How Museums Can Increase Payroll Donation Funds

Museums play a vital role in preserving culture, educating the public, and inspiring creativity. However, securing consistent funding to support these missions can be challenging. One promising avenue that museums can explore to enhance their fundraising efforts is payroll donations. This method offers a steady, reliable stream of income that can significantly bolster a museum’s financial health over time.

Payroll donations allow museums to tap into the generosity of employees who want to support cultural institutions through manageable, recurring contributions. By understanding how payroll donations work and implementing effective strategies, museums can unlock new opportunities to engage donors and sustain their programs. In this article, we will explore the concept of payroll donations, their benefits for museums, best practices to increase participation, and examples of companies that facilitate these giving programs.

Table of Contents

What are payroll donations?

Payroll donations are a form of workplace giving where employees elect to have a portion of their paycheck automatically donated to a nonprofit organization, such as a museum. This process is typically set up through an employer’s payroll system, making it easy and convenient for employees to contribute regularly without needing to take additional action each pay period.

These donations are often facilitated by employer giving platforms or coordinated through human resources departments. Many companies also offer matching gift programs that can double or even triple the impact of an employee’s payroll donation, further amplifying the support museums receive.

One of the key advantages of payroll donations is their consistency. Because contributions are deducted automatically, museums benefit from a predictable revenue stream. Donors often choose smaller amounts that fit their budgets, but when combined across many employees, these donations add up to a significant source of funding.

For museums, payroll donations represent a sustainable and accessible way to engage supporters who want to contribute regularly without the hassle of manual giving. This method also fosters a sense of ongoing commitment, as donors see their support as part of their routine, reinforcing their connection to the museum’s mission.

How payroll donations fit into workplace giving

Workplace giving programs, including payroll donations, are designed to encourage employees to support charitable causes through their place of work. These programs often include options like one-time donations, volunteer grants, and matching gifts, with payroll donations standing out for their recurring nature.

By integrating payroll donations into broader workplace giving initiatives, museums can position themselves as preferred beneficiaries, increasing visibility among employees and encouraging sustained generosity.

Eligibility and setup process

Employees interested in payroll donations typically enroll through their employer’s internal giving platform or HR portal. Museums need to be registered with these platforms or have established relationships with companies to be listed as eligible nonprofits.

Once enrolled, the donation amount is deducted automatically from each paycheck, making it a hassle-free way for donors to support museums continuously.

How do payroll donation funds benefit museums?

Payroll donation funds provide museums with a dependable and long-term source of financial support. While individual contributions may be modest, the cumulative effect of many donors giving regularly creates a steady revenue stream that museums can count on for budgeting and planning.

This predictability allows museums to sustain core programs, maintain exhibits, and invest in new initiatives with greater confidence. Unlike one-time gifts or event-based fundraising, payroll donations offer a level of financial stability that can help museums weather economic fluctuations or unexpected expenses.

Another significant advantage is that payroll donations often come as unrestricted funds. This flexibility means museums can allocate resources where they are most needed, whether that’s educational programming, conservation efforts, or community outreach.

Moreover, payroll donations signal ongoing commitment from supporters. Donors who choose to give regularly through payroll are demonstrating a deep belief in the museum’s mission and a willingness to be part of its future success. This ongoing engagement can lead to stronger relationships and increased advocacy for the museum’s work.

Supporting sustainable growth

With a reliable base of payroll donors, museums can plan for sustainable growth. This might include expanding collections, enhancing visitor experiences, or launching new educational programs. The steady income stream reduces reliance on unpredictable funding sources, enabling strategic investments.

Enhancing donor retention and engagement

Payroll donations encourage long-term donor retention because the giving process is automated and integrated into the donor’s routine. Museums can build on this foundation by regularly communicating impact stories and recognizing payroll donors, fostering a sense of community and shared purpose.

Best practices for museums to drive payroll donation funds

To maximize payroll donation participation, museums should adopt a proactive and strategic approach. Raising awareness and simplifying the donation process are key to encouraging supporters to enroll and maintain their contributions.

Educating supporters

Education is important. Museums can use newsletters, social media campaigns, and special events to inform supporters about the benefits and ease of payroll giving. Clear messaging that explains how small, recurring donations make a big difference can motivate more people to participate.

Creating a payroll giving page

Adding a dedicated payroll donation page or section on the museum’s website helps centralize information and provides a straightforward way for visitors to learn about and sign up for payroll giving. This page should include step-by-step instructions, FAQs, and testimonials from current payroll donors.

Integrating with broader campaigns

Encouraging recurring giving during peak fundraising campaigns can also boost payroll donation enrollment. Highlighting payroll giving as an option during annual drives or special appeals reminds supporters of this convenient giving method.

Acknowledging payroll giving donors

Recognizing and thanking payroll donors regularly is crucial for retention. Personalized acknowledgments, impact reports, and exclusive updates make donors feel valued and reinforce their commitment to the museum’s mission.

Leveraging technology and data

Utilizing donor management software and workplace giving tools can help museums track payroll donations, identify trends, and tailor communications. This data-driven approach ensures that outreach efforts are targeted and effective.

Building partnerships with employers

Developing relationships with companies that offer payroll giving programs can open doors for museums. Collaborating on employee engagement events or providing educational materials can increase the museum’s profile within these organizations.

Companies that offer payroll donations for museums

Many large corporations and socially responsible businesses provide payroll donation programs as part of their workplace giving or corporate social responsibility (CSR) initiatives. These programs enable employees to support nonprofits like museums through automatic paycheck deductions.

Companies such as Whole Foods Market, Netflix, Pacific Gas and Electric Company, and Hootsuite are known for their commitment to employee engagement and community support, often including payroll giving options in their benefits packages.

Museums should identify which of their current or potential supporters work for these companies. Collecting employer information during volunteer sign-ups, donor intake, or event registrations can help museums target outreach efforts effectively.

Researching workplace giving platforms and registering the museum as a beneficiary increases the chances of receiving payroll donations. By understanding how payroll giving is administered within these companies, museums can position themselves to benefit from this valuable funding source.

Maximizing opportunities with corporate partners

Engaging with companies that offer payroll giving programs can lead to additional support beyond donations, such as sponsorships, volunteer involvement, and joint events. Museums should explore these possibilities to deepen partnerships and expand their impact.

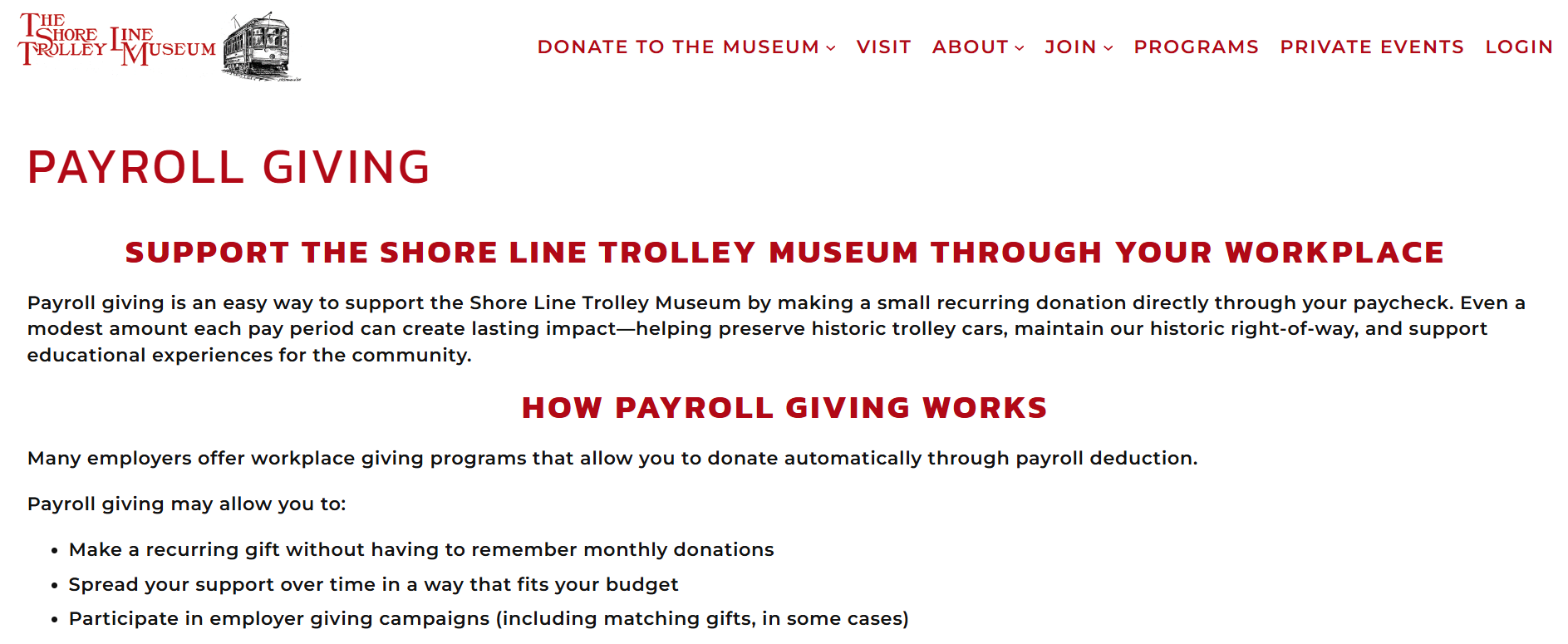

Example: Shoreline Trolley Museum’s payroll donation strategy

The Shore Line Trolley Museum provides a practical blueprint for how specialized museums can cultivate a reliable, “set-it-and-forget-it” revenue stream through workplace philanthropy. By hosting a dedicated “Payroll Giving” portal, the museum frames automatic paycheck deductions as an easy way to fund the labor-intensive work of preserving historic trolley cars and maintaining their historic right-of-way.

View the web page here: https://shorelinetrolley.org/payroll-giving/

Breaking Down the Mechanics of Workplace Philanthropy & Payroll Giving

The museum’s strategy focuses on educating the donor on the logistical ease of payroll deductions. By explicitly outlining “How Payroll Giving Works,” the institution removes the intimidation factor for supporters who may be unfamiliar with corporate giving programs.

Key benefits highlighted to potential donors include:

- Administrative Simplicity: Supporters can make recurring gifts without having to remember to make monthly manual donations.

- Budget-Friendly Support: The program allows donors to spread their financial commitment over time to fit their monthly budget.

- Amplified Impact: The museum encourages donors to participate in employer giving campaigns, noting that these often include matching gift opportunities that multiply the value of each paycheck deduction.

A unique element of the Shore Line Trolley Museum’s approach is its focus on collecting donor data. Because payroll platforms sometimes process gifts anonymously, the museum proactively asks donors to include their name and address within their giving platform. This allows the institution to properly thank and acknowledge supporters, turning a cold administrative transaction into a warm, long-term relationship.

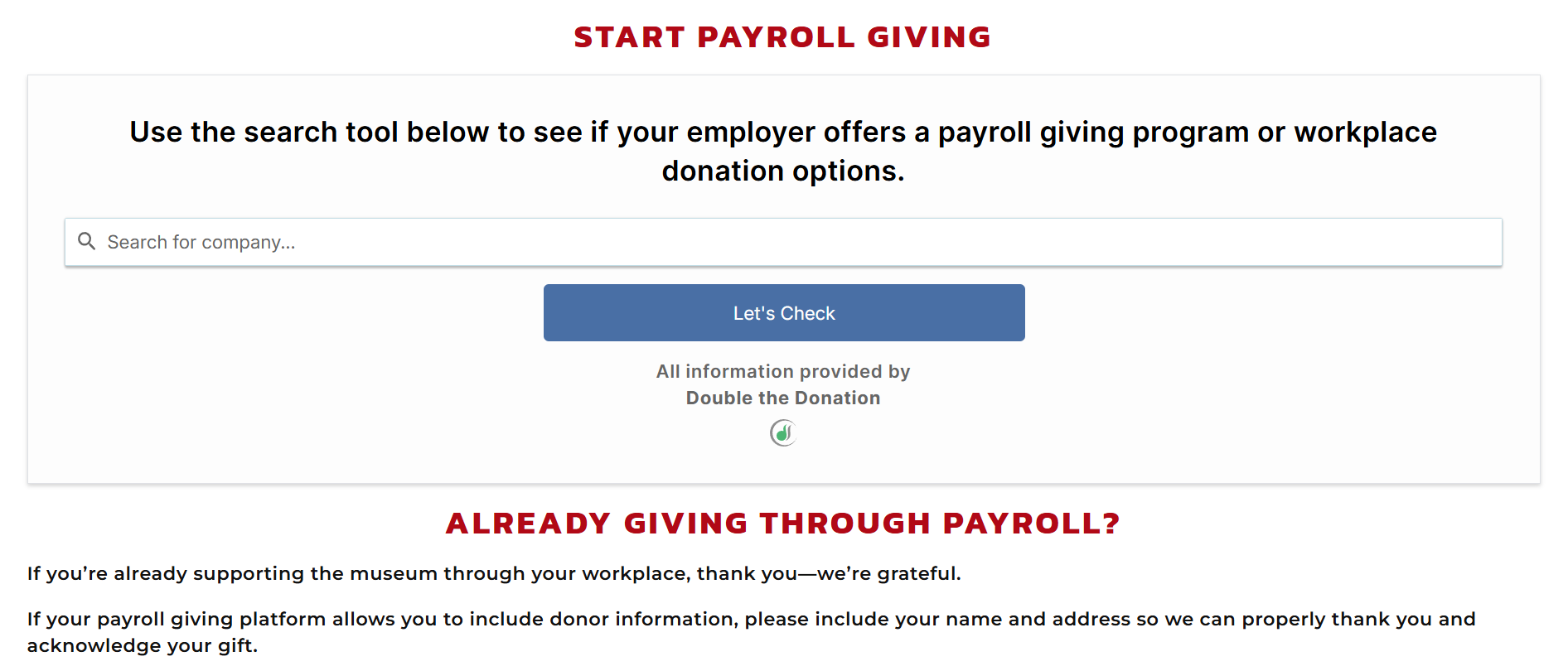

By integrating a specialized search tool directly on the page, the museum enables curious supporters to instantly verify whether their employer offers a compatible giving program. This frictionless digital journey ensures that a modest amount from each pay period can be converted into a lasting impact for community educational experiences.

Payroll donation FAQ for Museums

Can payroll donations be designated for specific museum programs?

While some payroll donation programs allow donors to specify how their contributions are used, many payroll donations come as unrestricted funds. Museums should clarify with employers and donors whether designation options are available and communicate how funds will be utilized to maximize transparency and trust.

Are payroll donations tax-deductible?

Yes, payroll donations to qualified nonprofit museums are generally tax-deductible. Donors typically receive a receipt or acknowledgment from the museum or employer for tax purposes. It’s important for museums to provide clear documentation to support donors’ tax filings.

What happens if an employee changes jobs or leaves the company?

Payroll donations are tied to the employee’s current employer. If an employee leaves the company, their payroll donations usually stop. Museums can encourage donors to continue their support through other giving methods or by enrolling with their new employer’s payroll giving program.

How can museums encourage employees to start payroll donations?

Museums can collaborate with employers to promote payroll giving through internal communications, presentations, and events. Providing easy-to-understand materials and highlighting the impact of donations helps motivate employees to participate.

Is there a minimum donation amount for payroll giving?

Minimum donation amounts vary by employer and payroll system. Many companies allow very small deductions, making payroll giving accessible to a wide range of employees. Museums should check with partner companies to understand any limits and communicate this information to potential donors.

Concluding thoughts on payroll donations for museums

Payroll donations represent a simple, sustainable, and often underutilized funding stream for museums. By leveraging this method, museums can secure consistent financial support that enables them to plan confidently, sustain vital programs, and grow their impact over time.

Encouraging payroll donations requires thoughtful outreach, strategic partnerships, and clear communication. Museums that invest in these areas will find payroll giving to be a powerful complement to their broader fundraising efforts, fostering deeper connections with supporters who are committed to their mission.

Discover new ways to grow your museum’s payroll giving revenue

Unlock the full potential of payroll giving with Double the Donation’s powerful, easy-to-use tools. Our Payroll Giving module automatically identifies which of your supporters work for companies that offer payroll giving programs, giving you the insights you need to reach the right people at the right time. From there, we provide company-specific program details so donors can take action quickly: no guesswork, no missed opportunities. By leveraging our solution, your organization can turn hidden eligibility into steady, recurring revenue that fuels your mission all year long.

Get a demo of Double the Donation today to learn more and see the tools in action.