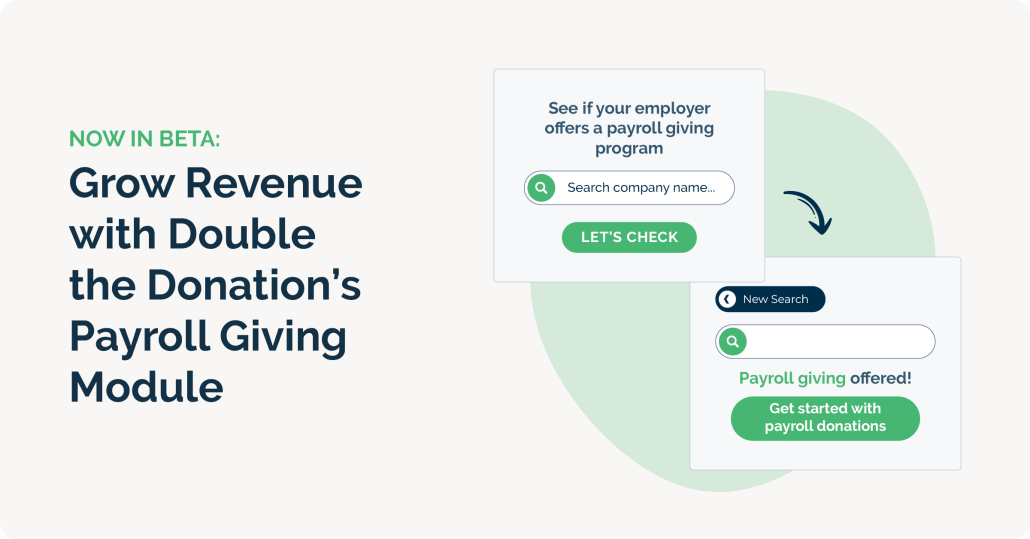

Now in Beta: Grow Revenue with Double the Donation’s Payroll Giving Module

In today’s fundraising landscape, corporate giving is growing in scale and impact. Since Double the Donation’s inception, we’ve remained committed to helping nonprofits and schools tap into that sustainable support through matching gifts and volunteer grants. Over the years, we’ve identified over $1 billion in workplace giving opportunities for over 6,000 fundraising organizations in our network.

We’re proud of these results, and we’re excited to take that even further with the beta launch of our Payroll Giving Module. This newest module is a first-of-its-kind solution, designed to enhance your workplace giving strategy by helping you uncover recurring, payroll donations with ease.

Why Payroll Giving Is a Missed Opportunity

While payroll giving is one of the most common employer-sponsored giving programs, it’s also one of the most underutilized. In fact, 59% of donors are unaware it even exists.

This represents a missed opportunity for nonprofits to grow funding and engage supporters meaningfully. When donors can give directly from their paycheck, it creates a habitual, easy giving experience for them that brings long-term value and health to your organization.

How this Newest Module Enhances the Double the Donation Workplace Giving Suite

Our new Payroll Giving Module works alongside your existing matching gift tools and volunteer grant tools to give you a complete picture of a supporter’s workplace eligibility. Collectively, the tools enable smarter workplace giving outreach so that you can tap into new revenue channels and strengthen your relationships.

Here’s what you can accomplish with the payroll giving module:

-

Make it easy for supporters to discover payroll giving

Embed our newest payroll giving plugin on your website in minutes. Then, supporters can type in their employer’s name and instantly see whether payroll giving is available along with any relevant match or volunteer grant opportunities.

Tip: Effectively market workplace giving on your website by placing this plugin on your payroll giving page, while using our matching gift and volunteer plugins on their respective pages. This ensures each supporter sees the most relevant opportunity first.

-

Unlock payroll gifts from your existing supporters

The payroll giving module relies on cross-module insights, so no manual upload is needed. Whenever a donor record enters your Double the Donation Matching account, we automatically screen it for payroll giving eligibility, too. That means you’ll see eligible supporters surfaced in your payroll giving dashboard for easy segmentation and follow-up.

Tip: Leverage our integrations to connect your donation forms and volunteer management system (VMS) with Double the Donation so that you can pass more supporter data into your account. The more supporter records in your account, the more opportunities you can uncover across programs!

What it means for your organization

The Payroll Giving Module gives you a new, easy path to grow recurring revenue without adding complexity.

By using our full suite of solutions, including our Matching module, Volunteering module, and newest Payroll Giving module, you can:

- Uncover multiple revenue streams from a single piece of supporter employment data

- Engage supporters meaningfully, based on their employer’s giving programs

- Expand your corporate fundraising with smarter tools and insights

If you’re already investing in workplace giving, this module can help you scale your success and grow funds.

Frequently Asked Questions (FAQ)

1. What is Double the Donation’s new Payroll Giving Module?

The Payroll Giving Module is a new feature designed to help nonprofits identify, track, and grow recurring payroll donations from supporters. It allows nonprofits to surface payroll-eligible donors and integrate payroll giving insights with existing workplace giving programs.

2. How does the Payroll Giving Module work for nonprofits and donors?

The module embeds a payroll giving plugin directly onto nonprofit websites, enabling donors to search for their employer’s payroll giving program. It identifies whether a donor is payroll-giving eligible and provides nonprofits with visibility into recurring workplace gifts previously hidden or hard to track.

3. What benefits does the Payroll Giving Module offer nonprofits using Double the Donation?

The module helps nonprofits unlock new recurring revenue streams, improve donor engagement, and streamline payroll giving workflows. By unifying payroll giving data with matching gift and volunteer grant insights, nonprofits can run more strategic, comprehensive workplace giving campaigns.

4. Why did Double the Donation expand its database to include payroll giving programs?

Payroll giving programs represent a valuable yet often overlooked source of recurring donations. By adding payroll giving to its database, Double the Donation helps nonprofits easily discover employer programs, engage eligible donors, and capture consistent workplace giving revenue.

5. How does access to payroll giving data help nonprofits grow revenue?

With employer payroll giving information integrated into the platform, nonprofits can identify new giving opportunities, better segment donor outreach, and promote recurring donations that provide long-term financial stability. This data ensures nonprofits never miss a payroll giving opportunity again.

How to get started

The payroll giving module is available in open beta to all current Double the Donation clients at no extra cost.

Current user? Log into your account and follow the self guided tour.

Not using Double the Donation yet? Connect with our team to learn how you can start growing your workplace giving revenue using our full suite of tools.