Matching Gifts + More: Tips for Special Fundraising Events

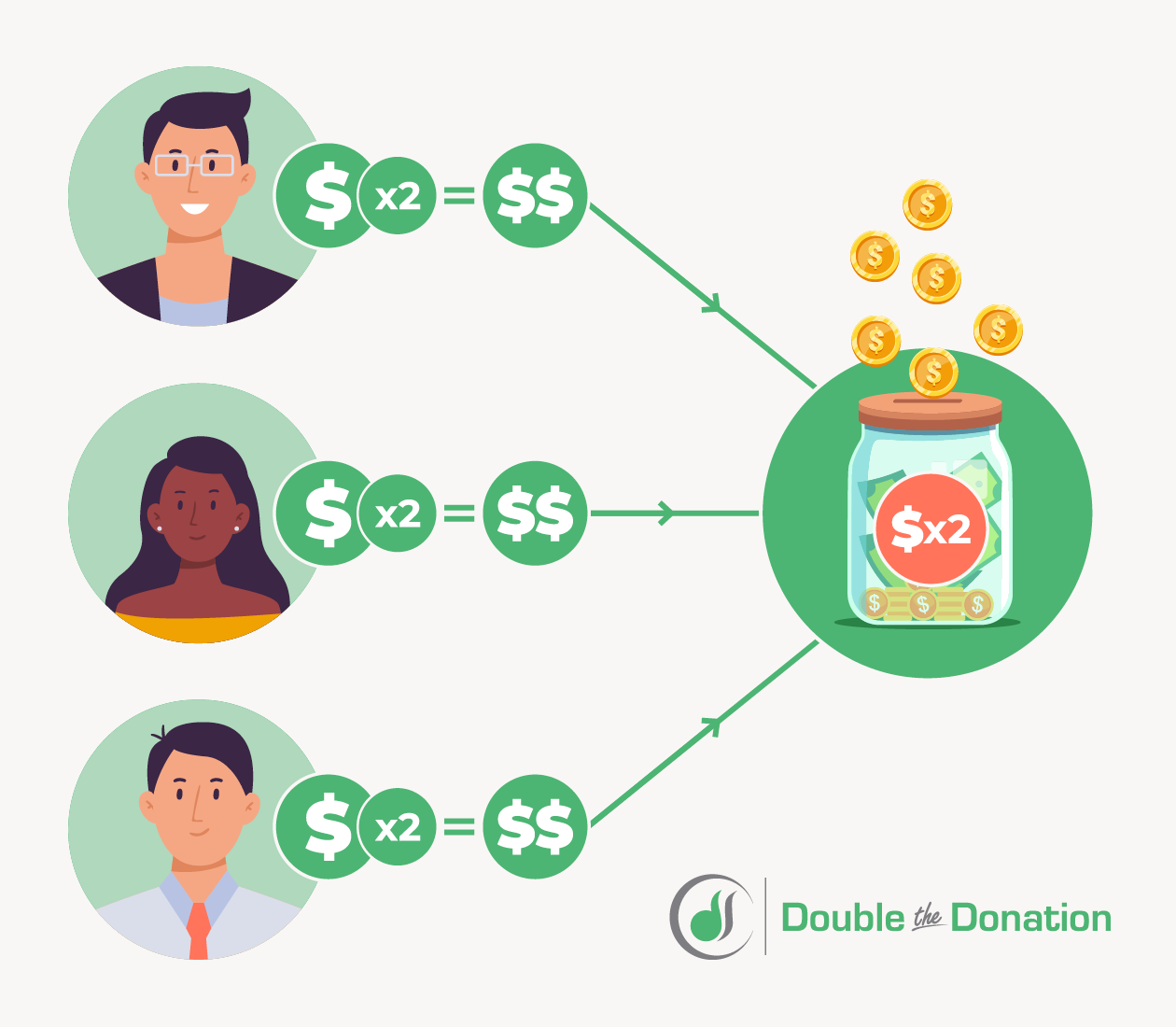

Special fundraising events are a golden opportunity for nonprofits to raise significant funds, build relationships, and generate excitement around their cause. However, the success of these events doesn’t just rely on ticket sales or individual donations. Corporate giving, particularly through matching gifts, can dramatically increase the total funds raised with minimal extra effort. But matching gifts are just the beginning. There are several other forms of corporate support that can be leveraged during these events, from in-kind donations to employee volunteer programs and event sponsorships.

In this post, we’ll explore how nonprofits can tap into these various forms of corporate giving to maximize the impact of their special fundraising events.

- Eligibility of Donations Made at Galas and Special Events

- Matching Gifts for Peer-to-Peer Fundraisers

- Tips for Promoting Matching Gifts to Special Event Attendees

- Incorporating Corporate Giving Beyond Matching Gifts

- How a Workplace Giving Database Can Help

With the right strategies, your organization can boost revenue, strengthen partnerships, and create a more engaging and rewarding experience for your supporters. Let’s dive into how you can make the most of matching gifts and more to enhance your next event.

Eligibility of Donations Made at Galas and Special Events

Because of your familiarity with the nonprofit world, you likely know that organizations typically incorporate donation requests within their special events. Let’s take a look at some notable special events hosted by some major, well-known organizations:

- The Greater Los Angeles Zoo Association provides individuals with exclusive naming rights. For donations between $1,000-$50,000, you can name an animal, receive recognition in the zoo publication, have your photo taken with the animal, and get a VIP tour.

- The Atlanta Botanical Garden has its Garden of Eden Gala, the organization’s largest annual fundraiser. Tickets range in price from a few hundred dollars to $25,000 for the presenting sponsor. Benefits include tickets to the organization’s Ball, a Patron Party, and much more.

- NEXT for Autism hosts its annual “Night of Too Many Stars”. Celebrities such as Jon Stewart, Katie Perry, Amy Poehler, Tina Fey, Seth Rogen, and many others auction off once-in-a-lifetime opportunities to hang out with them. For instance, becoming “best friends with Amy Poehler & Tina Fey” for an evening was auctioned for thousands of dollars a few years ago.

But where do matching gifts fit into these donations? It may come as a surprise, but many companies that offer matching gift programs will match contributions made at special events!

When reviewing a company’s matching gift form, you may notice a sentence similar to “the corporation will not match tickets or subscription costs.” For instance, if your organization is a symphony selling a concert ticket or a science museum selling an IMAX ticket, most companies won’t match the ticket price. The reason is that donors are receiving a tangible benefit that other for-profit organizations would charge for. For example, an IMAX movie could be compared to a regular movie ticket, while a symphony could be compared to a sporting event ticket.

If that’s the case, then why are gala tickets and special event tickets often eligible?

If you look at the fine print on many nonprofits’ special event tickets, you’ll notice that it mentions a tax-deductible amount for each ticket. That tax-deductible dollar amount is what’s eligible to be matched.

So, what does that mean? In general, when it comes to galas and other special fundraising events, you must subtract the cost of a similar meal and any gifts that guests receive. Otherwise, it won’t be considered matching-gift eligible. For instance, if you host a gala and sell $500 tickets, you have to determine the fair market value of the benefits. In other words, how much would someone spend on the event if it weren’t a fundraiser?

Let’s say people would typically spend $100 for a gala, plus $50 on the meal at a local restaurant. That makes the fair market value $150, meaning the tax-deductible amount is $350. In this case, $350 is the amount that would likely be eligible for matching.

The Bottom Line: A significant percentage of a gala ticket’s price is tax-deductible and is often eligible to be matched by an employee’s company. However, corporate guidelines do vary by company, so it’s a good idea to stay informed about your donors’ corporate programming.

Matching Gifts for Peer-to-Peer Fundraisers

In addition to galas and auctions, another popular event type for nonprofits is the peer-to-peer fundraiser. Often structured as a run/walk/ride event, these initiatives are an increasingly popular strategy that allows individuals to fundraise on behalf of your organization. And these events can be match-eligible, too! In fact, some companies offer to match not only the portion of funds that an employee donates themselves, but the entire amount the individual fundraised on behalf of your nonprofit, exponentially increasing the funds raised during these campaigns.

A number of major companies offer these particularly lucrative programs for peer-to-peer fundraisers. Some of the largest corporations with matching gift programs for employee fundraising efforts include:

- Intuit: Known for its generously philanthropic culture, Intuit matches employee donations and fundraising efforts, providing a valuable boost to nonprofit causes.

- McAfee: McAfee’s matching gift program is well-known in the tech industry. Employees who fundraise for a charitable cause can have their contributions matched, significantly increasing the funds raised during events.

- British Petroleum: BP matches employees’ fundraising efforts, particularly for charitable walkathons and other events. This program is a great way to boost contributions from their global workforce.

- State Street Corporation: With a strong commitment to community engagement, State Street encourages employees to fundraise for causes they are passionate about, offering matching gifts to further support their efforts.

- CVS Health: CVS Health offers a matching gift program that supports employee fundraising efforts, especially for health-related causes. Employees who participate in peer-to-peer fundraising can have their donations matched, further amplifying the impact of their contributions during events.

These are just a few examples, but there are many other companies that offer similar programs. By researching and identifying corporations that match employee fundraising, you can tap into new revenue streams and increase the effectiveness of your peer-to-peer campaigns.

Tips for Promoting Matching Gifts to Special Event Attendees

Matching gifts are a powerful tool for increasing fundraising revenue, but they are often underutilized during special events. As a result, nonprofits are much more likely to receive matching gifts for regular donations or annual fund contributions, making it crucial to raise awareness and promote matching gifts specifically during your event. However, with special events, there’s an added complexity: many attendees may not realize that a portion of their event ticket price or auction purchase is tax-deductible and eligible for matching gifts.

Even if donors are familiar with their company’s matching gift program, they rarely know that the amount they paid for their event ticket could be matched by their employer. This lack of awareness can lead to missed opportunities for increasing funds. Here’s how to ensure your donors know about matching gifts and are encouraged to take full advantage of this opportunity during your special event:

Here are a few easy suggestions we recommend:

1. Include Tax-Deductible Information on Event Tickets

Start by making the matching gift opportunity clear right on your event tickets. Many donors simply don’t realize that part of the ticket price is tax-deductible, and therefore eligible for matching gifts. If you don’t include this information, you risk donors not following through with the matching process.

What to Do:

-

On your event invitations, tickets, and confirmation pages, add a line such as: “Did you know $X of your ticket is tax-deductible? If your employer offers a matching gift program, you may be eligible to have your donation matched.”

-

Include the fair market value (or FMV) of the event’s benefits (such as meals or entertainment) to clearly show donors what portion is deductible and what portion is not.

This minor addition to your ticket materials can play a significant role in ensuring that donors easily recognize their eligibility for matching gifts, thus prompting them to take the next step.

2. Ask About Matching Gifts at Payment Stations

When donors are at payment stations or kiosks to pay for auction items, make additional donations, or complete their ticket purchases, ensure that your staff is actively prompting them to check if their company offers a matching gift program. These are key moments when donors are already engaged in the giving process, making them more likely to act on the opportunity to have their contributions matched.

What to Do:

-

Train your event staff to ask, “Do you work for a company that offers a matching gift program? If so, we’d love to help you get your donation matched!”

-

If possible, provide a quick reference sheet or matching gift search tool at the payment stations to make it easy for donors to look up their eligibility right there.

Even a brief prompt at a key time like this can significantly increase the chances that donors will pursue a matching gift after the event.

3. Use Event Signage to Raise Awareness

Visual prompts at your event can be a powerful way to encourage donors to think about matching gifts in real-time. Signage placed in strategic locations, such as near the ticket desk, auction area, or donation stations, can help spread awareness about matching gifts without overwhelming your guests.

What to Do:

-

Display large, clear signs that highlight matching gift opportunities. Include text like: “Double Your Impact: If your employer offers matching gifts, your donation today can be doubled!”

-

Use simple, eye-catching designs to make the process easy to understand, including a quick reference to a matching gift search tool and contact information for any questions.

This kind of helpful visual reminder can prompt event attendees to inquire further about matching gifts, even if they weren’t thinking about it before.

4. Follow Up After the Event with Matching Gift Reminders

Even after the event ends, your work isn’t done. Some matching gift programs have a short window for submission, so it’s important to send a follow-up email or reminder after the event to ensure donors don’t miss the chance to have their gifts matched. This is especially critical for donors who were unaware of the matching gift opportunity during the event or may have forgotten to submit the match request.

What to Do:

-

Send a thank-you email to event attendees, including a reminder to check if their employer offers a matching gift program.

-

Include a direct link to a matching gift search tool and clear instructions on how to apply for the match.

-

Consider offering personalized assistance for donors who might need help submitting their matching gift requests, ensuring that the process is as easy as possible.

Incorporating Corporate Giving Beyond Matching Gifts

How a Workplace Giving Database Can Help

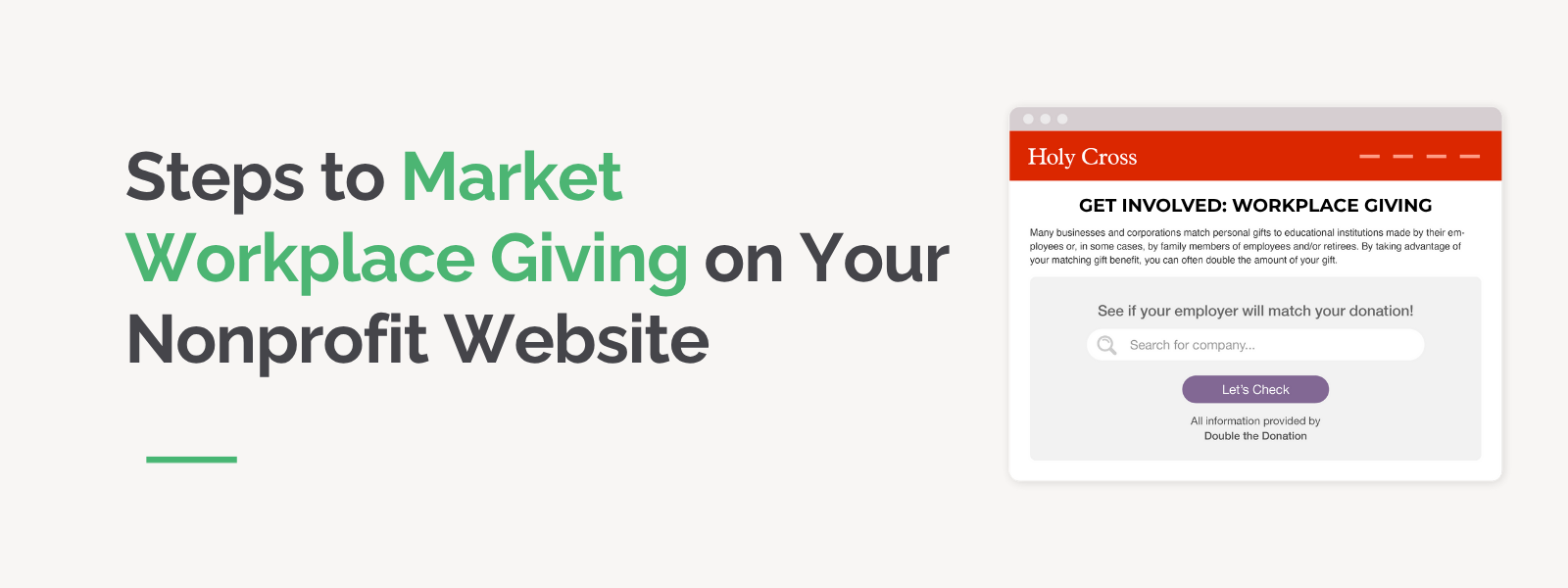

While matching gift and workplace giving software often play a key role in a nonprofit’s year-round fundraising strategy, they can also be a huge asset during special fundraising events. Leveraging a workplace giving database, like Double the Donation, can help your nonprofit maximize its revenue potential by making it easier for donors to access matching gift opportunities, even in the high-energy, fast-paced atmosphere of your event.

One of the most powerful features of a workplace giving database is its ability to make corporate philanthropy accessible for every donor at your event. Here’s a look at how the tool can seamlessly integrate into your special event fundraising strategy:

- Embed a matching gift search tool in your event website: Give attendees an easy way to check if their employer participates in matching gift programs, increasing the likelihood that they’ll follow through with the process while the event is still fresh in their minds.

- Automate matching gift reminders: Ensure donors don’t forget about the opportunity to double or triple their impact. Set up email campaigns to remind attendees about matching gifts after the event, providing clear instructions on how to submit their requests.

- Identify broader workplace giving programs, including volunteer grants and payroll giving: Workplace giving isn’t just about matching gifts. Double the Donation’s platform helps you identify other corporate giving programs, such as volunteer grants and payroll giving.

- Source corporate grant and in-kind donation opportunities: By identifying companies with active corporate giving programs, you can secure additional resources like event sponsorships, product donations, or specialized services.

- Collect employer data for targeted outreach: Easily collect employer information from donors during the event. This allows you to track which companies are providing matching gifts and target them with personalized outreach.

- Integrate with your other fundraising and event tools: Connect Double the Donation to your donation platforms, event management software, and donor CRM systems. These integrations streamline your process, making it easier to collect information, track donations, and follow up with donors without needing to switch between tools.

All in all, incorporating matching gifts into your special fundraising events doesn’t have to be a complicated or overwhelming process. By using tools like Double the Donation and integrating matching gift promotions into your event planning, you can ensure that your donors take full advantage of matching gift opportunities, resulting in significant additional funding for your cause.

Wrapping Up & Final Thoughts

Corporate philanthropy represents a significant opportunity for nonprofits. By taking the time to incorporate it into your fundraising and outreach strategies, you set your nonprofit up for success. Few nonprofits take the time to do proper research on these programs. Because of that, they overlook major revenue opportunities.

Now that you know special event tickets and donations can be matched by most employers, and what other corporate giving opportunities are out there, it’s time to get started boosting your revenue today!

![How to Register Your Nonprofit for Payroll Giving [6 Steps] How to Register Your Nonprofit for Payroll Giving [6 Steps]](https://doublethedonation.com/wp-content/uploads/2025/06/DTD_How-to-Register-Your-Nonprofit-for-Payroll-Giving-6-Steps_Feature.png)

![How to Find Grants for Nonprofits [Quickly & Easily!] How to Find Grants for Nonprofits [Quickly & Easily!]](https://doublethedonation.com/wp-content/uploads/2025/01/DTD_How-to-Find-Grants-for-Nonprofits-Quickly-Easily_Feature.png)