How Universities Can Increase Payroll Donation Funds

Universities play a vital role in shaping the future by educating students, advancing research, and fostering community engagement. To sustain and expand these impactful initiatives, securing reliable funding streams is essential. One often underutilized source of consistent support is payroll donations, a form of workplace giving that can significantly boost university fundraising efforts.

By encouraging faculty, staff, alumni, and supporters to participate in payroll donation programs, universities can tap into a steady flow of contributions that accumulate over time. This approach not only diversifies funding but also builds a community of committed donors who contribute regularly, helping universities plan and grow with confidence.

Table of Contents

- What are payroll donations?

- How do payroll donation funds benefit universities?

- Best practices for universities to drive payroll donation funds

- Companies that offer payroll donations to universities

- Case study: University of South Carolina’s payroll giving strategy

- Payroll donation FAQ for universities

What are payroll donations?

Payroll donations are a convenient and effective way for employees to support nonprofit organizations, including universities, by having a portion of their paycheck automatically donated on a recurring basis. This form of workplace giving allows donors to contribute manageable amounts regularly without the need for repeated manual transactions.

Typically, these donations are facilitated through employer giving platforms or coordinated by human resources departments. Many employers also offer matching gift programs that can double or even triple the impact of these contributions, making payroll donations an even more powerful funding source.

Because payroll donations are deducted directly from paychecks, they provide a consistent and predictable stream of income for nonprofits. This steady flow of funds is especially valuable for universities, which rely on ongoing support to maintain scholarships, research projects, and campus programs.

Moreover, payroll donations often appeal to donors who prefer to give smaller amounts regularly rather than making large one-time gifts. This accessibility encourages broader participation and fosters a culture of sustained generosity within the university community.

How payroll donations work

Employees opt in to payroll giving through their employer’s platform or HR department, selecting the organization they wish to support. The chosen donation amount is then automatically deducted from each paycheck and sent to the designated organization.

Employers may provide tools or portals where employees can manage their giving preferences, track donations, and learn about matching opportunities. This integration simplifies the process and enhances donor engagement.

Benefits of payroll donations for donors

For donors, payroll giving offers convenience, ease of budgeting, and the satisfaction of making a meaningful impact without the hassle of repeated donation requests. It also often includes tax advantages, as donations are typically made pre-tax or are tax-deductible, depending on local regulations.

How do payroll donation funds benefit universities?

Payroll donation funds provide universities with a reliable and sustainable source of revenue that supports their mission over the long term. While individual contributions may be modest, the cumulative effect of many donors giving regularly creates a significant and steady funding stream.

This predictability allows university development teams to plan budgets more effectively, ensuring that essential programs and services receive consistent support. It also enables investment in new initiatives, infrastructure improvements, and scholarship funds that enhance the university’s impact.

One of the key advantages of payroll donations is that they often represent unrestricted funds. Unlike grants or designated gifts, unrestricted donations give universities the flexibility to allocate resources where they are most needed, responding to emerging challenges and opportunities.

Furthermore, payroll donations symbolize ongoing commitment from supporters who believe deeply in the university’s mission. This recurring engagement fosters a strong sense of community and loyalty, which can translate into increased advocacy, volunteerism, and larger gifts over time.

Steady revenue for core programs

Universities rely on consistent funding to maintain scholarships, faculty research, student services, and campus facilities. Payroll donations help stabilize these core areas by providing dependable income that is less susceptible to economic fluctuations or one-time campaign cycles.

Flexibility through unrestricted funds

Because payroll donations are often unrestricted, universities can use these funds to address urgent needs, pilot innovative projects, or cover operational costs that might not be supported by restricted grants or endowments.

Building donor loyalty and engagement

Regular payroll donors tend to develop a deeper connection with the university, increasing the likelihood of continued support and participation in other fundraising activities. This ongoing relationship is invaluable for long-term institutional sustainability.

Best practices for universities to drive payroll donation funds

To maximize payroll donation participation, universities should adopt a strategic approach that raises awareness, simplifies the giving process, and nurtures donor relationships. Clear communication and consistent outreach are essential components of a successful payroll giving program.

Registering with CSR platforms

Registering with corporate social responsibility (CSR) platforms that facilitate payroll giving is critical. These platforms connect fundraising organizations with employers and employees, expanding the university’s visibility among potential donors.

Educating supporters

Regular communication through multiple channels ensures that supporters understand how payroll donations work and the difference their contributions make. Universities can use newsletters, social media campaigns, and special events to inform supporters about the benefits and ease of payroll donations. Highlighting stories of impact and donor testimonials can motivate participation.

Dedicated payroll donation webpage

Creating a dedicated payroll donation page or section on the university’s website provides a centralized resource where donors can learn about the program, check eligibility, and sign up. This page should be user-friendly and include clear calls to action.

Encouraging recurring giving during campaigns

Encouraging recurring giving during peak fundraising campaigns, such as annual giving drives or homecoming events, can boost payroll donation sign-ups. Offering recognition and expressing gratitude to payroll donors regularly helps maintain engagement and encourages retention.

Recognizing and thanking donors

Consistency in messaging and donor stewardship builds trust and reinforces the value of every gift, no matter the size. Universities that demonstrate the tangible impact of payroll donations inspire continued generosity and deepen supporter commitment.

Companies that offer payroll donations to universities

Many companies incorporate payroll donation programs into their workplace giving or corporate social responsibility (CSR) initiatives. These programs are common among large corporations and businesses that prioritize employee engagement and community involvement.

Employers such as Netflix, Etsy, Pacific Gas and Electric Company, and Aetna offer payroll giving options that enable their employees to support nonprofits, including universities, through automatic paycheck deductions.

Universities should identify which of their current or potential supporters work for these companies with payroll donation options. Collecting employer information during volunteer or donor intake processes can help development teams target outreach effectively.

Researching workplace giving platforms and registering the university as a beneficiary increases visibility and accessibility for employees interested in payroll donations. By understanding where supporters work and how payroll giving is administered, universities can proactively position themselves to receive these valuable funds.

Case study: University of South Carolina’s payroll giving strategy

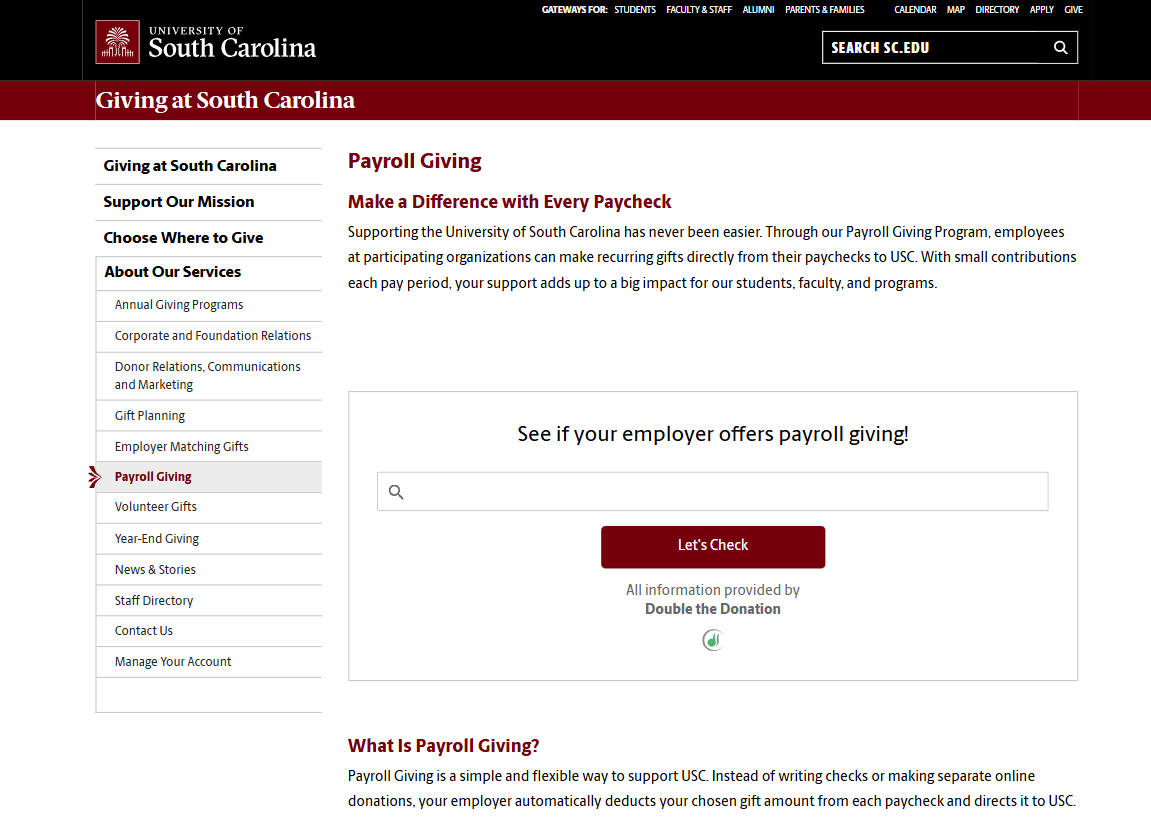

The University of South Carolina (USC) provides a sophisticated blueprint for how higher education institutions can transform the routine of workplace compensation into a primary driver for student and faculty success. By integrating a payroll donation portal into its advancement strategy, the university positions paycheck-based giving as a flexible, high-impact alternative to traditional check-writing.

View the web page here: https://sc.edu/giving/about_our_services/payroll-giving/index.php

Streamlining the Donor Journey through Integrated Search

The centerpiece of USC’s strategy is its ability to remove the administrative “friction” that often discourages busy professionals from initiating a pledge. Rather than requiring donors to navigate their own corporate HR portals, the university brings the tools to them.

Key elements of this user-friendly approach include:

- Embedded Corporate Search Tool: The portal features a prominent search bar that allows supporters at various participating organizations to instantly check for payroll giving eligibility.

- Automated Logistics: The university highlights that once a donor chooses a gift amount, their employer handles the deduction and directs the funds to USC automatically, ensuring a “set-it-and-forget-it” experience for the donor.

- Small Gifts, Big Results: USC’s messaging explicitly reinforces that even small contributions from each pay period add up to a significant impact over the academic year.

Building a Reliable Foundation for Academic Excellence

For universities, payroll deductions represent a premium form of recurring revenue that supports long-term institutional stability. By promoting these gifts as a way to support students, faculty, and programs simultaneously, USC allows donors to feel personally invested in the entire university ecosystem with every paycheck. This proactive digital stance helps the institution bridge the gap between alumni pride and practical philanthropy.

Payroll donation FAQ for universities

Can payroll donations be changed or stopped by the donor at any time?

Yes, donors typically have full control over their payroll donations and can adjust or cancel their contributions through their employer’s giving platform or HR department at any time. This flexibility makes payroll giving accessible and donor-friendly.

Are payroll donations tax-deductible?

In most cases, payroll donations to qualified nonprofit organizations, including universities, are tax-deductible. Donors should consult their tax advisor or review local tax laws to understand specific benefits and reporting requirements.

How can universities track payroll donations from multiple employers?

Universities can use donor management software and workplace giving platforms to track payroll donations. Collecting employer information during donor intake and integrating with tools that identify payroll giving eligibility helps streamline tracking and stewardship.

Do all companies offer payroll donation programs?

No, not all employers provide payroll donation options. Larger corporations and those with established CSR programs are more likely to offer these benefits. Universities should focus outreach on supporters employed by companies known to have payroll giving initiatives.

Can payroll donations be combined with matching gift programs?

Yes, many employers offer matching gift programs that complement payroll donations. This means that donations made through payroll giving can be matched by the employer, effectively increasing the total contribution to the university.

Concluding thoughts on payroll donations for universities

Payroll donations represent a simple, sustainable, and often underused funding stream that universities can leverage to enhance their financial stability and mission impact. By encouraging supporters to participate in payroll giving, universities gain access to a steady flow of unrestricted funds that support core programs and foster long-term donor relationships.

Implementing best practices such as partnering with CSR platforms, educating donors, and recognizing contributors can significantly increase payroll donation participation. Understanding the payroll giving programs offered by companies enables universities to strategically engage supporters and unlock new revenue opportunities.

Ultimately, payroll donations empower universities to build a resilient funding base that sustains their vital work in education, research, and community development.

Empower your university’s fundraising with Double the Donation

Unlock the full potential of payroll giving with Double the Donation’s powerful, easy-to-use tools. Our Payroll Giving module automatically identifies which of your supporters work for companies that offer payroll giving programs, giving you the insights you need to reach the right people at the right time. From there, we provide company-specific program details so donors can take action quickly: no guesswork, no missed opportunities. By leveraging our solution, your organization can turn hidden eligibility into steady, recurring revenue that fuels your mission all year long.

Get a demo of Double the Donation today to learn more and see the tools in action.