Dallas stands as a vibrant metropolis known not only for its bustling economy but also for its deep-rooted commitment to community engagement and philanthropy. The city’s dynamic corporate landscape plays a pivotal role in fostering a culture of volunteerism, with many leading companies actively encouraging their employees to give back through structured volunteer initiatives. These programs not only benefit the community but also strengthen the bonds between businesses and nonprofits, creating a thriving ecosystem of support and collaboration.

In Dallas, the synergy between corporations and nonprofits is particularly strong, thanks to the presence of numerous Fortune 500 and Fortune 1000 companies headquartered or operating in the area. This corporate presence fuels a robust environment where volunteer grant programs and Volunteer Time Off (VTO) initiatives flourish, offering nonprofits valuable opportunities to secure funding and engage with passionate volunteers. Understanding these programs and the companies behind them is essential for nonprofits aiming to maximize their impact in the Dallas community.

In this guide, we’ll walk you through:

Many of Dallas’ top companies are committed to giving back through robust volunteer programs, providing nonprofits with valuable resources to further their missions. In this guide, we’ll highlight key companies in this city’s corporate volunteer space and the impactful programs they offer nonprofits like yours.

What to Know About Major Dallas Companies in the Corporate Volunteer Space

Dallas is a major hub for business and nonprofit activity, making it a key city in the national and global economic landscape. As the ninth-largest city in the United States by population, Dallas boasts a diverse economy that spans technology, finance, healthcare, telecommunications, and energy sectors. This diversity has attracted a wide array of companies, many of which have established headquarters or significant operations in the city.

Among these are numerous Fortune 500 and Fortune 1000 companies, which contribute significantly to Dallas’s economic strength and philanthropic culture. The city is home to over 20 Fortune 500 companies, including giants in technology, telecommunications, and manufacturing. This concentration of corporate power creates fertile ground for workplace giving programs, including volunteer grants and Volunteer Time Off (VTO) initiatives.

Key industries such as technology and telecommunications dominate the Dallas corporate scene, not only driving economic growth but also championing corporate social responsibility through structured volunteer programs. The strong presence of these companies means nonprofits in Dallas have access to a wealth of resources and opportunities to engage with corporate volunteers and secure funding through volunteer grant programs.

Corporate volunteer programs in Dallas are designed to encourage employees to contribute their time and skills to community causes. Volunteer grants reward employees’ volunteer hours with financial donations to nonprofits, while VTO programs provide paid time off for employees to volunteer. These initiatives reflect a broader commitment by Dallas companies to foster social responsibility and community engagement, benefiting both the nonprofits they support and the employees who participate.

Top Companies in Dallas That Offer Volunteer Grant Programs

Volunteer grant programs are a powerful way for nonprofits to receive additional funding based on the volunteer hours contributed by employees of participating companies. In Dallas, many leading corporations have established such programs, providing nonprofits with opportunities to secure grants that recognize and reward employee volunteerism. Below, we explore some of the top companies in Dallas that offer volunteer grant programs, detailing their eligibility criteria, grant amounts, and unique features.

Microsoft

Microsoft, a global leader in technology and software development, has a well-established volunteer grant program that supports nonprofits worldwide, including those in Dallas. Employees who volunteer a minimum number of hours—typically 20 hours per year—can request a grant for the nonprofit they serve. Microsoft’s program offers grants up to $1,000 per employee annually, with the possibility of multiple submissions depending on the employee’s volunteer activities.

The program is open to all full-time and part-time employees, encouraging a wide range of volunteer activities, from education and technology training to environmental and social services. Microsoft’s commitment to volunteerism is part of its broader corporate social responsibility strategy, which emphasizes empowering communities through technology and service.

Learn more about the program here!

Texas Instruments

Texas Instruments, a major player in semiconductor manufacturing and technology innovation, offers a volunteer grant program that rewards employees for their community service. Employees who volunteer at least 20 hours in a calendar year can submit a grant request on behalf of the nonprofit organization they support. The grants typically range up to $500 per employee annually.

The program is designed to support a variety of causes, including STEM education, community development, and health initiatives. Texas Instruments encourages employees to engage in volunteer activities that align with the company’s values and community priorities, fostering a culture of giving back within the organization.

Learn more about the program here!

Southwest Airlines

Southwest Airlines, headquartered in Dallas and known for its customer-centric approach, also champions volunteerism through its volunteer grant program. Employees who volunteer a minimum of 20 hours per year can apply for grants up to $500 for the nonprofits they serve. The program supports a broad spectrum of volunteer activities, reflecting the company’s commitment to community engagement and social responsibility.

Southwest Airlines’ volunteer grant program is open to all employees, including part-time staff, and encourages participation in causes that improve the quality of life in the communities the airline serves. The company also promotes team volunteering events, amplifying the impact of its workforce’s community involvement.

Learn more about the program here!

Cisco

Cisco, a global leader in networking technology, offers a comprehensive volunteer grant program that rewards employees for their volunteer efforts. Employees who contribute at least 20 hours of volunteer service annually can request grants up to $500 for eligible nonprofits. Cisco’s program is notable for its flexibility, allowing employees to submit multiple grant requests throughout the year for different volunteer activities.

The program supports a wide range of causes, including education, technology access, and disaster relief. Cisco’s commitment to volunteerism is integrated into its corporate culture, encouraging employees to leverage their skills and time to make a positive impact in their communities.

Learn more about the program here!

AT&T

AT&T, a telecommunications giant headquartered in Dallas, offers a robust volunteer grant program that rewards employees for their community service. Employees who volunteer a minimum of 20 hours annually can submit grant requests up to $500 per year. The program covers a broad array of volunteer activities, including education, health, and community development initiatives.

AT&T’s volunteer grant program is open to all employees, with additional incentives for team volunteering and leadership roles in community projects. The company’s strong emphasis on corporate social responsibility is reflected in its support for employee volunteerism and community engagement.

Learn more about the program here!

Apple

Apple, a global technology leader with a significant presence in Dallas, offers a volunteer grant program that encourages employees to give back to their communities. Employees who volunteer at least 20 hours annually can request grants up to $500 for the nonprofits they support. Apple’s program focuses on a variety of causes, including education, environmental sustainability, and social justice.

The program is available to all employees and supports both individual and team volunteer efforts. Apple’s commitment to volunteerism is part of its broader mission to create positive social impact through innovation and community involvement.

Learn more about the program here!

Google

Google, a major player in technology and internet services, provides a volunteer grant program that rewards employees for their volunteer hours. Employees who volunteer a minimum of 20 hours per year can request grants up to $500 for eligible nonprofits. Google’s program is known for its inclusivity, supporting a wide range of volunteer activities and causes.

The program encourages employees to engage in community service that aligns with their passions and skills, fostering a culture of giving and social responsibility within the company. Google also supports team volunteering and offers additional resources to help employees maximize their impact.

Learn more about the program here!

Hewlett Packard

Hewlett-Packard (HP), a technology company with a strong presence in Dallas, offers a volunteer grant program that recognizes employees’ community service. Employees who volunteer at least 20 hours annually can submit grant requests up to $500 for the nonprofits they serve. HP’s program supports a diverse range of causes, including education, health, and environmental initiatives.

The program is open to all employees and encourages participation in both individual and group volunteer activities. HP’s commitment to corporate social responsibility is reflected in its support for employee volunteerism and community engagement.

Learn more about the program here!

Thomson Reuters

Thomson Reuters, a global provider of news and information services, offers a volunteer grant program that rewards employees for their volunteer efforts. Employees who volunteer a minimum of 20 hours per year can request grants up to $500 for eligible nonprofits. The program supports a variety of causes, including education, legal aid, and community development.

Thomson Reuters encourages employees to participate in volunteer activities that align with their interests and the company’s values. The program is designed to foster a culture of giving and social responsibility within the organization.

Learn more about the program here!

Leading Dallas Companies That Provide Volunteer Time Off

Volunteer Time Off (VTO) programs are another impactful way companies in Dallas support employee volunteerism. These programs allow employees to take paid time off to volunteer for causes they care about, making it easier for them to contribute their time without sacrificing income. Several leading Dallas companies offer VTO programs, each with unique features and eligibility criteria. Below, we explore some of the top companies providing VTO in Dallas.

AT&T

AT&T offers a comprehensive Volunteer Time Off program that allows employees to take paid time off specifically for volunteering. Employees are typically eligible for up to 16 hours (two days) of VTO annually, which they can use to support nonprofit organizations and community projects. The program encourages employees to engage in a wide range of volunteer activities, from mentoring youth to participating in environmental cleanups.

Eligibility for the VTO program generally requires employees to be in good standing and may include both full-time and part-time staff. AT&T also promotes team volunteering events, enabling groups of employees to contribute collectively during work hours. This program reflects AT&T’s commitment to fostering a culture of community involvement and social responsibility.

Learn more about the program here!

Southwest Airlines

Southwest Airlines provides a Volunteer Time Off program that supports employees in dedicating paid time to volunteer activities. Employees can typically access up to 16 hours of VTO per year, which they can use to participate in causes that resonate with them personally. The program is designed to be flexible, allowing employees to volunteer during regular work hours without loss of pay.

The VTO program is available to all employees, including part-time workers, and supports a broad spectrum of volunteer activities. Southwest Airlines also encourages employees to participate in company-sponsored volunteer events, amplifying the impact of their community engagement efforts.

Learn more about the program here!

Capital One

Capital One, a financial services company with operations in Dallas, offers a Volunteer Time Off program that provides employees with paid time off to volunteer. Employees are eligible for up to 16 hours of VTO annually, which they can use to support nonprofits and community initiatives. The program emphasizes flexibility and encourages employees to choose volunteer activities that align with their interests and skills.

Eligibility typically includes full-time employees with a minimum tenure requirement. Capital One also supports team volunteering and offers additional resources to help employees find meaningful volunteer opportunities. This program is part of Capital One’s broader commitment to corporate social responsibility and community investment.

Learn more about the program here!

Schneider Electric

Schneider Electric, a global specialist in energy management and automation, provides a Volunteer Time Off program that allows employees to take paid time off for volunteering. Employees can access up to 16 hours of VTO per year, supporting a variety of causes including environmental sustainability, education, and community development.

The program is open to full-time employees and encourages participation in both individual and group volunteer activities. Schneider Electric’s VTO program reflects the company’s dedication to sustainability and social impact, empowering employees to contribute meaningfully to their communities.

Learn more about the program here!

GM Financial

GM Financial, the financial services arm of General Motors, offers a Volunteer Time Off program that supports employee volunteerism by providing paid time off. Employees are eligible for up to 16 hours of VTO annually, which they can use to volunteer for nonprofits and community organizations. The program encourages employees to engage in causes that matter to them, fostering a culture of giving back.

Eligibility requirements typically include full-time employment status and a minimum tenure. GM Financial also promotes team volunteering and community service events, enhancing the collective impact of its workforce’s volunteer efforts.

Learn more about the program here!

Explore More Dallas Volunteer Programs with a Workplace Philanthropy Database

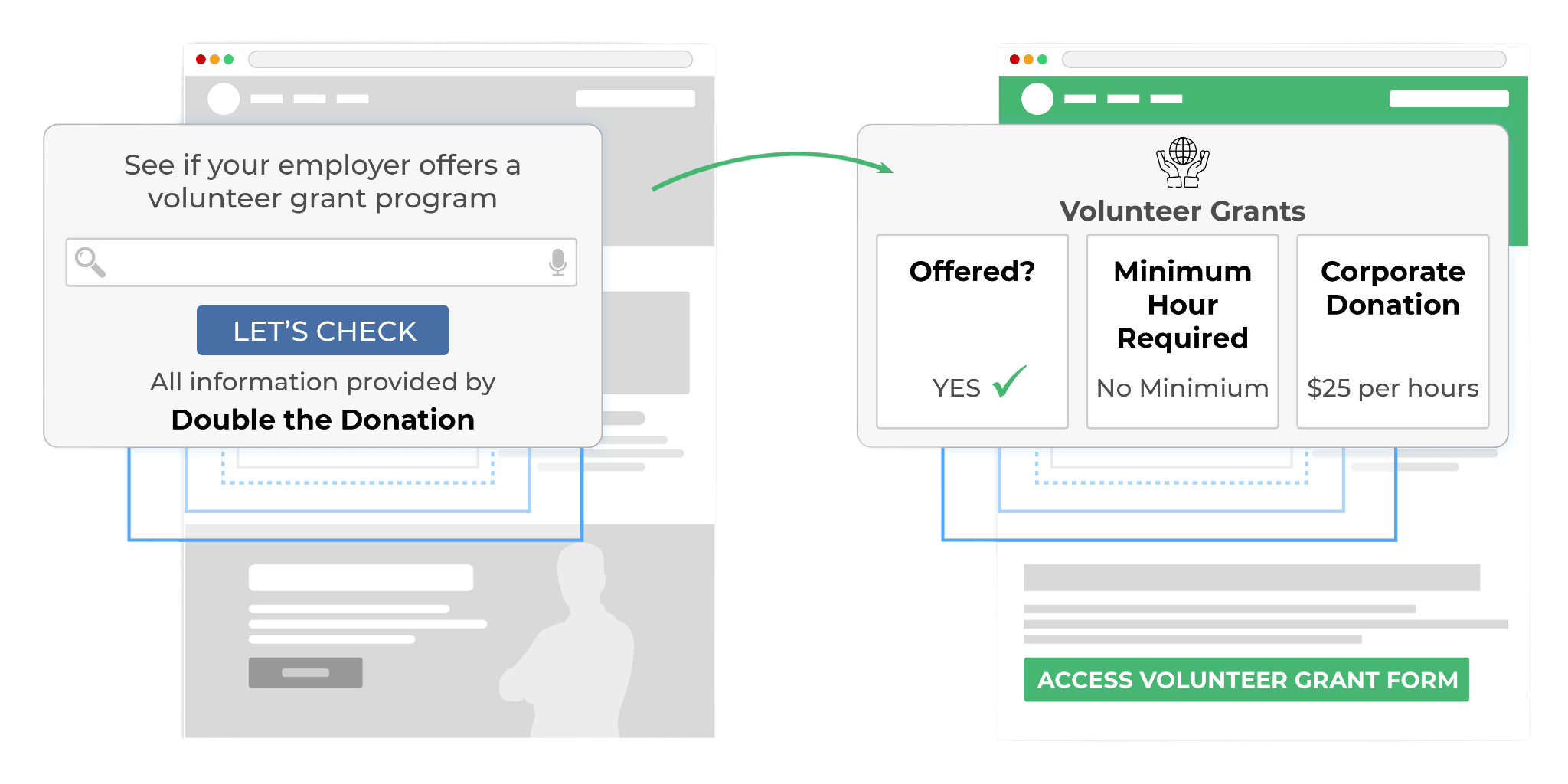

While the companies highlighted above represent some of the most prominent volunteer grant and VTO programs in Dallas, many more businesses in the city and beyond offer similar initiatives that nonprofits can tap into. To uncover these additional opportunities, nonprofits can leverage workplace philanthropy databases like Double the Donation, which provide comprehensive listings of corporate volunteer programs, matching gifts, payroll giving, and more.

These databases streamline the process of discovering and accessing volunteer grant programs and VTO offerings, making it easier for nonprofits to maximize their fundraising and engagement efforts. Moreover, many workplace philanthropy databases can be integrated directly into nonprofit workflows, such as registration forms, volunteer follow-ups, and dedicated volunteer web pages. This integration ensures that every volunteer can determine their eligibility for corporate volunteer grants and other workplace giving programs, increasing the likelihood of securing additional funding and support.

By utilizing these tools, nonprofits in Dallas can expand their reach within the corporate community, tapping into a broader network of volunteer programs and enhancing their capacity to serve their communities effectively.

Wrapping Up & Final Thoughts

Dallas is home to a wealth of companies that offer powerful volunteer initiatives, including volunteer grant programs and Volunteer Time Off opportunities. These programs represent valuable resources for nonprofits seeking to deepen their community impact and secure additional funding. By understanding the volunteer programs offered by major Dallas companies such as Microsoft, Texas Instruments, Southwest Airlines, and AT&T, nonprofits can strategically engage with corporate partners and leverage these initiatives to their advantage.

Volunteer grants provide financial recognition for employees’ volunteer hours, while VTO programs enable employees to dedicate paid time to causes they care about. Together, these programs foster a culture of corporate social responsibility and community engagement that benefits both businesses and nonprofits alike. Nonprofits in Dallas are encouraged to actively explore these opportunities, building relationships with companies that support volunteerism and workplace giving.

By tapping into the rich corporate volunteer landscape in Dallas, nonprofits can enhance their fundraising efforts, increase volunteer engagement, and ultimately expand their capacity to serve their communities.

How Double the Donation Volunteering Can Help Your Nonprofit Grow Corporate Volunteerism

Ready to unlock the full potential of corporate volunteer programs? With Double the Donation’s tools, you can effortlessly capture volunteer grants and employer-sponsored time off, helping you maximize the value of every hour your supporters give.

Don’t miss out on additional funding opportunities that could significantly boost your nonprofit’s revenue. Get started today, and see how easy it is to integrate volunteer incentives into your fundraising strategy. Let Double the Donation help you turn volunteer hours into lasting impact. Request a personalized demo today!

Companies in Atlanta that Offer Powerful Volunteer Initiatives

/in Learning Center, Company Spotlights, Volunteer Grant Companies /by Adam WeingerAtlanta stands as a vibrant epicenter of business innovation and nonprofit activity, making it a fertile ground for impactful volunteer initiatives. The city’s dynamic economy and diverse corporate landscape create a unique environment where companies actively engage in community betterment through structured volunteer programs. These initiatives not only empower employees to give back but also provide nonprofits with valuable resources to amplify their missions.

With a rich blend of Fortune 500 and Fortune 1000 companies headquartered in the city, Atlanta’s corporate sector plays a pivotal role in fostering a culture of volunteerism. This synergy between business and community organizations has cultivated a thriving ecosystem where volunteer grants and volunteer time off programs flourish, offering nonprofits multiple avenues to benefit from corporate generosity and employee engagement.

In this guide, we’ll walk you through:

Atlanta’s corporate volunteer landscape is vibrant and full of potential. This guide will introduce you to the top companies in Atlanta offering corporate volunteer opportunities and show you how to tap into these resources to expand your nonprofit’s reach and create a lasting impact in your community. Let’s get started!

What to Know About Major Atlanta Companies in the Corporate Volunteer Space

Atlanta is more than just Georgia’s capital; it is a major hub for commerce, culture, and community impact. As the ninth-largest metropolitan area in the United States, Atlanta boasts a population exceeding six million residents, making it a significant player on both the national and global economic stage. The city’s strategic location and robust infrastructure have attracted a diverse array of industries, including technology, finance, healthcare, and transportation.

Home to over 75 Fortune 1000 companies, Atlanta’s corporate landscape is marked by influential players that drive economic growth and social responsibility. This concentration of business powerhouses has naturally led to a strong culture of corporate philanthropy, where companies recognize the value of investing in their communities through volunteer programs. Many nonprofits have chosen Atlanta as their base, benefiting from the city’s thriving economy and the generosity of its corporate citizens.

Key industries such as technology and finance not only contribute to Atlanta’s economic vitality but also shape its approach to corporate giving. Tech giants and financial institutions alike have developed comprehensive volunteer initiatives that include volunteer grants and volunteer time off (VTO) programs. These initiatives encourage employees to dedicate their time and skills to causes they care about, while nonprofits gain access to additional funding and volunteer support. Understanding this landscape is essential for nonprofits seeking to maximize their engagement with Atlanta’s corporate sector.

Top Companies in Atlanta That Offer Volunteer Grant Programs

Volunteer grant programs are a powerful way for nonprofits to receive financial support tied directly to employee volunteerism. In Atlanta, several leading companies have established robust volunteer grant programs that reward employees’ time and dedication with monetary grants to nonprofits. These programs vary in eligibility, grant amounts, and submission frequency, offering nonprofits multiple opportunities to benefit.

Microsoft

Microsoft, a global leader in technology and software development, has a well-established volunteer grant program designed to encourage employee engagement in community service. Eligible employees can apply for grants after completing a minimum number of volunteer hours, typically around 20 hours per calendar year. Microsoft offers grants up to $1,000 per employee annually, which nonprofits can receive as a direct result of employee volunteerism.

The program allows employees to submit multiple grant requests throughout the year, provided they meet the minimum volunteer hour requirements. Microsoft’s volunteer grant program supports a wide range of volunteer activities, including education, environmental causes, and social services, making it accessible to nonprofits across various sectors.

Learn more about the program here!

Google

Google, renowned for its innovation in internet services and technology, also prioritizes corporate social responsibility through its volunteer grant program. Employees who volunteer a minimum of 20 hours annually are eligible to request grants of up to $500 per year for the nonprofits they support. Google’s program emphasizes flexibility, allowing employees to submit grant requests multiple times a year as they accumulate volunteer hours.

Nonprofits benefit from Google’s broad eligibility criteria, which encompass a diverse array of volunteer activities. This inclusivity ensures that organizations focused on education, health, community development, and other causes can access funding linked to employee volunteer efforts.

Learn more about the program here!

Apple

Apple, a global leader in consumer electronics and software, offers a volunteer grant program that rewards employees for their community involvement. Employees who complete at least 20 volunteer hours annually can request grants up to $500 for their chosen nonprofits. Apple’s program encourages employees to engage in meaningful volunteer work and supports a wide spectrum of nonprofit causes.

The company allows employees to submit grant requests on a rolling basis, providing nonprofits with ongoing opportunities to receive funding. Apple’s commitment to volunteerism reflects its broader corporate values centered on innovation, education, and social impact.

Learn more about the program here!

Cisco

Cisco, a multinational technology conglomerate specializing in networking hardware and telecommunications, has a comprehensive volunteer grant program that incentivizes employee volunteerism. Eligible employees who volunteer a minimum of 20 hours per year can request grants up to $500 for nonprofits. Cisco’s program is designed to support a variety of causes, including education, health, and community development.

The company encourages employees to participate actively in their communities by offering multiple grant submissions annually. This approach maximizes the potential for nonprofits to benefit from Cisco’s corporate volunteer initiatives.

Learn more about the program here!

Honeywell

Honeywell, a diversified technology and manufacturing company, supports employee volunteerism through its volunteer grant program. Employees who complete at least 20 hours of volunteer service annually are eligible to request grants up to $500 for nonprofits. Honeywell’s program covers a broad range of volunteer activities, reflecting the company’s commitment to community engagement and social responsibility.

Nonprofits partnering with Honeywell employees can expect flexible grant submission options and support for various causes, enhancing their ability to secure funding linked to volunteer efforts.

Learn more about the program here!

Siemens AG

Siemens AG, a global powerhouse in electronics and electrical engineering, offers a volunteer grant program that rewards employees for their community service. Employees who volunteer a minimum of 20 hours per year can request grants up to $500 for nonprofits. Siemens’ program supports diverse volunteer activities, aligning with the company’s focus on innovation and sustainability.

The program allows for multiple grant submissions annually, providing nonprofits with ongoing opportunities to benefit from employee volunteerism. Siemens’ commitment to corporate social responsibility is evident in its support for employee-driven community engagement.

Learn more about the program here!

Leading Atlanta Companies That Provide Volunteer Time Off

Volunteer Time Off (VTO) programs are another impactful way companies in Atlanta encourage employees to contribute to their communities. These programs provide paid time off specifically for volunteering, enabling employees to support causes they care about without sacrificing income. Several leading Atlanta companies have embraced VTO, offering generous policies that benefit both employees and nonprofits.

Southern Company

Southern Company, a major energy provider in the southeastern United States, offers a comprehensive VTO program that allows employees to take paid time off to volunteer. Employees are typically eligible for up to 16 hours of VTO annually, which they can use to support a wide range of nonprofit activities. Southern Company encourages employees to engage in causes related to education, environmental stewardship, and community development.

The program includes guidelines to ensure volunteer activities align with the company’s values, but it remains flexible enough to accommodate diverse nonprofit partnerships. Southern Company’s VTO program reflects its commitment to fostering strong community ties through employee engagement.

Learn more about the program here!

Coca-Cola Company

The Coca-Cola Company, a global leader in the beverage industry, provides a robust VTO program that supports employee volunteerism. Employees can access up to 16 hours of paid volunteer time each year, enabling them to contribute meaningfully to nonprofit organizations. Coca-Cola’s program emphasizes community impact and encourages employees to participate in activities that promote health, education, and social welfare.

Eligibility for the program typically requires employees to be in good standing and to coordinate volunteer activities with their managers. Coca-Cola’s VTO initiative is a key component of its broader corporate social responsibility strategy.

Learn more about the program here!

Delta Air Lines

Delta Air Lines, a major player in the global aviation industry, offers a generous VTO program that allows employees to take paid time off for volunteering. Employees are eligible for up to 16 hours of VTO annually, which they can use to support a variety of nonprofit causes. Delta encourages volunteer activities that align with its values, including education, disaster relief, and community development.

The program is designed to be flexible, accommodating employees’ schedules and interests while fostering a culture of giving back. Delta’s VTO program enhances employee engagement and strengthens the company’s connection to the communities it serves.

Learn more about the program here!

Cox Enterprises

Cox Enterprises, a diversified media and automotive services company headquartered in Atlanta, supports employee volunteerism through its VTO program. Employees can take up to 16 hours of paid volunteer time each year, allowing them to contribute to causes they are passionate about. Cox encourages volunteer activities that promote education, environmental sustainability, and community well-being.

The program includes clear guidelines to ensure volunteer efforts align with company values, while also providing flexibility to accommodate a wide range of nonprofit partnerships. Cox’s VTO initiative is a testament to its commitment to corporate citizenship and community engagement.

Learn more about the program here!

Equifax

Equifax, a global data, analytics, and technology company based in Atlanta, offers a VTO program that enables employees to take paid time off for volunteer work. Employees are eligible for up to 16 hours of VTO annually, which they can use to support nonprofit organizations across various sectors. Equifax encourages volunteerism that aligns with its corporate values, including education, financial literacy, and community development.

The program is designed to be inclusive and flexible, allowing employees to engage in meaningful volunteer activities while balancing their professional responsibilities. Equifax’s VTO program reflects its dedication to fostering a culture of social responsibility.

Learn more about the program here!

Explore More Atlanta Volunteer Programs with a Workplace Philanthropy Database

While the companies highlighted above represent some of the most prominent volunteer grant and VTO programs in Atlanta, many more businesses in the city (and abroad) offer similar opportunities that nonprofits can leverage. To uncover these additional programs, nonprofits can utilize workplace philanthropy databases like Double the Donation. These databases provide comprehensive listings of corporate volunteer initiatives, along with matching gifts, payroll giving, and more.

Using a workplace philanthropy database enables nonprofits to efficiently search for companies that offer programs such as volunteer grants and time off for volunteering. This targeted approach helps organizations identify potential corporate partners whose volunteer programs align with their mission and goals and inform their supporters about available programming. Moreover, these databases often offer integration capabilities, enabling nonprofits to embed corporate volunteer program information directly into their registration forms, follow-up communications, and volunteer web pages.

Wrapping Up & Final Thoughts

Atlanta’s corporate landscape is rich with opportunities for nonprofits to engage with powerful volunteer initiatives. From volunteer grant programs offered by tech giants like Microsoft and Google to Volunteer Time Off policies provided by leading companies such as Southern Company and Coca-Cola, the city’s businesses demonstrate a strong commitment to community involvement. These programs not only provide financial support but also foster deeper connections between employees and the causes they care about.

Nonprofits in and around the area can leverage these corporate volunteer initiatives to boost their impact, secure additional funding, and expand their volunteer bases with ease. By understanding the specific programs available and utilizing tools like workplace philanthropy databases to locate the best opportunities, organizations can strategically engage with companies that align with their missions.

Maximize Your Corporate Volunteer Potential with Double the Donation

Ready to unlock the full potential of corporate volunteer programs? With Double the Donation’s tools, you can effortlessly capture volunteer grants and employer-sponsored time off, helping you maximize the value of every hour your supporters give.

Don’t miss out on additional funding opportunities that could significantly boost your nonprofit’s revenue. Get started today, and see how easy it is to integrate volunteer incentives into your fundraising strategy. Let Double the Donation help you turn volunteer hours into lasting impact. Request a personalized demo today!

Companies in New York that Offer Powerful Volunteer Initiatives

/in Volunteer Grant Companies, Learning Center, Company Spotlights /by Adam WeingerNew York City stands as a beacon of opportunity and innovation, not only in business but also in corporate social responsibility. As one of the world’s most influential economic centers, it hosts a vast array of companies that actively engage in volunteer initiatives. These programs empower employees to contribute their time and skills to nonprofit organizations, creating a ripple effect of positive impact throughout the community.

Many of these companies have developed structured volunteer programs, including volunteer grant programs and Volunteer Time Off (VTO), which provide financial support and paid time for employees to volunteer. This culture of giving back is deeply embedded in New York’s corporate landscape, offering nonprofits valuable avenues to increase their resources and community engagement. Understanding these initiatives is essential for nonprofits aiming to maximize their partnerships with local businesses.

In this guide, we’ll walk you through:

New York City’s corporate volunteer landscape offers a wealth of opportunities, driven by its diverse economy and a strong emphasis on corporate social responsibility. With a broad range of industries, many companies in NYC are actively involved in giving back through volunteer programs and philanthropy initiatives. And we’re here to show you how you can tap into them!

What to Know About Major New York Companies in the Corporate Volunteer Space

New York City is not only the most populous city in the United States but also a global hub for commerce, finance, media, and culture. Its dynamic economy is home to thousands of companies, including a significant number of Fortune 500 and Fortune 1000 corporations. In fact, New York hosts more Fortune 500 headquarters than any other city in the country, underscoring its importance as a center for business leadership and innovation.

The city’s economic landscape is dominated by key industries such as technology, healthcare, media, and professional services. These sectors contribute to a thriving corporate environment that supports a wide range of philanthropic activities. Many nonprofits are headquartered or operate extensively in New York, benefiting from the city’s robust corporate giving culture.

Corporate volunteer programs are a vital part of this ecosystem. Companies recognize the value of encouraging their employees to engage with the community through volunteerism. This not only enhances employee satisfaction and retention but also strengthens the company’s social impact. As a result, nonprofits in New York can leverage these programs to expand their volunteer base and secure additional funding. By understanding the specific volunteer initiatives offered by these companies, nonprofits can tailor their outreach and partnership strategies to align with corporate goals and maximize mutual benefits.

Top Companies in New York That Offer Volunteer Grant Programs

Volunteer grant programs are a powerful tool for nonprofits seeking to increase funding through employee volunteerism. Many companies in New York have established such programs, allowing nonprofits to receive grants based on the number of volunteer hours logged by employees. These grants can significantly boost nonprofit budgets and support their missions.

New York Life Insurance

New York Life Insurance is a leading mutual life insurance company headquartered in New York City. Known for its strong commitment to community service, New York Life offers a volunteer grant program that rewards employees who dedicate their time to nonprofit organizations. Eligible employees can request grants after completing a minimum number of volunteer hours, typically around 10 hours per year. The program allows for multiple submissions annually, with grant amounts varying based on hours volunteered. This initiative encourages employees to engage deeply with causes they care about while providing nonprofits with valuable financial support.

Learn more about the program here!

Bank of New York

The Bank of New York, a major player in the financial services sector, supports community involvement through its volunteer grant program. Employees who volunteer a set minimum number of hours, often 10 or more, can submit requests for grants to the nonprofits they serve. The program is designed to be flexible, allowing employees to submit multiple grant requests throughout the year. This approach helps nonprofits benefit from sustained corporate support linked directly to employee volunteerism.

Learn more about the program here!

Pfizer

Pfizer, a global pharmaceutical giant headquartered in New York, offers a robust volunteer grant program as part of its corporate social responsibility efforts. Employees who volunteer their time to eligible nonprofits can request grants, with minimum volunteer hour requirements typically set at 10 hours. Pfizer’s program emphasizes support for health-related and community-focused organizations, reflecting the company’s mission. Grants are awarded on a rolling basis, providing nonprofits with timely financial assistance tied to employee engagement.

Learn more about the program here!

Verizon

Verizon Communications, a leader in telecommunications, has a well-established volunteer grant program that encourages employees to give back to their communities. Eligible employees who volunteer a minimum number of hours can submit grant requests to nonprofits they support. Verizon’s program often includes a cap on the maximum grant amount per employee per year, ensuring broad participation. The company also promotes volunteerism through additional incentives and recognition programs, enhancing the overall impact of its corporate giving.

Learn more about the program here!

Accenture

Accenture, a global professional services company with a strong presence in New York, offers a volunteer grant program that rewards employees for their community involvement. Employees who volunteer a minimum number of hours, usually 10 or more, can request grants for the nonprofits they serve. Accenture’s program is notable for its inclusivity, covering a wide range of volunteer activities and nonprofit types. The company encourages employees to engage regularly, with multiple grant submissions allowed annually.

Learn more about the program here!

American Express

American Express, a multinational financial services corporation headquartered in New York, supports volunteerism through its volunteer grant program. Employees who dedicate time to eligible nonprofits can request grants, with minimum volunteer hour requirements typically set at 10 hours. The program is designed to be user-friendly, allowing employees to submit grant requests multiple times per year. American Express also emphasizes volunteer activities that align with its corporate values, such as financial literacy and community development.

Learn more about the program here!

PwC (PricewaterhouseCoopers)

PwC, a global professional services network with offices in New York, offers a volunteer grant program that incentivizes employee volunteerism. Employees who complete a minimum number of volunteer hours can request grants for the nonprofits they support. PwC’s program is flexible, allowing multiple submissions and covering a broad spectrum of volunteer activities. The company’s commitment to corporate responsibility is reflected in its support for employee-driven philanthropy.

Learn more about the program here!

Warner Bros. Discovery

Warner Bros. Discovery, a major media and entertainment company based in New York, encourages employees to engage in volunteerism through its volunteer grant program. Employees who volunteer a minimum number of hours can request grants for their chosen nonprofits. The program supports a variety of causes, including arts, education, and community services. Warner Bros. Discovery’s initiative helps nonprofits tap into corporate resources linked directly to employee volunteer efforts.

Learn more about the program here!

Synchrony Financial

Synchrony Financial, a consumer financial services company headquartered in New York, offers a volunteer grant program that rewards employees for their volunteer hours. Eligible employees who meet the minimum volunteer hour threshold can submit grant requests to nonprofits. The program is designed to be accessible and encourages ongoing employee participation. Synchrony Financial’s support helps nonprofits increase funding while fostering a culture of community engagement within the company.

Learn more about the program here!

MetLife Services and Solutions

MetLife Services and Solutions, part of the global insurance and financial services provider MetLife, has a volunteer grant program that recognizes employee volunteerism. Employees who volunteer a minimum number of hours can request grants for the nonprofits they support. The program allows for multiple submissions and covers a wide range of volunteer activities. MetLife’s initiative reflects its commitment to social responsibility and community involvement.

Learn more about the program here!

Leading New York Companies That Provide Volunteer Time Off

Volunteer Time Off (VTO) programs are another impactful way companies support employee volunteerism. These programs provide paid time off for employees to volunteer during work hours, making it easier for them to contribute to causes they care about. Several leading companies in New York offer VTO programs, demonstrating their commitment to fostering a culture of giving back.

Bank of New York

The Bank of New York provides a VTO program that supports employee engagement in community service. Employees can take paid time off to volunteer, with eligibility criteria such as minimum tenure or role sometimes applying. The program promotes diverse volunteer opportunities and encourages employees to participate regularly. By offering VTO, the Bank of New York strengthens its ties to the community and enhances employee satisfaction.

Learn more about the program here!

Verizon

Verizon’s VTO program is designed to empower employees to contribute to their communities without sacrificing income. Employees receive paid time off specifically designated for volunteer activities, with clear guidelines on eligible causes and organizations. Verizon often pairs its VTO program with other volunteer incentives, creating a comprehensive approach to corporate social responsibility. This program is a key part of Verizon’s strategy to foster employee engagement and community impact.

Learn more about the program here!

MetLife

MetLife offers a VTO program that provides employees with paid time off to volunteer for nonprofit organizations. The program typically includes a set number of hours or days per year and may have eligibility requirements such as length of service. MetLife encourages employees to participate in a variety of volunteer activities, supporting causes that align with the company’s values. This program enhances MetLife’s commitment to social responsibility and community involvement.

Learn more about the program here!

Ernst & Young

Ernst & Young (EY), a global professional services firm with a strong presence in New York, offers a VTO program that allows employees to take paid time off for volunteering. The program supports a broad range of volunteer activities and encourages employees to engage with nonprofits regularly. EY’s VTO initiative is part of its broader corporate responsibility strategy, which emphasizes employee engagement and community impact. The program often includes additional support such as volunteer events and recognition.

Learn more about the program here!

Explore More New York Volunteer Programs with a Workplace Philanthropy Database

While the companies highlighted above represent some of the most prominent volunteer initiatives in New York, many more businesses in the city and further beyond offer volunteer grant programs and VTO opportunities as well. Nonprofits looking to expand their partnerships and funding sources can benefit greatly from using a workplace philanthropy database like Double the Donation.

Such databases provide comprehensive listings of companies offering various volunteer programs, including volunteer grants, volunteer time off, matching gifts, payroll giving, and more.

Moreover, these databases can be integrated directly into nonprofit workflows, such as registration forms, follow-up communications, and volunteer web pages. This integration ensures that every volunteer can determine their eligibility for corporate volunteer grants or VTO programs, maximizing the potential for additional support.

By leveraging a workplace philanthropy database, New York nonprofits can uncover a broader range of corporate volunteer initiatives, thereby enhancing their ability to engage with businesses and secure valuable resources. This strategic approach helps nonprofits build sustainable partnerships and deepen their impact within the community.

Wrapping Up & Final Thoughts

New York’s vibrant corporate landscape offers nonprofits a wealth of opportunities to engage with powerful volunteer initiatives. From volunteer grant programs to Volunteer Time Off, companies in the city are actively fostering a culture of community involvement and social responsibility. These programs not only provide nonprofits with critical financial support but also help build lasting relationships between businesses and the communities they serve.

Nonprofits can leverage these initiatives by understanding the specific programs offered by leading companies such as New York Life Insurance, Bank of New York, Pfizer, Verizon, and others. By aligning their outreach efforts with corporate volunteer programs, nonprofits can increase volunteer engagement, secure additional funding, and amplify their impact.

Ultimately, the powerful volunteer initiatives offered by New York companies represent a significant avenue for nonprofits to enhance their missions and create meaningful change. Embracing these opportunities can lead to sustained growth and stronger community partnerships.

Maximize Corporate Volunteering Opportunities with Double the Donation

Ready to unlock the full potential of corporate volunteer programs? With Double the Donation’s tools, you can effortlessly capture volunteer grants and employer-sponsored time off, helping you maximize the value of every hour your supporters give.

Don’t miss out on additional funding opportunities that could significantly boost your nonprofit’s revenue. Get started today, and see how easy it is to integrate volunteer incentives into your fundraising strategy. Let Double the Donation help you turn volunteer hours into lasting impact. Request a personalized demo today!

Companies in Seattle that Offer Powerful Volunteer Initiatives

/in Learning Center, Company Spotlights, Volunteer Grant Companies /by Adam WeingerSeattle stands as a vibrant city known not only for its stunning natural beauty but also for its dynamic business environment and thriving nonprofit sector. The city’s unique blend of innovation, culture, and community engagement creates fertile ground for impactful volunteer initiatives. Many companies headquartered in Seattle have embraced corporate social responsibility by developing robust volunteer programs that empower their employees to give back to the community in meaningful ways.

These volunteer initiatives range from volunteer grant programs, where companies provide financial support to nonprofits based on employee volunteer hours, to Volunteer Time Off (VTO) policies that allow employees to take paid time off to contribute their time and skills. For nonprofits operating in Seattle, understanding and leveraging these corporate volunteer programs can significantly enhance their capacity to serve and grow. This article explores the landscape of volunteer initiatives offered by major Seattle companies and how nonprofits can benefit from these opportunities.

In this guide, we’ll walk you through:

Seattle’s corporate volunteer scene is shaped by its diverse and innovative industries, from technology and aerospace to healthcare and retail. Many of the city’s largest companies are deeply invested in giving back to the community through robust volunteer programs and corporate social responsibility initiatives. In this guide, we’ll highlight the key companies in the corporate volunteer space and show you how to leverage these partnerships to enhance your nonprofit’s mission and strengthen community connections.

What to Know About Major Seattle Companies in the Corporate Volunteer Space

Seattle is a major hub for business and nonprofit activity, making it a unique ecosystem where corporate philanthropy thrives alongside a strong community spirit. The city is home to a diverse range of industries, including technology, aerospace, healthcare, and finance, all contributing to a robust economy that supports a vibrant nonprofit sector. This economic strength attracts many nonprofits to establish their presence in Seattle, creating a rich environment for collaboration between businesses and charitable organizations.

Seattle boasts a significant number of Fortune 500 and Fortune 1000 companies headquartered within its local region. The city ranks as one of the largest metropolitan areas in the United States by population and economic output, underscoring its importance on both national and global stages.

Key industries such as technology, aerospace, and retail dominate Seattle’s economy, and these sectors have embraced corporate volunteerism as a core part of their culture. Tech companies, in particular, have pioneered innovative volunteer grant programs and VTO policies that encourage employees to engage deeply with their communities. This culture of giving back is supported by a strong infrastructure of corporate philanthropy, making Seattle a model city for nonprofit and business partnerships.

For nonprofits, this means there is a wealth of opportunity to connect with companies that value volunteerism and community impact. By tapping into these corporate volunteer programs, nonprofits can access additional funding, increase volunteer engagement, and build lasting relationships with influential local businesses. Understanding the landscape of Seattle’s corporate volunteer initiatives is essential for nonprofits looking to maximize their impact and sustainability.

Top Companies in Seattle That Offer Volunteer Grant Programs

Many companies headquartered in Seattle offer volunteer grant programs, which provide nonprofits with financial support based on the volunteer hours contributed by employees. These programs vary in eligibility, grant amounts, and submission frequency, but all serve as valuable resources for nonprofits seeking to expand their funding and volunteer base.

T-Mobile

T-Mobile, a major telecommunications company based in Seattle, offers a volunteer grant program that rewards employees for their community service. Employees who volunteer a minimum number of hours, usually 10, can submit requests for grants up to $500 per year. The program supports various types of volunteer work, including education, health, and community development. T-Mobile’s commitment to social responsibility is reflected in its encouragement of employee engagement through these grants, which nonprofits can leverage to increase funding.

Learn more about the program here!

Microsoft

Microsoft, a global technology giant headquartered in the Seattle area, has a well-established volunteer grant program known as the Employee Giving Program. Employees who volunteer at least 15 hours annually can request grants of up to $500 for the nonprofits they support. Microsoft’s program is notable for its inclusivity, covering a broad spectrum of volunteer activities and allowing multiple grant submissions per year. This program is a significant resource for nonprofits in Seattle, given Microsoft’s large employee base and strong culture of philanthropy.

Learn more about the program here!

Google

Google’s Seattle office participates in the company’s global volunteer grant program, which enables employees to secure grants for nonprofits where they volunteer. Employees typically need to volunteer a minimum of 20 hours to qualify for a grant, with maximum amounts reaching $500 annually. Google’s program emphasizes support for education, technology access, and community development initiatives. Nonprofits in Seattle can benefit from Google’s volunteer grants by engaging with employees who are passionate about giving back.

Learn more about the program here!

Apple

Apple, with a significant presence in Seattle, offers a volunteer grant program that rewards employees for their community involvement. Employees who volunteer a minimum of 10 hours can request grants up to $500 per year. Apple’s program supports a wide range of volunteer activities, including environmental conservation, education, and health services. The company encourages employees to submit grant requests multiple times annually, providing ongoing support opportunities for nonprofits.

Learn more about the program here!

Cisco

Cisco, a leader in networking technology with offices in Seattle, provides a volunteer grant program that recognizes employee volunteerism. Employees who complete at least 10 hours of volunteer work can request grants up to $500 for eligible nonprofits. Cisco’s program supports diverse causes and allows multiple submissions per year. This initiative reflects Cisco’s commitment to corporate social responsibility and community engagement.

Learn more about the program here!

Honeywell

Honeywell, a multinational conglomerate with operations in Seattle, offers a volunteer grant program that encourages employees to contribute their time to charitable causes. Employees who volunteer a minimum of 10 hours can request grants up to $500 annually. Honeywell’s program supports a variety of volunteer activities and allows for multiple grant submissions, providing nonprofits with valuable funding linked to employee engagement.

Learn more about the program here!

SAP

SAP, a global software company with a Seattle presence, has a volunteer grant program that rewards employees for their community service. Employees typically need to volunteer at least 10 hours to qualify for grants up to $500 per year. SAP’s program supports a broad range of nonprofit causes and encourages repeated grant submissions, enhancing the potential for sustained nonprofit support.

Learn more about the program here!

Adobe

Adobe, a leader in creative software with offices in Seattle, offers a volunteer grant program that enables employees to request grants for nonprofits where they volunteer. Employees must complete a minimum of 10 volunteer hours to be eligible, with grants up to $500 annually. Adobe’s program supports diverse volunteer activities and allows multiple submissions, making it a valuable resource for nonprofits seeking corporate funding.

Learn more about the program here!

Alaska Airlines

Alaska Airlines, headquartered in Seattle, provides a volunteer grant program that rewards employees for their volunteer efforts. Employees who volunteer at least 10 hours can request grants up to $500 per year. The program supports a wide range of community causes and encourages employees to submit grant requests multiple times annually, offering nonprofits ongoing funding opportunities.

Learn more about the program here!

Starbucks

Starbucks, a Seattle-based global coffee company, offers a volunteer grant program that recognizes employee volunteerism. Employees who complete a minimum of 10 volunteer hours can request grants up to $500 annually. Starbucks supports various volunteer activities and allows multiple grant submissions, reflecting its commitment to community engagement and corporate social responsibility.

Learn more about the program here!

Leading Seattle Companies That Provide Volunteer Time Off

In addition to volunteer grant programs, many leading companies in Seattle offer Volunteer Time Off (VTO) policies. These programs allow employees to take paid time off to volunteer for causes they care about, enhancing employee engagement and providing nonprofits with valuable volunteer resources.

Nike

Nike, a global leader in athletic apparel with a significant presence in Seattle, offers a Volunteer Time Off program that provides employees with paid time to volunteer. Employees can usually take up to 16 hours of VTO per year. The program supports various volunteer activities, including youth sports, education, and environmental causes. Nike’s VTO program is designed to empower employees to make a positive impact while balancing work commitments.

Learn more about the program here!

Delta Air Lines

Delta Air Lines, with operations in Seattle, provides a Volunteer Time Off program that allows employees to take paid time off for volunteering. Employees are generally eligible for up to 8 hours of VTO annually. The program supports a broad range of volunteer activities and encourages employees to engage with causes that align with their passions. Delta’s VTO program enhances community involvement and strengthens employee connections to nonprofit organizations.

Learn more about the program here!

Lockheed Martin

Lockheed Martin, a major aerospace and defense company with a Seattle presence, offers a Volunteer Time Off program that provides employees with paid time to volunteer. Employees can typically access up to 16 hours of VTO per year. The program supports volunteer activities related to education, veterans’ services, and community development. Lockheed Martin’s VTO program reflects its commitment to corporate citizenship and community support.

Learn more about the program here!

Siemens AG

Siemens AG, a global industrial manufacturing company with offices in Seattle, provides a Volunteer Time Off program that allows employees to take paid time off for volunteering. Employees are usually eligible for up to 16 hours of VTO annually. The program encourages participation in a variety of volunteer activities, including STEM education, environmental sustainability, and social services. Siemens’ VTO program is part of its broader corporate responsibility strategy, promoting employee engagement and community impact.

Learn more about the program here!

Explore More Seattle Volunteer Programs with a Workplace Philanthropy Database

While the companies highlighted above represent some of the most prominent volunteer grant and VTO programs in Seattle, many more businesses in the city and beyond it offer similar initiatives that nonprofits can tap into. To uncover these additional opportunities, nonprofits can utilize a workplace philanthropy database like Double the Donation. Such databases provide comprehensive listings of corporate volunteer programs, including volunteer grants, matching gifts, payroll giving, and Volunteer Time Off policies.

These databases often include detailed program guidelines, eligibility criteria, and submission processes, enabling nonprofits to tailor their outreach and maximize funding opportunities.

Moreover, many workplace philanthropy databases can be integrated directly into nonprofit workflows, such as registration forms, volunteer follow-ups, and dedicated volunteer web pages. This integration ensures that every volunteer can determine their eligibility for corporate volunteer grants or VTO programs, streamlining the process and increasing the likelihood of securing additional support.

Wrapping Up & Final Thoughts

Seattle’s corporate landscape is rich with companies that offer powerful volunteer initiatives, including volunteer grant programs and Volunteer Time Off policies. These programs provide nonprofits with valuable resources to increase funding, expand volunteer engagement, and build meaningful partnerships with local businesses. By understanding the specific offerings of major Seattle companies such as Microsoft, Starbucks, and more, nonprofits can strategically leverage these opportunities to enhance their impact.

Nonprofits are encouraged to explore these programs actively and consider integrating workplace philanthropy databases into their operations to uncover even more opportunities. By doing so, they can deepen community ties, increase revenue streams, and foster long-term growth.

Discover How Double the Donation Can Help Your Nonprofit Grow Corporate Volunteering

Ready to unlock the full potential of corporate volunteer programs? With Double the Donation’s tools, you can effortlessly capture volunteer grants and employer-sponsored time off, helping you maximize the value of every hour your supporters give.

Don’t miss out on additional funding opportunities that could significantly boost your nonprofit’s revenue. Get started today, and see how easy it is to integrate volunteer incentives into your fundraising strategy. Let Double the Donation help you turn volunteer hours into lasting impact. Request a personalized demo today!

Companies in San Francisco that Offer Powerful Volunteer Initiatives

/in Learning Center, Company Spotlights, Volunteer Grant Companies /by Adam WeingerSan Francisco stands as a beacon of innovation and social responsibility, where the intersection of thriving businesses and passionate nonprofits creates a fertile ground for impactful volunteer initiatives. The city’s unique blend of technology, finance, and healthcare industries fosters a corporate culture deeply invested in community engagement and philanthropy. This environment not only benefits local nonprofits but also sets a national example for how companies can integrate volunteerism into their core values.

Many companies headquartered in San Francisco have embraced volunteer programs that empower their employees to give back in meaningful ways. These initiatives range from volunteer grant programs that financially reward employees’ volunteer hours to Volunteer Time Off (VTO) policies that provide paid time for community service. Understanding these programs is essential for nonprofits seeking to maximize their partnerships with corporate donors and volunteers in the city.

In this guide, we’ll walk you through:

San Francisco’s corporate volunteer landscape is rich with opportunities, driven by the city’s thriving tech industry and commitment to social good. Many of the world’s leading companies headquartered here prioritize giving back to the community through employee volunteer programs and corporate social responsibility initiatives. This guide will explore the top companies in San Francisco offering these opportunities, helping you connect with the right partners to amplify your nonprofit’s impact and foster meaningful community engagement.

What to Know About Major San Francisco Companies in the Corporate Volunteer Space

San Francisco is not only a cultural and technological hub but also a powerhouse in the corporate world. As the 14th largest city in the United States by population and a global center for innovation, it hosts a dynamic ecosystem where business and nonprofit sectors thrive side by side. The city’s economy is robust, driven by key industries such as technology, finance, biotechnology, and healthcare, all of which contribute significantly to corporate philanthropy and volunteerism.

Within San Francisco, there are over 30 Fortune 1000 companies, including several Fortune 500 giants, that have established headquarters or major operations. This concentration of corporate power translates into substantial resources and opportunities for nonprofits. Many of these companies have developed comprehensive volunteer programs that encourage employees to engage with their communities through both time and financial support.

The strong presence of tech giants, financial institutions, and healthcare leaders in San Francisco has cultivated a culture where corporate social responsibility is a priority. These companies recognize that supporting nonprofits through volunteer initiatives not only benefits the community but also enhances employee satisfaction and retention. As a result, nonprofits in San Francisco are uniquely positioned to leverage these corporate volunteer programs to expand their impact and secure additional funding.

Top Companies in San Francisco That Offer Volunteer Grant Programs

Volunteer grant programs are a powerful way for nonprofits to receive additional funding tied directly to the volunteer efforts of corporate employees. In San Francisco, many leading companies have established such programs, providing nonprofits with valuable opportunities to increase their revenue while benefiting from the time and talents of dedicated volunteers.

San Francisco Federal Credit Union

The San Francisco Federal Credit Union is a community-focused financial institution committed to supporting local causes. Their volunteer grant program rewards employees who dedicate time to nonprofit organizations, offering grants based on volunteer hours. Employees typically need to volunteer a minimum number of hours to qualify, and the program caps the maximum grant amount per employee annually. This initiative reflects the credit union’s dedication to community development and financial empowerment.

Learn more about the program here!

Google

Google, a global technology leader headquartered in the Bay Area, offers a comprehensive volunteer grant program that encourages employees to engage in community service. Eligible employees can submit volunteer hours to receive grants for the nonprofits they support. Google’s program often requires a minimum of 10 volunteer hours per grant request, with a maximum grant amount that can reach several hundred dollars annually. The company allows multiple submissions per year, enabling ongoing support for various causes.

Learn more about the program here!

Apple

Apple, renowned for its innovation in consumer electronics, also prioritizes corporate social responsibility through its volunteer grant program. Employees who volunteer a set number of hours can request grants that benefit the nonprofits they serve. Apple’s program typically includes eligibility for full-time employees and may have specific guidelines regarding the types of volunteer activities that qualify. The grants help amplify the impact of employee volunteerism by providing financial support alongside time contributions.

Learn more about the program here!

Microsoft

Microsoft’s volunteer grant program is part of its broader commitment to corporate citizenship. Employees who volunteer a minimum number of hours can apply for grants that support their chosen nonprofits. The program often features a generous maximum grant amount and allows employees to submit multiple requests annually. Microsoft’s initiative is designed to encourage sustained volunteer engagement and strengthen the connection between employees and community organizations.

Learn more about the program here!

Cisco

Cisco, a leader in networking technology, offers a volunteer grant program that rewards employees for their community involvement. Eligible employees can earn grants by volunteering a minimum number of hours, with the company providing financial support to the nonprofits benefiting from their time. Cisco’s program may include specific eligibility criteria and guidelines to ensure alignment with the company’s philanthropic goals.

Learn more about the program here!

Genentech

Genentech, a biotechnology pioneer based in San Francisco, supports volunteerism through its volunteer grant program. Employees who dedicate time to nonprofit causes can request grants that provide additional funding to these organizations. The program typically requires a minimum volunteer hour threshold and offers a maximum grant amount per employee annually. Genentech’s initiative reflects its commitment to advancing health and community well-being.

Learn more about the program here!

Adobe

Adobe, a global software company, encourages employee volunteerism with a volunteer grant program that translates volunteer hours into financial grants for nonprofits. Employees who meet the minimum volunteer hour requirement can submit grant requests, often with a cap on the total amount awarded per year. Adobe’s program supports a wide range of volunteer activities, emphasizing the company’s dedication to creativity and community impact.

Learn more about the program here!

SAP

SAP, a multinational software corporation, offers a volunteer grant program that incentivizes employees to engage in community service. Eligible employees who volunteer a specified number of hours can apply for grants that benefit their nonprofit partners. The program includes guidelines on qualifying volunteer activities and maximum grant amounts, helping nonprofits secure additional resources tied to employee engagement.

Learn more about the program here!

Airbnb

Airbnb, a leader in the hospitality and travel industry, has established a volunteer grant program to support employee-driven community service. Employees who volunteer a minimum number of hours can request grants for the nonprofits they assist. The program often allows multiple submissions per year and includes eligibility criteria to ensure broad participation. Airbnb’s initiative aligns with its mission to create a world where anyone can belong anywhere, including through community support.

Learn more about the program here!

Leading San Francisco Companies That Provide Volunteer Time Off

Volunteer Time Off (VTO) programs are an increasingly popular way for companies to encourage employees to contribute to their communities without sacrificing income. In San Francisco, several leading companies have adopted VTO policies that provide paid time off specifically for volunteering, enabling employees to support causes they care about during work hours.

Salesforce

Salesforce, a global leader in customer relationship management software, offers a robust VTO program that allows employees to take paid time off to volunteer. Employees are typically eligible for up to 56 hours of VTO annually, which they can use to support a wide range of nonprofit activities. Salesforce’s program includes guidelines to ensure volunteer activities align with the company’s values and encourages employees to engage deeply with their communities.

Learn more about the program here!

Atlassian

Atlassian, a software company known for collaboration tools, provides a VTO program that grants employees paid time off to volunteer. The program typically offers a specific number of hours annually and encourages employees to engage with nonprofits that align with Atlassian’s commitment to social impact. Eligibility criteria and guidelines help ensure the program supports meaningful volunteer experiences.

Learn more about the program here!

Wells Fargo

Wells Fargo’s VTO program is part of its comprehensive approach to corporate social responsibility. Employees can take paid time off to volunteer for causes important to them, with the company providing a set number of VTO hours each year. The program supports a broad range of volunteer activities and is designed to foster a culture of giving back within the organization.

Learn more about the program here!

Johnson & Johnson

Johnson & Johnson, a global healthcare company, offers a VTO program that enables employees to dedicate paid time to volunteer work. The program includes eligibility requirements and guidelines to ensure volunteer activities align with the company’s mission of advancing health and well-being. Employees are encouraged to use their VTO hours to support nonprofits that make a positive impact in their communities.

Learn more about the program here!

Explore More San Francisco Volunteer Programs with a Workplace Philanthropy Database

While the companies highlighted above represent some of the most prominent volunteer grant and VTO programs in San Francisco, many more businesses in the city and beyond offer similar initiatives that nonprofits can tap into. To uncover these additional opportunities, nonprofits can leverage workplace philanthropy databases like Double the Donation, which provide comprehensive listings of corporate volunteer programs.

Integrating a corporate volunteer database into nonprofit workflows can streamline the process of identifying eligible volunteers and matching their efforts with corporate programs. For example, nonprofits can embed these tools into registration forms, follow-up communications, and volunteer web pages, ensuring that every volunteer has the opportunity to maximize their impact through corporate incentives. Not to mention, beyond volunteer grants and VTO, these platforms also include information on matching gift programs, payroll giving, and other forms of workplace giving that can significantly boost nonprofit funding and engagement.

By utilizing a workplace philanthropy database, nonprofits in San Francisco can expand their reach, deepen corporate relationships, and unlock new revenue streams that support their missions. This strategic approach to corporate engagement is essential for organizations looking to thrive in a competitive philanthropic landscape.

Wrapping Up & Final Thoughts

San Francisco’s vibrant corporate environment offers nonprofits a wealth of opportunities to engage with powerful volunteer initiatives. From volunteer grant programs offered by companies like Google, Apple, and Wells Fargo to Volunteer Time Off policies at Salesforce and Johnson & Johnson, the city’s leading businesses demonstrate a strong commitment to community involvement.

Nonprofits that understand and leverage these programs can significantly enhance their impact by securing additional funding and encouraging deeper volunteer engagement. These corporate initiatives not only provide financial support but also foster long-term relationships between nonprofits and businesses, creating a sustainable ecosystem of giving and service.

By exploring the full range of volunteer programs available in San Francisco, including those accessible through workplace philanthropy databases like Double the Donation, nonprofits can position themselves for greater success. Taking advantage of these opportunities is a strategic step toward building stronger communities and achieving lasting social change.

Maximize Your Corporate Volunteer Potential with Double the Donation Volunteering

Ready to unlock the full potential of corporate volunteer programs? With Double the Donation’s tools, you can effortlessly capture volunteer grants and employer-sponsored time off, helping you maximize the value of every hour your supporters give.

Don’t miss out on additional funding opportunities that could significantly boost your nonprofit’s revenue. Get started today, and see how easy it is to integrate volunteer incentives into your fundraising strategy. Let Double the Donation help you turn volunteer hours into lasting impact. Request a personalized demo today!

Companies in Charlotte that Offer Powerful Volunteer Initiatives

/in Learning Center, Company Spotlights, Volunteer Grant Companies /by Adam WeingerCharlotte, North Carolina, stands as a vibrant and growing metropolitan area known for its dynamic business environment and strong community spirit. As a major hub for finance, technology, and manufacturing, the city has attracted a diverse array of corporations that not only drive economic growth but also actively engage in philanthropic efforts. These companies recognize the importance of giving back to the community, and many have developed robust volunteer initiatives that empower their employees to contribute time and resources to local nonprofits.

Nonprofits in Charlotte benefit greatly from this corporate culture of volunteerism. The presence of numerous Fortune 500 and Fortune 1000 companies headquartered or operating in the city creates a fertile ground for partnerships that enhance community impact. Volunteer grant programs and Volunteer Time Off (VTO) policies are just two examples of how Charlotte’s corporate sector supports nonprofit organizations, helping them expand their reach and effectiveness through employee engagement and financial support.

In this guide, we’ll walk you through:

Charlotte’s corporate volunteer landscape offers a unique blend of opportunities for nonprofits. With many companies in Charlotte embracing corporate social responsibility, nonprofits can tap into a range of volunteer programs designed to foster employee engagement and support local initiatives.

What to Know About Major Charlotte Companies in the Corporate Volunteer Space