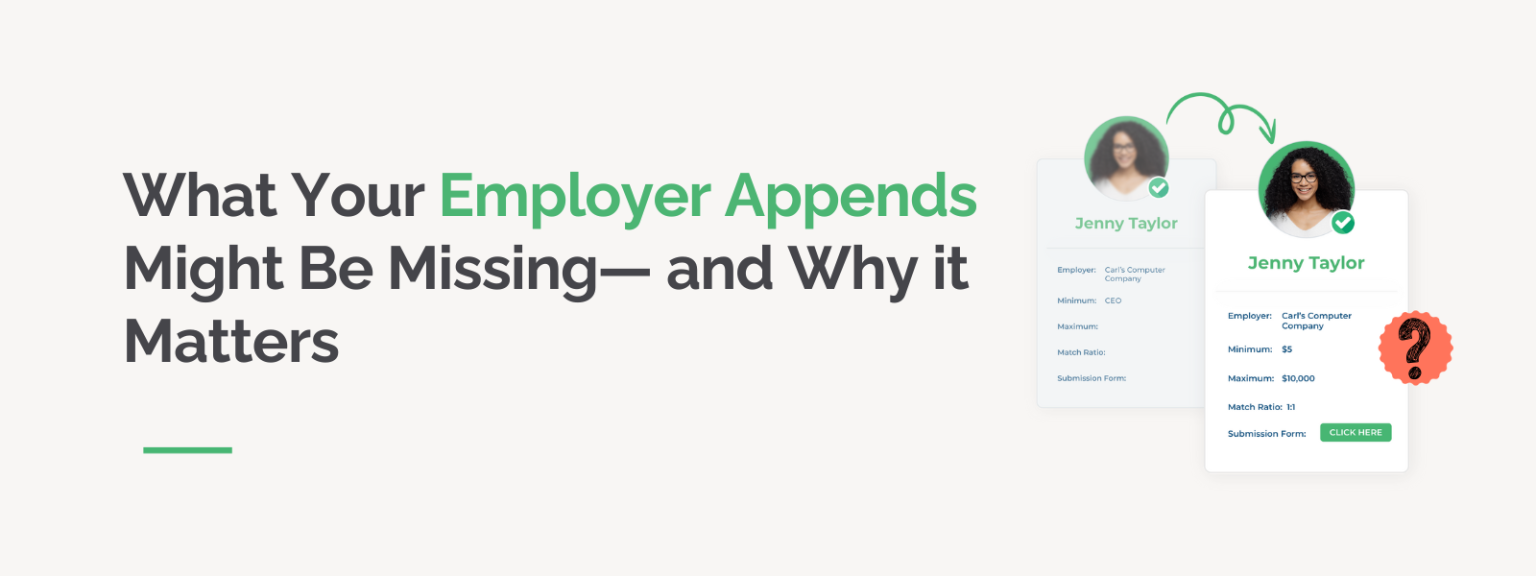

What Your Employer Appends Might Be Missing—and Why it Matters

When it comes to nonprofit fundraising, data is power—especially when that data tells you where your donors work. That’s why many organizations invest in employer appends to fill in the blanks.

But what if the data you’re relying on isn’t telling the whole story? While many employer appends can identify where someone works, they often stop short of revealing the most critical insights, leaving nonprofits with partial information and missed opportunities.

In a fundraising environment where every dollar counts, understanding what’s not included in your employer appends could be just as important as what is. That’s why we’re covering what your employer appends might be missing—and why it matters—in this blog. We’ll explore:

- What are employer appends?

- What your employer appends might be missing

- Why corporate giving matters in employer appends

- How Double the Donation fills in the gaps

Here’s a hint: When your employer data lacks insight into workplace giving eligibility—like matching gifts or payroll giving programs—you could be overlooking powerful opportunities to boost revenue and deepen donor engagement.

The good news? With the right data strategy, those hidden opportunities don’t have to stay hidden. Let’s take a closer look.

What are employer appends?

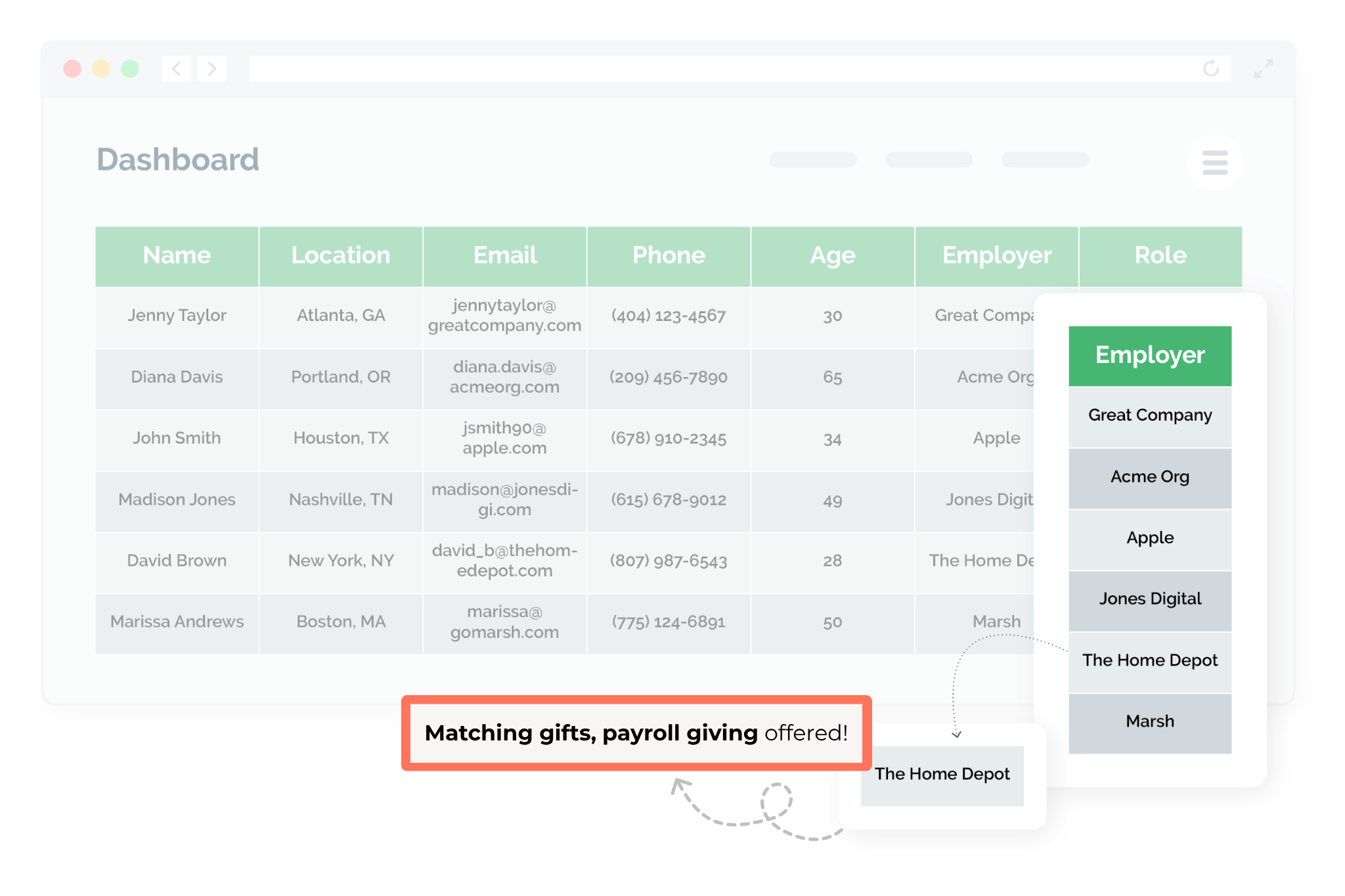

Employer appends are the process of enhancing your nonprofit or school’s donor database by adding missing employment information. In other words, identifying the companies where your donors work. This is typically done by matching existing donor records (such as names, emails, mailing addresses, or phone numbers) against external data sources that contain employment details.

The goal of an employer append is to fill in the blanks in your donor data . The process typically involves:

- Submitting donor data – You provide a file with donor contact information.

- Matching records – The data is compared against large databases of consumer or professional information to find potential employer matches.

- Appending employer details – Where a reliable match is found, the donor record is updated to include their current employer.

- Returning enriched data – The updated file is delivered back to your team for use in segmentation, outreach, or analysis.

While the output may simply look like a new column in your spreadsheet, that added employer information can become a foundational piece of your donor profile. Keep in mind, though, that the accuracy, freshness, and source of the appended data can vary depending on the provider, which is why understanding the append process is key to making informed decisions about your strategy.

What your employer appends might be missing

While employer appends can tell you where a donor works, they often fall short of revealing what really matters: the invaluable opportunities tied to that employment info. If your current or prospective data append service only provides company names without any insight into workplace giving or corporate philanthropy programs or the ability to connect supporters directly to those programs with minimal operational lift from your team, you may be overlooking powerful ways to deepen engagement and increase revenue.

Let’s break down the key gaps:

Workplace giving eligibility

Most standard employer appends don’t include details about a donor’s eligibility for workplace giving programs. These are critical elements that can transform a single gift into a recurring or matched donation—but they’re often missing entirely from basic data append services.

Here are some common programs that can help boost your fundraising revenue:

- Matching Gift Programs: Thousands of employers offer corporate matching gift programs where they double or even triple donations their staff make to qualifying nonprofits. However, these programs often slip through the cracks due to a lack of donor awareness—and eligibility is not something typically covered by your standard append service.

- Volunteer Incentives (Volunteer Grants and Paid Volunteer Time Off): Some companies reward employees for their volunteer hours with monetary grants or paid time off work. However, employer appends rarely flag whether a supporter’s company offers such a program, or how the individual can take advantage of it.

- Payroll Giving Programs: Payroll giving is one of the simplest ways for donors to give consistently, yet it’s vastly underutilized. Traditional employer appends typically don’t identify whether a donor’s company has a payroll giving platform or how they can opt in, leaving both the donor and nonprofit in the dark.

Without this added layer of information, you might know where a donor works, but not how they can support your mission through their workplace. And knowledge is the first step to maximizing the programs’ impact! Not to mention, many companies offer multiple types of giving programs, meaning that without insight, you may be missing out on numerous revenue and engagement opportunities.

Corporate sponsorship opportunities

Another major blind spot with employer appends is the lack of visibility into a company’s corporate giving potential. While these appends may tell you where your donors work, they typically don’t reveal whether those employers have existing programs—like matching gifts, sponsorships, or grants—that support nonprofits their employees care about. That’s a missed opportunity, because many companies actively look to fund and partner with organizations their workforce is already supporting. Without this layer of insight, nonprofits risk leaving valuable corporate funding on the table.

Some of the opportunities that basic employer data typically misses include:

- Corporate Grants (with Open Applications): Many companies use their corporate social responsibility (CSR) budgets to facilitate nonprofit grantmaking—including dedicated programs with open applications. Still, unless your data highlights which employers offer them, your organization could miss out entirely.

- In-Kind Giving Programs: Some companies offer product or service donations in addition to or instead of cash support. These can be incredibly valuable, and may even offer an opportunity for employees to advocate for your cause, but standard employer appends rarely include this type of insight.

In short, many employer appends only scratch the surface. To truly unlock the potential behind donor employment data, nonprofits need more than just company names—they need actionable insights into the giving programs, incentives, and grant opportunities that come with each employer. Without it, you’re only seeing part of the picture.

Why corporate giving matters in employer appends

At first glance, employer appends may seem like just another piece of demographic data—useful for segmentation, but not much more. In reality, when enriched with corporate giving insights, employment information becomes one of the most powerful assets in your fundraising toolkit.

Here’s why corporate giving matters in the context of employer appends:

It Transforms Static Data into Actionable Insights

Knowing a donor works at “ABC Corporation” is useful. Knowing that ABC Corporation offers a 2:1 matching gift program with an annual cap of $10,000—and that your donor is eligible to participate—is a game-changer. When employment data is connected to corporate giving details, it empowers your organization to move from passive information to an active fundraising strategy.

It Reveals Untapped Revenue Opportunities

Billions of dollars in corporate giving go unclaimed each year, largely because donors and nonprofits simply don’t know these programs exist. When employer appends include corporate philanthropy details—like matching gifts, volunteer incentives, or payroll giving options—you gain a direct path to unlocking those funds.

It Enables Personalized, Impactful Donor Outreach

Imagine reaching out to a donor not just with a thank-you, but with tailored next steps: “Thanks for your gift—did you know your employer, XYZ, will double it?” or “As a volunteer and employee at [Company], you may be eligible for a grant to support the time you give.”

Personalized outreach built on meaningful employer data increases engagement, trust, and long-term value. And it’s much more impactful than a generic, catch-all version of the same message! Plus, with a solution like Double the Donation, the touchpoints can be automated with ease, connecting supporters directly to those next steps.

It Strengthens Relationships with Companies, Too

Employer data with corporate giving context can help your organization identify clusters of donors working at the same company, uncover advocates, and open the door to deeper relationships with corporate partners. Whether it’s through matching gifts, employee-nominated grants, or broader sponsorships, these insights help you build partnerships based on real data—not guesswork.

How Double the Donation fills in the gaps

Most employer appends stop at supplying a company name, but Double the Donation goes the extra mile. We help get you donor data in a way that doesn’t just tell you where your donors work; it tells you what that employer can do to support your mission and empowers you to connect supporters to those next steps.

At the heart of this enhanced approach is our industry-leading corporate giving database, which powers the employer data we can supply. When you work with Double the Donation, you gain access to a wealth of insights that most data providers simply don’t include.

Here’s how we fill in the critical gaps:

1. Workplace Giving Eligibility, Right in Your Appends

Unlike traditional appends that stop at a name match, our offering then gives you insight into:

- Matching gift program availability and guidelines, including match ratios, minimum/maximum limits, and eligibility rules, along with submission links

- Volunteer incentive program details, highlighting programs that reward employee volunteer hours with donations to nonprofits or paid time off work

- Payroll giving options, identifying whether a donor’s employer offers direct paycheck contributions to nonprofits, and instructions on how to enroll

This information isn’t general—it’s mapped directly to the employer and backed by real-time updates from our proprietary database. That means when you append donor records with Double the Donation, you get not just where someone works but can then determine whether that employer offers programs that increase giving potential—and how to take action.

2. Visibility Into Open Corporate Giving Opportunities

Our database also includes valuable insights into corporate sponsorships, grants, and in-kind donation programs—especially those with open applications or employee-directed giving components. When you combine our append services with our database insights, you can discover:

- Which companies have active grant programs or donation funds

- Whether those programs accept nonprofit applications (generally with links!)

- How employees can advocate for your organization from within

By layering this intelligence onto employer data, you can identify donors who aren’t just supporters but potential gateways to corporate funding. This opens up new opportunities to pursue business partnerships strategically and based on facts.

3. Actionable, Automated, and Integrated

All this data becomes even more powerful when paired with Double the Donation’s complete workplace giving automation platform. When you use employer data with our automation tools, you can:

- Prompt donors with personalized matching gift instructions

- Surface relevant payroll giving and volunteer opportunities to encourage deeper involvement

- Identify clusters of donors from the same company for targeted outreach

- Track corporate giving revenue through a centralized dashboard

It’s a streamlined, end-to-end solution designed to maximize the impact of every employer connection in your database.

In short, Double the Donation transforms employer appends from basic data enhancement into a strategic fundraising advantage. With workplace giving eligibility and corporate sponsorship insights built-in, you’ll not only know who your donors work for—you’ll know how to turn that information into action.

Wrapping up & additional employer appends resources

At first glance, your employer append data might look complete. However, if it doesn’t reveal which donors are eligible for corporate giving programs, you’re only seeing part of the picture.

Without visibility into workplace giving opportunities like matching gifts or payroll giving, you may be missing the very insights that turn one-time gifts into multiplied impact.

The good news? There’s a better way to use employment data—one that not only tells you where your donors work but what giving opportunities come with it. When your data connects directly to corporate philanthropy programs, you unlock smarter fundraising, stronger donor relationships, and more dollars raised. It’s time to expect more from your employer appends and make sure nothing valuable is left out.

Ready to learn more about employer appends and data enhancement practices? Check out these additional recommended resources:

- What is a Data Append, and Why Does it Matter for Nonprofits? Learn the basics of data appending, how it works, and why it’s essential for enriching your donor database and improving outreach strategies.

- The Ultimate Guide to Employer Appends for Fundraisers. A deep dive into employer appends—what they are, how they’re used, and how to ensure you’re getting the most value from your employment data.

- Data Management for Nonprofits: Overcoming Common Challenges. Explore key data management pitfalls nonprofits face and discover practical solutions for keeping your records accurate, actionable, and campaign-ready.