How Child Welfare Organizations Can Increase Payroll Donation Funds

Child welfare organizations play a crucial role in supporting vulnerable children and families, providing essential services that promote safety, stability, and well-being. Securing consistent funding is vital for these organizations to maintain and expand their programs. One promising avenue for sustainable revenue is payroll donations, a form of workplace giving that can generate steady support over time.

Payroll donations allow employees to contribute a portion of their paycheck automatically to a nonprofit, creating a reliable stream of income that child welfare organizations can count on. By understanding and leveraging payroll donation programs, these organizations can tap into a powerful funding source that complements traditional fundraising efforts and strengthens their financial foundation.

Table of Contents

- What are payroll donations?

- How do payroll donation funds benefit child welfare organizations?

- Best practices for child welfare organizations to drive payroll donation funds

- Companies that offer payroll donations for child welfare organizations

- Case study: A look at Children International’s payroll donation strategy

- Payroll donation FAQ for child welfare organizations

What are payroll donations?

Payroll donations are a type of workplace giving where employees elect to have a fixed amount or percentage of their paycheck automatically donated to a nonprofit organization. This process is typically facilitated through an employer’s human resources department or a corporate giving platform, making it easy and convenient for employees to support causes they care about without needing to take repeated action.

These donations are often set up as recurring contributions, meaning the nonprofit receives steady funding on a monthly or biweekly basis. Many employers also offer matching gift programs that can double or even triple the impact of these payroll donations, further increasing the benefit to the nonprofit.

For child welfare organizations, payroll donations represent a manageable way for supporters to give regularly, often in smaller amounts that accumulate into significant funding over time. This method of giving is especially attractive because it requires minimal effort from donors once established, fostering long-term engagement and financial stability for the organization.

How payroll donations work

Employees opt in to payroll giving through their employer’s platform or HR system, selecting the nonprofit(s) they wish to support. The chosen donation amount is then deducted automatically from each paycheck and transferred to the nonprofit on a regular schedule.

Employers may provide tools or portals where employees can track their donations, update their preferences, or learn about matching opportunities. This integration helps maintain transparency and encourages ongoing participation.

Benefits of payroll donations for donors

Payroll donations offer donors a simple, hassle-free way to contribute consistently without needing to remember to give each time. The automatic nature of the deductions helps donors budget their charitable giving and feel connected to the causes they support through regular contributions.

Additionally, donors may benefit from tax deductions on their payroll contributions, depending on local regulations, making payroll giving both a generous and financially savvy choice.

How do payroll donation funds benefit child welfare organizations?

Payroll donation funds provide child welfare organizations with a dependable and predictable revenue stream that can significantly enhance their financial planning and program sustainability. While individual donations through payroll giving may be modest, the cumulative effect of many donors participating regularly creates a substantial and steady flow of funds.

This consistency allows organizations to budget more effectively, ensuring that core services such as foster care support, counseling, and family outreach programs can continue uninterrupted. Moreover, payroll donations often come as unrestricted funds, giving nonprofits the flexibility to allocate resources where they are most needed, whether for emergency interventions or innovative new initiatives.

Beyond the financial advantages, payroll donations symbolize ongoing commitment from supporters who believe deeply in the mission of child welfare. This recurring support fosters a sense of community and shared responsibility, encouraging organizations to engage donors with updates and impact stories that reinforce their connection.

Steady funding for long-term impact

With payroll donations, child welfare organizations can move beyond the unpredictability of one-time gifts and seasonal campaigns. The regularity of these funds enables strategic investments in program development, staff training, and infrastructure improvements that ultimately enhance service delivery and outcomes for children and families.

Flexibility through unrestricted funds

Unlike many grants or designated donations, payroll contributions are often unrestricted, meaning organizations can use them to address urgent needs or seize new opportunities as they arise. This financial agility is critical in the dynamic field of child welfare, where emerging challenges require timely responses.

Best practices for child welfare organizations to drive payroll donation funds

To maximize payroll donation participation, child welfare organizations should adopt a multi-faceted approach that raises awareness, simplifies the giving process, and nurtures donor relationships. Registering with corporate social responsibility (CSR) platforms is a foundational step, as it connects nonprofits with employers offering payroll giving programs and increases visibility among potential donors.

Registering with CSR platforms

Many companies use CSR platforms to manage their workplace giving programs. By registering with these platforms, child welfare organizations can be included in employer directories, making it easier for employees to find and select them as recipients of payroll donations.

Effective email strategies

Regular updates through email keeps payroll giving top of mind. Sharing stories of how payroll donations have made a difference personalizes the impact and encourages continued participation.

Throughout all email campaigns, make sure to link back to a dedicated payroll giving page on your website where you go into more detail about payroll giving and help the supporter determine their eligibility! Effective marketing of workplace giving on your website can be a gamechanger in encouraging participation.

Donor recognition and engagement

Personalized thank-you messages, donor spotlights, and exclusive updates help build a sense of community among payroll donors. Recognizing their commitment publicly or privately can increase donor satisfaction and retention.

Companies that offer payroll donations for child welfare organizations

Many large corporations and socially responsible businesses provide payroll donation programs as part of their employee engagement and community support initiatives. These programs enable employees to contribute directly from their paychecks to nonprofits, including child welfare organizations.

Here are a few examples of companies doing this right:

TripAdvisor’s payroll giving program

TripAdvisor encourages employees to give back through payroll donations and matches contributions to amplify impact. Their platform is user-friendly and integrates with nonprofit databases, making it easy for child welfare organizations to be included and receive funds.

Hootsuite

Hootsuite supports workplace giving by offering payroll donation options and matching gifts. Their commitment to social responsibility creates opportunities for nonprofits to engage with a tech-savvy workforce eager to support community causes.

Whole Foods Market

Whole Foods Market promotes employee giving through payroll donations and volunteer grants. Their culture of community involvement aligns well with child welfare missions, providing a strong partnership potential.

Pacific Gas and Electric Company

Pacific Gas and Electric Company offers comprehensive workplace giving programs, including payroll donations and matching gifts. Their large employee base and structured giving platforms present valuable opportunities for child welfare organizations to secure recurring support.

Child welfare organizations should identify supporters who work at these companies by collecting employer information during volunteer sign-ups, donor intake, or event registrations. Understanding where supporters are employed allows nonprofits to tailor outreach and register with relevant workplace giving platforms to increase visibility.

Researching and engaging with these corporate programs can open doors to new funding streams and deepen relationships with employees who are passionate about child welfare causes. By positioning themselves strategically, nonprofits can ensure they are top-of-mind when employees select payroll donation recipients.

Case study: A look at Children International’s payroll donation strategy

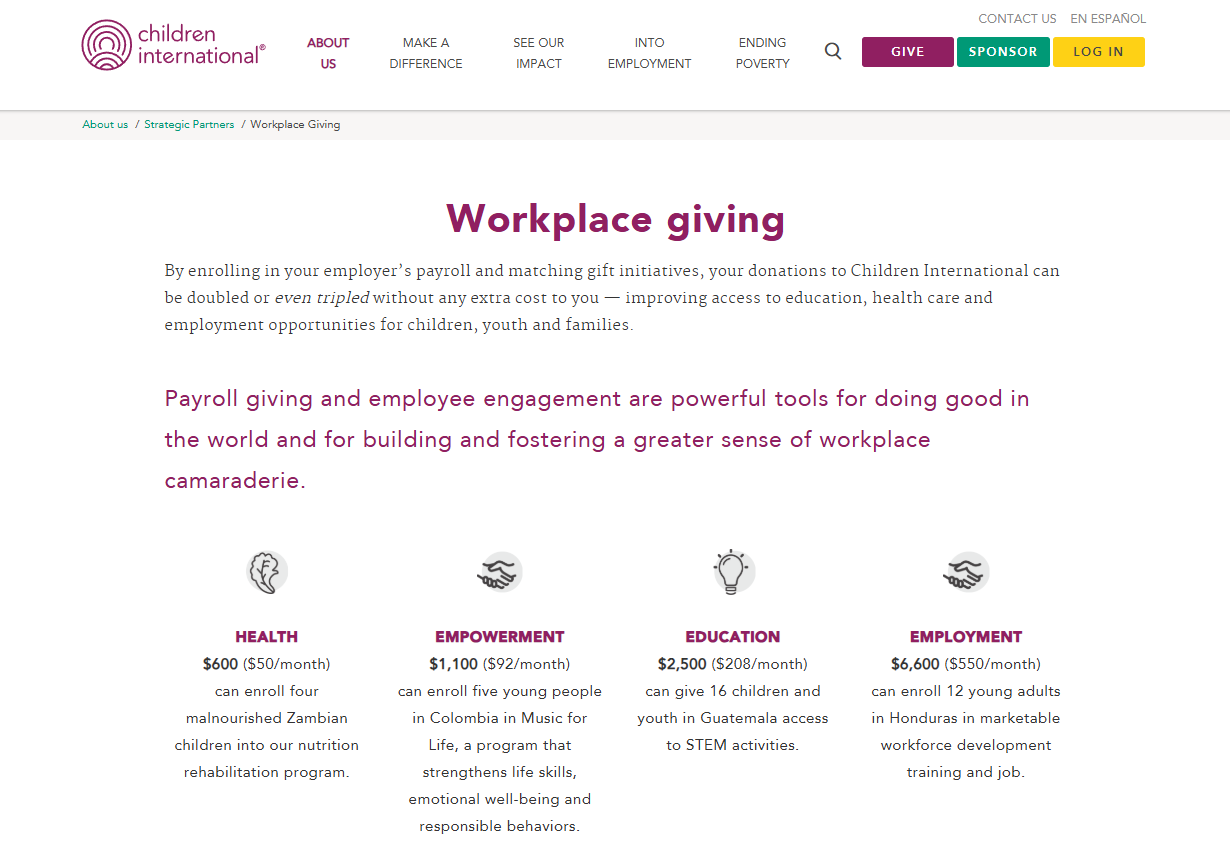

Children International provides a masterclass in how child welfare organizations can utilize workplace giving to create lasting change for youth and families. By integrating payroll initiatives into their “Workplace Giving” portal, the organization demonstrates how automatic paycheck deductions can be doubled or even tripled through employer matching, providing critical funding without any extra out-of-pocket cost to the donor.

View the web page here: https://www.children.org/learn-more/strategic-partners/workplace-giving

The Children International strategy focuses on making the impact of workplace giving tangible by providing specific, cost-based outcomes for different monthly donation levels. This approach fosters greater workplace camaraderie as employees see the collective power of their contributions.

Building Sustainability via Employee Engagement

For child welfare organizations, payroll giving is an essential tool for creating a reliable revenue stream that supports long-term programs like ending poverty and improving healthcare access. Unlike one-time donations, these recurring workplace contributions allow the organization to plan more effectively for multi-year initiatives in regions around the globe.

By framing payroll giving as a powerful tool for “doing good in the world,” Children International helps corporate employees align their professional roles with their personal values. This proactive educational approach ensures that every paycheck becomes a vehicle for improving access to education and health care for vulnerable children globally.

Payroll donation FAQ for child welfare organizations

Can donors change or stop their payroll donations at any time?

Yes, donors typically have full control over their payroll donations and can adjust or cancel their contributions through their employer’s HR system or giving platform. This flexibility helps maintain donor satisfaction and trust.

Are payroll donations tax-deductible?

In most cases, payroll donations are tax-deductible as charitable contributions. Donors should consult their local tax regulations and keep records of their donations for tax filing purposes.

How can child welfare organizations track payroll donations?

Organizations usually receive payroll donation funds through their financial systems or CSR platform reports. Maintaining clear records and reconciling donations regularly ensures accurate tracking and donor acknowledgment.

Do all employers offer payroll donation programs?

No, not all employers have payroll giving programs. However, many large corporations and socially responsible companies do. Nonprofits should focus on identifying and engaging supporters who work at companies with these programs.

Can payroll donations be combined with matching gift programs?

Yes, many employers offer matching gift programs that complement payroll donations. This means the nonprofit can receive additional funds matching the employee’s contribution, effectively doubling or increasing the gift’s value.

Concluding thoughts on payroll donations for child welfare organizations

Payroll donations represent a simple, sustainable, and often underutilized funding stream for child welfare organizations. By encouraging supporters to give through their paychecks, nonprofits can secure a steady flow of unrestricted funds that empower them to plan confidently and respond flexibly to the needs of children and families.

Embracing payroll giving not only strengthens financial health but also builds a community of committed donors who demonstrate their belief in the mission through ongoing support. With thoughtful strategies and engagement, child welfare organizations can unlock the full potential of payroll donations to enhance their impact and ensure long-term success.

Empower your child welfare organization’s payroll giving strategy

Unlock the full potential of payroll giving with Double the Donation’s powerful, easy-to-use tools. Our Payroll Giving module automatically identifies which of your supporters work for companies that offer payroll giving programs, giving you the insights you need to reach the right people at the right time. From there, we provide company-specific program details so donors can take action quickly: no guesswork, no missed opportunities. By leveraging our solution, your organization can turn hidden eligibility into steady, recurring revenue that fuels your mission all year long.

Get a demo of Double the Donation today to learn more and see the tools in action.