How Hospitals Can Increase Payroll Donation Funds

Hospitals play a critical role in providing essential healthcare services to communities, often relying on a mix of unique fundraising ideas to sustain their operations and expand their impact. One increasingly valuable yet sometimes overlooked source of support is payroll donations. These donations, made directly from employees’ paychecks, offer a steady and reliable stream of funding that can help hospitals maintain and grow their programs.

Understanding how to effectively encourage and manage payroll donations can empower hospitals to tap into this consistent revenue source. By fostering partnerships with employers and educating supporters about payroll giving, hospitals can build a foundation of recurring contributions that bolster their mission over the long term.

Table of Contents

What are payroll donations?

Payroll donations are a form of workplace giving where employees elect to have a portion of their paycheck automatically donated to a nonprofit organization on a recurring basis. This method of giving is designed to be convenient and manageable, allowing donors to contribute smaller amounts regularly without the need for repeated manual transactions.

Typically, payroll donations are facilitated through employer giving platforms or coordinated by human resources departments. Many companies integrate these programs into their corporate social responsibility (CSR) initiatives, making it easy for employees to participate. Additionally, some employers offer matching gift programs that can double or even triple the impact of these donations, further enhancing the benefit to the receiving organization.

For hospitals, payroll donations represent a dependable funding stream that accumulates over time. Because the contributions are automatic and recurring, they provide a level of financial predictability that can be difficult to achieve through one-time gifts alone. This steady inflow of funds can help hospitals plan more effectively and sustain critical services.

How payroll donations work

Employees typically sign up for payroll donations during onboarding or through their company’s employee portal. They select the nonprofit(s) they wish to support and specify the amount or percentage of their paycheck to be donated. The employer then deducts this amount from each paycheck and forwards it to the designated organization, often on a monthly or quarterly basis.

Because the process is automated, donors don’t have to remember to give each time, which increases the likelihood of sustained support. Hospitals benefit from this consistency, as it reduces fundraising volatility and builds a reliable donor base.

Benefits for donors

From the donor’s perspective, payroll donations offer a simple way to contribute without the hassle of manual payments. The recurring nature allows donors to budget their giving in smaller increments, making philanthropy more accessible. Additionally, donors may receive tax benefits for their contributions, depending on local regulations.

How do payroll donation funds benefit hospitals?

Payroll donation funds provide hospitals with meaningful, long-term financial support that can be instrumental in sustaining and expanding healthcare services. While individual donations through payroll giving may be modest, the cumulative effect of many employees contributing regularly creates a significant and predictable revenue stream.

This steady flow of funds enables hospitals to plan their budgets with greater confidence. Unlike one-time grants or sporadic donations, payroll donations offer a level of financial stability that supports ongoing programs and operational costs. Hospitals can allocate these funds flexibly, often as unrestricted donations, which means they can address the most pressing needs as they arise.

Moreover, payroll donations signal a deeper level of commitment from supporters. Employees who choose to give regularly through their paychecks demonstrate sustained belief in the hospital’s mission. This ongoing engagement can foster stronger relationships between the hospital and its community, encouraging further involvement and advocacy.

Supporting core programs and innovation

With reliable payroll donation income, hospitals can maintain essential services such as patient care, community outreach, and health education. They can also invest in innovative projects, technology upgrades, and staff training that improve patient outcomes. The flexibility of these funds allows hospitals to respond quickly to emerging healthcare challenges.

Enhancing donor retention and engagement

Payroll donations often lead to higher donor retention rates compared to one-time gifts. Because the giving is automatic and recurring, donors remain connected to the hospital’s mission over time. This sustained engagement opens opportunities for hospitals to deepen relationships through personalized communication, volunteer opportunities, and special events.

Best practices for hospitals to drive payroll donation funds

To maximize payroll donation participation, hospitals should adopt clear and actionable strategies that raise awareness and simplify the giving process. A multi-faceted approach that combines education, accessibility, and recognition can significantly boost payroll giving outcomes.

Register with CSR platforms that facilitate payroll giving

First, hospitals should register with corporate social responsibility (CSR) platforms that facilitate payroll giving. These platforms connect nonprofits with companies offering payroll donation programs, making it easier for hospitals to be discovered by potential donors.

Use a multi-channel marketing approach

Hospitals can use newsletters, social media campaigns, and community events to market payroll giving and inform supporters about the benefits and ease of payroll donations. Clear messaging that explains how small, recurring gifts add up to meaningful impact can motivate employees to participate.

Include mentions on your website

Creating a dedicated payroll donation page or section on the hospital’s website is another effective tactic. This page should provide step-by-step instructions, FAQs, and testimonials to guide donors through the process. Making the sign-up process straightforward and accessible encourages more supporters to take action.

Hospitals should also encourage recurring giving during peak fundraising campaigns, such as health awareness months or annual drives. Highlighting payroll donations as a convenient alternative to one-time gifts can increase participation during these critical periods.

Finally, recognizing and thanking payroll donors regularly is essential for retention. Personalized acknowledgments, impact reports, and exclusive updates help donors feel valued and connected to the hospital’s mission. This appreciation fosters loyalty and encourages continued support.

Build partnerships with employers

Hospitals should proactively engage with local employers to promote payroll giving programs. Collaborations with HR departments and CSR teams can facilitate smoother donation processes and increase visibility among employees.

Companies that offer payroll donations for hospitals

Many companies incorporate payroll donation programs into their workplace giving or corporate social responsibility initiatives. These programs are especially common among large corporations and businesses that prioritize employee engagement and community support.

For hospitals seeking to increase payroll donation funds, identifying supporters who work for companies with such programs is a strategic move. Collecting employer information during volunteer sign-ups or donor intake can reveal valuable connections. Additionally, researching workplace giving platforms where the hospital can register or be listed increases the chances of receiving payroll donations.

Some notable companies offering payroll donation programs include TripAdvisor, Whole Foods Market, Aetna, and Pacific Gas and Electric Company. Each of these organizations has established mechanisms to facilitate employee giving through payroll deductions, often complemented by matching gift opportunities.

Tips from St. Jude: How one hospital is growing payroll giving

St. Jude Children’s Research Hospital provides a world-class model for how healthcare institutions can use digital storytelling to drive high-volume workplace giving. By integrating compelling content directly within their payroll giving page, the hospital transforms a routine HR task into an emotional, life-saving opportunity.

View the web page here: https://www.stjude.org/get-involved/workplace-giving/employee-giving-signup.html

Leveraging Video to Humanize Workplace Pledges

The centerpiece of the St. Jude strategy is an embedded video titled “What if your payroll deduction gift…”, which serves as a powerful elevator pitch for potential donors. Research shows that 57% of people who watch a fundraising video go on to donate, and St. Jude uses this medium to bridge the gap between its corporate office and the hospital’s clinical front lines.

Turning Weekly Pledges into Concrete Cures

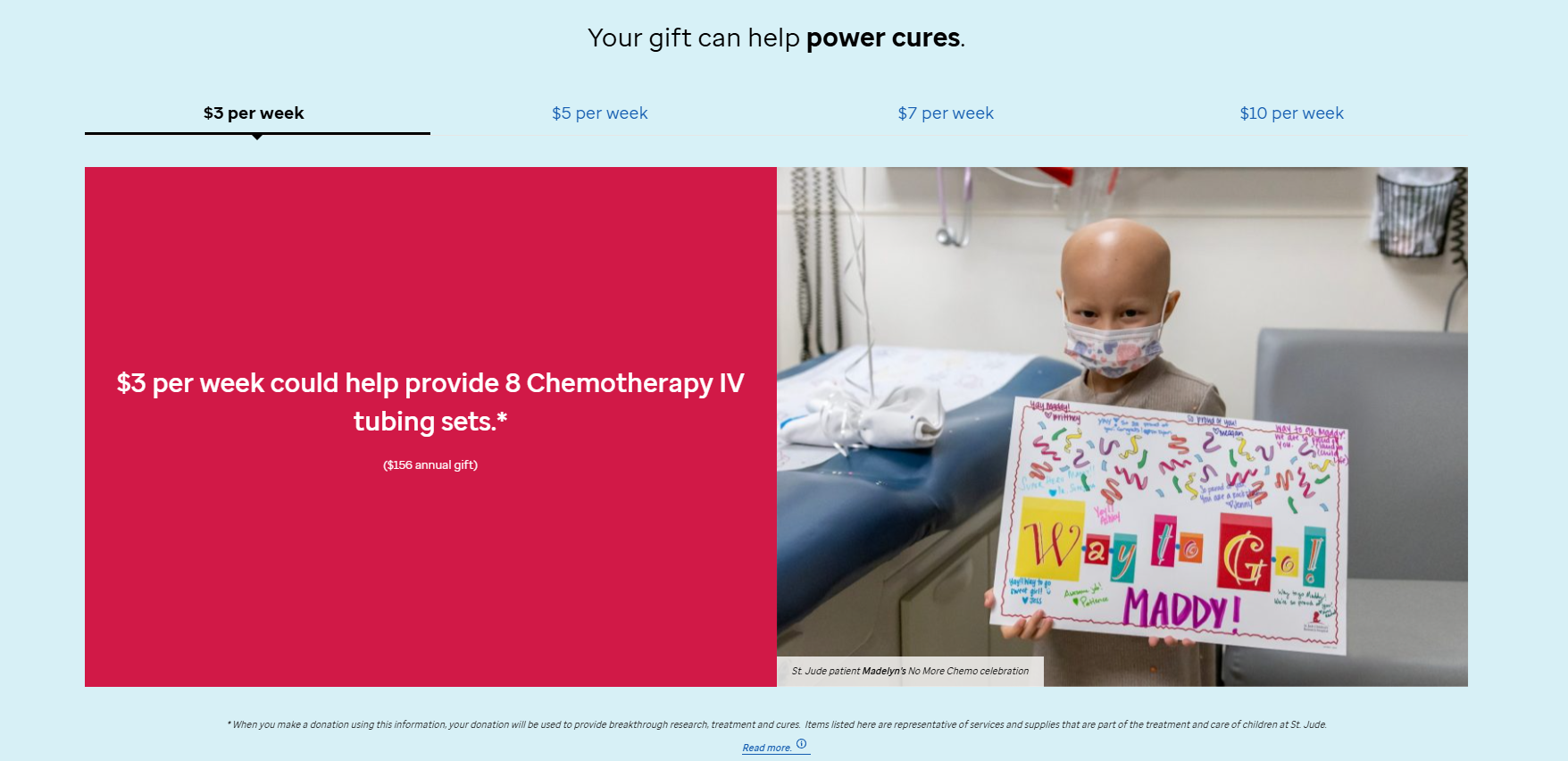

To complement the video, St. Jude uses an interactive scale to help employees visualize the specific impact of their automatic paycheck deductions. This transparency helps convert one-time donors into long-term workplace “Partners In Hope.”

The hospital demonstrates how even small weekly amounts ($3, $7, or $10) can scale over time.

By combining compelling video content with clear, itemized impact data, St. Jude ensures that every employee (from the entry-level to the executive suite) understands that their recurring support is the backbone of pediatric cancer research.

Payroll donation FAQ for hospitals

Can payroll donations be designated for specific hospital programs?

While some payroll donation programs allow donors to specify how their contributions are used, many payroll donations are pooled as unrestricted funds. Hospitals should communicate clearly with donors about how their gifts will be allocated and offer options when possible.

Are payroll donations tax-deductible?

In most cases, payroll donations to registered nonprofit hospitals are tax-deductible. Donors should consult their tax advisors for specific guidance based on their location and circumstances.

How can hospitals encourage employees of companies without payroll giving programs to donate?

Hospitals can suggest alternative giving methods such as direct recurring donations through their website or participation in other workplace giving campaigns. Educating donors about matching gift opportunities can also enhance their impact.

What is the typical minimum donation amount for payroll giving?

Minimum amounts vary by employer but are often set low to encourage participation. Some companies allow donors to specify any amount, while others have fixed increments.

How do hospitals track and acknowledge payroll donors?

Hospitals can use donor management systems to track payroll donations and generate reports. Regular communication and personalized thank-you messages help maintain donor relationships and encourage continued support.

Concluding thoughts on payroll donations for Hospitals

Payroll donations represent a simple, sustainable, and often underutilized funding stream for hospitals. By leveraging this form of workplace giving, hospitals can secure a steady flow of financial support that enhances their ability to deliver vital healthcare services. Encouraging payroll donations not only boosts revenue but also fosters ongoing engagement with supporters who are committed to the hospital’s mission. With thoughtful strategies and partnerships, hospitals can unlock the full potential of payroll giving to strengthen their impact in the communities they serve.

Empower your hospital’s fundraising with Double the Donation

Unlock the full potential of payroll giving with Double the Donation’s powerful, easy-to-use tools. Our Payroll Giving module automatically identifies which of your supporters work for companies that offer payroll giving programs, giving you the insights you need to reach the right people at the right time. From there, we provide company-specific program details so donors can take action quickly: no guesswork, no missed opportunities. By leveraging our solution, your organization can turn hidden eligibility into steady, recurring revenue that fuels your mission all year long.

Get a demo of Double the Donation today to learn more and see the tools in action.