a powerful multiplier effect available through corporate matching gifts. Many companies will match the charitable portion of their employees’ contributions, effectively doubling the scholarship funds available for students.

Despite this potential, CEA realized it was not capturing the full volume of available matching funds. Like many non-profits, they found that donors were often unaware that their tax credit contribution could be matched. To bridge this gap, CEA turned to a technological solution that could automate the discovery and pursuit of these funds. In less than a year, they uncovered over $135,000 in matching gift potential, proving that even complex funding models can benefit from streamlined automation.

The Challenge: Moving Beyond Passive Fundraising

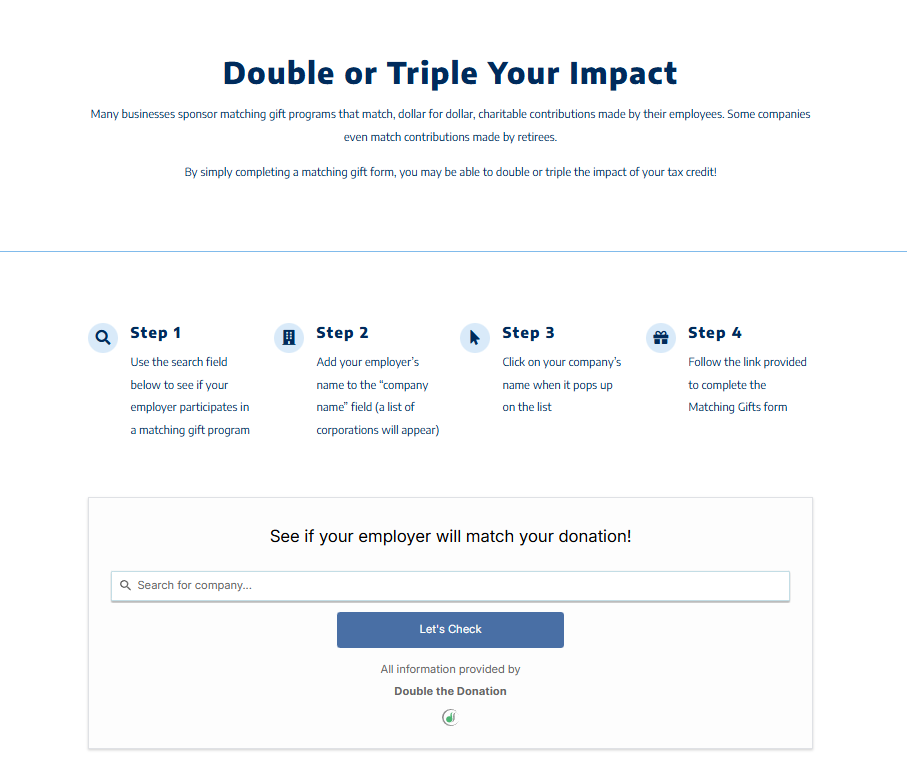

Before implementing its current automated system, Catholic Education Arizona used a simpler approach to matching gifts. The organization offered a standalone search tool on its website, allowing motivated donors to check their employer’s eligibility. While this was a useful resource, it suffered from the limitations inherent in “passive” fundraising.

The “Search and You Shall Find” Fallacy

The problem with a standalone tool is that it relies entirely on the donor’s initiative. For a match to be identified, a donor must:

- Know that tax credit contributions are eligible for matching (a common point of confusion).

- Navigate to the specific matching gift page on the CEA website.

- Search for their employer.

- Navigate to a separate corporate portal to submit the request.

For a busy parent or professional making a quick tax credit contribution before the April deadline, this multi-step process creates significant friction. Many donors likely assumed their gift wasn’t eligible or simply forgot to check.

The Operational Bottleneck

On the administrative side, CEA faced the classic “small team, big database” dilemma. With thousands of contributors annually, manually researching the employer of every donor was impossible. They needed a way to “proactively increase donor awareness” without adding hundreds of hours of administrative work to their staff’s plates.

The team realized that to truly serve their students, they needed to stop waiting for donors to find the matching gift forms and start delivering those forms directly to the donors.

The Solution: A Proactive, Integrated Ecosystem

To solve this challenge, Catholic Education Arizona upgraded to Double the Donation’s fully automated matching gift platform. This shift represented a fundamental change in strategy: from reactive availability to proactive guidance.

The solution integrated matching gift discovery directly into the donor’s natural workflow, utilizing three key touchpoints.

1. Integration into the Donation Flow

The most critical change was embedding the search tool directly into the donation forms.

- How it works: As donors fill out their information to make a tax credit contribution, they are presented with a search field to “See if your employer will match your donation.”

- The Strategic Value: This captures the information when the donor is most engaged. It validates immediately whether their employer participates, removing the uncertainty that often stops donors from acting.

2. The “Actionable” Confirmation Page

Once the contribution is submitted, the system utilizes a confirmation page plugin to keep the momentum going.

- Immediate Next Steps: Instead of a generic “Thank You,” eligible donors are shown specific instructions for their employer.

- Direct Links: The system provides direct links to the corporate submission forms, meaning the donor can complete the match request in just a few clicks while their credit card is still warm.

3. Automated Email Safety Nets

Recognizing that not every donor would complete the process immediately, CEA implemented “automated email triggers.”

- Customized Outreach: These emails are branded to look like they come directly from CEA, maintaining the trust and relationship the organization has built.

- Timely Reminders: The emails are sent automatically after the transaction, serving as a helpful reminder to busy donors who may have closed the browser tab too quickly.

The Results: Unlocking $135k for Scholarships

The implementation of this automated strategy produced immediate, measurable results for Catholic Education Arizona. The data highlights how effectively the system bridged the gap between donor intent and completed action.

Financial Impact: $135,000 Identified

In less than 12 months, the system identified over $135,000 in match-eligible dollars.

- Context: For an organization where every dollar translates to tuition assistance, $135,000 is a transformative sum. It represents full tuition for dozens of students, or partial assistance for many more.

- Efficiency: This revenue was identified without the development team having to send a single manual email or conduct a single prospect research session.

Donor Engagement: 60% Open Rate

One of the most impressive metrics from the CEA case study is the effectiveness of their email outreach. The automated matching gift emails achieved a 60% open rate.

- Industry Comparison: In the nonprofit sector, email open rates often hover around 20-25%. A 60% open rate indicates that CEA’s donors are highly engaged and eager to maximize their contributions.

- Messaging Success: This high open rate suggests that the subject lines and timing of the emails (focused on helping the donor “double their impact”) resonated deeply with the audience.

Driving Action: 54% Taking Next Steps

The ultimate goal is not just awareness, but action. The metrics showed that 54% of donors accessed matching gift forms or guidelines.

- Conversion: This means that more than half of the donors who were presented with the opportunity took a concrete step toward securing the match. This high conversion rate validates the “frictionless” nature of the integrated solution.

Strategic Analysis: The Unique Case of Tax Credits

One of the most interesting aspects of the Catholic Education Arizona case study is how it navigates the complexity of Tax Credit Contributions versus standard charitable donations.

In Arizona, individuals can receive a dollar-for-dollar tax credit for contributions to STOs. This is distinct from a standard tax deduction. A common misconception among donors is that because they are receiving a tax credit, the gift is not “charitable” and therefore not eligible for corporate matching.

Education as a Strategy

CEA utilized the matching gift platform to educate donors on this nuance. Their messaging explicitly clarifies: “In addition to utilizing individual tax credits, a contributor’s employer may match the tax credit contribution as part of their philanthropic efforts.”

- Clarifying Eligibility: By integrating the search tool, CEA allowed donors to check their specific company’s policy regarding tax credits. Many corporations do match these contributions because they recognize the 501(c)(3) status of the receiving organization.

- Double Dipping for Good: This strategy effectively allows donors to “double dip” on benefits: they get the state tax credit for themselves, and they trigger a corporate donation for the school, maximizing the leverage of their single financial action.

The Role of Corporate Partners

The success of this program also highlights the strong ecosystem of corporate philanthropy in Arizona. CEA has built relationships with major employers like Bank of America, Coca-Cola, and others who actively participate in matching programs.

By automating the verification process, CEA strengthened these corporate relationships.

- Data Accuracy: The automated system ensures that match requests are submitted with accurate data, reducing the administrative burden on corporate HR departments.

- Reporting: The “matching gift dashboard” allows CEA to track which companies are generating the most matches. This data can inform future corporate partnership strategies, allowing CEA to target specific companies for sponsorship or workplace giving campaigns.

Conclusion: A Lesson in Leveraging Technology

Catholic Education Arizona’s experience serves as a powerful case study for any School Tuition Organization or education-focused nonprofit. It demonstrates that complexity, whether it be tax codes or corporate policies, should not be a barrier to revenue.

By adopting a “proactive, automated” approach, CEA removed the burden of complexity from its donors. They replaced confusion with clarity and manual labor with automated efficiency.

The results are clear:

- $135,000+ in identified revenue.

- 60% email open rates.

- Thousands of students supported by the additional funds.

As CEA continues to “change lives, serve society, and transform culture,” its investment in matching gift automation ensures that it is maximizing every possible resource to support the next generation of students. For other organizations looking to scale their impact, the lesson is simple: make it easy for your donors to say “yes,” and the results will follow.

Download the full case study compilation here to uncover even more successful strategies.