The Complete Guide to In-Kind Donations for Nonprofits

In-kind gifts are the lifeblood of many nonprofit organizations, providing essential goods and services without the requirement of tapping into financial resources. Whether it’s donated office equipment, pro bono professional services, or bid-worthy auction items, in-kind donations for nonprofits can make a significant difference in an organization’s ability to achieve its mission.

However, successfully managing in-kind gifts requires a clear understanding of what these donations entail—including their benefits, challenges, and best practices for soliciting and managing them effectively. In this comprehensive guide, we’ll explore everything you need to know about in-kind donations.

This includes:

- The Basics of In-Kind Donations for Nonprofits

- Leading Benefits of In-Kind Donations

- Frequently Asked Questions Regarding In-Kind Donations

- Top Ways to Locate In-Kind Donation Opportunities

By the end, you’ll have the tools and insights needed to optimize your organization’s in-kind donation strategy, ensuring every contribution drives real, maximal impact.

The Basics of In-Kind Donations for Nonprofits

In-kind donations are a vital resource for many nonprofits, helping to bridge gaps in funding and providing the necessary goods and services to achieve their missions. But what exactly are in-kind donations, and how can nonprofits effectively incorporate them into their operations?

Understanding the basics of in-kind donations is the first step toward leveraging them well. With a clear grasp of what they are and their potential impact, nonprofits can better assess how these contributions fit into their overall strategy.

In short, in-kind donations generally refer to any non-monetary contributions made to a nonprofit organization.

Instead of providing cash, donors give goods, services, or other tangible and intangible resources that support the nonprofit’s work—and reduce their expenses. Like any gifts, these donations can come from individuals, businesses, or other organizations.

Types of In-Kind Gifts

In-kind donations are not a one-size-fits-all type of contribution. In fact, there are endless ways for supporters to get involved with in-kind giving—but most will land within one of the following categories:

- Tangible goods or products — Tangible goods are physical items donated to a nonprofit organization. These are materials that can be directly used by the organization or distributed to beneficiaries, often reducing operational costs and providing immediate support for programs and services.

- Examples include: Technology, office supplies, food and beverages, clothing items

- Services or expertise — Donated services or expertise involve professionals offering their skills to support a nonprofit’s operations or mission without charging a fee. These contributions are particularly valuable as they often cover essential tasks that would otherwise require significant funding.

- Examples include: Legal representation, IT support, graphic design, or financial services

- Intangible items — Intangible items are non-physical contributions that benefit a nonprofit in unique ways. These often include access, rights, or opportunities rather than material goods.

- Examples include: Use of event space or facilities, advertising time, or intellectual property

- Gifts of securities — Gifts of securities involve donations of financial instruments or investments. Rather than liquid cash, donors transfer ownership of these assets directly to the nonprofit.

- Examples include: Stocks, bonds, and mutual funds

All in all, understanding the various types of in-kind donations you may see enables nonprofits like yours to better align donor contributions with their needs and operational goals.

Leading Benefits of In-Kind Donations

In-kind donations are an invaluable asset for nonprofits, offering more than just financial relief. These contributions provide essential goods, services, and expertise that can significantly reduce operational costs, improve program delivery, and foster long-term relationships with donors. But the benefits of in-kind donations extend far beyond the nonprofit organization itself—donors also gain recognition, goodwill, and tax advantages from their contributions.

Let’s take a closer look at the widespread advantages of this type of giving.

Benefits of In-Kind Donations for Nonprofits

-

Cost Savings and Resource Efficiency

In-kind donations provide significant cost savings by reducing the need for nonprofits to purchase goods or pay for services on their own. By accepting donations of items like office supplies, food, or technology, organizations can stretch their budgets further, allocating more funds toward core programs. Meanwhile, donated professional services, such as legal advice or marketing support, allow nonprofits to access high-quality expertise without incurring the fees. These savings enable nonprofits to focus on their mission while maintaining financial stability.

-

Enhanced Program Delivery

In-kind donations directly contribute to the success of nonprofit programs by providing the necessary goods and services that support operational needs. Whether it’s food for a community pantry, clothing for a shelter, or IT services to streamline operations, these contributions enhance the nonprofit’s ability to serve its community. By receiving in-kind support, nonprofits can offer more comprehensive services without the constraints of limited financial resources.

-

Stronger Donor Relationships

In-kind donations help build lasting connections between nonprofits and their donors. When businesses and individuals contribute goods or services, it fosters a sense of shared purpose and deepens their investment in the nonprofit’s mission. Recognizing and celebrating in-kind donors can enhance donor loyalty and encourage ongoing support, too. These relationships are often built on mutual respect and collaboration, helping to create a network of advocates who feel personally connected to the nonprofit’s work.

-

Access to Expertise and Resources

In-kind donations can also provide access to valuable professional expertise and services that nonprofits might not otherwise be able to afford. Pro bono services such as legal counsel, accounting, or web development can make a significant impact on a nonprofit’s capacity to grow, improve operations, and achieve its goals. By leveraging the skills of professionals who donate their time, nonprofits gain access to high-level resources that help improve their organizational capacity and long-term sustainability.

Benefits of In-Kind Donations for Donors

-

Tax Advantages

One of the key benefits for those contributing in-kind donations is the potential for tax deductions. Donors (whether companies or individuals) who give goods, services, or securities can claim a tax deduction for the fair market value of their contribution, providing them with financial benefits while also supporting the nonprofit’s work. This creates a win-win scenario, where the nonprofit gains vital resources, and the donor reaps the rewards of their generosity.

-

Corporate Social Responsibility (CSR)

In-kind donations, particularly from businesses, play a significant role in promoting positive public relations and bolstering a company’s image. Companies that contribute goods, services, or resources demonstrate a commitment to corporate social responsibility (or CSR), which can help attract new customers, build brand loyalty, and enhance reputation. Consumers are often more inclined to support businesses that actively engage in philanthropy, making in-kind giving a strategic way for companies to strengthen their brand.

-

Stronger Community Connections

For both businesses and individuals, in-kind donations can foster deeper connections with local communities. Donating goods and services allows donors to directly contribute to causes they care about, creating a personal connection with the nonprofit and its beneficiaries. This sense of involvement and community engagement can be incredibly rewarding as donors witness the impact of their contributions in real-time. Additionally, donors often receive recognition for their support, strengthening their ties to the nonprofit and its mission.

Frequently Asked Questions Regarding In-Kind Donations

In order to grow your knowledge of all things in-kind giving, we’ve compiled a list of the most-asked questions (and answers) on the topic. Read through to get a better understanding of the opportunities at hand!

What counts as an in-kind donation?

An in-kind donation refers to a non-monetary contribution made to a nonprofit organization where the donor provides goods, services, or expertise instead of cash. Examples include tangible items such as office supplies, food, and clothing, as well as professional services like legal advice, graphic design, or IT support. These donations also encompass things like donated event spaces, volunteer time, or even intellectual property rights.

Essentially, anything that can support a nonprofit’s work without the exchange of money qualifies as an in-kind donation.

What are the pros and cons of in-kind donations?

In-kind donations offer many advantages for nonprofits, including significant cost savings and enhanced program delivery. They help reduce operational costs, allowing more funds to be directed toward mission-driven programs. Additionally, in-kind donations can build strong relationships with donors and the community, fostering goodwill and long-term support.

However, there are also challenges to consider. Managing in-kind donations may require logistical planning, such as storage, inventory, and handling. Furthermore, not all in-kind donations may be usable, and nonprofits should ensure that donations align with their needs.

Should my organization have an in-kind gift acceptance policy?

Yes, your organization should have an in-kind gift acceptance policy. A clear and well-defined policy helps set expectations for what types of in-kind donations your nonprofit will accept, ensuring that donations align with your mission and operational needs. This policy can also address important considerations such as the process for evaluating donations, storage limitations, and tax documentation requirements.

An established policy provides structure and consistency, ensuring that in-kind gifts are managed effectively and that donors understand the guidelines for giving.

What is an in-kind donation wishlist?

An in-kind donation wishlist is a list created by a nonprofit organization that outlines specific items or services the organization needs. It’s an essential tool for guiding potential donors on what types of in-kind contributions would be most beneficial.

A wishlist can include tangible goods such as food or clothing, as well as intangible items like services or volunteer expertise. By providing a clear wishlist, nonprofits can make it easier for donors to contribute in ways that directly support the organization’s goals and programs.

How are in-kind donations valued?

Valuing in-kind donations is an essential step for nonprofits, and it can be a bit trickier than with cash-based donations.

The value of tangible items is typically based on their fair market value, which is what the item would sell for in an open market. For services, the valuation is based on the standard cost of those services in the local market or the hourly rate of professionals offering them.

To ensure effective management, nonprofits should document these values accurately for both their own records and the donors’ tax purposes. In some cases, third-party valuations may be needed for more complex items, such as antiques or collectibles.

How should our team procure in-kind donations?

When soliciting in-kind donations, it’s important to be clear, specific, and respectful in your approach. Start by identifying your organization’s current needs and create a targeted in-kind donation wishlist.

Then, reach out to potential donors—whether businesses or other major donors—by highlighting how their contribution can directly support your mission. You can also target companies that offer open applications for their in-kind donation programs and apply for goods or services that way!

Regardless, be transparent about the impact of their donation and make it easy for them to contribute. Tailor your message to each prospective donor, focusing on how their specific goods or services can make a difference.

How can we maximize in-kind donations for events?

To maximize in-kind donations for events, start by creating a detailed event plan and identifying specific needs, such as catering, venue space, or volunteers. Then, reach out to local businesses and community members (or begin seeking open applications) and identify those who may be willing to donate goods or services in exchange for visibility and recognition at the event.

For example, a local restaurant could donate food, while a printing company might be willing to supply event materials. Regardless, be sure to offer donors visibility, such as their logo on event signage or social media shout-outs. Additionally, consider leveraging partnerships with companies that have a history of supporting nonprofits and events, increasing the chances of securing valuable donations.

How should we thank and steward in-kind donation givers?

Thanking and stewarding in-kind donation givers is essential for maintaining strong, long-term relationships. Be sure to promptly acknowledge the donation with a personalized thank-you letter or note expressing genuine appreciation for their contribution.

Then, depending on the size and significance of the donation, consider offering public recognition on social media, at events, or in newsletters. (This is a great opportunity for companies looking to get a marketing boost from their support!) For larger or ongoing in-kind donations, invite donors to tour your facilities or see firsthand how their contributions are being used.

Acknowledging their impact helps build trust and loyalty, ensuring that donors feel valued and encouraged to continue supporting your organization in the future.

Top Ways to Locate In-Kind Donation Opportunities

Locating in-kind donation opportunities is a vital part of a nonprofit’s resource acquisition strategy. Doing so effectively allows nonprofits to stretch their limited resources further, improving program delivery and strengthening relationships with donors.

If you’re not sure where to get started in your search for in-kind gifts, we recommend implementing the following strategies:

1) Identify giving opportunities using employment information.

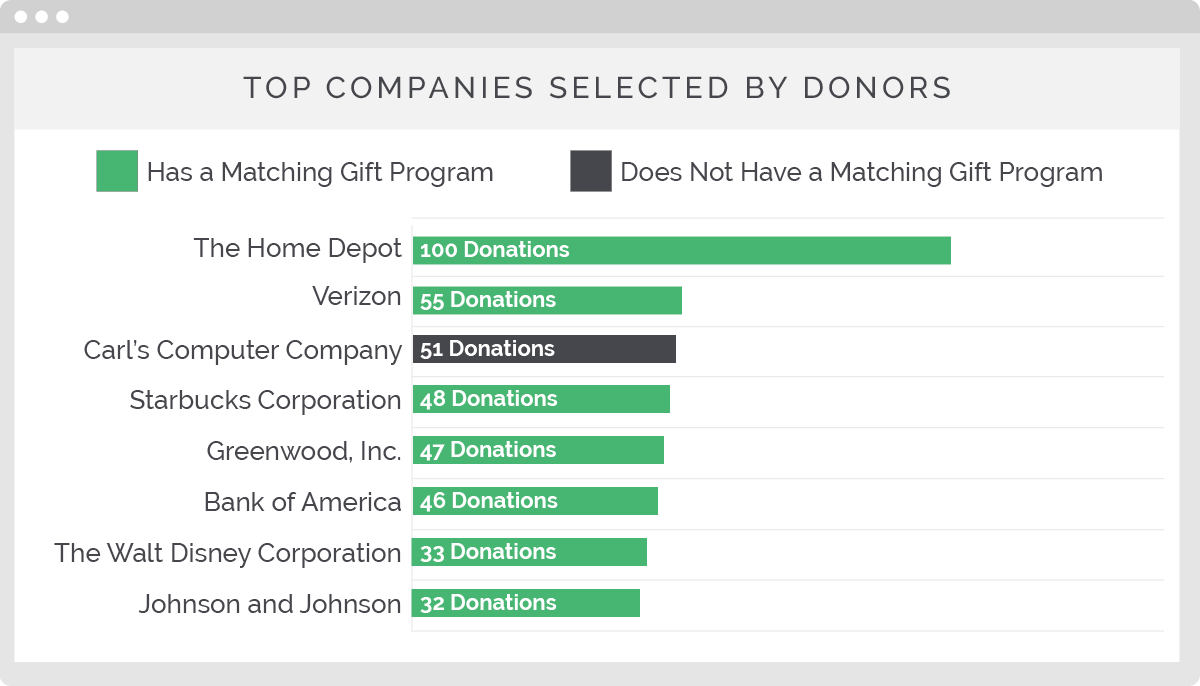

Nonprofits can identify in-kind donation opportunities through employment information by tapping into the corporate giving programs or employee-driven initiatives at various companies. After all, many donors likely work for companies with existing giving programs. Tons of corporations encourage their employees to engage in volunteerism and charitable giving by offering matching gifts, volunteer grants, or even organizing employee-driven donation programs, meaning they’re already charitable-minded.

To leverage this potential, nonprofits can:

- Research which of your donors’ employers have robust corporate social responsibility (CSR) programs or employee engagement initiatives. These organizations may provide in-kind donations through volunteerism or direct contributions of goods and services.

- Tap into employees’ skills and expertise through pro bono services (such as marketing, legal advice, or IT support). Corporations often have teams of skilled professionals who may be willing to donate their time or services to nonprofit causes. Many even offer paid volunteer time off for their employees to participate!

- Partner with organizations offering employee volunteer days, where employees can donate time, products, or services as part of company-wide volunteer initiatives.

These opportunities can be accessed by collecting employment information from donors and volunteers, networking with supporters, participating in company-hosted community events, or simply reaching out to the company’s CSR or community engagement teams. And Double the Donation’s platform can help uncover the top employers in your network, too!

2) Look into major companies known for giving generously.

Major companies, particularly large corporations or those with a strong presence in the local community, are often known for their commitment to giving back through in-kind donations and more. Many of these organizations run established programs that contribute to nonprofit causes, whether through corporate sponsorships, donations of goods, or volunteer time.

To find these opportunities, nonprofits can:

- Research companies that have a history of corporate philanthropy. Many large corporations, especially in industries like retail, technology, and food services, have established in-kind donation programs.

- Engage with corporate foundations or charitable arms of these companies. Many large companies create foundations to handle their philanthropic efforts and provide in-kind donations to nonprofits as part of their social impact strategy.

Building relationships with these companies and keeping an eye on corporate giving calendars or grant cycles can help your nonprofit access valuable in-kind donations.

3) Reach out to local businesses in your area.

Local businesses can be an excellent source of in-kind donations. After all, they’re often willing to support community organizations, seeing giving back as an important part of their business model. From restaurants to service providers, local businesses can donate goods, services, and expertise that are directly beneficial to nonprofits.

To locate in-kind donation opportunities with local businesses, nonprofits can:

- Approach small businesses, restaurants, or service providers that align with their mission or that could benefit from the visibility and goodwill of contributing to your cause.

- Attend local networking events or business association meetings to make connections with business owners who are open to supporting local causes. These relationships can lead to ongoing support in the form of in-kind donations.

- Offer local businesses opportunities for recognition in exchange for their donations. Publicly thanking them on social media, featuring their logos at events, or offering them tax-deductible acknowledgment can make in-kind giving more attractive to these businesses.

By reaching out to local businesses, nonprofits can develop mutually beneficial partnerships that support their goals while strengthening community ties.

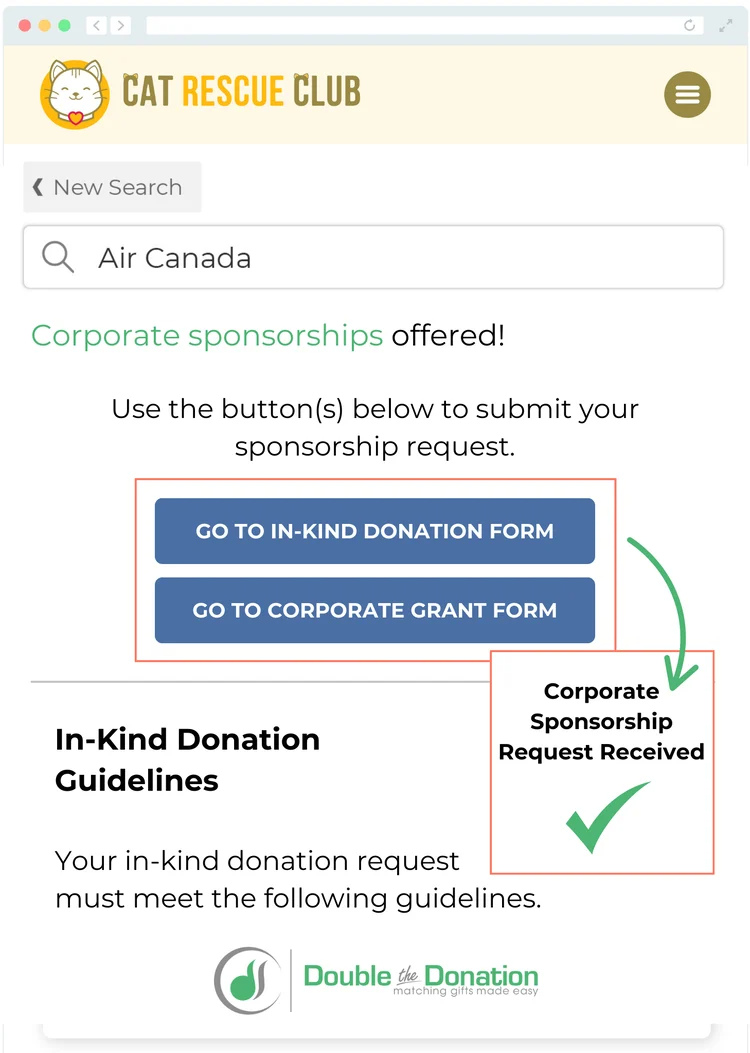

4) Tap into a centralized corporate giving database.

One of the most effective ways to find reliable, up-to-date in-kind donation opportunities is by using a centralized tool that does the heavy lifting for you. That’s where Double the Donation’s corporate giving database comes in.

While the platform is already known as the leading solution for matching gift automation, it now goes a step further—offering a growing list of corporate in-kind giving programs.

From tech products and printing services to gift cards and event sponsorships, these opportunities are often scattered across dozens of company websites or buried in employee handbooks. Double the Donation aggregates this information, saving your team hours of research and helping you uncover high-impact partners faster.

Wrapping Up & Additional Resources

In-kind donations offer nonprofits an incredible opportunity to expand their reach, reduce costs, and foster deeper community connections. Whether you’re receiving goods, services, or volunteer hours, these contributions can be transformative when managed strategically.

By understanding the nuances of in-kind donations, you can unlock their full potential for your organization. Remember, the key to success lies in aligning in-kind contributions with your nonprofit’s mission and needs.

Take the next step today. Start crafting your wishlist, engage with potential donors, and establish systems that make managing in-kind donations seamless. Every contribution, no matter the size, brings your mission closer than ever.

Interested in learning more about successful in-kind and other fundraising? Check out these additional resources:

- Tracking In-Kind Donations for Nonprofits: What to Know. A big part of effective in-kind donation management is tracking throughout the process. Find out how your team can track in-kind gifts with ease here.

- How to Identify Corporate Partnerships [With Double the Donation]. In-kind donations can lead to corporate sponsorships—and your matching gift software can help uncover these opportunities. Get started with our guide!

- The Value of Donor Employer Information in Fundraising. Your donors’ employment data can help illuminate in-kind donation potential. Learn how to collect and manage this information effectively here.

![How to Find Grants for Nonprofits [Quickly & Easily!]](https://doublethedonation.com/wp-content/uploads/2025/01/DTD_How-to-Find-Grants-for-Nonprofits-Quickly-Easily_Feature-80x80.png)