How Cultural Heritage Orgs Can Increase Payroll Donation Funds

For organizations dedicated to preserving and celebrating cultural heritage, securing consistent funding is essential to sustaining impactful programs and initiatives. Payroll donations represent a promising avenue for these organizations to tap into a steady stream of financial support. By encouraging supporters to allocate a portion of their paycheck automatically to their favorite cultural heritage nonprofits, organizations can build a reliable base of recurring contributions that fuel their mission.

Understanding how payroll donations work and how to effectively promote them can empower cultural heritage organizations to diversify their fundraising strategies. This approach not only helps generate funds but also fosters a deeper connection with donors who commit to supporting cultural preservation over the long term. In this article, we explore the concept of payroll donations, their benefits, best practices for increasing participation, and how to leverage corporate programs to maximize impact.

Table of Contents

- What are payroll donations?

- How do payroll donation funds benefit cultural heritage orgs?

- Best practices for cultural heritage orgs to drive payroll donation funds

- Companies that offer payroll donations for cultural heritage orgs

- Case study: Chinese American Service League’s payroll giving strategy

- Payroll donation FAQ for cultural heritage orgs

What are payroll donations?

Payroll donations are a form of workplace giving where employees elect to have a designated portion of their paycheck automatically donated to a nonprofit organization. This process is typically facilitated through employer-sponsored giving platforms or coordinated by human resources departments. The donations are deducted directly from the employee’s salary before they receive it, making the giving process seamless and effortless.

One of the key advantages of payroll donations is their recurring nature. Instead of one-time gifts, these contributions happen regularly—often monthly or with each pay period—providing nonprofits with a predictable and ongoing source of revenue. Many employers also offer matching gift programs that can double or even triple the impact of these donations, further amplifying the support cultural heritage organizations receive.

Payroll donations tend to be smaller amounts per individual, which makes it easier for employees to participate without financial strain. However, when aggregated across many donors, these modest contributions add up to significant funding that can sustain programs, exhibitions, educational outreach, and preservation efforts. For cultural heritage organizations, payroll giving represents a convenient, consistent, and scalable way to engage supporters in their mission.

How payroll donations are set up

Typically, employees enroll in payroll giving through an online portal provided by their employer or a third-party platform. They select the nonprofit(s) they wish to support and specify the donation amount. The employer then deducts this amount automatically from each paycheck and forwards it to the nonprofit, often on a monthly or quarterly basis.

Employers may also provide tools and resources to help employees learn about eligible nonprofits and the benefits of payroll giving. This infrastructure makes it easier for cultural heritage organizations to reach potential donors within the workforce.

Why payroll donations matter for donors

From the donor’s perspective, payroll donations offer a hassle-free way to contribute regularly without needing to remember to make individual gifts. The automatic nature of the donations helps build a habit of giving and allows donors to support causes they care about sustainably over time.

Additionally, payroll giving can provide tax advantages, as donations are often deducted before taxes are calculated, reducing taxable income. This financial benefit can encourage more employees to participate and increase the overall funds directed to cultural heritage nonprofits.

How do payroll donation funds benefit cultural heritage orgs?

For cultural heritage organizations, payroll donation funds provide a vital source of steady income that can be counted on to support ongoing operations. Unlike grants or event-based fundraising, which can fluctuate year to year, payroll donations create a predictable revenue stream that helps organizations plan with confidence.

Even though individual payroll donations may be modest, when pooled across many donors, they generate substantial funding. This consistency allows cultural heritage nonprofits to maintain core programs such as artifact conservation, educational workshops, community outreach, and exhibitions without the uncertainty of sporadic funding.

Another important payroll donation benefit is that they often come as unrestricted funds. This means the organization can allocate the money where it is most needed, whether that’s emergency repairs to historic sites, new technology for digital archives, or expanding access to cultural education. The flexibility afforded by unrestricted donations is invaluable for adapting to evolving priorities and challenges.

Moreover, payroll donations signal ongoing commitment from supporters. Donors who give regularly through payroll are demonstrating sustained belief in the organization’s mission. This reliable backing can strengthen the nonprofit’s credibility and encourage additional support from other funding sources.

Supporting long-term sustainability

By cultivating a base of payroll donors, cultural heritage organizations can reduce their dependence on unpredictable funding streams. This financial stability enables them to invest in strategic growth, staff development, and innovative programming that enhances their impact in preserving cultural legacies.

Building donor relationships through payroll giving

Payroll donors often feel a deeper connection to the organization because their giving is integrated into their daily lives. This ongoing relationship can be nurtured through regular communication, updates on how funds are used, and recognition of their contributions, fostering loyalty and increasing the likelihood of future support.

Best practices for cultural heritage orgs to drive payroll donation funds

To maximize payroll donation participation, cultural heritage organizations should adopt a multi-faceted approach that raises awareness and simplifies the giving process. One effective strategy is registering with corporate social responsibility (CSR) platforms that facilitate payroll giving. Being listed on these platforms increases visibility among employees looking for nonprofits to support through their workplace giving programs.

Education is key. Organizations should use newsletters, social media, and events to inform supporters about the benefits and ease of payroll donations. Sharing stories about how recurring gifts make a difference can inspire donors to enroll and maintain their contributions.

Adding a dedicated payroll donation page or section on the organization’s website unlocks growth. This page can provide step-by-step instructions, FAQs, and links to employer giving portals, making it straightforward for visitors to take action.

Encouraging recurring giving during peak fundraising campaigns can also boost payroll donation sign-ups. Highlighting payroll giving as a convenient alternative to one-time donations during these periods can attract new donors who prefer manageable, ongoing support.

Maintaining a consistent message about payroll giving and its impact helps keep it top of mind for supporters. Clear, transparent communication about how funds are used and the difference they make reinforces donor confidence and commitment.

Removing barriers to enrollment by providing direct links, simple instructions, and responsive support encourages more people to participate. The easier it is to access the steps to sign up, the higher the conversion rate for payroll donations.

Recognizing and thanking payroll donors regularly is essential for retention. Personalized acknowledgments, donor spotlights, and exclusive updates help donors feel valued and connected, increasing the likelihood they will continue their support

Companies that offer payroll donations for cultural heritage orgs

Many large companies and corporations have established payroll donation programs as part of their workplace giving or corporate social responsibility (CSR) initiatives. These programs are designed to engage employees in philanthropy and support community causes, including cultural heritage organizations.

Employers like Whole Foods Market, Aetna, IBM, and TripAdvisor are known for offering payroll giving options. These companies prioritize employee engagement and community support, making them valuable partners for cultural heritage nonprofits seeking payroll donations.

- Whole Foods Market encourages employees to contribute to nonprofits through payroll deductions, often matching donations to amplify impact.

- Aetna’s workplace giving program includes payroll donations as a key component, with a focus on supporting diverse community organizations.

- IBM has a long-standing commitment to corporate philanthropy, offering payroll giving alongside matching gifts and volunteer grants.

- TripAdvisor also supports employee giving through payroll donations, fostering a culture of generosity within its workforce.

For cultural heritage organizations, identifying supporters who work at these companies can open doors to new funding opportunities. Collecting employer information during volunteer sign-ups, donor intake, or event registrations helps nonprofits map potential payroll donors.

By understanding where their supporters work and how payroll giving is administered, cultural heritage organizations can proactively position themselves to receive these funds. This strategic approach turns employment data into a powerful fundraising asset.

Leverage corporate partnerships

Building relationships with companies that offer payroll giving programs can lead to additional support beyond donations, such as sponsorships, volunteer opportunities, and joint events. Engaging corporate partners strengthens the nonprofit’s network and visibility.

Encourage employee ambassadors

Supporters employed at companies with payroll giving programs can serve as ambassadors, spreading awareness among colleagues and encouraging participation. Providing these ambassadors with resources and recognition can amplify the organization’s reach within workplaces.

Case study: Chinese American Service League’s payroll giving strategy

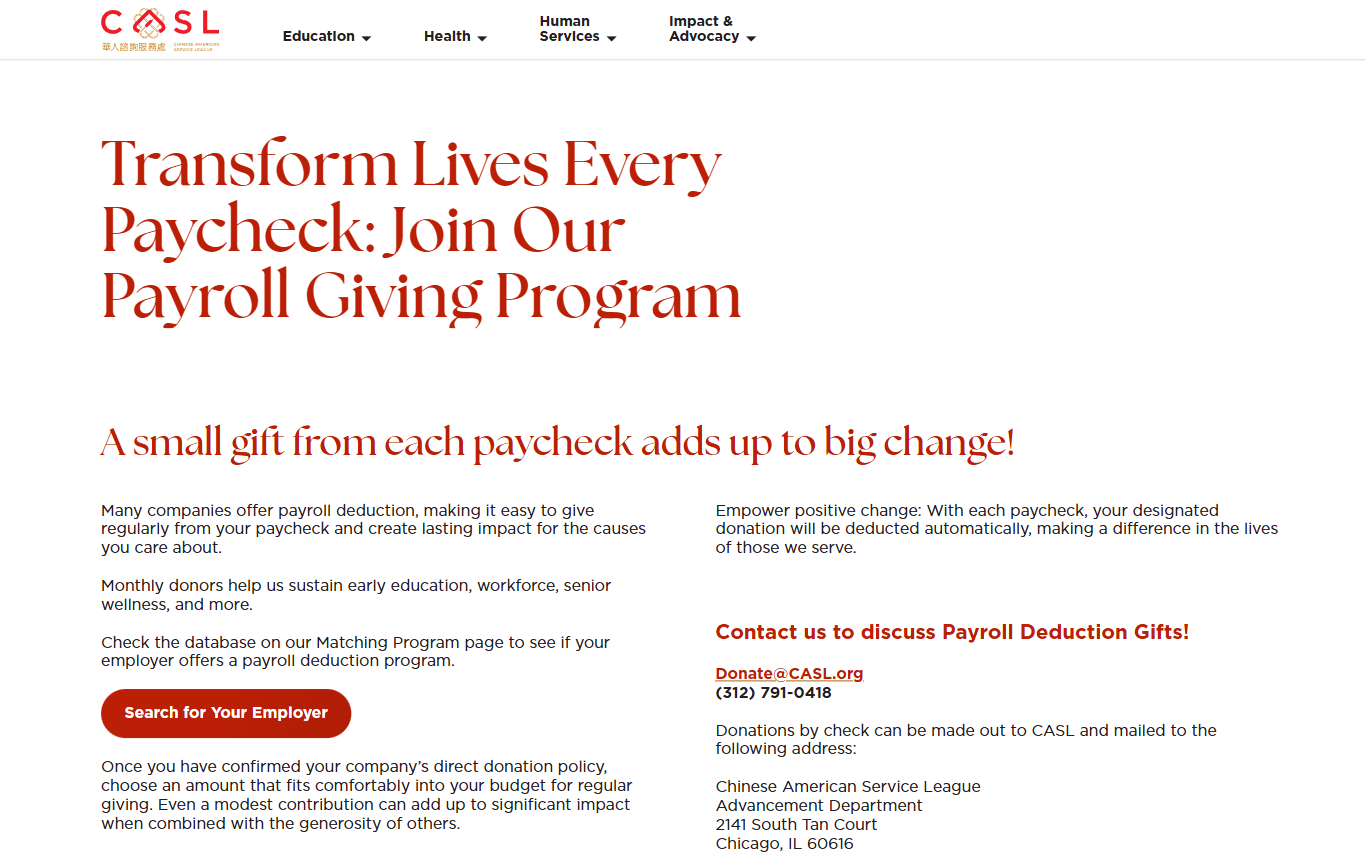

The Chinese American Service League (or CASL) provides a sophisticated blueprint for how cultural heritage and social service organizations can secure reliable, recurring revenue through workplace philanthropy. By hosting a dedicated “Join Our Payroll Giving Program” portal, the organization frames automatic paycheck deductions as a collective tool for long-term community transformation.

View the web page: https://casl.org/donate/payroll-deduction-gifts

Transforming Routine Paychecks into “Big Change”

The CASL digital strategy focuses on the cumulative power of small, consistent contributions. By using the slogan “A small gift from each paycheck adds up to big change!”, the organization lowers the psychological barrier to entry for donors who may feel their individual contributions are too small to make a difference.

Key elements of their user-centric approach include:

- Strategic Database Integration: The organization directs supporters to an integrated search tool on their “Matching Program” page, allowing donors to instantly verify if their employer offers a payroll deduction program.

- Impact-Driven Messaging: CASL explicitly links payroll funds to the sustainability of their core pillars, such as workforce development, early education, and senior wellness, providing a clear value proposition for the donor.

- Transparent Donation Pathways: Once a donor confirms their company’s policy, CASL encourages them to choose an amount that “fits comfortably” into their budget, reinforcing that even modest contributions lead to significant collective impact.

This proactive digital stance helps the organization bridge the gap between individual generosity and the logistical power of corporate social responsibility programs. By making the setup process simple and the results visible, CASL ensures that every paycheck becomes a vehicle for empowering the community and preserving cultural legacies.

Payroll donation FAQ for cultural heritage orgs

Can payroll donations be stopped or changed by the donor at any time?

Yes, donors typically have full control over their payroll donations. They can increase, decrease, or stop their contributions by contacting their employer’s HR department or adjusting their preferences through the workplace giving platform. This flexibility makes payroll giving a donor-friendly option.

Are payroll donations tax-deductible?

In most cases, payroll donations are tax-deductible since they are charitable contributions made to qualified nonprofits. Donors should receive a receipt or confirmation from the nonprofit or employer for tax filing purposes. It’s advisable for donors to consult a tax professional for specific guidance.

How quickly do nonprofits receive payroll donation funds?

The timing varies depending on the employer’s payroll schedule and processing systems. Generally, nonprofits receive aggregated donations monthly or quarterly. Organizations should communicate with employers or payroll platforms to understand disbursement timelines.

Can small nonprofits participate in payroll giving programs?

Yes, many payroll giving platforms welcome nonprofits of all sizes. However, smaller organizations may need to actively register and promote their presence on these platforms to attract donors. Registering with CSR platforms and engaging supporters can increase visibility.

Do payroll donations affect other workplace giving programs?

Payroll donations often complement other workplace giving initiatives such as matching gifts and volunteer grants. Donors can participate in multiple programs simultaneously, maximizing their overall impact. Nonprofits should educate supporters about all available giving options.

Concluding thoughts on payroll donations for cultural heritage orgs

Payroll donations offer cultural heritage organizations a simple, sustainable, and often underutilized funding stream. By enabling supporters to give consistently through automatic paycheck deductions, nonprofits gain a reliable source of unrestricted funds that support mission-critical work. This steady revenue helps organizations plan confidently, maintain essential programs, and adapt to changing needs.

Embracing payroll giving also deepens donor relationships, fostering ongoing commitment and engagement. With thoughtful promotion, clear communication, and strategic partnerships with companies offering payroll donation programs, cultural heritage nonprofits can unlock significant new revenue opportunities. Payroll donations are more than just a funding source—they are a powerful tool for building lasting support for the preservation and celebration of cultural heritage.

Empower your cultural heritage nonprofit with payroll giving insights

Unlock the full potential of payroll giving with Double the Donation’s powerful, easy-to-use tools. Our Payroll Giving module automatically identifies which of your supporters work for companies that offer payroll giving programs, giving you the insights you need to reach the right people at the right time. From there, we provide company-specific program details so donors can take action quickly: no guesswork, no missed opportunities. By leveraging our solution, your organization can turn hidden eligibility into steady, recurring revenue that fuels your mission all year long.

Get a demo of Double the Donation today to learn more and see the tools in action.