Workplace Giving vs. Payroll Giving: What’s the Difference?

As nonprofits seek new and sustainable ways to grow donor support, employer-backed giving programs present a powerful opportunity. However, understanding the difference between workplace giving vs. payroll giving is key to making the most of these channels.

While the terms are often used interchangeably, they refer to distinct models of employee giving, each with its own benefits and logistics. In this post, we’ll break down what sets workplace giving apart from payroll giving and how your organization can effectively engage with each to expand your donor base and deepen corporate partnerships.

Specifically, we’ll cover:

- What is payroll giving?

- What is workplace giving?

- How do workplace and payroll giving relate?

- How do workplace and payroll giving differ?

- Strategies for making the most of each

By understanding the nuances between these two giving models, your organization can better position itself to connect with engaged donors and align with companies that value social impact. Whether you’re just starting to explore employer-backed giving or looking to enhance your existing efforts, this guide will equip you with the insights and strategies needed to succeed.

What is payroll giving?

Payroll giving is a form of charitable donation in which employees contribute to nonprofits directly from their paychecks, typically on a recurring, pre-tax basis. This method enables donors to contribute regular donations with minimal effort, making it one of the most convenient ways to support a cause over time.

In a payroll giving program, employees choose a nonprofit they’d like to support and specify a donation amount to be automatically deducted from their salary each pay period. These deductions are then processed by the employer or a third-party platform and then disbursed to the nonprofit.

For nonprofits, payroll giving can establish a steady and predictable revenue stream while also deepening long-term donor relationships. Although individual contributions may be modest, their consistency and potential for growth—especially when supported by employer matching programs—can add up significantly over time.

As Julia from Double the Donation adds, “Payroll giving is the holy grail of recurring revenue for nonprofits because it eliminates donor fatigue. Once an employee opts in, the donation is automatic, reliable, and deeply integrated into their financial routine. This steady, predictable stream of revenue is foundational for budgeting and securing long-term mission sustainability.”

What is workplace giving?

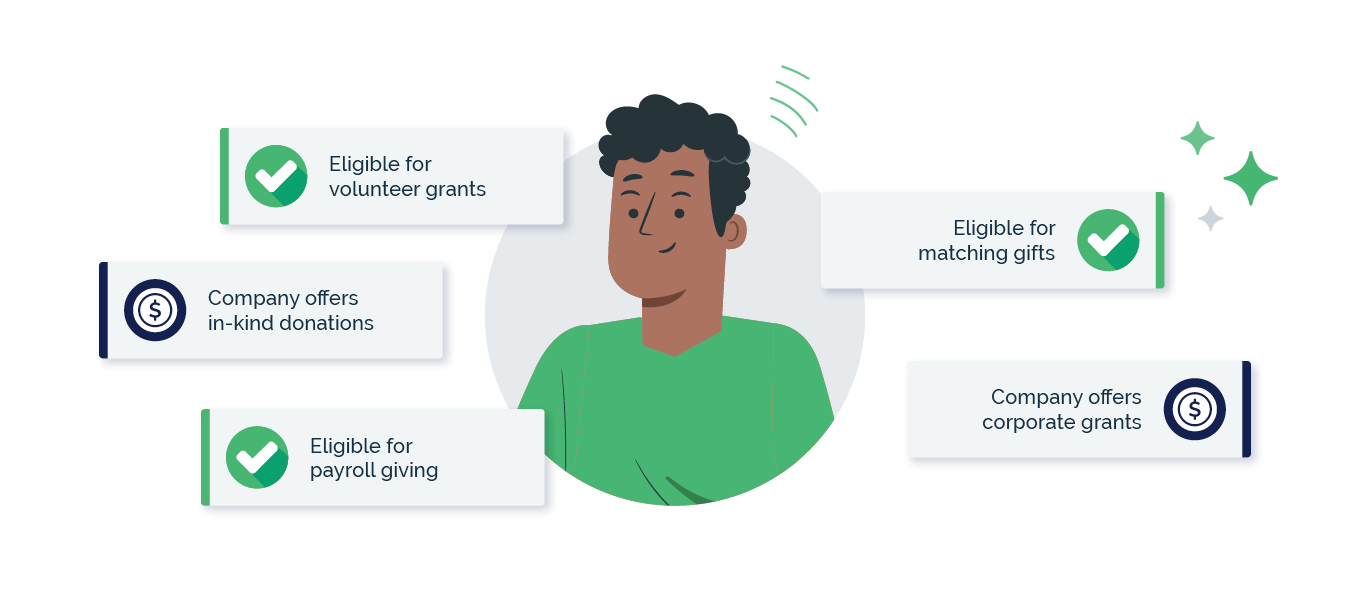

Workplace giving, on the other hand, is a broader term that refers to any program or initiative that enables employees to support charitable causes through their employer. Unlike payroll giving, which focuses specifically on paycheck deductions, workplace giving encompasses a wide range of giving opportunities—both financial and non-financial—that are facilitated by the workplace.

These programs can include:

- Payroll giving/deductions

- Employer donation matching

- Volunteer grants or paid Volunteer Time Off

- Company-sponsored fundraising campaigns

- Internal charity drives or giving days

Workplace giving is a powerful tool for nonprofit revenue growth, offering a consistent and often underutilized funding stream. By making it easier for employees to support causes they care about, companies create opportunities for nonprofits to tap into recurring donations, matching gifts, and other employer-sponsored contributions.

Participating in workplace giving programs is a smart revenue growth strategy for nonprofits, offering access to new donor networks and a reliable stream of recurring donations. These programs are a gateway to broader corporate giving opportunities—while payroll and matching gifts drive direct funding, they can also open doors to deeper partnerships like event sponsorships, in-kind donations, and employee volunteer programs. By leveraging workplace giving as an entry point, nonprofits can grow both immediate revenue and long-term corporate support.

How do workplace and payroll giving relate?

Workplace giving and payroll giving are closely connected—so much so that they’re often mentioned in the same breath. That’s because payroll giving is actually one component of the broader workplace giving landscape. In other words, all payroll giving is workplace giving, but not all workplace giving is payroll giving.

While payroll giving refers specifically to donations made directly from an employee’s paycheck, workplace giving encompasses payroll giving and other forms of support, including employer donation matching, fundraising campaigns, and volunteer incentives.

For nonprofits, understanding this relationship is essential. By recognizing payroll giving as a gateway to broader workplace engagement, organizations can utilize it as a foundation for more meaningful partnerships. For example, if a donor starts with payroll deductions, your nonprofit may later be eligible for employer matching funds or featured in a company-wide giving campaign. These connections help build long-term donor loyalty while expanding your reach within supportive companies.

How do workplace and payroll giving differ?

While workplace giving and payroll giving are closely related (and each incredibly valuable for charitable organizations), the two program types differ in scope, structure, and flexibility. As a result, each offers a unique set of advantages for nonprofits and donors alike.

Here’s what you should know about the programs’ differences:

1. Scope:

Payroll giving is a specific type of workplace giving that involves regular, automatic donations taken directly from an employee’s paycheck. In contrast, workplace giving encompasses a broader umbrella that includes payroll giving, as well as programs such as donation matching, charity drives, fundraising events, volunteer grants, and more.

As Julia from Double the Donation explains, “Nonprofits often use ‘workplace giving’ and ‘payroll giving’ interchangeably, which is a major mistake in outreach. The key distinction is that payroll giving is a passive, set-it-and-forget-it tool for convenience, while the rest of the workplace giving spectrum (like matching gifts and volunteer grants) requires active engagement. Understanding this difference allows us to market the correct program to the right employee at the right time.”

2. Donation Method:

Payroll giving is facilitated through payroll systems, with donations deducted pre- or post-tax (depending on the location or employer setup). Workplace giving, on the other hand, can involve various forms of giving—financial or time-based—that may not be tied to payroll, such as participating in a company-wide giving day or logging volunteer hours to earn grant dollars.

3. Donor Engagement:

Payroll giving is typically a passive, set-it-and-forget-it method. Once an employee signs up, donations occur automatically on a regular basis. Workplace giving, on the other hand, offers more active engagement opportunities, such as team fundraising challenges or company-hosted volunteer events, creating more touchpoints for deeper donor interaction.

4. Employer Involvement:

Employers typically play a larger role in broader workplace giving programs, offering powerful incentives such as donation matching or volunteer time off. Payroll giving may or may not include employer matching and often functions more independently from wider workplace culture initiatives.

Understanding these differences can help nonprofits tailor their outreach and messaging. While payroll giving provides steady, recurring revenue, broader workplace giving programs open the door to deeper engagement and additional corporate support. Both are valuable, and when used together, they can significantly amplify mission impact.

Strategies for making the most of each

To fully tap into the potential of payroll and workplace giving, nonprofits need more than just enrollment—they need a strategic approach. Here are some key ways to maximize visibility, engagement, and long-term impact through these valuable channels:

Get Listed on Workplace Giving Platforms

Many employers use third-party platforms to manage their giving programs, such as Benevity, Bright Funds, America’s Charities, YourCause, and more. Ensure your nonprofit is registered on these platforms so that employees can easily find and support you through payroll giving and other workplace initiatives.

Interested in a step-by-step breakdown of how your organization can register with leading platforms (including direct links to applications)? Check out this guide to get started.

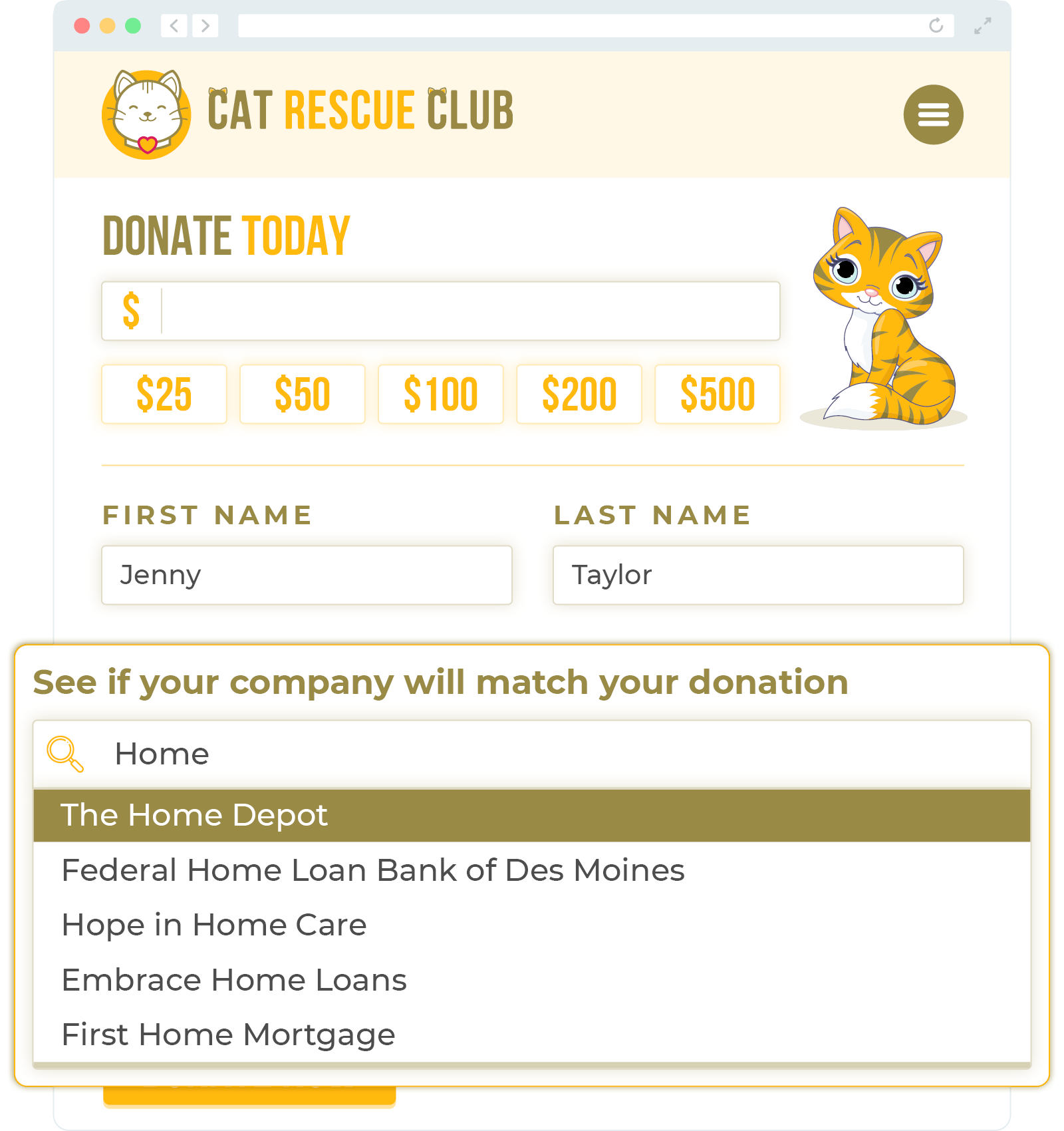

Collect Employment Information From Supporters

One of the simplest yet most powerful steps your nonprofit can take is to ask supporters where they work. Knowing a donor’s employer opens the door to potential payroll giving, matching gift opportunities, and broader workplace giving programs alike.

You can collect this information through donation forms, newsletter sign-ups, volunteer registrations, or follow-up outreach. Even a single field that asks, “Who is your employer?” can provide valuable insight for future outreach and segmentation.

Then, to fill in the remaining gaps in your database, you could even conduct an employer append with a third-party provider!

Once you have this data, you can:

- Identify companies with active workplace giving or matching gift programs using a workplace giving database.

- Tailor communication to highlight relevant giving opportunities tied to that employer.

- Encourage donors to explore whether their workplace offers payroll giving or match options.

- Reach out to CSR or HR contacts at those companies to explore potential partnerships.

The more you know about where your donors work, the better positioned you are to unlock corporate support, grow donor engagement, and maximize giving potential through employer-backed programs.

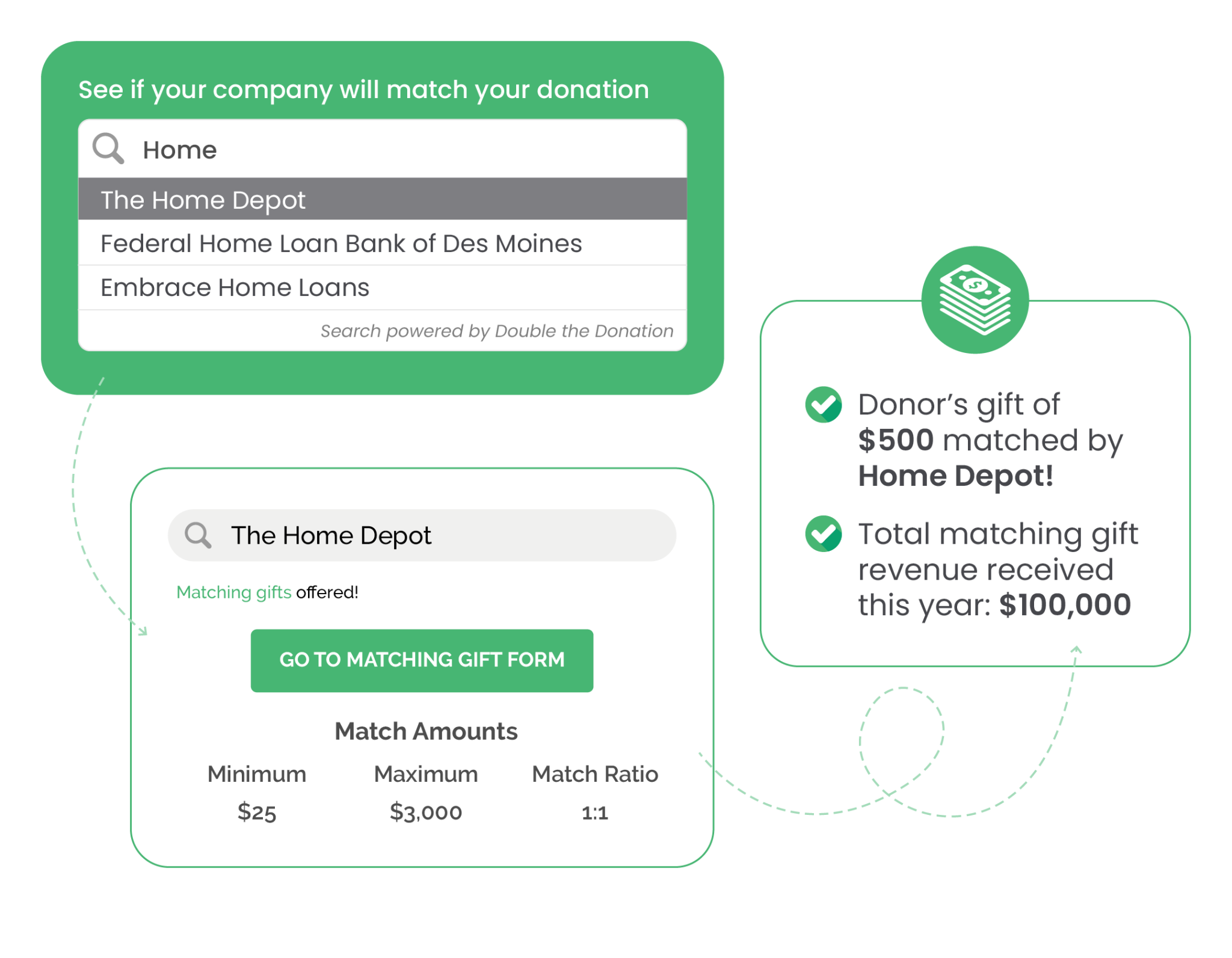

Promote Employer Matching

Many employees are unaware that their company offers donation matching, often in addition to other programs, such as payroll giving. Your team can help bridge that gap by creating or leveraging the right resources—like a matching gift lookup tool, FAQs, or social media content—to encourage donors to check if their gift can be doubled.

For the best results, highlight this in donation forms, confirmation emails, thank-you pages, and other relevant materials.

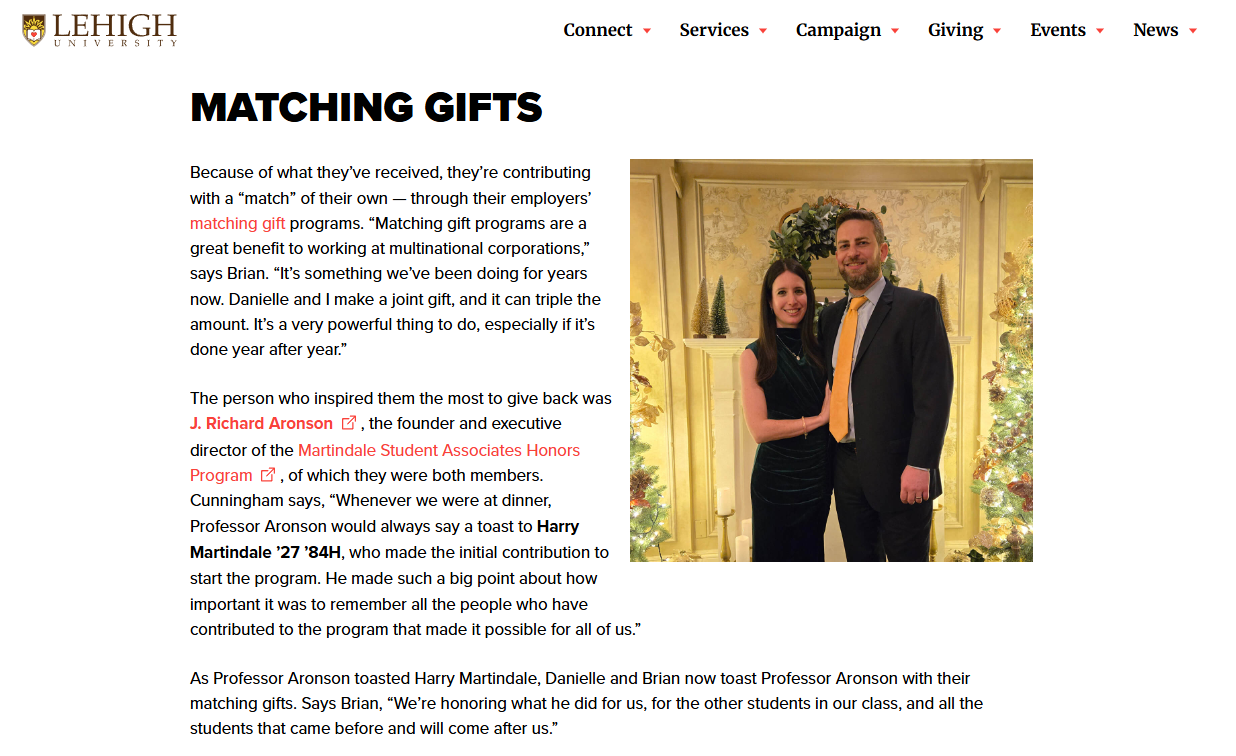

Share Clear Impact Stories

Whether donors give through payroll deductions or other company-sponsored campaigns, they want to know their contributions matter. Use newsletters, impact reports, and social media content to demonstrate how workplace and payroll gifts make a difference.

Here’s an example of a matching gift success story shared by Lehigh University:

You can even tailor these stories for a corporate audience when possible.

Build Relationships with CSR Teams

Kick off your efforts by establishing partnerships with companies’ corporate social responsibility (CSR) or HR teams. Offer to create co-branded promotional materials, provide speakers, host volunteer opportunities, or collaborate on giving campaigns.

These connections can lead to deeper engagement and additional funding beyond payroll giving alone.

Empower Donors to Advocate Internally

Your existing supporters can be your strongest advocates for new and improved workplace giving programs. When relevant, encourage them to nominate your organization for inclusion in their employer’s giving campaigns or volunteer days or provide a warm introduction to their employer.

You can even provide toolkits or one-pagers that they can share with HR or CSR leaders to help make a strong case for employee-directed philanthropy.

Track and Acknowledge Payroll Donations

Payroll donations can be harder to track than direct gifts, but they’re no less meaningful, and managing them effectively is no less crucial. Therefore, collaborate with platform providers to access donor information (when available) and express gratitude to contributors on a regular basis. After all, personalized acknowledgments help retain and grow long-term support.

By combining thoughtful outreach, strong partnerships, and clear communication, your nonprofit can make payroll and workplace giving a powerful, reliable part of your overall fundraising strategy.

Leverage Technology to Simplify Your Efforts

Technology like Double the Donation’s workplace fundraising solutions for nonprofits can help you alert donors to workplace giving opportunities and automate follow-ups. With this tool, you can easily notify supporters when their employer offers matching gifts, payroll giving, or volunteer grants. Automated email reminders and alerts make it simple to encourage donors to take advantage of matching opportunities, boosting your organization’s revenue. By using technology to simplify your strategy, you can ensure that no donation goes unnoticed and maximize corporate support.

Frequently Asked Questions (FAQ)

1. What is the difference between workplace giving and payroll giving?

Workplace giving is a broad category of employer-sponsored philanthropy that includes matching gifts, volunteer grants, and payroll giving. Payroll giving is a specific type of workplace giving in which employees donate automatically through recurring paycheck deductions.

2. How does payroll giving work for employees and nonprofits?

Payroll giving enables employees to contribute a set amount from each paycheck directly to a nonprofit of their choice. For nonprofits, this creates predictable, year-round revenue and helps build long-term donor relationships through consistent support.

3. Why should nonprofits promote payroll giving as part of their workplace giving strategy?

Promoting payroll giving encourages recurring donations, strengthens donor retention, and opens opportunities for additional employer-sponsored support such as matching gifts. Highlighting payroll giving on websites and during campaigns helps nonprofits grow sustainable funding.

4. Do companies match payroll gifts?

Yes, many companies match employee donations made through payroll giving programs. These payroll gift matches can double or even triple an employee’s recurring contribution, significantly increasing the nonprofit’s annual fundraising revenue.

5. Which companies are known to offer payroll gift matching?

Wrapping up & additional workplace giving resources

When it comes to workplace giving vs. payroll giving, understanding the differences between the two strategies is essential for nonprofits seeking to cultivate sustainable donor support through employer-backed programs. While payroll giving offers a reliable stream of pre-tax donations directly from employees, workplace giving encompasses a broader range of opportunities, including corporate matching, fundraising events, and volunteer engagement.

By understanding how each of these models operates and how they appeal to both employees and companies, your organization can tailor outreach strategies more effectively, foster stronger partnerships with businesses, and ultimately unlock new funding channels to support its mission.

Ready to learn more about workplace giving and beyond? Check out these additional recommended resources:

- Top Workplace Giving Companies: Leading Employers to Know. Discover which companies are setting the standard in employee giving programs. This resource highlights leading employers that actively support workplace giving, offering inspiration and partnership opportunities for your nonprofit.

- Free Download: Earning More Payroll Donation Revenue. Learn actionable strategies to increase payroll giving contributions. This guide walks nonprofits through best practices for engaging donors, optimizing visibility in workplace programs, and boosting recurring revenue.

- Free Download: Guide to Developing a Workplace Giving Plan. Build a clear, effective roadmap for your nonprofit’s workplace giving efforts. This comprehensive guide covers goal setting, outreach tactics, and partnership development to help you launch or strengthen your giving plan.

![Why and How to Reach Out to Payroll Giving Donors [A Guide]](https://doublethedonation.com/wp-content/uploads/2025/06/DTD_Why-and-How-to-Reach-Out-to-Payroll-Giving-Donors-A-Guide_Feature-80x80.png)