Corporate Grant Guidelines: What to Know to Increase Funding

Corporate philanthropy represents a massive, often untapped reservoir of revenue for the nonprofit sector. While individual donations and annual fundraising events are the lifeblood of many organizations, corporate grants for nonprofits can provide the substantial capital injections necessary to launch new programs, expand facilities, or stabilize operations. However, unlocking these funds requires more than just a worthy cause and a compelling story. It requires a mastery of corporate grant guidelines.

These guidelines serve as the rulebook, the map, and the gatekeeper to corporate treasuries. Every company that engages in philanthropy, from local businesses to Fortune 500 giants, operates under a specific set of criteria designed to ensure its charitable giving aligns with its business goals, brand values, and community footprint. For a nonprofit development director, understanding these guidelines is the difference between a rejected application and a funded proposal. Ignoring them is the quickest way to have your application discarded, while adhering to them signals professionalism and partnership potential.

In this guide, we’ll cover:

- The strategic importance of analyzing grant guidelines before applying

- How to decipher eligibility requirements regarding mission and location

- Navigating submission deadlines and funding cycles

- Understanding grant amounts and budget restrictions

- Best practices for tailoring proposals to meet specific corporate criteria

- How to leverage technology to streamline your grant research

Securing corporate grants is a competitive process, but it is not a lottery. It is a strategic exercise in alignment. By thoroughly understanding corporate grant guidelines, you can stop wasting time on long-shot applications and focus your energy on the partners who are actively looking for an organization just like yours.

What Are Corporate Grant Guidelines?

At their core, corporate grant guidelines are the parameters set by a company or its corporate foundation to manage the flow of charitable requests. Because corporations receive thousands of solicitations annually, they must establish strict filters to manage the volume and ensure their giving remains strategic. These guidelines are not meant to discourage you but rather to save time for both the applicant and the grantor by clearly defining what is—and what is not—a good fit.

These guidelines typically outline the “Who, What, Where, When, and How Much” of the company’s giving strategy. They are usually found on the company’s “Corporate Social Responsibility” (CSR), “Community Relations,” or “Investor Relations” webpages. For nonprofits, these documents are the cheat codes to the test. They tell you exactly what the funder wants to accomplish.

For example, a technology company might have guidelines that restrict funding to STEM education initiatives, while a grocery chain might focus strictly on hunger relief and nutrition. If your nonprofit focuses on art history, applying to the tech company would likely be a waste of resources, regardless of how well-written your proposal is. Understanding the “why” behind the guidelines helps you appreciate that these rules exist to maximize the impact of the corporation’s specific philanthropic vision.

Did You Know? Corporate grants often differ from private foundation grants in that they are frequently tied to the company’s marketing or employee engagement goals. While a private foundation exists solely to give money away, a corporation exists to generate profit, and its philanthropy often supports that goal by building brand loyalty or improving community relations in areas where they operate.

Decoding Eligibility: Mission and Location

The two most significant hurdles in any set of corporate grant guidelines are mission alignment and geographic scope. These are usually the first two questions on any eligibility quiz, and failing either results in an immediate disqualification.

Mission Alignment and Focus Areas

Corporations rarely give to “general good causes.” Instead, they establish specific pillars of giving that align with their industry or brand identity. This is often referred to as strategic philanthropy.

- Industry Alignment: A bank is likely to fund financial literacy programs, housing stability, or economic development. A pharmaceutical company will focus on health outcomes and medical research.

- Values Alignment: Companies often support causes that matter to their employees or customers. A retailer with a young customer base might focus on environmental sustainability, while a company with a veteran-heavy workforce might prioritize veteran affairs.

When reviewing guidelines, look for keywords that match your programs. If a guideline specifies “K-12 Education,” do not apply for your adult literacy program unless you can draw a very direct line between the two. The most successful grant writers are those who can frame their existing programs to fit the specific language used in the funder’s guidelines.

Geographic Restrictions

Unlike national foundations that may fund anywhere in the country, corporate grant giving is often intensely local. The mantra for corporate grants is often “give where we live and work.” Corporations want to improve the communities where their employees reside and where their customers shop.

- Headquarters vs. Footprint: Almost all companies give in the city of their corporate headquarters. However, retail chains, banks, and utility companies often have grant programs for every region where they have a branch or store.

- The “Employee Presence” Rule: Many guidelines state that they only fund organizations in communities with a significant number of employees. If you are a local nonprofit in Ohio, applying to a corporation based in California with no Ohio presence is likely futile.

Always check the “Locations” or “Where We Give” section of the guidelines before proceeding. If you are outside their footprint, your only chance of funding is usually if you have a personal connection to a high-level executive, and even then, the guidelines often prevail.

Navigating Submission Deadlines and Cycles

In the world of corporate grants, timing is everything. Corporate grant guidelines will detail the submission process, which generally falls into one of two categories: rolling deadlines or fixed funding cycles.

Rolling Deadlines

Some companies, particularly those with local community grant programs, accept proposals year-round. They review applications periodically (monthly or quarterly) and disburse funds until their annual budget is depleted.

- The Strategy: Apply early in the fiscal year. Once the budget is gone, even the best proposals will be turned away or deferred to the next year. Knowing when the company’s fiscal year starts is a crucial piece of intelligence.

Fixed Funding Cycles

Larger corporate foundations often operate with strict windows. The guidelines might state, “Education grants are accepted from January 1st to March 31st,” or “Health grants are reviewed in Q3.”

- The Strategy: Mark these dates on your calendar well in advance. These systems often close automatically at 5:00 PM on the deadline day. Attempting to submit a proposal at 5:01 PM usually results in being locked out.

The Letter of Inquiry (LOI)

Some guidelines require a preliminary step called a Letter of Inquiry. This is a short summary of your project. Only if the LOI is approved are you invited to submit a full proposal. This saves you from writing a 20-page narrative for a grant you have no chance of winning. If the guidelines mention an LOI, do not send a full proposal; it shows you cannot follow instructions.

Quick Tip: Create a “Grant Calendar” specifically for corporate opportunities. Unlike private foundations that might have consistent annual deadlines, corporate cycles can change based on business performance or shifts in corporate strategy. Review the guidelines on their website at the start of every quarter to ensure your calendar is up to date.

Understanding Grant Amounts and Budgetary Rules

One of the most common mistakes nonprofits make is asking for the wrong amount of money. Corporate grant guidelines almost always provide parameters regarding grant sizes. Asking for $100,000 from a program that typically awards $5,000 shows a lack of research and can lead to a quick rejection.

Minimum and Maximum Awards

Guidelines will often list a range, such as “Grants typically range from $2,500 to $10,000.”

- The “Sweet Spot”: If you are a new applicant, it is generally wise to ask for an amount in the mid-to-lower range. Once you have successfully managed a smaller grant and built a relationship, you can ask for larger amounts in subsequent years.

- Outlier Requests: If you need $50,000 for a capital campaign, do not apply to a local community grant program capped at $5,000. You need to find a different funding vehicle, perhaps through the company’s corporate headquarters or a specific capital campaign initiative.

Use of Funds

Guidelines also dictate how the money can be used.

- Program Support vs. General Operating: Most corporate grants are restricted to specific programs (e.g., buying books for a reading program). General operating support (keeping the lights on) is harder to find in the corporate world, though some progressive companies are moving in this direction.

- In-Kind Limitations: Some guidelines specify that they do not give cash but are willing to provide in-kind donations for nonprofits or services. If you need cash, do not apply to an in-kind program. Conversely, if you need products (like lumber from a hardware store or food from a grocer), look for guidelines specifically governing in-kind requests.

The Application Process: From Guideline to Grant

Once you have analyzed the corporate grant guidelines and determined that you are a perfect fit, it is time to apply. The application process acts as the final filter, testing your ability to communicate your mission clearly and compliantly.

The Online Portal

Most major corporations now use online grant management systems (like CyberGrants, Benevity, or YourCause). You will likely need to create an account, complete an eligibility quiz, and upload documents.

- Preparation: Have your Tax ID (EIN), IRS determination letter, list of board members, and current operating budget ready as PDF files. The eligibility quiz will ask the “knockout questions” based on the guidelines (e.g., “Are you a 501(c)(3)?” “Are you located in X county?”). Answering “no” to any of these based on the guidelines will end the application immediately.

The Narrative

Your proposal narrative should mirror the language found in the guidelines. If the company uses the term “food insecurity,” do not just say “hunger”; use their terminology. Explain how your program directly advances the goals they outlined in their guidelines.

- Measurable Outcomes: Corporations love data (ROI). Your application should clearly state the expected return on their investment. “This grant will allow us to serve 500 more meals,” or “This funding will provide job training to 50 veterans.”

Stewardship and Reporting

The guidelines often detail what happens after you get the money. Most corporate grants come with a reporting requirement. You will need to tell the company how the money was spent and the impact it achieved. Failing to submit a report is a guaranteed way to be blacklisted from future funding. Read the reporting guidelines before you accept the money to ensure you have the capacity to track the required data points.

Did You Know? Employee engagement is often a hidden guideline. Many companies prioritize grants to organizations where their employees already volunteer. If you have a group of volunteers from a specific company, mention that relationship in your grant application. It proves you are already a trusted partner in their ecosystem.

Maximizing Success with Technology and Research

Trying to manually track the changing guidelines of hundreds of corporations is a recipe for burnout. Savvy nonprofits leverage technology to streamline this process.

Corporate Giving Databases

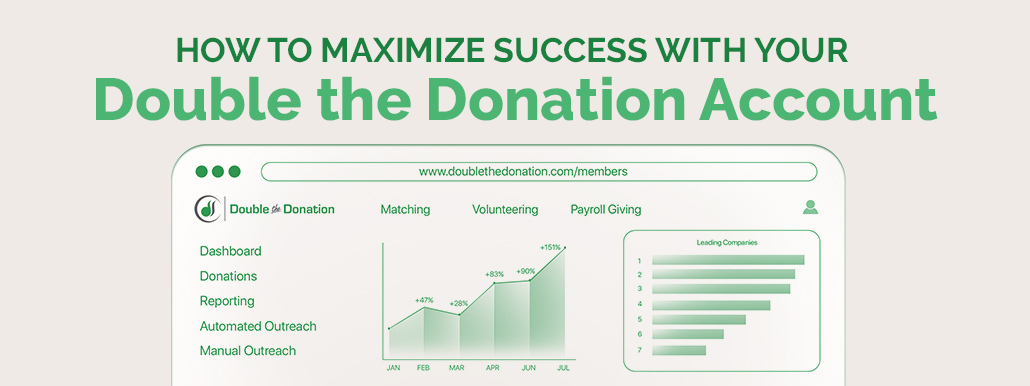

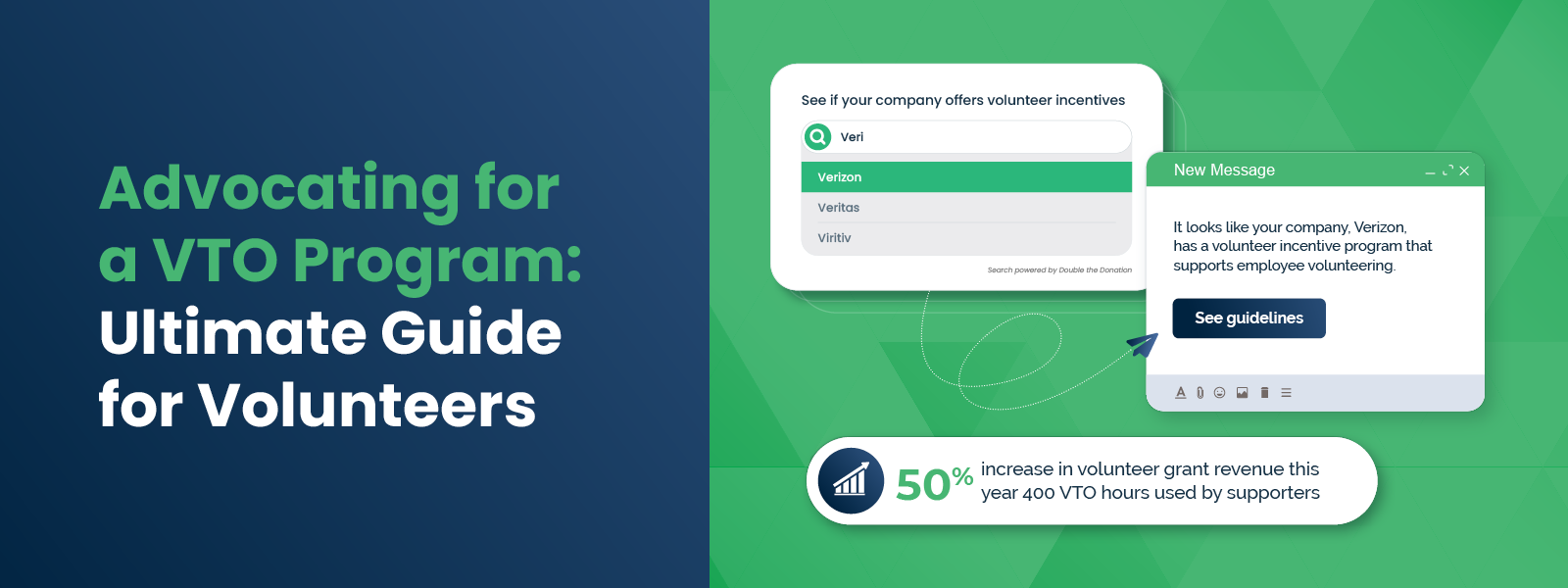

Tools like Double the Donation are essential for modern fundraising. While often used for matching gifts, these comprehensive databases also house vital information on volunteer grants and community giving programs. They can help you quickly identify which companies have guidelines that match your mission and location. By using a database, you can filter thousands of companies down to a manageable prospect list in minutes rather than days.

Employer Appends

Another strategy is to look at your existing donor data. Using a service to append employer information to your donor records can reveal “hidden” connections. If you discover that 50 of your donors work for Bank of America, you have a compelling case to present to their local grant officer. You can demonstrate that their employees are already financially invested in your success, which strongly aligns with guidelines regarding employee engagement.

Conclusion: Wrapping Up & Next Steps

Mastering corporate grant guidelines is the cornerstone of a successful corporate fundraising strategy. These documents are not just bureaucratic hurdles; they are the keys to the kingdom. They tell you exactly what a company values, where they invest, and how they want to be engaged. By respecting these rules and tailoring your approach to fit them, you distinguish your nonprofit as a professional, strategic partner.

When you align your mission with a corporation’s CSR goals, respect their geographic footprint, and adhere to their submission cycles, you move from “chasing money” to “building partnerships.” This shift leads to sustainable revenue, deeper relationships, and ultimately, a greater impact on the communities you serve.

Ready to start securing corporate grants?

- Audit Your Prospects: Look at your top local employers and vendors. Visit their websites and download their grant guidelines.

- Check Eligibility: Be ruthless. If you don’t fit the guidelines, don’t apply. Focus your limited time on the “high fit” opportunities.

- Leverage Your Network: Ask your board and volunteers where they work. Use those internal connections to get a “warm introduction” to the community relations department.

- Utilize Tools: Explore databases that aggregate corporate grant and matching gift information to save time and uncover new opportunities.

Corporate funding is out there, waiting for organizations that take the time to read the map. Start studying the guidelines today, and chart your course to your next major grant.

See how Double the Donation’s corporate giving database can help! Request a personalized demo to get started today.