5 Proven Ways to Increase Payroll Donations at Your Nonprofit

For organizations seeking consistent and reliable funding, payroll donations represent a powerful yet often underutilized resource. These employee-led giving programs enable donors to contribute small amounts from each paycheck, amounts that accumulate to provide significant support over time.

However, many nonprofits struggle to fully tap into this opportunity. Whether it’s due to a lack of awareness, poor promotion, or an overly complex process, potential contributions often go unrealized.

Looking to change that? In this post, we’ll explore five proven strategies to increase payroll giving at your nonprofit:

- Registering your organization with payroll giving platforms.

- Creating a dedicated payroll giving page on your website.

- Driving awareness with social media.

- Combining payroll donations with matching gifts.

- Recognizing and thanking your payroll giving donors.

From building a solid foundation to making giving as easy and engaging as possible, these tips will help you unlock a sustainable stream of donor support, all while deepening relationships with your existing community. And if you’re looking for a deeper dive into all things payroll giving-related, our free download, The Ultimate Guide to Payroll Giving, can help.

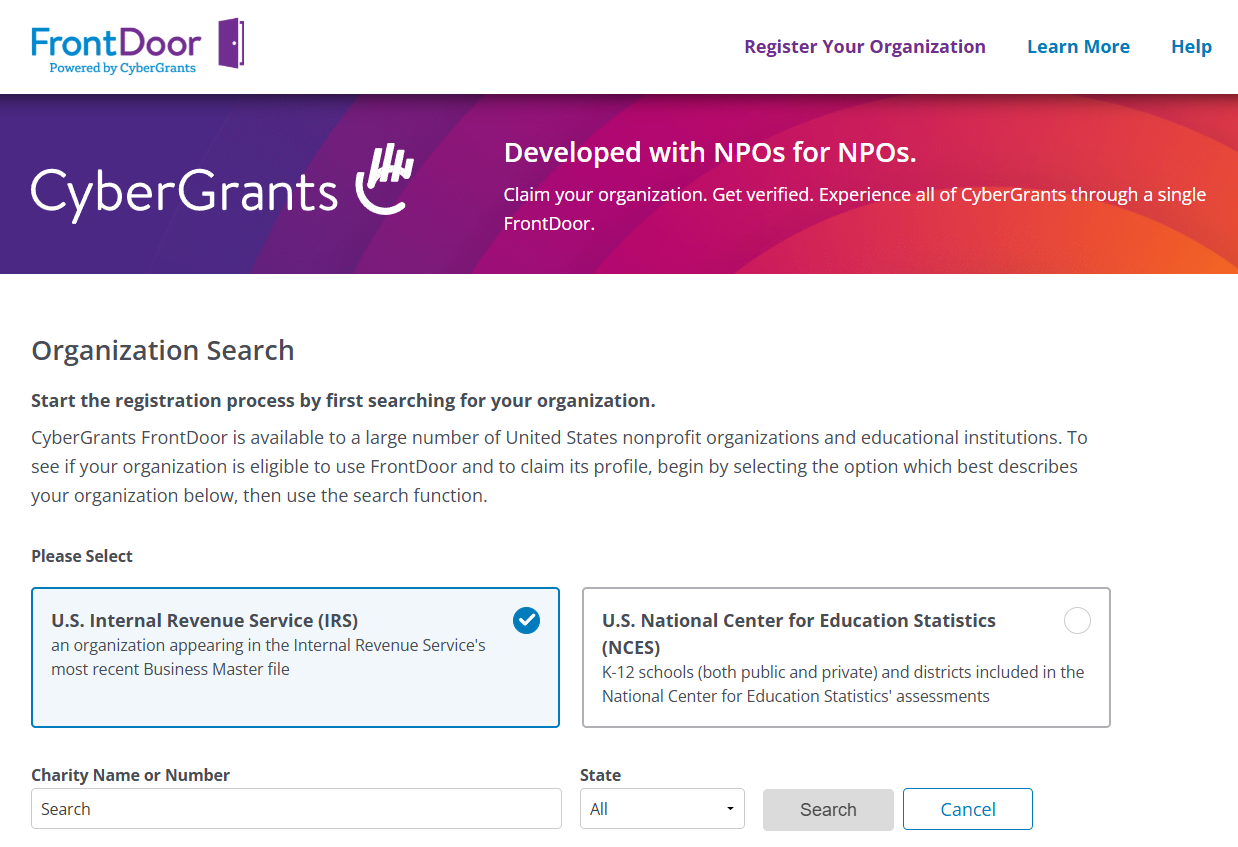

1. Register your organization with payroll giving platforms.

Before you can encourage supporters to donate through payroll giving, your nonprofit must be accessible through the platforms that facilitate these contributions. Many companies rely on workplace giving platforms (like Benevity, YourCause, Bright Funds, or America’s Charities) to manage and distribute employee donations. If your organization isn’t registered, you’re essentially invisible to potential donors using these tools.

The solution? Start by identifying and registering with the most commonly used platforms in your region or among your donors’ employers. Be prepared to submit essential information, including your Employer Identification Number (EIN), a description of your mission, and bank details for direct deposit.

Once your nonprofit is listed, take the time to optimize your profile. Include compelling descriptions, up-to-date branding, and high-quality images if the platform allows. The more professional and engaging your presence, the more likely employees are to choose your organization when setting up their payroll donations.

Key Tip: Keep a record of where you’re registered, and revisit these platforms regularly to update information or respond to donor inquiries. A complete and current profile can make a significant difference in securing recurring support.

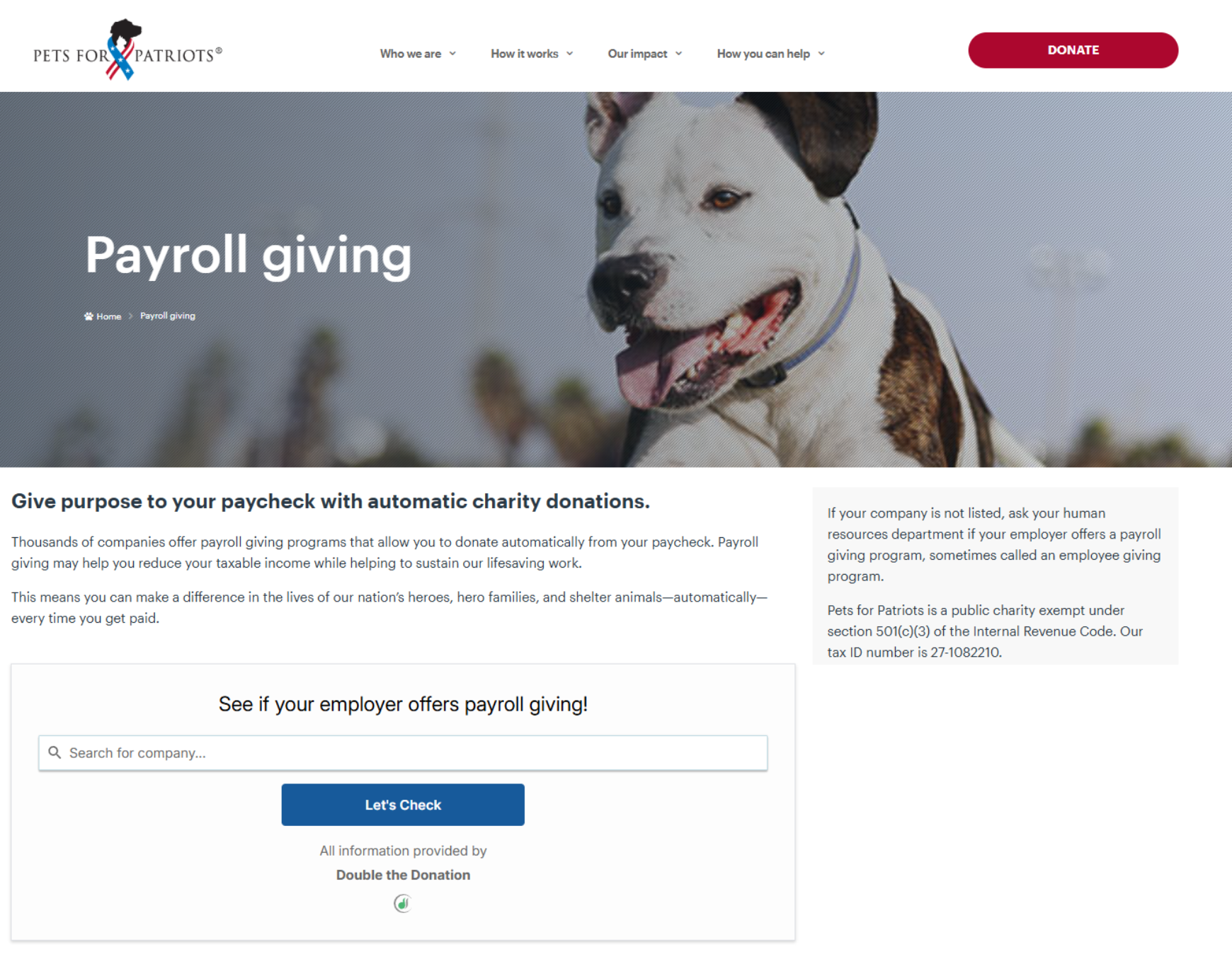

2. Create a dedicated payroll giving page on your website.

Once your nonprofit is set up on payroll giving platforms, the next step is making it easy for your supporters to take action, and that starts with your website. A dedicated payroll giving page serves as a central hub where visitors can learn about payroll giving, its importance, and how to get started.

Think of this page as both an educational and conversion tool. Use simple, accessible language and highlight the convenience of giving straight from their paycheck; no invoices, no reminders, just automated generosity.

As Julia from Double the Donation adds, “The dedicated payroll giving page is your most crucial piece of marketing collateral for this channel. It must serve two purposes: educate the donor on the financial benefit of pre-tax giving, and most importantly, reduce friction. By including a clear, step-by-step enrollment guide and linking directly to third-party platforms, you ensure that enthusiasm converts directly into action.”

As you build this page, here are a few things you might want to include:

- What payroll giving is and how it works

- The benefits to donors (e.g., tax-deductible, low effort, long-term impact)

- Step-by-step instructions on how to enroll in a program

- A list of companies that offer payroll giving, if you know where your donors work

- An embedded payroll giving search tool, allowing donors to determine their eligibility in real time

- A contact form or email for additional questions

- Real stories or testimonials from current payroll donors, if available

Check out this example Payroll Giving page from Pets for Patriots to see these practices in action:

Bonus Tip: Optimize the page for search engines by including relevant keywords such as “payroll giving,” “workplace donations,” or “employee giving programs.” Also, link to it from your main donation page and include it in your email footers and donor communications to increase visibility across your network.

By creating a clear and informative payroll giving page, you’re reducing friction for your donors and helping them say “yes” to ongoing support with confidence.

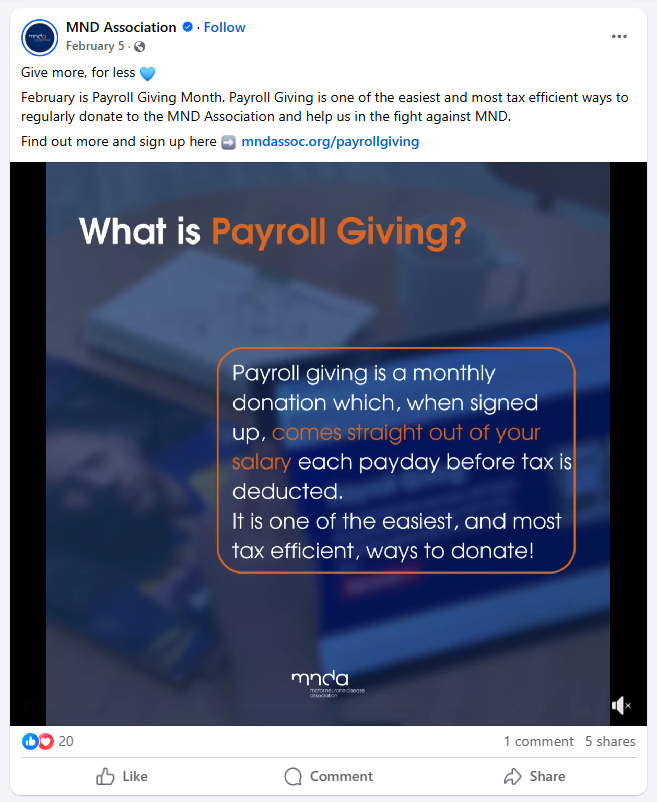

3. Drive awareness with social media.

Even if your nonprofit is registered with payroll giving platforms and has a great web page explaining the process, none of that matters if your supporters don’t know payroll giving exists. That’s where social media comes in.

Social media is one of the most effective tools for building awareness and driving engagement around payroll giving. With the right content, you can reach donors where they already spend time and inspire them to take action, especially if you make the message relatable, clear, and easy to share.

Here’s how to make the most of your social platforms to increase payroll donations:

- Educate your audience by explaining what payroll giving is and how it helps. Use short, digestible posts with branded graphics or quick videos.

- Highlight real impact. Share stories, statistics, or milestones that show how payroll donations are making a difference.

- Create reminders. Time your posts around key giving moments (like year-end, Giving Tuesday, or open enrollment periods at major employers).

- Use clear calls to action. Every post should direct users to your dedicated payroll giving page or inform them of the steps to get started through their employer.

For the best results, don’t forget to utilize platform-specific features, such as Instagram Stories, LinkedIn posts (especially useful for workplace-related topics), and Facebook Events or Live Q&As, to answer questions and engage your community in real time.

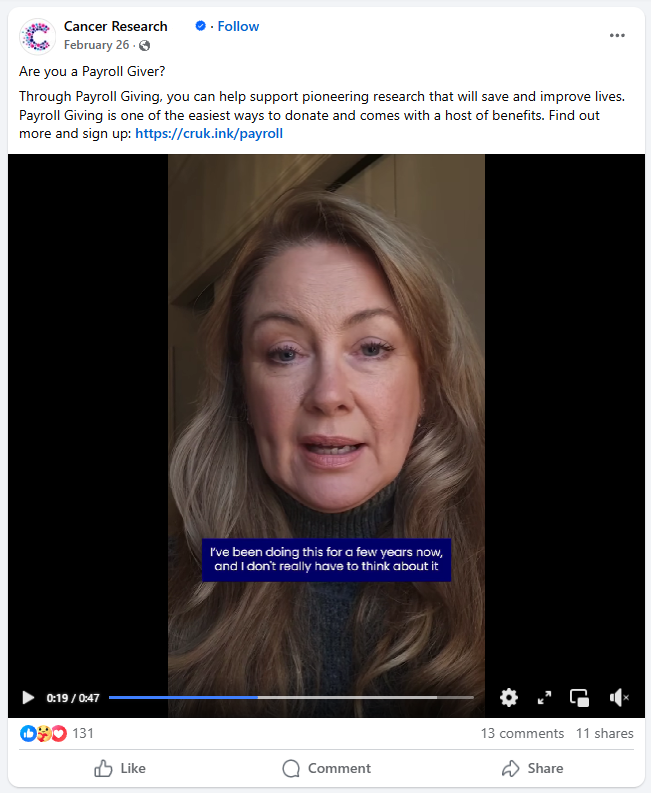

This sample Facebook post from the MND Association demonstrates how one organization can do so:

Pro Tip: Tag companies with payroll giving programs and encourage your supporters to share how they give through work. Peer advocacy can be one of the most persuasive motivators for new donors to join in.

By consistently discussing payroll giving on social media, you’re keeping the opportunity visible, relevant, and easy to act on: three essentials for cultivating long-term support.

4. Combine payroll donations with matching gifts.

One of the most effective ways to maximize the impact of payroll donations is by pairing them with matching gift opportunities. After all, many employers who offer payroll giving programs also provide donation matching, doubling (or even tripling) the contributions their employees make. Yet, these matching gifts often go unclaimed simply because donors don’t realize they exist or don’t know how to apply.

By actively promoting the combination of payroll giving and employer matching, your nonprofit can unlock significantly more funding with minimal additional effort from donors.

Here’s how to make this strategy work:

- Educate your supporters about matching gifts and how they can maximize the impact of their payroll donations. Emphasize that it’s a simple way to increase their impact without giving more.

- Provide clear instructions on how to check if their employer offers a matching program. Link to matching gift search tools directly from your payroll giving page.

- Coordinate your messaging. When promoting payroll giving (on your website, in emails, or on social media), mention matching gifts as a bonus benefit.

- Track and follow up. Flag payroll donors who work for companies with known matching programs. Then, follow up with a reminder or guide to help them submit their match request.

See how the GBS/CIDP Foundation aligns the two opportunities on their website here:

Pro Tip: Partner with a matching gift platform (like Double the Donation) to automate the match process where possible. Streamlining this experience reduces friction and increases the likelihood that donors will complete the additional step.

When payroll donations and matching gifts work together, the result is a steady, scalable stream of funding that can grow exponentially. It’s a win-win for your donors and your mission.

5. Recognize and thank your payroll giving donors.

Payroll giving donors are some of your most loyal and consistent supporters. They’ve committed to helping your organization month after month, often quietly and without much fanfare. That’s exactly why it’s so important to recognize their generosity and make them feel appreciated.

As Julia from Double the Donation explains, “Due to the passive nature of payroll giving, these donors can easily become invisible in your data. It is imperative to set up a specific communication segment to recognize their loyalty. A personalized thank-you, especially a note acknowledging their one-year or two-year anniversary of recurring support, reinforces their commitment and ensures they feel valued long after the initial sign-up.”

Consistent gratitude builds stronger relationships and encourages long-term giving. When payroll giving donors feel seen and valued, they’re more likely to continue, and even increase, their support. A thoughtful thank-you also reinforces the impact of their gift and fosters a deeper connection between them and your mission.

Here are some effective ways to appreciate payroll donors:

- Send personalized thank-you messages. Whether it’s a handwritten note, email, or quick video message, a personal touch goes a long way.

- Create a special donor segment. Acknowledge payroll donors in your annual report, on your website, or through exclusive updates or newsletters.

- Celebrate milestones. Recognize donor anniversaries (e.g., one year of giving via payroll) or share when their cumulative impact hits a certain level.

- Offer small tokens of appreciation. This could be branded swag, behind-the-scenes updates, or invitations to exclusive events.

- Highlight stories. With their permission, feature payroll donors in social posts or email spotlights. This not only honors them but also inspires others to join in.

Take a look at how the Cancer Research Foundation acknowledges existing payroll giving donors on social media, as showcased in this testimonial video they shared through Facebook. In it, the donor states, “I’ve been doing [payroll giving] for a few years now, and I don’t really need to think about [donating] once it was all set up.”

Pro Tip: Because payroll giving is often managed through third-party platforms, it’s important to keep your donor data organized. Make sure you’re capturing key information so you can reach out and thank these donors directly and appropriately.

Recognition isn’t just about saying thanks; it’s about building a lasting connection. When payroll donors feel acknowledged, they’re more likely to stay engaged, advocate for your cause, and continue supporting you for years to come.

Frequently Asked Questions (FAQ)

1. How can nonprofits increase employee participation in payroll giving programs?

Nonprofits can increase payroll giving participation by promoting these programs across email, social media, and donation touchpoints. Clear instructions, compelling impact stories, and reminders during key giving moments help inspire more employees to enroll.

2. Why should nonprofits create a dedicated payroll giving page on their website?

A dedicated payroll giving page centralizes instructions, employer tools, and messaging that educates donors on how payroll giving works. This improves donor understanding, reduces friction during enrollment, and increases long-term participation.

3. How can nonprofits use social media to boost payroll giving donations?

Social media can amplify payroll giving by sharing donor impact stories, spotlighting supportive employers, and reminding followers about the convenience of recurring payroll gifts. Visual content and clear calls-to-action drive higher engagement and conversions.

4. How can nonprofits effectively nurture payroll giving donors throughout the year?

Long-term nurturing requires consistent communication, clear impact reporting, and frictionless donor engagement. Nonprofits should follow up with payroll-giving donors regularly, reinforce the value of their recurring support, and offer mission updates that demonstrate tangible outcomes. The more personalized the communication, the higher the retention and lifetime value.

5. What messaging should nonprofits use to boost payroll giving during year-end campaigns?

Strong year-end messaging emphasizes convenience, sustained impact, and the opportunity to multiply support through employer programs. Nonprofits should highlight how recurring payroll gifts create predictable revenue, tie messaging to mission-critical year-end needs, and encourage donors to check eligibility for matching or workplace giving benefits.

Wrapping Up & Additional Resources

Payroll donations are more than just convenient; they also serve as a gateway to long-term donor engagement and financial stability. By implementing these proven strategies, your nonprofit can streamline the giving process, cultivate a culture of generosity, and maintain a steady stream of funding that supports your mission year-round.

Remember: the key to increasing payroll donations lies in education, accessibility, and ongoing communication. Start small, track your results, and keep optimizing for improvements. Your donors (and your bottom line) will thank you.

Interested in learning more about payroll giving? Check out these recommended resources to continue growing your knowledge:

- 7 Strategies for Marketing Payroll Giving to Your Supporters. Learn actionable marketing tactics to promote payroll giving and inspire your supporters to enroll. This guide covers messaging tips, strategies, and channels to maximize visibility and participation.

- Payroll Giving Statistics | 13 Fun Facts for Fundraisers. Get inspired with eye-opening payroll giving stats and fun facts. This resource is perfect for presentations, donor communications, or simply understanding the growing impact of paycheck-based giving.

- Explore 15 Leading Companies with Payroll Giving Programs. Discover major employers that offer payroll giving and how your nonprofit can benefit. Use this list to identify potential partners, outreach opportunities, or donor prospects.