How Food Banks Can Increase Payroll Donation Funds

Food banks play a critical role in addressing food insecurity and supporting vulnerable communities. To sustain and expand their vital services, these organizations need reliable and consistent funding sources. One often overlooked but highly effective method to boost financial support is through payroll donations.

Payroll donations offer a unique opportunity for food banks to tap into workplace giving programs, where employees contribute a portion of their paycheck directly to nonprofits. This approach not only simplifies the giving process for donors but also creates a steady stream of income that food banks can count on to plan and grow their impact.

Table of Contents

What are payroll donations?

Payroll donations are a form of workplace giving where employees elect to have a designated amount automatically deducted from their paycheck and donated to a nonprofit organization on a recurring basis. This method of giving is typically facilitated through employer-sponsored giving platforms or coordinated by human resources departments.

Many companies integrate payroll donations into their corporate social responsibility (CSR) initiatives, often pairing them with matching gift programs that can double or even triple the impact of an employee’s contribution. This makes payroll donations not only convenient but also highly effective in generating sustained support.

For donors, payroll giving is an accessible way to contribute smaller amounts regularly, which can accumulate into significant funding over time. For food banks, this means a dependable revenue stream that can help maintain essential programs and respond to community needs without the unpredictability of one-time donations.

Understanding payroll donations as a strategic funding source empowers food banks to engage supporters in a meaningful, ongoing partnership that benefits both the donor and the organization.

How payroll donations work

Employees sign up through their employer’s payroll system or giving platform to allocate a fixed amount or percentage of their salary to a nonprofit. This amount is then automatically deducted each pay period and sent directly to the organization.

Employers often provide tools and resources to help employees select causes they care about, making it easy to support food banks and other nonprofits. The recurring nature of payroll donations ensures a steady flow of funds without requiring donors to take repeated action.

Benefits of employer matching

Many companies enhance payroll donations by offering matching gift programs. When an employee donates through payroll giving, the employer matches the contribution, sometimes dollar for dollar or at a different ratio. This effectively increases the donation’s value and encourages more employees to participate.

Food banks can leverage this by educating donors about matching opportunities, helping maximize the impact of every gift received through payroll donations.

How do payroll donation funds benefit food banks?

Reliable, predictable income

Payroll donation funds provide food banks with a reliable and predictable source of income that supports long-term sustainability. While individual contributions may be modest, the cumulative effect of many donors giving regularly creates a significant financial foundation.

This steady revenue stream allows food banks to plan their budgets with greater confidence, ensuring that core programs such as food distribution, nutrition education, and emergency response can continue uninterrupted. It also enables organizations to invest in growth initiatives and infrastructure improvements that enhance their capacity to serve communities.

Commitment from supporters

Beyond the financial benefits, payroll donations represent a deep level of commitment from supporters. Donors who give regularly through payroll are signaling their ongoing belief in the food bank’s mission, creating a loyal base of advocates who can be engaged for volunteerism, advocacy, and additional fundraising efforts.

By viewing payroll donations as a strategic and scalable funding source, food banks can strengthen their financial health and deepen relationships with their community of supporters.

Consistency and predictability

Regular payroll donations reduce the uncertainty that often accompanies fundraising efforts. Food banks can forecast income more accurately and allocate resources efficiently, improving program delivery and impact measurement.

Flexibility through unrestricted funds

Unrestricted payroll donations empower food banks to respond to urgent needs, pilot new programs, or cover operational costs that are essential but harder to fund through restricted grants.

Best practices for food banks to drive payroll donation funds

To maximize payroll donation participation, food banks should adopt a proactive and multi-faceted approach that raises awareness and simplifies the giving process for supporters. Registering with corporate social responsibility (CSR) platforms is a foundational step, as it increases visibility among employees seeking to donate through their workplace.

Prioritize proactive marketing

Payroll giving marketing is equally important. Food banks can use newsletters, social media campaigns, and community events to inform supporters about the benefits and ease of payroll giving. Clear messaging that explains how payroll donations work and the impact of recurring gifts helps demystify the process and encourages participation.

Adding a dedicated payroll donation page or section on the organization’s website provides a centralized resource where donors can learn more and find instructions or links to employer giving platforms. This accessibility reduces friction and increases conversion rates.

Time messaging around campaigns

Encouraging recurring giving during peak fundraising campaigns can also boost payroll donation sign-ups. Highlighting payroll giving as a convenient alternative to one-time donations can attract donors looking for manageable ways to contribute.

Finally, recognizing and thanking payroll donors regularly fosters retention and builds a sense of community. Personalized acknowledgments, impact reports, and exclusive updates make donors feel valued and connected to the food bank’s mission.

Consistency in communication, transparency about the use of funds, and making every donor feel their contribution matters are key to sustaining and growing payroll donation revenue.

Companies that offer payroll donations for food banks

Many large corporations and forward-thinking businesses include payroll donation programs as part of their workplace giving or CSR initiatives. These programs are designed to engage employees in philanthropy while supporting community organizations like food banks.

Here are a few examples:

Pacific Gas and Electric Company

PG&E’s payroll giving program allows employees to support local nonprofits with ease, often enhanced by company matching contributions.

Adobe

Adobe integrates payroll donations with matching gifts and volunteer grants, providing multiple avenues for employee philanthropy.

UnitedHealth Group

UnitedHealth Group’s workplace giving includes payroll donations, reflecting their commitment to community health and support.

Visa

Visa’s payroll donation program is part of a broader CSR strategy that encourages employee engagement and community investment.

Food banks should actively identify supporters who work at these companies and others with payroll donation programs. Collecting employer information during volunteer sign-ups or donor intake processes can help target outreach efforts effectively.

Researching workplace giving platforms and registering the food bank as a beneficiary ensures the organization is visible and accessible to employees looking to give through payroll deductions. This strategic approach positions food banks to capture new and sustained funding from corporate payroll donation programs.

Example: SF-Marin Food Bank’s payroll giving strategy

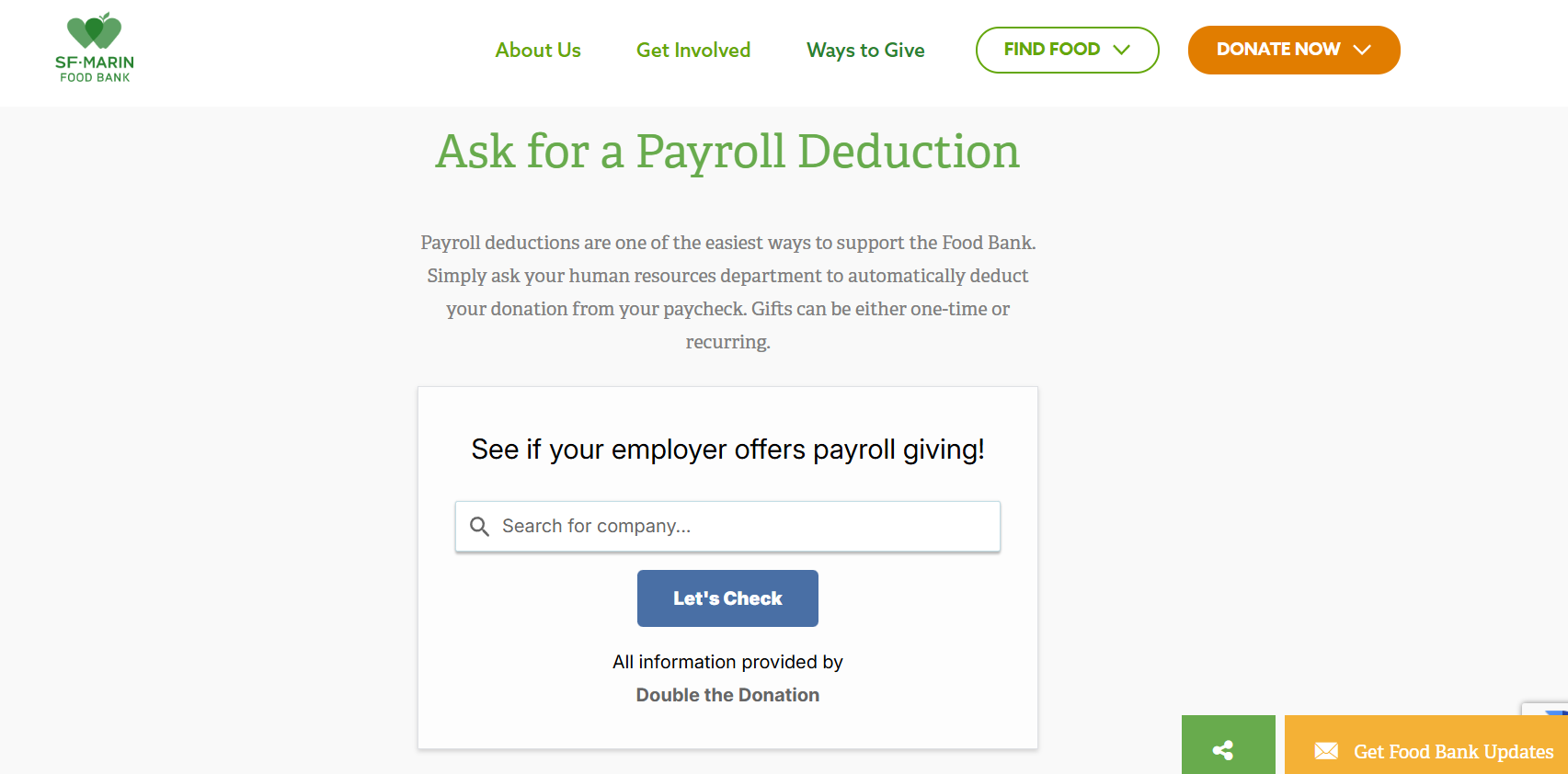

The SF-Marin Food Bank provides a high-impact example of how food banks can secure reliable, long-term funding by promoting payroll deductions. By hosting a dedicated “Ask for a Payroll Deduction” page, the organization highlights one of the easiest ways for supporters to provide ongoing relief to their community.

View the web page here: https://www.sfmfoodbank.org/workplace-giving/

Creating a Frictionless Path for Workplace Donors

SF-Marin Food Bank’s digital strategy focuses on simplifying the payroll giving process. Their portal frames these deductions as a convenient way to automatically support the mission, allowing donors to choose between one-time or recurring gifts, with payments deducted directly from their paychecks.

Building Recurring Revenue for Hunger Relief

For food banks, payroll deductions are a premier fundraising channel because they provide a steady and predictable stream of income. When a donor authorizes a recurring deduction, the food bank organization can more accurately forecast its budget and coordinate large-scale food recovery efforts with national and local retailers.

By making the “Ask” simple and providing the tools to execute it, SF-Marin Food Bank transforms its website into a gateway for corporate social responsibility. This proactive stance helps the organization bridge the gap between individual desire to help and the logistical power of workplace giving programs.

Payroll donation FAQ for food banks

Can donors change or stop their payroll donations at any time?

Yes, employees typically have the flexibility to adjust or cancel their payroll donations through their employer’s giving platform or HR department. This ensures donors maintain control over their contributions.

Are payroll donations tax-deductible?

Payroll donations to qualified nonprofits, including food banks, are generally tax-deductible. Donors should keep records of their contributions and consult tax professionals for specific advice.

How can food banks verify if a donation came from payroll giving?

Donations made through payroll giving are usually accompanied by documentation or identifiers from the employer’s giving platform. Food banks can coordinate with employers or payroll providers to track and acknowledge these gifts accurately.

Do all companies offer payroll donation programs?

No, not all employers have payroll giving options. Larger corporations and those with established CSR programs are more likely to offer them. Food banks should focus outreach on companies known to provide these benefits.

How can food banks encourage more employees to participate in payroll giving?

Food banks can collaborate with employers to provide educational materials, host informational sessions, and share impact stories that motivate employees to enroll in payroll donation programs.

Concluding thoughts on payroll donations for food banks

Payroll donations represent a simple, sustainable, and often underutilized funding stream for food banks. By embracing this method of workplace giving, food banks can secure a steady flow of unrestricted funds that support their mission and enhance their ability to serve communities in need.

With strategic outreach, education, and partnership-building, food banks can unlock the full potential of payroll donations. This approach not only strengthens financial stability but also fosters lasting relationships with committed supporters who believe in the power of consistent giving.

Ultimately, payroll donations offer food banks a scalable and reliable way to grow their impact and continue fighting hunger effectively.

Empower Your Food Bank’s Payroll Giving Strategy with Double the Donation

Unlock the full potential of payroll giving with Double the Donation’s powerful, easy-to-use tools. Our Payroll Giving module automatically identifies which of your supporters work for companies that offer payroll giving programs, giving you the insights you need to reach the right people at the right time. From there, we provide company-specific program details so donors can take action quickly: no guesswork, no missed opportunities. By leveraging our solution, your organization can turn hidden eligibility into steady, recurring revenue that fuels your mission all year long.

Get a demo of Double the Donation today to learn more and see the tools in action.