If you’re a nonprofit, you’re likely aware of how critical fundraising is to sustaining and growing your mission. While individual donations are essential, corporate matching gifts can dramatically increase the total amount you raise with minimal additional effort. However, many nonprofits unknowingly leave money behind by failing to fully leverage these matching gift opportunities.

In fact, research shows that up to 90% of eligible matching gifts go unclaimed, representing a significant amount of potential funding that could boost your nonprofit’s revenue. The result? More than $4 to $7 billion in matching gifts are being left on the table each year.

So, how can you ensure that you’re not missing matching gifts? In this post, we’ll explore the five key signs that you’re leaving gifts unmatched, why that matters, and how to fix the problem. This includes:

- Not actively promoting matching gifts.

- Not integrating matching gifts into your donation flow.

- Not collecting donor employment information.

- Not following up with recurring or payroll givers.

- Not tracking matching gifts as they are submitted.

All in all, matching gifts are one of the easiest and most effective ways to boost nonprofit donations. However, many organizations continuously fail to make the most of this opportunity.

Whether it’s a lack of promotion, insufficient follow-up, or not having the right tools in place, you might be leaving money on the table if you’re not capturing matching gifts effectively. But this guide will help you capture every possible donation to increase your nonprofit’s success! Let’s begin with the first sign your organization is missing the mark on matching gifts.

Sign #1: You’re not actively promoting matching gifts.

One of the first and most obvious signs you’re missing matching gifts is a lack of promotion. If you’re not regularly promoting matching gift opportunities, many of your donors may not even be aware that they can double (or triple) their contributions through their employer’s matching gift programs.

Why This Matters:

Active promotion is key to ensuring your donors are aware of matching gift opportunities and understand how simple it is for them to take advantage of them. Without making matching gifts a key part of your messaging, donors may overlook the opportunity, and the funds will go unclaimed.

Many donors simply don’t think about matching gifts unless they’re actively reminded.

How to Fix It:

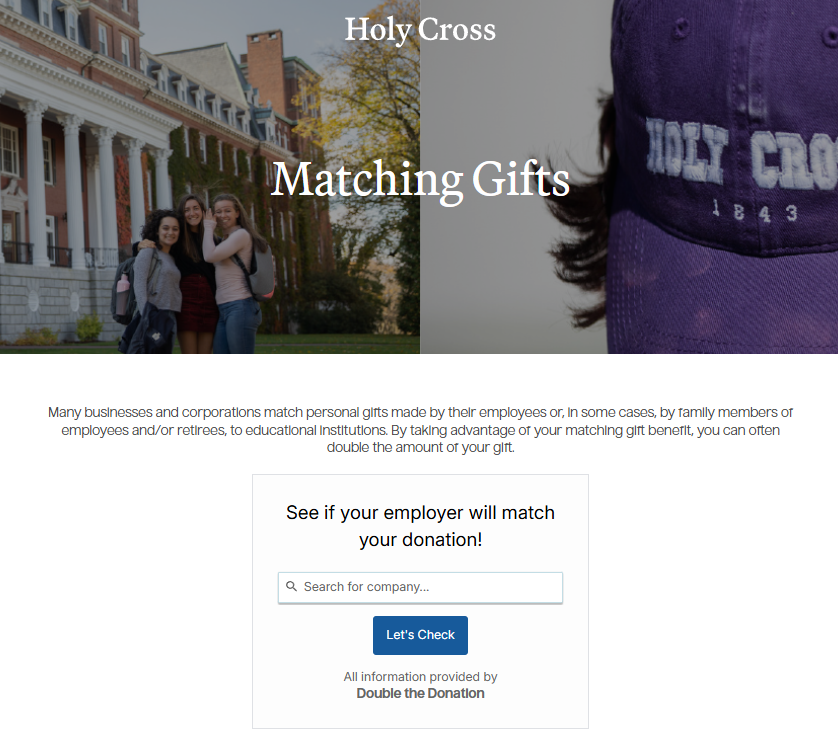

- Incorporate matching gift information on your website: Prominently feature matching gift details on your website, providing easy access to tools that let donors search for their company’s program. One of the best ways to do this is by building a dedicated matching gift page with an embedded company database search tool. This empowers you to provide helpful links to donors’ matching gift submission portals directly from your site!

- Promote via email and social media: Send targeted campaigns to your donors at regular intervals, particularly before key fundraising periods such as Giving Tuesday, end-of-year appeals, or your nonprofit’s anniversary. Use engaging visuals and compelling messages to highlight the ease and impact of matching gifts.

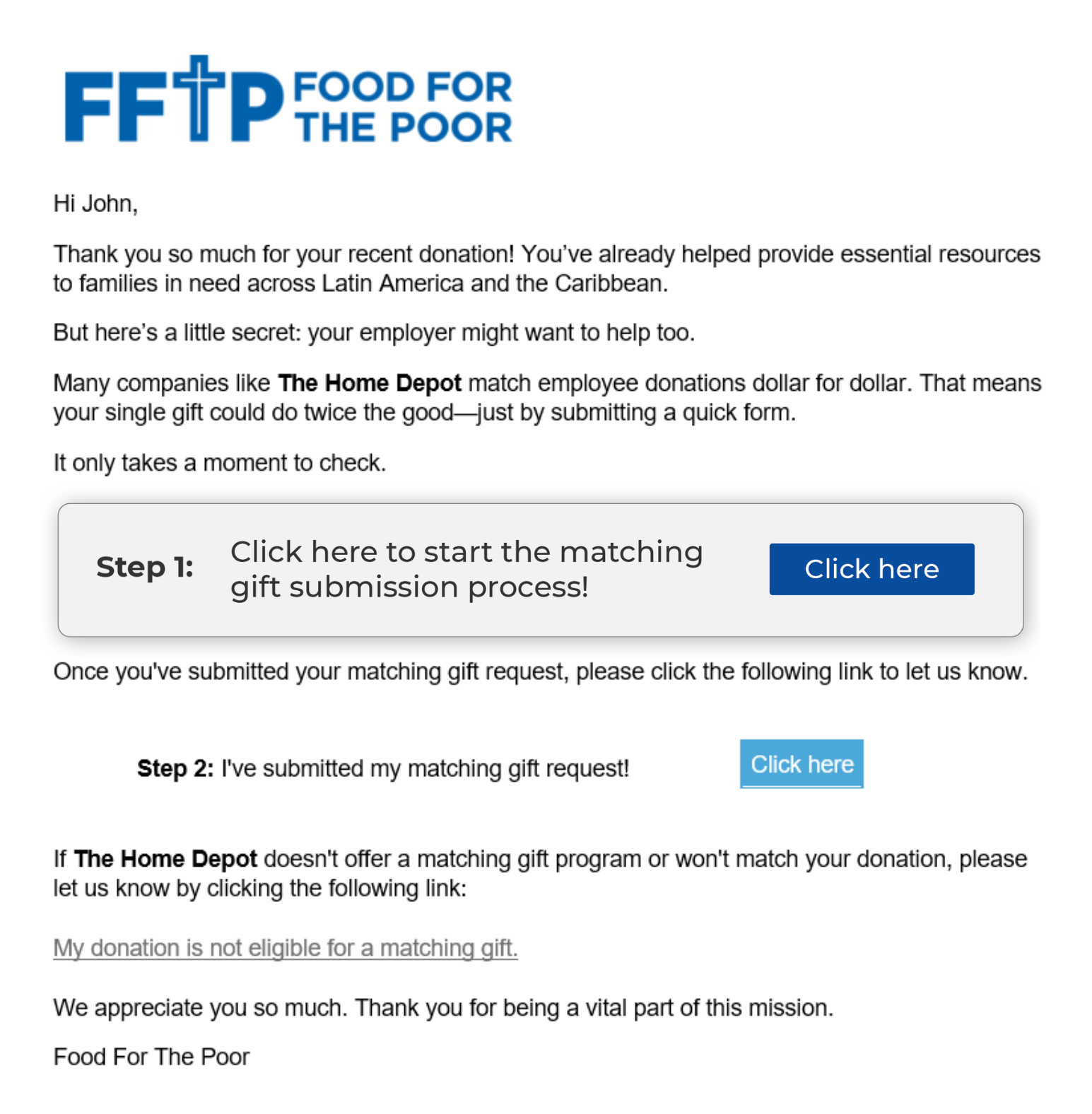

- Highlight matching gifts in thank-you messages: When thanking donors for their contributions, always include a reminder about the possibility of matching gifts. Be specific about how they can apply for the match, and even make this information prominent in your email signatures.

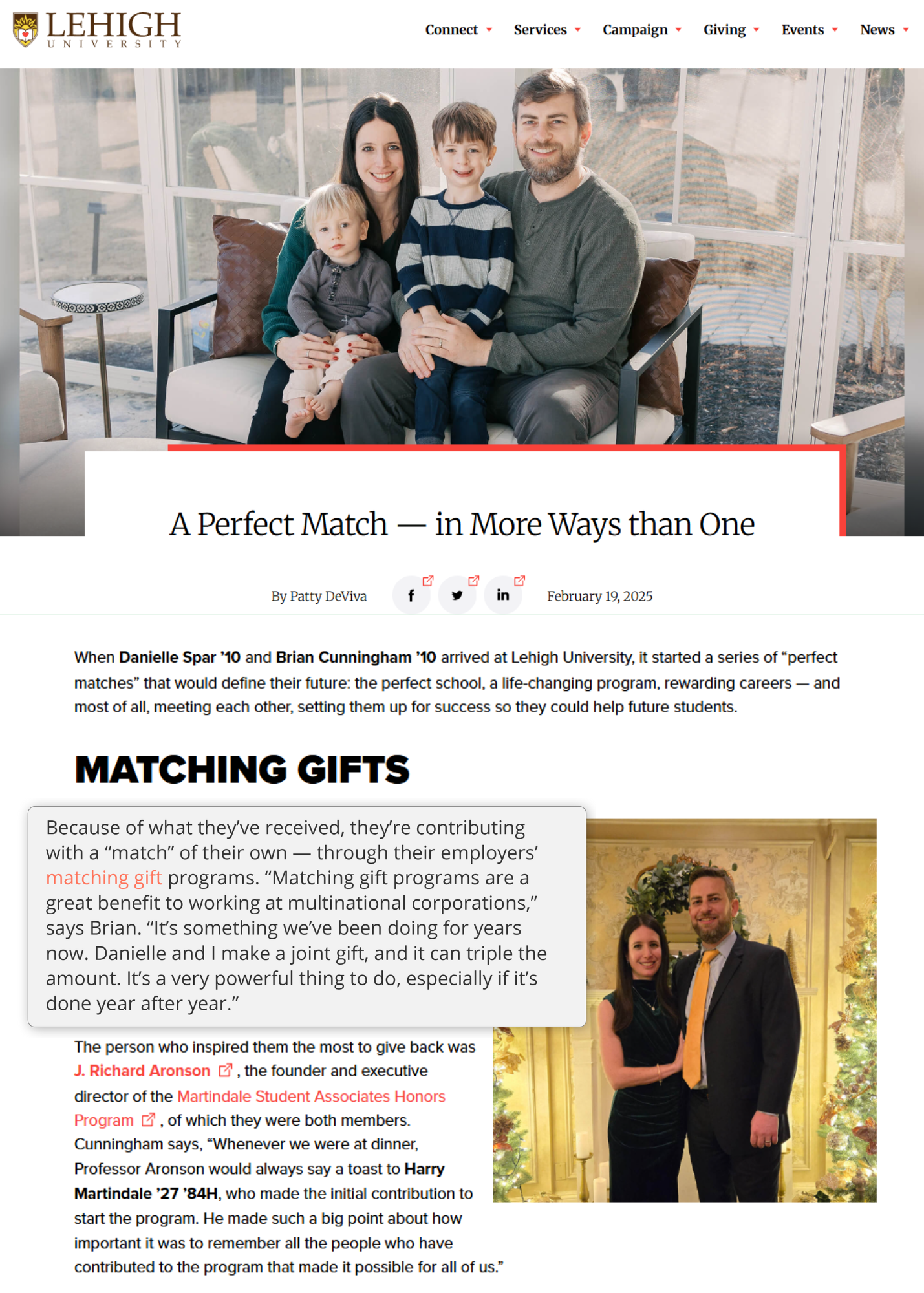

Create engaging content around matching gifts: Develop blog posts, videos, or infographics that explain how matching gifts work and why they matter. This content can be shared on social media or included in your donor-facing newsletter.

Quick Tip: Did you know that some companies (like Grainger, Coca-Cola, Soros Fund Management, General Mills, and more) match gifts up to 3 times the original donation amount? That could mean a huge increase in revenue for your nonprofit if you’re promoting it effectively!

Sign #2: You haven’t integrated matching gifts into your donation flow.

Even if you’re promoting matching gifts in emails and social media, you might be missing out if matching gifts aren’t integrated into the donation process itself. If matching gift options aren’t featured at the point of donation, you could be losing opportunities right from the start.

Why This Matters:

Integrating matching gifts into your donation flow ensures that donors can take advantage of them seamlessly while making their donation. If matching gifts are an afterthought or are not included at the point of donation, many donors may forget to claim their match or may be unsure about how to do so.

How to Fix It:

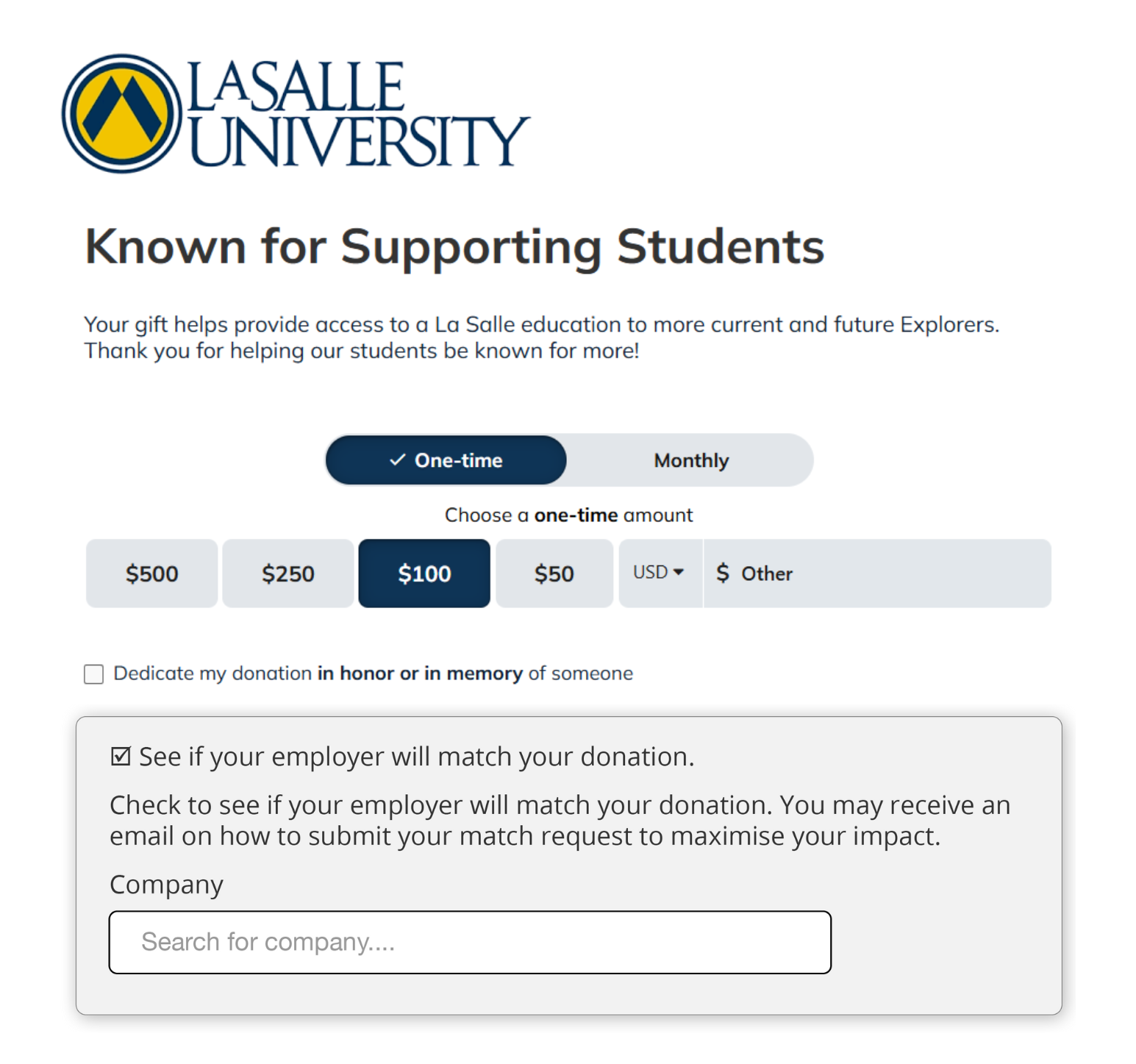

- Add a matching gift prompt during the donation process: Include a field asking if the donor’s employer matches gifts. Make it easy for them to enter this information right when they donate, which will prevent them from having to go back and submit the request later.

- Provide a matching gift search tool: Integrate a tool that helps donors search for their company’s matching gift policy. A matching gift search tool, such as Double the Donation, makes this process much easier and increases the likelihood of donors following through with their match request. For the simplest donor experience, look for a solution that offers matching gift auto-submission, too!

- Offer clear instructions: Once donors indicate that they are eligible for a match, provide them with detailed instructions on how to submit the matching gift request. This could be a link to their employer’s portal or a simple PDF guide explaining the process.

Most often, donors are at the height of their engagement with your cause while actively donating to the organization. That makes it the perfect time to incorporate matching gift opportunities seamlessly into the giving process. By presenting matching gifts as an extension of the donation experience itself, you not only simplify the donor experience but also increase conversion rates.

Instead of treating matching gifts as an afterthought or a separate step, make it a natural part of the donation flow. This minimizes friction and maximizes the chance that donors will follow through with their employer’s matching gift request, resulting in more funds for your cause with little additional effort.

Sign #3: You lack donor employment information.

If you don’t collect donor employment information, you may miss the opportunity to match their gift with their employer’s contribution. Many matching gift programs require nonprofits to identify which employees are eligible for matching gifts. Without this information, it becomes impossible to track or claim matching funds.

Why This Matters:

Without knowing where your donors work, you won’t be able to claim matching funds from their employer. Collecting this information is crucial because it allows you to identify potential matching opportunities and follow up with donors or employers directly.

How to Fix It:

- Collect employment data on donation forms: Add a prominently placed field on your donation form where donors can voluntarily share their employer’s name. Make sure it’s optional, but encourage donors to fill it out, as it will allow you to capture more matching gifts and broader workplace giving opportunities.

- Incorporate employment data into follow-up communications: When thanking donors, include a gentle reminder to share their employment information so you can track and follow up on matching gifts.

- Use an employer append service to locate employment information: If you’re unable to collect employment details directly from donors, consider using employer appends. These dedicated services match your donor database with publicly available employment information, allowing you to identify where your donors work and whether their company offers a matching gift program. This method helps ensure you’re capturing matching gift opportunities even when employment information isn’t known upfront, and it can help you grow revenue and engagement through other forms of workplace giving, too.

Did You Know? More than 65% of Fortune 500 companies offer matching gift programs. If you’re not asking for employment information, you’re missing out on potential revenue from these enterprise-level businesses!

Sign #4: You’re not following up with recurring or payroll givers.

While it’s easy to forget about matching gifts once a donor has set up a recurring donation or payroll gift, these ongoing donors can be prime candidates for donation-matching opportunities. However, if you don’t follow up with them, they may never apply for the match.

Why This Matters:

Recurring givers and payroll donors are often forgotten when it comes to matching gifts, yet they’re some of the most loyal supporters you have. These donors may assume that their gift can’t be matched or may forget to apply for matching funds after they’ve donated.

How to Fix It:

- Set up a recurring matching gift follow-up system: After a donor signs up for a recurring gift (whether through their payroll system or otherwise), be sure to send periodic reminders about matching gift opportunities. For the best results, follow up with simple instructions and offer them support if they have any questions.

- Engage payroll donors at key points: For payroll givers, consider sending reminders during payroll periods or around key dates, such as the anniversary of their initial donation or the end of the calendar year, to encourage them to apply for matching gifts.

- Make matching gifts part of your donor journey: Ensure that matching gift information is included not only during the initial donation process but also woven throughout the donor journey. From your new donor welcome series to ongoing engagement for recurring and payroll givers, you’ll want to consistently remind them about the potential to maximize their contributions through matching gifts.

Following up with recurring or payroll givers is crucial. After all, it ensures that matching gift opportunities don’t go unnoticed. Since these donors are already invested in your cause, they are more likely to take advantage of matching gifts if they are reminded regularly.

Quick Tip: For a look at leading companies that match payroll donations, check out our compilation list here.

Sign #5: You don’t track matching gifts as they are submitted.

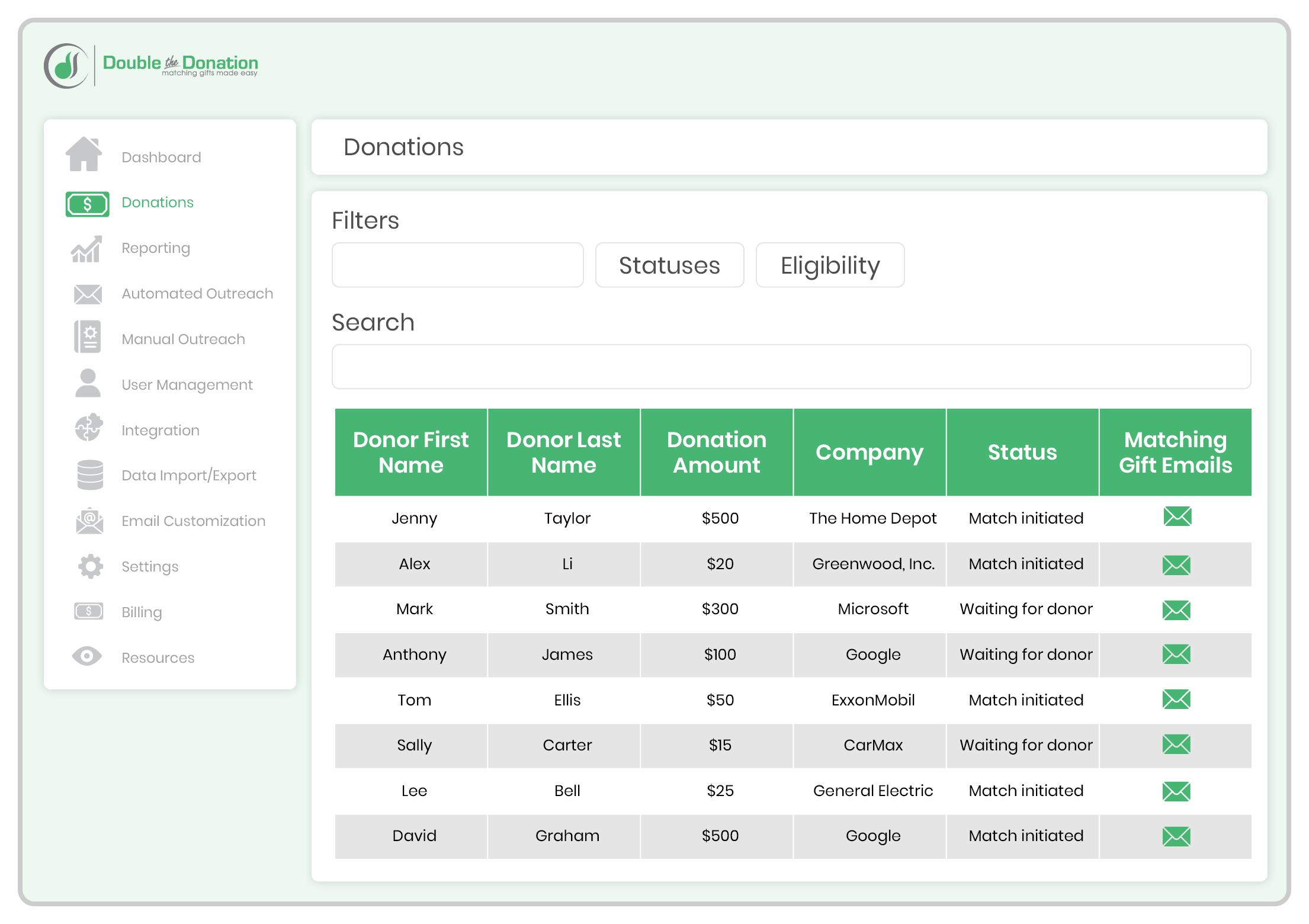

One of the most significant issues nonprofits face with matching gifts is the lack of tracking throughout the process. If you’re not tracking matching gifts from the moment the opportunity is identified through the time the donor ultimately submits the request, you risk missing matching funds or failing to follow up in a timely manner.

Why This Matters:

Tracking matching gifts allows you to follow up with donors and their employers, ensuring that matches are completed successfully. Without proper tracking, there’s no way to ensure that your nonprofit receives the full amount of donations you’re eligible for.

How to Fix It:

- Use matching gift software: Tools like Double the Donation allow you to track matching gifts throughout the donor journey. These systems help you stay organized and follow up with donors and employers when necessary.

- Monitor progress regularly: Create a system for reviewing the status of matching gift requests on a regular basis. This can be done manually or through an automated platform to ensure no matches are left unprocessed.

- Set up follow-up reminders: Develop a system that automatically reminds you to follow up with donors or companies if a matching gift is still pending. This will ensure no matching opportunities fall through the cracks.

Proper tracking of matching gifts is essential for ensuring your nonprofit receives each and every dollar it’s entitled to. Moreover, setting up automated tracking not only ensures no matching gift goes unclaimed but also strengthens your relationship with donors by showing them that you care about maximizing the impact of their contributions. Talk about a win-win!

Frequently Asked Questions (FAQ)

1. What are the signs that a nonprofit is missing matching gift opportunities?

Nonprofits may be missing matching gifts if they are not collecting employer information, lack matching gift reminders on donation forms, or fail to follow up with donors after a gift is made. These gaps lead to significant unclaimed revenue from corporate matching programs.

2. How can nonprofits improve the visibility of matching gift opportunities for donors?

Improving visibility starts with placing matching gift search tools on donation pages, adding clear calls-to-action, and incorporating matching gift prompts into emails, confirmation screens, and receipts. Consistent promotion ensures donors know how to submit their match requests.

3. Why is collecting donor employment information important for matching gifts?

Employment data is essential for identifying match-eligible donors. When donors share their employer information, nonprofits can guide them through the matching gift process, send personalized follow-ups, and avoid leaving corporate match money unmet.

4. How can nonprofits benefit from matching gift programs?

Matching gift programs allow small nonprofits to multiply donor contributions without increasing fundraising costs. By promoting employer matching and making participation easy, smaller organizations can unlock meaningful revenue and strengthen donor engagement.

5. What steps can nonprofits take to promote matching gifts more effectively?

Nonprofits can promote matching gifts by adding a dedicated webpage, educating donors via email and social media, and integrating employer lookup tools into their donation forms. Clear instructions and ongoing reminders help donors complete the matching process.

Wrapping Up & Additional Resources

Matching gifts offer nonprofits a huge opportunity to increase their revenue without much additional effort. However, many organizations are missing out on these funds because they aren’t promoting, tracking, or following up on matching gift opportunities effectively. By addressing these five signs you’re missing matching gifts, you can significantly increase your fundraising potential and maximize the impact of each donation.

Start by reviewing your current processes and implementing the strategies outlined in this post. From actively promoting matching gifts to integrating them into your donation flow, these steps will help ensure that you capture every dollar of potential matching funds. The more you optimize your process, the more successful your matching gift program will be.

Interested in learning more about incorporating strategic matching gift efforts into your overall fundraising strategy? Check out these recommended guides:

- Top 20+ Matching Gift Companies: Leaders in Corporate Giving. Find out if your donors work for these leading employers! Explore the top matching gift companies and determine if they’re present in your fundraising network.

- How to Increase Matching Gift Revenue in 30 Minutes or Less. Drive additional match revenue by implementing the easy steps outlined in this blog. Make sure no matching gifts are slipping through the cracks!

- Free Download: The Ultimate Guide to Marketing Matching Gifts. Get ready to promote matching gifts to your audience effectively. Use the tips and strategies in this free downloadable resource to better market the programs.

Create engaging content around matching gifts: Develop blog posts, videos, or infographics that explain how matching gifts work and why they matter. This content can be shared on social media or included in your donor-facing newsletter.

Create engaging content around matching gifts: Develop blog posts, videos, or infographics that explain how matching gifts work and why they matter. This content can be shared on social media or included in your donor-facing newsletter.