Avoid These 5 Employer Appending Mistakes Nonprofits Make

When it comes to maximizing donor intelligence, employer appending can be a game-changer for nonprofits looking to grow workplace giving revenue. By enriching your database with employment information—such as where your donors work and their eligibility for corporate giving programs—you unlock powerful insights that can drive your corporate giving success. But like any data project, success hinges on more than just good intentions. Many organizations rush into employer appends without the proper planning, only to encounter disappointing results. In this post, we’ll walk you through five common employer appending mistakes nonprofits make during the process—and, more importantly, how to avoid them.

These include:

- Starting with unclean or disorganized data

- Relying too fully on appends for data collection

- Choosing the wrong data appending vendor

- Lack of a data integration plan

- Not using the insights to power workplace giving programs

Avoiding these pitfalls doesn’t require a massive overhaul—just a more intentional approach. By understanding what can go wrong and planning accordingly, your nonprofit can turn employer appending into a smart, strategic asset.

Let’s dive into the five key mistakes to watch out for—and how to sidestep them for better results.

1. Starting with unclean or disorganized data

One of the most common—and most costly—mistakes nonprofits make when beginning an employer append is skipping the crucial step of data hygiene. If your donor records are riddled with typos, outdated contact info, or missing key fields, even the best appending service will struggle to return accurate or useful results.

Why It Matters:

Employer append vendors match your data against external databases using identifiers like name, address, email, and phone number. If that information is incorrect, inconsistent, or incomplete, the chances of a successful match drop significantly. Worse, it can lead to mismatched records or misleading insights that hinder your fundraising instead of helping it.

How to Avoid This Mistake:

- Run a data audit before the append. Identify and flag duplicates, missing fields, and formatting inconsistencies.

- Standardize your inputs. Make sure names are consistently formatted (e.g., “John A. Smith” vs. “Smith, John A.”), addresses follow USPS formatting, and emails are current.

- Fill in the gaps. Verify and fill in basic information (like mailing address or phone number) before submitting your list for employer appending.

- Create a clean version of your list. Work with a deduplicated and verified subset of records for the append process, especially if your full database contains outdated or inactive contacts.

Pro Tip: Cleaning up your data upfront not only boosts your match rates but also ensures you’re making decisions based on trustworthy information. By prioritizing clean, organized data from the start, your nonprofit sets the stage for a more successful—and actionable—employer append project.

2. Relying too fully on appends for data collection

Employer appending is a powerful tool—but it shouldn’t be your only strategy for collecting donor employment data. One major mistake nonprofits make is leaning too heavily on appending services to fill in all the gaps without putting systems in place to gather this information directly from supporters.

Why It Matters:

Appending services are only as good as the data they match against—and even the best providers can’t deliver 100% coverage. If your donor file lacks strong identifying information or the donor simply isn’t in the external database, you’ll be left with incomplete results. More importantly, relying solely on third-party sources limits your ability to capture current information directly from your audience and connect them to their workplace giving opportunities faster.

How to Avoid This Mistake:

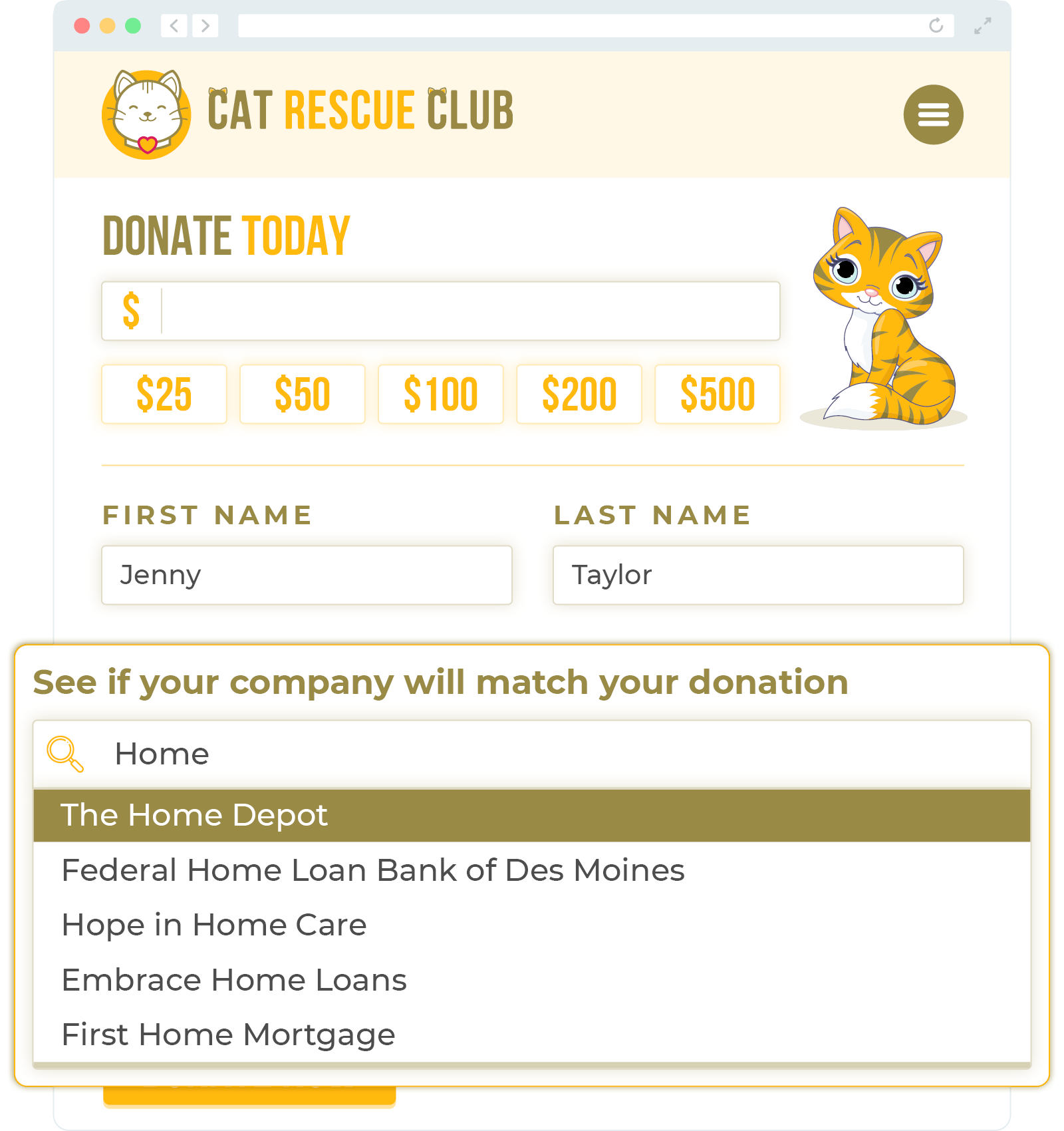

- Add employer fields to your forms. Include optional fields for employer name and job title in donation forms, event registrations, volunteer sign-ups, and membership forms. Be sure to frame this field around discovering someone’s eligibility for a workplace giving program to increase reporting!

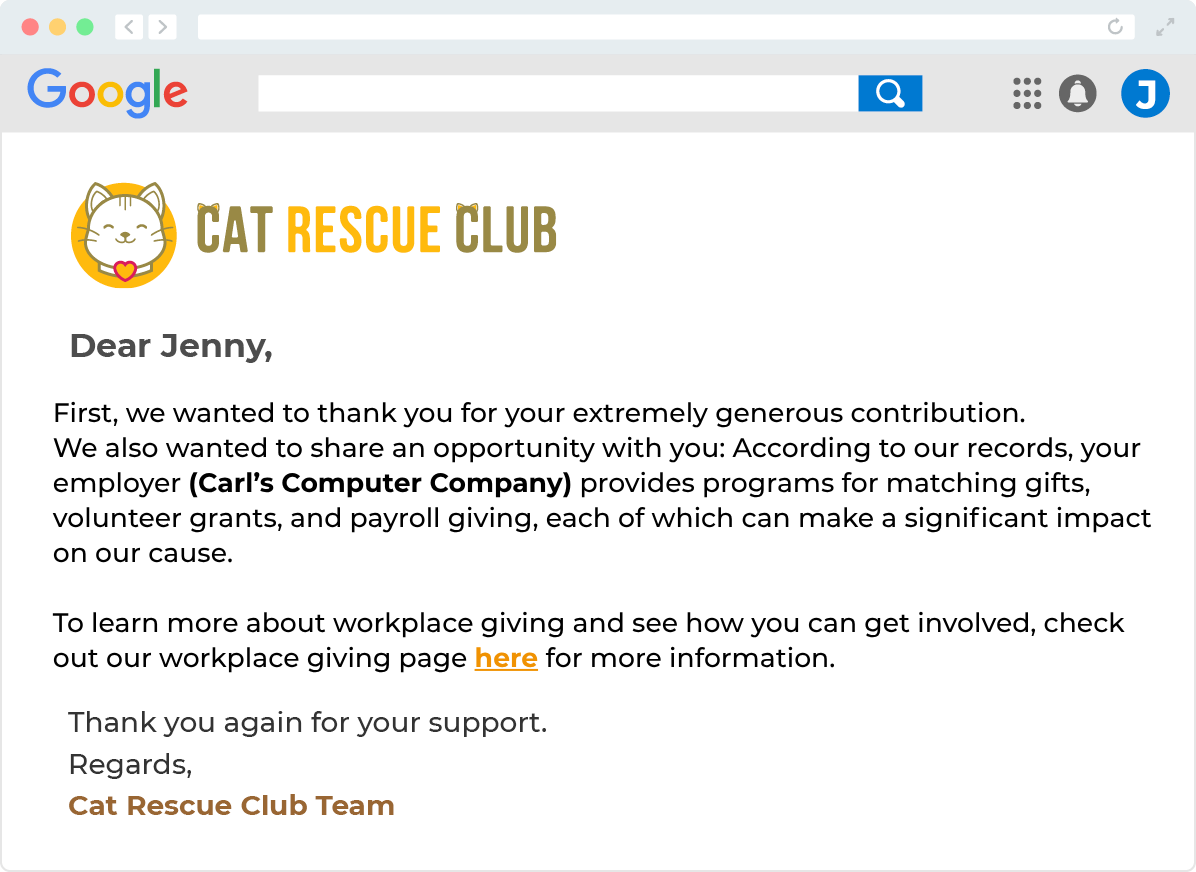

- Use follow-up emails to gather info. After a donation or engagement, send a brief thank-you email with a friendly prompt asking supporters to share where they work so that you can connect them to their company’s matching gift, volunteer grant, or other workplace giving program.

- Integrate employer info into donor conversations. Major gift officers and stewardship staff can ask about employment during one-on-one outreach, especially when building donor profiles. This helps them discover and communicate workplace giving opportunities back to supporters in real time, especially with the help of a corporate database tool like Double the Donation.

Pro Tip: Make it simple for the supporter to find and enter their company name! If you integrate your donation forms and volunteer management system with Double the Donation, supporters can search directly in our database, finding their employer’s information quickly and easily. That means they can be connected to any matches or grant opportunities in mere seconds!

By building employer data collection into your regular donor engagement, you create a more complete, up-to-date picture of your supporters—one that enhances append efforts and increases the accuracy of your workplace giving strategies.

3. Choosing the wrong data appending vendor

Not all employer appending vendors are created equal—and choosing the wrong one can undermine your data strategy. Some nonprofits make the mistake of selecting a vendor based solely on price or convenience without fully understanding what they’re getting in terms of data quality, match rates, compliance, and the ability to act on the information right away.

Why It Matters:

The vendor you choose determines how accurate, complete, and useful your appended employer data will be. A low-cost provider may rely on outdated or limited data sources, resulting in poor match rates or inaccurate employer information. Worse, vendors that don’t follow data privacy regulations can expose your organization to compliance risks.

How to Avoid This Mistake:

- Do your homework. Research the vendor’s data sources, match process, and update frequency. Are they using verified, permission-based data? How often is their database refreshed?

- Ask about match methodology. Some vendors use deterministic matching (precise identifiers), while others rely on probabilistic methods. Knowing the difference helps set realistic expectations about accuracy.

- Check references and reviews. Ask for client testimonials or case studies from similar nonprofits. Learn how other organizations have used the service—and what kind of results they saw.

- Clarify deliverables. Make sure you know what fields you’ll receive (e.g., employer name, title, industry, location, and workplace giving eligibility), how the data will be formatted, and how long the process will take.

- Understand compliance and security standards. Choose a vendor that prioritizes data privacy, follows GDPR/CCPA where applicable, and offers clear terms on how data is handled and stored.

Pro Tip: Ultimately, the right vendor should act as a partner—not just a data provider. By choosing carefully, you ensure that the appended data adds real value to your workplace giving outreach efforts rather than becoming a missed opportunity or an administrative burden.

4. Not using the insights to power workplace giving programs

A surprising number of nonprofits go through the process of appending employer data—only to let those valuable insights sit unused. One of the biggest missed opportunities is failing to leverage employer information to fuel workplace giving programs, such as matching gifts, payroll giving, and corporate volunteer grants.

Why It Matters:

Employer data isn’t just nice to have—with workplace giving opportunities available, it can be a direct revenue driver. Many companies offer donation matching gifts, volunteer grants, and payroll giving programs (along with other forms of charitable support) for employees, but they often go untapped simply because the nonprofit doesn’t know which donors are eligible. If your organization collects employer information but doesn’t connect it to workplace giving outreach, you’re leaving money—and engagement—on the table.

How to Avoid This Mistake:

- Run a workplace giving eligibility check. Use your appended employer data with a tool like Double the Donation to identify which donors work for companies that offer matching gifts, volunteer grants, payroll giving, and more.

- Segment your communications. Create targeted outreach campaigns for donors who work at eligible companies. Tailor the messaging to inform them of the opportunity and guide them through the submission process.

- Update your donation forms, volunteer sign-ups, and thank-you pages. Include prompts like “Does your employer offer matching gifts or volunteer grants?” and an employer search tool so supporters can take action immediately after engaging.

- Incorporate into stewardship efforts. When thanking a donor, include a reminder about their company’s workplace giving program if you have that information on file.

Pro Tip: Workplace giving isn’t just about revenue—it’s also a great way to deepen donor engagement. When supporters see their employer amplifying their impact, it reinforces their commitment to your cause.

5. Not using the insights to strengthen corporate partnerships

While workplace giving is a valuable use of employer data, many nonprofits miss a second, equally powerful opportunity: using employment insights to build or deepen corporate partnerships. After all, appended employer data doesn’t just tell you where your donors work—it can reveal hidden connections to companies that may be strong candidates for in-kind gifts, event sponsorships, volunteer support, or even grants.

Why It Matters:

Your donor base may already include employees—sometimes even executives—at companies that align well with your mission. But without employment data, you won’t know who these individuals are or how to activate those connections. When nonprofits overlook this insight, they miss a chance to cultivate warm leads and grow high-impact corporate relationships rooted in shared values and personal ties.

How to Avoid This Mistake:

- Analyze for concentration. Review your appended data to find clusters of donors working at the same company or within the same industry. These insights can reveal companies with an existing culture of giving or a natural connection to your cause.

- Identify internal champions. Look for donors who may be well-positioned to introduce your organization to their company’s CSR team, philanthropic committee, or leadership. A warm intro often opens more doors than a cold pitch.

- Personalize your corporate outreach. When reaching out to potential partners, mention your existing donor connections and the shared values that link your missions. This helps your proposal stand out and feel more authentic.

- Pursue strategic asks. Use employer data to tailor your request—whether it’s an event sponsorship, an in-kind donation, or a volunteer service day—and show how the partnership would benefit both sides.

Pro Tip: Don’t wait for your corporate partnerships team to initiate this process—equip fundraisers and donor relations staff with employer insights so they can help uncover connections and spark new opportunities across departments.

Wrapping Up & Additional Employer Appends Resources

Employer appending can open new doors for workplace giving, but only if it’s done thoughtfully. By avoiding these five common mistakes, you’ll position your organization to make the most of your data investment.

The key is to treat employer appending not as a quick fix but as a strategic tool within your broader workplace and corporate giving efforts. With the right approach, the insights you gain can fuel smarter campaigns, deeper donor relationships, and, ultimately, greater impact.

Ready to learn more about employer appends for nonprofit fundraising? Check out these additional recommended resources:

- What is Data Appending? Basics, Benefits, and Best Practices. New to data appending? Start here. This beginner-friendly overview explains what data appending is, how it supports fundraising goals, and the key best practices to follow for reliable, ethical results.

- The Ultimate Guide to Employer Appends for Fundraisers. A comprehensive, step-by-step guide that breaks down everything fundraisers need to know about employer appending—from how it works and what data it provides to how to use it to boost matching gifts and corporate outreach.

- 4 Best Ways to Maximize Your Employer Append Records. Already have employer data? Learn how to put it to work. This post examines actionable strategies for leveraging employment insights to enhance segmentation, improve donor engagement, and unlock workplace giving potential.