Master These Payroll Giving Best Practices: Helpful Tips

Securing a reliable stream of unrestricted revenue is the “holy grail” for nonprofit development teams. While major gifts and grants provide significant influxes of capital, they often lack the consistency required for long-term operational stability. This is where payroll giving emerges as a transformative solution. Often overshadowed by its more famous cousin, matching gifts, payroll giving is a powerful mechanism that allows employees to donate to charities directly from their salary, often on a pre-tax basis. It is a gateway to predictable, recurring income that builds a foundation of financial security for your organization.

Despite the clear financial advantages, many nonprofits struggle to capitalize on this opportunity. The barrier is rarely a lack of donor interest; rather, it is the friction associated with the process. Donors often do not know if they are eligible, or they find the enrollment process through their corporate portals too cumbersome to navigate. To unlock this potential, organizations must adopt specific payroll giving best practices that prioritize user experience and education. By making it effortless for supporters to determine their eligibility and providing them with direct pathways to enroll, you can turn passive interest into active, long-term support.

In this guide, we’ll cover:

- The strategic value of payroll giving for donor retention

- Using technology to instantly determine donor eligibility

- Streamlining the enrollment process with direct links

- Building a high-converting dedicated web page

- Marketing strategies to normalize workplace giving

- Incentivizing participation and stewarding relationships

- Measuring success with data-driven KPIs

Success in payroll giving does not happen by accident. It requires a deliberate strategy to remove barriers and guide donors from intent to action. By implementing these best practices, you can integrate payroll giving into your core fundraising efforts and secure a steady flow of support that grows with every paycheck.

Understanding the Strategic Value of Payroll Giving

Before executing a campaign, it is vital to understand why payroll giving is worth the investment. At its core, payroll giving is a “set and forget” donation method. Once an employee opts in, the donation is deducted automatically from their salary during each pay cycle. This automation eliminates the need for monthly credit card entries or manual check writing, drastically reducing the friction that leads to donor churn.

Predictable Revenue Streams: For nonprofits, the primary benefit is the creation of a consistent cash flow. Unlike sporadic one-time gifts, payroll donations provide a steady baseline of income that allows for better financial planning and program continuity. This predictability is essential for budgeting and scaling operations with confidence.

Higher Donor Retention: Payroll donors tend to donate for longer periods than those who give via other channels. Because the deduction happens automatically and often pre-tax, the donor effectively “doesn’t miss” the money, making them less likely to cancel the recurring gift during belt-tightening periods. This leads to significantly higher lifetime value (LTV) for each supporter acquired through this channel.

Tax Efficiency for Donors: It is important to articulate the financial benefits to the donor as well. Donations made through payroll giving are often deducted from gross pay before tax is calculated. This tax-efficient giving method means that a donation costs the employee less in real terms than a standard post-tax donation, allowing them to give more to your cause without significantly impacting their take-home pay.

Did You Know? Payroll giving offers a unique “win-win-win” scenario. Nonprofits gain lower administrative overhead and sustainable income; donors enjoy tax-efficient, effortless giving; and employers boost their Corporate Social Responsibility (CSR) profile and employee engagement.

Best Practice 1: Determine Eligibility with Precision

The first major hurdle in payroll giving is awareness. Many supporters simply do not know that their employer offers a giving program. To overcome this, you must make it incredibly easy for donors to determine their eligibility without forcing them to dig through their own HR handbooks.

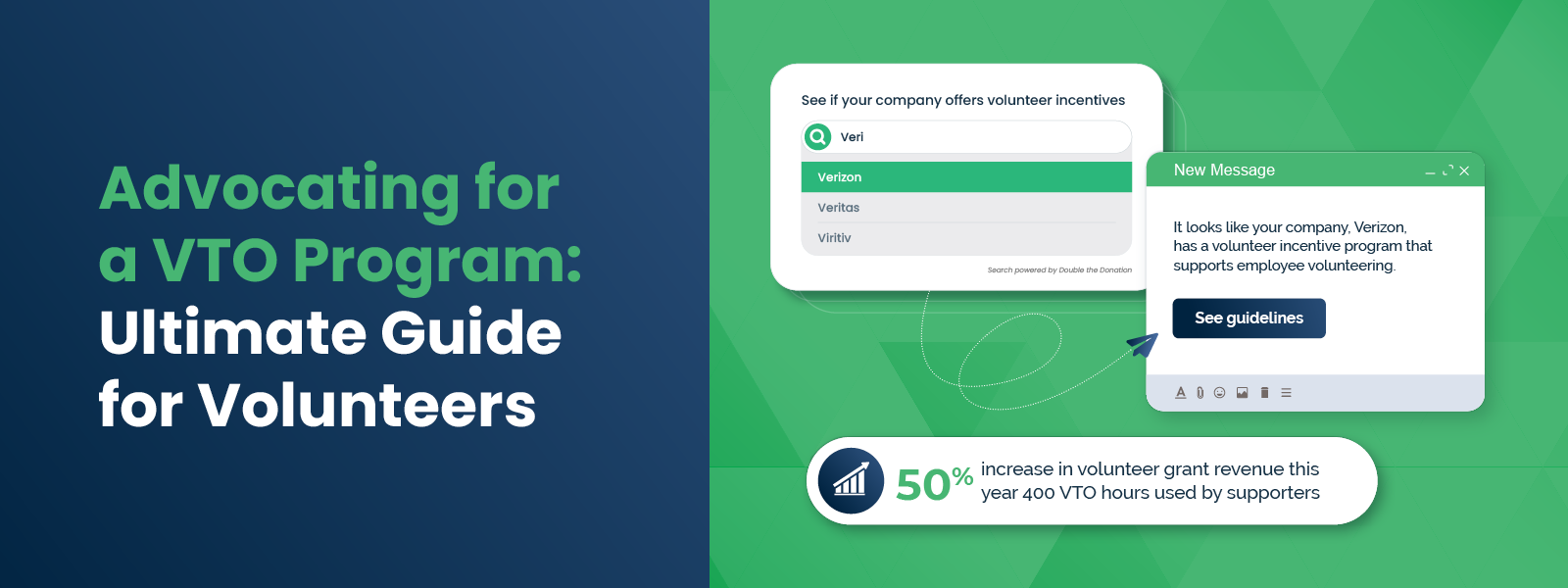

- Leverage Database Search Tools: The most effective way to solve the eligibility puzzle is by integrating an employer search tool directly into your fundraising infrastructure. Tools like Double the Donation’s payroll giving widget allow donors to enter their company name and instantly see whether their employer offers payroll giving, matching gifts, or volunteer grants.

- Capture Employment Data Early: Don’t wait until a donor has already given to ask about their employer. Incorporate an optional “Company” or “Employer” field into your donation forms, event registrations, and volunteer sign-ups. By collecting this data upfront, you can screen your existing database using employer appends to identify high-value segments of donors who work for companies with established payroll giving programs.

- Promote Search Functionality: Place your eligibility search tool prominently on your website. It should not be hidden on a sub-page; it should be integrated into your main “Ways to Give” page and your dedicated payroll giving landing page. The goal is to reduce the cognitive load on the donor. If they can type their company name and get an instant “Yes,” they are far more likely to proceed to the next step.

Best Practice 2: Streamline Enrollment with Direct Links

Once a donor knows they are eligible, the next obstacle is the enrollment process itself. Navigating corporate intranets or third-party CSR platforms can be confusing. To maximize conversion, you must provide clear, company-specific instructions that bridge the gap between your website and their payroll system.

- Provide Company-Specific Instructions: Generic instructions like “ask your HR department” are conversion killers. Instead, provide detailed, step-by-step guides for major employers. For example, if you know a large portion of your donor base works for a specific corporation, outline exactly which portal they need to visit and which forms to fill out.

- Link to Giving Platforms: Many companies manage their payroll giving through third-party platforms like Benevity, Blackbaud, CyberGrants, or YourCause. If possible, provide direct links to your organization’s profile within these platforms. This allows the donor to click a button on your site, log in to their corporate portal, and land directly on your donation page, minimizing the risk of drop-off.

- Simplify the Ask: When providing instructions, keep them simple and actionable. Use clear calls to action such as “Enroll Now” or “Go to Employee Portal.” If the process requires filling out a physical form, provide a downloadable PDF of that form pre-filled with your nonprofit’s details (Tax ID, address, etc.) to save the donor time.

Quick Tip: Create a “Cheat Sheet” for your donors. List the top 10-20 employers in your donor base and provide a one-click link or a specific set of instructions for each. This tailored approach demonstrates that you value their time and understand their specific workplace environment.

Best Practice 3: Establish a Dedicated Web Page

Your website is the hub of your fundraising efforts, and payroll giving deserves its own spotlight. A dedicated payroll giving landing page serves as a central resource where you can educate donors, explain the benefits, and guide them through the enrollment process.

- Educational Content: Use this page to explain what payroll giving is in simple, user-friendly terms. Avoid jargon. Clearly articulate the benefits for the donor, such as tax efficiency and the convenience of automatic deductions.

- Visual Impact: Incorporate visuals that demonstrate the power of recurring giving. Use an impact calculator or infographic to show how a small deduction per paycheck adds up over a year. For example, show that $10 per pay period provides enough food for a family for a month.

- Social Proof: Include testimonials from current payroll donors. Stories from peers are powerful motivators. A quote from a donor saying, “I love payroll giving because I don’t even miss the money, but I know I’m making a difference every two weeks,” can be very persuasive.

- Employer Search Tool: Embed your Double the Donation search widget directly on this page. This allows visitors to immediately check their eligibility and access the specific forms and guidelines they need to participate.

Best Practice 4: Leverage Multi-Channel Marketing

Building the program infrastructure is only half the battle; you must also actively market it. Payroll giving should be woven into your broader nonprofit marketing strategy to normalize it as a standard way to give.

- Email Campaigns: Email remains a highly effective channel for donor communication. Segment your email lists to target past donors, volunteers, or event attendees who have already expressed interest in your cause. Send targeted campaigns to donors with known employers, explicitly mentioning their company’s program: “Did you know [Company Name] allows you to donate directly from your paycheck?”.

- Social Media Integration: Use social media to raise awareness. Share short, educational posts explaining how payroll giving works. Create graphics that highlight the ease of the process. You can even run specific campaigns, such as a “Payroll Giving Week,” to create a sense of urgency and focus. Use hashtags like #GiveThroughWork or #PayrollGiving to increase discoverability.

- Newsletter Features: Include a permanent “Payroll Giving” section or button in your regular newsletters. Even a small P.S. line at the bottom of donation appeals can be effective: “Want to make your donation go further? Sign up for payroll giving and support us every payday”.

Best Practice 5: Incentivize and Steward Donors

People are more likely to take action when they feel recognized and valued. Because payroll giving is often invisible (happening automatically in the background), deliberate stewardship is essential to keep these donors engaged.

- Offer Exclusive Perks: Consider creating a special club or designation for payroll donors. Offer incentives such as welcome gifts (stickers, mugs), digital badges they can share on LinkedIn, or access to exclusive donor-only webinars and events.

- Corporate Match Bonuses: If a corporate partner is willing, organize a “match drive” where the company agrees to double or triple payroll donations for a limited time. This creates a powerful incentive for employees to sign up immediately.

- Regular Impact Reporting: Don’t let payroll donors feel like an ATM. Send them exclusive updates that show exactly how their sustained support is making a difference. Frame these communications as appreciation rather than solicitation. For example: “Thanks to payroll donors like you, we were able to plan ahead and launch this new program”.

Best Practice 6: Measure Success and Optimize

To ensure your payroll giving program grows over time, you must track its performance. Data-driven insights allow you to identify bottlenecks in the enrollment process and refine your marketing strategies.

- Key Metrics to Track: Establish a baseline and monitor key performance indicators (KPIs). Important metrics include:

- Number of active payroll donors: Tracks growth and participation trends.

- Total revenue from payroll giving: The core financial metric for assessing ROI.

- Donor retention rate: A high retention rate signals strong engagement and program “stickiness”.

- Employer participation rate: Which companies have the highest number of enrolled employees?.

- Consolidate Data: Payroll giving data often comes from multiple sources: different corporate portals and your own CRM. Create a centralized tracking system to consolidate this information. Regular reporting reviews will help you spot trends, such as a sudden drop-off in donors from a specific company, allowing you to intervene quickly.

- Iterate and Improve: Use this data to continuously improve your donor journey. If you see high traffic to your payroll giving page but low conversions, you may need to simplify the instructions or make the search tool more prominent. Regularly solicit feedback from current payroll donors to understand their motivations and pain points.

Wrapping Up & Next Steps

Implementing these payroll giving best practices is a strategic investment in the long-term sustainability of your nonprofit. By shifting your focus from passive acceptance to active promotion, you can unlock a reliable revenue stream that complements your existing fundraising efforts. Payroll giving transforms one-time donors into consistent partners, allowing your mission to grow with every paycheck.

To get started, audit your current website and donation forms. Ensure you are capturing employment data and providing a clear, searchable pathway for donors to check their eligibility. Build a dedicated resource page, and begin segmenting your email communications to target employees at companies with known programs.

Ready to streamline your corporate fundraising? Request a demo with Double the Donation to see how our industry-leading tools can help you identify, track, and secure more workplace giving and matching gift opportunities today.