Nonprofit Basics: Planned Giving

Planned giving is an important part of a robust nonprofit fundraising strategy. This diverse category of gifts can unlock growth for your organization, help you reach new prospects, and deepen your ties with donors.

Getting started with planned giving is challenging for many organizations since this form of fundraising is unlike typical campaign-based and annual fundraising. However, the benefits of launching even a small-scale preliminary planned giving program are worth the effort and will scale over time to drive even greater results for your nonprofit.

To get started, you must understand the basics. This quick guide will cover the essentials by answering the following key questions:

- What is planned giving?

- What are the benefits of planned giving?

- How do you get started with planned gift fundraising?

What is planned giving?

Planned giving consists of donations to nonprofits made through donors’ estates or financial plans. Organizations that pursue these gifts consistently do so through dedicated planned giving programs, which are often managed as part of or alongside their other development efforts like major gift fundraising.

Most planned gifts are bequests established in donors’ wills and disbursed after their passing. But planned giving is much more than bequests—it’s an extremely diverse category of gifts.

What are the common types of planned gifts?

In addition to bequests, planned giving includes donations like:

- Retirement plans and life insurance: A donor chooses to name a nonprofit as the beneficiary of a life insurance policy or unused retirement assets.

- Charitable gift annuities: A donor gives a large donation in exchange for a fixed income payment. The nonprofit can invest these funds and keep any remaining funds when the annuity’s terms are up or the donor passes away.

- Charitable remainder trusts: A donor gives a gift of cash or securities in exchange for an income payment of a percentage of the principal amount, which can be revalued and increased annually depending on the type of trust created.

- Charitable lead trusts: A donor makes payments to the nonprofit for a certain number of years or their lifetime. At the end of that term, the payments are returned to the donor or their beneficiaries.

Each type of planned gift brings different requirements and benefits, so the gift that a donor ultimately decides to make will hinge on several factors including their financial situation and giving motivations. Some gifts will also work best for only certain types of high-impact donors.

Many nonprofits also pursue a variety of non-cash gifts alongside their planned giving programs since the processes of identifying these donors and setting up their gifts can be fairly similar. Popular non-cash gift options include:

- Grants from donor-advised funds

- Donations of real estate

- Gifts of private or public stock or mutual funds

- Gifts of cryptocurrency

Explore the additional resources at the end of this article to start learning more about these types of donations.

What is the state of planned giving today?

How much opportunity is there for nonprofits in planned giving today? Who creates planned gifts? Understanding the context and trends of this type of giving will empower your organization to create the best possible strategy.

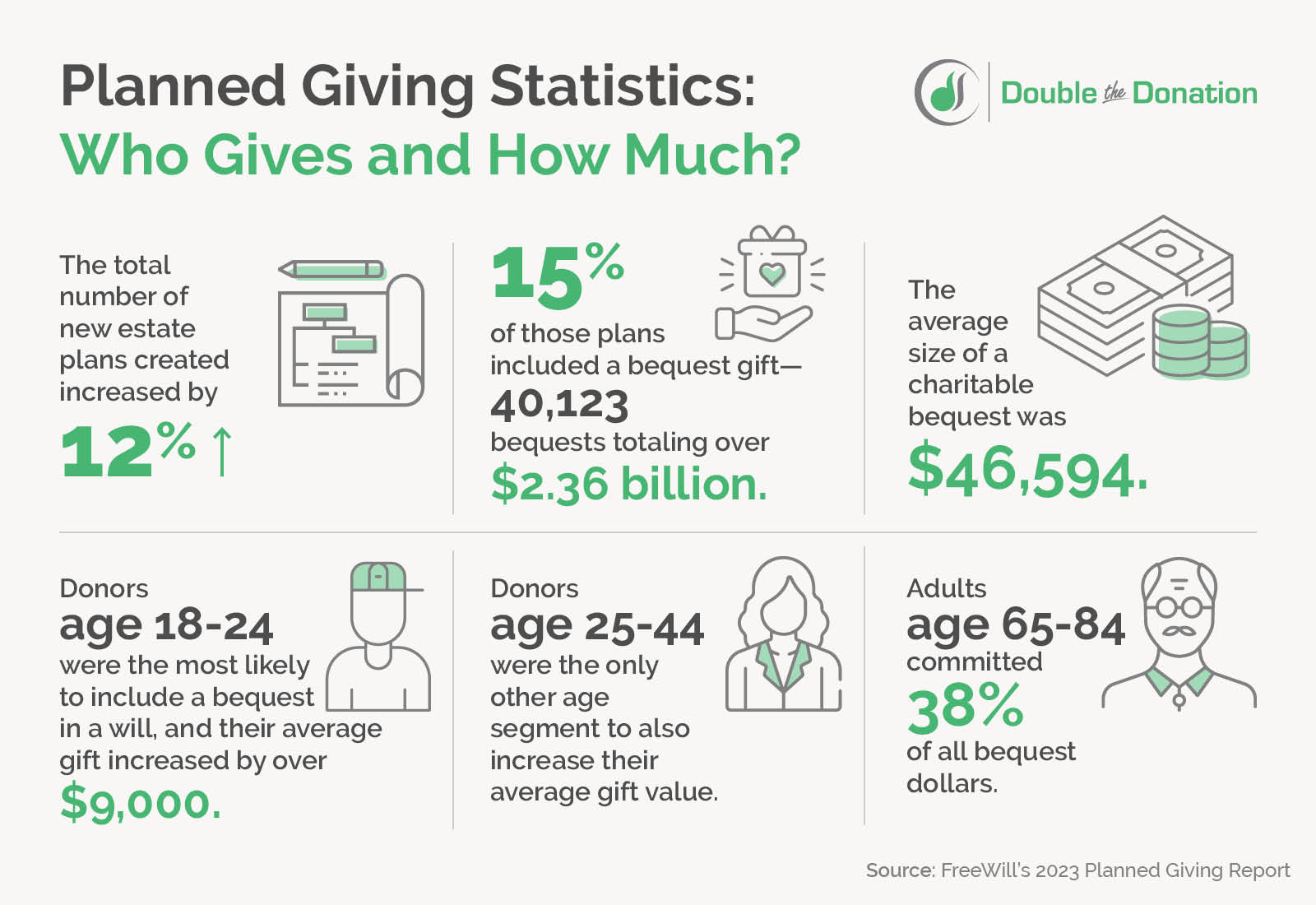

Consider these 2023 statistics from FreeWill, a will creation and planned giving platform for nonprofits:

- The total number of estate plans created increased by 12% over the previous year.

- 15% of those users chose to create a bequest gift—a total of 40,123 bequests adding up to a value of over $2.36 billion.

- The average size of a charitable bequest was $46,594.

- Younger will-makers are expressing an increased interest in bequests. Those aged 18-24 were the most likely to include a bequest in a will, and their average gift increased by over $9,000. Those aged 25-44 were the only other age segment to also increase their average gift value.

- Older will-makers still represent the largest groups involved in planned giving, with adults aged 65-84 committing 38% of all bequest dollars.

(Source: FreeWill’s 2023 Planned Giving Report)

These trends are occurring within the larger phenomenon of the “Great Wealth Transfer,” an unprecedented transfer of assets from the aging Baby Boomer population to their heirs and charitable organizations—estimated to be around $68 trillion over the next 25 years.

Key takeaways: Donors are making wills and estate plans, especially as they age. If you’re not asking them to consider creating a planned gift, you’re missing out. Considering the giving patterns of older donors, the Great Wealth Transfer, and younger generations enjoying or entering their prime working years, a robust planned giving strategy can generate significant revenue for your organization. You’ll just need to know how to talk about planned giving effectively, starting with its benefits.

What are the benefits of planned giving?

Planned giving can help both the donor and the nonprofit in significant ways. Let’s take a closer look.

Benefits for Donors

- Planned gifts allow donors to create lasting legacies and impact on the missions that they care about and/or have been meaningful for their families.

- These donations are also highly flexible, giving donors the option of designating specific purposes for the funds and updating their instructions over time.

- Planned gifts often also bring significant tax benefits for donors, usually relating to estate taxes, which can be a major motivator for some. However, the exact tax implications of planned gifts can vary widely, so it’s crucial to avoid giving donors explicit advice and instead direct them to professionals to confirm the specifics.

Benefits for Nonprofits

- Planned giving is inherently meaningful and can greatly deepen relationships between your organization and its donors when thoughtfully stewarded.

- Financially speaking, planned gifts can be extremely helpful for nonprofits. They’re often much larger than typical cash donations, and they’re usually unrestricted. A planned giving program can create a projectable, dependable source of general funding.

- Planned gifts are also more accessible to more donors than cash gifts of the same values—while you might have only a handful of donors who can give a major cash gift, there’s a good possibility that you have more donors who could give the equivalent through saved assets.

- Effective stewardship strategies have also been shown to increase annual donations from committed planned donors over time.

How do you get started with planned giving?

Your organization should spend time creating a strategy for its planned giving program before getting started asking for these gifts. Follow these steps to successfully execute your program:

- Educate and organize your teams. Decide your goals and determine who will lead your planned giving efforts (usually a member of your development or fundraising department). Educate the members of your fundraising, marketing, or communications teams and any other staff who will play roles in your program.

- Gather the right tools. You’ll need tools to market your program, track donation data, and help donors set up their planned gifts. Look for a planned giving platform that gives donors free will creation tools and provides you with the data you need to follow up and steward your relationships with them over time.

- Identify potential donors. When looking for prospects, start with those most dedicated to your cause, including board members, volunteers, and longtime donors. Ask about their awareness of and interest in planned giving (and if they’ve already created a planned gift). Use these responses to build an initial prospect list, get a sense of their shared characteristics, and refine your approach as you learn more.

- Create a legacy giving society. This can cultivate a feeling of community and inclusion in your organization, especially if it comes with perks like public acknowledgment or access to special events.

- Outline a marketing strategy. Use multiple marketing channels to explain what planned giving is and why it’s so beneficial for both donors and your mission. Make it easy for donors to access information about planned giving, ideally by adding it as a section on your Ways to Give page or on a dedicated planned giving microsite.

- Steward and learn more about planned donors over time. As you begin asking for and receiving planned gifts, actively work to keep those donors involved and engaged. Learn more about why they choose to give to inform your future strategies.

Don’t be afraid of starting small—your planned giving program can grow over time. By beginning with a targeted focus on simpler gifts like bequests, you can lay out an effective framework for eventually asking for more complex planned gifts or different types of non-cash gifts over time.

The key is to keep learning more and refining your approach as you go. Your development team already likely follows best practices for conducting prospect research, qualifying donors, building relationships, and stewarding donors. Use and adapt these strategies to your new planned giving goals.

Additional Planned Giving Resources

Nonprofit Basics – Learn more nonprofit management essentials by exploring our other introductory guides and glossary entries.

Planned Giving Marketing – Here are seven strategies to get your donor base on board with planned giving.

Donor-Advised Funds — Check out this complete introduction to DAFs, a type of philanthropic fund that’s skyrocketed in popularity in recent years.

Moves Management — Learn the basics of how to keep track of donor interactions as you work towards a specific goal like creating a planned gift.