Corporate Matching Gift Forms | The Ultimate Guide

Most match-eligible donors rely on some kind of matching gift forms to complete their end of the matching gift process. However, these forms (and the steps taken to submit them) can look wildly different from one company to the next.

In order to best simplify and guide employee donors through the submission process, it’s important that you understand the ins and outs of paper, electronic, and e-submission match forms—plus form alternatives.

From the nonprofit side, giving your supporters the tools they need to complete a match request helps maximize the matching gift revenue you ultimately collect.

On the other hand, as a company, considering all available options for submission forms can make a big difference as you work to develop and finetune your matching gift program.

In this guide, we’ll provide everything you need to know about corporate matching gift forms, including:

- What are matching gift submission forms?

- Why matching gift forms matter

- Elements of a corporate matching gift form

- 3 types of matching gift submission forms (and alternatives)

- How a matching gift database fits in

As a main source of corporate philanthropy, matching gifts are not an opportunity you want to miss out on. That’s true regardless of whether you’re looking at it from the nonprofit or the business perspective.

The right matching gift forms—and an understanding of how to use them—can bring your team’s strategy to the next level.

Let’s get started!

What are matching gift submission forms?

Matching gift submission forms are a specific type of documentation used within the corporate matching gift process.

When a company launches a matching gift program, it typically provides employees with access to a blank form (note: while some companies may still offer paper options, these forms are most often made available online and hosted within a corporate matching vendor platform). This document typically incorporates a number of fields that share context into the individual donation, the receiving nonprofit, and the team member submitting the request.

The form is then completed by the donor after making their initial nonprofit contribution as a way to formally request a match from their employer.

Then, the application is submitted to the company through the business’s specified channel. From there, the employer reviews the provided materials, verifies the initial donation, ensures the gift meets the company’s matching criteria, and approves the match.

Why matching gift forms matter

From start to finish, the matching gift process encompasses a few key phases. These include the initial donation, the employee request, the match review, and finally, the corporate gift.

Of these stages, the majority of match-eligible gifts drop off before or during the employee request component. For nearly all companies, the request stage involves the employee donor filling out an online matching gift form. And the ease with which an individual can complete their match form directly correlates to fulfilled matching gift success.

In other words, the best matching gift forms result in more matching gifts.

If that’s not enough of an answer, let’s take a closer look at why corporate matching gift forms matter…

To Donors

From the donor’s perspective, a matching gift form comprises the vast majority of the matching gift experience. Without it, there’s no employer donation ultimately secured, thus inhibiting the amplified giving impact an individual is aiming to make.

Not to mention, the donor is the one who actively completes the form to request a match on behalf of their favorite organization. It makes sense that a positive user experience is a priority for this key stakeholder!

To Nonprofits

An estimated $4 to $7 billion in available matching revenue goes unclaimed each year. That’s funding that could be going to nonprofit causes but is ultimately left on the table by qualifying organizations and their donors.

In fact, most fundraising groups see only a fraction of the matching gift dollars available to them. Since one of the most significant roadblocks facing incomplete matches is the submission process, nonprofits understand that optimized matching gift forms can go a long way toward driving matches to completion.

To Companies

Companies invest time and effort into launching their matching gift programs. It goes without saying that they want employees to partake. After all, heightened staff participation levels result in better overall CSR—and, with it, increased employee engagement, improved company culture, unique cause marketing benefits, elevated brand reputation, and more.

However, complicated request processes can be a significant hindrance to team-wide engagement with the offerings. Thus, companies want to establish easy-to-use corporate match forms that provide positive experiences for their employees.

Elements of a corporate matching gift form

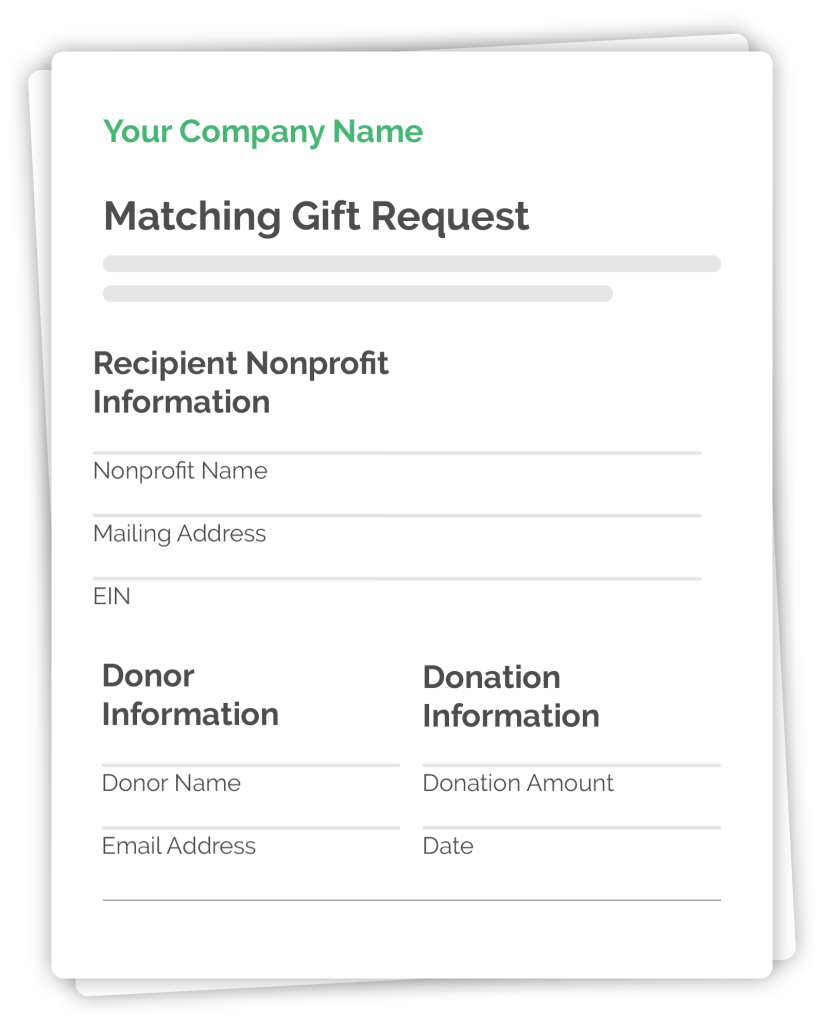

Regardless of the type of form a company utilizes, most matching gift submissions request the same pieces of information. And this information generally falls into three overarching categories:

Donor Information

Companies typically request a number of personal data points relating to the individual employee within the matching gift application. Though it can vary greatly from business to business, this information might include:

- The donor’s name

- Employee identification number

- Corporate email address

- Personal mailing address

- Phone number

Providing these details generally certifies that the donor is who they say they are (i.e., an employee of the company from which they’re requesting a match). Plus, it ensures the employer knows who is requesting the matching gift for their own records and to track participation and donation totals over time.

Nonprofit Information

Most match forms also ask specific questions pertaining to the organization an individual has supported. This might include:

- The recipient organization’s name

- Website URL

- Employer identification (or tax ID) number

- Type of organization (e.g., cultural, educational)

- Phone number

- Mailing address

Information about the nonprofit can help determine that the organization meets the company’s eligibility requirements (i.e., mission type). Not only that, but it also ensures that the person in charge of the corporate matching program has appropriate contact information for the nonprofit group, should they need to get in touch to verify the initial donation.

Donation Information

This final section is typically where the company asks employees to provide details regarding the original donation. Again, this enables the employer to determine whether the initial gift qualifies for a match (falls within the donation threshold, is submitted prior to the submission deadline, etc.).

Commonly required fields include:

- Gift amount

- Transaction date

- Payment currency

- Donation method

Many companies also request proof of the original donation, which nonprofits often provide in the form of tax-deductible gift receipts. And that’s where the individual donor’s side of the matching gift submission typically ends.

However, some employers require the recipient organization to verify the initial contribution themselves. In those cases, a vital step of the matching process falls into the hands of the nonprofit group.

After an employee completes the matching gift request, the nonprofit is typically notified (whether by mail or within a CSR portal) that an employee has requested a match. At this point, the organization must log into the company’s verification system to confirm that the specified employee made a donation to the cause. They may even be asked to provide a letter verifying the organization’s IRS-sanctioned 501(c)(3) status.

3 types of matching gift submission forms (and alternatives)

There are currently three main types of matching gift forms. These include paper, electronic, and Double the Donation’s standard form. However, innovative corporate giving platforms are developing streamlined submission processes that allow donors to bypass the matching gift form altogether.

Each company that offers a matching program is able to establish its own match request process. This includes selecting one or more matching gift forms and/or alternatives to accept.

Let’s take a closer look at each submission type, and the general process asked of donors to complete it.

Paper Matching Gift Forms

When it comes to matching gift forms, paper documents are where it all started. In fact, the first-ever matching gift program was developed before the internet was even invented!

Today, however, most matching gift donors prefer electronic forms; though some companies continue to accept—or even require—traditional paper documentation.

We don’t recommend companies use this type of outdated match form. After all, it’s a lot of extra work for the donor, the nonprofit, and the company itself. Still, it’s important to understand the process should you run into a situation involving paper submission forms in any case.

And here’s how it typically works. Employees at corporations with paper match forms go through the following steps to submit their match requests:

Match Eligibility Identification

The first step involved in any matching gift process is determining match program eligibility. And there can be quite a few factors at play here, including whether the company matches employee gifts at all, whether the employee in question qualifies for matching, whether the donation amount and recipient organization meet the company’s standards, and more.

This information can be uncovered in a few ways, from the company itself to a third-party tool such as Double the Donation.

Request Form Location

The next phase of the process involves locating the appropriate matching gift form. And unfortunately, this can be a bit trickier with paper forms compared to other types of matching gift submissions.

Double the Donation or the employer may provide access to printable versions of the forms online, or they may be requested in person from the HR department or company leadership.

Paper Matching Gift Form Submission

Once the match request forms have been accessed, donors are prompted to complete and submit the document via the channel established by the company. Some employers may accept the forms in person (again, likely to the HR office or manager), while others may require match forms to be submitted via mail to a provided address. Others yet can offer some sort of fillable PDF option, which may be completed and submitted online.

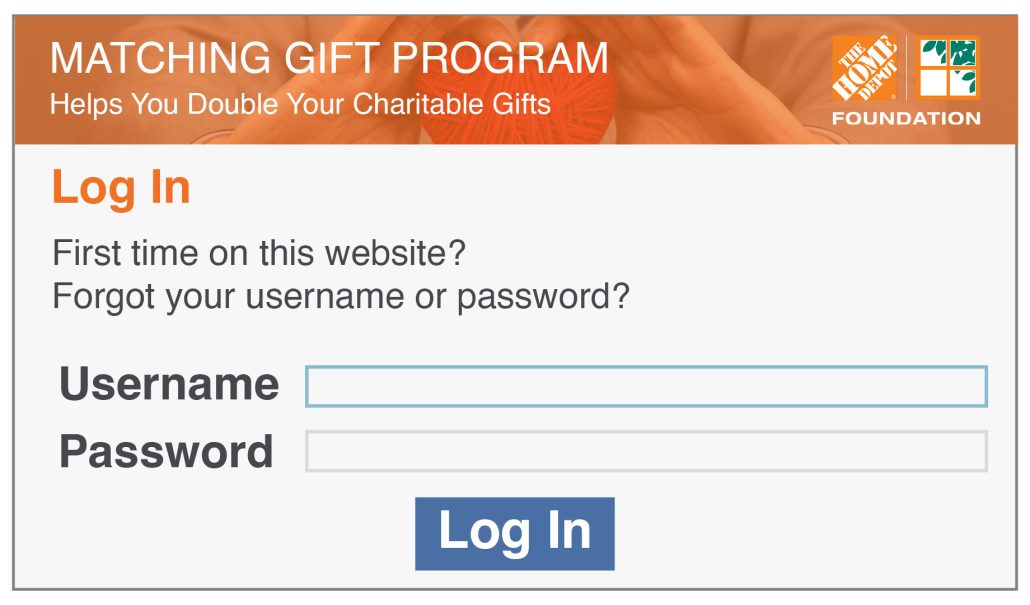

Electronic Matching Gift Forms

Technology is rapidly progressing, so it makes sense that many companies have transitioned to electronic forms. Doing so not only reduces programming costs and administrative lift but also simplifies participation for employees.

Electronic forms give donors a bit more freedom regarding when, where, and how easily they complete their requests.

Here’s what the process typically looks like:

Employee Sign-In / Registration

To access and complete electronic matching gift forms, employees usually have to log into the company’s CSR platform. This step typically involves creating or signing in with a username and password for the site.

In order to locate the login page, individuals may be directed from their company’s HR department or manager, or they might receive a link through the nonprofit to which they contributed—specifically if the organization uses Double the Donation’s tools.

Match Request Submission

Once in, the employee is prompted to complete the actual request process.

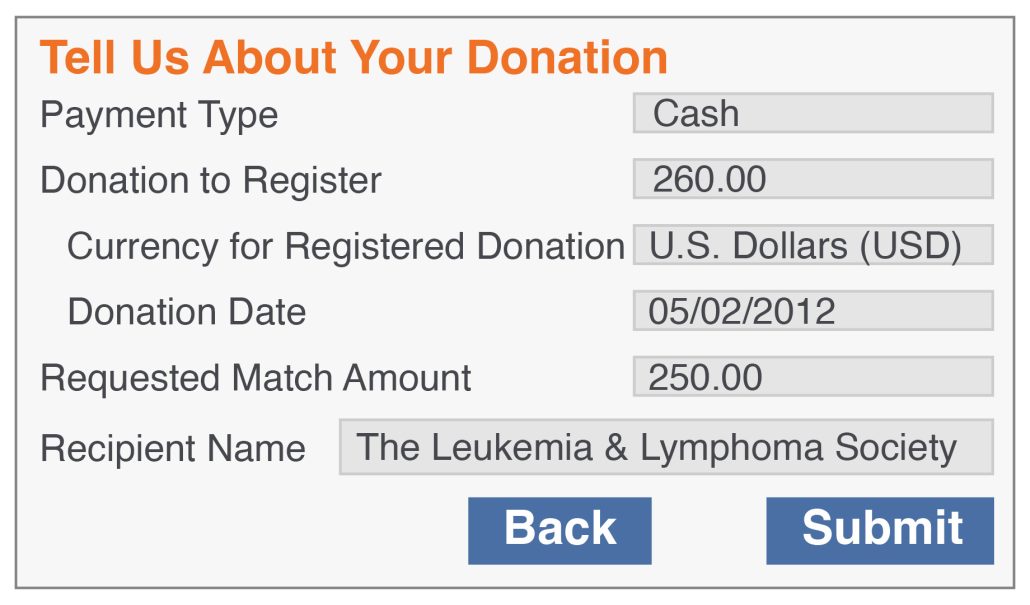

Like paper forms, individuals are asked to register their match requests by providing key data points. Though the exact process can vary based on the CSR portal a company uses, donors generally begin by searching for (or adding) the nonprofit they’ve supported from the portal’s list of verified causes.

From there, individuals typically provide a number of data points pertaining to their recent gifts—such as payment type, domain amount, currency, transaction date, and more.

Double the Donation’s Standard Matching Gift Form

Somewhere between a paper matching gift request and a complete online submission portal is Double the Donation’s intuitive standard match form.

Companies can easily opt into accepting this online form, which then enables streamlined automated electronic submissions for their employees. With this offering, donors can more easily complete their matching gift requests, thus increasing program usage and impact overall.

Double the Donation aims to make matching gifts as simple as possible, and the standard form was designed for just that purpose.

Here’s what the process looks like for eligible donors submitting the standard matching gift form:

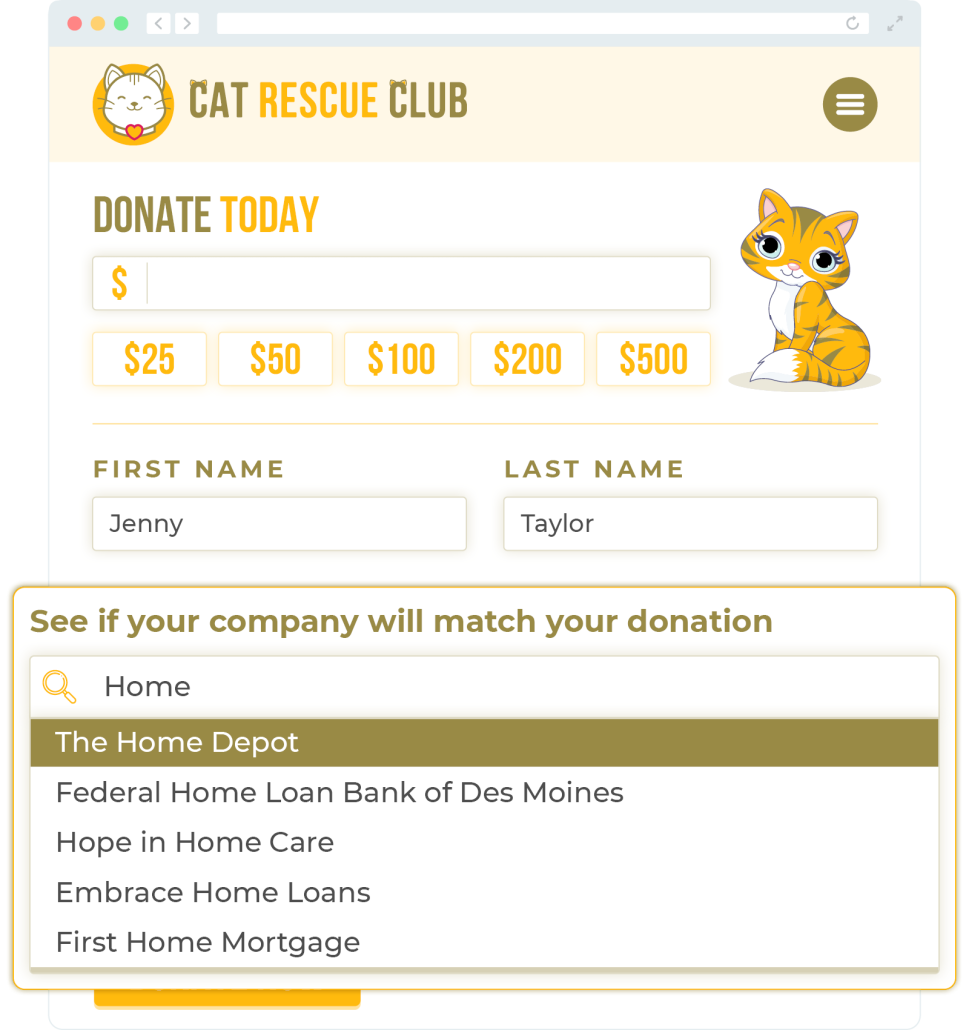

Employer Selection

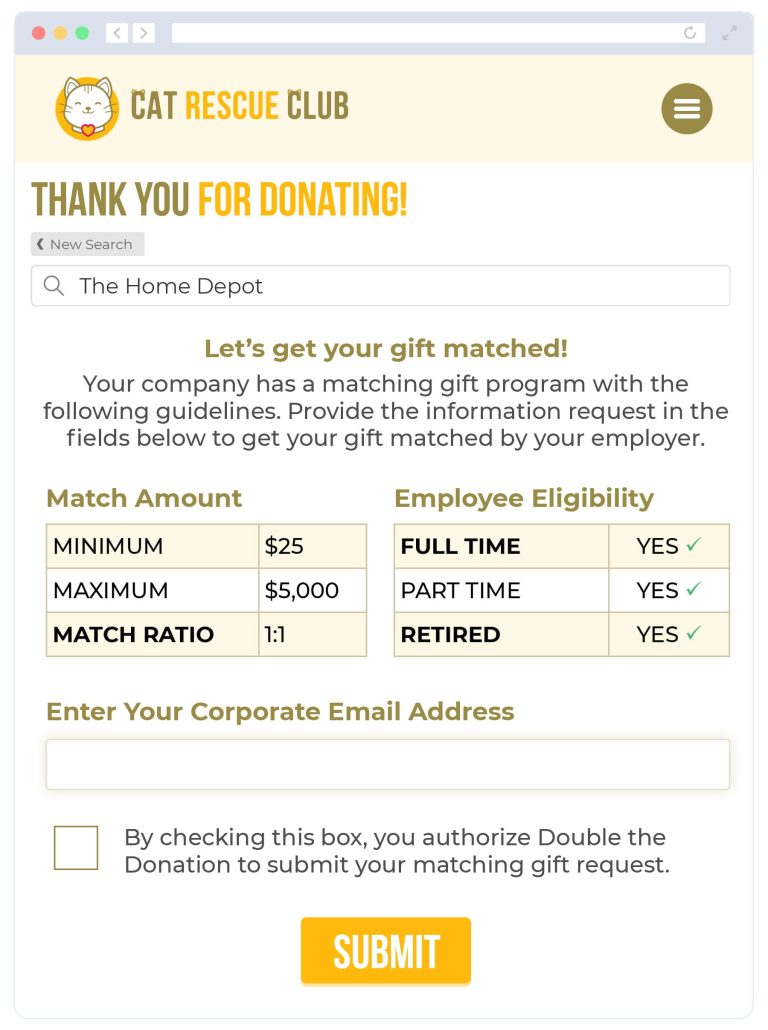

As donors give to nonprofits that use Double the Donation’s matching gift software, they’re prompted to enter their employing company in an auto-completing search tool embedded in the donation form. This is done to uncover match eligibility and determine whether the company accepts the standard matching gift form.

Identity Verification and Authorization

If so, the donor is provided with an opportunity to submit their match automatically, directly from the organization’s gift confirmation screen. Typically, all they are required to do here is verify their identity by providing a corporate email address and check a box that authorizes Double the Donation to submit the match request on their behalf.

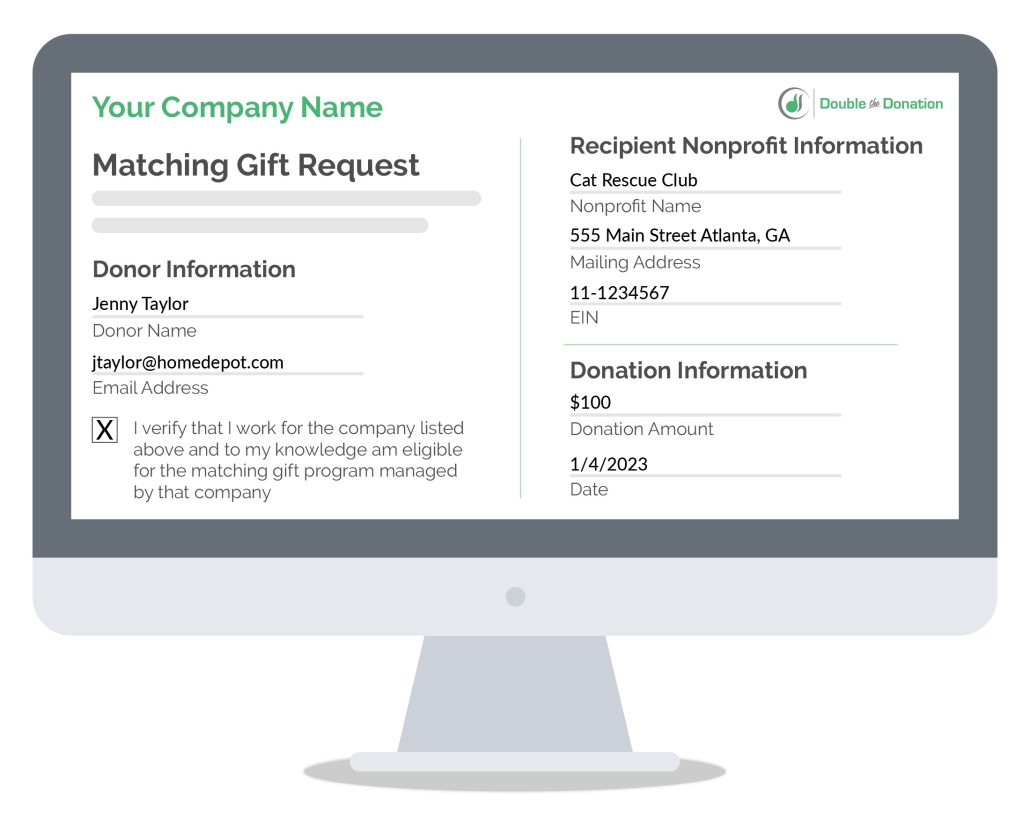

Behind-the-Scenes Submission

Once authorized, Double the Donation pulls necessary information from the donation process itself and automatically fills in the blanks on the premade standard matching gift form. Upon completion, the form is sent as a PDF document to the matching gift coordinator designated by the company to review and approve as usual.

Matching Gift Form Alternative — Auto-Submission

Online match portals that facilitate electronic request forms have long been working to streamline and improve the match submission process. And Double the Donation shares the same goal.

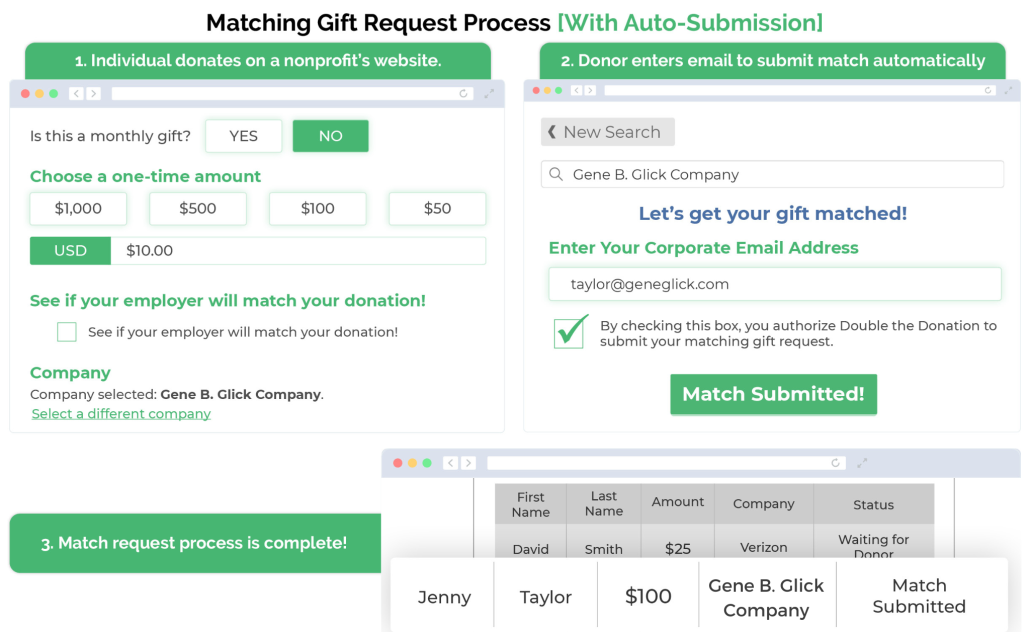

Now, Double the Donation is partnering with select CSR software providers to do exactly that. By providing an innovative matching gift form alternative, auto-submission allows qualifying donors to submit match requests without a matching gift form at all.

Auto-submission was recently moved out of beta and is now growing its integrated network with CSR solutions.

All they’re typically asked to do is enter their corporate email address on the gift confirmation screen and authorize Double the Donation to submit a match on their behalf. From there, the integrated software ecosystem collects necessary data points and funnels the information directly to the employer’s corporate giving platform behind the scenes.

Then, the company reviews and approves the match within the software system as usual.

This revolutionary new function benefits donors (with streamlined submission processes and fewer roadblocks), nonprofits (with increased match revenue), and companies (elevated program participation) alike. It’s a win-win-win!

And as more companies and CSR providers begin rolling out the feature in partnership with Double the Donation, an ever-growing number of nonprofit supporters will be able to leverage the matching gift form alternative.

Learn more about matching gift auto-submission here.

How a matching gift database fits in

Double the Donation has compiled the industry’s most in-depth source of matching gift information. Our comprehensive database provides access to details regarding more than 24,000 companies’ (equating to approximately 99.68% of all match-eligible donors) program guidelines and request processes.

By sharing a summary of each company’s matching gift program, we aim to make it increasingly easy for donors to complete their matches on behalf of the organizations they support.

When donors search for their employers using the associated database search tool, they’ll instantly receive any available guidelines for their employers’ programs. If available (which, over 91% of companies’ forms are), a direct link to online match forms and other related documents will be given to them, too!

Here’s an example of what you might see when searching for an employer with Double the Donation’s matching gift database search tool:

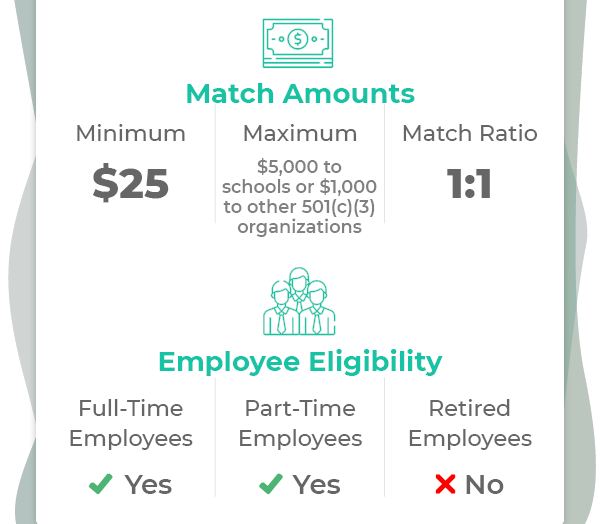

Donors will also be provided with other relevant information, such as:

- The company’s match ratio;

- Minimum and maximum match amounts;

- Eligible employee groups (full-time, part-time, retired, spouses, etc.);

- Qualifying nonprofit mission types;

- Match request processes and forms (online or offline);

- Submission deadlines;

- Other available programs (i.e., volunteer grants).

A corporate database can provide powerful insights into thousands of companies’ matching gift programs and next steps. That can go a long way toward maximizing program participation for donors by simplifying the processes involved.

Nonprofits interested in benefiting from our innovative matching gift database and automation software can do so by requesting a demo here.

As for companies, make sure your giving program is included in our comprehensive database of corporate match information. This enables employees to have quick and easy access to program guidelines and forms from their favorite organizations’ giving pages! Click here to add your company to Double the Donation’s matching gift database.

Wrapping Up

Matching gift forms play a crucial role in the overall matching gift process—not to mention strategic corporate match fundraising.

At this point, your team should know all about the different types and components of corporate matching gift forms, the value for nonprofits, companies, and donors, and more. Now, it’s time to get out there and start maximizing your matching gift revenue!

Interested in learning more about matching gift best practices? Check out these additional recommended resources:

- Matching Gift Process: A Complete Step-by-Step Overview. Corporate matching gift forms essentially kick off the match request experience. Walk through the entire process in this detailed guide to see each step in action.

- 8 Ways to Encourage Donors to Submit Matching Gift Requests. Providing easy access to donors’ matching forms can go a long way toward driving requests to completion. Check out several other practices for doing so!

- Matching Gift Guidelines | Ratios, Minimums, Maximums & More. Before completing a matching gift form, you’ll need to understand the company’s match eligibility guidelines. Discover common criteria and how to locate it here.

Take matching a step further with auto-submission functionality.